Market Overview

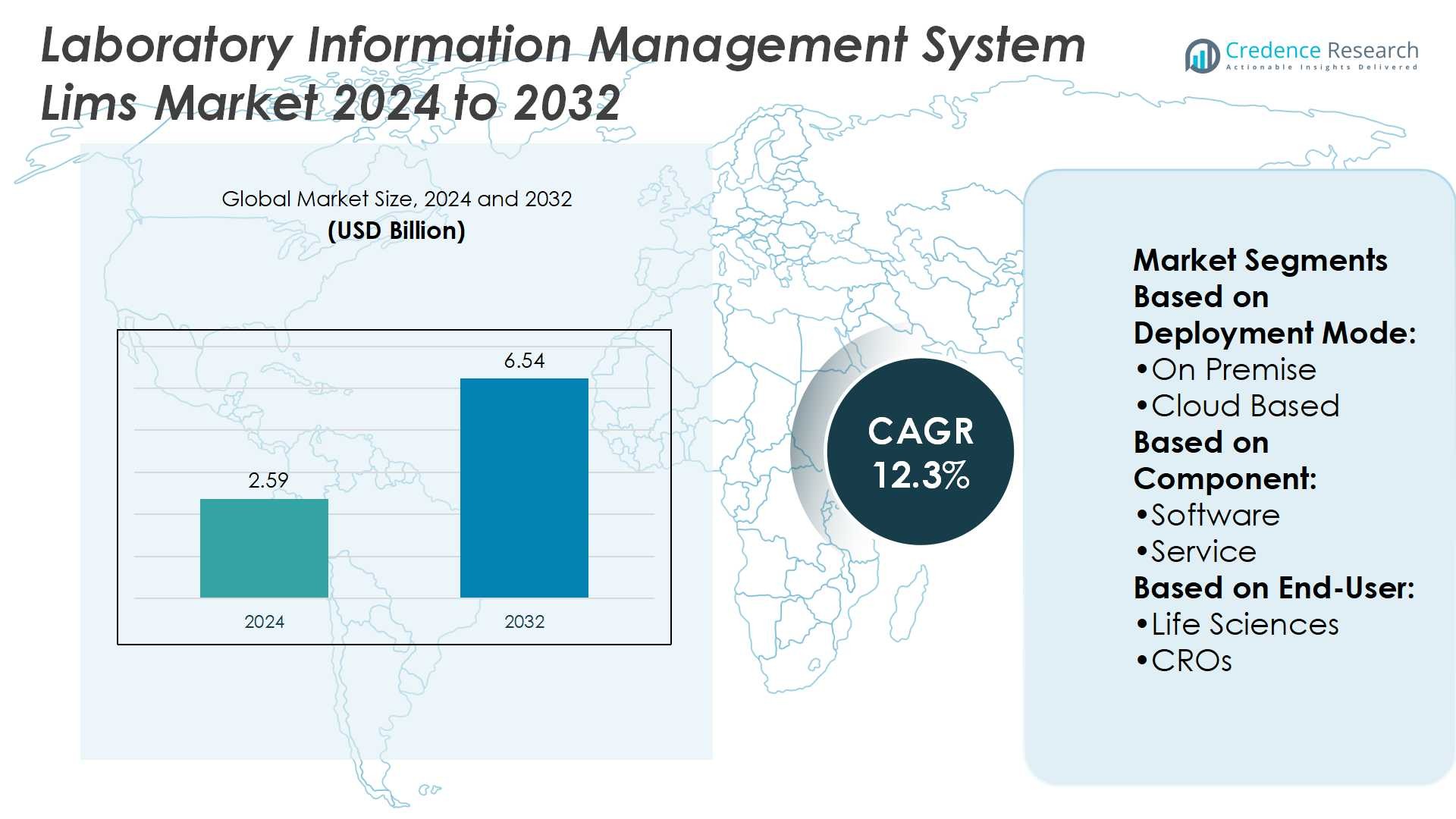

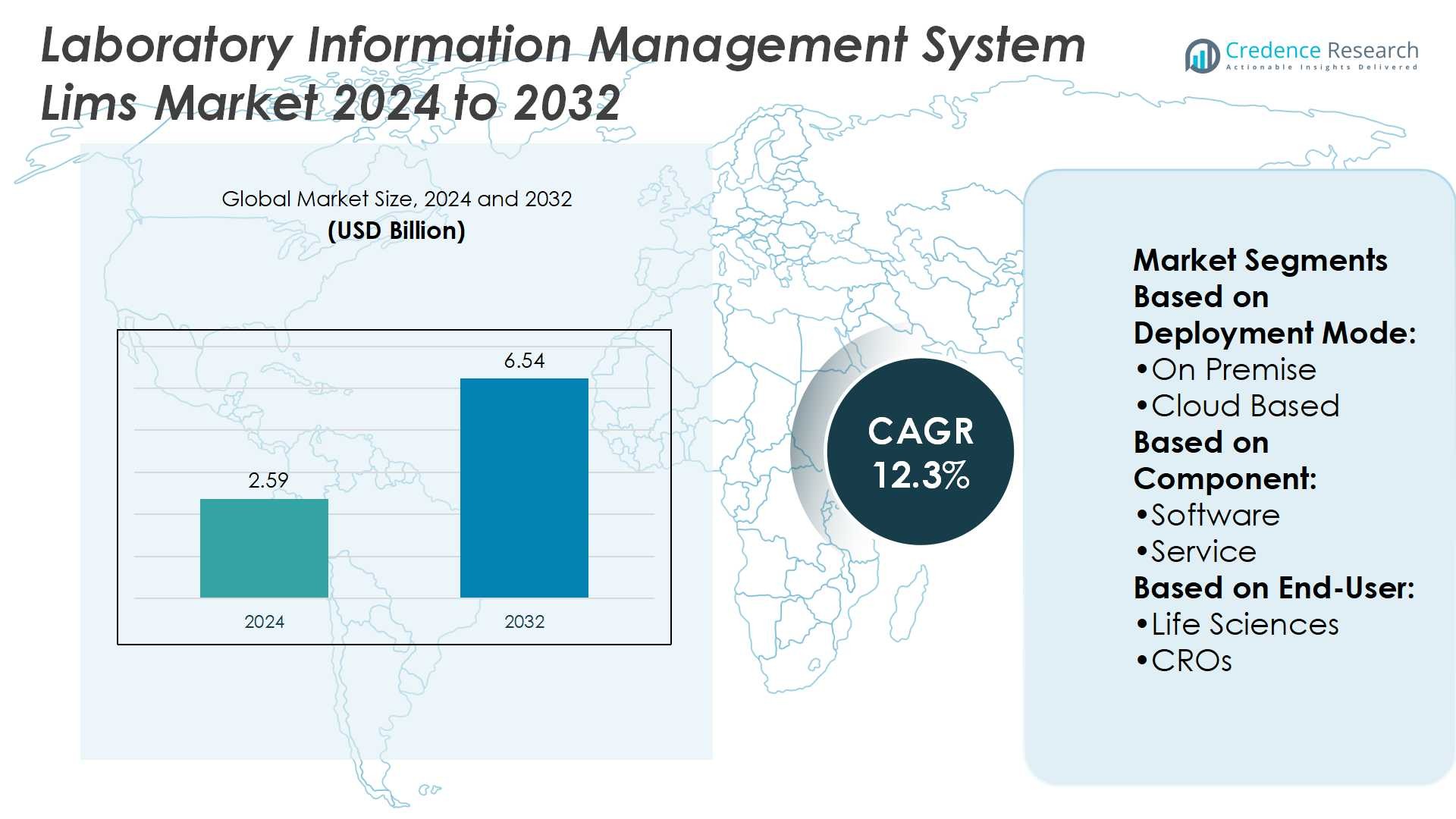

Laboratory Information Management System Market size was valued at USD 2.59 billion in 2024 and is anticipated to reach USD 6.54 billion by 2032, at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laboratory Information Management System Lims Market Size 2024 |

USD 2.59 Billion |

| Laboratory Information Management System Lims Market, CAGR |

12.3% |

| Laboratory Information Management System Lims Market Size 2032 |

USD 6.54 Billion |

The Laboratory Information Management System Lims Market grows with rising demand for digital transformation, regulatory compliance, and automation in laboratories. Organizations adopt LIMS to improve data accuracy, streamline workflows, and ensure secure traceability. Cloud-based platforms gain momentum by offering scalability, cost efficiency, and remote access. Integration of artificial intelligence and analytics enhances predictive insights, supporting faster decision-making in research and diagnostics. Life sciences, healthcare, and contract research organizations drive adoption with expanding needs for precision medicine and clinical trials. Strong focus on interoperability with enterprise systems and instruments further strengthens market growth across global laboratory networks.

North America holds the largest share of the Laboratory Information Management System Lims Market, supported by strong pharmaceutical and biotech industries, while Europe follows with strict regulatory compliance driving adoption. Asia Pacific shows the fastest growth due to rising investments in healthcare, diagnostics, and research infrastructure. Latin America and the Middle East & Africa present steady opportunities through modernization of laboratory systems. Key players include Labworks, LABTRACK, Illumina Inc., CloudLIMS.com, Autoscribe Informatics, Ovation, LabLynx Inc., Abbott Laboratories, AssayNet, and Computing Solutions Inc.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Laboratory Information Management System Lims Market size was valued at USD 2.59 billion in 2024 and is projected to reach USD 6.54 billion by 2032 at a CAGR of 12.3%.

- Market drivers include rising demand for digital transformation, automation, and strict regulatory compliance in laboratories.

- Market trends highlight growing adoption of cloud-based platforms offering scalability, cost efficiency, and remote access.

- Competitive analysis shows players focusing on AI integration, interoperability, and sector-specific solutions to strengthen market presence.

- Market restraints include high implementation costs, integration challenges, and concerns over data security.

- Regional analysis shows North America leading with the largest share, Europe following with regulatory-driven demand, and Asia Pacific growing fastest with healthcare and research investments.

- Latin America and the Middle East & Africa provide steady opportunities through modernization of laboratory infrastructure and growing interest in cost-effective cloud solutions.

Market Drivers

Growing Emphasis on Data Integrity and Regulatory Compliance

The Laboratory Information Management System Lims Market is driven by strict global compliance requirements. Industries such as pharmaceuticals, biotechnology, and healthcare must meet FDA, EMA, and ISO standards. LIMS ensures reliable data traceability, secure audit trails, and electronic signatures. It supports laboratories in maintaining compliance without manual record errors. Demand for standardized workflows grows as quality control becomes central to approval processes. The need for consistent data handling drives adoption across multiple regions.

- For instance, Labworks LIMS is installed in over 500 laboratories worldwide, ranging from small single-researcher sites to large industrial facilities.This includes more than 150 environmental laboratories that use built-in features like chain-of-custody, mobile field data capture, and EPA-method compliance for auditing.

Rising Demand for Automation and Digital Transformation in Laboratories

The Laboratory Information Management System Lims Market benefits from laboratories seeking to reduce manual work. Automation streamlines sample tracking, test scheduling, and results management. It improves accuracy, reduces turnaround time, and cuts operational costs. The system aligns with digital transformation initiatives that prioritize efficiency and productivity. Industries increasingly invest in solutions that centralize laboratory operations. Growing reliance on real-time dashboards and analytics strengthens its market importance.

- For instance, LABTRACK LIMS highlights rapid deployment capabilities, with smaller laboratories able to complete full implementation in under 7 days.

Expanding Applications Across Healthcare, Pharma, and Food Industries

The Laboratory Information Management System Lims Market grows as diverse industries adopt advanced data platforms. Healthcare facilities rely on LIMS for patient diagnostics, biobanking, and research. Pharmaceutical firms use it for drug development, clinical trials, and quality assurance. Food and beverage industries adopt LIMS for contamination checks and regulatory safety compliance. Broader adoption across environmental testing and petrochemicals further expands demand. Its versatility supports both specialized and high-volume laboratory settings.

Integration of Cloud-Based Platforms and Advanced Analytics

The Laboratory Information Management System Lims Market experiences strong momentum from cloud deployment. Cloud systems improve scalability, data security, and remote accessibility. Vendors integrate advanced analytics, AI, and IoT to enhance performance. These features allow predictive maintenance, real-time monitoring, and automated decision support. Organizations prefer cloud models for reduced infrastructure costs and easier upgrades. Growing partnerships between software providers and laboratory networks fuel long-term adoption. It positions LIMS as a critical element of connected laboratory ecosystems.

Market Trends

Shift Toward Cloud-Based Deployment and Remote Access

The Laboratory Information Management System Lims Market is witnessing a clear shift toward cloud models. Cloud platforms deliver scalability, secure storage, and remote data access. Laboratories benefit from reduced IT infrastructure costs and simplified upgrades. Vendors design solutions that allow seamless integration across multiple sites. It enables faster collaboration between research teams and global operations. Rising demand for remote accessibility strengthens the role of cloud LIMS in both public and private laboratories.

- For instance, Illumina’s BaseSpace Clarity LIMS provides the software offers more than 60 prepackaged workflow for Illumina Next-Generation Sequencing (NGS) and array applications.

Integration of Artificial Intelligence and Advanced Analytics

The Laboratory Information Management System Lims Market is shaped by integration with AI and analytics. These tools enhance decision-making through predictive insights and real-time monitoring. AI supports anomaly detection, workflow optimization, and smart reporting. Laboratories adopt analytics to identify performance trends and reduce errors. It creates a foundation for precision medicine, drug discovery, and next-generation diagnostics. The growing role of intelligent systems pushes vendors to invest in innovation-driven upgrades.

- For instance, Illumina and Ovation launched a dataset comprising 25,000 whole genomes, plus proteomic profiles of 5,000 samples, each measuring 9,500 human proteins per sample.

Growing Adoption of Modular and Customizable Platforms

The Laboratory Information Management System Lims Market is trending toward flexible and modular systems. Organizations demand tailored features to match specific workflows and testing needs. Vendors offer customizable modules that support genetics, toxicology, and food safety laboratories. It provides adaptability for diverse industries without the cost of full redesign. This modular trend enhances user experience and increases long-term system retention. Rising preference for scalable platforms underscores the importance of flexibility in LIMS adoption.

Expansion of Interoperability and Integration with Emerging Technologies

The Laboratory Information Management System Lims Market reflects a trend of wider interoperability. Laboratories seek systems that connect seamlessly with ERP, EHR, and laboratory instruments. Vendors focus on building APIs and connectors for smooth data exchange. It reduces duplication, ensures consistency, and supports comprehensive reporting. Integration with IoT sensors and blockchain also enters focus for data security and traceability. The trend highlights the importance of connected ecosystems in modern laboratory infrastructure.

Market Challenges Analysis

High Implementation Costs and Complex Integration Requirements

The Laboratory Information Management System Lims Market faces barriers from high upfront costs and complex integration. Smaller laboratories often struggle with the financial burden of software licenses, customization, and training. Integrating LIMS with legacy systems, instruments, and enterprise platforms requires technical expertise and extended timelines. It creates resistance among organizations with limited budgets or IT resources. Frequent upgrades and vendor dependency add further strain to long-term cost planning. These challenges limit adoption in cost-sensitive regions, despite proven efficiency benefits.

Data Security Concerns and Limited User Adaptability

The Laboratory Information Management System Lims Market encounters significant challenges related to data security and user adoption. Laboratories deal with sensitive patient, pharmaceutical, and environmental data that demand strict protection. Cybersecurity threats and regulatory non-compliance risks create hesitation in deploying cloud-based solutions. It raises concerns among stakeholders about confidentiality and system vulnerability. At the same time, employees often resist adapting to digital workflows, preferring traditional record-keeping methods. Insufficient training and limited technical support slow adoption across diverse laboratory environments. These challenges continue to restrict widespread utilization despite strong digital transformation momentum.

Market Opportunities

Rising Demand from Expanding Healthcare, Pharma, and Biotech Sectors

The Laboratory Information Management System Lims Market holds strong opportunities with rapid growth in healthcare, pharma, and biotech industries. Rising investments in clinical trials, personalized medicine, and advanced diagnostics drive adoption. It enables accurate patient data management, streamlined trial workflows, and secure compliance reporting. Growing research in genomics and molecular diagnostics further strengthens demand for LIMS platforms. Vendors can expand by offering sector-specific solutions tailored to evolving needs. The market gains momentum from global healthcare digitization and ongoing focus on precision-driven outcomes.

Advancements in Cloud Deployment and Global Laboratory Networks

The Laboratory Information Management System Lims Market presents opportunities through cloud-based platforms and connected laboratory ecosystems. Cloud deployment supports scalability, cost efficiency, and seamless collaboration across international sites. It allows laboratories to access real-time data, optimize resource allocation, and improve decision-making. Vendors offering advanced features like AI integration, IoT connectivity, and blockchain data security can capture new growth. Expanding partnerships with contract research organizations and academic labs strengthens adoption across regions. These advancements create a pathway for broader implementation in diverse industries beyond traditional laboratory settings.

Market Segmentation Analysis:

By Deployment Mode

The Laboratory Information Management System Lims Market demonstrates strong diversification across deployment modes. On-premise deployment remains preferred among large enterprises and government laboratories due to higher data control and security. It appeals to institutions handling highly confidential data in pharmaceutical or defense-related testing. Cloud-based deployment shows the fastest growth, supported by cost efficiency, scalability, and remote access. It enables laboratories to reduce infrastructure expenses while ensuring real-time collaboration across multiple sites. Web-hosted platforms gain traction among mid-sized organizations that require flexibility without full cloud migration. Vendors continue to expand deployment options to meet varied organizational requirements.

- For instance, LabLynx, a company offering laboratory software solutions, has provided its services to over 100 clients globally, including clients in the United States, United Kingdom, Singapore, and Germany.

By Component

The Laboratory Information Management System Lims Market is driven by the software segment, which forms the core of laboratory digitalization. Software platforms manage data entry, reporting, and workflow automation with increasing sophistication. It integrates advanced features such as AI-driven analytics, predictive modeling, and compliance tools. Services form a crucial support element, covering implementation, training, customization, and ongoing maintenance. Laboratories often depend on service providers for technical expertise and long-term optimization. Demand for managed services grows as organizations seek continuous upgrades and reliable vendor support. The combined strength of software and services ensures sustainable adoption across global markets.

- For instance, STARLIMS QM 12.0, built on platform v11.7, included an integrated request portal and interfaced with Chromeleon™, Empower™, and SAP without extra coding. It also delivered a verification kit for streamlined validation.

By End User

The Laboratory Information Management System Lims Market finds strong adoption across life sciences companies. These organizations use LIMS to support drug discovery, clinical trials, biobanking, and regulatory compliance. It provides efficient management of vast research data while maintaining strict traceability. Contract Research Organizations (CROs) represent another expanding end-user group. CROs rely on LIMS to manage diverse client projects, reduce turnaround time, and enhance reporting accuracy. Growing outsourcing of research activities strengthens demand for advanced LIMS platforms in this segment. Both end-user groups play a pivotal role in accelerating adoption across global laboratory ecosystems.

Segments:

Based on Deployment Mode:

Based on Component:

Based on End-User:

Based on the Geography:

o U.S.

o Canada

o Mexico

o UK

o France

o Germany

o Italy

o Spain

o Russia

o Belgium

o Netherlands

o Austria

o Sweden

o Poland

o Denmark

o Switzerland

o Rest of Europe

o China

o Japan

o South Korea

o India

o Australia

o Thailand

o Indonesia

o Vietnam

o Malaysia

o Philippines

o Taiwan

o Rest of Asia Pacific

o Brazil

o Argentina

o Peru

o Chile

o Colombia

o Rest of Latin America

o UAE

o KSA

o Israel

o Turkey

o Iran

o Rest of Middle East

o Egypt

o Nigeria

o Algeria

o Morocco

o Rest of Africa

Regional Analysis

North America

North America holds the largest share of the Laboratory Information Management System Lims Market, about 44–47%. The United States dominates with strong adoption in pharmaceuticals, biotech, and healthcare. Canada also contributes with growing use of digital lab systems. The region benefits from advanced research facilities, strict regulatory rules, and high R&D spending. Both on-premise and cloud deployments are common, with cloud adoption increasing rapidly. North America continues to lead the global market because of strong investments and early technology adoption.

Europe

Europe takes the second position, holding around 23–31% of the global market. Germany, the UK, and France lead due to strict EU regulations and heavy investment in lab automation. The region focuses on compliance with GDPR and ISO standards, which drives system adoption. Pharmaceutical and biotech companies in Europe depend on LIMS for research and testing. Government programs supporting digital healthcare also encourage adoption. Europe is a strong base for vendors offering compliance-driven solutions.

Asia Pacific

Asia Pacific accounts for about 19–20% of the global market. China leads with major investments in biotech and clinical research. India follows with strong demand from contract research organizations (CROs) and growing regulatory alignment. Japan, South Korea, and Australia also expand adoption, focusing on healthcare, diagnostics, and food testing. The region shows the fastest growth due to rising R&D activity and digital transformation. Affordable cloud solutions and localized support make the market attractive for laboratories in this region.

Latin America

Latin America represents around 6% of the Laboratory Information Management System Lims Market. Brazil and Argentina are the leading countries, supported by growing pharmaceutical and environmental testing activities. Public healthcare systems are adopting digital solutions to improve efficiency and compliance. Budget limitations remain a challenge, but interest in cloud-based systems is rising. Vendors offering cost-effective solutions see opportunities in this region. The market here is still developing but shows steady potential.

Middle East & Africa

Middle East & Africa holds the smallest share, between 4–7%. Countries like Saudi Arabia, the UAE, and South Africa are leading adopters. Investments in healthcare infrastructure and digital transformation push the demand for LIMS. Cloud deployment is gaining attention, especially in areas with limited IT capacity. Government initiatives to modernize healthcare support adoption. The region offers long-term opportunities, but growth depends on stable investment and better infrastructure.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Laboratory Information Management System Lims Market players such as Labworks, LABTRACK, Illumina Inc., CloudLIMS.com, Autoscribe Informatics, Ovation, LabLynx Inc., Abbott Laboratories, AssayNet, and Computing Solutions Inc. The Laboratory Information Management System Lims Market is shaped by innovation, service differentiation, and technology adoption. Vendors focus on developing configurable platforms that align with diverse laboratory workflows while meeting global compliance standards. Cloud-based solutions gain momentum as laboratories demand cost efficiency, scalability, and secure access across multiple locations. Strong emphasis is placed on integrating advanced features such as AI-driven analytics, real-time monitoring, and interoperability with existing enterprise systems. Competition also extends to service quality, with implementation support, customization, and training playing vital roles in client retention. The market remains dynamic, with companies investing in global expansion and partnerships to strengthen their position in a digitally transforming laboratory ecosystem.

Recent Developments

- In April 2025, the U.S. Food and Drug Administration (FDA) issued a final rule mandating electronic submission of laboratory data for certain applications, creating a surge in demand for robust LIMS solutions to meet regulatory compliance (FDA Final Rule).

- In March 2024, Genseq integrated the Sapio LIMS platform to enhance its next-generation sequencing services. This partnership aims to optimize laboratory operations and improve data management, enabling Genseq to deliver high-quality sequencing results efficiently.

- In August 2023, Thermo Fisher Scientific, Inc. introduced the EXENT solution, a comprehensive and automated mass spectrometry platform designed to address unmet clinical needs in the management of monoclonal gammopathy.

- In July 2023, LIMS Wizards partnered with LabTwin to introduce LabTwin’s innovative voice-activated digital lab assistant to the North American market.

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Component, End-User and Geography. It details leading market players, providing an overview of their business,product offerings, investments, revenue streams, and key applications. Additionally, the reportincludes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Laboratory Information Management System Lims Market will expand with rising demand for digital laboratory solutions.

- Cloud-based platforms will continue to gain preference due to scalability and remote accessibility.

- Integration with artificial intelligence and analytics will improve data accuracy and predictive insights.

- Regulatory compliance will remain a key driver, pushing laboratories to adopt advanced systems.

- Customizable and modular platforms will attract diverse industries with flexible workflows.

- Growth in biobanking, genomics, and precision medicine will strengthen adoption across healthcare and life sciences.

- Interoperability with enterprise systems and instruments will enhance efficiency and data traceability.

- Emerging markets will show strong adoption as healthcare and research infrastructure modernize.

- Cybersecurity and data protection features will become central to vendor strategies.

- Continuous innovation in connected ecosystems will position LIMS as a critical tool for global laboratories.