Market Overview

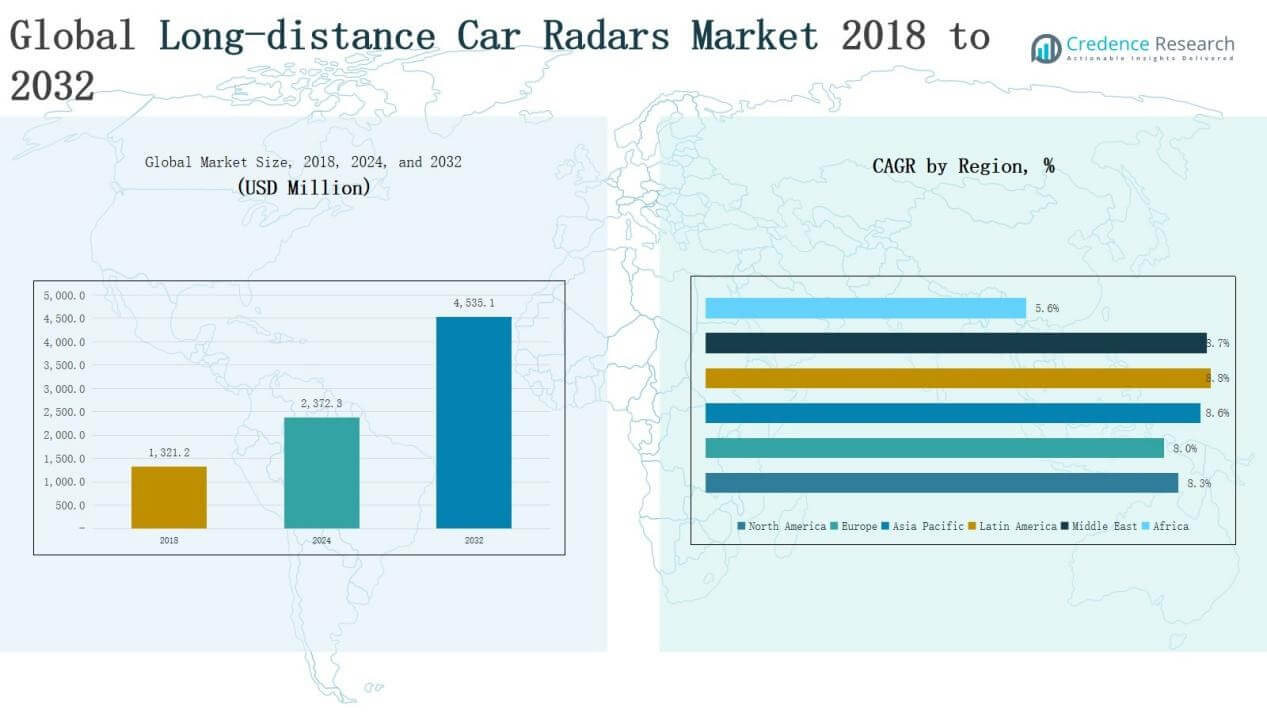

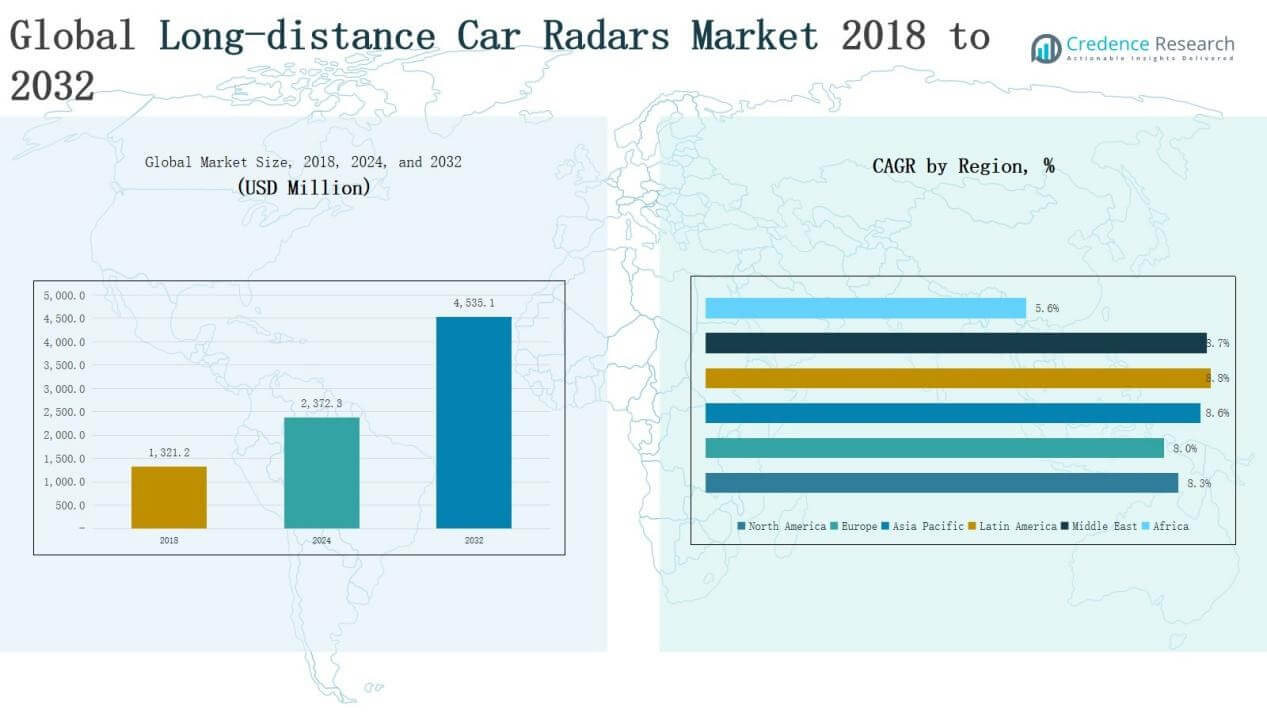

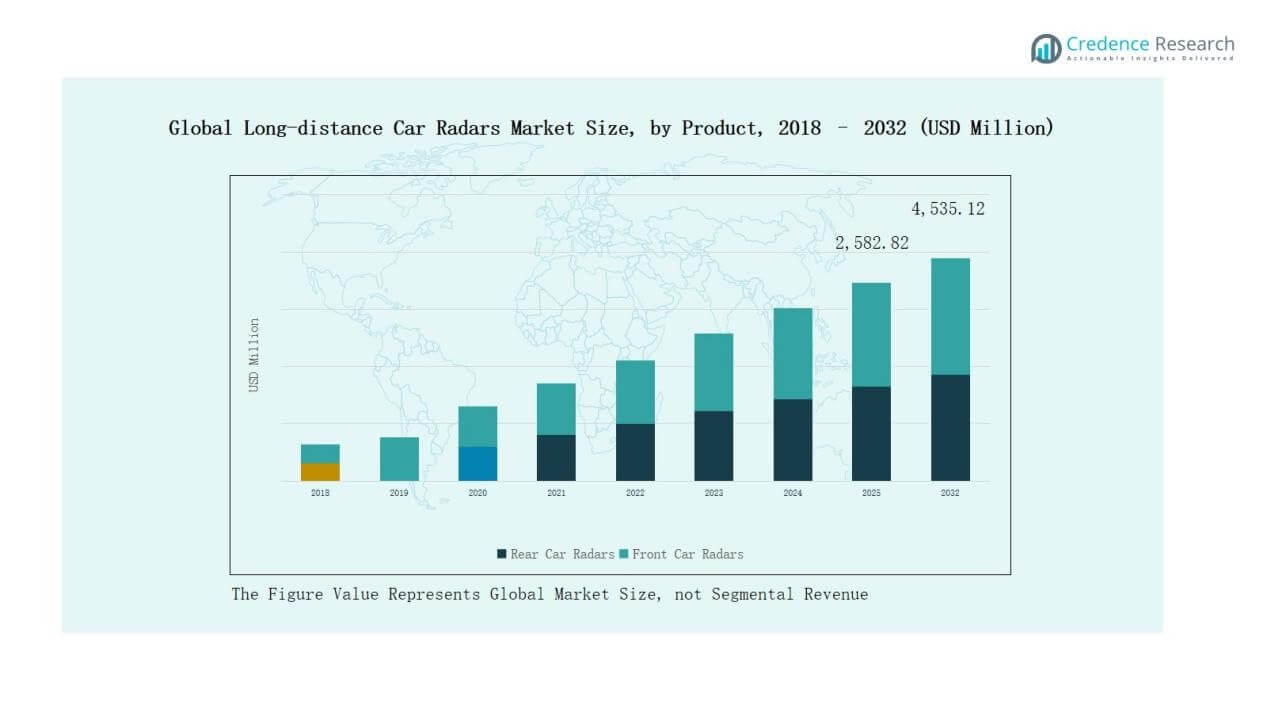

Global Long-distance Car Radars Market size was valued at USD 1,321.2 million in 2018 to USD 2,372.3 million in 2024 and is anticipated to reach USD 4,535.1 million by 2032, at a CAGR of 8.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Long-distance Car Radars Market Size 2024 |

USD 2,372.3 Million |

| Long-distance Car Radars Market, CAGR |

8.37% |

| Long-distance Car Radars Market Size 2032 |

USD 4,535.1 Million |

The global long-distance car radars market is shaped by key players such as Robert Bosch GmbH, Continental AG, Valeo, Aptiv PLC, Denso Corporation, NXP Semiconductors, Infineon Technologies, Texas Instruments, Delphi Automotive PLC, and Toshiba Corporation. These companies maintain leadership through strong collaborations with automakers, advanced radar portfolios, and continuous investment in R&D to enhance range, resolution, and integration with ADAS and autonomous driving systems. Regional analysis highlights Asia Pacific as the leading market, commanding a 35% share in 2024, driven by large-scale automotive production, regulatory emphasis on safety, and rapid adoption of advanced driver-assistance technologies.

Market Insights

- The Global Long-distance Car Radars Market grew from USD 1,321.2 million in 2018 to USD 2,372.3 million in 2024 and is projected to reach USD 4,535.1 million by 2032, expanding at a CAGR of 8.37%.

- Asia Pacific led with a 35% share in 2024, valued at USD 837.48 million, driven by large-scale vehicle production, ADAS adoption, and regulatory safety initiatives.

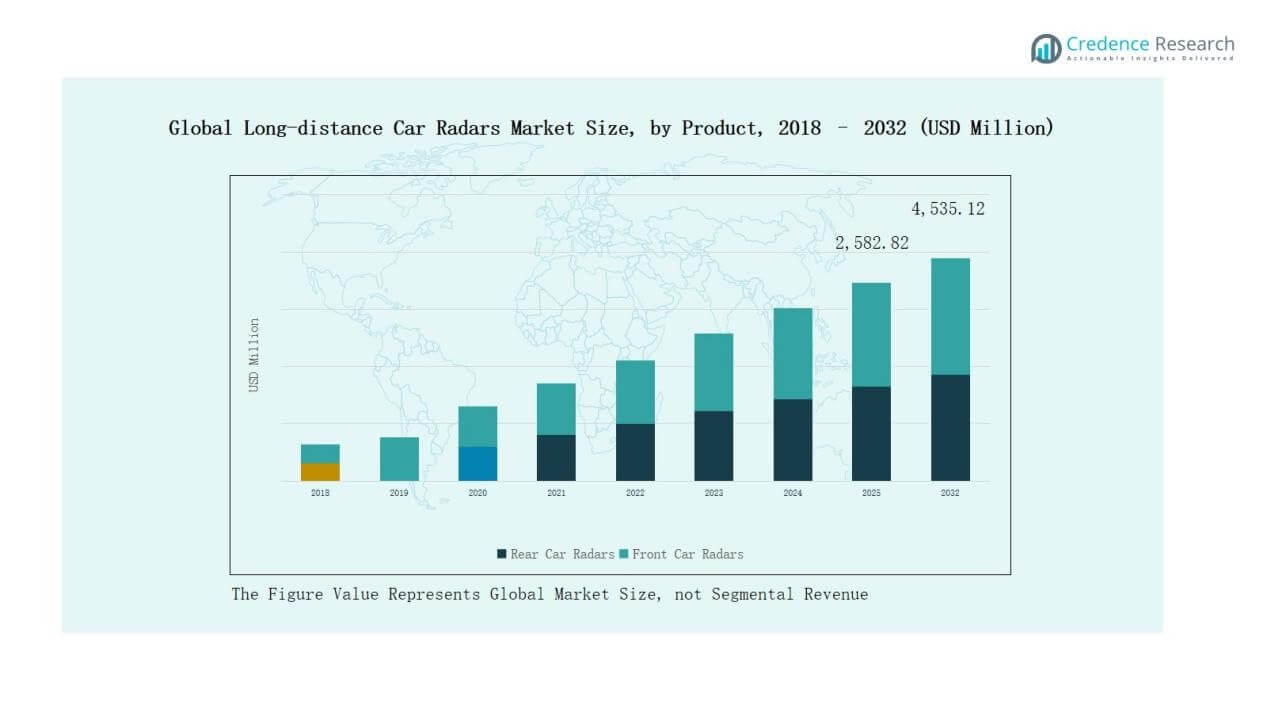

- Front car radars dominated with 62% share in 2024 due to their critical role in ADAS features, while rear radars accounted for 38%, supporting parking and blind-spot detection.

- Adaptive Cruise Control held 35% market share in 2024, followed by Autonomous Emergency Braking at 28%, reflecting regulatory support and strong adoption across premium and mid-segment vehicles.

- Passenger vehicles accounted for 71% share in 2024, supported by higher production volumes and consumer demand for safety, while commercial vehicles represented 29%, driven by fleet modernization.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Product

Front car radars held the dominant share of 62% in 2024, driven by their critical role in advanced driver-assistance systems (ADAS). They enable long-range detection, supporting functions such as adaptive cruise control and forward collision warning, making them essential for safety and performance. Rear car radars, with a 38% share, are gaining demand for improved parking assistance and blind-spot detection, especially in mid-range passenger vehicles, where affordability and practicality drive adoption.

For instance, Continental AG reported supplying its sixth-generation long-range radar to multiple OEMs, designed to improve forward collision avoidance and highway driving functions.

By Detection Type

Adaptive Cruise Control (ACC) led the detection type segment with 35% market share in 2024, supported by rising adoption in premium and mid-segment cars. Autonomous Emergency Braking (AEB) followed with 28%, backed by regulatory mandates in North America and Europe, pushing higher integration rates. Forward Collision Warning System (FCWS) accounted for 22%, while Pedestrian Automatic Emergency Braking System (PAEB) held 15%, with increasing integration in urban safety-focused models, particularly in regions prioritizing pedestrian safety and road accident reduction.

For instance, Volvo announced that all new models sold in the European Union would include AEB as standard, aligning with EU safety regulations.

By Vehicle Type

Passenger vehicles dominated with 71% share in 2024, reflecting higher production volumes and widespread integration of ADAS technologies in compact, mid-size, and luxury cars. This trend is further supported by consumer preference for safety, comfort, and convenience in personal mobility solutions. Commercial vehicles held a 29% share, with growth fueled by logistics fleet modernization and rising demand for safety compliance in heavy trucks and buses, where efficiency, regulation, and accident prevention are driving technology adoption.

Key Growth Drivers

Key Growth Drivers

Rising Adoption of ADAS Technologies

The growing adoption of Advanced Driver Assistance Systems (ADAS) is a primary driver for the global long-distance car radars market. Front and rear radars are integral to features like adaptive cruise control, collision warning, and lane assistance, ensuring enhanced vehicle safety. Increasing consumer awareness about accident prevention and regulatory requirements for safety systems in major markets like North America and Europe further accelerate deployment. Automakers are actively integrating radar-based ADAS into both premium and mid-range vehicles, expanding adoption across diverse consumer segments.

For instance, in October 2023, Hyundai Motor India announced its initiative to equip 100% of its vehicle lineup with Advanced Driver Assistance Systems (ADAS) and Blue Link connectivity by 2025.

Regulatory Push for Vehicle Safety Standards

Stringent government regulations mandating advanced safety features are strengthening radar deployment worldwide. Regions such as Europe and the United States have introduced policies requiring Autonomous Emergency Braking (AEB) and pedestrian detection systems in new vehicles. This regulatory environment creates consistent demand for long-distance car radars as compliance becomes mandatory for automakers. Simultaneously, developing regions like Asia-Pacific are aligning safety standards with global norms, further fueling installations. Such mandates position radar technologies as an indispensable component of future automotive safety ecosystems.

For instance, in July 2024, the European Union mandated Autonomous Emergency Braking (AEB) and additional Advanced Driver Assistance Systems (ADAS) for all new vehicle models under Regulation (EU) 2019/2144, requiring automakers to equip vehicles with intelligent speed assistance, AEB, and pedestrian detection systems.

Growth in Autonomous and Semi-Autonomous Vehicles

The rising momentum of autonomous and semi-autonomous vehicles is significantly boosting the long-distance car radars market. Radars offer reliable performance in varied weather and lighting conditions, making them a key sensor for automated driving systems. Manufacturers are investing in next-generation radar modules with enhanced resolution and range to support higher levels of autonomy. As major automotive players and technology firms expand pilot projects and commercial launches of autonomous cars, demand for radars is expected to surge globally, especially in urban and highway mobility applications.

Key Trends & Opportunities

Integration with AI and Sensor Fusion

The integration of long-distance car radars with artificial intelligence (AI) and sensor fusion technologies is emerging as a transformative trend. By combining radars with cameras, LiDAR, and ultrasonic sensors, automakers achieve more accurate object detection and predictive decision-making. AI algorithms enhance radar performance by reducing false alarms and improving classification of objects, including pedestrians and cyclists. This trend is creating new opportunities for radar manufacturers to collaborate with software providers and develop advanced driver-assistance platforms that cater to evolving demands in autonomous mobility.

For instance, Jaguar Land Rover developed high-frequency radar systems that improve pedestrian detection and vehicle perception in urban environments.

Expansion in Emerging Automotive Markets

Emerging regions, particularly Asia-Pacific and Latin America, present significant opportunities for long-distance car radar adoption. Rapid vehicle production growth, rising disposable incomes, and increasing consumer demand for safer driving experiences are boosting installations. Governments in these regions are also enhancing vehicle safety frameworks, encouraging radar adoption across both passenger and commercial vehicles. Additionally, the expansion of ride-hailing and logistics fleets in urban centers creates a strong need for radar-based safety and monitoring systems. These factors position emerging economies as key growth markets for radar suppliers.

For instance, Continental recently announced it has produced 200 million radar sensors, used across ADAS, blind-spot, adaptive cruise, and emergency braking functions.

Key Challenges

Key Challenges

High Cost of Advanced Radar Systems

The relatively high cost of advanced long-distance radar systems remains a barrier to mass adoption, particularly in entry-level vehicles. Automakers face pressure to balance affordability with safety innovation, especially in price-sensitive markets. While premium and luxury car segments integrate radar-based ADAS extensively, penetration in low-cost vehicles lags due to pricing concerns. Reducing production costs through economies of scale and technological advancements remains a key challenge for suppliers aiming to expand adoption across all vehicle categories globally.

Complexity of System Integration

Integrating radar sensors with other onboard systems poses technical challenges for automakers. Sensor calibration, data fusion, and ensuring seamless interaction with braking, steering, and navigation systems require significant engineering expertise. Failure in integration can lead to false alarms or reduced system reliability, undermining consumer confidence. Automakers must also address software compatibility issues when combining radars with AI-driven platforms. As vehicles adopt multiple safety features simultaneously, the complexity of ensuring accurate performance and interoperability across components continues to challenge industry stakeholders.

Competition from Alternative Sensing Technologies

Growing advancements in alternative sensing technologies such as LiDAR and high-resolution camera systems present competitive challenges for radar adoption. LiDAR, in particular, offers superior object recognition in specific scenarios, attracting strong investment from autonomous vehicle developers. Although radar remains reliable under poor weather and low visibility, its competition with rapidly improving alternatives creates pricing and adoption pressures. Radar manufacturers must continuously innovate in resolution, range, and cost efficiency to maintain their relevance in an increasingly diversified automotive sensing ecosystem.

Regional Analysis

North America

North America accounted for 27% of the global long-distance car radars market in 2024, valued at USD 646.21 million, up from USD 362.28 million in 2018. By 2032, the region is projected to reach USD 1,224.48 million, growing at a CAGR of 8.3%. Strong regulatory mandates for advanced driver-assistance systems (ADAS) and early adoption of autonomous technologies drive market growth. The U.S. leads with high consumer preference for safety and premium vehicles, while Canada and Mexico contribute through increasing vehicle production and technology integration in mid-segment cars.

Europe

Europe represented 22% of the market share in 2024, reaching USD 514.24 million, up from USD 292.12 million in 2018. It is projected to grow to USD 956.91 million by 2032, at a CAGR of 8.0%. The region’s market is supported by strict automotive safety regulations, including mandatory integration of Autonomous Emergency Braking (AEB) and collision warning systems. Germany, France, and the UK dominate with strong automotive manufacturing bases, while Eastern Europe shows emerging potential. Consumer demand for safer and technologically advanced vehicles also underpins steady radar adoption across both premium and mid-size vehicle categories.

Asia Pacific

Asia Pacific dominated the global market with 35% share in 2024, valued at USD 837.48 million, up from USD 459.52 million in 2018. The region is forecast to reach USD 1,632.64 million by 2032, recording the highest CAGR of 8.6%. Growth is driven by large-scale vehicle production, rising adoption of ADAS in China, Japan, and South Korea, and increasing regulatory emphasis on road safety. India and Southeast Asia contribute with growing demand for affordable vehicles integrated with radar-based safety features. Expanding middle-class incomes and government-led smart mobility programs further strengthen the market outlook in this region.

Latin America

Latin America captured 9% of the market share in 2024, valued at USD 216.86 million, compared with USD 117.72 million in 2018. It is expected to reach USD 428.57 million by 2032, growing at a CAGR of 8.8%. Brazil leads regional demand, followed by Argentina and Mexico, supported by expanding automotive production and rising adoption of safety technologies. Government initiatives to reduce road accidents and the modernization of commercial vehicle fleets fuel radar installations. The region’s growing urbanization and rising disposable incomes also contribute to the increased demand for vehicles equipped with advanced driver-assistance features.

Middle East

The Middle East held a 6% market share in 2024, valued at USD 115.83 million, rising from USD 63.15 million in 2018. By 2032, the region is projected to reach USD 227.66 million, at a CAGR of 8.7%. Demand is driven by high adoption of premium and luxury cars in GCC countries, coupled with increasing investments in smart city and autonomous vehicle projects. Israel and Turkey also contribute with advanced automotive technology integration and growing emphasis on road safety. Rising consumer preference for technologically advanced vehicles further boosts radar adoption in this region.

Africa

Africa accounted for 1.7% of the global market share in 2024, with revenues of USD 41.65 million, up from USD 26.42 million in 2018. The region is projected to reach USD 64.85 million by 2032, growing at a CAGR of 5.6%, the lowest among all regions. Market growth is limited by lower penetration of advanced automotive technologies, weaker regulatory enforcement, and high vehicle import dependency. South Africa leads in radar adoption, supported by its relatively advanced automotive industry. However, broader regional growth remains modest due to affordability challenges and slower infrastructure development.

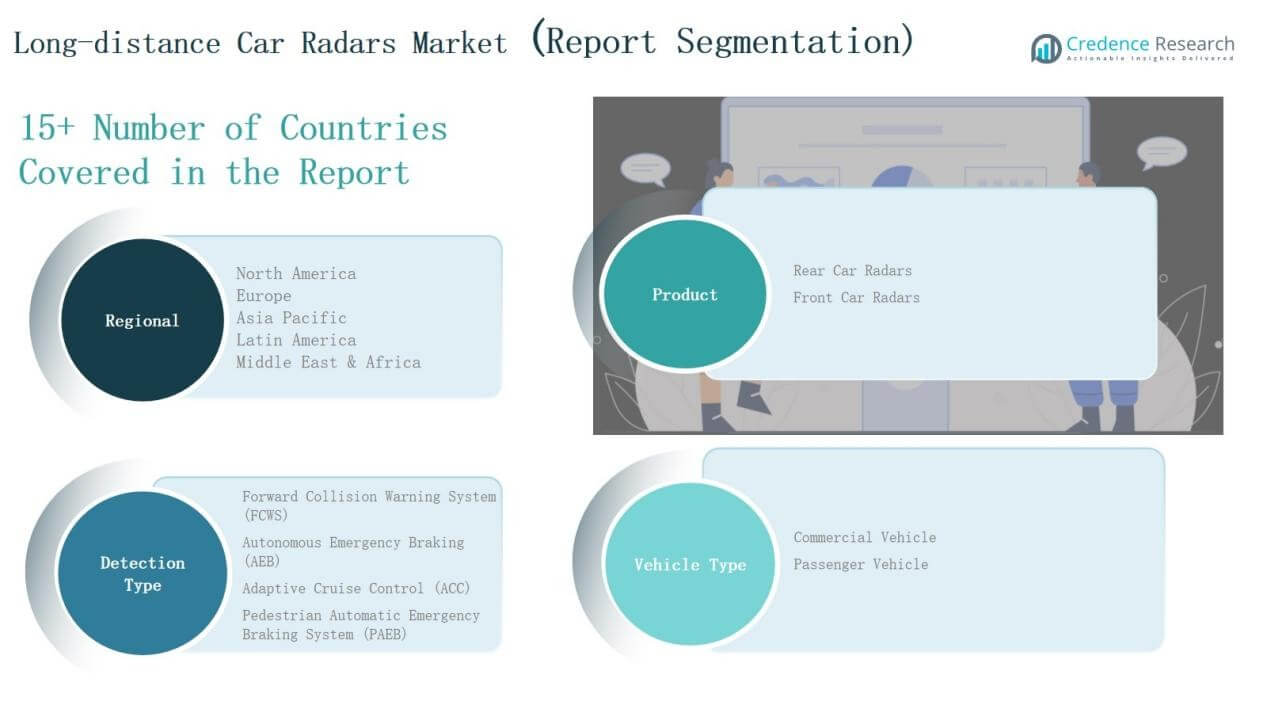

Market Segmentations:

Market Segmentations:

By Product

- Rear Car Radars

- Front Car Radars

By Detection Type

- Forward Collision Warning System (FCWS)

- Autonomous Emergency Braking (AEB)

- Adaptive Cruise Control (ACC)

- Pedestrian Automatic Emergency Braking System (PAEB)

By Vehicle Type

- Commercial Vehicle

- Passenger Vehicle

By Region

- North America

- Europe

- Germany

- France

- The U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global long-distance car radars market is highly competitive, shaped by the presence of leading automotive technology providers and semiconductor companies. Key players such as Robert Bosch GmbH, Continental AG, Valeo, Aptiv PLC, and Denso Corporation dominate with extensive product portfolios and strong collaborations with automakers. These companies focus on enhancing radar performance through higher resolution, longer detection ranges, and integration with advanced driver-assistance systems (ADAS). Semiconductor firms including NXP Semiconductors, Infineon Technologies, and Texas Instruments play a critical role by supplying radar chipsets and sensors that enable accuracy and efficiency. Strategic partnerships, acquisitions, and continuous R&D investments remain central to maintaining market leadership. Emerging players are also entering with AI-driven radar solutions and cost-effective models to cater to mass-market vehicles. The market shows increasing consolidation as larger firms acquire niche technology providers, strengthening innovation capabilities while expanding regional presence in both developed and emerging automotive markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

- Robert Bosch GmbH

- Continental AG

- NXP Semiconductors N.V.

- Texas Instruments, Inc.

- Delphi Automotive PLC

- Valeo

- Aptiv PLC

- Zenuity

- Toshiba Corporation

- Others

Recent Developments

- In October 2023, Bosch announced a new generation of 4D imaging radar, offering significantly enhanced resolution for more detailed environmental perception.

- In September 2023, Continental revealed plans to integrate advanced radar into its next-generation ADAS platforms, targeting Level 3 autonomous driving.

- In July 2023, NXP Semiconductors partnered with a leading automotive OEM to develop integrated radar and sensor fusion solutions for future mobility.

- In March 2025, indie Semiconductor partnered with GlobalFoundries to develop high-performance 77 GHz and 120 GHz radar SoCs for automotive and industrial long-distance applications.

Report Coverge

The research report offers an in-depth analysis based on Product, Detection Type, Vehicle Type and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for radar-based safety systems will increase with stricter global vehicle safety regulations.

- Automakers will integrate radars more widely across mid-segment and entry-level vehicles.

- Advancements in AI and sensor fusion will enhance radar accuracy and reliability.

- Autonomous and semi-autonomous vehicle adoption will drive higher radar installations.

- Asia Pacific will remain the leading region due to large-scale automotive production.

- Partnerships between radar suppliers and semiconductor companies will strengthen technology development.

- Cost reduction initiatives will make radars more accessible in price-sensitive markets.

- Premium vehicle manufacturers will continue prioritizing long-range radars for advanced ADAS features.

- Urbanization and rising accident prevention measures will boost radar demand in emerging economies.

- Continuous innovation in compact and energy-efficient radar modules will expand market opportunities.

Key Growth Drivers

Key Growth Drivers Key Challenges

Key Challenges Market Segmentations:

Market Segmentations: