Market Overview:

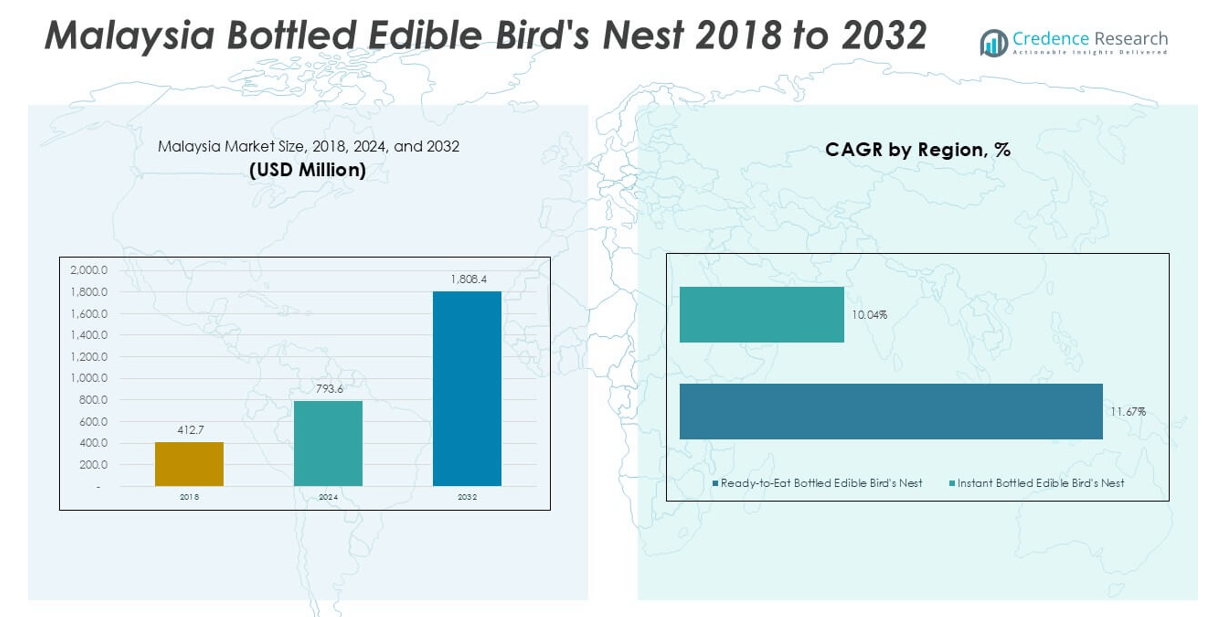

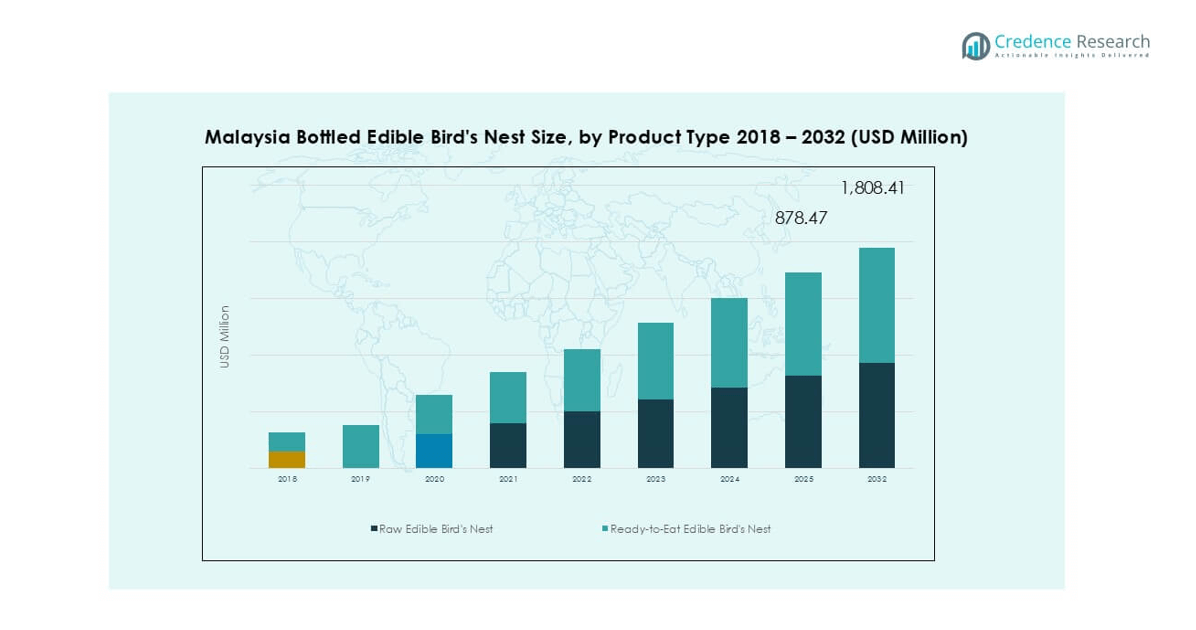

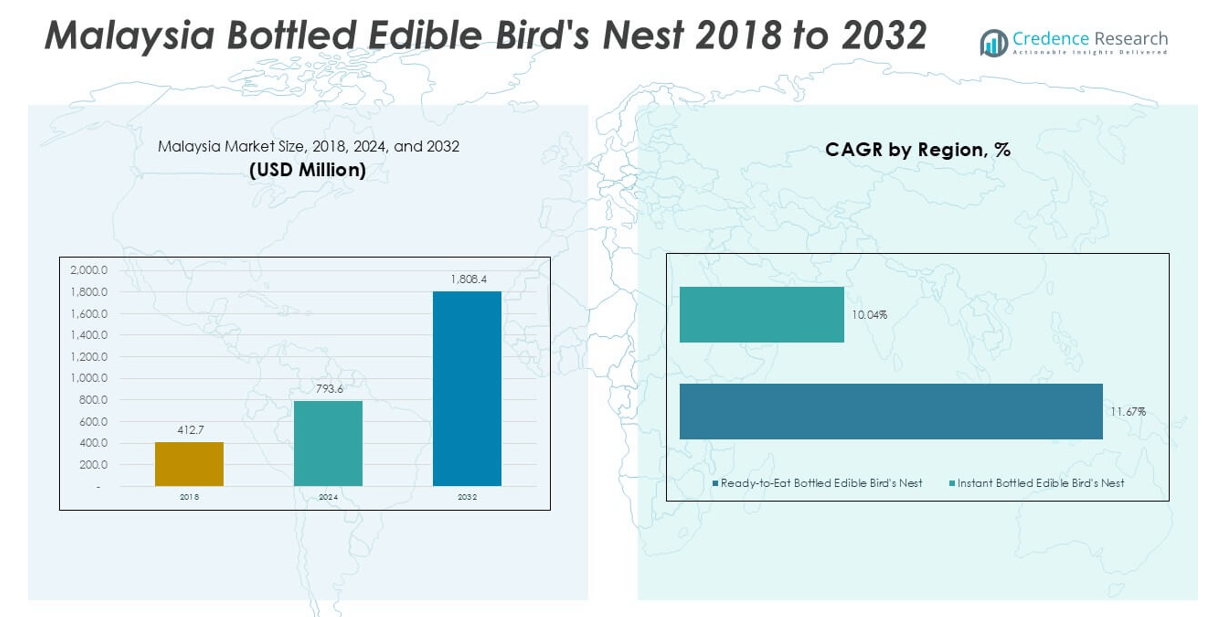

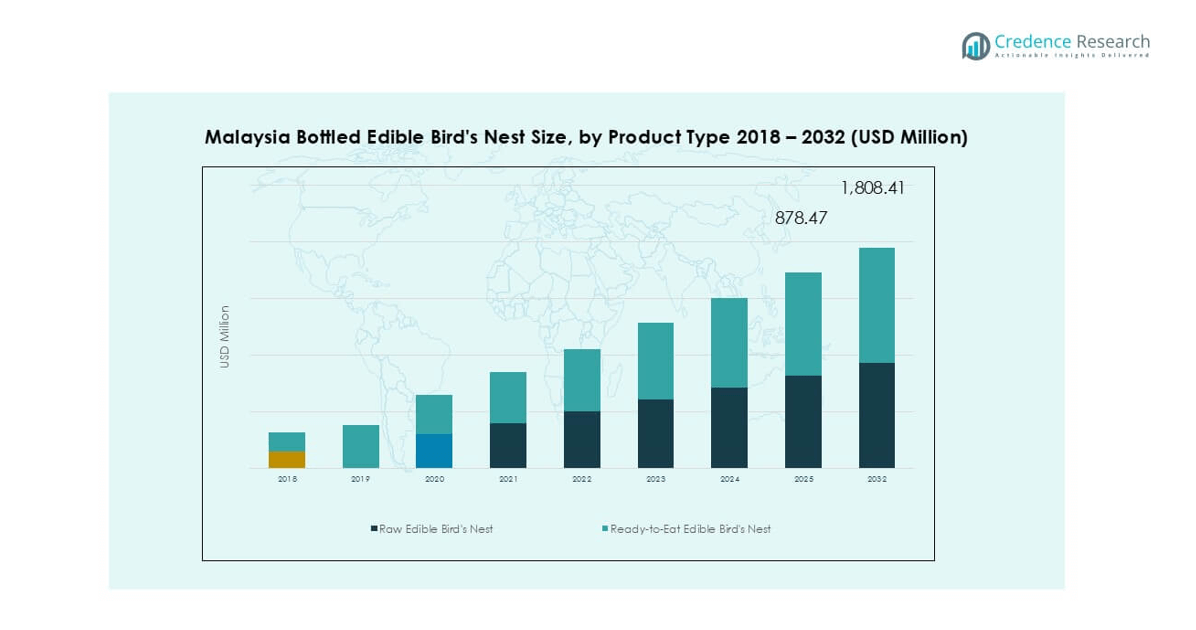

The Malaysia Bottled Edible Bird’s Nest market was valued at USD 412.7 million in 2018 and increased to USD 793.6 million in 2024. The market is expected to reach USD 1806.4 million by 2032, expanding at a CAGR of 11.67% during the forecast period from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Malaysia Bottled Edible Bird’s Nest Market Size 2024 |

USD 793.6 million |

| Malaysia Bottled Edible Bird’s Nest Market, CAGR |

11.67% |

| Malaysia Bottled Edible Bird’s Nest Market Size 2032 |

USD 1806.4 million |

In the Malaysia bottled edible bird’s nest market, top players such as Ecolite Biotech Manufacturing Sdn Bhd, YNH Birdnest, Golden Bird’s Nest Sdn Bhd, and TRBM (The Real Birdnest Malaysia) dominate the competitive landscape through diversified product portfolios and strong distribution networks. These companies have established a significant presence by offering ready-to-drink formulations that cater to both traditional and health-focused consumers. Ecolite and Golden Bird’s Nest lead in product innovation and retail penetration. Regionally, the Central Region, encompassing Selangor and Kuala Lumpur, holds the largest market share at 34%, driven by high consumer purchasing power, urban demand for wellness beverages, and advanced retail infrastructure. The East Malaysia region follows with 21% market share, supported by strong production capabilities and growing domestic consumption. These regional dynamics, combined with strategic branding and Halal certification, position the leading players to capitalize on both domestic demand and export opportunities.

Market Insights

- The Malaysia Bottled Edible Bird’s Nest market was valued at USD 412.7 million in 2018 and increased to USD 793.6 million in 2024. The market is expected to reach USD 1806.4 million by 2032, expanding at a CAGR of 11.67% during the forecast period from 2024 to 2032.

- Rising health awareness and cultural acceptance of bird’s nest as a traditional wellness product continue to drive strong demand, particularly for ready-to-drink formulations, which accounted for over 65% of the product segment in 2024.

- Premiumization, collagen-enriched products, and Halal-certified offerings are gaining traction, especially among younger urban consumers and export-focused manufacturers.

- The market remains moderately consolidated, with key players like Ecolite Biotech Manufacturing, YNH Birdnest, and Golden Bird’s Nest Sdn Bhd leading through brand strength and diversified portfolios.

- The Central Region leads with 34% market share due to high urban demand and retail accessibility, followed by East Malaysia at 21%, supported by strong production infrastructure and increasing regional consumption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

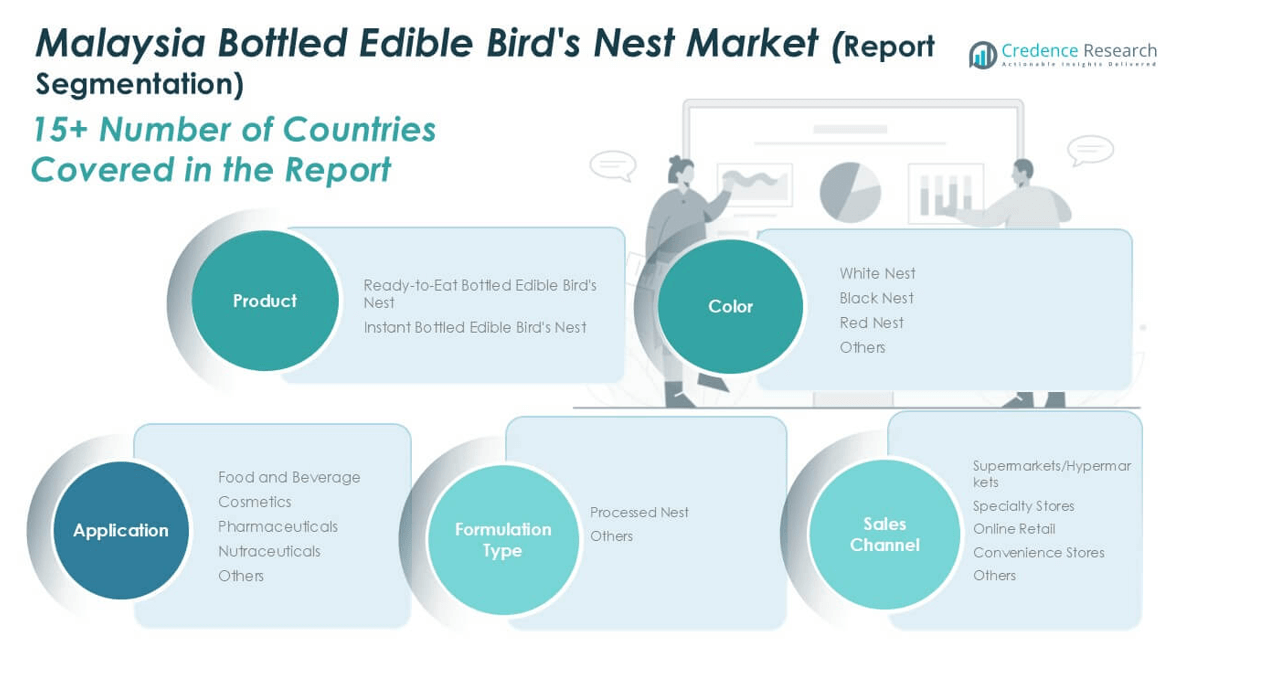

Market Segmentation Analysis:

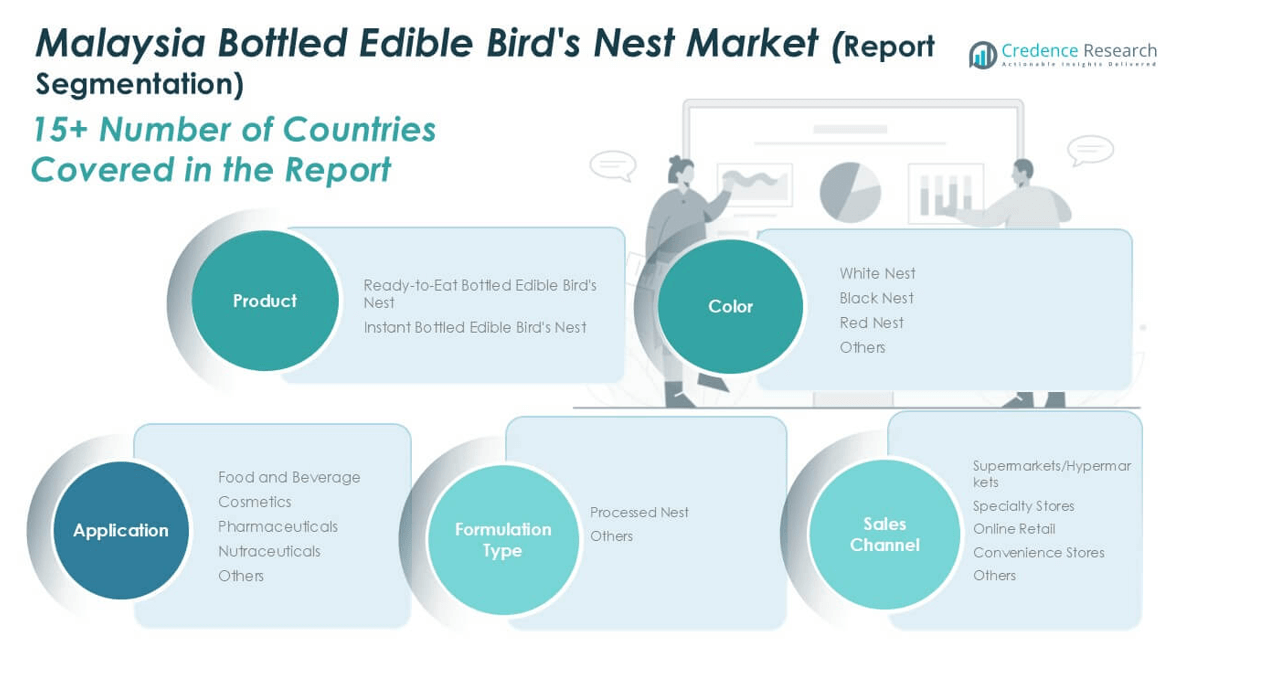

By Product Type

In the Malaysia Bottled Edible Bird’s Nest market, the Ready-to-Eat Bottled Edible Bird’s Nest segment holds the dominant share, accounting for over 65% of the market in 2024. This growth is primarily driven by increasing consumer preference for convenience and health-focused products that require no preparation. The busy urban lifestyle of Malaysian consumers has propelled the demand for ready-to-consume wellness products, positioning this segment ahead of instant variants. Moreover, expanding retail availability and product innovations—such as sugar-free or collagen-enhanced ready-to-eat formulations—further reinforce the dominance of this segment in the market.

- For instance, Ecolite Biotech Manufacturing launched its “Bird’s Nest with Collagen” in 2023, incorporating 2,000 mg of marine collagen per bottle, boosting its monthly production to over 500,000 units to meet increasing domestic demand.

By Color:

Among color-based segments, the White Nest segment dominates, capturing approximately 58% of the total market share in 2024. Its premium perception, backed by traditional beliefs about its higher nutritional and medicinal value, makes it the most sought-after variant among Malaysian consumers. White nests are widely preferred for their lighter texture, neutral taste, and ease of processing, contributing to their widespread use across bottled product lines. In contrast, black and red nests remain niche due to their limited availability and higher prices, while “Others” include lower-grade nests that serve price-sensitive customer groups.

- For instance, Golden Bird’s Nest Sdn Bhd reported that 92% of its total raw material procurement in 2023 consisted of white nest grades, enabling them to scale production to over 1.2 million bottles annually across premium and mid-tier SKUs

By Application:

The Food and Beverage segment leads the application landscape, accounting for nearly 72% of the Malaysia Bottled Edible Bird’s Nest market in 2024. This dominance is largely driven by the strong cultural association of bird’s nest consumption with wellness, vitality, and luxury dietary habits in Malaysia. The increasing demand for functional foods and natural supplements further boosts the incorporation of edible bird’s nests into beverages and nutritional products. Meanwhile, applications in cosmetics, pharmaceuticals, and nutraceuticals are gaining traction due to the rising awareness of bird’s nest extract’s benefits for skin health, immunity, and anti-aging, though these remain secondary in market share.

Market Overview

Rising Health Consciousness and Nutritional Demand

The growing awareness of health and wellness among Malaysian consumers is a primary driver for the bottled edible bird’s nest market. Rich in glycoproteins, amino acids, and epidermal growth factors, edible bird’s nest products are widely recognized for supporting immune function, skin regeneration, and overall vitality. Consumers increasingly seek functional beverages that align with preventive health trends, pushing demand for bottled bird’s nest products. The shift towards natural remedies and daily nutritional supplements continues to boost this market across both urban and suburban regions.

- For instance, TRBM (The Real Birdnest Malaysia) introduced a functional line in 2022 featuring 1,500 mg of pure bird’s nest and no preservatives, resulting in a 40% year-on-year growth in retail sales by Q4 2023.

Cultural and Traditional Acceptance

Bird’s nest consumption has deep cultural and traditional significance in Malaysia, particularly among the Chinese-Malaysian population. Traditionally regarded as a delicacy and health tonic, bottled bird’s nest products benefit from consistent demand during festive seasons, gift-giving occasions, and as part of traditional Chinese medicine practices. This cultural attachment ensures a stable customer base, regardless of economic fluctuations. Manufacturers capitalize on these traditions by offering heritage-inspired packaging and formulations, further anchoring the product in Malaysian households and enhancing year-round market resilience.

- For instance, YNH Birdnest customized its Lunar New Year limited edition series with traditional motifs in 2023, selling 80,000 gift packs in just six weeks across Klang Valley and Penang.

Expansion of E-commerce and Retail Availability

The increasing penetration of online retail platforms and specialty health stores across Malaysia is significantly driving market accessibility. Brands are leveraging e-commerce channels such as Lazada, Shopee, and dedicated wellness websites to reach a broader demographic, including younger, tech-savvy consumers. Simultaneously, growing shelf space in pharmacies, supermarkets, and duty-free outlets enhances product visibility and impulse purchasing. Strategic partnerships with retail distributors and targeted digital marketing campaigns have allowed brands to expand both market reach and consumer engagement.

Key Trends & Opportunities

Premiumization and Functional Innovation

Premiumization is emerging as a key trend, with consumers willing to invest in high-quality bird’s nest beverages that offer added functionality. Manufacturers are introducing formulations enriched with collagen, goji berries, ginseng, and reduced sugar options to appeal to health-focused buyers. Additionally, advancements in processing technology have enabled preservation of nutrients while extending shelf life. The trend toward cleaner labels and scientifically backed claims creates opportunities for brands to differentiate through quality assurance, ingredient transparency, and tailored health benefits.

- For instance, Royal Bird’s Nest Malaysia installed a low-temperature vacuum extraction line in 2023 that retains up to 92% of natural glycoproteins post-processing, improving nutritional integrity across its premium SKUs.

Growing Interest from Halal and Export Markets

Malaysia’s strong halal certification infrastructure presents an opportunity for bottled bird’s nest brands to expand into Islamic markets across Southeast Asia and the Middle East. With increasing global interest in traditional Asian health foods, halal-certified products have a competitive edge in cross-border trade. Export opportunities are further supported by government initiatives promoting local small and medium enterprises (SMEs), along with improved international logistics. This positions Malaysian brands to capture new market segments, diversify revenue streams, and achieve export-led growth.

- For instance, Lo Hong Ka (Malaysia Operations) expanded its export portfolio to 12 countries by the end of 2023, with certified Halal bottled bird’s nest accounting for 78% of its international sales volume, reaching 3.1 million bottles annually.

Key Challenges

High Production Costs and Supply Chain Dependence

One of the major challenges faced by the bottled edible bird’s nest industry in Malaysia is the high cost of raw materials and processing. Bird’s nests require labor-intensive harvesting and cleaning, contributing to significant overhead expenses. Additionally, the industry remains reliant on specific regional farms and seasonal yields, making it vulnerable to supply chain disruptions. These cost pressures often limit price competitiveness, especially against alternative health drinks or synthetic supplements, and impact the affordability of products for mass-market consumers.

Regulatory and Quality Compliance Issues

Strict regulations surrounding the hygiene, authenticity, and labeling of edible bird’s nest products pose a continuous challenge for manufacturers. Compliance with national food safety standards and certification processes—including halal, GMP, and HACCP—demands significant investment and operational discipline. Moreover, any breach in quality or counterfeit issues can damage brand credibility and consumer trust. Smaller players often face difficulties navigating these regulatory frameworks, which restricts their scalability and market entry potential compared to larger, established firms with greater compliance infrastructure.

Regional Analysis

Northern Peninsula

The Northern Peninsula region, encompassing states like Penang, Kedah, and Perlis, accounted for approximately 18% of the Malaysia bottled edible bird’s nest market in 2024. This region benefits from a strong presence of traditional Chinese communities and established swiftlet farming operations, particularly in Perak and Penang. Local demand remains robust, supported by cultural preferences and the popularity of bird’s nest products in traditional medicine. Retail penetration in urban centers like George Town supports both premium and mid-range offerings. Additionally, proximity to processing hubs facilitates efficient supply chains, making the region an important contributor to both domestic consumption and exports.

Southern Peninsula

The Southern Peninsula, including Johor, Melaka, and Negeri Sembilan, holds a market share of around 15%. Johor, in particular, plays a dual role as both a production and consumption hub due to its proximity to Singapore, where bird’s nest products command higher prices. The region benefits from affluent consumers and rising health awareness, contributing to increased demand for ready-to-drink formulations. Johor’s active role in cross-border trade supports the presence of well-established brands. With enhanced logistics infrastructure and swiftlet farm clusters, this region is positioned as a growing node in Malaysia’s overall edible bird’s nest ecosystem.

Central Region

The Central region, covering Selangor, Kuala Lumpur, and Putrajaya, dominates the bottled edible bird’s nest market with a market share of nearly 34% in 2024. It serves as the commercial and economic heart of the country, hosting a high concentration of affluent, health-conscious consumers. The region features advanced retail networks, specialty health stores, and e-commerce fulfillment centers, ensuring widespread product availability. With strong urban demand and rising premiumization, major brands often launch new SKUs in this region first. Moreover, the Central region acts as a strategic distribution and branding hub, attracting significant investment from domestic and international market players.

East Coast

The East Coast region—including Kelantan, Terengganu, and Pahang—contributes approximately 12% to the national bottled edible bird’s nest market. While this region is less urbanized, local consumption is gradually increasing, driven by improving awareness of health benefits and growing middle-class income. The presence of traditional beliefs in herbal and nutritional remedies supports modest but steady demand. Additionally, swiftlet farming activity, especially in Terengganu, supports local processing and small-scale distribution. Although retail penetration is lower compared to western Malaysia, targeted promotions and government initiatives to support rural entrepreneurship are gradually expanding the market footprint in this region.

East Malaysia

East Malaysia, comprising Sabah and Sarawak, accounts for roughly 21% of the bottled edible bird’s nest market in 2024. This region is notable for its extensive swiftlet farming and natural cave harvesting, particularly in Sarawak, which contributes significantly to national bird’s nest production. Export-oriented processing units are growing, spurred by rising international demand. Local consumption is supported by rising urbanization in cities like Kota Kinabalu and Kuching, with increased interest in health beverages. Although logistics remain a challenge in remote areas, infrastructure improvements and regional investment initiatives are facilitating faster market growth and deeper brand penetration.

Market Segmentations:

By Product Type

- Ready-to-Eat Bottled Edible Bird’s Nest

- Instant Bottled Edible Bird’s Nest

By Color

- White Nest

- Black Nest

- Red Nest

- Others

By Application

- Food and Beverage

- Cosmetics

- Pharmaceuticals

- Nutraceuticals

- Others

By Formulation Type

- Whole Nest

- Processed Nest

- Powdered Extract

- Others

By Sales Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Online Retail

- Convenience Stores

- Others

By Geography

- Northern Peninsula

- Southern Peninsula

- Central

- East Coast

- East Malaysia

Competitive Landscape

The Malaysia bottled edible bird’s nest market is moderately consolidated, with a mix of established domestic manufacturers and emerging regional players competing for market share. Key players such as Ecolite Biotech Manufacturing Sdn Bhd, YNH Birdnest, and Golden Bird’s Nest Sdn Bhd lead the market by offering a wide range of ready-to-drink and functional health products targeting diverse consumer segments. These companies leverage strong branding, premium packaging, and extensive retail and online distribution networks to maintain a competitive edge. Emerging players like TRBM (The Real Birdnest Malaysia) and RBN Malaysia focus on innovation, such as sugar-free or collagen-infused formulations, to attract younger and health-conscious consumers. Strategic partnerships, celebrity endorsements, and Halal certification are commonly used to strengthen brand credibility and market reach. Continuous investment in quality assurance, traceability systems, and export capabilities is crucial for maintaining competitiveness, especially as international demand for Halal-certified bird’s nest products from Malaysia continues to grow.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Ecolite Biotech Manufacturing Sdn Bhd

- YNH Birdnest

- Dragon Brand Bird’s Nest (Malaysia Branch)

- Natural Bird’s Nest (NBN Group)

- Golden Bird’s Nest Sdn Bhd

- TRBM (The Real Birdnest Malaysia)

- Royal Bird’s Nest (RBN Malaysia)

- Lo Hong Ka (Malaysia Operations)

Recent Developments

- In February 2025, Ecolite maintains a professional bottled bird’s nest production process. Their facility, established in 2007, is Malaysia’s first specialized bird’s nest processing factory, equipped with two bottling lines and adhering to GMP and HACCP standards. They focus on preserving the texture and quality of the bird’s nest through a hygienic, modern production line. Ecolite ensures high quality by using raw materials and processes that comply with national safety and export certifications.

- In July 2023, Glyken Bio Products, a Malaysian biotech company, launched a retail store called GLK Birdnest to sell value-added bird’s nest products, leveraging biotechnology to expand its market reach. This move signifies a growing trend of biotech-driven innovation within Malaysia’s bird’s nest industry.

Market Concentration & Characteristics

The Malaysia Bottled Edible Bird’s Nest Market exhibits a moderately concentrated structure, led by a few dominant players including Ecolite Biotech Manufacturing, YNH Birdnest, and Golden Bird’s Nest Sdn Bhd. It reflects characteristics of a premium health and wellness segment, where brand credibility, product quality, and Halal certification determine consumer trust and loyalty. The market favors vertically integrated companies that control sourcing, processing, and packaging to ensure authenticity and compliance with stringent quality standards. It targets health-conscious consumers and leverages traditional beliefs surrounding bird’s nest benefits to maintain steady demand. Urban areas, particularly in the Central Region, show the highest consumption due to higher disposable income and access to specialty retail outlets. Companies differentiate through product innovation such as sugar-free, collagen-infused, and flavored variants that cater to evolving consumer preferences. E-commerce and digital marketing channels support market expansion, especially among younger demographics. It continues to grow in both domestic and export markets, supported by Malaysia’s strong regulatory framework and swiftlet farming infrastructure.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Color, Application, Formulation Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to witness steady growth driven by rising consumer awareness of the nutritional benefits of edible bird’s nest.

- Increasing demand for convenient, ready-to-drink health beverages will continue to boost product innovation.

- Premium and functional formulations, such as collagen-infused and sugar-free options, will gain wider acceptance among health-conscious consumers.

- E-commerce will play a crucial role in expanding market reach, particularly among urban millennials and younger demographics.

- Halal certification and compliance with export standards will support entry into broader Southeast Asian and Middle Eastern markets.

- Strong government support for swiftlet farming and small business development is expected to enhance local production capacity.

- Continued urbanization and rising disposable incomes will drive higher consumption in central and metropolitan regions.

- Investments in branding, packaging, and traceability systems will become essential for maintaining consumer trust and competitive advantage.

- Strategic collaborations and distribution partnerships will accelerate penetration across retail and specialty channels.

- Demand for bird’s nest products in the cosmetics and nutraceutical sectors is likely to create new application opportunities.