Market Overview:

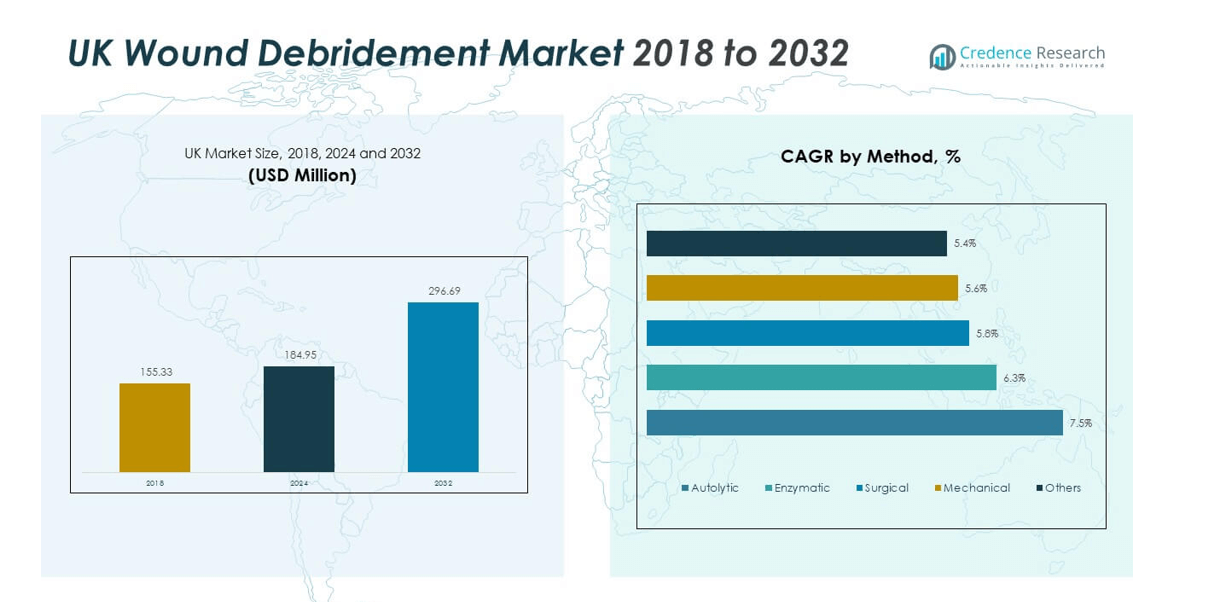

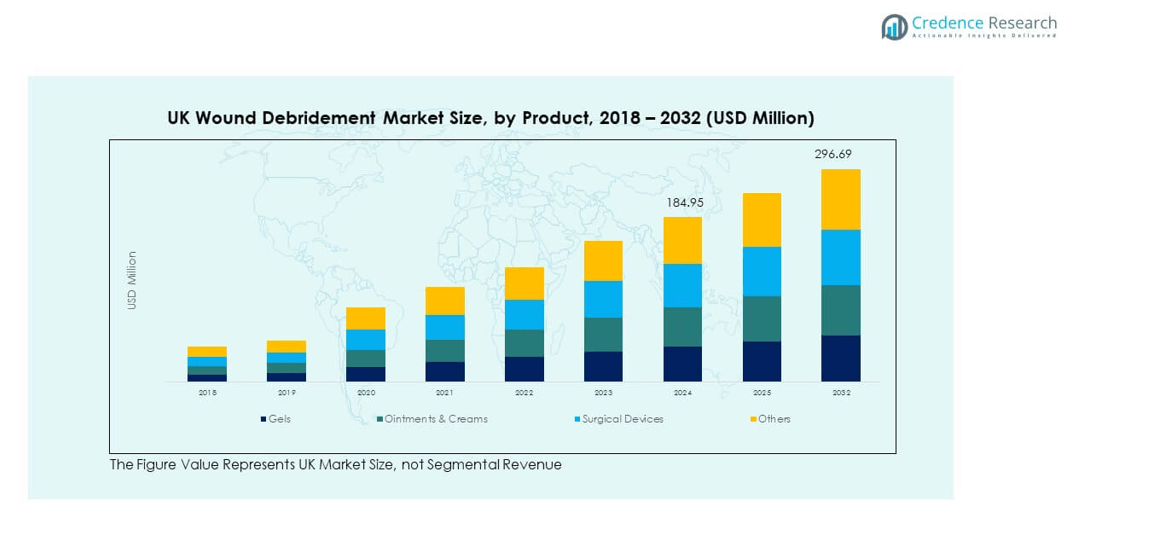

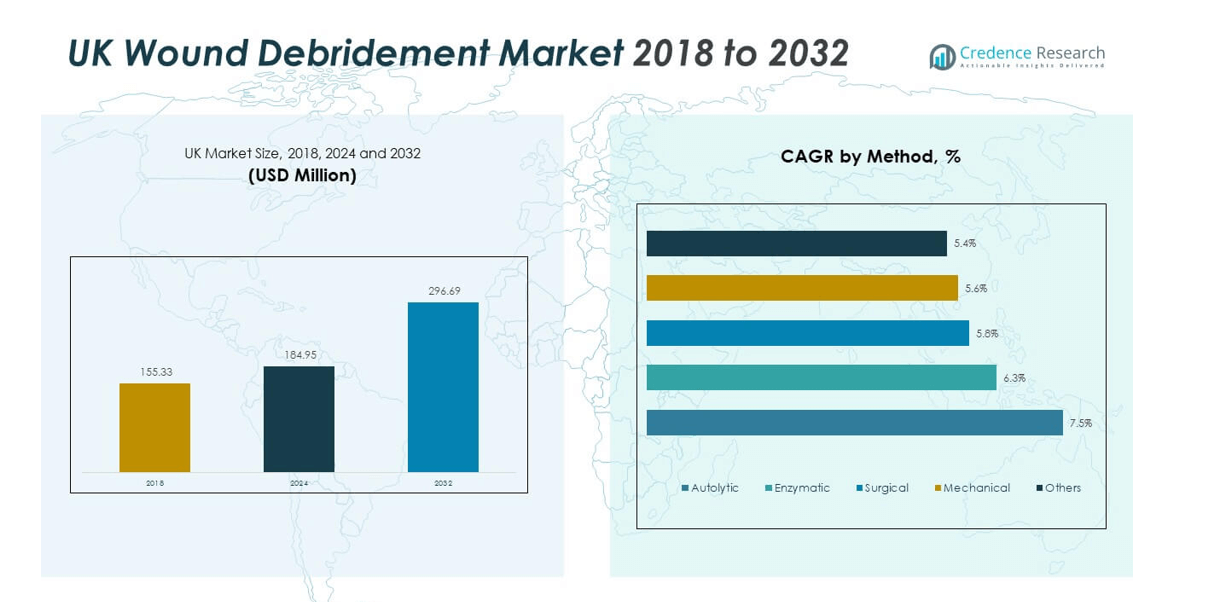

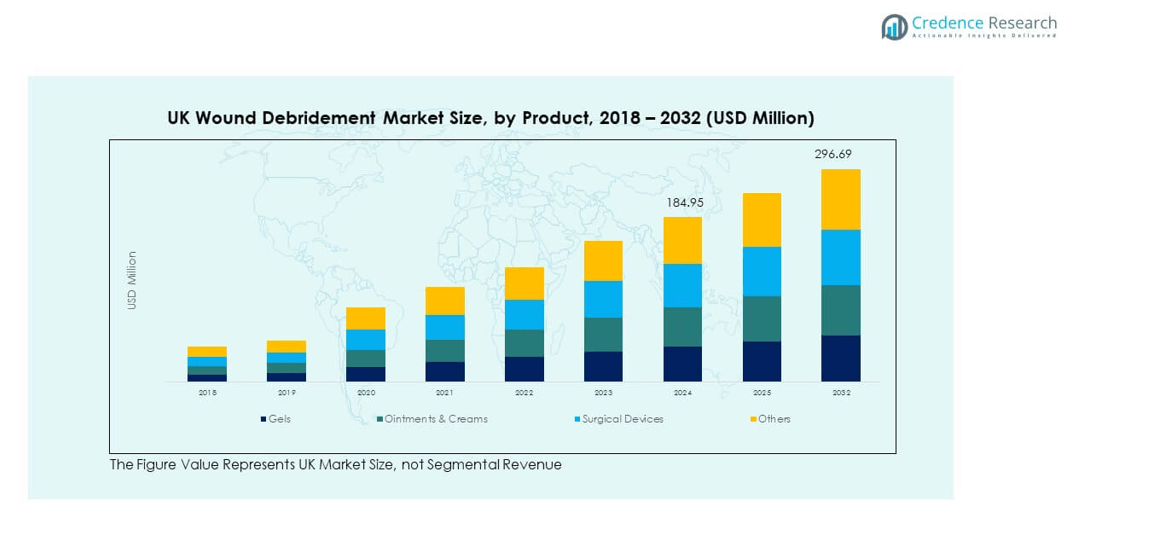

The UK Wound Debridement Market size was valued at USD 155.33 million in 2018 to USD 184.95 million in 2024 and is anticipated to reach USD 296.69 million by 2032, at a CAGR of 6.09% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Wound Debridement Market Size 2024 |

USD 184.95 million |

| UK Wound Debridement Market, CAGR |

6.09% |

| UK Wound Debridement Market Size 2032 |

USD 296.69 million |

The market growth is driven by the increasing prevalence of chronic wounds such as diabetic foot ulcers, venous leg ulcers, and pressure ulcers. Rising awareness among patients and healthcare professionals about advanced wound care methods supports product adoption. Technological innovations in enzymatic and mechanical debridement solutions also strengthen the market. Furthermore, a growing elderly population and a surge in hospital admissions for surgical procedures boost demand for efficient wound management.

Geographically, the UK holds a strong position in Europe’s wound care sector due to its advanced healthcare infrastructure and government-led wound management programs. England dominates the market owing to a high number of specialized wound care centers and strong NHS initiatives. Scotland and Wales are emerging markets with increasing healthcare investments and awareness campaigns promoting modern wound treatment solutions.

Market Insights:

- The UK Wound Debridement Market was valued at USD 155.33 million in 2018, reached USD 184.95 million in 2024, and is projected to attain USD 296.69 million by 2032, expanding at a CAGR of 6.09% during 2024–2032.

- England held the dominant share of 65% in 2024, supported by its robust healthcare infrastructure, NHS-backed programs, and high concentration of advanced wound care facilities.

- Scotland accounted for 18% of the market share, driven by public health initiatives to reduce chronic wound incidence and strong hospital participation in research and innovation.

- Wales and Northern Ireland collectively held 17% of the market, marking the fastest-growing regional cluster due to expanding healthcare access, growing home care services, and digital wound management adoption.

- By product type, gels accounted for nearly 32% of the 2024 market, while surgical devices represented 26%, reflecting a rising preference for advanced enzymatic gels and precision-based surgical tools.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Prevalence of Chronic and Diabetic Wounds in the Aging Population

The UK Wound Debridement Market is driven by a sharp rise in chronic wounds linked to diabetes, vascular diseases, and pressure ulcers among elderly patients. The aging demographic increases the number of individuals requiring long-term wound care support. Hospitals and clinics are adopting advanced debridement techniques to manage these conditions effectively. Increasing diabetic cases contribute to higher incidences of foot ulcers, driving consistent demand. The focus on patient outcomes encourages early wound management and faster healing. Advanced mechanical and enzymatic products support this goal. The growing number of wound care centers ensures easier access to specialized treatment. It continues to expand with government and private efforts promoting diabetic wound prevention programs.

- For instance, the UK’s NICE guidance on Smith & Nephew’s PICO◊ single-use negative pressure wound therapy reports a significant reduction in surgical site complications among high-risk patients, including improved post-surgical wound healing and fewer readmissions for diabetic foot ulcers.

Technological Innovations and Availability of Advanced Debridement Solutions

Technological advancement in wound debridement methods significantly boosts market growth in the UK Wound Debridement Market. The adoption of ultrasonic, enzymatic, and autolytic debridement techniques ensures greater precision and faster recovery. Research investments from healthcare companies lead to improved bio-compatible and non-invasive formulations. Hospitals are focusing on smart wound care systems integrating sensors for monitoring wound progress. The shift from traditional sharp debridement to less painful solutions enhances patient compliance. Increased R&D funding encourages product diversification and regulatory approvals. Healthcare professionals are increasingly trained in using advanced tools for complex wounds. It continues to benefit from strong collaborations between medical device makers and NHS-backed clinical studies.

- For instance, the NICE guidance (MTG43) states that the PICO system is recommended for use in the NHS for closed surgical incisions in patients who are at high risk of developing surgical site infections (SSIs). A systematic review and meta-analysis of evidence, which includes NICE guidance and supporting studies, indicates that PICO is associated with fewer SSIs and seromas (a type of wound exudate) compared with standard dressings in this specific patient group.

Expansion of Healthcare Infrastructure and Government Support for Wound Care

Growing healthcare investments and government programs focused on wound management are key drivers of the UK Wound Debridement Market. NHS initiatives to reduce hospital stays promote effective wound healing strategies. Public awareness campaigns highlight the importance of timely wound care interventions. Reimbursement policies support advanced debridement procedures in both hospitals and community settings. The presence of wound care specialists and clinics boosts access to treatment. Medical training programs improve skill levels in modern debridement practices. Hospitals are investing in specialized wound units equipped with advanced devices. It benefits from a strong healthcare ecosystem emphasizing chronic wound reduction and patient-centered care.

Increasing Adoption of Home Healthcare and Outpatient Wound Management

The growing preference for home-based wound care services supports the UK Wound Debridement Market. Patients with mobility issues prefer debridement treatments in non-hospital environments. Portable and easy-to-use products such as enzymatic gels and pads drive this trend. Rising healthcare costs encourage a shift toward cost-effective outpatient solutions. Manufacturers focus on developing compact and disposable debridement devices suited for home use. Community nurses and telemedicine play an increasing role in wound care delivery. Government initiatives support remote monitoring systems for chronic wound patients. It continues to grow with the trend toward decentralized healthcare and better patient engagement.

Market Trends:

Shift Toward Minimally Invasive and Painless Debridement Techniques

The UK Wound Debridement Market shows a clear move toward painless, non-surgical wound care solutions. Patients and clinicians prefer enzymatic and autolytic methods that minimize discomfort. Ultrasonic and hydrosurgical techniques are becoming popular for precision and reduced recovery time. Hospitals aim to lower infection risks by avoiding aggressive mechanical approaches. Medical device firms introduce gentler formulations to improve patient adherence. The growing demand for single-use instruments supports hygienic wound treatment. Increased R&D efforts enhance the efficiency of non-contact methods. It continues to evolve toward techniques ensuring comfort and shorter healing durations.

- For instance, NICE medtech briefings highlight the increasing adoption of atraumatic, single-use instruments and hydrosurgical systems to reduce the risk of cross-infection and improve compliance in hospital settings.

Integration of Digital Tools and AI in Wound Assessment and Care

Technology adoption plays a strong role in shaping the UK Wound Debridement Market. AI-based wound assessment tools provide accurate diagnosis and monitor healing progress. Digital imaging systems help clinicians evaluate tissue condition with precision. Mobile health apps improve patient adherence through regular follow-ups and wound tracking. Hospitals are introducing telehealth platforms for remote consultations and wound management. Integration with electronic medical records enhances data accessibility and continuity of care. Startups are developing algorithms that predict healing outcomes and infection risks. The use of smart sensors enables real-time monitoring and clinical decision support. It benefits from healthcare digitalization and AI-driven innovations in chronic wound care.

Growing Demand for Personalized and Targeted Wound Care Products

Personalized care is becoming a strong trend in the UK Wound Debridement Market. Manufacturers are developing debridement products customized for specific wound types and patient conditions. Biomaterial-based gels and enzymatic agents provide targeted tissue removal with minimal side effects. Hospitals are increasingly adopting wound care kits tailored for diabetic, pressure, or post-surgical wounds. The focus on precision medicine drives the use of bioactive compounds and antimicrobial dressings. Collaboration between clinicians and R&D teams helps refine product performance. The shift toward patient-specific solutions improves treatment success rates. It continues to grow with the emphasis on individualized wound healing protocols.

Sustainability and Biodegradable Materials in Wound Debridement Products

Sustainability trends are influencing manufacturing in the UK Wound Debridement Market. Companies are focusing on eco-friendly and biodegradable components in debridement dressings and gels. The use of plant-based enzymes and bio-compatible polymers reduces environmental impact. Regulatory bodies encourage the adoption of green medical materials. Hospitals and suppliers prefer sustainable packaging to lower medical waste. Research focuses on sourcing renewable raw materials for advanced wound care. Manufacturers promote low-carbon production practices aligned with national sustainability goals. It continues to advance through eco-conscious innovations and ethical manufacturing approaches.

Market Challenges Analysis:

High Cost of Advanced Debridement Procedures and Limited Reimbursement Coverage

The UK Wound Debridement Market faces challenges linked to the high cost of modern treatment solutions. Advanced enzymatic, autolytic, and ultrasonic techniques are often more expensive than conventional methods. Many healthcare providers face budget constraints when adopting these products. Reimbursement policies vary across regions, limiting patient access to premium solutions. Small clinics and care centers struggle to afford specialized wound devices. Price sensitivity among patients affects the adoption rate of advanced debridement options. The lack of standardized reimbursement models for outpatient care adds complexity. It remains a concern for stakeholders aiming to make modern wound care more affordable.

Shortage of Skilled Professionals and Inconsistent Clinical Practices

The shortage of trained wound care professionals limits the efficiency of the UK Wound Debridement Market. Not all healthcare centers have specialists experienced in using advanced techniques. Inconsistent clinical guidelines lead to varied treatment outcomes. Training programs for nurses and general practitioners are still insufficient. The manual nature of some debridement methods increases risk when not handled correctly. Limited awareness of modern options among rural practitioners affects service reach. Hospitals face pressure to maintain consistent care quality across all regions. It continues to face workforce and practice standardization issues impacting treatment effectiveness.

Market Opportunities:

Growing Research Investment and Innovation in Biochemical Debridement Products

Expanding R&D activity presents strong opportunities for the UK Wound Debridement Market. Companies are investing in next-generation enzymatic agents and biopolymer-based gels. These innovations improve tissue selectivity and reduce healing time. Collaborations between medical institutions and biotechnology firms accelerate new product launches. The demand for non-invasive solutions encourages continuous research on bioactive formulations. Startups focusing on wound diagnostics and therapy optimization create new value streams. Hospitals are open to pilot testing advanced products under clinical supervision. It benefits from rising interest in biologically inspired wound debridement technologies.

Rising Home Care Demand and Expansion of Community-Based Wound Management

Growing acceptance of home-based and community wound care offers new growth avenues for the UK Wound Debridement Market. Patients prefer convenience and cost efficiency through outpatient and at-home treatments. Portable enzymatic kits and pre-moistened dressings fit this shift. Telemedicine supports remote wound monitoring and consultation. Healthcare reforms encourage training for home nurses specializing in debridement. The model reduces hospital congestion and improves patient satisfaction. It continues to gain traction as health systems move toward decentralized care delivery and patient empowerment.

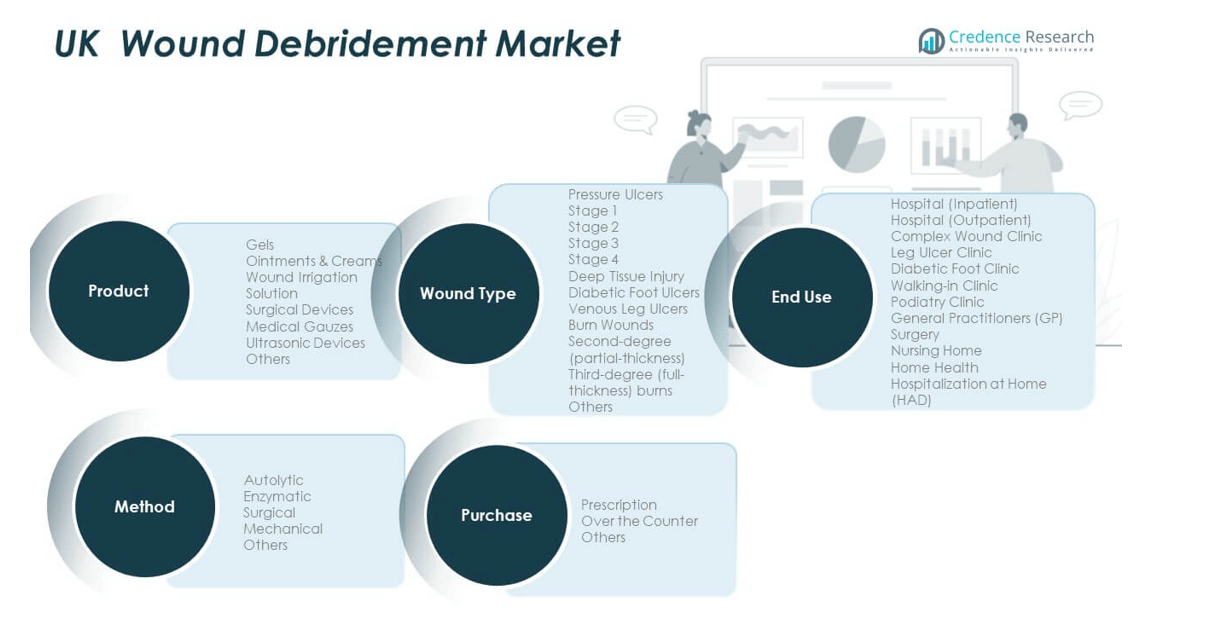

Market Segmentation Analysis:

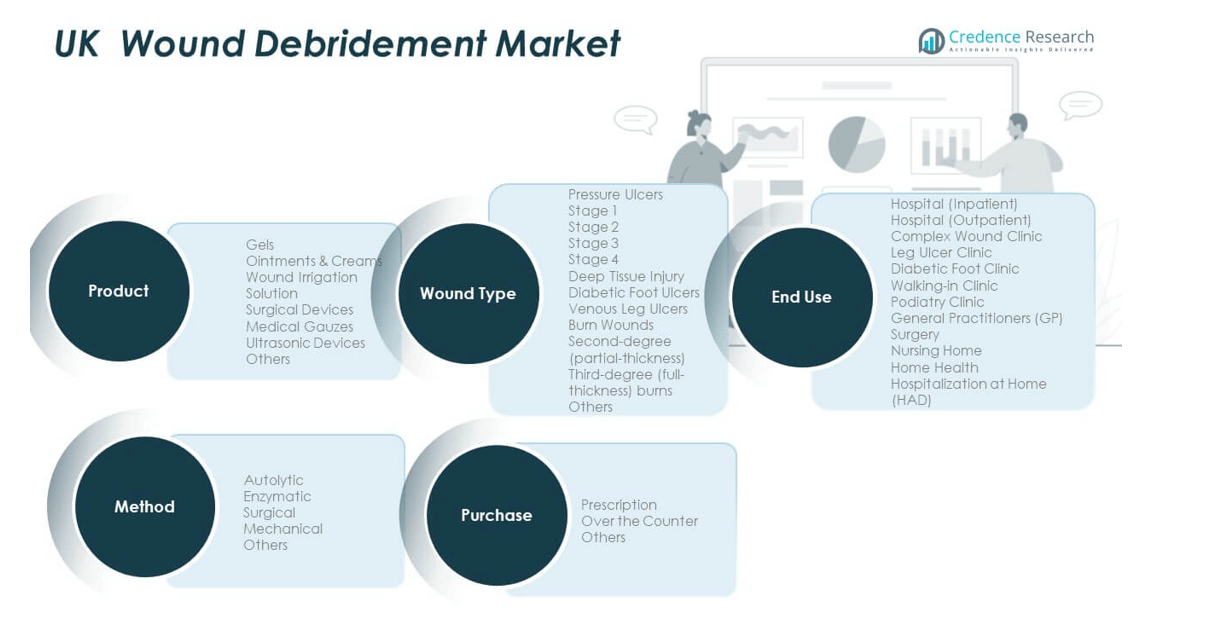

By Product Segment

The UK Wound Debridement Market includes gels, ointments and creams, wound irrigation solutions, surgical devices, medical gauzes, ultrasonic devices, and others. Gels lead the segment due to their ease of application and strong demand for enzymatic formulations. Surgical and ultrasonic devices are gaining traction in hospitals for complex wound treatments. Medical gauzes and irrigation solutions maintain steady adoption in primary care settings. It continues to grow as manufacturers introduce advanced bioactive gels and eco-friendly formulations to improve wound healing outcomes.

- For instance, Smith+Nephew has cited a systematic review and meta-analysis published in 2021 that showed its IODOSORB Cadexomer Iodine dressing range was more than twice as likely to heal wounds compared to standard care over 8 to 12 weeks for chronic ulcer patients. The analysis confirmed the measurable efficacy of advanced gel-based debridement therapies in the clinical setting.

By Method Segment

The market is segmented into autolytic, enzymatic, surgical, mechanical, and others. Autolytic and enzymatic methods dominate due to their painless and selective tissue removal process. Surgical debridement remains crucial for severe wound management in clinical settings. Mechanical techniques are used for cost-effective treatment in outpatient clinics. It benefits from innovation in enzyme-based solutions that reduce healing time and infection risks.

- For instance, studies like one published in the Journal of Wound Care in 2011 have demonstrated that Mölnlycke Health Care’s Debrisoft mechanical pad achieves fast and effective debridement. A 2012 evaluation by Stephen-Haynes and Callaghan further reinforced this, with 85% of nurses reporting clearer visibility of the wound bed after using Debrisoft, significantly optimizing the speed and efficiency of wound bed preparation compared to conventional mechanical methods in outpatient environments.

By Wound Type Segment

The market covers pressure ulcers, diabetic foot ulcers, venous leg ulcers, and burn wounds across various stages. Pressure ulcers and diabetic foot ulcers account for the largest share due to rising chronic cases in elderly populations. Burn wounds, including second and third-degree injuries, require advanced enzymatic and surgical care. It continues to expand with growing demand for specialized products addressing deep tissue injuries and chronic ulcers.

By End-use and Purchase Segment

Hospitals, complex wound clinics, diabetic foot clinics, and home healthcare facilities are major end users. Hospital inpatient and outpatient care lead due to high procedure volumes and skilled specialists. Community clinics and home health settings are emerging growth areas driven by portable products. Prescription-based products dominate, while over-the-counter options grow with consumer self-care awareness. It sustains momentum through expanding outpatient and home-based wound care adoption.Top of Form

Segmentation:

By Product Segment

- Gels

- Ointments & Creams

- Wound Irrigation Solution

- Surgical Devices

- Medical Gauzes

- Ultrasonic Devices

- Others

By Method Segment

- Autolytic

- Enzymatic

- Surgical

- Mechanical

- Others

By Wound Type Segment

- Pressure Ulcers

- Stage 1

- Stage 2

- Stage 3

- Stage 4

- Deep Tissue Injury

- Diabetic Foot Ulcers

- Venous Leg Ulcers

- Burn Wounds

- Second-degree (Partial-thickness)

- Third-degree (Full-thickness)

- Others

By End-use Segment

- Hospital (Inpatient)

- Hospital (Outpatient)

- Complex Wound Clinic

- Leg Ulcer Clinic

- Diabetic Foot Clinic

- Walk-in Clinic

- Podiatry Clinic

- General Practitioners (GP) Surgery

- Nursing Home

- Home Health

- Hospitalization at Home (HAD)

By Purchase Segment

- Prescription

- Over the Counter

- Others

Regional Analysis:

England – Market Leader with Strong Institutional Healthcare Network

England holds the largest share of the UK Wound Debridement Market, accounting for around 65% of total revenue. The dominance is supported by a well-established healthcare system under the NHS and the presence of advanced wound management centers. Large hospitals in London, Manchester, and Birmingham actively adopt enzymatic and ultrasonic debridement products. Government programs focused on chronic wound management and diabetic care create consistent demand. Continuous R&D funding and partnerships with global wound care firms enhance product accessibility. The strong network of community health services ensures effective post-treatment wound care support. It benefits from integrated healthcare policies and growing emphasis on early wound intervention.

Scotland – Expanding Through Government-Led Health Initiatives

Scotland contributes about 18% of the UK Wound Debridement Market, driven by initiatives improving patient access to specialized wound care. The Scottish government’s focus on reducing hospital-acquired pressure ulcers supports market adoption. Regional hospitals and care homes use enzymatic and autolytic methods for chronic wound management. Investments in medical device procurement strengthen public hospital capabilities. Collaboration between wound care specialists and research institutions drives clinical innovation. Home care services are expanding, increasing product use beyond hospitals. It grows steadily with emphasis on cost-effective and patient-friendly wound care methods.

Wales and Northern Ireland – Emerging Segments with Improving Healthcare Outreach

Wales and Northern Ireland collectively account for nearly 17% of the UK Wound Debridement Market. Both regions are witnessing growth through better healthcare infrastructure and patient education programs. Rural outreach clinics and telemedicine services are improving access to debridement therapies. Hospitals in Cardiff and Belfast are upgrading wound management units with advanced mechanical and enzymatic systems. Local health boards promote awareness campaigns addressing diabetic and venous ulcers. Rising elderly populations create consistent demand for long-term wound treatment products. It continues to expand through regional collaborations and the introduction of new wound care technologies tailored to local needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

The UK Wound Debridement Market is moderately consolidated, with key players focusing on innovation and product expansion. Leading companies such as Smith & Nephew, ConvaTec Group PLC, and Advanced Medical Solutions Limited maintain dominance through advanced wound care portfolios. Regional firms like Advancis Medical and URGO Medical enhance competition by offering specialized and cost-effective debridement products. Companies invest in R&D to develop biocompatible gels, enzymatic solutions, and ultrasonic systems for faster healing. Strategic collaborations with hospitals and clinics strengthen distribution networks. It continues to advance through technology integration and partnerships aimed at improving wound management outcomes.

Recent Developments:

- In September 2025, ConvaTec Group PLC initiated a significant share buyback program valued at up to $300 million, aiming to optimize shareholder value and reinforce its financial position within the UK wound care and wound debridement sector.

- In August 2025, Advancis Medical introduced the Activon Manuka Honey Barrier Cream across the UK, using 25% medical grade Manuka honey and specifically targeting enhanced wound healing and protection in clinical and home care settings.

- In June 2025, Advanced Medical Solutions Limited announced regulatory approval and expansion of new product launches for advanced wound management in the UK, including entering the market with new biosurgical devices and leveraging the recent acquisition of Peters Surgical to strengthen its UK wound care portfolio.

Report Coverage:

The research report offers an in-depth analysis based on product type, method, wound type, end use, and purchase segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for advanced enzymatic and autolytic debridement products will rise across clinical settings.

- Integration of digital wound monitoring tools will strengthen remote and home-based care adoption.

- Hospitals will invest in ultrasonic and mechanical devices for faster, safer debridement.

- Growth in the elderly population will increase chronic wound incidence, driving product demand.

- Collaborations between manufacturers and healthcare systems will expand training and awareness.

- Eco-friendly and biodegradable wound care materials will gain popularity in procurement policies.

- Smaller domestic players will enter niche markets through cost-efficient and localized products.

- R&D in bioactive compounds and tissue-selective agents will enhance healing efficiency.

- Home healthcare services will expand, supporting portable and user-friendly wound care kits.

- The UK Wound Debridement Market will evolve toward patient-centric, technology-enabled treatment solutions.