| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Licensed Toy Market Size 2024 |

USD 29,845.23 million |

| Licensed Toy Market, CAGR |

4.60% |

| Licensed Toy Market Size 2032 |

USD 42,778.99 million |

Market Overview

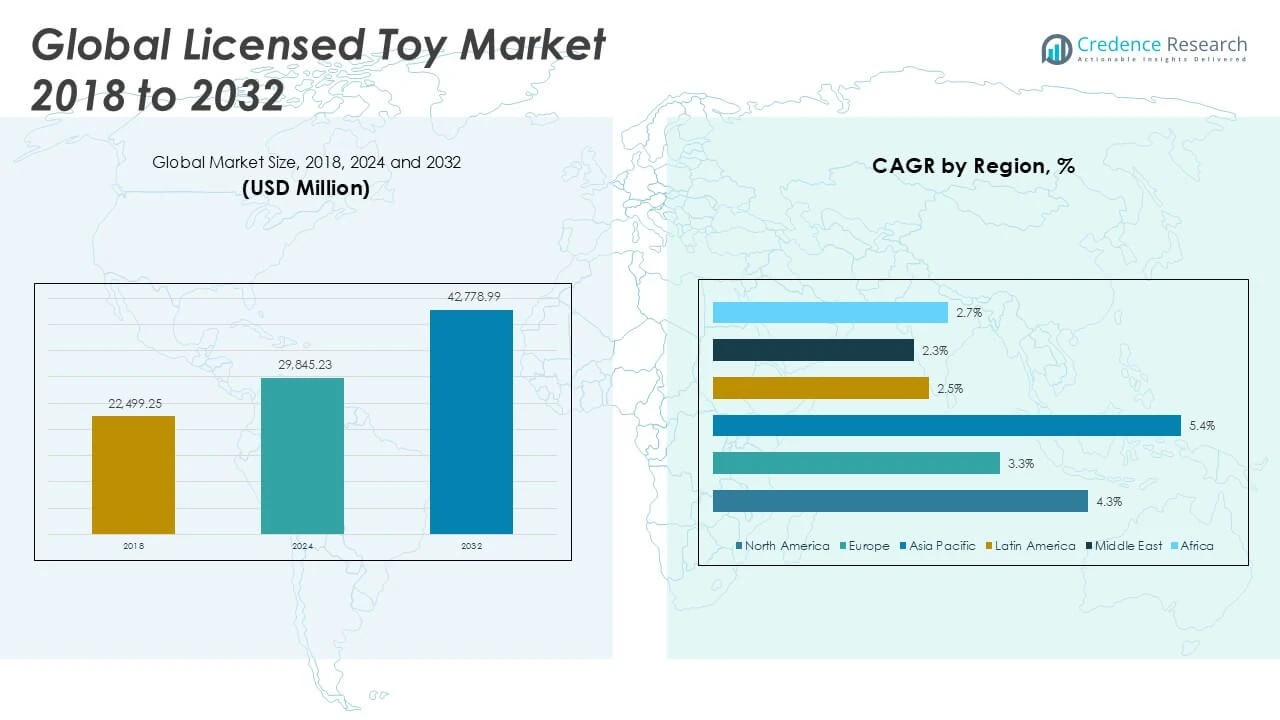

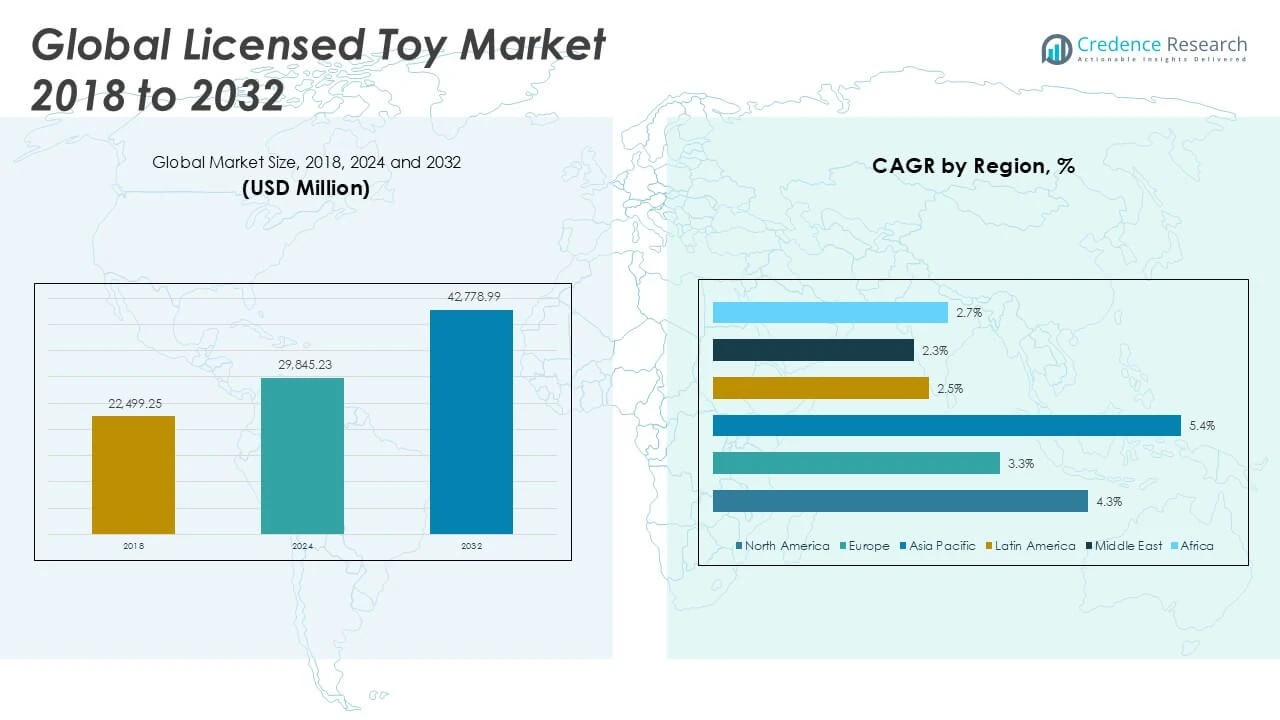

Licensed Toy Market size was valued at USD 22,499.25 million in 2018 to USD 29,845.23 million in 2024 and is anticipated to reach USD 42,778.99 million by 2032, at a CAGR of 4.60% during the forecast period.

The Licensed Toy Market experiences steady growth, driven by the global appeal of popular entertainment franchises and characters that resonate with both children and collectors. Strategic collaborations between toy manufacturers and media companies lead to continuous product innovation and frequent new launches, sustaining consumer interest and brand loyalty. The expansion of digital streaming platforms and social media amplifies the reach of licensed properties, fueling demand across multiple demographics and regions. E-commerce growth and omnichannel retail strategies improve accessibility and convenience for buyers, supporting rising sales volumes. Manufacturers respond to evolving consumer expectations by prioritizing product safety, eco-friendly materials, and unique designs that stand out in a competitive landscape. Trends such as collectible toys, limited editions, and interactive features further boost engagement and repeat purchases. Together, these drivers and trends reinforce the Licensed Toy Market’s position as a dynamic and resilient segment within the global toy industry.

The Licensed Toy Market demonstrates strong global presence, with North America, Europe, and Asia Pacific accounting for the largest revenue contributions due to advanced retail networks, high consumer spending, and deep-rooted connections to major entertainment franchises. Rapid urbanization and rising disposable incomes in Asia Pacific support accelerated growth, especially in countries like China and Japan, where demand for character-based and collectible toys is surging. Europe maintains robust demand for high-quality, safety-certified licensed toys, while Latin America, the Middle East, and Africa exhibit steady growth as international brands expand their reach and local adaptations gain popularity. Leading players in the market include Bandai Namco Holdings Inc., LEGO Group, Hasbro Inc., and Mattel Inc., all of whom leverage strong partnerships with entertainment companies, innovative product design, and diverse portfolios to maintain competitive advantage and capture evolving consumer preferences across regions.

Market Insights

- The Licensed Toy Market was valued at USD 22,499.25 million in 2018, reached USD 29,845.23 million in 2024, and is expected to reach USD 42,778.99 million by 2032, reflecting a CAGR of 4.60% during the forecast period.

- Strong demand for toys based on popular entertainment franchises, movies, and TV series fuels continuous market growth across multiple age groups.

- Key market trends include the rise of collectibles, integration of interactive technology, and a shift toward sustainable and eco-friendly licensed products.

- Major players such as Bandai Namco Holdings Inc., LEGO Group, Hasbro Inc., and Mattel Inc. focus on strategic partnerships, innovative product launches, and expanding their global reach.

- The market faces challenges from counterfeit products, intellectual property concerns, and rapidly shifting consumer preferences that require ongoing adaptation.

- North America, Europe, and Asia Pacific remain the primary regions for market activity, benefiting from advanced retail infrastructure, established licensing agreements, and strong entertainment industries.

- The increasing influence of digital media, gaming, and social media-driven licensing opportunities is expected to shape future product development and support diversified growth in emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Enduring Influence of Entertainment Franchises

The Licensed Toy Market benefits significantly from the enduring influence of globally recognized entertainment franchises. Major film studios, television networks, and digital content creators partner with toy manufacturers to launch products featuring beloved characters and storylines. This synergy drives recurring consumer interest and repeat purchases, as new movie releases, streaming series, and gaming titles generate fresh demand for licensed merchandise. The ability of franchises to cross generations allows the market to appeal to both children and adult collectors. The sustained popularity of brands such as Marvel, Disney, and Star Wars strengthens the market’s foundation. By aligning toy launches with media events, the Licensed Toy Market ensures consistent engagement and visibility across multiple platforms.

- For instance, licensing agreements with major entertainment franchises have led to increased sales of die-cast toys featuring characters from blockbuster films.

Strategic Collaborations and Licensing Agreements

Strategic collaborations and licensing agreements serve as key growth engines for the Licensed Toy Market. Leading manufacturers actively seek partnerships with global entertainment, sports, and gaming brands to diversify their product portfolios. These agreements enable access to well-established fan bases and create opportunities for co-branded products. The market responds quickly to new trends by securing timely licensing rights, enabling rapid development and launch of on-trend toys. Licensing partnerships foster innovation in product design, packaging, and marketing campaigns, which strengthens consumer loyalty. Manufacturers use these alliances to remain agile and competitive in a fast-evolving industry.

- For instance, Indian toy manufacturers now collaborate with international entertainment properties such as Disney, Marvel, Nickelodeon, and DC Comics to produce high-quality toys based on memorable characters.

Advancements in Retail and Distribution Channels

Expanding retail and distribution channels underpin the growth of the Licensed Toy Market. E-commerce platforms, specialty stores, and omnichannel retail strategies improve accessibility and convenience for consumers globally. The rise of digital marketing and influencer collaborations amplifies product reach, while robust logistics networks support efficient distribution. Retailers capitalize on seasonal events, exclusive launches, and bundled promotions to drive sales and maintain shopper interest. The market adapts quickly to shifting consumer behaviors by integrating online and offline experiences. This diversified retail presence ensures that licensed toys remain visible and readily available to a wide audience.

Focus on Innovation, Safety, and Sustainability

A strong focus on innovation, safety, and sustainability differentiates leading players in the Licensed Toy Market. Manufacturers invest in advanced materials, interactive features, and smart technologies to enhance product appeal and functionality. Stringent safety standards guide product development, addressing the concerns of parents and regulators alike. Eco-friendly materials and sustainable production practices gain traction, reflecting growing consumer awareness of environmental impact. The market introduces limited-edition and collectible items to foster exclusivity and encourage repeat purchases. These drivers collectively ensure the Licensed Toy Market remains resilient and responsive to evolving market expectations.

Market Trends

Rise of Collectibles and Limited Editions

The Licensed Toy Market witnesses a pronounced trend toward collectible and limited-edition products. Manufacturers create exclusive releases tied to major entertainment franchises, anniversaries, or media events, generating excitement and urgency among both children and adult collectors. These items often feature unique packaging, numbered certificates, or special accessories, enhancing their perceived value and desirability. The market sees strong secondary sales and trading communities develop around rare licensed toys, driving further engagement. Limited production runs help brands manage inventory risks and command premium prices. This trend amplifies brand loyalty and keeps consumer interest high throughout product life cycles.

- For instance, limited edition niche collectibles for movies, games, and anniversaries are increasingly becoming popular, and the market for such keeps expanding.

Expansion of Licensing Beyond Traditional Media

The Licensed Toy Market expands its scope beyond traditional film and television franchises to include video games, social media influencers, and sports personalities. The proliferation of digital content enables new licensing opportunities, allowing brands to tap into niche fandoms and diverse audiences. Toys inspired by viral internet trends, esports teams, or digital celebrities gain rapid popularity, reflecting shifting entertainment consumption habits. Manufacturers capitalize on these dynamics by adapting product portfolios to align with emerging icons and platforms. This broadens the appeal of licensed toys and supports sustained market growth across multiple demographics.

- For instance, streaming platforms like Netflix and Disney+ are serving as incubators for new intellectual property, which toy companies then translate into licensed toy lines.

Integration of Technology and Interactive Features

Integration of advanced technology stands out as a key trend in the Licensed Toy Market. Brands incorporate smart features such as app connectivity, voice recognition, and augmented reality to create immersive experiences. Interactive toys foster deeper engagement and encourage repeat use by offering customizable content or learning modules linked to licensed properties. The convergence of physical toys with digital platforms supports broader storytelling and cross-media promotion. Parents appreciate the educational value and entertainment options these toys deliver, while children are drawn to their novelty. Manufacturers prioritize partnerships with tech firms to accelerate product development and maintain a competitive edge.

Emphasis on Sustainability and Ethical Sourcing

Sustainability emerges as a central trend in the Licensed Toy Market, with companies adopting eco-friendly materials and transparent sourcing practices. Brands promote recyclable packaging, biodegradable plastics, and responsibly sourced fabrics to address rising consumer concerns about environmental impact. Licensing agreements increasingly include guidelines for ethical production and reduced carbon footprints. The market responds to regulatory pressures and consumer advocacy by publicizing sustainability initiatives and certifications. This commitment supports corporate social responsibility goals while attracting environmentally conscious buyers. Embracing sustainability enhances brand image and aligns licensed toy products with broader global values.

Market Challenges Analysis

Intellectual Property and Counterfeit Risks

The Licensed Toy Market faces persistent challenges related to intellectual property protection and the proliferation of counterfeit products. Unauthorized copying and distribution of popular licensed toys undermine brand reputation and erode the market share of legitimate manufacturers. It imposes significant legal and financial burdens on companies, forcing them to invest heavily in monitoring, enforcement, and anti-counterfeiting measures. The presence of fakes in both physical and online retail channels confuses consumers and raises concerns about product safety and quality. Brands must continually innovate in packaging, authentication, and supply chain management to combat these risks. Ensuring consumer confidence requires vigilant oversight and collaboration with regulatory bodies.

Evolving Consumer Preferences and Regulatory Pressures

Rapid shifts in consumer preferences and tightening regulations present further challenges for the Licensed Toy Market. Changing trends in entertainment and media can quickly alter demand for licensed properties, requiring manufacturers to adapt product lines at a fast pace. The growing emphasis on eco-friendly materials and ethical production places additional pressure on companies to overhaul sourcing and manufacturing practices. Meeting international safety standards demands continuous investment in research, testing, and compliance. Heightened scrutiny from parents, advocacy groups, and regulators increases the complexity of bringing new licensed toys to market. The need to balance innovation, safety, and sustainability often tests the agility and resilience of market participants.

- For instance, the Indian toy industry has witnessed a significant decline in imports due to government-led initiatives promoting domestic manufacturing and quality control.

Market Opportunities

Expansion into Digital and Emerging Media Properties

The Licensed Toy Market holds substantial opportunity in partnering with digital content creators, gaming companies, and social media influencers. The rapid rise of online streaming, mobile gaming, and short-form video platforms generates a continuous stream of new characters and brands that resonate with younger audiences. By securing licensing agreements with these fast-growing media properties, toy manufacturers can launch timely and relevant products that capture emerging consumer trends. It enables brands to reach niche fandoms and capitalize on viral phenomena that traditional media may not cover. Expanding into digital-first franchises supports product diversification and aligns with evolving entertainment consumption habits. This approach fosters innovation and keeps the Licensed Toy Market agile and competitive.

Focus on Sustainability and Ethical Consumerism

The Licensed Toy Market also finds strong opportunity in embracing sustainability and ethical business practices. Consumers are increasingly prioritizing eco-friendly materials, recyclable packaging, and responsible sourcing in their purchasing decisions. Leading companies invest in product innovation to develop toys that meet these expectations without compromising quality or safety. Partnerships with licensors can include sustainability guidelines, driving industry-wide adoption of greener practices. Highlighting ethical initiatives and certifications strengthens brand image and attracts environmentally conscious buyers. This focus positions the Licensed Toy Market for long-term growth, opening new segments and supporting higher brand loyalty in a changing global marketplace.

Market Segmentation Analysis:

By Product Type:

The Licensed Toy Market demonstrates a dynamic and diverse segment structure that supports broad consumer appeal and sustained growth. By product type, action figures and dolls & plush toys account for substantial market share, driven by popular entertainment franchises and the enduring appeal of character-based play. Arts & crafts, games & puzzles, outdoor & sports toys, construction sets, and educational toys each address distinct developmental and recreational needs, while the “others” segment captures niche and seasonal products.

By Price:

Segmenting by price, the market serves a wide spectrum of buyers through low, medium, and high price points. Low-priced toys attract budget-conscious families, while medium-priced options balance affordability with quality and brand recognition. The high-end segment features premium collectibles and limited-edition licensed items, targeting enthusiasts and gift buyers seeking exclusivity.

By Age Group:

Based on age group, the Licensed Toy Market provides tailored offerings from infants below 1 year to children and teenagers up to age 12+, ensuring relevance across every stage of childhood and extending to collectors. This comprehensive segmentation supports targeted marketing, innovation, and product differentiation in a competitive landscape.

Segments:

Based on Product Type:

- Action Figures

- Dolls & Plush Toys

- Arts & Crafts

- Games & Puzzles

- Outdoor & Sports Toys

- Construction Sets

- Educational Toys

- Others

Based on Price:

Based on Age Group:

- Below 1 Yrs.

- Age 1–3

- Age 3–5

- Age 5–12

- Age 12+

Based on End- User:

Based on Distribution Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Licensed Toy Market

North America Licensed Toy Market grew from USD 8,352.40 million in 2018 to USD 10,944.10 million in 2024 and is projected to reach USD 15,738.18 million by 2032, reflecting a CAGR of 4.3%. North America is holding a 37% market share in 2024. The region benefits from a mature retail landscape, strong presence of leading toy manufacturers, and continuous demand for toys linked to blockbuster entertainment franchises. High disposable incomes and a culture of seasonal gifting drive sustained growth. The United States remains the largest market, with frequent launches of licensed toys supported by integrated marketing campaigns. E-commerce and omnichannel strategies enhance accessibility and consumer engagement, reinforcing the region’s dominant position.

Europe Licensed Toy Market

Europe Licensed Toy Market grew from USD 5,202.50 million in 2018 to USD 6,595.87 million in 2024 and is expected to reach USD 8,769.81 million by 2032, with a CAGR of 3.3%. Europe accounts for a 22% market share. The market is shaped by a strong tradition of character-based toys and an emphasis on product safety and sustainability. Key markets such as the United Kingdom, Germany, and France lead adoption, driven by collaborations between toy brands and popular media franchises. Retailers leverage both online and offline channels to reach diverse consumer segments. Licensing agreements with European sports teams and animation studios further boost market growth.

Asia Pacific Licensed Toy Market

Asia Pacific Licensed Toy Market grew from USD 6,642.45 million in 2018 to USD 9,292.76 million in 2024 and is projected to reach USD 14,502.29 million by 2032, posting the fastest CAGR at 5.4%. Asia Pacific holds a 31% market share in 2024. Rapid urbanization, rising incomes, and a growing young population fuel strong demand for licensed toys across China, Japan, and Australia. Local adaptations of global entertainment franchises and the increasing popularity of anime and gaming properties drive product launches. E-commerce growth supports broad product reach, while seasonal promotions and educational campaigns stimulate sales. The region is positioned as a key driver of future global market expansion.

Latin America Licensed Toy Market

Latin America Licensed Toy Market grew from USD 952.62 million in 2018 to USD 1,246.12 million in 2024 and is set to reach USD 1,556.85 million by 2032, registering a CAGR of 2.5%. Latin America captures a 4% market share. Brazil and Mexico lead regional demand, with consumer interest rising for toys featuring international movie and TV characters. Urbanization, improvements in retail infrastructure, and targeted marketing campaigns support incremental growth. E-commerce and specialty stores expand product access, while price-sensitive consumers drive demand for value-oriented licensed products. Regional licensing of local sports and cultural icons also adds diversity to market offerings.

Middle East Licensed Toy Market

Middle East Licensed Toy Market grew from USD 697.48 million in 2018 to USD 853.38 million in 2024 and is projected to reach USD 1,052.09 million by 2032, reflecting a CAGR of 2.3%. The Middle East holds a 3% market share. The market benefits from a young population and increasing adoption of Western entertainment franchises. Key markets include the UAE and Saudi Arabia, where premium licensed toys are in demand. Expanding retail malls and the rise of e-commerce platforms increase accessibility. Licensing of regional characters and educational toys supports market diversification. Economic stability and tourism also help sustain demand.

Africa Licensed Toy Market

Africa Licensed Toy Market grew from USD 651.80 million in 2018 to USD 913.00 million in 2024 and is forecast to reach USD 1,159.78 million by 2032, at a CAGR of 2.7%. Africa holds a 3% market share. Growth is driven by an expanding young population, urbanization, and improving access to international brands. South Africa, Nigeria, and Egypt serve as key growth hubs, supported by investments in retail development and digital infrastructure. Price-sensitive consumers prefer affordable licensed toys, while awareness campaigns build interest in global characters. The market is in a developing stage, presenting long-term opportunities as incomes rise and retail networks mature.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Bandai Namco Holdings Inc.

- Basic Fun!

- Funko Inc.

- LEGO Group

- Hasbro Inc.

- JAKKS Pacific Inc.

- Mattel Inc.

- Melissa & Doug LLC

- Ravensburger AG

- VTech Holdings Ltd.

- Spin Master Corp.

- Tomy Company Ltd.

Competitive Analysis

The Licensed Toy Market is highly competitive, led by major players such as Bandai Namco Holdings Inc., Basic Fun!, Funko Inc., LEGO Group, Hasbro Inc., JAKKS Pacific Inc., Mattel Inc., Melissa & Doug LLC, Ravensburger AG, VTech Holdings Ltd., Spin Master Corp., and Tomy Company Ltd. These companies command strong brand recognition through established partnerships with global entertainment studios, movie franchises, and gaming companies, enabling them to secure exclusive rights to high-demand licensed properties. They invest heavily in product innovation, launching new collections and limited editions that keep consumer interest high and support premium pricing. Marketing strategies rely on coordinated releases with media events, influencer collaborations, and digital campaigns to reach a broad audience. These players continuously adapt to shifting consumer trends by incorporating technology, sustainability, and customization into their offerings. Robust distribution networks across e-commerce and retail channels ensure widespread product accessibility. To maintain their leadership, these companies emphasize quality, safety, and rapid response to market changes, positioning themselves as trendsetters in the evolving Licensed Toy Market.

Recent Developments

- In May 2025, JAKKS Pacific announced a new toy line for the DC x Sonic the Hedgehog crossover, launching fall 2025. The line features action figures, vehicles, and plush toys combining characters from both franchises, following the launch of a related DC comic series in March 2025.

- In March 2025, Bandai Namco launched a new initiative to strengthen its licensing business, establishing a dedicated licensing division from April 1, 2025. The company listed 27 IPs for potential licensing, including classics like Pac-Man, Ridge Racer, Soul Calibur, and the WonderSwan handheld, aiming to create more opportunities for collaborations and licensed products.

- In February 2025, Basic Fun! announced a worldwide licensing agreement with Hasbro to manufacture and distribute classic and reimagined Stretch Armstrong toys. The new line, featuring “Power Plasma” filling and multi-scale figures, will debut globally in fall 2025, including co-branded Stretch Armstrong-inspired licensed character action figures with other entertainment brands.

- In February 2025, Funko partnered with the NBA to launch personalized Pop! Yourself collectibles, allowing fans to create custom vinyl figures featuring official logos of all 30 NBA teams. This initiative debuted during NBA All-Star 2025, expanding Funko’s library of licensed NBA/NBPA products.

Market Concentration & Characteristics

The Licensed Toy Market displays a moderately high level of market concentration, with a select group of major players holding substantial influence over global sales and product innovation. It is shaped by dynamic collaborations between toy manufacturers and leading entertainment franchises, driving a steady pipeline of new product launches aligned with popular media releases. The market is highly responsive to trends in entertainment, technology, and consumer preferences, supporting continuous evolution in design, materials, and features. Its characteristics include frequent integration of collectible, interactive, and eco-friendly elements to meet the expectations of both children and adult collectors. Distribution is broad, spanning traditional retail, e-commerce, and omnichannel platforms that enable brands to reach diverse global audiences. The Licensed Toy Market benefits from strong brand loyalty, seasonal demand spikes, and the ability to adapt quickly to licensing opportunities and regulatory changes, making it a resilient and competitive segment of the global toy industry.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Price, Age Group, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to continue its steady growth, driven by increasing consumer demand for comfort and wellness products.

- Rising awareness of the therapeutic benefits of heat therapy is expected to boost the adoption of microwaveable stuffed animal toys among both children and adults.

- Manufacturers are likely to focus on incorporating eco-friendly and sustainable materials to meet the growing consumer preference for environmentally conscious products.

- The integration of aromatherapy elements, such as lavender and chamomile scents, is anticipated to enhance the appeal of these toys for stress relief and relaxation.

- Customization options, including personalized designs and scents, are expected to become more prevalent, catering to individual consumer preferences.

- The expansion of e-commerce platforms will continue to facilitate wider distribution and accessibility of microwaveable stuffed animal toys globally.

- Seasonal demand, particularly during colder months and holiday seasons, is projected to contribute significantly to market sales.

- The market may face challenges related to safety regulations and the need for rigorous testing to ensure product safety, especially for children’s use.

- Collaborations with healthcare providers and wellness centers could open new avenues for product application and market expansion.

- Continuous innovation in product design and functionality will be crucial for companies to maintain a competitive edge in the evolving market landscape.