Market Overview

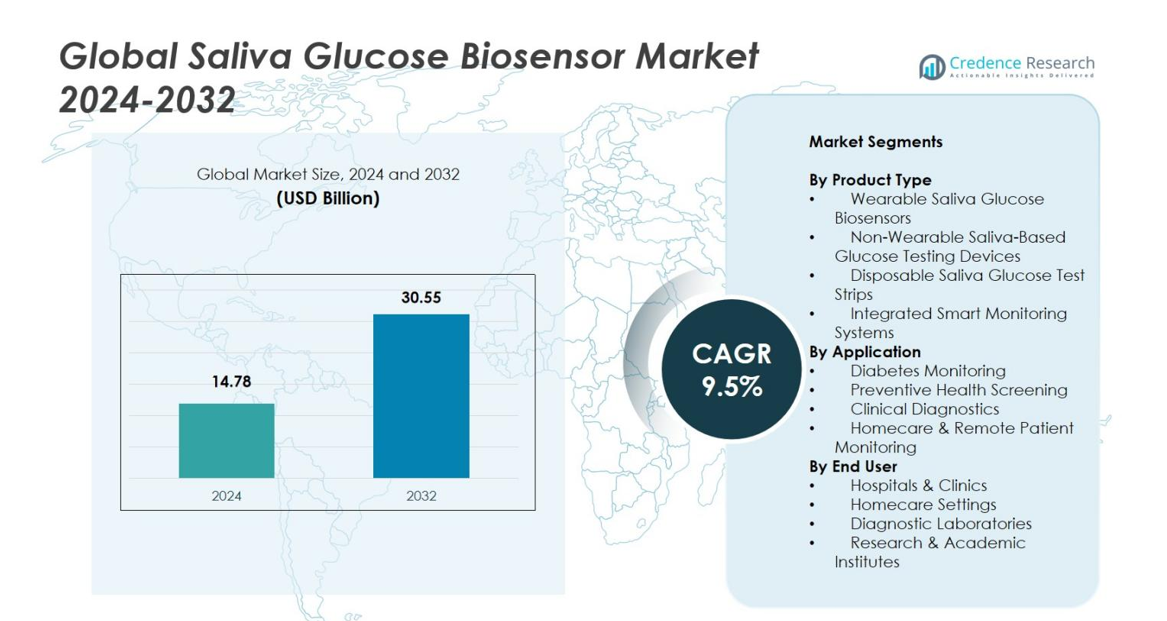

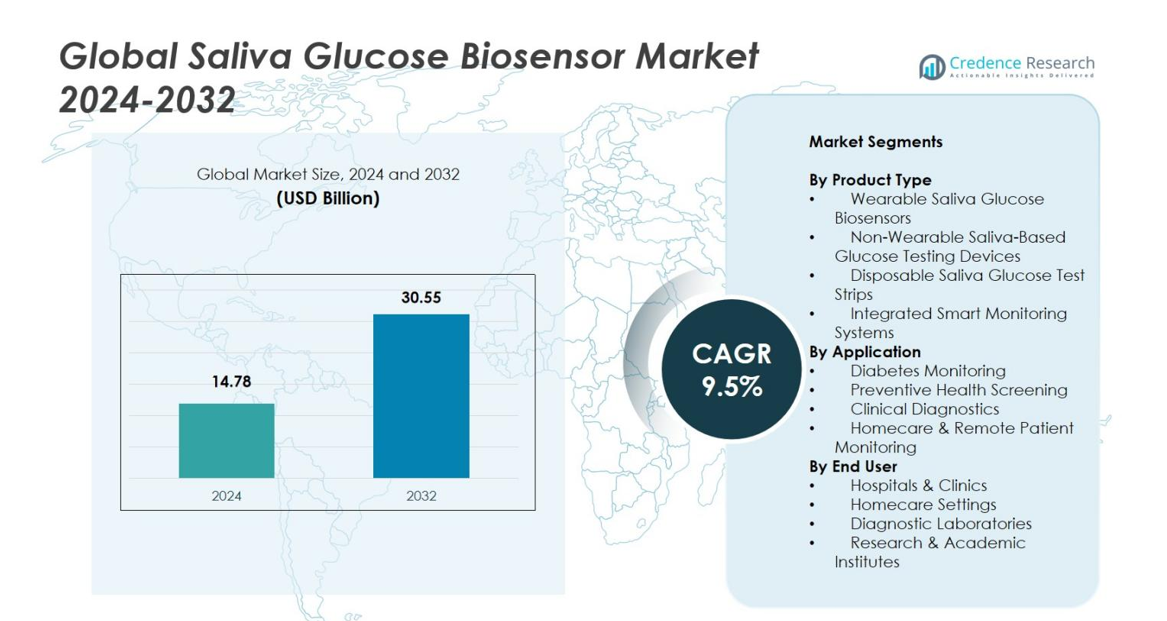

Global Saliva Glucose Biosensor Market size was valued at USD 14.78 Billion in 2024 and is anticipated to reach USD 30.55 Billion by 2032, at a CAGR of 9.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Saliva Glucose Biosensor Market Size 2024 |

USD 14.78 Billion |

| Saliva Glucose Biosensor Market, CAGR |

9.5% |

| Saliva Glucose Biosensor Market Size 2032 |

USD 30.55 Billion |

Global Saliva Glucose Biosensor Market is shaped by leading players such as Abbott Laboratories, Dexcom, F. Hoffmann-La Roche, Medtronic, Nova Diabetes Care, Sanofi, GlySens, Trividia Health, Bayer, and LifeScan, all focusing on advancing non-invasive glucose monitoring technologies. These companies invest in high-sensitivity biosensors, AI-enabled data platforms, and wearable integration to strengthen market presence. North America dominates the market with a 38 percent share, driven by strong R&D capabilities and rapid adoption of digital health solutions. Europe holds 27 percent, supported by preventive healthcare initiatives, while Asia-Pacific captures 24 percent, reflecting rising diabetes prevalence and expanding diagnostic infrastructure.

Market Insights

- Global Saliva Glucose Biosensor Market reached USD 14.78 Billion in 2024 and will expand at a 9.5% CAGR through 2032.

- Market growth is driven by rising demand for non-invasive glucose monitoring, with wearable saliva glucose biosensors holding the largest segment share due to strong adoption in homecare and digital health settings.

- Key trends include rapid integration of biosensors with smart wearables and AI-enabled platforms that support continuous monitoring, personalized insights, and enhanced patient adherence.

- Major players such as Abbott, Dexcom, Roche, Medtronic, Sanofi, and LifeScan are investing in advanced sensing materials, wireless connectivity, and miniaturized designs to strengthen technology leadership.

- Regional performance is led by North America with 38 percent share, followed by Europe at 27 percent and Asia-Pacific at 24 percent, each supported by strong diabetes prevalence, expanding telehealth models, and growing preference for non-invasive diagnostics.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Product Type

Wearable Saliva Glucose Biosensors lead the Global Saliva Glucose Biosensor Market with a 42% share, driven by strong demand for continuous, non-invasive monitoring and seamless integration with smartphones and digital health platforms. Their ability to provide real-time glucose trends strengthens adoption among diabetic and prediabetic populations. Non-wearable saliva-based testing devices hold a moderate share due to their utility in clinical diagnostics, while disposable saliva glucose test strips and integrated smart monitoring systems gain traction as affordable and user-friendly solutions for home-based care and preventive screening initiatives.

- For instance, the iQ Group Global (via its licensee, GBS Inc.) has developed a non-invasive, point-of-care glucose biosensor technology using BioSensor™ platform, which is designed to measure glucose in saliva

By Application

Diabetes Monitoring dominates the application segment with a 58% share, supported by the growing global diabetic population and the need for painless, user-friendly alternatives to blood-based glucose testing. Saliva biosensors enable continuous insights without finger-pricking, enhancing patient compliance. Preventive Health Screening is expanding steadily as biosensors gain relevance for early metabolic assessments. Clinical Diagnostics and Homecare & Remote Patient Monitoring are also rising, driven by telehealth adoption and increasing trust in saliva-based accuracy for routine glucose evaluation across both clinical and consumer wellness settings.

- For instance, paper described a hand-held optical biosensor that uses saliva for non-invasive glucose monitoring offering a point-of-care solution that avoids finger-pricks and can be used outside laboratory settings.

By End User

Hospitals & Clinics hold the largest share at 36%, as healthcare providers increasingly adopt saliva glucose biosensors for rapid, non-invasive assessments that improve patient experience and reduce testing time. Homecare Settings follow closely, benefiting from rising demand for self-monitoring solutions and integration with remote-care programs. Diagnostic Laboratories utilize these biosensors for early-stage metabolic screening, while Research & Academic Institutes contribute to innovation and validation studies. The growing shift toward decentralized care further strengthens demand across all end users, reinforcing adoption in both clinical and consumer environments.

Key Growth Drivers

Rising Demand for Non-Invasive Glucose Monitoring

The Global Saliva Glucose Biosensor Market experiences strong momentum as patients increasingly prefer non-invasive, pain-free glucose monitoring alternatives to traditional blood-based methods. The shift is driven by widespread dissatisfaction with finger-prick testing and growing awareness of saliva-based biosensing accuracy. Advances in biosensor materials, microfluidics, and enzymatic detection significantly improve reliability, boosting adoption among prediabetic and diabetic populations. Expanding home-based monitoring, coupled with rising cases of Type 2 diabetes, accelerates market penetration across both developed and emerging regions.

- For instance, a peer-reviewed study reported a saliva biosensor achieving correlation coefficients of 0.97 (fasting) and 0.90 (post-prandial) compared with blood glucose, demonstrating near-clinical precision.

Technological Advancements in Biosensor Design

Rapid innovation in nanotechnology, semiconductor biosensing, and wearable health devices enhances performance, durability, and sensitivity of saliva glucose biosensors. Integrating AI-enabled analytics enables real-time glucose trend prediction, creating a more personalized monitoring experience. Major players are investing in miniaturized sensor platforms that support wireless connectivity and continuous sampling. These advancements reduce calibration errors and improve clinical relevance, making saliva biosensors increasingly viable for remote patient monitoring. Such innovation strengthens market scalability and drives wider acceptance among healthcare providers.

- For instance, researchers developed a BioTFT-based semiconductor saliva glucose sensor capable of detecting glucose from 500 nM to 20 mM within 60 seconds, demonstrating high sensitivity suitable for continuous monitoring applications.

Growing Adoption of Digital Health and Remote Monitoring

The global push toward telehealth and remote diagnostics significantly boosts demand for saliva glucose biosensors. Healthcare systems aim to reduce hospital visits for chronic disease management, and saliva-based sensing aligns well with digital care models. Cloud-linked biosensors enhance patient-clinician communication, enabling continuous data tracking and quicker interventions. Governments and insurers increasingly support remote monitoring solutions to manage diabetes-related costs, further fueling adoption. As digital health ecosystems expand, saliva biosensors gain a strategic position in long-term glucose management programs.

Key Trends & Opportunities

Integration of Wearable and Smart Connected Platforms

A major trend shaping the market is the integration of saliva glucose biosensors with wearable devices and smartphone apps. Companies are developing patches, smart mouthguards, and ingestible micro-sensors that allow seamless data transmission. These connected solutions enable continuous glucose monitoring without user intervention, improving adherence and health outcomes. This trend presents significant opportunities for partnerships between biosensor developers and digital health platforms, supporting broader commercialization and enabling advanced predictive analytics.

- For instance, a UCSD-led team advanced a flexible epidermal patch designed to analyze glucose and other biomarkers from sweat and saliva simultaneously, enabling continuous monitoring through Bluetooth connectivity.

Expansion of Personalized and Preventive Healthcare Applications

As global healthcare shifts toward preventive and personalized care, saliva glucose biosensors gain traction beyond traditional diabetes monitoring. Their ability to provide early metabolic insights creates opportunities in wellness programs, prediabetes screening, and lifestyle monitoring. Integration with AI-enhanced risk assessment tools allows users to receive individualized recommendations, creating new value propositions for consumer wellness brands. This trend widens market applications and encourages R&D investments in multi-analyte saliva biosensor platforms.

- For instance, Life Science Biosensor Diagnostics, a subsidiary, filed for FDA Breakthrough Devices Designation to expedite approval for this non-invasive alternative to finger-prick testing.

Key Challenges

Accuracy and Standardization Concerns

Despite technological advancements, saliva glucose biosensors still face concerns regarding measurement accuracy compared to established blood-based systems. Variations in saliva composition, contamination risks, and lower glucose concentration levels introduce calibration challenges. Regulatory bodies require rigorous validation, slowing approval timelines. Limited clinical evidence for long-term performance further impacts physician confidence. Addressing these accuracy gaps remains essential for widespread adoption, requiring continued improvements in biosensor materials, signal amplification techniques, and algorithmic compensation models.

Regulatory and Commercialization Barriers

The pathway from prototype to commercial product remains complex, with strict regulatory requirements for medical biosensing technology. Startups face challenges securing funding due to lengthy approval cycles and high development costs. Large players must navigate global regulatory standards, including FDA, CE, and ISO frameworks, which differ in validation parameters. Additionally, market entry may be slowed by limited reimbursement policies for saliva-based monitoring devices. Overcoming these barriers requires strategic regulatory planning, strong clinical trial data, and advocacy for updated reimbursement frameworks.

Regional Analysis

North America

North America leads the Global Saliva Glucose Biosensor Market with 38% share in 2024, driven by strong adoption of non-invasive diagnostic technologies and a well-established diabetes management ecosystem. The region benefits from advanced healthcare infrastructure, high awareness of continuous glucose monitoring, and rapid integration of digital health platforms. Strong R&D investments from major biosensor developers and supportive regulatory pathways accelerate commercialization. Rising demand for home-based monitoring and growing subscription-based telehealth models further strengthen market expansion, positioning North America as the primary hub for innovation and early product deployment.

Europe

Europe holds 27% share of the Global Saliva Glucose Biosensor Market, supported by increasing focus on preventive healthcare and government initiatives promoting digital monitoring solutions for chronic diseases. High diabetes prevalence, combined with strong reimbursement frameworks in Western Europe, encourages adoption of innovative biosensing technologies. Research programs across Germany, the U.K., and the Netherlands drive advancements in wearable and saliva-based diagnostics. Growing acceptance of connected healthcare devices and rising consumer demand for personalized monitoring tools further enhance market potential across both clinical and homecare settings in the region.

Asia-Pacific

Asia-Pacific captures 24% share and represents the fastest-growing region in the Global Saliva Glucose Biosensor Market, propelled by rising diabetes incidence and expanding access to affordable diagnostic technologies. Countries such as China, India, Japan, and South Korea actively invest in non-invasive biosensor development and digital health infrastructure. Growing penetration of smartphones and telemedicine services accelerates direct-to-consumer adoption. Government programs supporting early diabetes screening and increasing healthcare expenditure contribute significantly to market growth. Strong manufacturing capabilities and partnerships between biotech firms and universities further strengthen the region’s innovation landscape.

Latin America

Latin America accounts for 6% share of the Global Saliva Glucose Biosensor Market, supported by increasing awareness of non-invasive glucose monitoring and improving healthcare access. Countries such as Brazil, Mexico, and Argentina show rising adoption of digital health platforms that facilitate home-based diabetes management. While reimbursement limitations and slower regulatory approvals pose challenges, growing private healthcare investment and partnerships with technology providers enhance market prospects. Expanding diabetes screening campaigns and the introduction of cost-effective biosensor solutions contribute to steady growth in both urban and semi-urban populations.

Middle East & Africa

The Middle East & Africa region holds 5% share of the Global Saliva Glucose Biosensor Market, with growth driven by rising diabetes burden and increasing government focus on modernizing healthcare infrastructure. Wealthier GCC countries, including the UAE and Saudi Arabia, are early adopters of innovative diagnostic tools and digital monitoring systems. Wider awareness campaigns for chronic disease management and growing private sector investment strengthen market adoption. However, limited clinical infrastructure in parts of Africa may restrain faster penetration, although ongoing telehealth expansion and non-invasive testing initiatives continue to create new opportunities.

Market Segmentations

By Product Type

- Wearable Saliva Glucose Biosensors

- Non-Wearable Saliva-Based Glucose Testing Devices

- Disposable Saliva Glucose Test Strips

- Integrated Smart Monitoring Systems

By Application

- Diabetes Monitoring

- Preventive Health Screening

- Clinical Diagnostics

- Homecare & Remote Patient Monitoring

By End User

- Hospitals & Clinics

- Homecare Settings

- Diagnostic Laboratories

- Research & Academic Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Global Saliva Glucose Biosensor Market features leading players such as Abbott Laboratories, Dexcom, F. Hoffmann-La Roche, Medtronic, Nova Diabetes Care, Sanofi, GlySens, Trividia Health, Bayer, and LifeScan. Market participants actively invest in non-invasive glucose monitoring technologies, focusing on improving sensitivity, accuracy, and real-time data integration. Innovation centers on nanotechnology-based biosensors, smart wearable platforms, and AI-driven analytics to enhance predictive capabilities. Established companies leverage strong distribution networks and regulatory expertise to accelerate commercialization, while emerging biotech firms pursue rapid prototyping and niche clinical applications. Strategic collaborations with digital health providers, academic institutions, and sensor component manufacturers support faster product development. Rising demand for remote monitoring and personalized metabolic insights encourages players to expand product portfolios and strengthen regional presence across North America, Europe, and Asia-Pacific. As technological advancements accelerate, competition intensifies, pushing companies to differentiate through design miniaturization, connectivity features, and subscription-driven service models.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott Laboratories

- Dexcom, Inc.

- F. Hoffmann-La Roche Ltd. (Roche)

- Medtronic

- Nova Diabetes Care

- Sanofi

- GlySens Incorporated

- Trividia Health, Inc.

- Bayer AG

- LifeScan IP Holdings, LLC

Recent Developments

- In August 2024, Dexcom officially launched its Stelo over-the-counter continuous glucose monitor biosensor, making it available for purchase without prescription through Stelo.com.

- In March 2024, Dexcom received FDA clearance for Stelo – the first glucose biosensor cleared by the FDA for over-the-counter use without a prescription, designed for individuals aged 18 and older not using insulin therapy.

- In January 2024, Abbott introduced Lingo across the UK – a pioneering biowearable device designed to track glucose spikes and dips in real time with personalized insights and customized coaching for consumers.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong adoption as non-invasive glucose monitoring becomes a preferred alternative to blood-based testing.

- Continuous innovation in nanotechnology and biosensor materials will significantly enhance accuracy and clinical reliability.

- Integration with wearable devices and smart health platforms will expand real-time glucose monitoring capabilities.

- AI-driven analytics will enable predictive glucose trend insights, improving personalized diabetes management.

- Remote patient monitoring programs will accelerate commercial adoption across homecare and telehealth ecosystems.

- Regulatory approvals for next-generation saliva-based sensors will increase as validation studies strengthen clinical confidence.

- Expansion into wellness, preventive screening, and metabolic health applications will broaden end-user demand.

- Strategic partnerships between biotech firms, digital health providers, and research institutions will drive faster product development.

- Growing manufacturing investments in Asia-Pacific will support large-scale production and cost optimization.

- Rising global diabetes incidence will sustain long-term demand and stimulate continuous product innovation.