Market overview

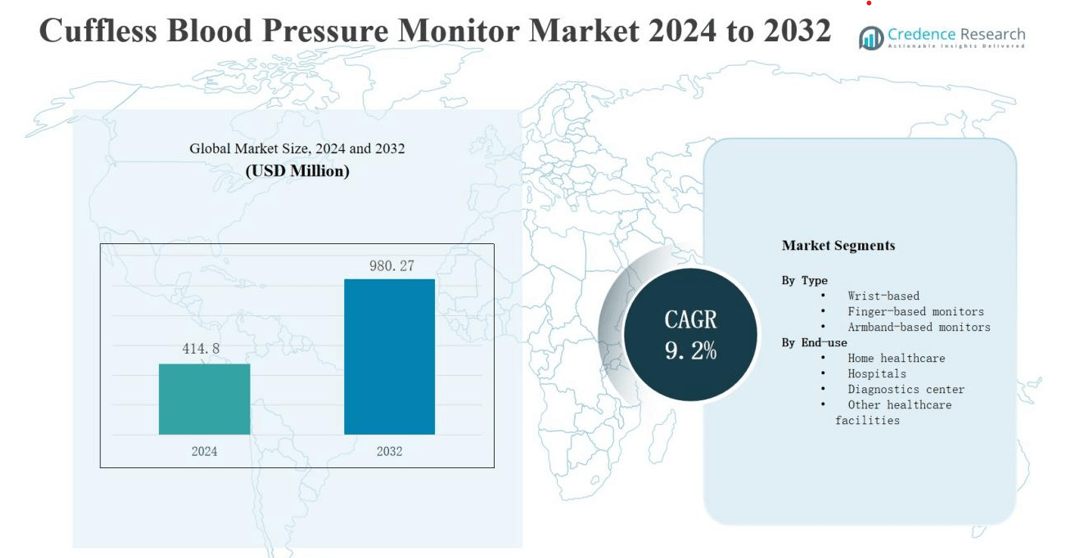

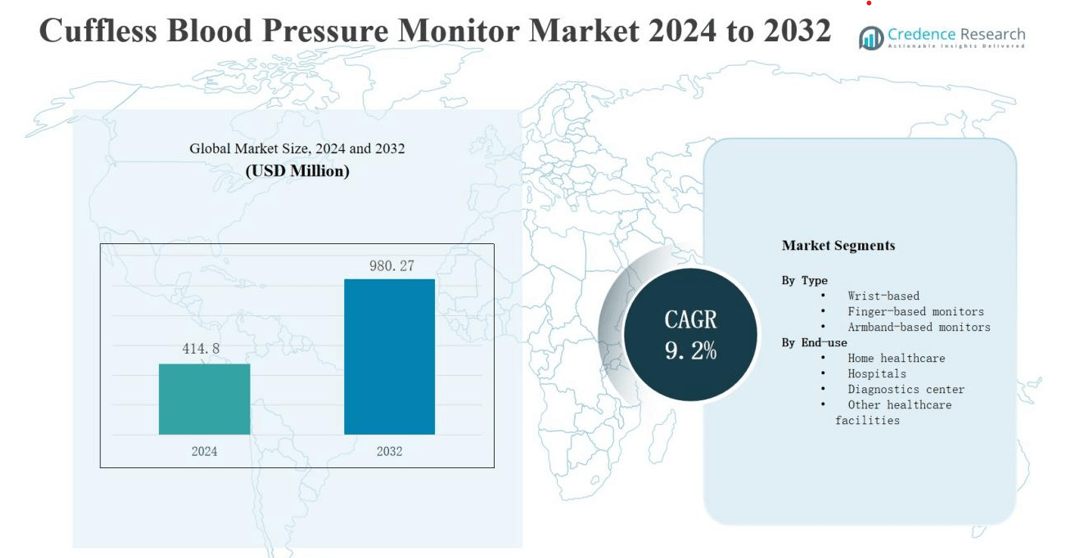

The Cuffless Blood Pressure Monitor Market size was valued at USD 414.8 million in 2024 and is anticipated to reach USD 980.27 million by 2032, growing at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cuffless Blood Pressure Monitor Market Size 2024 |

USD 414.8 million |

| Cuffless Blood Pressure Monitor Market, CAGR |

9.2% |

| Cuffless Blood Pressure Monitor Market Size 2032 |

USD 980.27 million |

The Cuffless Blood Pressure Monitor Market is shaped by strong competition among key players, including Omron Healthcare, Biobeat Technologies, Aktiia SA, Valencell Inc., Samsung Electronics Co., Ltd., Huawei Technologies Co., Ltd., Xiaomi Corporation, A&D Medical, Biospectal SA, and Garmin Ltd. These companies focus on innovation, clinical accuracy, and integration of AI-driven wearable technologies to strengthen their market presence. Continuous advancements in optical sensors and wireless connectivity enhance usability and reliability for both healthcare professionals and consumers. North America leads the global market with a 38% share in 2024, supported by advanced healthcare infrastructure, early adoption of digital health devices, and strong consumer awareness of hypertension management.

Market Insights

- The Cuffless Blood Pressure Monitor Market was valued at USD 414.8 million in 2024 and is expected to reach USD 980.27 million by 2032, growing at a 2% CAGR.

- North America leads the market with a 38% share, driven by advanced healthcare infrastructure, high awareness of hypertension management, and strong adoption of digital health technologies.

- The wrist-based segment dominates with a 46% share in 2024, supported by its portability, continuous tracking capability, and integration with smartphone-based applications.

- The home healthcare segment holds a 49% share, fueled by self-monitoring trends, telehealth adoption, and rising demand for cost-effective, Bluetooth-enabled monitoring solutions.

- Key players such as Omron Healthcare, Biobeat Technologies, Aktiia SA, Samsung Electronics, and Huawei Technologies focus on AI-driven innovation, wearable design, and wireless sensor advancements to strengthen global presence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segment Insights

By Type

The wrist-based segment dominates the Cuffless Blood Pressure Monitor Market, accounting for 46% share in 2024. Its popularity stems from portability, ease of use, and suitability for continuous blood pressure tracking. Advancements in wearable sensor technology and integration with smartphones enhance accuracy and user convenience. Growing demand for non-invasive, real-time monitoring among patients with hypertension further supports adoption. Manufacturers focus on miniaturized designs and improved calibration algorithms to ensure reliable long-term measurements.

- For instance, Valencell introduced its Wrist-Worn Cuffless Blood Pressure Monitor, leveraging photoplethysmography sensors for continuous, non-invasive readings validated in clinical trials.

By End-use

The home healthcare segment leads the Cuffless Blood Pressure Monitor Market with a 49% share in 2024. Increasing preference for self-monitoring, coupled with rising awareness about preventive healthcare, drives segment growth. Technological integration with telehealth platforms allows remote monitoring and physician feedback. Aging populations and the rise in chronic hypertension cases strengthen household adoption. Cost-effectiveness, convenience, and Bluetooth-enabled connectivity features make home healthcare devices more appealing to consumers seeking accurate daily blood pressure management.

- For instance, Omron Healthcare enhanced its HeartGuide wearable with improved Bluetooth-enabled data synchronization, expanding its usability for patients who require frequent self-monitoring at home.

Key Growth Drivers

Rising Hypertension Prevalence

Te increasing global burden of hypertension is a major growth driver for the Cuffless Blood Pressure Monitor Market. With lifestyle-related health risks and sedentary habits on the rise, regular monitoring is essential. Cuffless devices offer a painless, convenient alternative to traditional monitors, encouraging consistent use. Healthcare providers also recommend these devices for early detection and long-term management of blood pressure fluctuations, especially in high-risk populations such as the elderly and diabetic patients.

- For instance, Aktiia SA (Neuchâtel, Switzerland) has developed a CE-marked cuffless monitor that uses a wrist-worn optical sensor to collect photoplethysmography signals, enabling continuous, pain-free 24-hour blood pressure monitoring in daily conditions.

Advancements in Sensor and AI Technology

Rapid progress in optical, photoplethysmography (PPG), and ECG-based sensors enhances the accuracy of cuffless blood pressure monitors. Integration of artificial intelligence and machine learning algorithms improves calibration and predictive capabilities. These technologies allow real-time data processing and early anomaly detection, strengthening preventive healthcare. Continuous innovation by manufacturers supports better user experience, device miniaturization, and seamless data synchronization with mobile applications, expanding adoption among both patients and healthcare professionals.

- For instance, Movano Health announced the Evie Ring, which combines PPG and temperature sensors with AI analytics to provide continuous cardiorespiratory insights tailored for women’s health monitoring.

Growing Demand for Remote Patient Monitoring

Expanding telehealth infrastructure and increasing preference for at-home care boost the adoption of cuffless blood pressure monitors. These devices enable continuous monitoring without the need for frequent clinical visits. Hospitals and diagnostic centers increasingly integrate remote monitoring tools into chronic disease management programs. The COVID-19 pandemic further accelerated this shift toward home-based health tracking, leading to broader awareness and acceptance of wearable, wireless monitoring systems for long-term patient management.

Key Trends & Opportunities

Integration with Smart Wearable Ecosystems

A major trend shaping the Cuffless Blood Pressure Monitor Market is integration with multifunctional wearables. Devices like smartwatches now combine heart rate, blood pressure, and oxygen saturation tracking in one platform. This convergence enhances convenience and data accessibility for users. Manufacturers are partnering with tech firms to create interoperable solutions compatible with fitness and health applications, opening opportunities for expansion into preventive healthcare and fitness-oriented consumer segments.

- For instance, the HUAWEI WATCH D2 features a TruSense system with a high-precision pressure sensor, mini pump, and airbag to provide accurate blood pressure measurements along with continuous monitoring of vital signs, enhancing user convenience.

Expansion in Emerging Healthcare Markets

Emerging economies present strong growth opportunities for cuffless blood pressure monitors due to rising healthcare awareness and improving digital infrastructure. Increasing disposable incomes and government focus on preventive care are driving adoption. Regional healthcare programs in Asia-Pacific, Latin America, and the Middle East promote affordable access to remote monitoring devices. Manufacturers investing in cost-effective, AI-driven solutions tailored to local needs are likely to capture significant market potential in these fast-growing regions.

- For instance, Microlife’s CRADLE VSA, developed with low-cost design for low-resource settings, has been deployed across Africa and Asia: in one study it reduced obstetric haemorrhage referrals from 0.29 % to 0.16 % in peripheral clinics.

Key Challenges

Accuracy and Calibration Concerns

Despite technological progress, achieving consistent accuracy remains a critical challenge in the Cuffless Blood Pressure Monitor Market. Variability in readings due to motion artifacts, skin tone, or physiological differences limits reliability. Continuous calibration with reference devices is often required, adding complexity for users. Addressing these accuracy limitations through better sensor algorithms and clinical validations remains essential to build confidence among healthcare providers and regulatory bodies.

High Device Cost and Limited Reimbursement

High production costs and limited insurance reimbursement policies hinder widespread adoption. Advanced sensors, AI algorithms, and wireless connectivity increase device prices, restricting affordability in low- and middle-income markets. Many healthcare systems do not yet classify cuffless monitors as reimbursable medical devices, reducing institutional purchases. Manufacturers must focus on cost optimization, regulatory alignment, and demonstrating clinical efficacy to encourage broader acceptance among consumers and healthcare organizations.

Data Privacy and Integration Barriers

The increasing use of digital health technologies raises data security and integration concerns. Cuffless blood pressure monitors collect sensitive patient data that must comply with privacy standards such as HIPAA and GDPR. Limited interoperability between device platforms and hospital systems complicates clinical data sharing. Ensuring secure, seamless integration with electronic health records while maintaining user confidentiality remains a significant challenge for manufacturers and healthcare providers alike.

Regional Analysis

North America

North America leads the Cuffless Blood Pressure Monitor Market with a 38% share in 2024. Strong healthcare infrastructure, advanced R&D capabilities, and early adoption of digital health technologies support regional dominance. The United States drives growth through high awareness of hypertension management and the presence of key manufacturers. Rising demand for remote patient monitoring and integration of wearable health devices further strengthen adoption. Government support for preventive healthcare programs promotes home-use monitoring devices. It benefits from established reimbursement frameworks that encourage consumer confidence and device utilization.

Europe

Europe holds a 28% share of the Cuffless Blood Pressure Monitor Market in 2024, driven by increasing emphasis on preventive healthcare and chronic disease management. The region benefits from widespread acceptance of non-invasive medical technologies. Germany, the UK, and France lead demand due to strong public health systems and active digital health initiatives. Continuous technological innovation and regulatory support from the EU accelerate market growth. It experiences steady adoption across hospitals, diagnostic centers, and homecare applications. Aging populations and a high prevalence of cardiovascular diseases sustain regional expansion.

Asia-Pacific

Asia-Pacific accounts for a 24% market share in 2024 and represents the fastest-growing region in the Cuffless Blood Pressure Monitor Market. Rising healthcare investments, expanding middle-class populations, and growing awareness of lifestyle diseases drive market penetration. China, Japan, and India lead the region with rapid digital health adoption. Local manufacturers are entering the market with cost-effective, wearable devices that cater to a broader consumer base. It benefits from government-led initiatives promoting home healthcare and remote monitoring systems. Increasing smartphone use and AI integration enhance accessibility and data-driven health management.

Latin America

Latin America captures an 6% share in the global market in 2024. Growth is supported by gradual improvements in healthcare access and awareness of hypertension-related risks. Brazil and Mexico lead regional demand through rising adoption of portable health monitoring solutions. It gains momentum from expanding telemedicine networks and public health programs. Increasing partnerships between global device makers and local distributors improve availability. Continuous focus on affordable cuffless devices aligns with the region’s growing preference for home-based medical care.

Middle East & Africa

The Middle East & Africa region holds a 4% share in 2024. Expanding healthcare infrastructure and increasing investments in digital health support market presence. The Gulf countries lead adoption with government-backed e-health initiatives and higher healthcare spending. It faces limited penetration in low-income areas due to cost and awareness barriers. Growing prevalence of hypertension and obesity creates untapped potential for wearable monitoring devices. Strategic collaborations and mobile health programs are expected to accelerate growth in coming years.

Market Segmentations:

By Type

- Wrist-based

- Finger-based monitors

- Armband-based monitors

By End-use

- Home healthcare

- Hospitals

- Diagnostics center

- Other healthcare facilities

By Region

-

- Germany

- UK

- France

- Italy

- Spain

- Switzerland

- The Netherlands

- Denmark

- Poland

- Sweden

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- New Zealand

- Thailand

- Vietnam

- Indonesia

- Latin America

-

- Brazil

- Mexico

- Argentina

- Colombia

- Chile

-

- Saudi Arabia

- South Africa

- UAE

- Turkey

Competitive Landscape

The competitive landscape of the Cuffless Blood Pressure Monitor Market is characterized by strong innovation, strategic partnerships, and rapid technology integration. Leading players such as Omron Healthcare, Biobeat Technologies, Aktiia SA, Valencell Inc., Samsung Electronics, Huawei Technologies, and Xiaomi Corporation focus on expanding their product portfolios through advanced wearable designs and AI-driven monitoring solutions. Companies invest heavily in R&D to enhance accuracy, connectivity, and comfort for end users. Collaborations with healthcare institutions and digital health platforms strengthen clinical validation and user trust. Startups and tech firms increasingly compete by offering affordable, smartphone-integrated devices that appeal to consumer and homecare segments. Continuous improvements in optical and ECG-based sensors, coupled with rising regulatory approvals, boost market credibility. It remains highly dynamic, with frequent product launches and acquisitions aimed at improving competitiveness, expanding regional reach, and addressing the growing global demand for continuous, non-invasive blood pressure monitoring solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In April 2024, Philips announced a strategic partnership with smartQare B.V. (not Biobeat Technologies) to integrate smartQare’s wearable biosensor solution, viQtor, with Philips’ patient monitoring platforms for continuous monitoring both in and out of the hospital. As part of this agreement, smartQare acquired Philips’ Healthdot business.

- In July 2025, Biobeat Technologies launched its AI-powered cuffless monitoring platform in U.S. hospitals for real-time tracking.

- On September 25, 2025, Sky Labs officially launched CART BP, a ring-type personal cuffless blood pressure monitor, approved by Korea’s Ministry of Food and Drug Safety.

Report Coverage

The research report offers an in-depth analysis based on Type, End Use and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for wearable and connected health monitoring devices will continue to increase.

- Integration of AI and machine learning will improve measurement accuracy and predictive insights.

- Home healthcare adoption will expand due to growing awareness of preventive monitoring.

- Smartphone-linked devices will dominate with seamless data synchronization and remote access.

- Manufacturers will focus on miniaturized designs for better comfort and continuous tracking.

- Partnerships between tech firms and healthcare providers will drive clinical validation and trust.

- Regulatory approvals will rise as cuffless devices gain recognition as medical-grade tools.

- Emeraging markets will witness strong adoption due to affordable innovations and rising incomes.

- Cloud-based data analytics will enhance personalized health management and patient engagement.

- Continuous advancements in sensor technology will strengthen long-term reliability and market growth.