Market overview

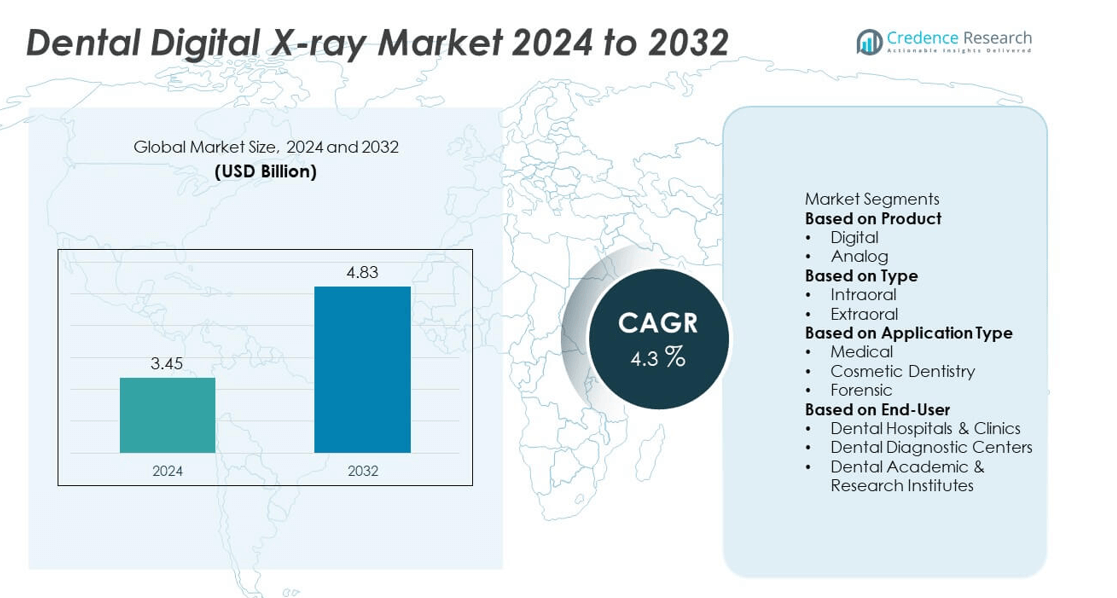

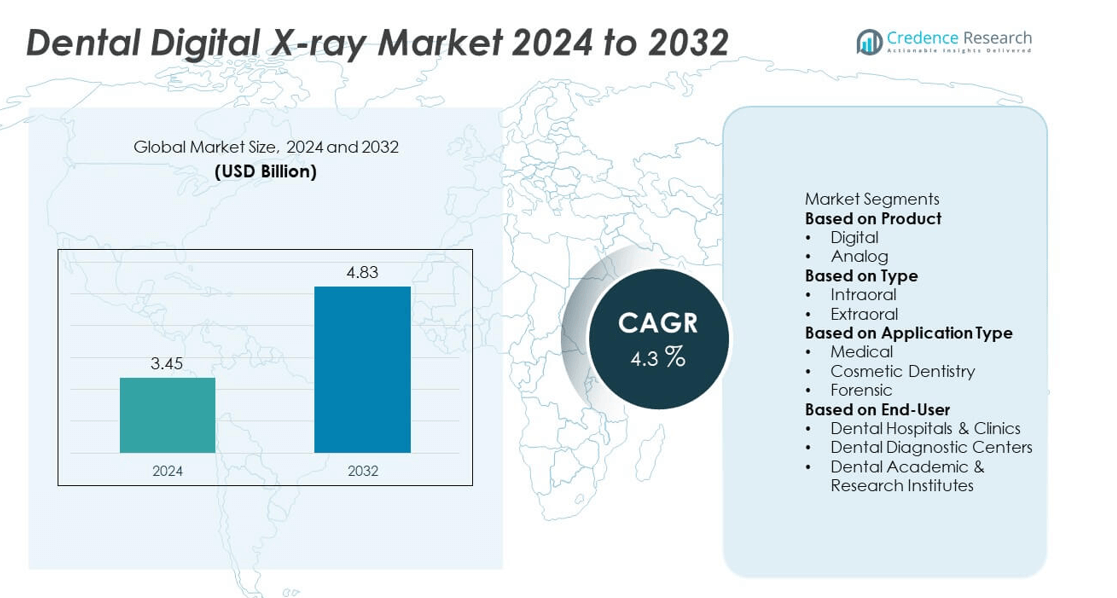

The global Dental Digital X-ray market was valued at USD 3.45 billion in 2024 and is projected to reach USD 4.83 billion by 2032, registering a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dental Digital X-ray Market Size 2024 |

USD 3.45 billion |

| Dental Digital X-ray Market, CAGR |

4.3% |

| Dental Digital X-ray Market Size 2032 |

USD 4.83 billion |

The dental digital X-ray market is led by prominent players such as Dentsply Sirona, 3M Company, Biolase Inc, Zimmer Biomet Holdings, Planmeca OY, Align Technology Inc, Danaher Corporation, A-Dec, Institute Straumann, and Carestream Dental. These companies dominate through continuous innovation in imaging technologies, including AI-based diagnostic tools and cone-beam computed tomography systems. North America remains the leading region, holding a 36% share in 2024, supported by advanced dental infrastructure and early technology adoption. Europe follows with 29% share, driven by strong preventive care programs, while Asia Pacific, holding 22%, is the fastest-growing region due to rising healthcare investments and expanding dental networks.

Market Insights

- The dental digital X-ray market was valued at USD 3.45 billion in 2024 and is projected to reach USD 4.83 billion by 2032, growing at a CAGR of 4.3%.

- Rising demand for advanced imaging in dental diagnostics and increasing prevalence of oral diseases are key drivers, boosting adoption of digital radiography across clinics and hospitals.

- The market is witnessing trends such as integration of AI-based imaging software, portable X-ray systems, and 3D cone-beam computed tomography for enhanced precision and patient safety.

- Leading players, including Dentsply Sirona, 3M Company, Biolase Inc, and Planmeca OY, focus on product innovation, strategic partnerships, and digital workflow solutions to strengthen market position.

- North America held 36% share in 2024, followed by Europe with 29% and Asia Pacific with 22%, while the digital product segment dominated with 82% share; high equipment costs and integration challenges remain key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The digital segment dominated the dental digital X-ray market in 2024, accounting for over 82% share. This leadership is driven by superior image quality, faster processing, and reduced radiation exposure compared to analog systems. The shift toward digital platforms enables seamless image storage and sharing, supporting efficient diagnosis and treatment planning. Dental practices increasingly adopt digital sensors and imaging software for workflow integration and accuracy. Moreover, the growing use of AI-based image enhancement tools further supports the transition from analog to digital radiography across dental clinics and hospitals.

- For instance, Planmeca has integrated AI-powered software, such as the Adaptive Image Noise Optimiser (AINO) for intelligent noise reduction and the Planmeca CALM® algorithm for movement artifact correction, into its ProMax 3D imaging systems for enhanced diagnostic precision.

By Type

The intraoral segment held the largest market share of around 64% in 2024, driven by its critical role in detecting cavities, monitoring root health, and assessing bone structure. These X-rays are widely used for early-stage dental diagnosis due to their precision and low radiation dose. The segment benefits from rising patient visits for preventive care and orthodontic assessment. Innovations such as wireless intraoral sensors and high-resolution imaging systems have improved diagnostic accuracy and patient comfort, encouraging higher adoption among dental professionals globally.

- For instance, Carestream Dental’s RVG 6200 intraoral sensor utilizes a high-resolution Super CMOS detector with a 12-bit depth and pixel size of 19 microns, allowing clinicians to capture detailed dental structures while maintaining minimal radiation exposure.

By Application Type

The medical segment led the market in 2024, capturing approximately 59% share, supported by increasing demand for accurate diagnostics and treatment planning in dental diseases. Rising prevalence of periodontitis, tooth decay, and oral cancers drives this dominance. Hospitals and dental clinics use digital imaging for surgical planning, implant assessment, and restorative procedures. The growing geriatric population and demand for efficient oral healthcare further enhance adoption. Additionally, integration of 3D imaging in medical dentistry strengthens diagnostic capabilities, positioning the segment as the primary contributor to market expansion.

Key Growth Drivers

Rising Adoption of Digital Imaging Technologies

Dental professionals increasingly prefer digital X-ray systems for their speed, clarity, and safety. These systems deliver high-quality images with lower radiation exposure and faster results than analog models. The integration of smart imaging software enhances workflow efficiency and supports accurate diagnoses. Advancements in sensor technology and wireless connectivity allow dentists to analyze and store images seamlessly. Growing awareness of radiation safety and the benefits of digital data management further encourage clinics and hospitals to upgrade to digital systems.

- For instance, Dentsply Sirona’s Axeos 3D imaging unit uses a high-resolution 14-bit CMOS detector with a voxel size of 80 microns, providing ultra-sharp images while reducing exposure time to under 4.4 seconds per scan, improving clinical efficiency and patient safety.

Increasing Prevalence of Oral Diseases

A growing number of people suffer from dental disorders such as cavities, gum disease, and oral cancer. These conditions require precise imaging for early detection and treatment planning. Dental X-rays enable professionals to identify issues that are not visible during physical examinations. Rising awareness of preventive dental care and regular check-ups fuels demand for advanced imaging. The expansion of dental care access and the focus on early intervention continue to drive digital imaging adoption across both developed and emerging regions.

- For instance, Planmeca’s ProScanner 2.0 digital imaging plate system utilizes RFID technology for fast scanning and plate identification. It significantly speeds up the intraoral imaging workflow with its quick scanning process, allowing dentists to promptly diagnose the captured images.

Expanding Cosmetic Dentistry and Aesthetic Procedures

Cosmetic dentistry is becoming a major application area for digital X-rays. Patients increasingly seek treatments for smile design, tooth restoration, and alignment correction. Digital imaging provides detailed visualization of jaw and tooth structures, helping dentists achieve aesthetic precision. Improved image clarity aids in treatment customization and patient communication. The growing influence of social media and consumer focus on appearance encourage investment in modern diagnostic tools, supporting the widespread use of digital radiography in aesthetic dentistry.

Key Trends and Opportunities

Integration of Artificial Intelligence in Imaging Systems

Artificial intelligence is transforming dental diagnostics by enabling automated image reading and pattern recognition. AI tools improve detection accuracy for cavities, fractures, and bone abnormalities while reducing manual workload. These technologies enhance clinical efficiency and support personalized dental care through predictive insights. Many imaging manufacturers are embedding AI algorithms into their systems for real-time analysis. This trend opens new possibilities for precision diagnostics, cloud-based image processing, and faster decision-making in both hospital and private practice settings.

- For instance, Dentsply Sirona’s DS Core platform integrates AI-powered features for both 2D and 3D imaging, supporting faster and more accurate treatment planning across dental practices worldwide.

Growing Demand for Portable and Chairside Imaging Solutions

Portable dental X-ray systems are gaining popularity for their mobility and convenience. These compact devices allow imaging directly at the patient’s chair, improving workflow and reducing waiting time. The demand for such systems is rising in home-based, community, and emergency dental care. Modern models with wireless capabilities and long battery life are well-suited for clinics seeking flexibility and space efficiency. The increasing focus on patient comfort and faster diagnostics continues to drive the adoption of portable imaging technologies.

- For instance, Dexcowin’s iRay D3 portable dental X-ray generator delivers an exposure output of 60 kV and 2 mA with a 0.8 mm focal spot, and offers high-resolution chairside imaging without compromising portability or diagnostic clarity.

Key Challenges

High Initial Investment and Maintenance Costs

The transition from analog to digital X-ray systems involves considerable upfront costs. Equipment purchase, software integration, and ongoing maintenance can strain the budgets of smaller clinics. Replacing sensors and performing regular calibrations add to operational expenses. While digital systems offer long-term efficiency and superior image quality, the financial burden remains a barrier for many practitioners. This challenge is especially prominent in developing markets where capital budgets are limited and reimbursement rates are low.

Data Security and Integration Issues

The increasing digitization of dental imaging introduces risks related to data management and cybersecurity. Patient records stored in digital systems must be protected from breaches and unauthorized access. Inconsistent software standards also hinder smooth integration with electronic health records. Clinics adopting cloud-based image storage must comply with strict privacy regulations. Ensuring data encryption, secure sharing, and system compatibility has become essential for maintaining trust and operational efficiency in digital dental imaging environments.

Regional Analysis

North America

North America held the largest share of 36% in the dental digital X-ray market in 2024. The region’s dominance is driven by advanced healthcare infrastructure, high dental care awareness, and widespread adoption of digital imaging technologies. Strong insurance coverage and a growing elderly population further contribute to market growth. The United States leads due to early technology adoption and high investment in AI-based dental diagnostics. Canada also shows steady growth through government-supported oral health programs and expanding private dental clinics offering advanced digital radiography services.

Europe

Europe accounted for 29% share of the dental digital X-ray market in 2024. Increasing prevalence of oral diseases and strong focus on preventive dental care support market growth. Germany, France, and the United Kingdom are leading contributors, driven by well-established healthcare systems and high dentist-to-patient ratios. The region benefits from regulatory initiatives promoting radiation safety and digital transformation in dental practices. Technological advancements, such as cone-beam computed tomography and intraoral imaging systems, are gaining rapid adoption. The growing number of specialized dental clinics further strengthens market expansion across Europe.

Asia Pacific

Asia Pacific captured 22% of the dental digital X-ray market in 2024, emerging as a fast-growing region. Rising disposable incomes, expanding healthcare infrastructure, and increasing oral health awareness drive adoption across major countries like China, Japan, and India. Government initiatives promoting dental health and foreign investments in dental equipment manufacturing enhance accessibility. The rapid growth of private dental chains and medical tourism in Southeast Asia further accelerates digital X-ray adoption. Continuous technological integration and competitive pricing make the region a focal point for future market development.

Latin America

Latin America accounted for 8% share of the dental digital X-ray market in 2024. Growth is driven by improving dental care infrastructure and rising investment in healthcare modernization. Brazil and Mexico lead the regional market due to increasing urbanization and adoption of advanced dental technologies. Expanding middle-class populations and growing awareness of preventive dental care encourage clinics to invest in digital imaging systems. However, high equipment costs and uneven access to modern facilities limit adoption in rural areas, creating opportunities for affordable portable imaging solutions.

Middle East & Africa

The Middle East and Africa held 5% share of the dental digital X-ray market in 2024. Growth is supported by rising healthcare investments and increasing establishment of dental clinics across urban centers. The United Arab Emirates and Saudi Arabia are leading markets due to rapid technological adoption and expansion of private dental networks. In Africa, growing awareness of oral health and partnerships with global dental equipment suppliers are improving access to digital imaging tools. Ongoing healthcare reforms and education initiatives continue to strengthen the regional market outlook.

Market Segmentations:

By Product

By Type

By Application Type

- Medical

- Cosmetic Dentistry

- Forensic

By End-User

- Dental Hospitals & Clinics

- Dental Diagnostic Centers

- Dental Academic & Research Institutes

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Afric

Competitive Landscape

The competitive landscape of the dental digital X-ray market is characterized by strong participation from leading players such as Dentsply Sirona, 3M Company, Biolase Inc, Zimmer Biomet Holdings, Planmeca OY, Align Technology Inc, Danaher Corporation, A-Dec, Institute Straumann, and Carestream Dental. These companies focus on technological innovation, product diversification, and strategic collaborations to strengthen their global presence. Manufacturers are investing in AI-driven imaging software, cloud-based diagnostic tools, and portable digital radiography systems to enhance diagnostic precision and workflow efficiency. Continuous advancements in cone-beam computed tomography and intraoral imaging are key competitive areas. Firms are also expanding their footprint through mergers, acquisitions, and partnerships with dental clinics and distributors. Additionally, growing emphasis on radiation safety, ergonomic design, and real-time image sharing capabilities is driving product differentiation. Competitive intensity remains high as global and regional players strive to balance affordability, performance, and regulatory compliance in a rapidly evolving digital imaging market.

[cr_cta type=”customize_now“]

Key Player Analysis

- Dentsply Sirona

- 3M Company

- Biolase Inc

- Zimmer Biomet Holdings

- Planmeca OY

- Align Technology Inc

- Danaher Corporation

- A-Dec

- Institute Straumann

- Carestream Dental

Recent Developments

- In September 2025, Dentsply Sirona announced the U.S. rollout of AI-powered 3D X-ray diagnostic features within its DS Core platform.

- In August 2025, Carestream Dental upgraded its Horizon X-ray System with a six-way floating table, improving patient positioning accuracy and workflow efficiency for dental clinics.

- In March 2025, Carestream Dental launched an enhancement for its DRX-Rise mobile X-ray unit, integrating a collapsible column system to boost mobility and navigation in compact clinical environments.

- In June 2024, Dentsply Sirona partnered with Siemens Healthineers to introduce the world’s first dental-dedicated MRI (ddMRI) system, designed to complement radiation-based imaging in advanced dental diagnostics.

Report Coverage

The research report offers an in-depth analysis based on Product, Type, Application Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of AI-driven imaging tools will enhance diagnostic accuracy and treatment planning.

- Demand for portable and wireless X-ray systems will continue to grow in mobile dental setups.

- Integration with cloud-based platforms will improve data storage, sharing, and remote access.

- 3D and cone-beam computed tomography technologies will see wider clinical applications.

- Digital workflow automation will streamline dental imaging and reduce turnaround times.

- Rising cosmetic dentistry demand will boost advanced imaging adoption for aesthetic procedures.

- Energy-efficient and low-radiation imaging systems will gain stronger market preference.

- Expansion of dental clinics in emerging markets will create new growth opportunities.

- Collaborations between manufacturers and dental software companies will increase product innovation.

- Continued focus on affordability and interoperability will shape competitive strategies worldwide.