Market Overview:

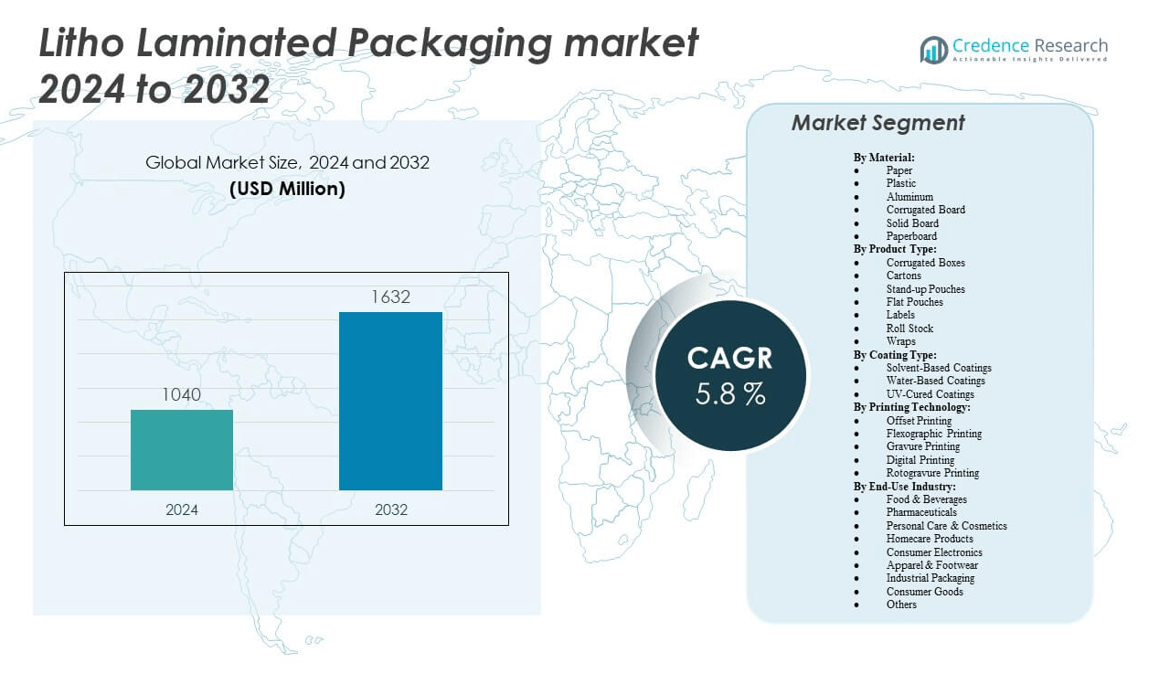

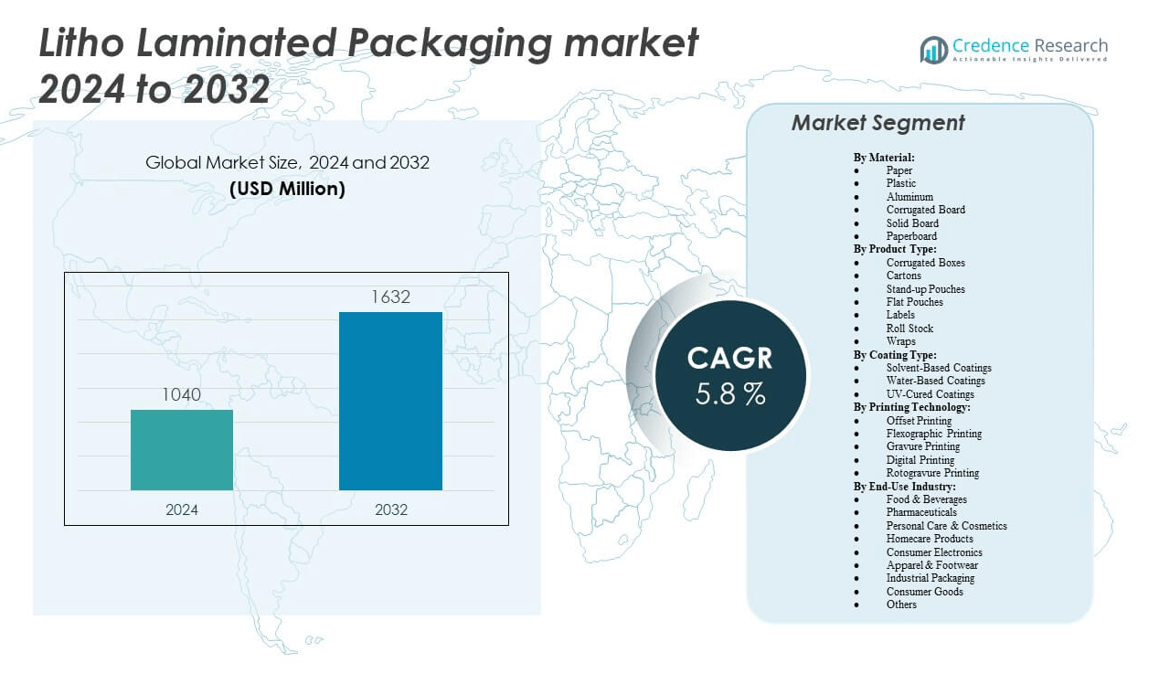

The Litho Laminated Packaging market is projected to grow from USD 1,040 million in 2024 to an estimated USD 1,632 million by 2032, with a compound annual growth rate (CAGR) of 5.8% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Litho Laminated Packaging Market Size 2024 |

USD 1,040 million |

| Litho Laminated Packaging Market, CAGR |

5.8% |

| Litho Laminated Packaging Market Size 2032 |

USD 1,632 million |

Market dynamics are shifting as consumer demand for high‑quality, visually appealing packaging intensifies across food, pharmaceutical, and premium consumer goods sectors. Innovation in printing and lamination technologies enhances barrier performance and shelf appeal, encouraging brand owners to adopt litho laminated packaging. Supply chain optimization and a growing focus on sustainable materials further support investment in this segment. In this environment, manufacturers proactively scale capacity and streamline operations to meet evolving regulatory and environmental expectations while preserving cost efficiency.

Regionally, the packaging ecosystem shows strong momentum in North America and Western Europe, where established food and pharma industries, coupled with stringent quality and sustainability norms, drive high adoption of litho laminated solutions. Emerging markets, notably in Asia‑Pacific—particularly India and Southeast Asian countries—are rapidly embracing this packaging format as disposable incomes rise and modern retail expands. Latin America and parts of Eastern Europe are also showing encouraging uptake, supported by increasing local production standards and growing export activity.

Market Insights:

- The Litho laminated packaging market was valued at USD 1,040 million in 2024 and is expected to reach USD 1,632 million by 2032, growing at a CAGR of 5.8%.

- Demand for premium, high-graphic packaging in retail and e-commerce channels continues to drive market growth.

- Increasing adoption of sustainable paper-based materials supports long-term expansion of litho laminated solutions.

- High setup and material costs pose challenges for smaller manufacturers in achieving profitability.

- North America leads the market with 34% share, followed by Europe at 29%, due to strong retail and food packaging demand.

- Asia Pacific is the fastest-growing region, driven by expanding consumer markets in China, India, and Southeast Asia.

- Regional brands in emerging economies are adopting litho laminated packaging for better shelf presence and product differentiation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing demand for premium visual presentation across retail and consumer segments

The growing need for visually engaging packaging continues to drive the litho laminated packaging market. Brands focus on enhancing shelf presence to influence buying decisions and improve brand recall. It supports high-resolution graphics, making it suitable for premium and promotional packaging. Consumers associate litho laminated cartons with product quality and reliability. Food and beverage companies adopt this packaging for its appeal and strength. Electronics and cosmetics sectors also value its printability and structural integrity. Packaging plays a crucial role in product differentiation, especially in competitive retail environments. Brands invest in litho lamination to elevate perceived value and stand out.

Expansion of organized retail and e-commerce platforms globally

The global retail landscape is evolving, with rapid growth in modern trade and digital commerce. The litho laminated packaging market benefits from this expansion due to its ability to withstand shipping and handling stress. E-commerce packaging requires durability and branding support, both of which it delivers effectively. Consumers prefer packages that arrive in good condition and with attractive presentation. This packaging format maintains structural strength without compromising aesthetics. Growing middle-class populations and urbanization contribute to increased product consumption. Retailers seek packaging that balances protection and promotional value. Litho lamination meets these dual demands efficiently.

Increasing importance of sustainable and recyclable packaging materials

Sustainability is a major consideration in packaging decisions across industries. The litho laminated packaging market aligns with this shift through its compatibility with recycled substrates and eco-friendly inks. Companies aim to reduce environmental impact without compromising branding. It helps brands transition from plastic to paper-based solutions while maintaining quality. Governments and regulators impose strict norms on single-use plastics. Litho lamination on corrugated board provides a greener yet effective alternative. Consumers also prioritize eco-conscious packaging options in purchasing behavior. This fosters a favorable environment for sustainable laminated formats. Manufacturers adapt to meet evolving environmental standards.

- For example, Coca‑Cola HBC confirmed in its 2023 sustainability documentation that its adoption of KeelClip™ and QFlex carton solutions helped avoid over 2,300 tonnes of plastic shrink film across its supply chain in 2023 compared to previous years

Advancements in printing and lamination technology for customization and efficiency

Technological progress enhances the versatility and efficiency of litho laminated packaging. Modern printing presses offer better image clarity, faster throughput, and cost-effective short runs. It supports customization, versioning, and regional campaigns with minimal production delays. Digital workflows integrate seamlessly with lamination, reducing turnaround times. Consistency across large volumes remains a key strength of litho lamination. Automated systems also improve operational efficiency for converters and brand owners. This enables faster product launches and reactive marketing campaigns. Packaging becomes a dynamic branding tool in fast-moving consumer markets. Litho laminated solutions match this agility with premium output.

- For example, BOBST’s MASTERFLEX HD+ press, presented at drupa 2024 and described in its official product release, operates at up to 15,000 sheets per hour and incorporates the “Start & Go” automated registration system, ensuring high precision.

Market Trends:

Rise in demand for shelf-ready packaging solutions in fast-moving consumer goods

Retailers increasingly favor shelf-ready packaging to reduce restocking time and improve product visibility. The litho laminated packaging market supports this trend with formats that offer both structure and display appeal. Shelf-ready units require clean designs and quick unboxing for retail staff. Litho lamination ensures that packaging doubles as a marketing surface while maintaining integrity. Brands use this format to strengthen in-store messaging. Print quality enhances product appeal and drives impulse purchases. Large retailers often specify laminated formats for promotional displays. This trend promotes multifunctional packaging that combines logistics with branding.

- For instance, Greif’s litho-laminated solutions in North America offer the broadest range of corrugated board combinations—such as C, B, D, E, F, and N flutes—with custom print runs and board sizes, supporting rapid restocking and strong visual merchandising.

Customization and versioning driving short-run, targeted packaging campaigns

Brand strategies increasingly focus on personalization and micro-campaigns across geographies. The litho laminated packaging market accommodates this shift through short-run flexibility and high-quality output. Digital tools allow quick design changes without disrupting production. It becomes easier for marketers to launch seasonal, regional, or demographic-specific designs. Litho lamination helps maintain brand identity across multiple SKU variations. Fast-paced product development cycles benefit from this adaptability. It also supports niche products and direct-to-consumer launches. This trend reflects the market’s shift from mass uniformity to tailored experiences. Packaging plays a strategic role in such differentiated campaigns.

- For example, Superior Lithographics and Complete Design & Packaging (CDP) have installed single-pass EFI Nozomi C18000 digital presses, delivering up to 6,600 full-sized boards per hour and print speeds of 246 linear feet per minute.

Adoption of hybrid substrates and specialty coatings for enhanced performance

Material innovation influences packaging trends by improving functionality and durability. The litho laminated packaging market reflects this shift with hybrid boards and high-performance coatings. These advancements enhance moisture resistance, print retention, and barrier properties. Specialty finishes like matte, gloss, and soft-touch elevate tactile appeal. Brands choose coatings that align with luxury positioning or product type. Lamination also improves protection for perishable or sensitive goods. Technical upgrades offer solutions for new product categories. Packaging functions extend beyond protection into sensory and experiential marketing. Litho lamination adapts to support these evolving needs.

Growth of private label and niche brand packaging investments

Private label and emerging brands invest in premium packaging to compete with established players. The litho laminated packaging market benefits from this demand for cost-effective yet high-quality solutions. Retailers promote store brands with improved aesthetics and structural strength. It helps smaller brands gain shelf presence without large-scale budgets. The format allows consistent quality across different packaging types. Print flexibility supports frequent artwork updates and limited editions. This levels the field for boutique brands entering mature markets. Litho lamination becomes an accessible upgrade for growing companies. The trend signals wider adoption across brand tiers.

Market Challenges Analysis:

High initial investment and operational cost in litho lamination processes

Cost remains a barrier for small and mid-sized enterprises aiming to adopt litho laminated packaging. High-quality printing, plate setup, and lamination add to the total expenditure. It creates challenges for low-margin products or infrequent print runs. The litho laminated packaging market requires scale to balance setup and production costs. Smaller converters often lack in-house capabilities, depending on outsourcing. Turnaround times increase when components are not vertically integrated. Capital costs for new presses and lamination units remain significant. Rising raw material prices also impact profit margins. Price-sensitive industries hesitate to shift toward this format.

Complexity in recycling multilayer laminated structures poses sustainability concerns

Sustainability remains a concern when multilayer laminated structures complicate recycling. Paperboard with laminated film often faces limited recyclability due to bonded layers. The litho laminated packaging market must address this issue to align with circular economy goals. Brands face pressure from regulators and consumers for recyclable solutions. Recycling facilities vary in their ability to handle coated substrates. It affects the end-of-life value of packaging materials. Some converters explore water-based adhesives and recyclable laminates. Adoption depends on cost, performance, and compatibility with current systems. Market players must innovate to balance aesthetics with sustainability.

Market Opportunities:

Expansion of sustainable litho laminated formats using recyclable or compostable materials

Environmentally conscious innovation presents strong growth potential in the litho laminated packaging market. Brands actively seek laminated structures that meet recyclability standards. It encourages investment in compostable films, eco-friendly adhesives, and sustainable paperboards. New material combinations maintain durability while supporting green claims. Retailers adopt such packaging to align with ESG goals and reduce plastic use. Packaging legislation in Europe and parts of Asia accelerates adoption. Suppliers offering certified recyclable laminated solutions stand to benefit. These developments create space for competitive differentiation through sustainability.

Rising packaging demand from emerging economies and rural retail expansion

Emerging economies offer robust opportunity due to rising consumption and improved logistics infrastructure. The litho laminated packaging market finds traction in urban and semi-urban areas through rising demand for packaged goods. Rural markets open new distribution channels for FMCG, electronics, and agri-products. Packaging that ensures product integrity during transport gains relevance. Litho laminated solutions cater to this need while promoting local branding. Regional brands explore high-quality printed formats to boost recognition. Investments in regional packaging plants lower delivery times and costs. These trends create sustained demand in high-growth markets.

Market Segmentation Analysis:

By material type, the litho laminated packaging market features a diverse material landscape, with corrugated board and paperboard holding dominant positions due to their durability and excellent printability. Paper and solid board are widely used for sustainable and lightweight packaging applications. Plastic and aluminum materials serve niche sectors where moisture resistance and extended shelf life are essential, such as medical or specialty food items. Each material type is selected based on the required balance of strength, cost-efficiency, and visual appeal.

- For example, Greif’s Meta® Pail packaging system is a hybrid incorporating an 8-sided corrugated Meta® container, designed to handle demanding applications (pet food, condiments), maximizing stacking efficiency and supporting space-saving double palletization.

By product type, corrugated boxes lead market demand due to their strength, stacking ability, and suitability for shipping and display purposes. Cartons and labels follow, especially in the food, beverage, and personal care sectors, where branding and product visibility are crucial. Stand-up and flat pouches address flexible packaging needs, particularly in convenience and single-use categories. Roll stock and wraps support high-speed filling lines and bulk packaging formats.

- For instance, WestRock’s Meta® modular packaging solution enables eight-sided corrugated containers with stacking performance that supports double-palletization, reducing storage space by up to 30% in retail logistics.

By coating technologies are vital for performance and finish. Water-based coatings are gaining share due to their eco-friendly profile and regulatory compliance. Solvent-based coatings remain relevant in applications requiring chemical and abrasion resistance. UV-cured coatings offer fast curing and superior gloss, often used in premium and decorative packaging solutions. Each coating type contributes to packaging longevity, visual quality, and safety.

By printing technology plays a central role in packaging effectiveness. Offset printing dominates with its ability to deliver sharp, high-resolution graphics. Flexographic and digital printing offer speed, cost-efficiency, and flexibility, especially in short runs and customization. Gravure and rotogravure are applied in high-volume, image-rich applications. The choice of printing method depends on cost, volume, and design complexity.

By End-use industries drive specific packaging requirements. Food and beverages lead in volume due to the need for secure, branded packaging. Pharmaceuticals demand precision, barrier properties, and regulatory compliance. Personal care and cosmetics prioritize visual appeal and shelf impact. Consumer electronics require sturdy yet attractive packaging, while apparel, homecare, and industrial sectors value structural integrity and protection. Consumer goods and specialty segments like luxury items or stationery expand the scope for litho laminated solutions across diverse market needs.

Segmentation:

. By Material:

- Paper

- Plastic

- Aluminum

- Corrugated Board

- Solid Board

- Paperboard

By Product Type:

- Corrugated Boxes

- Cartons

- Stand-up Pouches

- Flat Pouches

- Labels

- Roll Stock

- Wraps

By Coating Type:

- Solvent-Based Coatings

- Water-Based Coatings

- UV-Cured Coatings

By Printing Technology:

- Offset Printing

- Flexographic Printing

- Gravure Printing

- Digital Printing

- Rotogravure Printing

By End-Use Industry:

- Food & Beverages

- Pharmaceuticals

- Personal Care & Cosmetics

- Homecare Products

- Consumer Electronics

- Apparel & Footwear

- Industrial Packaging

- Consumer Goods

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America holds the leading position in the litho laminated packaging market, accounting for 34% of the global share. Strong demand from the food, beverage, and e-commerce sectors drives adoption across the United States and Canada. Retailers and manufacturers in this region prefer litho laminated solutions for their visual appeal and structural performance. Investments in automation and advanced printing support production efficiency and scalability. Regulatory focus on sustainable materials encourages the shift from plastic to laminated paper-based formats. The market continues to evolve with high consumer expectations for branded, durable, and eco-friendly packaging.

Europe follows closely with a 29% market share, driven by stringent packaging regulations and a mature retail landscape. Countries like Germany, France, and the UK prioritize environmentally responsible solutions that align with EU directives. The litho laminated packaging market benefits from a strong preference for high-quality visual communication in product packaging. Luxury goods, cosmetics, and premium food brands invest heavily in printed corrugated formats. Regional converters offer a wide range of sustainable laminates to meet evolving brand strategies. E-commerce growth in Southern and Eastern Europe further contributes to packaging demand.

Asia Pacific holds 23% of the global litho laminated packaging market and represents the fastest-growing region. China, India, Japan, and Southeast Asia witness increased consumption of packaged goods driven by urbanization and rising disposable income. It benefits from expanding retail networks, improving supply chain infrastructure, and growing middle-class demographics. Local and international brands use litho laminated packaging to differentiate products in crowded marketplaces. Government incentives for sustainable manufacturing boost local production capabilities. The region’s cost competitiveness and export potential position it as a key hub for future growth in laminated packaging.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Graphic Packaging International, LLC

- WestRock Company

- DS Smith

- Smurfit Kappa Group (via Saxon Packaging)

- International Paper

- Mayr-Melnhof Karton AG

- Parksons Packaging Ltd

- Mondi Group

- Amcor

- Georgia-Pacific

- Accurate Box Company, Inc.

- Pratt Industries

- Sonoco Products

- Box Litho

- Grief, Inc.

Competitive Analysis:

The litho laminated packaging market features a mix of global packaging conglomerates and specialized regional players. Companies such as Graphic Packaging International, WestRock, DS Smith, and Smurfit Kappa dominate the landscape with integrated capabilities and strong distribution networks. It remains competitive due to consistent investments in printing technologies, automation, and sustainable materials. Firms like Accurate Box Company and Parksons Packaging differentiate through design innovation and short-run customization. Strategic mergers and capacity expansions reinforce market presence and customer retention. Global players focus on high-volume production, while niche firms target premium and flexible packaging segments. This dynamic fosters steady innovation and service diversification.

Recent Developments:

- In July 2025, Graphic Packaging International launched striking new packaging for Unilever’s WHITE NOW oral care range. The refreshed design, produced with FSC-certified paperboard, features premium finishes like holographic and metallic accents and marks a strategic repositioning for the brand, supporting bolder shelf appeal and a stronger connection with modern consumers.

- In May 2025, International Paper also celebrated the groundbreaking of a state-of-the-art sustainable box plant in Waterloo, Iowa, aiming to serve the protein sector with advanced, eco-friendly packaging and bringing new jobs and technological advancements to the region.

- In February 2025, International Paper and DS Smith completed a combination, forming a new global leader in sustainable packaging, leveraging both companies’ extensive portfolios across North America and EMEA. This union enhances customer offerings, innovation, and operational reach worldwide.

Market Concentration & Characteristics:

The litho laminated packaging market is moderately concentrated, with top players accounting for a significant portion of global revenue. It shows strong vertical integration among leaders, offering end-to-end solutions from board manufacturing to high-end lamination. The market emphasizes high print quality, structural integrity, and branding support. Demand varies across sectors, with food, beverage, and e-commerce driving consistent volume. Regional players often cater to local customization and quick turnaround needs. Sustainability, print versatility, and scalability define key competitive attributes. It continues to evolve through product differentiation and operational agility.

Report Coverage:

The research report offers an in-depth analysis based on Material, Product Type, Coating Type, Printing Technology and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for litho laminated packaging will rise due to increased emphasis on premium shelf appeal across retail sectors.

- Adoption of recyclable laminated materials is expected to accelerate in response to global sustainability mandates.

- Advancements in digital printing and automation will enhance production efficiency and customization capabilities.

- E-commerce growth will continue to drive demand for durable, visually appealing corrugated packaging formats.

- Emerging markets will see strong uptake driven by urbanization, consumer goods growth, and modern retail expansion.

- Short-run packaging and personalized campaigns will gain traction, supported by flexible lamination workflows.

- Investments in water-based adhesives and compostable laminates will create differentiation opportunities for suppliers.

- Consolidation among key players may intensify as companies seek scale and vertical integration.

- Packaging for electronics, cosmetics, and specialty food products will increasingly adopt litho laminated solutions.

- Regulatory support for sustainable paperboard use will influence material choices and boost eco-friendly innovation