Market Overview

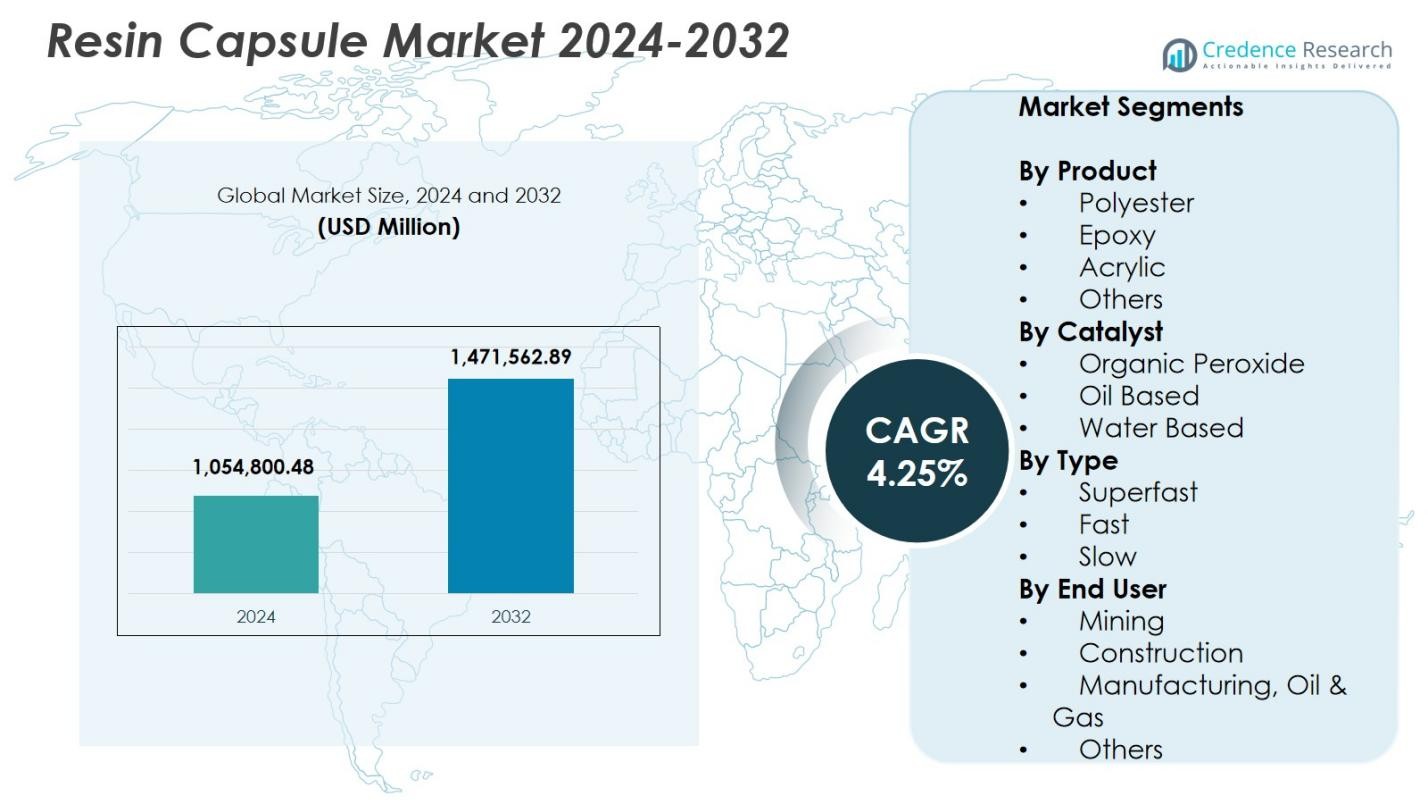

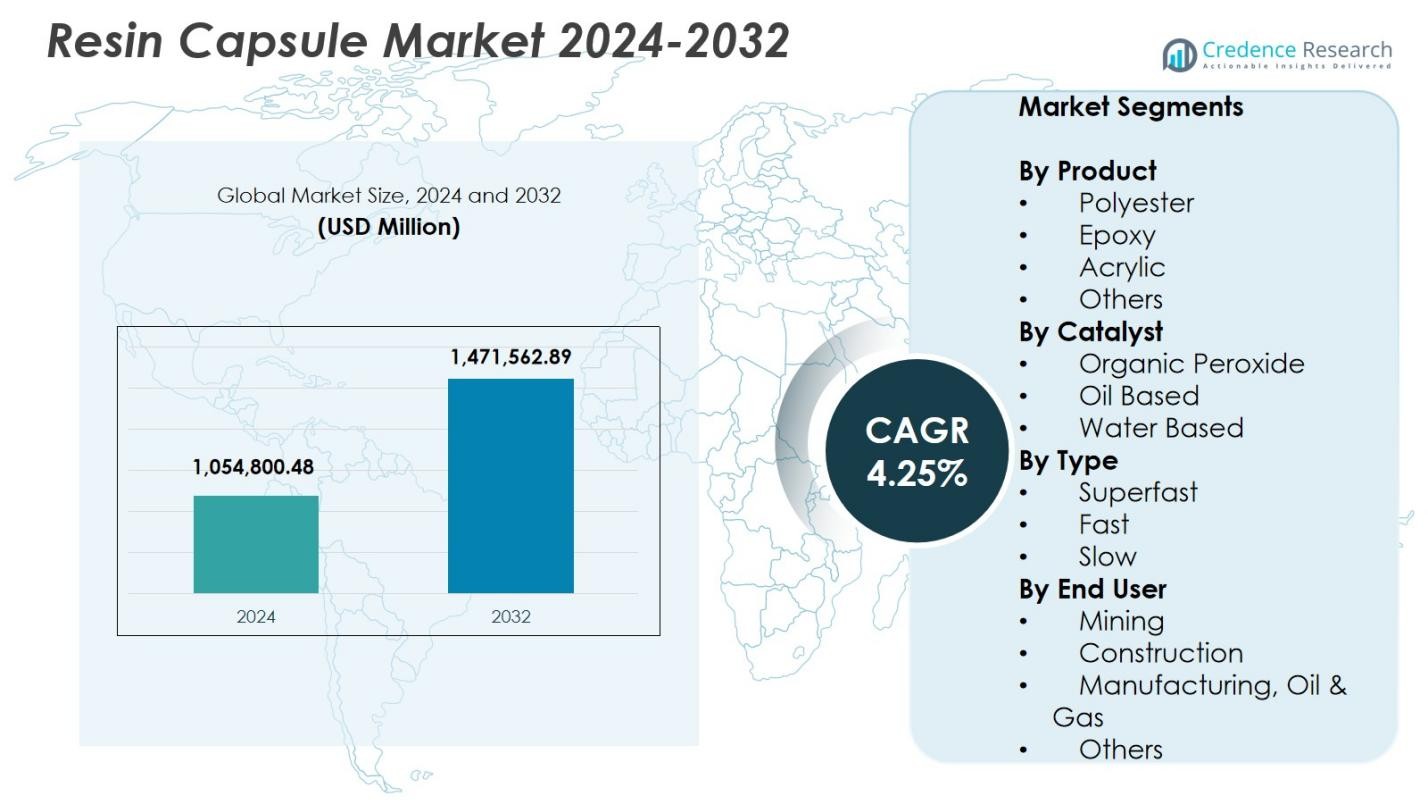

Resin Capsule Market size was valued at USD 1,054,800.48 Million in 2024 and is anticipated to reach USD 1,471,562.89 Million by 2032, at a CAGR of 4.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Resin Capsule Market Size 2024 |

USD 1,054,800.48 Million |

| Resin Capsule Market, CAGR |

4.25% |

| Resin Capsule Market Size 2032 |

USD 1,471,562.89 Million |

Resin Capsule Market features major players such as Hexion, DAIKIN, Kukdo Chemical Co. Ltd., DuPont, Cardolite Corporation, Arkema, PPG Industries Inc., Huntsman International LLC, AkzoNobel N.V., and BASF SE, all focusing on high-performance resin formulations for anchoring and ground-support applications. These companies strengthen their presence through product innovation, expanded production capabilities, and enhanced distribution networks in mining and construction sectors. Asia-Pacific led the global Resin Capsule Market with 36.7% share in 2024, driven by extensive mining output, rapid urban infrastructure development, and growing adoption of mechanized bolting systems across China, India, and Australia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Resin Capsule Market was valued at USD 1,054,800.48 million in 2024 and is projected to reach USD 1,471,562.89 million by 2032, growing at a CAGR of 4.25%.

- Market expansion is supported by rising mining and tunneling activities, with the polyester segment leading at 42.6% share due to strong bonding strength and cost-efficiency in underground reinforcement.

- Trends include increased adoption of eco-friendly, low-VOC resin systems and rapid-curing formulations compatible with mechanized and automated bolting technologies.

- Major players such as Hexion, BASF SE, Arkema, Huntsman, and AkzoNobel focus on improving product performance, scaling production, and enhancing distribution networks across high-demand regions.

- Asia-Pacific held 36.7% share in 2024, followed by North America at 28.4% and Europe at 23.1%, supported by strong mining output, tunneling projects, and rising safety compliance.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product:

The polyester segment dominated the Resin Capsule Market with 42.6% share in 2024, driven by its high bonding strength, cost-effectiveness, and suitability for mining, tunneling, and civil reinforcement applications. Polyester capsules offer rapid curing, strong mechanical anchorage, and stable performance under varying geological conditions, making them widely preferred in both coal and metal mining operations. Epoxy and acrylic products continue to gain traction for structural applications requiring superior chemical resistance, while other resins support niche uses; however, the established supply chain and lower installation costs keep polyester firmly positioned as the leading product category.

- For instance, Minova’s Lokset® Advance capsules feature reinforced thixotropic polyester resin mastic and an organic peroxide catalyst separated by a physical barrier, enabling rapid insertion into boreholes for rock bolting in coal and hard rock mining, with quick high-load transfer and resistance to vibration-induced anchoring failure.

By Catalyst:

The organic peroxide segment accounted for 47.3% share in 2024, making it the leading catalyst type in the Resin Capsule Market due to its fast curing characteristics and strong compatibility with polyester and epoxy resin systems. Organic peroxides enable high-strength anchoring, reliable performance across diverse temperature conditions, and consistent reactivity, which supports their preference in mining, construction, and heavy-duty bolting applications. Oil-based and water-based catalysts continue to expand their presence due to environmental considerations and controlled curing requirements, yet organic peroxides remain dominant because they deliver superior mechanical fixation and predictable curing profiles essential for high-load reinforcement.

- For instance, Minova’s Lokset J Series capsules employ organic peroxide with reinforced polyester mastic for anchoring steel elements in construction and long tendon support like cable bolts.

By Type:

The superfast type dominated the Resin Capsule Market with 39.4% share in 2024, propelled by the increasing need for rapid installation, immediate load-bearing capability, and high efficiency in underground excavation and roadway support operations. Superfast capsules significantly reduce downtime, improve safety in dynamic mining environments, and enable rapid stabilization of rock strata. Fast-setting and slow-setting types retain relevance in applications requiring extended working time or controlled curing, but the industry’s emphasis on high-productivity mining cycles and accelerated reinforcement processes continues to strengthen the demand for superfast resin capsules as the preferred type.

Key Growth Drivers

Rising Mining and Tunneling Activities

Expanding global mining operations and large-scale tunneling projects strongly drive the Resin Capsule Market, as these sectors require reliable, fast-curing anchoring solutions for ground stabilization. Resin capsules support enhanced safety, improved load-bearing capacity, and rapid installation, making them essential in underground excavation and roadway reinforcement. Increasing investment in mineral exploration, particularly in Asia-Pacific and Latin America, further accelerates demand. Growth in infrastructure development, metro rail expansions, and hydropower tunneling also contributes to higher adoption, reinforcing resin capsules as a critical structural support technology.

- For instance, Sika’s Rokkon R (FS) resin capsules reinforce strata in Indian tunnel projects, enabling quick anchoring of rock bolts in mining and civil tunneling for overhead stability in demanding environments.

Shift Toward Higher Safety and Structural Reliability

Growing emphasis on worker safety and stringent reinforcement standards significantly boosts market growth. Resin capsules deliver consistent curing, strong bonding strength, and predictable load performance features that align with modern regulatory requirements across mining and civil engineering sectors. Companies increasingly prefer resin anchoring over mechanical fasteners due to better vibration resistance, long-term durability, and reduced failure risks. The rising adoption of systematic rock bolting, smart monitoring systems, and standardized reinforcement protocols further strengthens demand for reliable capsule-based anchoring solutions worldwide.

- For instance, Sandvik’s Fasloc® resin capsules provide fast curing and immediate load transfer for rock bolts in underground mining, enabling rapid installation while certified to EPD and CE standards for enhanced ground stability.

Technological Advancements in Resin Formulation

Advances in resin chemistry, catalyst optimization, and capsule manufacturing techniques drive market expansion by improving product performance and environmental compliance. New formulations offer enhanced temperature resistance, faster curing, improved adhesion to various substrates, and reduced VOC emissions. Manufacturers are also developing resin systems tailored for high-stress geological conditions and automation-friendly installation. Integration of recyclable packaging, longer shelf-life materials, and performance additives supports broader adoption. These improvements enable safer work environments, greater efficiency, and reduced maintenance requirements, making innovation a major growth driver.

Key Trends & Opportunities

Increasing Adoption of Eco-Friendly and Low-Emission Resin Systems

Sustainability emerges as a major trend as industries shift toward low-VOC, low-toxicity, and eco-compliant resin formulations. Growing environmental regulations and corporate sustainability commitments encourage manufacturers to innovate greener alternatives without compromising performance. This creates significant opportunities for water-based catalysts, bio-based acrylic resins, and recyclable capsule materials. As mining and construction companies aim to lower environmental footprints, demand for environmentally responsible resin capsule systems rises, positioning green chemistry as a strategic growth pathway for future product offerings.

- For instance, Arkema partnered with Catalyxx to develop bio-based acrylic resins from bioethanol-derived n-butanol, enabling drop-in replacement in existing production lines for coatings and adhesives used in construction and e-mobility.

Automation and Mechanized Bolting Systems Expanding Market Scope

The increasing use of mechanized and automated bolting equipment in mining and tunneling operations creates opportunities for resin capsule manufacturers to develop optimized, machine-compatible products. Automation enhances installation speed, reduces human error, and improves underground safety, making it ideal for high-production environments. Capsules with consistent dimensions, rapid curing times, and enhanced flow characteristics align well with robotic bolting systems. As companies modernize excavation procedures and adopt digitalized maintenance frameworks, demand for advanced resin capsules tailored for automated reinforcement continues to grow.

- For instance, Epiroc’s Boltec rig deploys pumpable resin with self-drilling anchor bolts at Vale’s Voisey’s Bay mine, allowing one-shot installations that cut cycle times by enabling immediate load transfer without redrilling.

Key Challenges

Fluctuating Raw Material Prices

The Resin Capsule Market faces challenges from volatile prices of key raw materials, including polyester, epoxy resins, catalysts, and specialty additives. These fluctuations directly impact production costs and reduce profit margins for manufacturers. Dependence on petrochemical derivatives makes pricing highly sensitive to global supply disruptions, energy costs, and geopolitical uncertainties. Manufacturers must manage inventory strategically and invest in material-efficient formulations to mitigate price instability. The challenge intensifies as customers demand high-performance products at competitive pricing, creating pressure across the supply chain.

Environmental and Regulatory Compliance Barriers

Strict environmental and safety regulations concerning chemical handling, VOC emissions, and underground application standards pose significant challenges for manufacturers. Resin capsules containing organic peroxides or hazardous compounds require rigorous compliance, specialized storage, and controlled transportation. Meeting evolving global standards often increases production complexity and operational costs. Companies must invest in safer formulations, improved packaging technologies, and regulatory certifications to maintain market access. These compliance requirements can slow product development cycles and create barriers for smaller manufacturers with limited R&D resources.

Regional Analysis

North America

North America held 28.4% share in 2024, driven by extensive mining operations, strong adoption of mechanized bolting systems, and stringent safety regulations across underground construction environments. The U.S. leads regional demand due to continuous investments in metal mining, shale development, and infrastructure rehabilitation. Advanced resin technologies, higher safety compliance, and strong supplier presence further support growth. Increasing tunneling activities for transit expansion and maintenance of aging civil structures contributes to sustained consumption. Ongoing modernization of mining equipment enhances the use of fast-curing, high-strength resin capsules across both industrial and commercial applications.

Europe

Europe accounted for 23.1% share in 2024, influenced by well-established mining activities, strict regulatory frameworks, and growing infrastructure reinforcement requirements. Countries such as Germany, Poland, and the UK drive consumption through active coal mining, tunneling projects, and underground engineering works. The region’s early adoption of eco-friendly resin formulations and low-VOC catalyst systems strengthens demand for advanced capsule technologies. Investments in metro expansions, renewable-energy-related tunneling, and rehabilitation of old transport corridors further support market growth. Strong emphasis on worker safety and structural integrity continues to elevate resin capsule usage across construction and mining sectors.

Asia-Pacific

Asia-Pacific dominated the Resin Capsule Market with 36.7% share in 2024, supported by rapid industrialization, extensive mining output, and large-scale tunneling for transportation, hydropower, and urban infrastructure projects. China, India, and Australia remain the primary contributors due to high mineral extraction volumes and expanding underground developments. The region’s shift toward advanced anchoring solutions, increased mechanized bolting, and rising safety compliance accelerates adoption. Growing investments in metro systems, expressway tunnels, and smart city construction further stimulate demand. Expanding local manufacturing capacity also enhances supply flexibility, reinforcing Asia-Pacific as the leading regional market.

Latin America

Latin America captured 7.6% share in 2024, mainly driven by substantial mining activities across Chile, Peru, and Brazil, where resin capsules are widely used for rock reinforcement and ground stabilization. Growing investments in copper, lithium, and gold mining projects strengthen demand for high-strength anchoring solutions. Infrastructure upgrades and tunneling for water management and transportation systems also contribute to market expansion. The region increasingly adopts improved resin systems to enhance underground safety and operational efficiency. However, fluctuating mining output and economic instability can influence demand patterns, balancing regional growth prospects.

Middle East & Africa

The Middle East & Africa region accounted for 4.2% share in 2024, supported by ongoing mining developments, rising quarrying activities, and infrastructure-oriented tunneling projects. South Africa leads demand due to its strong mining sector, particularly in gold, platinum, and coal. Gulf countries increasingly adopt resin capsules for underground utility tunnels, metro expansions, and large-scale construction programs. Growing focus on worker safety and improved ground reinforcement techniques accelerates the shift toward reliable resin-based anchoring. Despite lower industrial penetration compared to other regions, increasing exploration and infrastructure investments continue to support steady market growth.

Market Segmentations:

By Product

- Polyester

- Epoxy

- Acrylic

- Others

By Catalyst

- Organic Peroxide

- Oil Based

- Water Based

By Type

By End User

- Mining

- Construction

- Manufacturing, Oil & Gas

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Resin Capsule Market features leading players including AkzoNobel N.V., PPG Industries Inc., Arkema, Hexion, Huntsman International LLC, Cardolite Corporation, BASF SE, Kukdo Chemical Co. Ltd., DuPont, and DAIKIN. The market is characterized by strong product innovation, capacity expansion, and portfolio diversification as companies focus on delivering high-performance resin formulations tailored for mining, tunneling, and infrastructure reinforcement. Manufacturers invest heavily in developing fast-curing, eco-friendly, and high-strength anchoring systems to meet evolving safety and regulatory standards. Strategic partnerships with mining contractors, expansion of distribution networks in emerging markets, and advancements in catalyst technology further enhance market positioning. Increasing demand for mechanized bolting and automation-friendly capsules is driving R&D efforts toward consistent curing behavior, improved adhesion, and enhanced temperature tolerance. Moreover, global players are strengthening supply capabilities and local manufacturing to minimize logistics disruptions and ensure stable delivery for large-scale underground projects.

Key Player Analysis

- Hexion (U.S.)

- DAIKIN (Japan)

- Kukdo Chemical Co., Ltd. (South Korea)

- Dupont (U.S.)

- Cardolite Corporation (U.S.)

- Arkema (France)

- PPG Industries Inc. (U.S.)

- Huntsman International LLC (U.S.)

- AkzoNobel N.V. (Netherlands)

- BASF SE (Germany)

Recent Developments

- In June 2025, Sandvik launched a new pumpable resin system for its i-series bolters, including the DS412i, enhancing bolting efficiency with monitored resin flow and compatibility with DSI Inject Mineral Bolt resin.

- In September 2024, Sandvik introduced Fasloc SF Styrene-Free resin capsules and an updated ARI (Automatic Resin Injection) system for automated installation in underground mining.

- In May 2023, Minova opened a new Lokset Resin Cartridge production facility at its Hamilton, Ontario site in Canada to expand manufacturing capacity.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product, Catalyst, Type, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady demand growth driven by continued mining expansion and tunneling projects worldwide.

- Adoption of fast-curing and high-strength resin formulations will increase as safety standards become more stringent.

- Eco-friendly and low-VOC resin systems will gain traction due to rising environmental compliance requirements.

- Automation and mechanized bolting technologies will accelerate the shift toward precision-engineered resin capsules.

- Manufacturers will invest more in localized production to improve supply stability and reduce logistics costs.

- Advanced catalyst systems offering improved curing control will shape future product innovations.

- Infrastructure rehabilitation and metro rail expansion will continue to boost resin capsule consumption.

- Digital monitoring and smart reinforcement systems will enhance integration with resin-based anchoring.

- Strategic partnerships between resin suppliers and mining contractors will strengthen long-term market growth.

- Emerging economies will offer significant growth opportunities as underground development activities expand.

Market Segmentation Analysis:

Market Segmentation Analysis: