Market Overview:

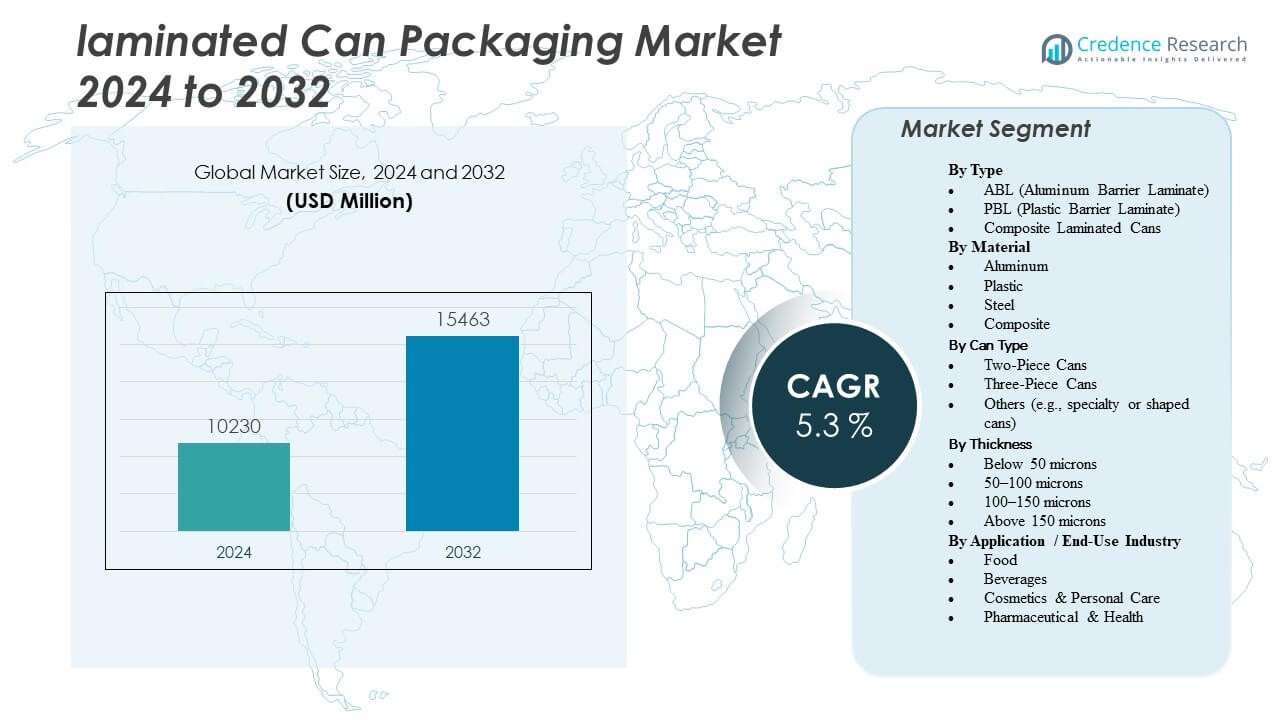

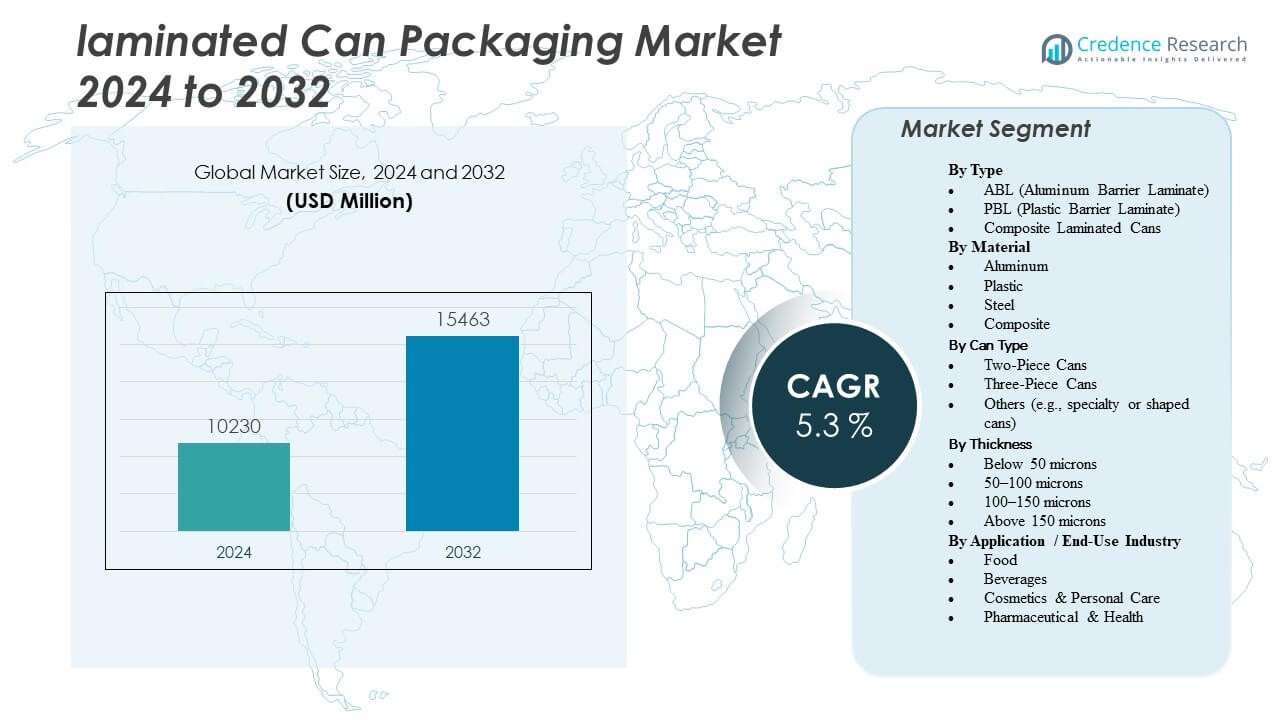

The laminated can packaging market is projected to grow from USD 10,230 laminated can packaging market million in 2024 to an estimated USD 15,463 million by 2032, with a compound annual growth rate (CAGR) of 5.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Laminated Can Packaging Market Size 2024 |

USD 10,230 Million |

| Laminated Can Packaging Market , CAGR |

5.3% |

| Laminated Can Packaging Market Size 2032 |

USD 15,463 Million |

Growth in the laminated can packaging market is primarily driven by rising demand for lightweight, durable, and visually appealing packaging solutions across the food, beverage, and personal care sectors. Brands increasingly prefer laminated cans for their superior barrier properties, extended shelf life, and ease of customization. Sustainability trends are further boosting adoption, as manufacturers shift to recyclable and low-carbon footprint materials. The rise of ready-to-eat meals, premium beverages, and functional food products is also contributing to the market expansion.

Regionally, North America and Europe lead the laminated can packaging market due to high consumption of packaged goods, strong manufacturing infrastructure, and widespread adoption of sustainable packaging. The Asia Pacific region is emerging rapidly, supported by urbanization, expanding middle-class population, and growing demand for convenient consumer packaging in countries like China, India, and Indonesia. Latin America and the Middle East & Africa are gradually catching up, driven by increased retail penetration and evolving consumer preferences.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The laminated can packaging market is projected to grow from USD 10,230 million in 2024 to USD 15,463 million by 2032, registering a CAGR of 5.3% during the forecast period.

- Rising demand for recyclable, lightweight, and high-barrier packaging is a key driver fueling growth across food, beverage, and healthcare sectors.

- Strong consumer preference for premium and sustainable packaging formats supports adoption in cosmetics and personal care applications.

- High cost of multi-layer laminates and complexity in recycling composite materials limit broader scalability for some manufacturers.

- North America leads the market with 32% share, supported by high consumption of canned foods and investment in packaging innovation.

- Europe maintains strong demand driven by sustainability regulations and growing adoption of bio-based laminated structures.

- Asia-Pacific emerges as the fastest-growing region, backed by urbanization, increasing disposable income, and retail sector expansion.

Market Drivers:

Surging Demand for Lightweight and Sustainable Packaging Across Consumer Goods

Consumers are shifting toward lightweight, recyclable, and eco-conscious packaging, propelling demand for laminated cans. The market benefits from the transition away from heavy metal containers toward multi-layer laminates that reduce material usage while maintaining strength. FMCG brands actively seek packaging that aligns with sustainability goals without compromising performance or visual appeal. The laminated can packaging market benefits from its ability to reduce shipping weight and support carbon reduction efforts. It aligns with evolving regulatory frameworks that promote green materials. High recyclability and the use of BPA-free laminates support safe food and beverage storage. This combination of sustainability and efficiency strengthens its appeal across industries. The laminated can packaging market capitalizes on these trends to gain a broader footprint.

- For example, Novelishas achieved a 33% reduction in CO2 emissions for beverage can ends by developing laminated aluminum coil technology that uses less heat and fewer chemicals than traditional liquid coatings.

Expanding Application Scope in Food, Beverage, and Nutraceutical Segments

The rise in functional beverages, on-the-go snacks, infant nutrition, and fortified products has expanded the utility of laminated cans across food and beverage segments. These cans offer excellent shelf-life extension, flavor preservation, and tamper-evident sealing, enhancing product integrity. The convenience of stackable, easy-open, and microwave-compatible formats increases their preference among busy consumers. It enables manufacturers to meet stringent hygiene and safety standards in processed foods and health supplements. Growing consumer preference for portion-controlled, resealable packs also aligns with the advantages of laminated cans. Shelf differentiation and attractive aesthetics further support brand visibility. The laminated can packaging market gains momentum from the expanding range of applications that demand safe, attractive, and functional formats. This versatility fosters rapid adoption across product lines.

Brand Customization and Shelf Appeal Drive Packaging Innovation

The ability to integrate high-resolution graphics, foil stamping, and specialized finishes makes laminated cans attractive to marketing teams aiming for strong shelf presence. Brands use laminated cans to differentiate in competitive retail environments through bold design elements and tactile finishes. Enhanced printability across curved surfaces supports intricate branding while retaining durability. It helps premium products maintain consistent brand image without degradation in visual quality. Transparent windows, QR code integration, and augmented reality features enhance customer engagement. Packaging plays a pivotal role in influencing consumer purchase behavior, especially in high-impulse categories. The laminated can packaging market enables both global and niche brands to communicate value through packaging innovation. This creates strategic leverage for market growth.

- For instance, Daiwa Can Company introduced photogravure printing on laminated metal cans, enabling vivid image reproduction with 100% in-line quality inspection and zero VOC emissions during lamination. This technology allows brands to achieve premium aesthetics while meeting environmental standards and enhancing consumer engagement.

Functional Integrity and Barrier Protection Support Supply Chain Efficiency

Laminated cans deliver strong protection against moisture, light, oxygen, and external contaminants, ensuring long shelf life and reduced spoilage. Their multi-layer structure supports flexible barrier design suited to product sensitivity. It allows manufacturers to extend product viability without relying heavily on additives or preservatives. This contributes to operational cost savings and quality assurance. Enhanced mechanical strength reduces the risk of damage during storage and transportation. Laminated structures support hot and cold filling processes, increasing production line compatibility. These performance features improve supply chain dependability across various temperature-controlled logistics. The laminated can packaging market meets the packaging demands of global supply networks. Its adaptability helps streamline distribution across evolving retail formats.

Market Trends:

Adoption of Smart Packaging Technologies for Enhanced Consumer Interaction

Smart packaging solutions such as QR codes, NFC tags, and digital watermarking are finding growing adoption in laminated can formats. Brands aim to provide traceability, authenticity, and interactive experiences to tech-savvy consumers. These embedded technologies allow real-time access to product origin, usage instructions, and promotional content. It enables companies to connect directly with end-users while collecting valuable behavioral data. Consumer demand for transparency in sourcing and manufacturing supports this digital integration. The laminated can packaging market supports smart packaging without compromising mechanical strength or appearance. Integration with mobile applications and loyalty platforms strengthens customer retention. These developments shape the future of data-driven, interactive packaging formats.

Integration of Recycled Content and Bio-Based Films in Laminate Layers

Manufacturers are incorporating post-consumer recycled (PCR) plastics and bio-based polymers in lamination films to improve environmental performance. This trend aligns with global sustainability mandates and brand-level ESG commitments. Laminated can structures are now designed with lower carbon materials without sacrificing functionality. It allows packaging firms to meet circular economy goals while enhancing brand reputation. Certifications such as FSC and compostability standards drive material innovation. Consumer expectations for sustainable sourcing are influencing material selection at the design stage. The laminated can packaging market aligns well with these shifts in packaging material engineering. This trend enhances brand positioning in green-conscious markets.

- For example, EcoPackables manufactures GRS 4.0–certified films that can be made from up to 100% PCR content, leveraging both post-consumer and post-industrial plastics and reducing water and energy use compared to virgin polymer manufacture; these films are available in thicknesses from 30μm to 110μm.

Miniaturization and Personalization Trends Boost Smaller Pack Formats

Consumers increasingly prefer smaller, personalized packaging sizes that fit individual needs, particularly in health, beauty, and food segments. Laminated cans are well-suited for portion-controlled, travel-friendly, and single-serve packaging due to their structure and resealability. It enables brands to cater to demographic-specific needs such as children, seniors, or fitness enthusiasts. The demand for variety packs and trial-size versions also fuels interest in compact formats. Laminated cans retain premium aesthetics even at small volumes, helping attract high-value customers. Market players leverage this trend to diversify offerings and expand SKU portfolios. The laminated can packaging market taps into this trend to increase product engagement and convenience.

- For example, Berry Global’s recent patent for registered embossing allows intricate tactile and visual customization even at miniaturized scales, combining artwork, logos, and personalized messaging with 360° decoration in one streamlined production pass.

Premiumization and Luxury Branding through High-End Packaging Aesthetics

Luxury and wellness brands are turning to laminated cans for their sleek finish, durability, and upscale visual presentation. High-gloss and matte surfaces, metallic foils, and specialty coatings allow customization that matches premium brand narratives. It supports the growing trend of experiential packaging where the tactile and visual feel reinforces product positioning. Laminated cans maintain integrity across long shelf life, critical for prestige products. This packaging solution aligns with clean-label and organic product categories that demand both purity and elegance. The laminated can packaging market benefits from luxury branding efforts across cosmetics, gourmet foods, and herbal beverages. Premium packaging design elevates perceived value and drives customer loyalty.

Market Challenges Analysis:

High Cost of Laminate Materials and Processing Equipment Affects Scalability

The cost of multi-layer laminate films and specialized equipment for forming laminated cans presents a significant entry barrier. Smaller manufacturers often face capital limitations, reducing their ability to adopt or scale laminated packaging formats. Processing laminated structures involves complex machinery, heating elements, and precision tooling, which require technical expertise and investment. It creates disparities in adoption between large global brands and regional players. Price sensitivity among end consumers in developing economies also limits premium packaging usage. The laminated can packaging market faces scalability concerns when unit costs cannot match low-cost alternatives. Balancing performance with affordability remains a persistent challenge for industry expansion.

Recycling Complexity Due to Multi-Layer Composition Slows Circular Transition

Laminated cans often contain multiple materials fused together—plastics, aluminum, and adhesives—which complicate post-consumer recycling processes. Many recycling systems are not equipped to efficiently separate or repurpose composite packaging formats. It creates barriers to full recyclability and contributes to environmental concerns among eco-conscious buyers. Industry regulations increasingly call for design-for-recycling principles, putting pressure on manufacturers to redesign laminates. It adds time and cost to R&D processes and slows innovation cycles. The laminated can packaging market must navigate material compatibility, waste stream integration, and end-of-life labeling issues. These factors challenge the sector’s ability to support closed-loop packaging systems at scale.

Market Opportunities:

Emerging Markets Open Growth Avenues through Urbanization and Consumption Shifts

Rapid urbanization and lifestyle shifts in emerging economies such as India, Brazil, Vietnam, and Egypt open new growth avenues for laminated can packaging. Rising disposable incomes and demand for convenience packaging support strong market entry. The growing middle class seeks packaged food, beverages, and personal care products in hygienic, durable containers. Laminated cans offer reliable protection and premium aesthetics that resonate with evolving consumer expectations. It enables global brands to enter these markets with differentiated formats that combine safety and branding. Local producers also adopt laminated cans to elevate product image and expand exports. The laminated can packaging market gains a competitive edge in high-growth economies.

E-commerce Growth Spurs Demand for Durable and Attractive Secondary Packaging

The rise of e-commerce and direct-to-consumer retail channels boosts demand for packaging that can withstand handling and transport while retaining visual impact. Laminated cans provide structural integrity and visual consistency, ensuring products arrive in optimal condition. It supports unboxing experiences that influence brand loyalty and online reviews. Product visibility on digital storefronts benefits from the high design fidelity of laminated surfaces. Laminated cans accommodate various closure types and protective overwraps suited for parcel shipping. The laminated can packaging market captures this opportunity by offering e-commerce-ready solutions across categories. Strong performance in this domain creates new revenue streams and competitive differentiation.

Market Segmentation Analysis:

The laminated can packaging market is segmented by type, material, can type, thickness, and application.

By type,

ABL leads the market due to its superior barrier properties and recyclability, followed by PBL for its cost-efficiency and flexibility. Composite laminated cans are gaining adoption where multi-layer strength and tailored protection are required.

- For example, Neopac’s Polyfoil® tubes are widely used in pharmaceutical ointments due to their exceptional oxygen and moisture barrier properties and recyclability.

By material,

aluminum holds a strong share due to its lightweight and high-performance characteristics, while plastic and composite options offer versatility in design. Steel is used in composite formats to provide structural integrity and impact resistance in industrial or specialty applications.

- For instance, Toyo Seikan’s aTULC cans are the world’s lightest aluminum beverage cans, used by Coca-Cola Japan for its Georgia coffee brand, reducing GHG emissions by 8% per can.

By can type,

two-piece cans dominate because of their seamless construction and reliability in food and beverage packaging. Three-piece cans are preferred for larger volumes and custom designs, while other specialty shapes support niche branding.

By thickness,

the 50–100-micron range is widely adopted across industries, while higher thicknesses are preferred in pharmaceuticals and retort applications.

By end-use industry,

food holds the largest share, with strong contributions from beverages, personal care, and healthcare segments. The laminated can packaging market benefits from its adaptability to diverse structural and functional demands across these categories.

Segmentation:

By Type

- ABL (Aluminum Barrier Laminate)

- PBL (Plastic Barrier Laminate)

- Composite Laminated Cans

By Material

- Aluminum

- Plastic

- Steel

- Composite

By Can Type

- Two-Piece Cans

- Three-Piece Cans

- Others (e.g., specialty or shaped cans)

By Thickness

- Below 50 microns

- 50–100 microns

- 100–150 microns

- Above 150 microns

By Application / End-Use Industry

- Food

- Beverages

- Cosmetics & Personal Care

- Pharmaceutical & Health

By Region

- North America (United States, Canada, Mexico)

- Europe (Germany, United Kingdom, France, Italy, Spain, Netherlands, Poland)

- Asia-Pacific (China, India, Japan, South Korea, Australia, Indonesia, Thailand, Vietnam)

- Latin America (Brazil, Argentina, Chile, Colombia, Peru)

- Middle East & Africa (South Africa, UAE, Saudi Arabia, Egypt, Nigeria)

Regional Analysis:

North America leads the laminated can packaging market with a market share of 32%. Strong consumer demand for premium, sustainable, and convenient packaging drives widespread adoption across food, beverage, and healthcare sectors. Major packaging companies in the United States and Canada invest heavily in R&D, focusing on high-performance laminate structures and advanced barrier properties. The region’s well-established retail and e-commerce infrastructure supports demand for aesthetically appealing, shelf-stable packaging. Regulatory focus on recyclable and BPA-free materials further strengthens the market position. Multinational brands operating in this region prefer laminated cans for differentiated branding. It continues to benefit from high per capita consumption of packaged goods and strong supply chain capabilities.

Europe holds the second-largest share in the laminated can packaging market, accounting for 28%. Countries like Germany, France, and the UK emphasize circular economy goals and green packaging innovations, boosting demand for laminated cans with eco-friendly laminates. European food and beverage manufacturers increasingly replace metal containers with laminated options that offer design flexibility and lower carbon footprint. The rise of functional drinks, plant-based products, and nutraceuticals also contributes to higher adoption rates. Market participants align product offerings with EU sustainability directives and consumer awareness trends. The growing use of digital printing and premium labeling supports demand for laminated formats in both retail and specialty packaging. It benefits from supportive legislation and rapid product diversification.

Asia Pacific captures 25% of the laminated can packaging market and remains the fastest-growing region. Rapid urbanization, expanding middle-class population, and increasing demand for on-the-go and shelf-stable products fuel regional growth. China, Japan, India, and South Korea serve as key contributors due to rising consumption of packaged food, cosmetics, and personal care items. Local manufacturers focus on affordable yet durable packaging formats to meet evolving consumer expectations. The shift from traditional rigid formats to laminated cans accelerates in metro areas with strong retail networks. It offers cost-effective solutions and design adaptability, meeting the needs of price-sensitive and quality-conscious markets. The region’s manufacturing scalability and export potential enhance its global competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- HUIYANG Packaging Factory

- RMCL

- DaklaPack

- TCL Packaging

- SUNPACK CORPORATION

- OPM Group

- API

- Glenroy

- BPI Protec

- Granitol

Competitive Analysis:

The laminated can packaging market features strong competition among global and regional players focusing on innovation, material advancements, and branding solutions. Key companies include Sonoco Products Company, Toyo Seikan Group Holdings, Nampak Ltd., Impress Holdings, and Silgan Holdings Inc. These players invest in lightweight laminate structures, recyclable materials, and premium finishes to gain market differentiation. Strategic collaborations, regional expansions, and acquisition activities help them expand production capacity and customer base. New entrants face barriers due to capital-intensive equipment and technical expertise requirements. It sees continuous product development tailored to food, beverage, and personal care applications. Market leaders emphasize sustainability, print quality, and shelf appeal to secure long-term contracts with FMCG brands.

Recent Developments:

- In June 2025, HUIYANG Packaging Factory showcased its latest innovations in laminated flexible packaging for food applications during EXPO PACK Guadalajara. These new products feature customized laminated metallized plastic films designed to enhance shelf appeal and barrier properties for can packaging applications.

- In February 2025, DaklaPack, a global leader in sustainable packaging, launched a new website to highlight its expanding range of laminated packaging solutions. The showcased products include high-barrier, recyclable, and compostable laminated films designed for various sectors like food, beverages, and pharmaceuticals.

- Glenroy announced in March 2022 its investment in a new Tandem Adhesive Laminator, fully operational by spring, aimed at increasing capacity for high-barrier laminations and sustainable pouches including applications in laminated can packaging.

Market Concentration & Characteristics:

The laminated can packaging market is moderately concentrated, with a mix of multinational corporations and specialized regional firms. It demonstrates high entry barriers due to the complexity of multi-layer lamination processes and equipment investments. The market exhibits strong customization capabilities, offering tailored formats across diverse end-use industries. It favors players with advanced R&D, regulatory compliance, and supply chain agility. Product differentiation, innovation in barrier properties, and recyclable laminate adoption define market success. Demand remains stable across developed economies while accelerating in emerging regions. The competitive landscape rewards companies that balance design flexibility with environmental responsibility.

Report Coverage:

The research report offers an in-depth analysis based on Type, Material, Can Type, Thickness and Application / End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for recyclable and sustainable laminated cans will drive material innovation across packaging lines.

- Growth in premium and functional beverages will expand applications in health and wellness segments.

- E-commerce and direct-to-consumer brands will favor durable laminated formats for secure delivery and brand impact.

- Advancements in digital printing and smart labeling will enhance interactive packaging capabilities.

- Manufacturers will adopt bio-based and post-consumer recycled laminates to meet regulatory compliance.

- Asia Pacific will emerge as a manufacturing and consumption hub, supported by urban retail expansion.

- Compact and personalized packaging formats will gain traction in cosmetics, nutraceuticals, and snacks.

- Strategic collaborations between converters and FMCG brands will accelerate customized packaging development.

- Automation in production and filling lines will boost laminated can adoption among large-scale processors.

- Continued emphasis on shelf appeal and functionality will keep laminated cans competitive against traditional rigid formats.