Market Overview:

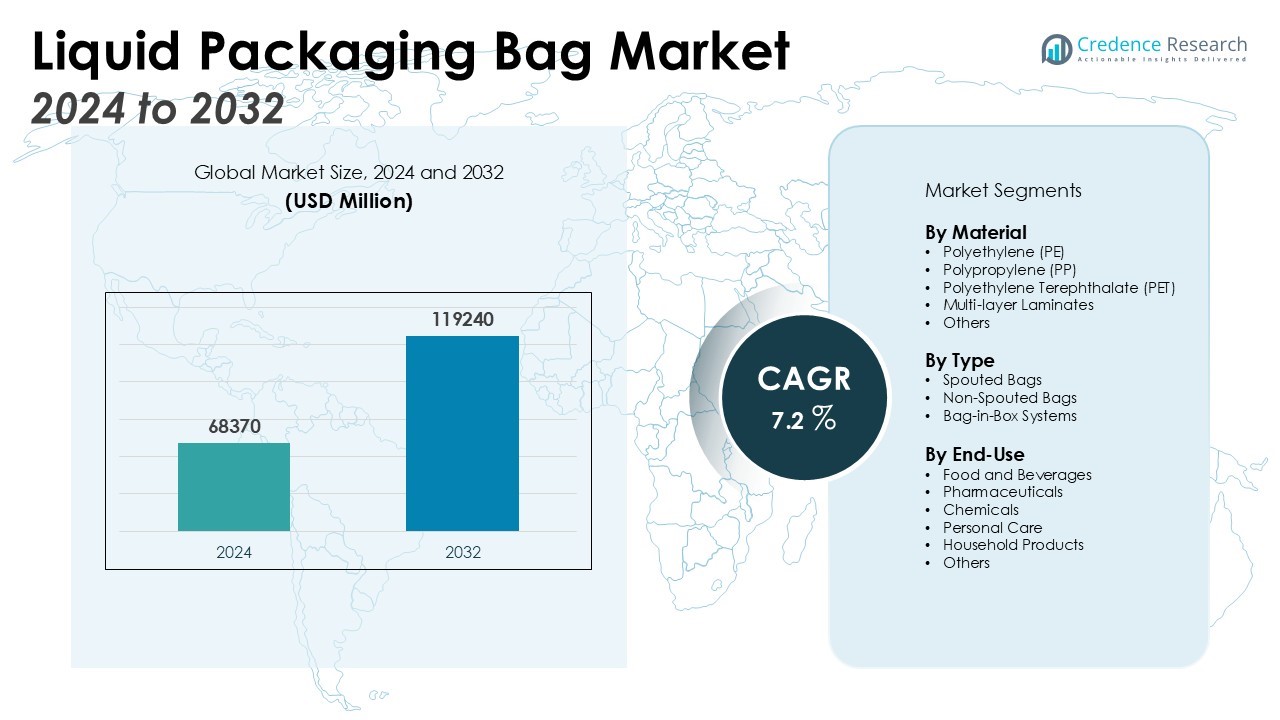

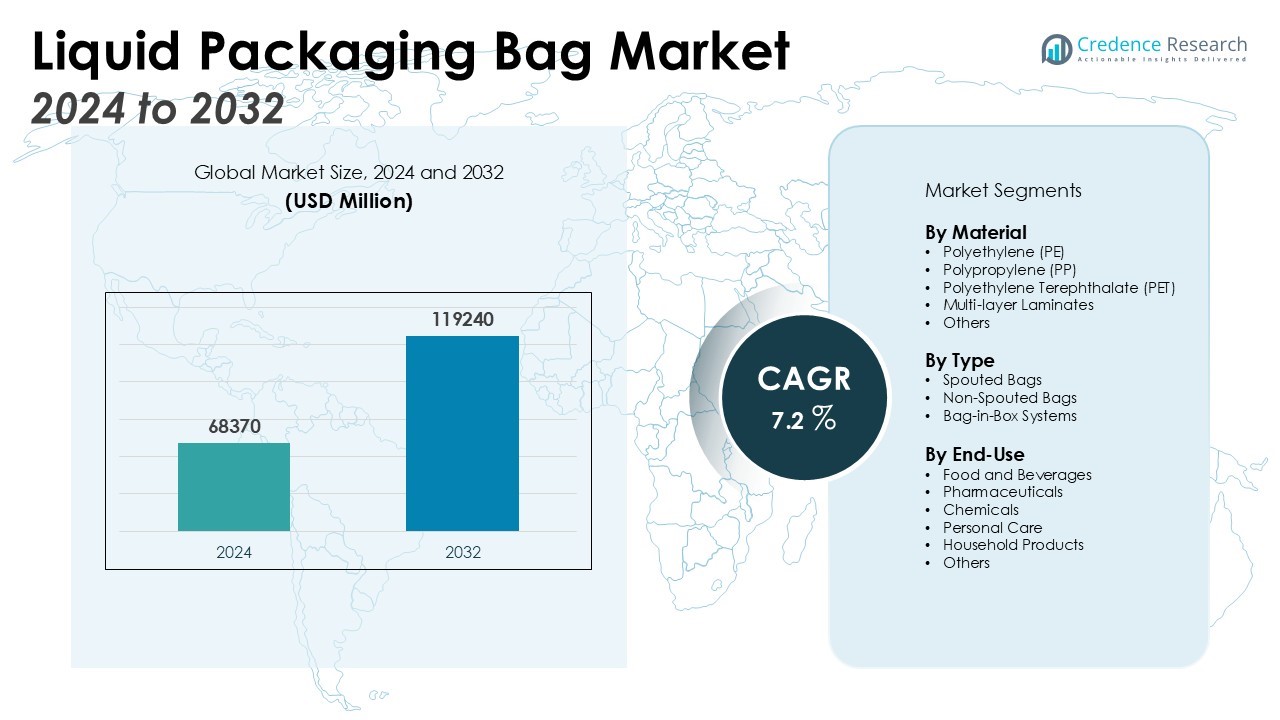

The liquid packaging bag market size was valued at USD 68370 million in 2024 and is anticipated to reach USD 119240 million by 2032, at a CAGR of 7.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid packaging bag market Size 2024 |

USD 68370 Million |

| Liquid packaging bag market, CAGR |

7.2 % |

| Liquid packaging bag market Size 2032 |

USD 119240 Million |

Key drivers of the liquid packaging bag market include heightened demand for convenient, single-serve, and on-the-go consumption formats, especially in beverages and ready-to-drink segments. The market benefits from rapid urbanization and evolving consumer lifestyles. Technological advancements in barrier films, spout designs, and aseptic packaging enable longer product preservation and better protection against contamination. Brands and manufacturers increasingly favor liquid packaging bags for their adaptability to a variety of liquid products—ranging from juices, dairy, and edible oils to detergents and chemicals.

Regionally, the Asia Pacific dominates the liquid packaging bag market, driven by large-scale beverage consumption, expanding urban populations, and robust manufacturing infrastructure, particularly in China, India, and Southeast Asia. North America and Europe maintain significant market shares due to strong demand for premium packaged beverages, coupled with stringent quality and safety regulations. Leading companies such as Amcor plc, Sonoco Products Company, Berry Global Inc, Stora Enso, Tetra Pak, SIG, DS Smith, and Mondi shape the competitive landscape in these regions. The Middle East, Africa, and Latin America exhibit emerging growth potential, supported by rising disposable incomes and increasing adoption of flexible packaging in food and beverage applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The liquid packaging bag market reached USD 68,370 million in 2024 and will hit USD 119,240 million by 2032.

- Demand for convenient, single-serve, and portable packaging drives adoption in beverages, dairy, and personal care sectors.

- Sustainability initiatives push brands to introduce recyclable, bio-based, and lightweight material options.

- Advancements in barrier films, spout designs, and aseptic filling boost product shelf life and protection.

- Regulatory compliance and material restrictions challenge manufacturers to innovate while meeting global standards.

- Asia Pacific leads with a 48% share, followed by North America at 23% and Europe at 17%.

- Leading companies such as Amcor, Sonoco Products, Berry Global, Stora Enso, Tetra Pak, SIG, DS Smith, and Mondi define the competitive landscape.

Market Drivers:

Surge in Demand for Convenient and Portable Packaging Formats:

Consumer preference for on-the-go lifestyles is a key driver for the liquid packaging bag market. Flexible packaging offers easy storage, lightweight handling, and mess-free dispensing, appealing to beverage, dairy, and personal care brands. Urbanization, increasing employment rates, and growing travel activities fuel demand for portable liquid containers. Manufacturers focus on single-serve, family-size, and refillable options, expanding the application range and reinforcing the importance of convenience in packaging.

Focus on Sustainability and Environmental Responsibility:

Sustainability plays a significant role in shaping the liquid packaging bag market, driving companies to adopt recyclable and bio-based materials. Growing consumer and regulatory demands for reduced plastic usage, lighter packaging, and smaller carbon footprints have encouraged investment in eco-friendly resins and advanced recycling technologies. The material efficiency of liquid packaging bags and lower transportation emissions make them a favored choice for environmentally conscious brands aiming to meet global sustainability standards.

- For instance, Procter & Gamble diverted nearly 676,000 metric tons of manufacturing waste from landfill in fiscal year 2023, demonstrating large-scale waste mitigation through circular value chains.

Technological Advancements in Packaging Materials and Design:

Rapid innovations in packaging film technology, spout systems, and barrier coatings enhance the performance of liquid packaging bags. Advances in puncture resistance, oxygen barriers, and aseptic filling methods help preserve liquid quality, making the packaging ideal for food, pharmaceuticals, and chemicals. The integration of digital printing and custom closures, including tamper-evident features, improves brand visibility and market adaptability, allowing quick design changes and shorter production runs to meet evolving consumer needs.

Expansion of Food, Beverage, and Industrial Liquid Applications:

The growing popularity of ready-to-drink beverages, functional drinks, and liquid foods supports the expansion of the liquid packaging bag market. Consumer trends toward health-consciousness and the increasing demand for packaged food are fueling higher volumes of liquid products. The versatility of liquid packaging bags in packaging items like edible oils, syrups, detergents, and chemicals further broadens their market appeal. Rising exports and the need for tamper-proof, leak-resistant packaging continue to drive steady market growth across various industries.

- For instance, Berry Global collaboration with Mars eliminated over 1,300 metric tons of virgin plastic annually by introducing 100% recycled plastic packaging for M&M’S, SKITTLES, and STARBURST pantry jars, supporting sustainable scale-up in packaged food volumes.

Market Trends:

Adoption of Smart Packaging Technologies and Customization:

The adoption of smart packaging technologies shapes the liquid packaging bag market, driving innovation and brand differentiation. It features interactive labels, QR codes, and freshness indicators that provide consumers with real-time product information and traceability. Manufacturers integrate digital printing and advanced graphic designs to support limited edition launches and brand storytelling. This trend helps brands target specific demographics and respond swiftly to changing consumer preferences. Demand for personalized packaging increases, enabling businesses to offer customized sizes, shapes, and dispensing features. The integration of smart elements not only enhances consumer engagement but also supports anti-counterfeiting efforts in premium product segments.

- For instance, Scholle IPN manufactures custom-fit Bag-in-Box solutions, with the company producing more than 500 different bag designs per year for customers in the beverage and food sectors, tailored to specific dispensing and size requirements.

Shift Toward Sustainable and Circular Packaging Solutions:

The liquid packaging bag market trends toward sustainable and circular packaging solutions, reflecting growing environmental awareness. It sees accelerated use of recyclable films, compostable materials, and mono-material structures to meet global regulatory requirements and consumer expectations. Companies introduce closed-loop recycling programs and promote the reuse of packaging bags in both B2B and B2C applications. Investments in lightweight materials and energy-efficient production processes reduce overall resource consumption. This shift supports the development of eco-friendly alternatives that appeal to environmentally conscious buyers and reinforce brand reputation. The focus on sustainability continues to redefine industry standards and supply chain practices.

- For instance, DS Smith designs and implements circular packaging systems, boasting a closed-loop process where returned boxes can be recycled and made into new ones within just 14 days, supporting large-scale operational sustainability.

Market Challenges Analysis:

Stringent Regulatory Compliance and Material Limitations:

The liquid packaging bag market faces ongoing challenges from evolving global regulations and stringent material standards. It must address compliance with food safety, chemical migration, and recyclability mandates set by various national authorities. Restrictions on certain plastic types and additives put pressure on manufacturers to identify alternative raw materials without sacrificing performance or shelf life. Meeting these diverse regulatory requirements often increases production costs and lengthens development timelines. Manufacturers also encounter barriers in obtaining certifications for new materials and formats, which can delay product launches. These factors create complexity in global operations and supply chain management.

Concerns Over Durability and Consumer Perception:

Durability issues and consumer perception present significant hurdles for the liquid packaging bag market. It must ensure that bags maintain structural integrity during transportation and storage, preventing leaks or ruptures. Negative experiences with faulty packaging can damage brand reputation and erode consumer trust. The market also contends with skepticism regarding the recyclability and environmental claims of flexible packaging. Educating consumers and ensuring clear labeling become essential to address misconceptions and reinforce product value. These challenges require continuous investment in product quality, testing, and transparent communication strategies.

Market Opportunities:

Expansion into Emerging Applications and End-Use Segments:

The liquid packaging bag market holds significant opportunities through expansion into emerging applications and end-use sectors. It can capture demand in industries such as pharmaceuticals, agrochemicals, and industrial lubricants that require safe, efficient, and contamination-free packaging. Growth in e-commerce and direct-to-consumer models creates new avenues for single-serve and bulk packaging solutions. Brands can diversify their portfolios with innovative dispensing technologies and tamper-evident features tailored to specialized liquid products. The ability to meet unique product handling requirements allows the market to address previously untapped segments. This diversification supports sustained market growth and resilience against demand fluctuations.

Advancements in Sustainable Materials and Circular Economy Initiatives:

The pursuit of sustainable materials and circular economy initiatives presents strong growth prospects for the liquid packaging bag market. It benefits from investments in bio-based resins, compostable substrates, and closed-loop recycling systems. Brands that introduce fully recyclable or biodegradable packaging can gain competitive advantage and strengthen consumer loyalty. Collaborations with material science companies and recycling organizations enable the development of next-generation packaging solutions. Growing consumer and regulatory emphasis on sustainability incentivizes rapid adoption of eco-friendly designs. The focus on innovation and environmental stewardship creates long-term market opportunities and drives industry transformation.

Market Segmentation Analysis:

By Material:

The liquid packaging bag market features materials such as polyethylene (PE), polypropylene (PP), polyethylene terephthalate (PET), and multi-layer laminates. PE dominates due to its cost-effectiveness, flexibility, and strong seal integrity, making it suitable for both food and industrial liquids. Multi-layer laminates see growing use for products requiring advanced barrier properties and extended shelf life. PET and PP offer enhanced clarity and chemical resistance, supporting specialized applications in beverages, personal care, and pharmaceuticals.

- For instance, LyondellBasell Moplen polypropylene resin is noted for a water absorption rate of just 0.03 based on ASTM D570 testing, ensuring reliable chemical resistance for sensitive liquid packaging.

By Type:

The market segments by type into spouted bags, non-spouted bags, and bag-in-box systems. Spouted bags gain traction for convenience, resealability, and precise dispensing, widely used in juices, dairy, and personal care. Non-spouted bags support industrial and bulk liquid handling due to their simple structure and cost advantage. Bag-in-box systems expand in foodservice and beverage sectors, valued for their efficiency in storage, transport, and waste reduction.

- For instance, Fluid-Bag’s flexible IBC containers are widely utilized in the industrial sector, with each unit providing a precise capacity of 1,000L for the delivery of lubricants and greases, allowing for up to 99% product recovery and exceptionally low residue.

By End-Use:

Key end-use segments include food and beverages, pharmaceuticals, chemicals, personal care, and household products. The food and beverage sector leads the liquid packaging bag market, supported by demand for dairy, juices, sauces, and edible oils. Pharmaceuticals leverage liquid packaging bags for contamination-free and dosage-controlled solutions. The chemical, personal care, and household product segments continue to adopt flexible bags for cost, safety, and sustainability benefits.

Segmentations:

By Material:

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Multi-layer Laminates

- Others

By Type:

- Spouted Bags

- Non-Spouted Bags

- Bag-in-Box Systems

By End-Use:

- Food and Beverages

- Pharmaceuticals

- Chemicals

- Personal Care

- Household Products

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia Pacific: Leading the Liquid Packaging Bag Market with Robust Growth Drivers and Market Dynamics

Asia Pacific commands a 48% share of the liquid packaging bag market, supported by large-scale beverage consumption and advanced manufacturing capabilities. It benefits from rapid urbanization, rising disposable incomes, and expansion of food, beverage, and pharmaceutical sectors. Countries such as China, India, and Japan drive high-volume demand through their robust retail networks and growing middle-class populations. Regulatory support for sustainable packaging fuels adoption of recyclable and bio-based liquid packaging solutions. Local manufacturers invest in automation and product innovation to meet diverse end-user requirements. The region remains a preferred location for global brands seeking efficient production and distribution hubs.

North America: Strong Market Presence Fueled by Premium Demand, Sustainability Focus, and Regulatory Support

North America holds a 23% share of the liquid packaging bag market, driven by demand for premium packaged beverages and stringent regulatory compliance. It prioritizes product quality, safety, and traceability in food, beverage, and pharmaceutical applications. The region demonstrates a strong focus on sustainable materials, with brands introducing recyclable and mono-material packaging formats. Investments in digital printing and smart packaging technologies enhance shelf appeal and support limited-edition product launches. E-commerce expansion encourages development of leak-proof and tamper-evident bags for direct-to-consumer distribution. The mature retail environment and consumer emphasis on convenience drive steady growth.

Europe: A Leader in Sustainable Packaging Practices and Innovation, Shaping the Future of Liquid Packaging Bags

Europe accounts for 17% of the liquid packaging bag market, propelled by strict environmental mandates and advanced recycling infrastructure. It fosters innovation through collaborations between packaging suppliers, brands, and technology providers. Countries such as Germany, France, and the United Kingdom implement robust circular economy strategies, accelerating adoption of eco-friendly packaging materials. The market supports a diverse array of liquid products, including juices, dairy, personal care, and household cleaners. Consumer preference for sustainable and visually distinctive packs influences design trends and purchasing decisions. The region’s regulatory framework positions it as a leader in responsible packaging practices.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Tetra Pak

- SIG

- Amcor plc

- Sonoco Products Company

- Berry Global Inc

- ProAmpac

- DS Smith

- Stora Enso

- Ball Corporation

- Mondi

Competitive Analysis:

The liquid packaging bag market features strong competition among established global players and specialized regional firms. Leading companies such as Amcor plc, Sonoco Products Company, Berry Global Inc, Stora Enso, Tetra Pak, SIG, DS Smith, and Mondi compete through product innovation, advanced barrier technologies, and sustainable material development. It sees key players invest in new manufacturing facilities, mergers, and strategic alliances to expand market presence and serve diverse end-use sectors. Competitors differentiate by offering customizable spouted and non-spouted bag solutions, rapid design adaptation, and compliance with evolving sustainability mandates. Continuous research and development support the introduction of recyclable and bio-based bags, strengthening market positions. The liquid packaging bag market rewards agility and technical expertise, driving companies to respond quickly to changing regulations and customer preferences across regions.

Recent Developments:

- In July 2025, Tetra Pak announced a second artificial intelligence investment site to enhance the sorting of food and beverage cartons in the UK, furthering its commitment to sustainable packaging technologies.

- In June 2025, Sonoco Products Company launched its new recyclable paper can with a paper bottom made from 100% recycled fiber in North America, providing a more sustainable food and beverage packaging solution.

- In May 2025, Tetra Pak launched the 2025 edition of its Dairy Processing Handbook, introducing new chapters on mixing technology, lactose-free products, and sustainability, helping processors advance production efficiency and meet evolving consumer trends.

Market Concentration & Characteristics:

The liquid packaging bag market demonstrates moderate concentration, with several global and regional players competing across key geographies. It features a mix of multinational packaging groups, specialist flexible packaging firms, and innovative start-ups. Leading companies focus on product differentiation through advanced film technologies, custom spout designs, and eco-friendly materials to capture niche segments. Strategic alliances, mergers, and new facility investments shape the competitive landscape. The market values agility in addressing diverse regulatory requirements and responding quickly to shifting consumer preferences. Continuous innovation in materials and sustainable solutions defines its core characteristics, supporting resilience in dynamic global supply chains.

Report Coverage:

The research report offers an in-depth analysis based on Material, Type, End-Use and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Industry participants pursue development of fully recyclable and compostable liquid packaging bag formats to meet evolving sustainability demands.

- Brands adopt advanced aseptic filling and barrier technologies to preserve product integrity in sensitive liquid segments.

- Companies invest in digital printing and customization to deliver visually distinct packaging and support limited-run product launches.

- Manufacturers integrate smart labels and traceability features to enhance consumer engagement and ensure supply chain transparency.

- Packaging suppliers collaborate with resins and film developers to introduce high-performance mono-material structures.

- Expansion into pharmaceutical, agrochemical, and industrial lubricant applications creates diversified revenue opportunities.

- E-commerce growth fuels demand for tamper-evident and leak-resistant designs tailored to direct-to-consumer logistics.

- Regional manufacturing centers in Asia and Europe scale operations to support global brand needs and optimize supply chains.

- Investment in lightweight, transport-efficient bag designs allows brands to lower distribution costs and reduce carbon footprint.

- Emerging markets in Latin America, Africa, and Southeast Asia attract strategic focus due to rising packaged liquid consumption.