Market Overview

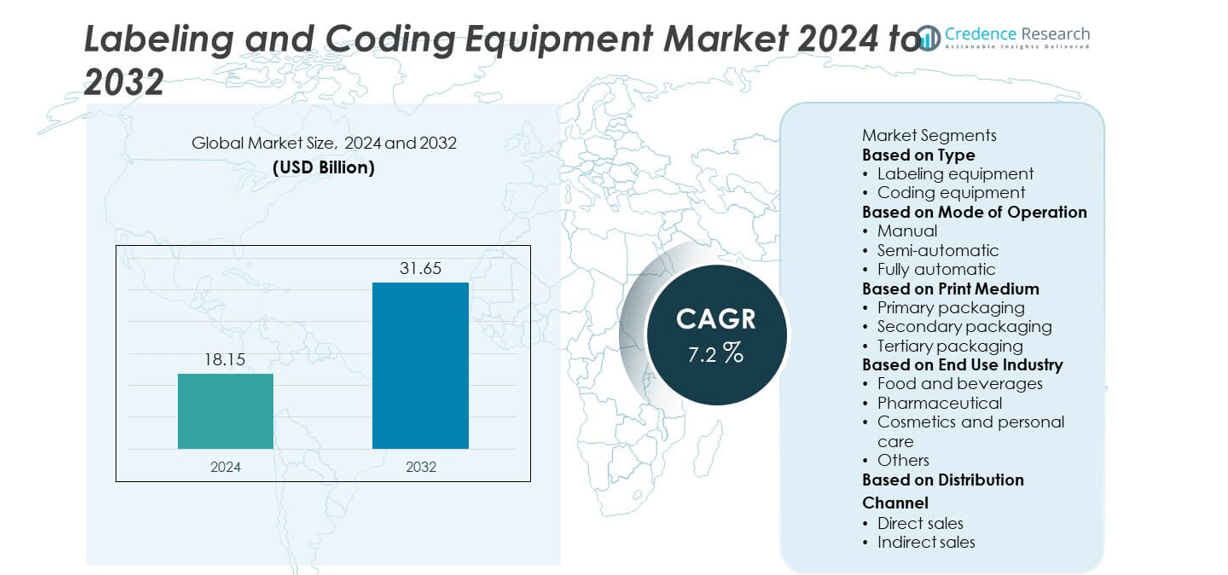

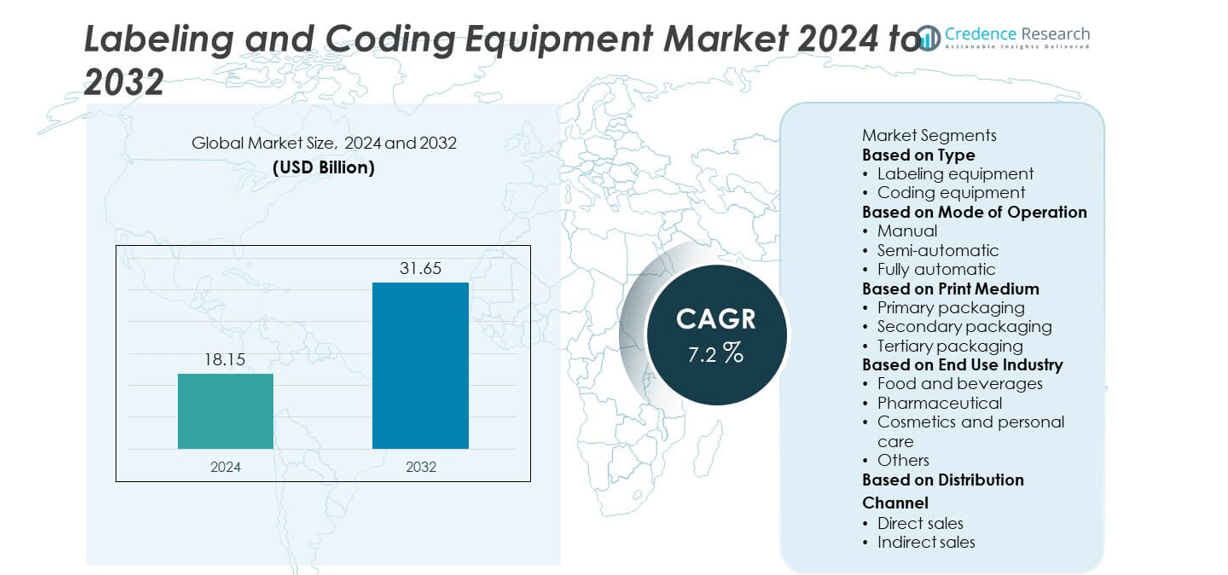

The Labeling and Coding Equipment Market size was valued at USD 18.15 billion in 2024 and is projected to reach USD 31.65 billion by 2032, growing at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Labeling and Coding Equipment Market Size 2024 |

USD 18.15 billion |

| Labeling and Coding Equipment Market, CAGR |

7.2% |

| Labeling and Coding Equipment Market Size 2032 |

USD 31.65 billion |

The Labeling and Coding Equipment Market grows with strong demand from industries such as food, beverage, pharmaceuticals, and logistics that require accurate product identification and regulatory compliance. Rising automation in packaging lines fuels adoption of advanced coding systems that ensure speed, efficiency, and traceability.

The Labeling and Coding Equipment Market shows strong geographical spread across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America leads adoption with advanced packaging infrastructure, strict regulatory frameworks, and high automation in food, beverage, and pharmaceutical sectors. Europe emphasizes sustainability and compliance with labeling standards, driving steady demand in consumer goods and industrial applications. Asia-Pacific emerges as the fastest-growing region, supported by rising industrialization, expanding e-commerce, and growing manufacturing bases in China and India. Latin America and the Middle East & Africa witness gradual growth with increasing investments in packaging modernization and food safety compliance. Key players shaping this market include Domino Printing Sciences, Markem-Imaje, HERMA, and BW Integrated Systems, all of which focus on advanced labeling solutions, sustainable technologies, and strategic partnerships to strengthen their presence.

Market Insights

- The Labeling and Coding Equipment Market was valued at USD 18.15 billion in 2024 and is projected to reach USD 31.65 billion by 2032, growing at a CAGR of 7.2%.

- Rising demand from food, beverage, pharmaceutical, and personal care industries drives adoption of labeling and coding systems to ensure compliance, traceability, and brand authenticity.

- Market trends show increasing use of eco-friendly inks, digital printing technologies, and automated solutions designed to improve efficiency and reduce waste.

- Competitive landscape features major players such as Domino Printing Sciences, Markem-Imaje, HERMA, BW Integrated Systems, and Hitachi IESA, which focus on product innovation, global expansion, and partnerships.

- Market restraints include high equipment costs, integration challenges with existing production lines, and ongoing maintenance expenses that restrict adoption for small and mid-sized enterprises.

- North America leads the market with advanced automation and strict compliance frameworks, while Europe shows growth with sustainability-driven demand and Asia-Pacific emerges as the fastest-growing region due to industrialization and e-commerce growth.

- Long-term opportunities exist in smart labeling, RFID-enabled solutions, and digital tracking systems that enhance supply chain transparency and meet evolving regulatory requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Product Identification and Traceability

The Labeling and Coding Equipment Market grows with strong demand for accurate product identification and traceability across industries. Companies in food, beverages, and pharmaceuticals rely on durable codes to meet safety and recall standards. Governments enforce stricter regulations for labeling to ensure consumer safety and supply chain transparency. Manufacturers adopt advanced solutions such as thermal inkjet, laser coding, and thermal transfer for precise applications. The ability to support compliance and reduce counterfeit risks reinforces adoption. It secures the role of labeling and coding equipment as a critical enabler of product integrity.

- For instance, the Domino Printing Sciences Ax550i inkjet printer delivers high-resolution, fast coding at speeds of up to 7.2 m/s, supporting 24/7 production lines. The printer features robust, marine-grade 316 stainless-steel enclosures with an IP66 rating, making it ideal for washdown environments.

Expanding Adoption Across Food, Beverage, and Pharmaceutical Sectors

The Labeling and Coding Equipment Market benefits from rising use in food, beverage, and pharmaceutical sectors, where compliance and branding are essential. Packaging lines integrate high-speed coding equipment to deliver clear expiration dates, batch codes, and barcodes. Growth in ready-to-eat products and global pharmaceutical trade accelerates demand for reliable systems. Flexible packaging formats also drive adoption of versatile labeling solutions. Regulatory pressure on pharmaceutical serialization expands coding equipment use globally. It reinforces the need for scalable systems that combine efficiency with reliability.

- For instance, the Markem‑Imaje SmartLase F500 provides permanent fiber‑laser codes at speeds exceeding 1,750 cans per minute and is built with a mean time before failure of 100,000 hours

Increasing Integration with Automation and Smart Manufacturing

The Labeling and Coding Equipment Market advances with growing integration into automated production systems. Manufacturers invest in automated labeling solutions to improve accuracy, reduce downtime, and boost throughput. Smart factories rely on connected systems that monitor labeling processes and ensure consistency. Equipment with IoT connectivity and real-time monitoring supports predictive maintenance. This integration reduces errors while cutting operational costs in high-volume industries. It highlights labeling and coding equipment as a vital part of Industry 4.0 strategies.

Focus on Sustainability and Eco-Friendly Packaging Solutions

The Labeling and Coding Equipment Market grows with rising emphasis on sustainability and eco-friendly packaging. Brands prioritize recyclable packaging materials, creating demand for labeling technologies that work on diverse substrates. Equipment using solvent-free inks and laser coding reduces environmental impact while maintaining quality. Green labeling practices align with global initiatives promoting sustainable production. Consumers prefer products with clear, eco-conscious labels, boosting adoption across personal care and household products. It ensures long-term opportunities by linking equipment innovation with sustainability targets.

Market Trends

Adoption of Digital and Smart Labeling Solutions

The Labeling and Coding Equipment Market shows a clear trend toward digital and smart labeling systems. Industries adopt digital printing and QR code technology to provide interactive product information. Smart labels support track-and-trace applications, helping companies strengthen supply chain visibility. E-commerce and retail sectors drive adoption as they require flexible coding for diverse packaging. Integration of digital solutions allows personalization and quick product differentiation. It ensures labeling equipment evolves to meet growing demands for data-rich communication.

- For instance, Markem‑Imaje’s 9450 E CIJ printer codes on extruded materials at up to 1,000 meters per minute and can mark optical fibers as narrow as 1 mm.

Growth of Laser Coding and Eco-Friendly Technologies

The Labeling and Coding Equipment Market advances with strong adoption of laser coding technologies. Laser systems offer permanent, high-quality marks without consumables, reducing costs and waste. Companies shift toward solvent-free, low-VOC inks to align with environmental regulations. Industries focus on adopting eco-friendly equipment that supports recyclable and biodegradable packaging. Laser and green labeling solutions lower operational risks by ensuring compliance with sustainability standards. It highlights the role of innovation in meeting environmental goals and consumer expectations.

- For instance, Markem‑Imaje’s SmartLase C150 and C350 CO₂ lasers code at up to 150,000 products per hour on plastic substrates.

Integration with Automation and Industry 4.0 Platforms

The Labeling and Coding Equipment Market evolves with rising integration into automated and smart manufacturing lines. Equipment increasingly features IoT connectivity, enabling real-time monitoring and predictive maintenance. Automation supports high-speed production lines, improving accuracy and reducing human errors. Companies seek equipment that integrates seamlessly with robotics and smart factory ecosystems. This trend strengthens efficiency while reducing operational costs across industrial environments. It positions labeling and coding equipment as an essential component of digital manufacturing strategies.

Expansion of Flexible Packaging and Diverse Applications

The Labeling and Coding Equipment Market grows with the expansion of flexible packaging across food, beverage, and healthcare sectors. Companies demand equipment capable of coding on varied substrates such as films, plastics, and foils. Growth in ready-to-eat meals, pharmaceuticals, and personal care supports higher equipment adoption. Compact, versatile solutions are developed to handle smaller, customizable packaging formats. This trend drives demand for adaptable technologies that can support high product variation. It reinforces the need for multi-functional labeling systems across global industries.

Market Challenges Analysis

High Costs of Advanced Equipment and Maintenance

The Labeling and Coding Equipment Market faces challenges from the high costs associated with advanced systems. Laser and digital coding machines require significant upfront investment compared to traditional solutions. Small and medium enterprises often hesitate to adopt due to cost-sensitive operations. Maintenance expenses, consumables, and frequent upgrades further increase the financial burden. In competitive industries with tight margins, these costs delay large-scale adoption. It limits growth opportunities among smaller manufacturers that lack the resources for advanced technology.

Regulatory Complexity and Performance Limitations

The Labeling and Coding Equipment Market also struggles with regulatory compliance and performance issues across diverse industries. Different regions impose varying requirements on labeling standards, creating complexity for global companies. Inaccurate coding or failure to meet guidelines can result in fines and reputational damage. Equipment must adapt to different packaging materials, which sometimes reduces printing quality and efficiency. Frequent downtime due to technical errors disrupts high-speed production lines. It underscores the need for innovation to deliver consistent performance across global applications.

Market Opportunities

Expansion in Automation and Smart Packaging Solutions

The Labeling and Coding Equipment Market offers strong opportunities with the rapid expansion of automation and smart packaging. Manufacturers adopt advanced coding machines to support high-speed production lines and reduce human error. Growth in e-commerce and retail industries requires accurate and durable labeling for product identification and tracking. Smart packaging, equipped with QR codes and digital tags, increases demand for precise coding systems. Integration with Industry 4.0 platforms supports real-time monitoring and predictive maintenance. It strengthens the role of labeling and coding equipment in improving operational efficiency and compliance.

Sustainability and Growth in Emerging Markets

The Labeling and Coding Equipment Market also benefits from the rising focus on sustainability and growing adoption in emerging economies. Eco-friendly inks, recyclable packaging, and energy-efficient coding systems align with global sustainability goals. Manufacturers in developing regions invest in labeling equipment to meet international trade regulations and consumer expectations. Expansion of pharmaceutical, food, and personal care sectors in Asia-Pacific, Latin America, and Africa fuels demand. Partnerships with local distributors improve accessibility and affordability of advanced systems. It positions labeling and coding equipment as a critical enabler of sustainable and inclusive market growth.

Market Segmentation Analysis:

By Type

The Labeling and Coding Equipment Market divides into printers, labeling machines, and coding machines. Printers, including thermal and inkjet models, hold a strong position due to wide use in packaging and retail. Labeling machines dominate in industries such as food, beverages, and pharmaceuticals, where accurate identification is critical. Coding machines show steady growth, supported by demand for barcodes, date codes, and batch numbers. The need for compliance and traceability in global supply chains accelerates the adoption of all types. It highlights how diverse equipment solutions address sector-specific requirements effectively.

- For instance, Domino’s K300 monochrome UV inkjet printer prints variable data at speeds up to 250 meters per minute at 300 dpi (820 ft/min), or 125 meters per minute at 600 dpi, with a print width of 54.1 mm (single station) or 108.2 mm

By Mode of Operation

The Labeling and Coding Equipment Market operates through automatic, semi-automatic, and manual modes. Automatic systems lead adoption due to efficiency and suitability for high-volume production lines. Semi-automatic equipment caters to mid-scale enterprises seeking cost-effective solutions with controlled operation. Manual systems remain relevant in small-scale or niche applications requiring flexibility. Growing adoption of automation in manufacturing drives steady demand for fully automated equipment. It reinforces the importance of operational efficiency and reduced human error in modern production environments.

- For instance, Pack Leader USA’s PRO-625W wrap-around labeling machine supports fully automatic labeling for round containers at speeds up to 131 feet per minute. It includes an optional vision system to verify label placement and barcode quality.

By Print Medium

The Labeling and Coding Equipment Market demonstrates broad adoption across paper, metal, plastic, and glass print mediums. Paper dominates due to its use in consumer goods packaging and retail applications. Plastic shows strong growth as industries rely on flexible packaging for food, beverages, and personal care products. Glass maintains demand in pharmaceuticals and premium beverages where clear and permanent coding is required. Metal supports labeling for industrial and automotive applications, ensuring durability and compliance. It ensures equipment designs remain versatile to accommodate diverse substrates across industries.

Segments:

Based on Type

- Labeling equipment

- Coding equipment

Based on Mode of Operation

- Manual

- Semi-automatic

- Fully automatic

Based on Print Medium

- Primary packaging

- Secondary packaging

- Tertiary packaging

Based on End Use Industry

- Food and beverages

- Pharmaceutical

- Cosmetics and personal care

- Others

Based on Distribution Channel

- Direct sales

- Indirect sales

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Labeling and Coding Equipment Market, accounting for 33% in 2024. The region benefits from well-established packaging industries, advanced manufacturing practices, and strict regulatory requirements in food, pharmaceuticals, and consumer goods. The United States dominates the market, driven by strong investments in automation, traceability, and compliance with FDA and labeling standards. Canada contributes with demand from healthcare, retail, and agricultural packaging, while Mexico strengthens growth through expanding manufacturing bases. High adoption of smart and automated labeling solutions supports efficiency and reduces labor costs. It reinforces North America’s position as a leading hub for labeling and coding technologies across multiple sectors.

Europe

Europe represents the second-largest region in the Labeling and Coding Equipment Market, with a 29% share in 2024. Strong focus on sustainability and compliance with EU packaging and labeling directives accelerates equipment demand. Countries such as Germany, France, and the United Kingdom lead adoption, particularly in food, beverage, and pharmaceutical industries. Growth in e-commerce and consumer demand for product transparency further supports labeling innovations. Eastern Europe shows steady expansion, as regional industries invest in modern packaging and traceability systems. Manufacturers in the region emphasize eco-friendly labels and digital printing solutions to align with green initiatives. It secures Europe’s role as a sustainability-driven market for labeling and coding solutions.

Asia-Pacific

Asia-Pacific accounts for 25% of the Labeling and Coding Equipment Market in 2024 and emerges as the fastest-growing region. Rapid industrialization, population growth, and rising disposable incomes drive demand for packaged goods, pharmaceuticals, and electronics. China dominates with large-scale manufacturing, while India strengthens adoption through expanding food processing and retail sectors. Japan and South Korea contribute with strong focus on precision labeling and advanced technology integration. Local players offer cost-effective solutions, expanding accessibility across emerging economies. Government support for industrial automation and stricter compliance standards further accelerate market expansion. It positions Asia-Pacific as a critical growth engine for the global labeling and coding industry.

Latin America

Latin America contributes 7% share to the Labeling and Coding Equipment Market in 2024. Brazil and Mexico lead adoption, supported by expanding food and beverage sectors, pharmaceuticals, and agriculture. Demand for cost-effective labeling solutions grows as regional manufacturers upgrade operations to meet international trade standards. Rising middle-class populations drive packaged goods consumption, reinforcing adoption of labeling and coding systems. Local industries focus on balancing affordability with compliance in both consumer and industrial applications. Partnerships with global suppliers strengthen access to advanced technologies. It supports steady market expansion across Latin America’s diverse economies.

Middle East & Africa

The Middle East & Africa holds 6% share of the Labeling and Coding Equipment Market in 2024. Gulf countries such as Saudi Arabia and the UAE invest heavily in industrial packaging, pharmaceuticals, and food industries. Africa shows gradual adoption, supported by rising demand for packaged goods and improving manufacturing infrastructure. Limited local production capacity creates reliance on imports, though growing e-commerce platforms increase demand for reliable labeling solutions. Governments encourage compliance with international trade and product safety standards, strengthening equipment adoption. It highlights the region as an emerging market with long-term opportunities for labeling and coding equipment suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

Competitive landscape of the Labeling and Coding Equipment Market is shaped by leading players such as Domino Printing Sciences, Markem-Imaje, HERMA, BW Integrated Systems, Hitachi IESA, Leibinger, Pack Leader USA, BellatRx, Ambrose Packaging, and CVC Technologies. These companies compete by delivering advanced labeling and coding solutions that address high-speed production needs, strict regulatory compliance, and sustainability goals. Innovation remains a central focus, with players investing in digital printing, laser marking, and eco-friendly ink technologies to enhance accuracy and reduce environmental impact. Strategic partnerships with food, beverage, pharmaceutical, and logistics companies strengthen global market reach, while expansions into emerging economies support long-term growth. Investments in Industry 4.0 integration and smart labeling technologies enable greater connectivity, data management, and supply chain transparency. Cost optimization, regional manufacturing, and after-sales support further reinforce competitiveness, allowing these players to capture opportunities across diverse applications. The market remains highly dynamic, driven by constant innovation and regulatory pressures.

Recent Developments

- In August 2025, Pack Leader USA Published guides like ‘Smart Setup: How to Add Expiration Dates on Food Packaging Efficiently’ and ‘Smart Packaging Solutions to Scale Your Line Without Breaking the Bank’ on their blog.

- In July 2025, BW Integrated Systems consolidated its Accraply and Harland pressure-sensitive labeling brands under the single global Harland brand, aiming to improve innovation and customer experience by leveraging the combined expertise and resources of both entities.

- In July 2025, Markem‑Imaje Announced expansion of wax-based ink production and opening a new R&D and engineering office in Salem, New Hampshire, expected by end of 2025.

- In Jan 2025, Markem‑Imaje Launched the 9712 Bi‑Jet continuous inkjet printer. It speeds up large-code printing and allows more data per print.

Report Coverage

The research report offers an in-depth analysis based on Type, Mode of Operation, Print Medium, End Use Industry, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for labeling and coding equipment will rise with stricter global regulations.

- Automation and Industry 4.0 integration will drive adoption in high-speed production lines.

- Eco-friendly inks and recyclable label materials will gain stronger preference.

- Digital printing technologies will replace traditional systems in multiple industries.

- E-commerce growth will increase demand for durable and accurate product labeling.

- RFID-enabled and smart labeling solutions will expand supply chain visibility.

- Emerging economies will provide new opportunities through industrial expansion.

- Pharmaceutical and healthcare sectors will drive adoption for serialization and compliance.

- Customizable and compact equipment will gain traction among small and mid-sized enterprises.

- Continuous innovation in coding accuracy and efficiency will shape long-term competitiveness.