Market Overview:

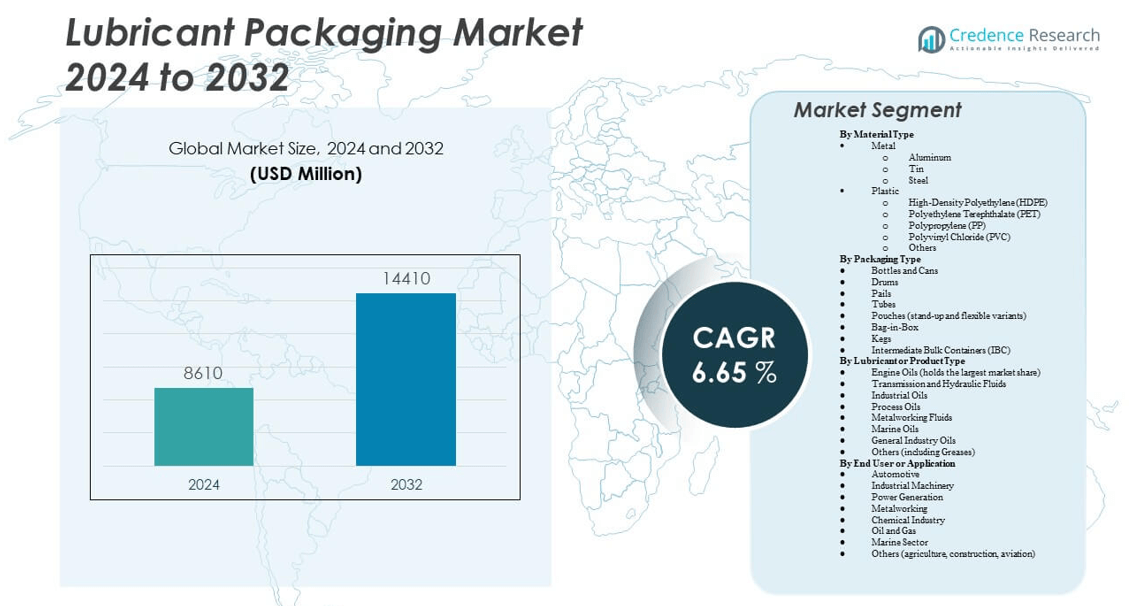

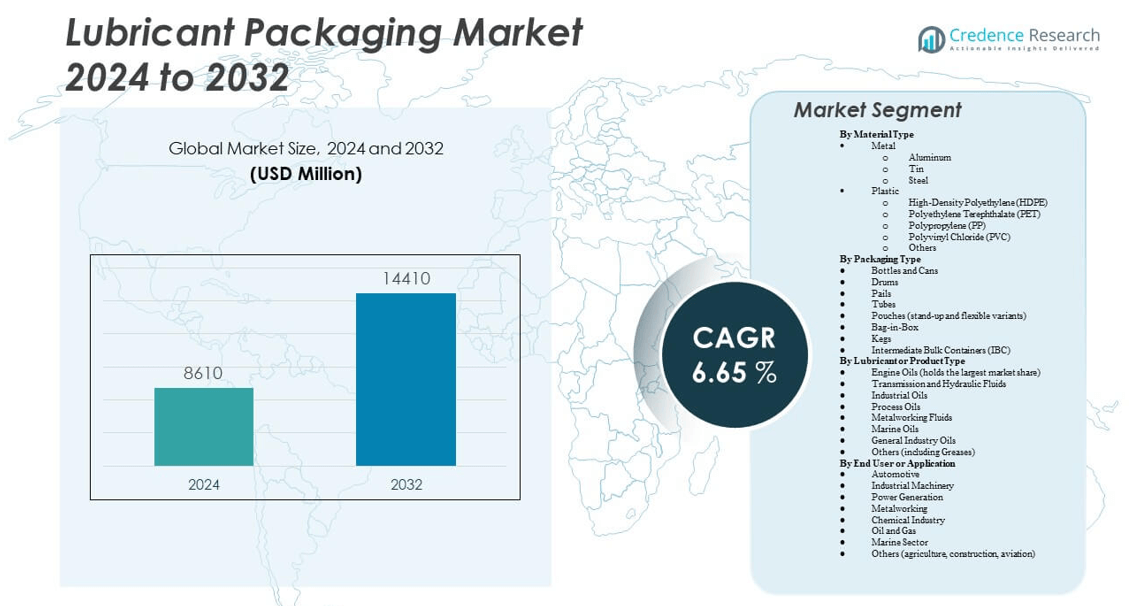

The Lubricant Packaging Market is projected to grow from USD 8,610 million in 2024 to an estimated USD 14,410 million by 2032, with a compound annual growth rate (CAGR) of 6.65% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lubricant Packaging Market Size 2024 |

USD 8,610 million |

| Lubricant Packaging Market, CAGR |

6.65% |

| Lubricant Packaging Market Size 2032 |

USD 14,410 million |

The market growth is driven by increasing demand for lubricants in automotive, industrial, and marine applications, requiring durable, leak-proof, and cost-effective packaging. As vehicle ownership rises and industrialization expands, the need for efficient lubricant handling solutions grows. Manufacturers are shifting toward lightweight, recyclable packaging formats to meet sustainability targets and regulatory standards. Innovations in flexible pouches, barrier containers, and anti-counterfeit labeling are further enhancing product differentiation and consumer appeal.

Regionally, Asia-Pacific leads the market due to rapid industrialization, large-scale automotive production, and expanding transportation infrastructure in countries like China, India, and Japan. North America and Europe follow closely, driven by technological innovation and stringent packaging regulations. Meanwhile, Latin America and the Middle East & Africa are emerging as fast-growing regions, supported by economic development, rising construction activity, and increasing machinery use. These regions are witnessing growing investments in manufacturing and lubricant distribution networks, strengthening their position in the global lubricant packaging landscape.

Market Insights:

- The Lubricant Packaging Market was valued at USD 8,610 million in 2024 and is projected to reach USD 14,410 million by 2032, growing at a CAGR of 6.65%.

- Rising demand for high-performance automotive and industrial lubricants is driving packaging innovation and material optimization.

- Stringent environmental regulations are pushing manufacturers to adopt recyclable and lightweight packaging solutions.

- High dependency on petrochemical-derived raw materials creates pricing instability and cost management challenges.

- Asia Pacific leads the market with the largest share, driven by industrial expansion and growing vehicle ownership.

- North America and Europe show strong demand for sustainable and smart lubricant packaging formats.

- Emerging economies in Latin America and the Middle East are witnessing rising lubricant consumption, boosting regional packaging needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Expansion of Automotive Sector Driving Lubricant Packaging Demand Across Global Markets

The global growth in vehicle ownership and maintenance needs is directly increasing lubricant consumption. Engine oils, transmission fluids, and greases require secure, durable packaging to protect product integrity. Automakers and service networks depend on consistent supply of well-packaged lubricants to maintain vehicle performance and meet service timelines. The Lubricant Packaging Market benefits from increased automotive manufacturing and aftersales service requirements. It supports both OEM and aftermarket distribution. High-volume demand from commercial transportation fleets fuels bulk and small-pack lubricant packaging innovations. Suppliers must ensure packaging complies with global logistics and temperature variances. Brand consistency and tamper evidence in lubricant packaging strengthen consumer trust in competitive automotive sectors.

Industrial Growth and Infrastructure Modernization Increasing Lubricant Usage

Construction, manufacturing, and mining industries depend on machinery requiring regular lubrication. The ongoing infrastructure expansion in emerging economies supports growing demand for packaged lubricants. Companies prefer safe, easy-to-store, and portable packaging formats for use in remote and industrial locations. The Lubricant Packaging Market adapts to this requirement by offering high-durability containers and sealed dispensing systems. It addresses challenges of handling in rugged work environments. Industrial automation also increases machine uptime expectations, placing greater emphasis on lubricant availability. Oil storage regulations also encourage improved packaging that ensures compliance. Reusability and safety features in industrial-grade packaging have become critical performance metrics for suppliers.

- For example, Greif, Inc. offers steel drums that meet high UN certification standards, including drop, pressure, stacking, and individual leak testing. These drums are designed for industrial and hazardous materials, making them suitable for lubricant packaging and transport. Greif also supplies composite steel-plastic drums that provide enhanced mechanical resistance and meet international safety regulations.

Consumer Preference for Convenience and Smaller Units Accelerating Packaging Innovation

Retail customers now seek easy-to-use, single-serve or smaller lubricant packs for two-wheelers, lawn equipment, and small engines. This shift in purchasing behavior influences manufacturers to offer a wider variety of SKUs. The Lubricant Packaging Market supports these changes by offering flexible pouches, squeeze tubes, and easy-pour bottles. It emphasizes shelf presence, portability, and consumer convenience. Standardized dispensing mechanisms enhance the user experience. Smaller packages also reduce waste and improve storage at the consumer level. The retail segment creates strong pressure for differentiation through design and labeling. Packaging has become a primary touchpoint for brand engagement in non-industrial segments.

Sustainability Initiatives Prompt Transition to Eco-Friendly Packaging Solutions

Global sustainability mandates are pushing lubricant manufacturers to adopt recyclable, reusable, or biodegradable packaging formats. Plastics used in traditional packaging are under scrutiny due to environmental concerns. The Lubricant Packaging Market is responding with lightweight containers, post-consumer recycled (PCR) plastics, and bio-based materials. It ensures product safety while minimizing environmental impact. Brands align packaging goals with broader ESG targets. Regulatory pressure in Europe and North America forces rapid innovation in packaging formats. Supply chains adapt to reduce carbon emissions from packaging production and disposal. The industry views sustainable packaging not just as compliance, but as a brand differentiation opportunity.

- For example, TotalEnergies Lubrifiantsdeveloped a new 20L packaging (France/Belgium) that is 7% lighter and contains 50% post-consumer recycled polyethylene. The cap is also 25% lighter and contains 50% recycled material. This initiative saves approximately 280 tonnes of CO2eq per year, a 6% emissions reduction.

Market Trends

Adoption of Smart Packaging Technologies to Enhance Supply Chain Visibility

The integration of QR codes, RFID, and NFC tags into lubricant packaging is gaining traction. These technologies help track inventory, verify product authenticity, and monitor distribution flows. The Lubricant Packaging Market incorporates smart labels to enhance security and traceability. It enables manufacturers and distributors to detect tampering or unauthorized use. These systems improve recall efficiency and regulatory compliance. Real-time data supports operational decision-making in high-volume lubricant logistics. End-users in industrial sectors increasingly demand digitally enabled packaging for maintenance tracking. Smart packaging also supports customer engagement through mobile-accessible product information.

Rise in Customized and Region-Specific Packaging Formats Across Global Markets

Manufacturers are designing packaging tailored to regional usage patterns, climate conditions, and consumer preferences. Markets in Asia-Pacific, for instance, require different dispensing systems compared to North America. The Lubricant Packaging Market adjusts its formats to meet local regulatory norms and transportation needs. It accounts for language-specific labeling and container compatibility with existing filling equipment. Companies localize packaging designs to strengthen market penetration. Limited edition and seasonal packaging options are also emerging in certain markets. Suppliers offer high versatility in materials, closures, and dimensions. Regional customization drives stronger brand recognition and customer loyalty.

- For example, Shell Lubricants introduced 100% post-consumer recycled (PCR) plastic bottles for its premium Shell Helix Ultra engine oil in India and Thailand, supporting its sustainability goals. The durable, eco-friendly packaging earned recognition from SCGP and reflects Shell’s focus on region-specific, circular packaging solutions.

Increased Use of Barrier Materials to Enhance Product Shelf Life and Safety

Oxygen, moisture, and UV exposure degrade lubricant quality over time. Manufacturers are adopting multilayer barrier films and high-density materials to extend shelf life. The Lubricant Packaging Market incorporates advanced barrier properties into flexible and rigid packaging formats. It prevents chemical degradation and leakage during transport and storage. Innovations in laminates and co-extruded films meet the evolving standards for high-performance lubricants. Heat-resistant and anti-static properties are also increasingly required. Industrial sectors with high environmental variability demand packaging that resists corrosion and material fatigue. These trends shape R&D investments across packaging manufacturers.

- For example, Amcor Flexibles offers high-barrier co‑extruded films under the AmLite Ultra family, featuring an ultra-thin SiOx (silicon oxide) coating. These films deliver oxygen barrier performance comparable to or exceeding aluminum, according to MOCON and Gelbo-Flex testing a 30% improvement after 100 flexing cycles.

Design Innovation for Ergonomics and Efficient Dispensing in Consumer Packaging

Consumer lubricant packaging now emphasizes spill-free, ergonomic, and reusable dispensing formats. Innovations like angled nozzles, push-pull caps, and collapsible pouches reduce product waste and enhance convenience. The Lubricant Packaging Market focuses on design improvements that support single-handed use and accurate dosing. It reflects growing demand in DIY vehicle maintenance and small equipment servicing. Visual appeal and functional usability are equally prioritized in product development. Clear labeling, volume indicators, and tamper-evident seals add value in consumer-oriented applications. Packaging designers now collaborate with marketing teams to align functionality with brand storytelling.

Market Challenges Analysis

Volatility in Raw Material Prices Disrupts Packaging Cost Structures

The Lubricant Packaging Market relies heavily on petrochemical-derived materials such as HDPE, PET, and PP. Fluctuating oil prices and supply chain disruptions frequently impact packaging costs. Manufacturers face difficulty maintaining pricing stability for end customers. Price volatility also affects packaging innovation timelines, as companies delay investment in new molds or tooling. Unpredictable costs challenge profitability, especially in competitive retail segments. Packaging suppliers must manage contracts carefully to avoid margin erosion. Alternative materials often require requalification, adding regulatory and technical hurdles. Cost-sensitive clients in emerging markets limit the adoption of premium packaging formats. This creates an ongoing trade-off between material quality and affordability.

Regulatory Pressures Around Environmental Impact Intensify Compliance Burden

Environmental regulations are tightening globally, requiring lubricant packaging to meet recycling, labeling, and safety standards. The Lubricant Packaging Market faces mounting pressure to reduce single-use plastic and carbon emissions. Compliance with Extended Producer Responsibility (EPR) laws increases the complexity of packaging operations. Smaller manufacturers often struggle to align with evolving international mandates. Certifications such as REACH, RoHS, and ISO standards require continuous updates in material sourcing and process validation. Non-compliance risks product bans and reputational damage. Developing sustainable packaging also requires new investments in R&D and logistics. These regulations limit flexibility and add to operational costs for packaging producers.

Market Opportunities

Growing Demand for Sustainable Packaging Creates Scope for Green Innovations

The global push for circular economy practices opens new opportunities in eco-friendly packaging solutions. The Lubricant Packaging Market can leverage bio-based resins, compostable films, and reusable container models to appeal to sustainability-driven customers. Businesses are willing to pay a premium for packaging that aligns with their ESG strategies. Refill stations and bulk dispensing systems create secondary packaging opportunities for industrial clients. Green certifications enhance brand value in mature and emerging markets. Packaging suppliers are forming partnerships with recyclers to close the loop on used lubricant containers. Government incentives for sustainable packaging provide a supportive regulatory backdrop for growth.

Digital Transformation in Packaging Operations Enhances Competitive Edge

Smart factory concepts are extending into the packaging domain, with IoT-enabled equipment improving precision and speed. The Lubricant Packaging Market benefits from automation in filling, labeling, and sealing systems. Digital twins, predictive maintenance, and machine learning applications reduce downtime and optimize throughput. Real-time data analytics help brands track packaging performance and waste. Cloud-based platforms facilitate remote monitoring of packaging assets across locations. These digital tools lower production costs and shorten time-to-market. Early adopters of digital transformation in packaging are gaining competitive advantage through efficiency and agility. This technology adoption opens new business models and service offerings in lubricant packaging.

Market Segmentation Analysis:

The Lubricant Packaging Market is segmented by material, packaging type, lubricant type, and end-user application.

By material, plastic dominates due to its durability, versatility, and cost-effectiveness. High-Density Polyethylene (HDPE) is widely used for its resistance to chemicals and impact, while PET and PP offer transparency and rigidity for smaller containers. Metal packaging, including aluminum, tin, and steel, remains relevant for bulk and industrial-grade lubricants requiring higher strength and protection.

- For example, Valvoline, Shell, and TotalEnergiesuse High-Density Polyethylene (HDPE) bottles for most retail engine and industrial oils due to HDPE’s superior chemical resistance and impact durability.

By packaging type, bottles and cans hold a significant share in retail and automotive applications due to convenience and branding potential. Drums, pails, and IBCs serve industrial and commercial needs where volume, safety, and reusability are critical. Flexible packaging options such as pouches and bag-in-box formats are gaining traction for their lightweight and sustainable characteristics.

- For example, Chevron and Shell Lubricants offer industrial and commercial lubricants in standard 55-gallon (208L) steel drums and 5-gallon (20L) pails across North America. These formats are commonly used for products such as hydraulic oils, engine oils, and gear lubricants, supporting large-scale applications in heavy industry and fleet operations.

By lubricant or product type, engine oils lead the market, followed by transmission fluids and industrial oils. These require reliable, contamination-resistant packaging.

By end-user, the automotive sector remains the largest contributor, with industrial machinery, oil and gas, and marine applications driving additional demand. The market responds to varied performance, safety, and regulatory requirements across these segments.

Segmentation:

By Material Type

-

- High-Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Others

By Packaging Type

- Bottles and Cans

- Drums

- Pails

- Tubes

- Pouches (stand-up and flexible variants)

- Bag-in-Box

- Kegs

- Intermediate Bulk Containers (IBC)

By Lubricant or Product Type

- Engine Oils (holds the largest market share)

- Transmission and Hydraulic Fluids

- Industrial Oils

- Process Oils

- Metalworking Fluids

- Marine Oils

- General Industry Oils

- Others (including Greases)

By End User or Application

- Automotive

- Industrial Machinery

- Power Generation

- Metalworking

- Chemical Industry

- Oil and Gas

- Marine Sector

- Others (agriculture, construction, aviation)

By Regional

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

Asia-Pacific holds the largest share of the Lubricant Packaging Market, accounting for 42% of the global revenue. The region’s dominance stems from rapid industrialization, booming automotive production, and expanding infrastructure projects in countries such as China, India, Japan, and South Korea. High lubricant consumption across manufacturing and transportation sectors increases demand for efficient and cost-effective packaging. It supports diverse formats, including pouches, drums, and cans, to meet local distribution needs. Government initiatives promoting domestic manufacturing further drive market growth. The region’s evolving environmental regulations also create scope for sustainable packaging alternatives.

North America captures 26% of the global market share, driven by strong demand across automotive, aerospace, and heavy machinery industries. The U.S. leads regional growth, backed by advanced packaging technology adoption and regulatory enforcement. It emphasizes tamper-proof, recyclable, and safety-compliant lubricant containers to meet both industrial and retail segment needs. The presence of major lubricant manufacturers supports packaging innovation across formats and materials. Stringent EPA guidelines influence the transition toward low-waste and high-performance packaging solutions. Canada also contributes to regional momentum, particularly in industrial lubricant consumption.

Europe accounts for 21% of the Lubricant Packaging Market, shaped by environmental mandates and automotive leadership in countries like Germany, France, and the UK. It favors recyclable and low-emission packaging formats, aligning with regional sustainability goals. Industrial automation and electric vehicle growth are changing lubricant product demands, influencing packaging volume and design. The market favors efficient, lightweight containers that meet both EU standards and branding expectations. It also sees growth in refillable and bulk packaging models for OEMs and maintenance hubs. The focus on closed-loop systems and circular economy policies accelerates packaging innovation across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Plc

- Berry Global Inc.

- Greif, Inc.

- Mauser Packaging Solutions

- Scholle IPN

- Mold-Tek Packaging

- Balmer Lawrie & Co. Ltd.

- Time Technoplast

- Mondi Group

- Glenroy Inc.

Competitive Analysis:

The Lubricant Packaging Market features a mix of global and regional players competing across rigid and flexible formats. Key companies include Greif Inc., Mauser Packaging Solutions, Scholle IPN, Time Technoplast, and Mold-Tek Packaging. These firms focus on innovations in material efficiency, recyclability, and advanced dispensing systems. It experiences steady product development, with firms investing in lightweight and tamper-evident solutions. Strategic mergers, acquisitions, and regional expansions help leading players strengthen their supply chains and customer base. OEM partnerships and industrial contracts remain central to long-term competitiveness. Private labeling and contract packaging also see growing interest. Pricing pressure and sustainability mandates drive firms to optimize operations without compromising quality.

Recent Developments:

- In February 2025, Berry Global Inc. showcased its new bottle and cap solution made from 100% post-consumer recycled (PCR) plastic. This launch was in partnership with Green Oil for ‘eco-friendly’ lubricants, offering bottles and closures that meet strict sustainability credentials and support the growing demand for recyclable lubricant packaging.

- In November 2024, Greif, Inc. entered into a partnership with GREIF-VELOX and Specialty Equipment Corporation to enhance their offerings in liquid filling machinery, directly benefiting the lubricant packaging segment. This partnership strengthens their presence in the U.S. market for liquid and lubricant packaging machinery, offering cutting-edge solutions to customers.

Market Concentration & Characteristics:

The Lubricant Packaging Market shows moderate to high concentration, with a few dominant players controlling a significant portion of global supply. It is highly competitive, shaped by price sensitivity, performance standards, and evolving environmental regulations. The market emphasizes material durability, leak resistance, and compliance with transportation standards. Customization and rapid delivery are key service differentiators. Innovation cycles focus on reducing material weight, increasing recyclability, and improving user convenience. Flexible packaging formats gain traction across small-scale applications, while rigid containers continue to serve bulk and industrial uses. The market responds quickly to shifts in end-user preferences and regional compliance requirements.

Report Coverage:

The research report offers an in-depth analysis based on material, packaging type, lubricant type, and end-user application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for high-performance lubricants will increase the need for durable and functional packaging solutions.

- Sustainability concerns will drive the adoption of recyclable, biodegradable, and lightweight packaging materials.

- Flexible packaging formats will expand in small-engine and consumer applications due to ease of use.

- Smart packaging technologies like QR codes and RFID will improve traceability and product authentication.

- Regional customization will rise, with companies adapting packaging to local preferences and regulations.

- Growth of electric vehicles will change lubricant types and influence packaging volume and compatibility.

- Refillable and reusable packaging will gain traction in industrial sectors to support sustainability and cost savings.

- Digitalization in packaging operations will improve efficiency, precision, and waste reduction.

- Strategic collaborations between lubricant producers and packaging firms will accelerate innovation and differentiation.

- Infrastructure development in emerging markets will open new opportunities for localized packaging strategies.