Market Overview

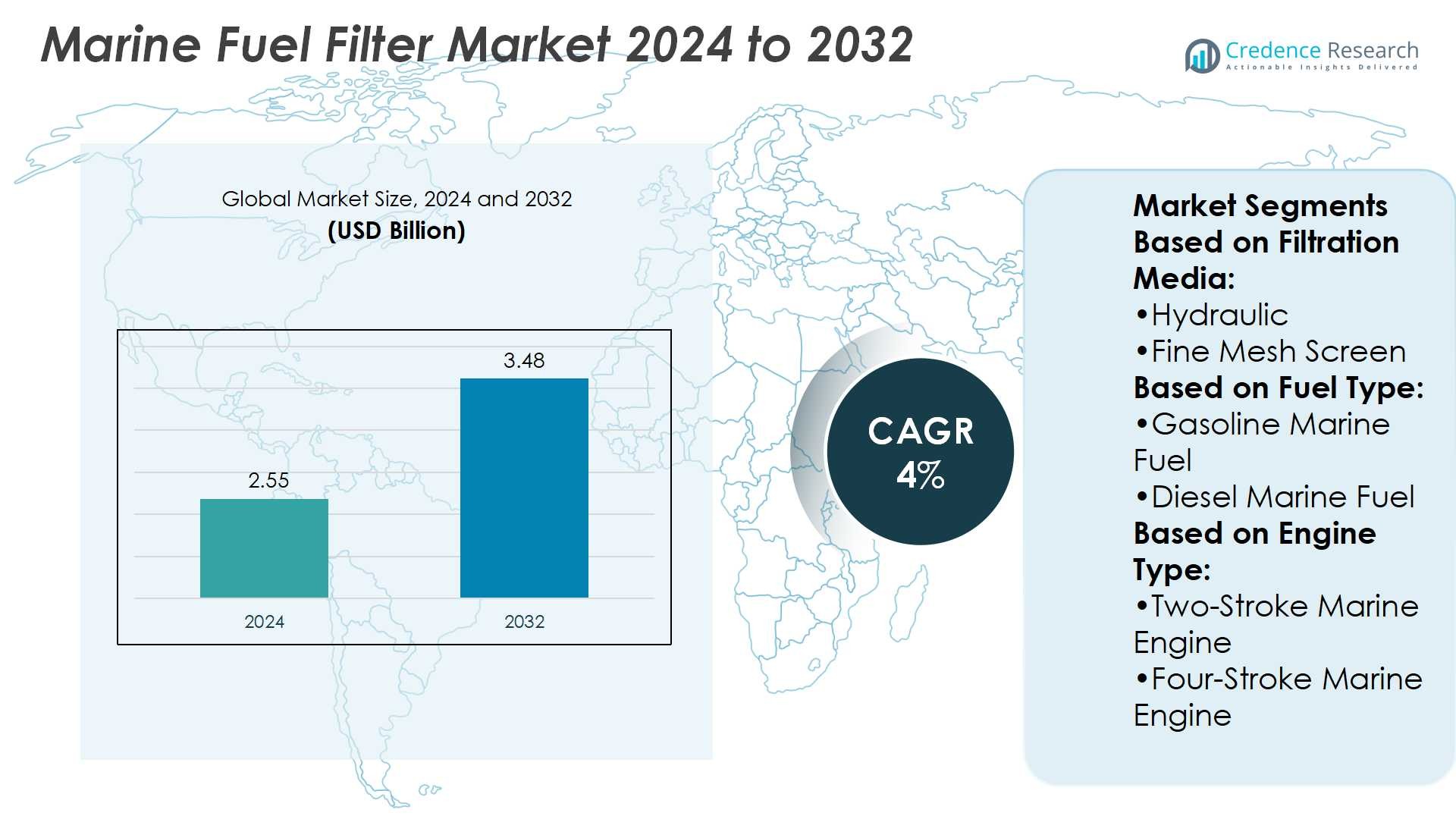

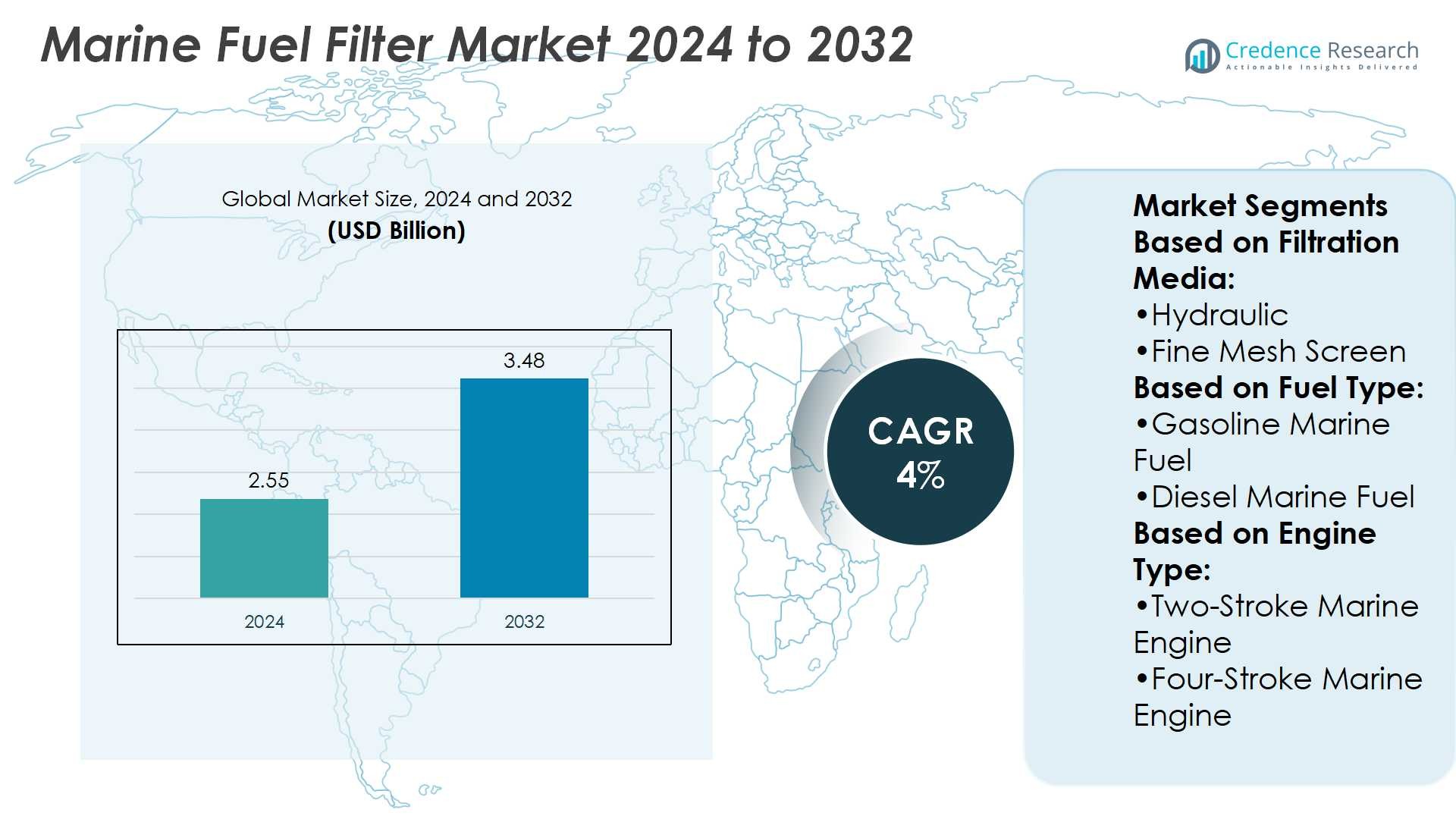

Marine Fuel Filter Market size was valued at USD 2.55 billion in 2024 and is anticipated to reach USD 3.48 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Marine Fuel Filter Market Size 2024 |

USD 2.55 Billion |

| Marine Fuel Filter Market, CAGR |

4% |

| Marine Fuel Filter Market Size 2032 |

USD 3.48 Billion |

The Marine Fuel Filter Market is driven by rising global trade volumes, stricter emission regulations, and the need for reliable engine protection across commercial, naval, and recreational vessels. Operators invest in high-performance filters to extend engine life, reduce maintenance costs, and ensure compliance with International Maritime Organization (IMO) standards. Trends highlight growing adoption of digital monitoring systems, smart sensors, and eco-friendly filtration materials designed to manage low-sulfur and alternative fuels. Demand for customized solutions tailored to vessel type and fuel profile continues to expand, while sustainability goals and technological advancements shape long-term growth opportunities in the industry.

The Marine Fuel Filter Market shows strong geographical presence, with Asia Pacific leading due to robust shipbuilding and trade, followed by Europe with strict emission norms and North America driven by commercial fleets and recreational boating. Latin America and the Middle East & Africa present emerging opportunities through growing port activities and offshore projects. Key players include World Fuel Services Corporation, BP p.l.c., Chevron Phillips Chemical Company LLC, Gazprom International Limited, TotalEnergies, BUNKER HOLDING, Shell plc, Marathon Petroleum Corporation, Exxon Mobil Corporation, and BP SINOPEC MARINE FUELS.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Marine Fuel Filter Market size was valued at USD 2.55 billion in 2024 and is expected to reach USD 3.48 billion by 2032, growing at a CAGR of 4%.

- Rising global trade volumes and stricter emission rules drive strong demand for reliable filtration solutions.

- Adoption of smart sensors, digital monitoring, and eco-friendly filter materials is expanding across global fleets.

- Competition remains intense with key players focusing on innovation, R&D, and strategic partnerships to strengthen market share.

- High operational costs and maintenance complexities act as restraints for smaller operators and limit adoption.

- Asia Pacific leads with strong shipbuilding and trade activity, followed by Europe with tough emission standards and North America with commercial and recreational fleets.

- Latin America and Middle East & Africa present emerging opportunities supported by offshore energy projects, naval modernization, and port expansions.

Market Drivers

Rising Demand for Cleaner Marine Operations

Stringent environmental regulations drive strong adoption of advanced fuel filtration systems. Governments enforce emission control standards that require vessels to reduce harmful exhaust. Marine Fuel Filter Market growth is supported by the need for compliance and efficiency. Shipping operators invest in filters to cut emissions and protect engines. Clean operations enhance reputation and reduce maintenance costs. It aligns with sustainability goals while ensuring fleet reliability. This driver strengthens long-term demand across both cargo and passenger fleets.

- For instance, World Fuel Services supports cleaner marine operations through its supply network across over 1,200 seaports worldwide, backed by storage assets capable of pumping 350 metric tons of IFO fuel per hour and 155 metric tons of marine gas oil per hour at its Nederland, Texas facility.

Increasing Global Trade and Fleet Expansion

Growth in international shipping volumes accelerates the requirement for reliable filtration. Expanding fleets in bulk carriers, container ships, and tankers depend on high-performance filters. The Marine Fuel Filter Market benefits from continuous vessel additions and upgrades. Rising trade routes across Asia, Europe, and North America increase operational hours for engines. Filters support consistent performance under heavy workloads and reduce downtime. It also ensures uninterrupted transport of goods by maintaining clean fuel flow. Expansion of maritime logistics strengthens this demand base.

- For instance, BP charters over as part of its supply and trading operations, BP is a significant charterer of vessels. According to its website, BP typically has “over 200 vessels on charter at any one time”.

Focus on Operational Efficiency and Engine Protection

Operators seek solutions that extend engine life and cut operating costs. High fuel quality standards make effective filtration essential for modern propulsion systems. The Marine Fuel Filter Market gains traction from innovations that improve filter durability and efficiency. Shipowners install filters to prevent injector wear, clogging, and costly breakdowns. It improves fuel economy and supports longer service intervals. These benefits create strong adoption incentives for commercial and naval fleets alike. Efficient filtration translates into significant cost savings for operators.

Growing Investments in Offshore and Defense Sectors

Rising offshore exploration and naval modernization projects create strong opportunities for filtration solutions. Offshore vessels demand uninterrupted operations under extreme conditions, making filters critical. The Marine Fuel Filter Market benefits from defense spending on advanced ships and submarines. Governments prioritize modern fleets that require dependable filtration to sustain readiness. It secures mission capability while reducing equipment failure risk. Offshore energy projects and defense expansion collectively boost market penetration. Strong investment in these sectors sustains future market growth.

Market Trends

Advancements in Filtration Technology for Enhanced Performance

Manufacturers invest in advanced designs that improve fuel purity and engine safety. Multi-stage filtration and high-capacity filter elements are gaining preference across fleets. The Marine Fuel Filter Market reflects this innovation trend, enabling longer service intervals. It helps operators meet stricter quality standards while reducing maintenance costs. Companies integrate nanofiber and synthetic media to capture finer particles. These developments strengthen adoption among both commercial and defense vessels. The focus remains on achieving superior efficiency in demanding marine environments.

- For instance, Chevron Phillips Chemical built a world-scale ethane cracker at Baytown, Texas, processing 1.5 million metric tons of ethane per year, supported by two polyethylene units in Old Ocean, Texas, each producing 500,000 metric tons of resin annually, demonstrating their capacity for high-volume, advanced industrial operations.

Rising Integration of Digital Monitoring Solutions

Smart monitoring systems are reshaping how operators manage fuel filtration. Real-time data on filter condition and fuel quality allows predictive maintenance. The Marine Fuel Filter Market benefits from sensors that alert crews to clogging and water contamination. It reduces risks of sudden breakdowns and improves operational safety. Connected solutions support data-driven decision-making for fleet managers. Increased adoption of IoT-based systems improves efficiency across shipping and offshore operations. This trend enhances reliability and aligns with broader digital transformation in maritime industries.

- For instance, TotalEnergies deployed AVEVA predictive analytics on 320 rotating-shaft lines, which triggered 36,000 alerts with 429 critical equipment detections, helping them prevent a production shortfall of nearly 500,000 barrels.

Growing Shift Toward Eco-Friendly and Sustainable Designs

Sustainability goals encourage development of recyclable and low-waste filter materials. Manufacturers explore biodegradable elements and energy-efficient designs for future adoption. The Marine Fuel Filter Market incorporates eco-conscious features to align with global maritime standards. It supports emission reduction efforts by ensuring cleaner fuel delivery. Adoption of green technologies strengthens the reputation of ship operators. Filters designed for longer use cycles also reduce replacement waste. This trend highlights the industry’s transition toward environmentally responsible practices.

Expanding Demand for Customized Solutions Across Vessel Types

Different vessel categories require specialized filtration systems tailored to unique fuel profiles. Offshore support vessels, naval ships, and container carriers all demand specific filter designs. The Marine Fuel Filter Market evolves through customized offerings that match operational needs. It provides flexibility in managing high-sulfur fuels, blended fuels, or alternative fuels. Demand for modular and scalable solutions grows among fleet operators. Tailored designs enhance efficiency and ensure compliance with diverse regulations. This trend highlights the growing importance of application-specific product innovation.

Market Challenges Analysis

High Operational Costs and Maintenance Complexities

Marine operators face rising costs linked to frequent filter replacements and maintenance procedures. Advanced filtration systems often require specialized components that increase procurement expenses. The Marine Fuel Filter Market encounters challenges when fleets struggle to balance cost efficiency with performance. It also demands skilled technicians to ensure proper installation and servicing. Short service life of filters under harsh marine conditions adds to recurring costs. These factors create pressure on small and medium fleet operators with limited budgets. Cost-related hurdles often slow large-scale adoption of advanced systems.

Variability in Fuel Quality and Compliance Pressures

Inconsistent fuel quality across ports complicates filtration requirements for global operators. Contaminants such as water, microbial growth, and fine sediments vary significantly by region. The Marine Fuel Filter Market must address these issues while meeting evolving international regulations. It forces operators to adapt filters that can manage unpredictable fuel standards. Compliance with IMO sulfur limits and regional emission rules intensifies the complexity. Filters that fail to deliver consistent performance risk costly downtime and penalties. These challenges create uncertainty and raise barriers to operational reliability.

Market Opportunities

Rising Adoption of Alternative and Low-Sulfur Fuels

The transition toward low-sulfur and alternative fuels creates strong opportunities for advanced filtration solutions. Operators require systems that handle diverse fuel blends without compromising efficiency. The Marine Fuel Filter Market benefits from this shift by supporting compliance and engine protection. It enables vessels to meet IMO regulations while reducing operational risks. Filters designed for biofuels, LNG, and blended fuels expand product demand. Growing adoption of clean fuels across global fleets increases the need for high-performance systems. This trend opens opportunities for manufacturers offering adaptable and future-ready filtration technologies.

Expanding Investments in Digitalization and Smart Fleet Management

Global shipping companies invest in digital solutions that improve operational reliability and efficiency. Intelligent filters with embedded sensors provide real-time data on performance and fuel quality. The Marine Fuel Filter Market gains growth potential through integration with IoT-based monitoring platforms. It allows predictive maintenance, reduces unplanned downtime, and extends equipment lifespan. Demand for connected systems aligns with the broader digital transformation in maritime industries. Offshore and defense sectors also explore advanced monitoring to ensure mission readiness. Rising investments in smart technologies create long-term opportunities for innovative filter solutions.

Market Segmentation Analysis:

By Filtration Media

The Marine Fuel Filter Market is segmented into hydraulic, fine mesh screen, magnetic, auto back wash, centrifugal, and manual clean filters. Hydraulic and fine mesh screen filters are widely used in commercial vessels due to their ability to trap fine particles and ensure consistent engine performance. Magnetic filters gain adoption for removing metallic debris, especially in high-performance engines. Auto back wash filters see rising demand for large vessels that require continuous operations without frequent manual intervention. Centrifugal filters support heavy-duty applications by handling large volumes of contaminated fuel efficiently. Manual clean filters maintain relevance in smaller fleets where cost efficiency outweighs automation needs. This diverse range of filtration media reflects the industry’s focus on balancing cost, efficiency, and operational requirements.

- For instance, Bunker Holding received more than 105,562 inquiries in the 2023-24 financial year—about one inquiry every five minutes—and supports its physical supply services across over 1,600 ports worldwide.

By Fuel Type

Segmentation by fuel type covers gasoline marine fuel and diesel marine fuel. Diesel fuel dominates usage in global shipping, driving higher adoption of advanced filters for large engines. The Marine Fuel Filter Market sees strong demand for diesel-compatible solutions to maintain fuel purity and engine safety. It ensures compliance with emission standards and supports long voyages where fuel quality variation is common. Gasoline fuel filters remain significant in leisure boats, patrol vessels, and smaller crafts. This segment benefits from growing recreational boating activities and naval patrol operations worldwide. Both categories highlight the critical role of tailored filtration systems for specific fuel types.

- For instance, The Shell Water Detector capsule is used to detect water in fuel and is designed for single use—it tests 5 milliliters of fuel per test, indicating the presence of water when the capsule changes color.

By Engine Type

Based on engine type, the market divides into two-stroke and four-stroke marine engines. Two-stroke engines dominate large vessels such as bulk carriers and container ships, creating consistent demand for heavy-duty filters. The Marine Fuel Filter Market benefits from the high reliability needs of these engines, where uninterrupted fuel flow is essential. It supports performance by minimizing wear, injector clogging, and contamination risks. Four-stroke engines, common in passenger ships, offshore vessels, and naval fleets, drive demand for precision filtration systems. These filters enhance efficiency, support emission compliance, and extend engine life. Both engine categories strengthen the need for advanced fuel filtration, with manufacturers offering solutions adapted to each operational profile.

Segments:

Based on Filtration Media:

- Hydraulic

- Fine Mesh Screen

Based on Fuel Type:

- Gasoline Marine Fuel

- Diesel Marine Fuel

Based on Engine Type:

- Two-Stroke Marine Engine

- Four-Stroke Marine Engine

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 30% of the Marine Fuel Filter Market. The United States drives the largest share due to strong commercial shipping activity, naval fleets, and one of the world’s biggest leisure boating communities. Strict environmental rules from the Environmental Protection Agency (EPA) push operators to adopt advanced fuel filtration systems that minimize emissions and engine damage. Canada contributes through growing marine trade along the Atlantic and Pacific coasts, while Mexico supports regional demand with expanding port operations and coastal shipping. It benefits from investments in IoT-enabled filters that support predictive maintenance and efficiency. North America continues to see balanced demand from both recreational and industrial segments, making it a stable and important market.

Europe

Europe accounts for 25% of the global Marine Fuel Filter Market. Germany, Norway, and the Netherlands lead adoption, supported by advanced shipping industries and modern shipyards. Europe enforces strict International Maritime Organization (IMO) sulfur regulations, increasing demand for filters capable of handling low-sulfur and alternative fuels. Cruise tourism in the Mediterranean adds consistent need for reliable systems. Naval modernization in Northern and Western Europe also pushes demand for high-quality filters. It reflects a mature market where buyers prefer durable, eco-friendly, and efficient filtration systems. Europe’s strong focus on sustainability ensures long-term adoption of advanced products.

Asia Pacific

Asia Pacific dominates with 35% share of the Marine Fuel Filter Market. China, Japan, and South Korea are global leaders in shipbuilding and vessel operations, making this region the largest consumer of marine fuel filters. Strong trade volumes through ports like Shanghai, Singapore, and Busan drive steady demand for high-capacity filtration systems. India strengthens the market with investments in naval modernization and coastal shipping, while Southeast Asia adds growth through increasing maritime trade and expanding passenger traffic. Australia contributes through its recreational boating and offshore support operations. It remains the fastest-growing regional market due to a combination of infrastructure investment, fleet expansion, and export-oriented trade.

Latin America

Latin America holds 5% of the Marine Fuel Filter Market. Brazil leads the region, driven by its oil and gas shipping sector and offshore operations. Mexico and Chile support growth through increasing port traffic and trade routes. Local fleets face challenges with varying fuel quality, which raises the need for durable and reliable filters. It creates opportunities for cost-effective solutions tailored to regional requirements. Expansion of naval programs and investments in port modernization are expected to enhance future adoption.

Middle East & Africa

Middle East & Africa account for 5% of the Marine Fuel Filter Market. The Gulf region, including Saudi Arabia and the UAE, generates strong demand through offshore energy fleets and oil transport vessels. Africa adds demand through rising trade across key hubs such as South Africa and Nigeria. Operators seek filters that withstand harsh operating conditions and inconsistent fuel quality. Naval modernization across the Middle East further supports adoption of advanced filtration systems. It remains an emerging market with long-term growth potential as trade and defense investments increase.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- World Fuel Services Corporation (U.S.)

- BP p.l.c. (U.K.)

- Chevron Phillips Chemical Company LLC (U.S.)

- Gazprom International Limited (Russia)

- TotalEnergies (France)

- BUNKER HOLDING (Denmark)

- Shell plc (U.K.)

- Marathon Petroleum Corporation (U.S.)

- Exxon Mobil Corporation (U.S.)

- BP SINOPEC MARINE FUELS (Singapore)

Competitive Analysis

The Marine Fuel Filter Market players such as World Fuel Services Corporation (U.S.), BP p.l.c. (U.K.), Chevron Phillips Chemical Company LLC (U.S.), Gazprom International Limited (Russia), TotalEnergies (France), BUNKER HOLDING (Denmark), Shell plc (U.K.), Marathon Petroleum Corporation (U.S.), Exxon Mobil Corporation (U.S.), and BP SINOPEC MARINE FUELS (Singapore). The Marine Fuel Filter Market is highly competitive, driven by growing demand for advanced filtration systems that ensure cleaner fuel flow, protect engines, and meet strict emission standards. Companies focus on developing high-efficiency filters that can handle varying fuel qualities, including low-sulfur blends and alternative fuels. Innovation centers on durability, longer service cycles, and integration with digital monitoring systems to support predictive maintenance. Global supply networks and strong port service coverage play a critical role in strengthening market presence. Sustainability initiatives, eco-friendly materials, and compliance with International Maritime Organization (IMO) regulations remain top priorities. The market continues to see strategic partnerships, acquisitions, and technology investments as leading firms seek to expand customer bases and reinforce their positions in both established and emerging regions.

Recent Developments

- In July 2024, Captain Fresh, a prominent seafood company, continued its expansion strategy with the acquisition of Koral, a manufacturer of smoked salmon products. Koral, which operates 26 production lines and processes 120 tonnes of fish daily, will help Captain.

- In July 2024, Akva Group, a leader in the aquaculture solutions industry, acquired 100% of Observe Technologies, a UK-based company specializing in AI-driven feeding solutions for aquaculture.

- In May 2024, NYK Line and the Global Centre for Maritime Decarbonization (GCMD) in Singapore co-operated on a six-month project to test marine biofuel for bunkering. The companies expect to trial marine biofuel that is a blend of 24% fatty acid methyl esters (FAME) and very low sulfur fuel oil (VLSFO) on a short-sea vessel carrier, which will stop at various ports.

- In April 2024, French oil company TotalEnergies formed a joint venture with the Oman National Oil Company to provide liquified natural gas as a marine fuel. Marsa LNG Gas will manage upstream gas production and downstream gas liquefaction.

Report Coverage

The research report offers an in-depth analysis based on Filtration Media, Fuel Type, Engine Type and Geography. It details leading market players, providing an overview of their business,product offerings, investments, revenue streams, and key applications. Additionally, the reportincludes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced filters will rise with stricter emission and fuel quality regulations.

- Adoption of smart sensors in filters will grow to enable predictive maintenance.

- Alternative fuels such as LNG and biofuels will create need for adaptable filtration systems.

- Shipowners will prefer eco-friendly filter materials to meet sustainability targets.

- Asia Pacific will remain the dominant region due to strong shipbuilding and trade activities.

- Europe will continue to lead in green shipping initiatives and premium filter adoption.

- North America will see steady growth supported by recreational boating and naval fleets.

- Offshore energy projects will drive demand for high-capacity and durable filtration solutions.

- Naval modernization programs will boost investment in advanced marine filter technologies.

- Partnerships and R&D will expand as companies seek competitive advantage in global markets.