Market Overview:

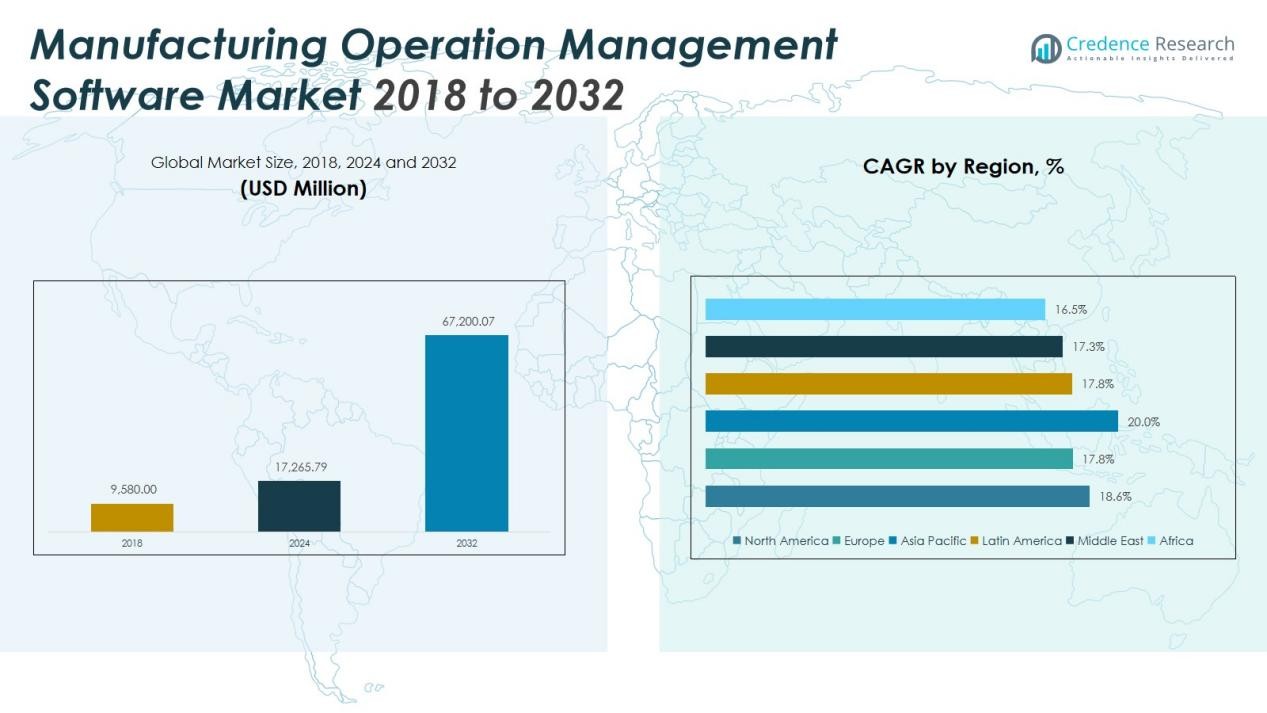

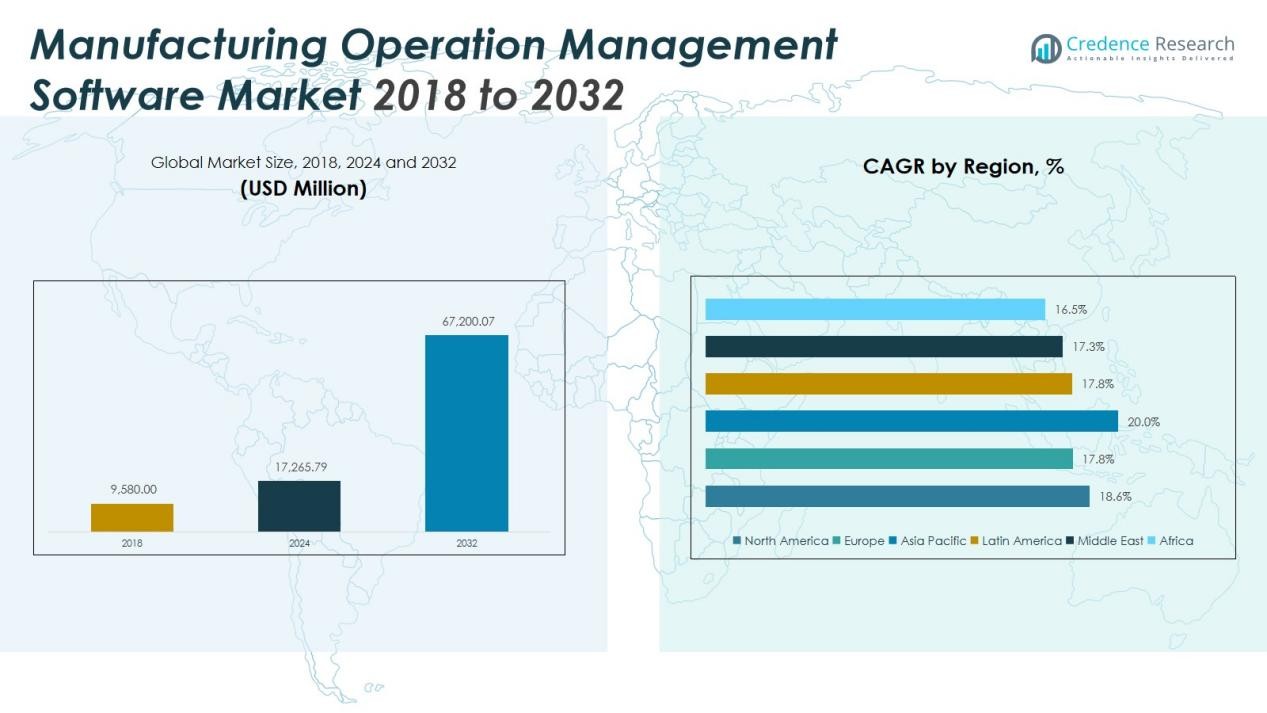

The Global Manufacturing Operation Management Software Market size was valued at USD 9,580 million in 2018 to USD 17,265.79 million in 2024 and is anticipated to reach USD 67,200.07 million by 2032, at a CAGR of 18.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Manufacturing Operation Management Software Market Size 2024 |

USD 17,265.79 Million |

| Manufacturing Operation Management Software Market, CAGR |

18.64% |

| Manufacturing Operation Management Software Market Size 2032 |

USD 67,200.07 Million |

Growing demand for automation, quality management, and predictive maintenance drives market expansion. Manufacturers are integrating MOM solutions with IoT, AI, and cloud technologies to streamline processes, reduce downtime, and achieve higher operational efficiency. The growing emphasis on Industry 4.0, smart factories, and paperless production environments also supports adoption across sectors such as automotive, electronics, and pharmaceuticals.

Regionally, North America dominates the Global Manufacturing Operation Management Software Market due to strong technology adoption and presence of major software providers. Europe follows, driven by strict compliance requirements and sustainability initiatives in manufacturing. The Asia Pacific region is expected to witness the fastest growth, fueled by industrial digitalization in China, India, Japan, and South Korea, alongside government initiatives promoting advanced manufacturing and smart industry development.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Manufacturing Operation Management Software Market was valued at USD 9,580 million in 2018, rising to USD 17,265.79 million in 2024, and is projected to reach USD 67,200.07 million by 2032, growing at a CAGR of 18.64%.

- Strong demand for automation, quality management, and predictive maintenance continues to drive large-scale adoption across industries.

- Integration of IoT, AI, and cloud platforms enhances real-time data visibility, process control, and efficiency in manufacturing operations.

- North America leads the market with a 34% share, supported by advanced IT infrastructure, digital transformation programs, and major software providers.

- Europe holds 27% of the market, driven by compliance-focused manufacturing, sustainability initiatives, and Industry 5.0 adoption.

- Asia Pacific captures 30% of the share and is the fastest-growing region, led by industrial digitalization in China, India, Japan, and South Korea.

Market Drivers:

Rising Demand for Digital Transformation and Smart Manufacturing

The Global Manufacturing Operation Management Software Market is driven by the growing shift toward digital transformation across production environments. Manufacturers are deploying MOM systems to enable data-driven operations, optimize workflows, and increase production visibility. These platforms help organizations integrate automation, analytics, and IoT for real-time control and performance tracking. It supports the transition to smart manufacturing by connecting machines, operators, and enterprise systems into a unified digital ecosystem.

Increasing Need for Operational Efficiency and Cost Reduction

Companies focus on improving productivity while minimizing operational costs, driving the demand for MOM software. The solutions streamline scheduling, production planning, and resource allocation to maximize throughput and reduce downtime. It enables predictive maintenance and energy management, lowering waste and enhancing equipment lifespan. This efficiency-focused approach helps manufacturers maintain profitability and competitiveness in dynamic market conditions.

- For instance, Honeywell’s Operational Intelligence software addresses productivity challenges in logistics, where a single device issue can cause 60-100 minutes of lost driver productivity, by providing actionable insights to prevent such disruptions.

Growing Adoption of Industry 4.0 and Cloud-Based Solutions

The adoption of Industry 4.0 technologies significantly accelerates the use of MOM platforms. Cloud-based deployment allows flexible scalability, remote access, and faster implementation across global manufacturing networks. It facilitates real-time collaboration between supply chain stakeholders and production units. The integration of AI, machine learning, and advanced analytics enhances data utilization for process optimization and decision-making.

Stringent Regulatory Requirements and Quality Control Standards

Rising compliance demands from industries such as pharmaceuticals, aerospace, and food processing strengthen the role of MOM systems. These platforms ensure traceability, document control, and quality assurance in line with international standards. It helps manufacturers reduce product recalls and maintain audit readiness. Growing emphasis on product consistency and safety continues to make MOM software a critical part of modern production management.

- For instance, Hindustan Petroleum Corporation Ltd. (HPCL) deployed AI-based soft sensors from AspenTech at its Mumbai Refinery, an operation with a capacity of 190,000 barrels per day, to predict product quality parameters in real-time and maintain stringent quality standards.

Market Trends:

Integration of Artificial Intelligence, IoT, and Advanced Analytics in Manufacturing Operations

The Global Manufacturing Operation Management Software Market is witnessing a strong trend toward integrating AI, IoT, and advanced analytics for intelligent process control. Manufacturers are adopting predictive and prescriptive analytics to improve production efficiency and reduce unplanned downtime. It enables real-time monitoring of assets, resource consumption, and process deviations. AI-driven algorithms optimize production schedules and quality management, leading to higher accuracy and responsiveness. The growing deployment of digital twins and sensor-based monitoring enhances visibility across manufacturing ecosystems. IoT-enabled MOM systems also improve data interoperability between machines, suppliers, and enterprise platforms, creating a connected and adaptive production environment.

- For instance, Japanese automation company Fanuc uses AI-powered robots to operate its production floors, allowing the machinery to run continuously for up to 30 days without human intervention.

Shift Toward Cloud-Based and Modular Manufacturing Management Platforms

A major trend shaping the market is the transition from on-premise to cloud-based and modular MOM platforms. These systems allow manufacturers to scale operations easily and access centralized data from multiple locations. It supports integration with ERP and MES systems, enabling unified production planning and performance management. Vendors focus on providing flexible, subscription-based models that lower deployment costs and accelerate adoption among small and medium-sized manufacturers. The rising use of edge computing improves data processing speed, ensuring faster response times on the factory floor. This shift toward modular and cloud-enabled solutions aligns with the industry’s goal of achieving agility, transparency, and operational resilience in global manufacturing networks.

- For instance, implementing edge computing reduces the data processing round-trip latency for real-time control loops from seconds down to milliseconds.

Market Challenges Analysis:

High Implementation Costs and Integration Complexity Across Legacy Systems

The Global Manufacturing Operation Management Software Market faces challenges due to high implementation costs and complex integration with legacy systems. Many manufacturers operate with outdated IT infrastructure, making seamless connectivity difficult. It requires significant investment in software customization, staff training, and hardware upgrades. Smaller enterprises often delay adoption due to budget constraints and uncertainty about return on investment. Integration with existing ERP, MES, and automation systems can lead to compatibility issues and operational disruptions. These challenges slow down large-scale deployment, especially in cost-sensitive industries.

Data Security Concerns and Limited Skilled Workforce

Data privacy and cybersecurity risks create major barriers to adopting cloud-based MOM platforms. The growing interconnectivity of systems exposes production environments to potential cyber threats and data breaches. It demands strong security protocols and continuous monitoring, increasing operational complexity. Another challenge lies in the shortage of skilled professionals capable of managing digital manufacturing systems. Many organizations struggle to recruit and retain experts proficient in IoT, AI, and industrial data analytics. The lack of specialized workforce limits the effective utilization of MOM solutions and slows the pace of digital transformation.

Market Opportunities:

Expanding Adoption of Smart Factories and Industrial IoT Platforms

The Global Manufacturing Operation Management Software Market presents strong opportunities through the expansion of smart factory initiatives. Manufacturers are investing in connected production environments that rely on real-time data and automation. It enables improved asset utilization, predictive maintenance, and adaptive production planning. The integration of MOM software with Industrial IoT platforms supports continuous improvement and efficiency gains. Governments across major economies promote smart manufacturing programs, creating favorable conditions for adoption. Growing use of edge computing and AI-based analytics further enhances system responsiveness and decision-making.

Rising Demand from Emerging Economies and Small Manufacturers

Emerging markets in Asia Pacific, Latin America, and the Middle East offer significant potential for MOM solution providers. Rapid industrialization and government-backed digital transformation projects increase awareness of operational efficiency tools. It creates opportunities for vendors offering cost-effective, scalable, and cloud-based solutions tailored for small and medium manufacturers. Local partnerships and industry collaborations support faster technology transfer and localization. The shift toward flexible manufacturing and customized production models drives the need for advanced management systems. Expanding infrastructure and growing workforce skills in these regions strengthen the long-term market outlook.

Market Segmentation Analysis:

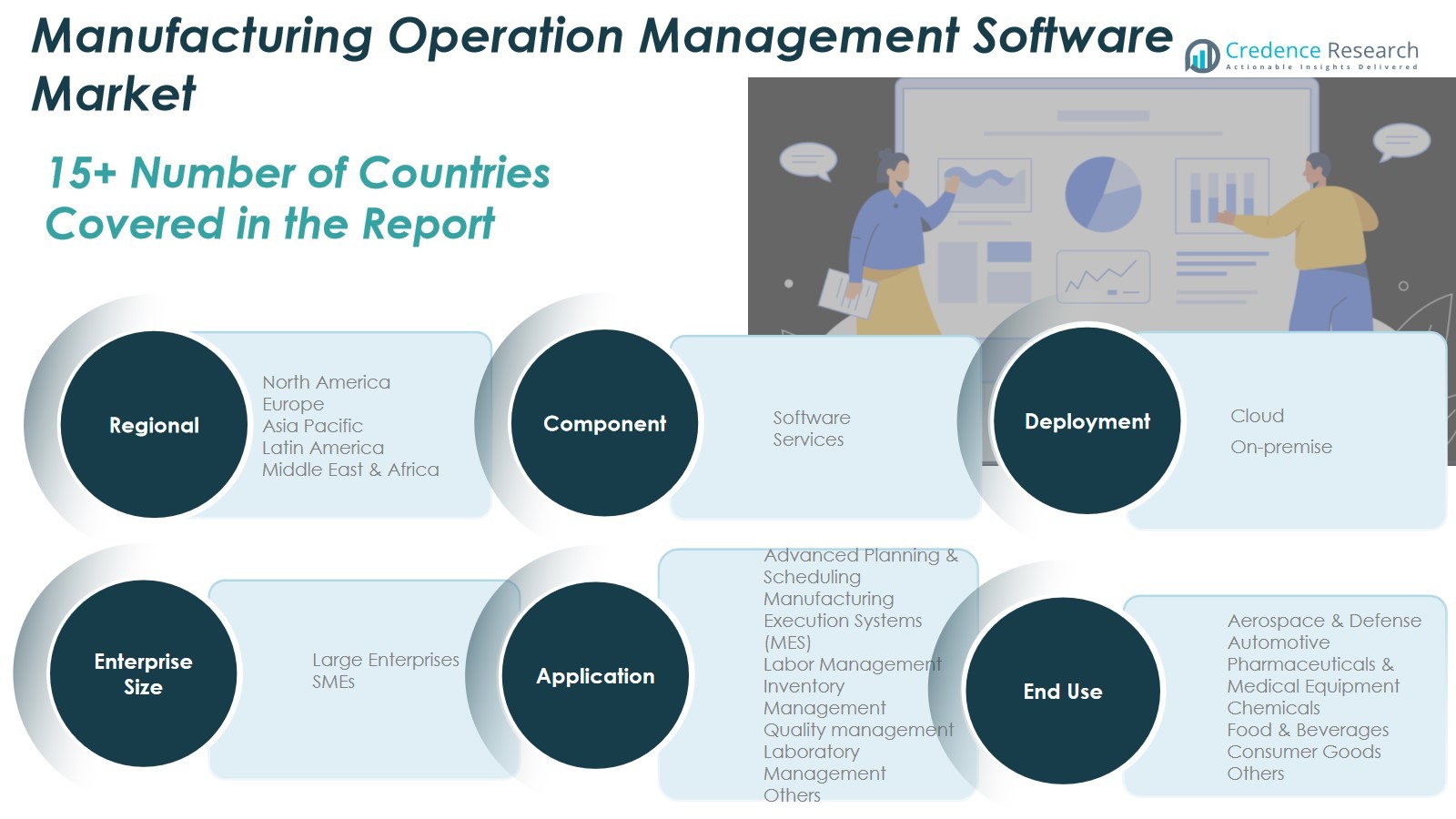

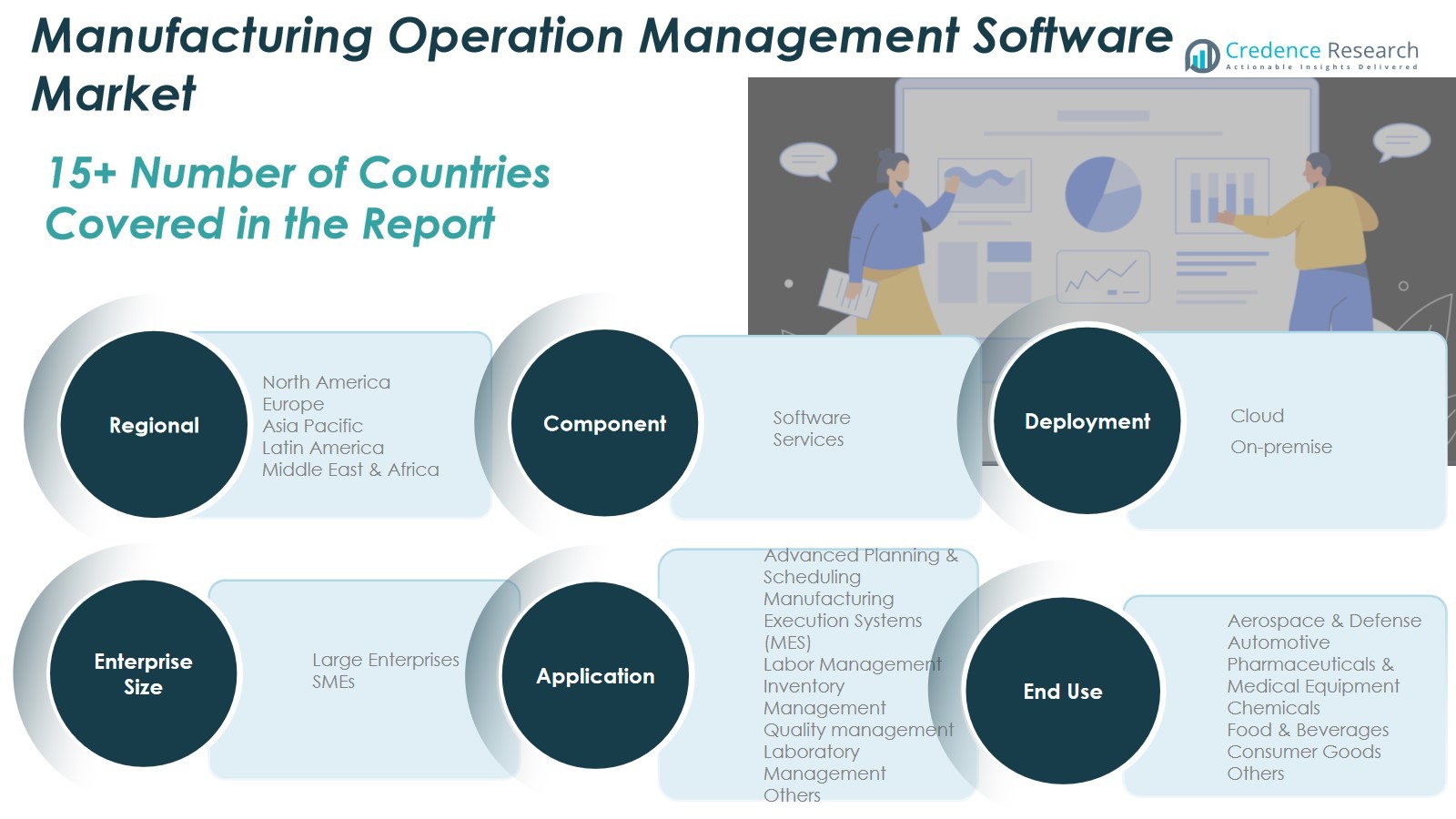

By Component

The Global Manufacturing Operation Management Software Market is segmented into software and services. The software segment dominates due to its critical role in real-time production tracking, workflow automation, and data analytics. It supports manufacturers in managing operations efficiently through integration with ERP and MES systems. The services segment, including implementation, maintenance, and training, is gaining traction as companies seek tailored solutions and technical support. It ensures system reliability and performance optimization across production environments.

- For instance, Honeywell Aerospace launched a blockchain-powered software marketplace for aircraft parts, creating a network of trust that attracted over 2,500 users to the platform.

By Application

The market is categorized into advanced planning and scheduling, manufacturing execution systems (MES), labor management, inventory management, quality management, laboratory management, and others. MES holds the largest share, driven by growing demand for production visibility and quality control. It enables seamless data exchange between production units and enterprise systems. Advanced planning and scheduling tools are also expanding rapidly with the rise of smart factories. These applications help optimize production cycles and resource allocation to improve efficiency.

By Deployment

The market is divided into cloud and on-premise segments. Cloud deployment leads the segment due to scalability, cost efficiency, and remote accessibility. It supports real-time collaboration and centralized monitoring across multiple facilities. On-premise deployment remains relevant among large manufacturers that require data control and high customization. It offers enhanced security and compliance benefits for industries with strict data regulations.

- For instance, underscoring the scalability of cloud solutions, a collaboration between Siemens, IBM, and Red Hat noted a single manufacturing site can generate over 2,200 terabytes of data in one month.

Segmentations:

By Component:

By Application:

- Advanced Planning & Scheduling

- Manufacturing Execution Systems (MES)

- Labor Management

- Inventory Management

- Quality Management

- Laboratory Management

- Others

By Deployment:

By End-Use:

- Aerospace & Defense

- Automotive

- Pharmaceuticals & Medical Equipment

- Chemicals

- Food & Beverages

- Consumer Goods

- Others

By Enterprise Size:

- Small and Medium Enterprises

- Large Enterprises

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Manufacturing Operation Management Software Market size was valued at USD 3,147.03 million in 2018 to USD 5,595.74 million in 2024 and is anticipated to reach USD 21,746.06 million by 2032, at a CAGR of 18.6% during the forecast period. The region holds 34% of the global market share, driven by high adoption of automation and Industry 4.0 technologies. The Global Manufacturing Operation Management Software Market benefits from the strong presence of leading software developers and industrial automation providers in the U.S. and Canada. It gains momentum through the growing use of cloud-based and AI-integrated solutions across manufacturing sectors such as automotive, aerospace, and electronics. The region’s robust IT infrastructure supports large-scale data analytics, remote operations, and smart manufacturing integration. Government incentives for digital transformation and sustainable production also enhance market expansion across industrial enterprises.

Europe

The Europe Manufacturing Operation Management Software Market size was valued at USD 2,519.54 million in 2018 to USD 4,364.32 million in 2024 and is anticipated to reach USD 16,044.20 million by 2032, at a CAGR of 17.8% during the forecast period. Europe accounts for 27% of the global market share, led by Germany, the UK, and France. The Global Manufacturing Operation Management Software Market in this region is driven by strict compliance standards and demand for traceable, efficient production systems. It benefits from growing investments in smart factories, industrial IoT, and predictive maintenance. European manufacturers emphasize sustainability and energy efficiency, increasing reliance on digital management solutions. Strong initiatives under the “Industry 5.0” framework further push integration of human-centric automation and advanced analytics.

Asia Pacific

The Asia Pacific Manufacturing Operation Management Software Market size was valued at USD 2,469.72 million in 2018 to USD 4,638.38 million in 2024 and is anticipated to reach USD 19,830.79 million by 2032, at a CAGR of 20.0% during the forecast period. The region holds 30% of the global market share and is expected to grow fastest. The Global Manufacturing Operation Management Software Market gains strong traction in China, Japan, India, and South Korea due to rapid industrial digitalization. It is driven by growing investments in smart manufacturing and automation across electronics, automotive, and semiconductor industries. Governments promote digital industrial transformation through initiatives like “Made in China 2025” and “Make in India.” Expanding adoption of cloud-based platforms and rising local software development capabilities strengthen regional growth.

Latin America

The Latin America Manufacturing Operation Management Software Market size was valued at USD 761.61 million in 2018 to USD 1,362.10 million in 2024 and is anticipated to reach USD 4,997.67 million by 2032, at a CAGR of 17.8% during the forecast period. Latin America holds 5% of the global market share. The Global Manufacturing Operation Management Software Market in this region is supported by modernization in industries such as mining, automotive, and food processing. It is gaining attention due to digital transformation projects in Brazil and Mexico. Increasing cloud adoption and the entry of global software vendors are improving accessibility for regional manufacturers. Government efforts to boost productivity and competitiveness in export-oriented sectors further drive market expansion.

Middle East

The Middle East Manufacturing Operation Management Software Market size was valued at USD 413.86 million in 2018 to USD 704.33 million in 2024 and is anticipated to reach USD 2,506.93 million by 2032, at a CAGR of 17.3% during the forecast period. The region holds 3% of the global market share. The Global Manufacturing Operation Management Software Market benefits from growing industrial diversification efforts in the Gulf Cooperation Council (GCC) countries. It supports national goals for smart industry development and sustainable manufacturing under initiatives like Saudi Vision 2030 and UAE Industry 4.0. Increasing investment in petrochemical, energy, and construction industries boosts demand for MOM solutions. Expanding industrial automation and partnerships with global software firms improve technology penetration.

Africa

The Africa Manufacturing Operation Management Software Market size was valued at USD 268.24 million in 2018 to USD 600.92 million in 2024 and is anticipated to reach USD 2,074.42 million by 2032, at a CAGR of 16.5% during the forecast period. Africa holds 1% of the global market share, but growth prospects remain strong. The Global Manufacturing Operation Management Software Market in the region is driven by industrialization initiatives in South Africa, Egypt, and Nigeria. It gains traction through rising adoption of digital manufacturing tools to enhance productivity and reduce inefficiencies. Local industries increasingly invest in software-driven automation to compete globally. Support from international development programs and growing internet penetration accelerate market awareness and technology adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ABB

- Aegis Industrial Software Corporation

- Aspen Technology Inc.

- AVEVA Solutions Limited

- Dassault Systèmes

- DURR Group

- Epicor Software Corporation

- GE Vernova

- Honeywell International Inc.

- iBase-t

- Oracle

- Rockwell Automation

- SAP SE

- Schneider Electric

- Siemens

Competitive Analysis:

The Global Manufacturing Operation Management Software Market is highly competitive, featuring established automation and software leaders alongside specialized solution providers. Major players such as ABB, Aegis Industrial Software Corporation, Aspen Technology Inc., AVEVA Solutions Limited, Dassault Systèmes, DURR Group, Epicor Software Corporation, and GE Vernova dominate global operations through broad product portfolios and strategic partnerships. It focuses on offering integrated platforms that enhance production visibility, process automation, and real-time decision-making. Honeywell International Inc. emphasizes AI-driven analytics and connected factory solutions to strengthen operational performance. Companies invest in R&D and digital innovation to expand their software capabilities across manufacturing verticals. Mergers, acquisitions, and cloud-based solution launches remain key strategies to maintain competitiveness and global reach.

Recent Developments:

- In October 2025, SoftBank Group announced a definitive agreement to acquire ABB’s robotics business for approximately $5.375 billion.

- In February 2025, Aspen Technology announced its financial results for the second quarter of fiscal year 2025, reporting total revenue of $303.6 million for the quarter ending December 31, 2024.

Report Coverage:

The research report offers an in-depth analysis based on Component, Application, Deployment, End-Use, Enterprise Size and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The Global Manufacturing Operation Management Software Market will witness strong expansion driven by rapid adoption of Industry 4.0 technologies.

- Growing integration of AI, IoT, and machine learning will enhance predictive decision-making and automation efficiency.

- Manufacturers will increasingly adopt cloud-based and hybrid deployment models for scalability and remote accessibility.

- Digital twins and advanced analytics will transform real-time process monitoring and asset optimization.

- Small and medium enterprises will accelerate adoption with affordable, modular software solutions.

- Cybersecurity-focused MOM platforms will gain importance due to rising data protection concerns.

- Vendors will emphasize interoperability with ERP, MES, and PLM systems for seamless data flow.

- Regional demand will rise in Asia Pacific and Latin America as governments promote industrial digitalization.

- Sustainability-driven manufacturing will encourage software upgrades focused on energy optimization and waste reduction.

- Strategic collaborations between technology firms and manufacturers will shape the next generation of smart production ecosystems.