| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japanese Food Market In London Market Size 2024 |

USD 2190.72 Million |

| Japanese Food Market In London Market, CAGR |

4.32% |

| Japanese Food Market In London Market Size 2032 |

USD 3072.75 Million |

Market Overview:

The Japanese Food Market In London Market is projected to grow from USD 2190.72 million in 2024 to an estimated USD 3072.75 million by 2032, with a compound annual growth rate (CAGR) of 4.32% from 2024 to 2032.

Several factors contribute to the expansion of the Japanese food market in London. A significant driver is the increasing health consciousness among consumers. Japanese cuisine is often perceived as a healthy dining option, emphasizing fresh ingredients and balanced flavors. This perception aligns with the global trend towards healthier eating habits. Additionally, the growing multicultural population in London has heightened interest in diverse culinary experiences, including Japanese food. The proliferation of Japanese restaurants and the availability of Japanese products in supermarkets cater to this demand, making Japanese cuisine more accessible to a broader audience. The rise of delivery services and online ordering platforms has further facilitated the consumption of Japanese food, offering convenience to consumers and contributing to market growth.

London serves as a central hub for the Japanese food market in the UK, owing to its diverse population and cosmopolitan nature. The city boasts a high concentration of Japanese restaurants, ranging from traditional establishments to modern fusion eateries. This variety caters to both purists and those seeking innovative culinary experiences. Areas with significant foot traffic, such as Soho and the City of London, host numerous Japanese dining options, attracting both locals and tourists. The presence of Japanese cultural institutions and events in London also supports the market, fostering a deeper appreciation for Japanese cuisine and culture. While other UK cities like Birmingham and Manchester are experiencing growth in Japanese food offerings, London remains the epicenter, continually influencing culinary trends nationwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Japanese food market in London is projected to grow from USD 2,190.72 million in 2024 to USD 3,072.75 million by 2032, with a CAGR of 4.32%.

- Health-conscious consumers are driving the growth of Japanese cuisine, as the cuisine is seen as fresh, nutritious, and balanced, aligning with global trends toward healthier eating.

- London’s multicultural population has fueled a demand for diverse culinary experiences, with Japanese cuisine gaining popularity across various consumer segments.

- The rise in the number of Japanese restaurants and food chains in London, including major brands like Yo! Sushi and Wagamama, is expanding accessibility to Japanese food.

- Consumer preferences are shifting toward authentic Japanese dining experiences, with increased demand for high-quality ingredients and culturally immersive restaurants.

- The growing awareness of the health benefits of Japanese food, particularly its use of fresh seafood and vegetables, is attracting a broader audience, especially among wellness-focused consumers.

- Despite the growth, challenges such as the high cost of authentic ingredients, supply chain disruptions, and intense market competition remain key obstacles for businesses in the Japanese food sector.

Market Drivers:

Rising Popularity of Japanese Cuisine

The growing demand for Japanese food in London can be attributed to its rising popularity among diverse consumer segments. As the UK continues to embrace global cuisines, Japanese dishes such as sushi, ramen, and tempura have garnered significant attention. This trend is further amplified by the increasing influence of Japanese culture, particularly through media and social platforms, which promotes both traditional and modern Japanese culinary experiences. The perception of Japanese food as healthy, light, and fresh adds to its allure, especially among health-conscious consumers seeking balanced and nutritious meal options. For instance, sushi is often considered a wholesome choice due to its low calorie count and nutrient-dense ingredients like seafood and vegetables.

Increasing Number of Japanese Restaurants and Food Chains

Another key driver of the Japanese food market in London is the expansion of Japanese restaurants and food chains. Over recent years, London has seen a steady increase in both independent Japanese establishments and larger restaurant chains. Major chains such as Wagamama, Yo! Sushi, and Wasabi have been instrumental in shaping the dining landscape by introducing Japanese cuisine to a wider audience. Furthermore, the rise of food delivery services and the growing trend of home dining have led to the expansion of Japanese food offerings in the online space, making it more accessible to consumers across the city.

Shifting Consumer Preferences Towards Authentic Dining Experiences

In addition to the growing availability of Japanese food, there has been a marked shift in consumer preferences toward more authentic and high-quality dining experiences. London’s discerning consumers are increasingly seeking out traditional Japanese dining experiences that offer not only the food but also a full cultural immersion. For instance, restaurants like Sushi Kanesaka have set benchmarks for authenticity by sourcing premium ingredients from Japan and offering omakase-style dining for an elevated experience. This trend has led to an influx of premium Japanese restaurants that focus on authentic ingredients, skilled chefs, and culturally rich dining atmospheres. As a result, the market has seen a rise in demand for high-end, authentic Japanese eateries that cater to both local and international clients.

Growing Awareness of Japanese Food Benefits

The growing awareness of the health benefits associated with Japanese cuisine is also contributing to the expansion of the market. Japanese food is widely regarded for its nutritional value, including its emphasis on fresh seafood, seasonal vegetables, and balanced portion sizes. This health-conscious aspect of Japanese dining is particularly appealing to the London population, which is increasingly prioritizing wellness and healthy eating. Moreover, the rise of plant-based and sustainable eating habits in the city has aligned with the Japanese culinary focus on plant-based ingredients and environmentally friendly practices. These factors combined create a conducive environment for the continued growth of the Japanese food market in London.

Market Trends:

Growth of Sushi and Ready-to-Eat Offerings

One of the most prominent trends in the Japanese food market in London is the increasing popularity of sushi and ready-to-eat offerings. Sushi, in particular, has seen significant growth, driven by its convenience and perceived health benefits. Consumers, particularly busy professionals, are opting for sushi as a quick and nutritious meal option. The rise of sushi as a mainstream food choice has led to the development of numerous sushi chains and delivery services, making it widely accessible across the city. Ready-to-eat sushi and meal kits have become a popular choice for consumers looking for quick yet high-quality dining experiences at home, especially with the expansion of online grocery stores and food delivery platforms. For instance, Tazaki Foods, a key player in the UK’s Japanese food sector, has contributed significantly to making sushi ingredients and meal kits mainstream by offering products like their Yutaka brand in supermarkets.

Rise in Plant-Based and Vegan Japanese Options

As plant-based and vegan diets continue to gain traction in London, there has been a noticeable rise in plant-based and vegan Japanese food options. Many Japanese restaurants are adapting their menus to include vegan-friendly versions of traditional dishes such as sushi, ramen, and tempura. The growing demand for plant-based food in London has prompted both established Japanese eateries and new entrants to cater to this segment, providing innovative dishes made from tofu, tempeh, and other plant-based ingredients. This trend is not only attracting health-conscious consumers but also those who follow ethical eating practices, making plant-based Japanese food a key market trend.

Expansion of Japanese Street Food Culture

Japanese street food culture has experienced a surge in popularity within the London food scene. The rise of food markets, festivals, and pop-up events dedicated to Japanese cuisine has significantly contributed to the growth of street food offerings. Food trucks and temporary stalls offering casual Japanese meals such as takoyaki, okonomiyaki, and yakitori are becoming common sights at London’s outdoor markets. This trend reflects a growing interest in affordable, high-quality food that captures the essence of Japanese street food culture. As these street food options grow in popularity, they appeal to both local Londoners and tourists, further establishing Japanese cuisine as a prominent part of the city’s culinary landscape.

Increased Focus on Authentic and Regional Japanese Specialties

Another emerging trend in the Japanese food market in London is the increasing focus on authentic regional Japanese specialties. While sushi and ramen have long been staples, consumers are now showing a greater interest in exploring lesser-known regional dishes. Restaurants in London are expanding their menus to feature specialties from different parts of Japan, such as Hiroshima-style okonomiyaki, kaiseki (traditional multi-course meals), and yakitori from Tokyo. For example, recent openings like Ichikokudo Hokkaido Ramen in London celebrate regional ingredients such as Hokkaido-sourced kelp for added authenticity. This trend reflects the growing consumer interest in experiencing the full diversity of Japanese cuisine beyond the mainstream offerings. It also highlights a more sophisticated approach to dining, with London’s food scene increasingly embracing authenticity and variety within Japanese culinary traditions.

Market Challenges Analysis:

High Costs of Authentic Ingredients

One of the primary restraints in the Japanese food market in London is the high cost of authentic ingredients. Traditional Japanese cuisine relies heavily on specific, high-quality ingredients such as fresh seafood, specialty rice, and exotic vegetables. These ingredients can be expensive to import, leading to higher production costs for restaurants and food outlets. For instance, bluefin tuna, a key ingredient in high-end sushi, is both expensive and subject to price fluctuations due to overfishing and environmental factors. This can result in higher menu prices, potentially limiting the affordability of Japanese food for certain consumer segments. Smaller and independent eateries may particularly feel the strain, as they struggle to maintain profitability while ensuring authenticity in their offerings.

Supply Chain and Import Challenges

The Japanese food market in London also faces supply chain and import challenges, which can lead to inconsistencies in product availability. Geopolitical issues, customs regulations, and transportation disruptions can affect the timely delivery of key ingredients from Japan. These disruptions can lead to shortages, higher costs, and a lack of variety in certain dishes. For restaurants and food businesses that rely on specific Japanese products to maintain their authenticity and quality, these challenges can disrupt operations and affect customer satisfaction. Additionally, as demand for Japanese cuisine grows, competition for supply can further exacerbate these issues.

Intense Competition in the Market

The Japanese food market in London is highly competitive, with both established brands and new entrants constantly vying for consumer attention. This intense competition can make it difficult for individual businesses to stand out, particularly in a city where diverse food options are readily available. Furthermore, the increasing number of Japanese restaurants and chains may result in market saturation, leading to price wars, lower margins, and pressure to constantly innovate. For smaller or niche Japanese food businesses, competing with larger, well-established brands may present a significant challenge in terms of brand recognition and customer loyalty.

Market Opportunities:

A key opportunity for the Japanese food market in London lies in the growing demand for delivery and takeaway services. With the increasing reliance on food delivery platforms and changing consumer lifestyles, many customers are opting for the convenience of ordering Japanese meals from home. The rise of platforms like Deliveroo, Uber Eats, and Just Eat has significantly boosted the demand for convenient meal options, including sushi, ramen, and other Japanese dishes. Japanese food businesses that invest in delivery-friendly packaging, efficient online ordering systems, and strategic partnerships with delivery services can tap into this growing market. Additionally, the expansion of meal kit services featuring Japanese recipes provides another avenue for restaurants and food brands to reach consumers who prefer cooking at home but still desire an authentic experience.

Another promising opportunity lies in targeting niche consumer segments, particularly health-conscious, vegan, and sustainability-focused consumers. As the awareness of plant-based and sustainable eating practices grows in London, there is a rising demand for Japanese food offerings that cater to these preferences. Japanese cuisine, with its emphasis on fresh seafood, vegetables, and minimal use of processed ingredients, naturally aligns with these trends. By introducing more plant-based options, promoting sustainable sourcing practices, and offering health-conscious alternatives, Japanese food businesses can attract a dedicated consumer base. Furthermore, promoting authentic regional Japanese specialties could appeal to adventurous eaters seeking unique dining experiences. This focus on specialized offerings can differentiate businesses and foster customer loyalty within specific market segments.

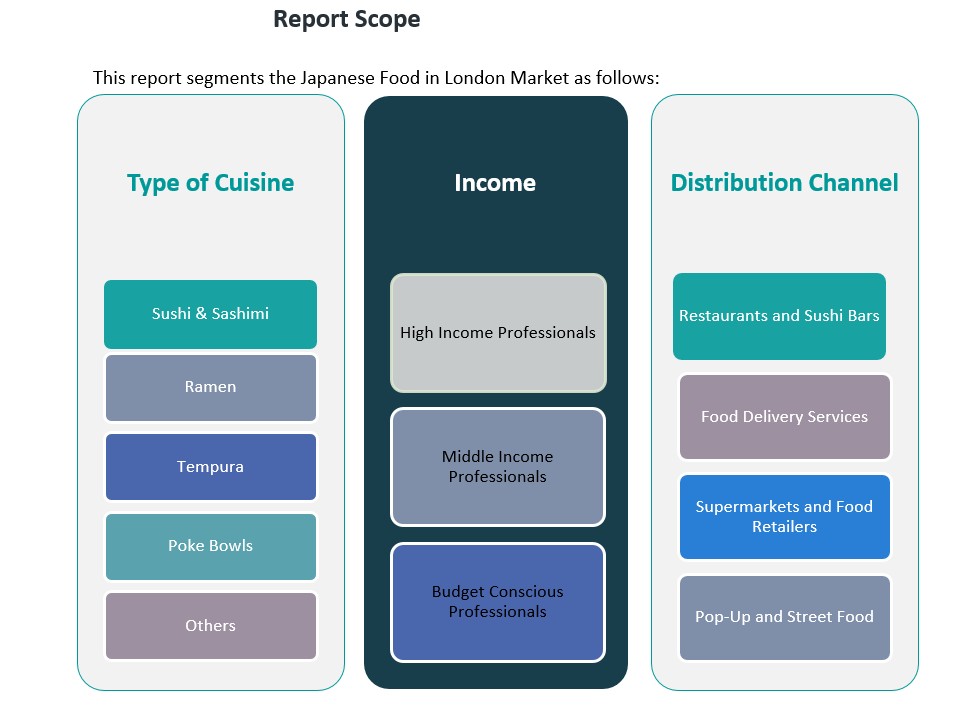

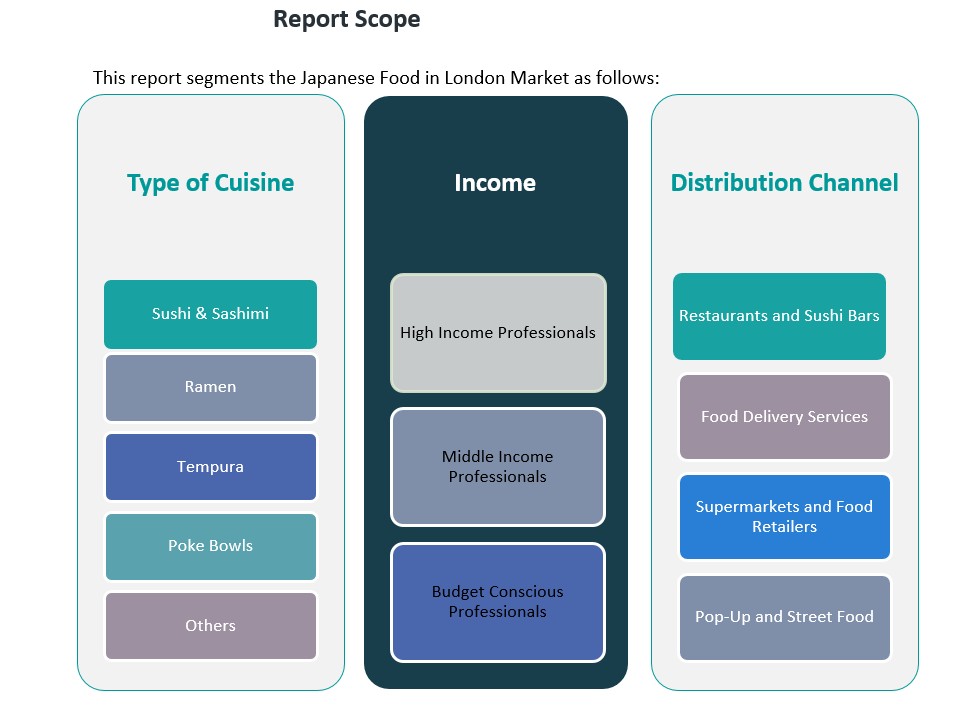

Market Segmentation Analysis:

The Japanese food market in London exhibits distinct segmentation across type of cuisine, income levels, and distribution channels, providing diverse opportunities for growth.

By Type of Cuisine Segment:

Sushi & Sashimi remain the dominant offerings within the market, driven by their global appeal and perceived health benefits. Ramen follows closely, with its comforting and customizable nature capturing significant consumer interest, especially in colder months. Tempura continues to thrive as a traditional favorite, while Poke Bowls have gained popularity due to their freshness and alignment with health-conscious eating trends. Other Japanese cuisine offerings, including donburi and yakitori, also contribute to the market’s diversity, catering to evolving consumer preferences.

By Income Segment:

The market is divided into three key income segments. High-income professionals seek premium dining experiences, often frequenting high-end restaurants and exclusive Japanese establishments. Middle-income professionals favor more affordable, yet high-quality, options, such as sushi chains and ramen bars. Budget-conscious professionals are drawn to value-for-money offerings, such as takeaway sushi and tempura, often opting for quick and affordable meals from supermarkets or food trucks.

By Distribution Channel Segment:

The distribution channels reflect changing consumer behaviors. Restaurants and sushi bars remain the most established segment, attracting customers seeking traditional dining experiences. Food delivery services have gained prominence, with consumers increasingly opting for convenience and the ability to enjoy Japanese food at home. Supermarkets and food retailers offer an expanding range of Japanese ingredients and ready-to-eat meals, while pop-up and street food markets provide an exciting, affordable, and casual alternative, particularly for younger and more adventurous consumers.

Segmentation:

By Type of Cuisine Segment:

- Sushi & Sashimi

- Ramen

- Tempura

- Poke Bowls

- Others

By Income Segment:

- High Income Professionals

- Middle Income Professionals

- Budget Conscious Professionals

By Distribution Channel Segment:

- Restaurants and Sushi Bars

- Food Delivery Services

- Supermarkets and Food Retailers

- Pop-Up and Street Food

Regional Analysis:

Dominance of London in Japanese Cuisine Consumption

London stands as the primary hub for Japanese cuisine within the United Kingdom, attributed to its diverse and multicultural populace. The city’s vibrant food scene boasts numerous Japanese restaurants, specialty food stores, and cultural festivals, solidifying its status as the epicenter of Japanese culinary experiences. This concentration not only caters to the local demand but also attracts international visitors seeking authentic Japanese flavors.

Influence of Other UK Regions

Beyond London, other regions such as the South East, North West, West Midlands, and Scotland exhibit a growing appreciation for Japanese cuisine. Cities like Birmingham, Manchester, and Glasgow have seen an increase in Japanese restaurants and food offerings, reflecting a broader national interest. However, these regions’ market shares remain significantly smaller compared to London, indicating that while there is a national appreciation for Japanese food, consumption is predominantly urban and heavily centered in the capital.

Key Player Analysis:

- Hakata Ramen

- Uzumaki London

- Japan Centre

- Sanjugo Angel

- Tokii

Competitive Analysis:

The Japanese food market in London is characterized by a dynamic and competitive landscape, featuring a blend of established chains and emerging independent establishments. The market is primarily dominated by a few key players, with Wagamama Ltd holding a significant share. In addition to Wagamama, other notable chains such as Itsu and Yo! Sushi contribute to the competitive environment. Itsu, for instance, operates 83 stores in the UK, with a substantial concentration in London. The company has ambitious expansion plans, aiming to increase its UK outlets to 300 and expand internationally. The competitive atmosphere is further intensified by a multitude of independent Japanese restaurants that offer diverse culinary experiences. Establishments like Sushi Kanesaka, The Aubrey, and Taku have garnered acclaim for their authentic offerings and unique dining experiences. This competitive landscape drives continuous innovation and quality enhancement, benefiting consumers with a wide array of choices that cater to varying preferences and price points.

Recent Developments:

- In April 2025, Marugame Udon, one of Japan’s leading restaurant brands, announced a major expansion in the UK and Ireland through a master franchise agreement with Karali Group. This partnership marks a significant shift from company-operated restaurants to a fully franchised model. Karali Group has acquired Marugame Udon’s existing estate, which includes eight outlets in London and one in Reading, and will spearhead the development of new locations.

Market Concentration & Characteristics:

The Japanese food market in London is characterized by a high degree of market concentration, with a few key players dominating the landscape. Chains such as Itsu, Wasabi, and Yo! Sushi have established a significant presence, collectively accounting for a substantial share of the market. For instance, Itsu operates 83 stores in the UK, with a majority located in London, and has ambitious plans for further expansion. This concentration is further evidenced by the presence of large-scale establishments like Ichiba, Europe’s largest Japanese food hall, located in Westfield London. The dominance of these major players has led to a competitive environment where innovation and quality are continually enhanced to meet consumer demands. However, this market structure also poses challenges for smaller, independent establishments striving to capture market share amidst the influence of these large chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on By Type of Cuisine Segment, By Income Segment and By Distribution Channel Segment. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The demand for Japanese food in London is expected to continue growing due to increasing consumer interest in global cuisines.

- Sushi and ramen will remain dominant, but niche offerings like vegan and plant-based Japanese dishes will see significant growth.

- Delivery services and takeaway options will become even more crucial, driven by convenience and the ongoing trend of home dining.

- The rise of sustainable and ethically sourced ingredients will influence Japanese food businesses to adopt eco-friendlier practices.

- Regional Japanese specialties will gain popularity as consumers seek more authentic and diverse dining experiences.

- The increasing number of food festivals and pop-up events will provide new platforms for Japanese food businesses to engage with consumers.

- The market will see more investments in technology, such as AI-powered ordering systems and automated food preparation.

- London’s multicultural demographic will continue to drive demand for Japanese food, attracting both locals and tourists.

- As health-conscious eating grows in importance, Japanese cuisine’s reputation for being fresh and nutritious will strengthen its market position.

- Smaller independent restaurants will face greater challenges in competing with large, established chains, prompting innovation to stay relevant.