Market Overview

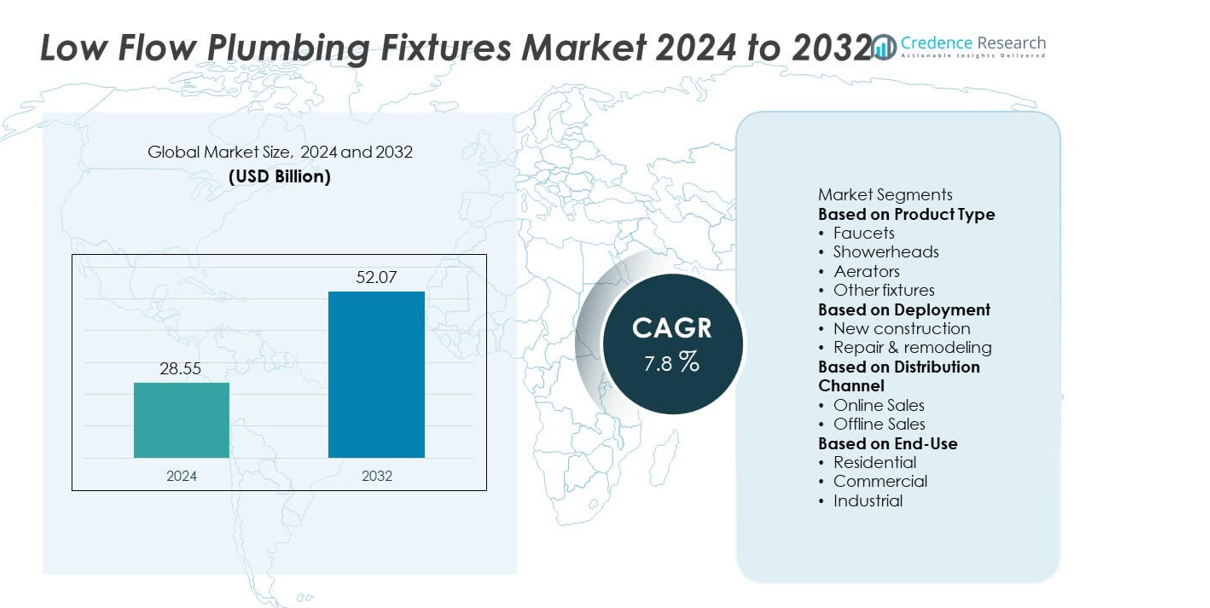

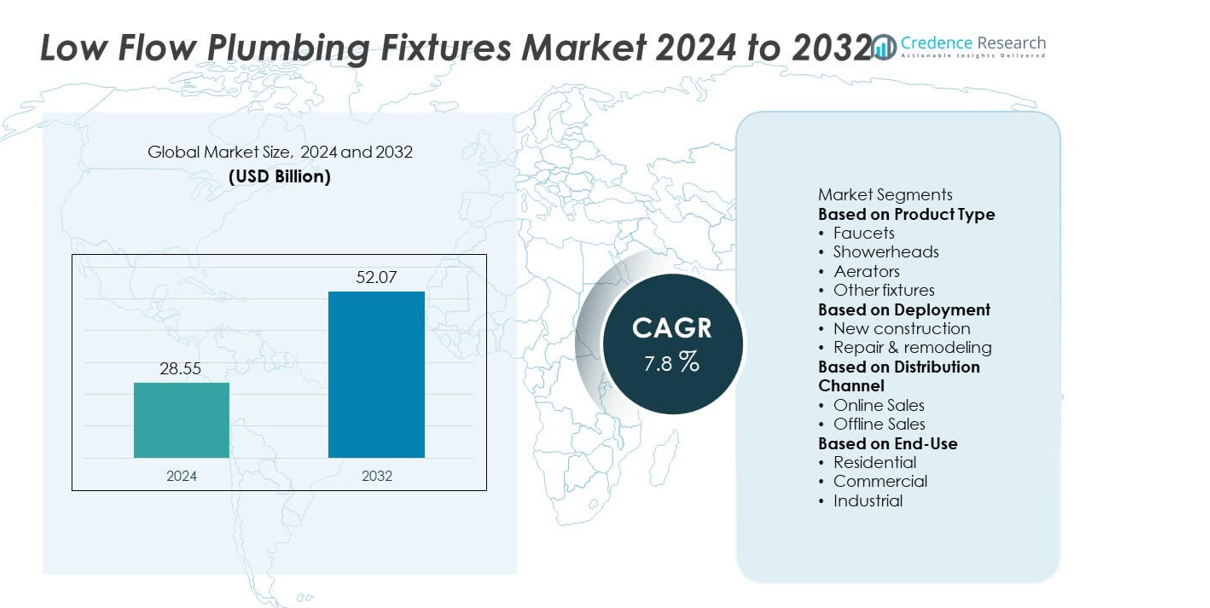

Low Flow Plumbing Fixtures Market was valued at USD 28.55 billion in 2024 and is expected to reach USD 52.07 billion by 2032, growing at a CAGR of 7.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Flow Plumbing Fixtures Market Size 2024 |

USD 28.55 billion |

| Low Flow Plumbing Fixtures Market, CAGR |

7.8% |

| Low Flow Plumbing Fixtures Market Size 2032 |

USD 52.507billion |

The Low Flow Plumbing Fixtures Market grows with rising global emphasis on water conservation, strict building regulations, and increasing adoption of sustainable construction practices. Governments enforce efficiency standards, while consumers seek solutions that reduce utility costs and support environmental goals.

The Low Flow Plumbing Fixtures Market demonstrates strong geographical presence across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. North America shows steady growth with widespread adoption in residential and commercial projects driven by water conservation policies and smart building standards. Europe emphasizes sustainability through strict environmental regulations and certifications, while Asia-Pacific records rapid expansion fueled by urbanization, smart city initiatives, and rising consumer awareness of water efficiency. Latin America and the Middle East & Africa witness gradual adoption supported by infrastructure upgrades and water scarcity management programs. Key players shaping the market include Kohler Co., known for its innovative designs and eco-friendly product range, Toto Ltd., leading in advanced toilet systems with high efficiency, Grohe AG, offering sensor-based and modern water-saving solutions, and Hansgrohe SE, focusing on stylish, durable, and sustainable fixtures. These companies continue to drive growth through technological innovation, global expansion, and strong product portfolios.

Market Insights

- The Low Flow Plumbing Fixtures Market was valued at USD 28.55 billion in 2024 and is expected to reach USD 52.07 billion by 2032, growing at a CAGR of 7.8%.

- Rising global focus on water conservation, strict efficiency regulations, and sustainability initiatives drive strong adoption of low flow plumbing fixtures.

- Market trends highlight integration of sensor-based faucets, dual-flush toilets, and smart shower systems that enhance both efficiency and user convenience.

- Leading companies such as Kohler Co., Toto Ltd., Grohe AG, Hansgrohe SE, and American Standard Brands (LIXIL) strengthen competition with eco-friendly and design-focused innovations.

- High upfront installation costs, retrofitting complexities, and consumer misconceptions about reduced performance act as restraints in some regions.

- North America grows with advanced building codes, Europe emphasizes eco-certified construction, Asia-Pacific expands rapidly with urbanization, while Latin America and the Middle East & Africa show steady adoption through infrastructure development.

- The overall market outlook remains positive as governments, businesses, and consumers align with sustainability goals, expand smart home integration, and increase adoption of retrofitting projects in water-stressed areas.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Global Focus on Water Conservation

The Low Flow Plumbing Fixtures Market grows with the increasing emphasis on water conservation initiatives worldwide. Governments and environmental agencies promote efficient water usage to combat scarcity and ensure long-term sustainability. It supports adoption across residential and commercial buildings by reducing water wastage. Rising awareness among consumers about responsible resource management also fuels demand. Manufacturers introduce products that align with conservation policies and green building standards. This focus on efficiency positions low flow fixtures as essential in modern construction.

- For instance, Hansgrohe’s EcoSmart lavatory faucets limit water flow to approximately 5 liters per minute at 3 bar, while EcoSmart+ models reduce it further to around 4 liters per minute

Stringent Regulations and Building Standards

Regulatory frameworks mandating sustainable plumbing systems drive consistent adoption of low flow technologies. The Low Flow Plumbing Fixtures Market benefits from certifications such as LEED and WaterSense, which encourage builders to integrate eco-friendly solutions. It ensures compliance with water efficiency codes and environmental targets. Construction companies prioritize fixtures that meet regulatory demands while lowering long-term utility costs. Growing alignment between government policies and industry standards strengthens the role of low flow fixtures. The regulatory push ensures sustainable market growth across all regions.

- For instance, Kohler offers WaterSense-labeled faucets like its Hint widespread model, with a maximum flow rate of 1.2 gallons per minute (approximately 4.5 liters per minute).

Rising Demand from Residential and Commercial Construction

Expanding real estate and infrastructure projects generate steady demand for efficient plumbing solutions. The Low Flow Plumbing Fixtures Market supports developers seeking cost savings and sustainability in new housing, offices, and public spaces. It provides long-term economic benefits by reducing utility bills for end users. Hospitality and healthcare sectors also favor these systems due to high daily water consumption. Renovation projects in aging buildings create additional opportunities for fixture replacement. Growing urbanization reinforces adoption across diverse construction segments.

Technological Advancements in Fixture Design

Innovations in product design strengthen adoption by addressing performance concerns associated with traditional low flow models. The Low Flow Plumbing Fixtures Market integrates advanced aerators, dual-flush systems, and sensor-based technologies to ensure comfort without compromising efficiency. It offers users enhanced convenience while meeting sustainability goals. Manufacturers invest in R&D to develop durable, aesthetically appealing, and cost-effective solutions. Growing integration of smart technologies expands product functionality. These advancements make low flow fixtures more appealing for mass adoption across global markets.

Market Trends

Integration of Smart and Sensor-Based Technologies

The Low Flow Plumbing Fixtures Market is witnessing rapid integration of smart and sensor-based systems. Automatic faucets, dual-flush toilets, and sensor-enabled showers enhance water efficiency while improving user convenience. It allows facilities to monitor water usage in real time and reduce wastage. Smart fixtures align with the growing adoption of connected building technologies. Commercial spaces such as airports, hotels, and offices are leading adopters of these solutions. The trend reflects the demand for intelligent plumbing systems that balance performance and sustainability.

- For instance, Hansgrohe’s Focus Electronic Basin Mixer features a hygiene rinse—activating a 10‑second automatic flow every 24 hours—and a 180‑second permanent rinse option for thermal disinfection; it also maintains a maximum flow of 5 liters per minute at 3 bar.

Expansion of Eco-Friendly Building Certifications

Green building initiatives fuel adoption of low flow plumbing systems across global construction projects. The Low Flow Plumbing Fixtures Market benefits from certifications such as LEED, BREEAM, and WaterSense that encourage sustainable construction practices. It supports developers in achieving compliance while enhancing the marketability of their projects. Real estate firms increasingly integrate eco-certified fixtures to attract environmentally conscious buyers. Government incentives linked to water efficiency standards strengthen this trend further. Growing alignment with sustainability certifications continues to expand adoption.

- For instance, Delta Faucet’s Touch2O kitchen faucets automatically shut off after four minutes of continuous flow, helping to prevent wastage when users forget to turn them off.

Increasing Use of Durable and Aesthetic Designs

Product innovation now extends beyond water efficiency to include aesthetics and durability. The Low Flow Plumbing Fixtures Market emphasizes modern designs that combine visual appeal with functional efficiency. It enables manufacturers to target both premium and mass-market segments. Consumers prefer fixtures that enhance interior design while meeting water-saving goals. Use of high-quality materials improves durability, reducing maintenance costs over time. The demand for stylish and efficient fixtures accelerates adoption in both residential and commercial sectors.

Growing Role of Retrofitting and Renovation Projects

Retrofitting of old plumbing systems creates strong opportunities for low flow fixture adoption. The Low Flow Plumbing Fixtures Market benefits from rising renovation projects in urban housing, hotels, and public infrastructure. It allows property owners to replace outdated, high-consumption systems with efficient alternatives. Municipal water-saving programs encourage widespread retrofitting, particularly in water-stressed regions. Builders and contractors view retrofitting as a cost-effective method of improving sustainability. This trend supports consistent growth alongside new construction demand.

Market Challenges Analysis

High Initial Costs and Consumer Perception Issues

The Low Flow Plumbing Fixtures Market faces challenges linked to higher upfront costs compared to conventional systems. Price-sensitive consumers often hesitate to invest despite long-term savings on water and energy bills. It creates resistance in emerging economies where awareness of water conservation is still developing. Misconceptions about poor performance, such as reduced water pressure and limited comfort, further limit adoption. Marketing efforts and educational campaigns are required to shift consumer attitudes. The need to balance affordability with efficiency remains a critical challenge for manufacturers.

Complex Retrofitting and Regulatory Variations

Retrofitting existing buildings with low flow fixtures often demands additional infrastructure adjustments, raising installation complexity. The Low Flow Plumbing Fixtures Market is affected by regional differences in plumbing standards and codes, which complicate product standardization. It increases costs for manufacturers that need to adapt designs for multiple markets. Smaller contractors may lack the expertise to handle advanced installations, slowing adoption in older buildings. Varying regulations across regions also delay widespread penetration. These challenges require stronger collaboration between regulators, builders, and manufacturers to ensure consistent market growth.

Market Opportunities

Rising Demand from Sustainable Construction and Green Buildings

The Low Flow Plumbing Fixtures Market holds strong opportunities due to the global shift toward sustainable construction. Developers and builders increasingly integrate water-efficient fixtures to comply with green building certifications such as LEED and BREEAM. It helps projects gain higher market value and attract environmentally conscious buyers. Governments support adoption through subsidies, incentives, and strict water efficiency regulations. Large-scale urban development projects emphasize eco-friendly solutions, creating steady demand for advanced fixtures. The alignment of sustainability goals with construction practices offers long-term growth prospects.

Expansion in Emerging Economies and Retrofitting Projects

Emerging economies present untapped potential as rapid urbanization and infrastructure development drive water conservation needs. The Low Flow Plumbing Fixtures Market benefits from rising adoption across residential, commercial, and public infrastructure projects in Asia-Pacific, Latin America, and Africa. It supports retrofitting initiatives in aging buildings where outdated systems increase water wastage. Municipal programs encouraging efficiency upgrades further fuel demand. Manufacturers offering affordable and easy-to-install solutions gain a competitive edge in these markets. The combination of new construction and retrofitting projects creates a wide base for future expansion.

Market Segmentation Analysis:

By Product Type

The Low Flow Plumbing Fixtures Market is segmented into faucets, showerheads, toilets, and others such as urinals and bidets. Faucets hold a significant share due to their widespread use across residential and commercial spaces. It supports water conservation by integrating aerators and sensor-based technology that reduce flow without compromising performance. Showerheads also record strong demand as households and hotels prioritize efficiency alongside comfort. Low flow toilets, particularly dual-flush models, gain adoption in both new construction and renovation projects. The diverse product portfolio enables the market to serve multiple applications, strengthening overall growth.

- For instance, Grohe’s dual-flush elongated toilet in the Essence line uses 1.28 gallons per full flush and just 1.0 gallon for a partial flush—ensuring effective waste removal with controlled water use

By Deployment

Deployment in the Low Flow Plumbing Fixtures Market is categorized into residential and commercial applications. Residential adoption grows with rising awareness of water conservation and the push for sustainable housing. It offers homeowners cost savings on utility bills and compliance with local water efficiency standards. Commercial deployment shows robust growth in sectors such as hospitality, healthcare, and public infrastructure, where daily water usage is high. Builders integrate low flow fixtures into smart building projects to align with environmental certifications. Both segments contribute significantly, with commercial projects often driving bulk demand.

- For instance, the Moen HydroEnergetix showerhead operates at a maximum flow rate of 1.75 gallons per minute (6.65 liters per minute). It is a water-efficient product. It is widely marketed to residential customers for their homes.

By Distribution Channel

The Low Flow Plumbing Fixtures Market is distributed through online and offline channels. Offline retail, including specialty stores and hardware outlets, continues to dominate due to consumer preference for in-person product selection and installation services. It provides customers with physical access to a wide range of fixtures for immediate purchase. Online platforms, however, are gaining traction as e-commerce adoption rises globally. Consumers benefit from broader product availability, competitive pricing, and doorstep delivery. Manufacturers leverage online sales to expand reach into emerging markets. The balance between offline reliability and online convenience ensures steady distribution growth.

Segments:

Based on Product Type

- Faucets

- Showerheads

- Aerators

- Other fixtures

Based on Deployment

- New construction

- Repair & remodeling

Based on Distribution Channel

- Online Sales

- Offline Sales

Based on End-Use

- Residential

- Commercial

- Industrial

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for 34% of the Low Flow Plumbing Fixtures Market in 2024, making it the largest regional market. Growth is supported by stringent water conservation policies and advanced green building codes across the U.S. and Canada. It benefits from high awareness among consumers and strong adoption in both residential and commercial projects. The presence of established manufacturers and government-backed rebate programs accelerates fixture replacement in older buildings. Urban areas facing water stress, such as California and Arizona, further push adoption of low flow solutions. Continuous innovation in sensor-based faucets and showerheads reinforces North America’s leadership.

Europe

Europe represents 27% of the Low Flow Plumbing Fixtures Market in 2024, driven by strict environmental regulations and the European Union’s sustainability goals. Countries such as Germany, the UK, and France adopt low flow fixtures in large-scale commercial and residential developments. It gains momentum through compliance with certifications like BREEAM and LEED, which encourage eco-friendly construction. Renovation projects in historic buildings also integrate efficient fixtures to reduce water consumption. Governments provide incentives and awareness programs to accelerate adoption. Europe’s strong focus on reducing environmental footprint secures its position as the second-largest regional market.

Asia-Pacific

Asia-Pacific holds 25% of the Low Flow Plumbing Fixtures Market in 2024 and records the fastest growth. Rapid urbanization in China, India, and Southeast Asia drives adoption across large-scale housing and infrastructure projects. It benefits from increasing government investments in water conservation and smart city programs. Rising awareness of sustainable living among middle-class populations supports residential demand. Hospitality and healthcare sectors also integrate low flow fixtures due to high water usage. Affordable product offerings by regional manufacturers further expand adoption. The region’s rapid infrastructure development ensures continued market expansion.

Latin America

Latin America accounts for 8% of the Low Flow Plumbing Fixtures Market in 2024, with Brazil and Mexico leading adoption. The region’s construction sector integrates efficient fixtures to meet sustainability goals and reduce operating costs. It gains support from international green building certifications adopted in urban projects. Rising consumer awareness about water scarcity encourages fixture replacement in households. Economic fluctuations remain a challenge, but government-backed conservation initiatives create growth opportunities. Expanding hospitality and commercial projects reinforce adoption in key urban centers.

Middle East & Africa

The Middle East & Africa region represents 6% of the Low Flow Plumbing Fixtures Market in 2024, supported by growing water scarcity and government-led efficiency programs. Gulf countries such as the UAE and Saudi Arabia integrate low flow fixtures into modern infrastructure and smart city developments. It addresses urgent needs for sustainable water management in arid regions. Africa shows gradual adoption, with South Africa and Egypt leading in urban projects. International collaborations help introduce affordable solutions across developing economies. Rising infrastructure investments and stricter conservation policies enhance long-term growth prospects in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Hansgrohe SE

- Kohler Co.

- Toto Ltd.

- Grohe AG

- Delta Faucet Company

- American Standard Brands (LIXIL)

- Moen Incorporated

- Roca Sanitario S.A.

- Jaquar Group

- Villeroy & Boch AG

Competitive Analysis

The competitive landscape of the Low Flow Plumbing Fixtures Market is defined by leading players such as Kohler Co., Moen Incorporated, American Standard Brands (LIXIL), Delta Faucet Company, Grohe AG, Hansgrohe SE, Toto Ltd., Roca Sanitario S.A., Jaquar Group, and Villeroy & Boch AG. These companies compete by offering innovative product portfolios that balance water efficiency, durability, and aesthetic appeal. Manufacturers focus on integrating advanced technologies such as sensor-based faucets, dual-flush systems, and aerated showerheads to enhance performance without sacrificing user comfort. Sustainability remains a key differentiator, with players aligning product development with green building certifications and government-led water conservation programs. Expanding presence in high-growth regions like Asia-Pacific and the Middle East strengthens their global market reach. Partnerships with construction firms and large-scale infrastructure projects further drive adoption. Competitive intensity is also shaped by e-commerce expansion, where brands leverage online platforms to reach new customer bases. Continuous innovation, regulatory alignment, and regional expansion strategies enable these companies to maintain leadership in an evolving market focused on water conservation and sustainable living.

Recent Developments

- In September 2025, Hansgrohe plans to quadruple production in India, scaling from 50,000 to 200,000 bathroom fitting pieces annually by 2028—a move aimed at serving growing demand for eco-conscious fittings like low‑flow showers and faucets.

- In May 2025, Hansgrohe began a partnership with Hydraloop, introducing an IoT-controlled greywater recycling system in hotel bathrooms. The system captures and treats shower wastewater for reuse—boosting water efficiency.

- In March 2025, Hansgrohe unveiled the AXOR ShowerSphere collection, featuring a unique elliptical design that delivers a generous low-flow spray, blending luxury feel with reduced water use.

- In March 2025, At ISH 2025, Hansgrohe unveiled its ECO 2030 initiative, pledging to equip all water-bearing products with water-saving technologies by 2030. The presentation highlighted sustainable concepts such as a bathroom design with 90 percent lower water and energy use

Report Coverage

The research report offers an in-depth analysis based on Product Type, Deployment, Distribution Channel, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising global awareness of water conservation and sustainability.

- Green building certifications will drive higher adoption in residential and commercial projects.

- Smart and sensor-based plumbing fixtures will become a standard feature in modern construction.

- Retrofitting initiatives in aging infrastructure will create strong demand for replacement products.

- Affordable product lines will increase adoption in emerging economies with rapid urbanization.

- Design-focused fixtures combining aesthetics and efficiency will appeal to premium and mid-range consumers.

- Governments will strengthen regulations mandating water-efficient systems in new construction.

- Online sales channels will gain prominence as consumers prefer convenient purchasing options.

- Partnerships with real estate developers will expand opportunities for large-scale installations.

- Continuous innovation in materials and eco-friendly technologies will define long-term market growth.