Market Overview

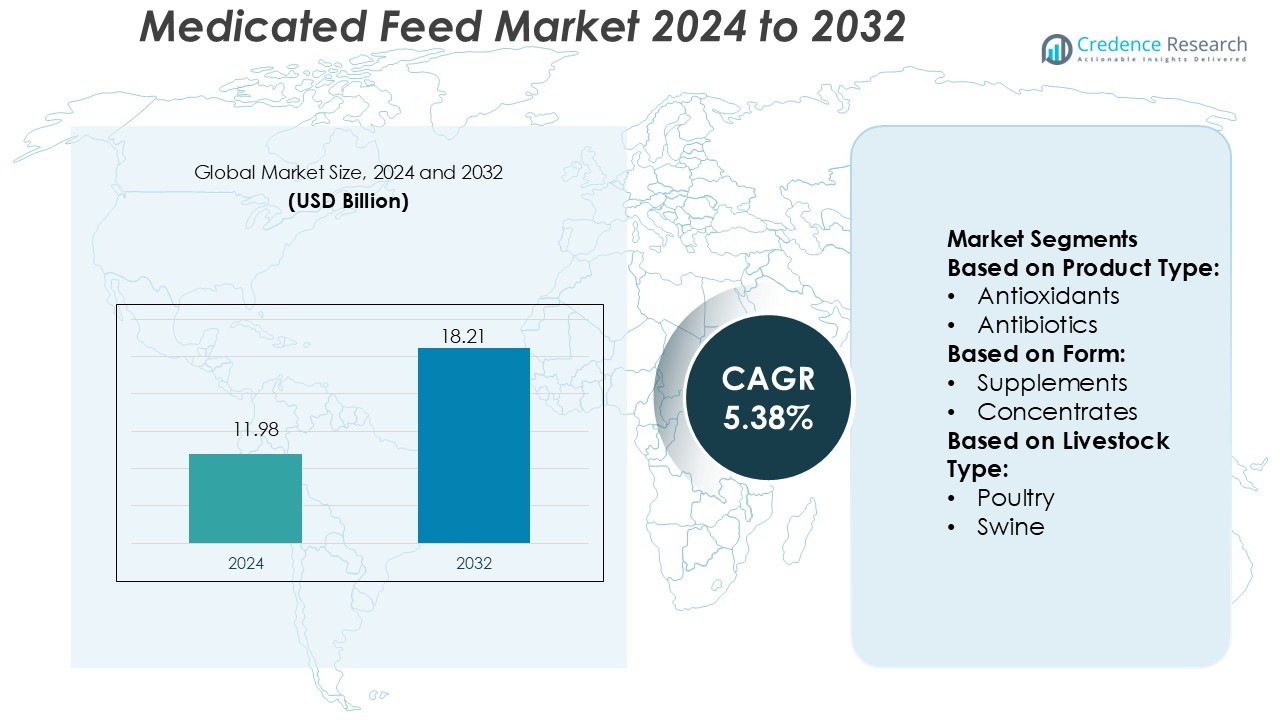

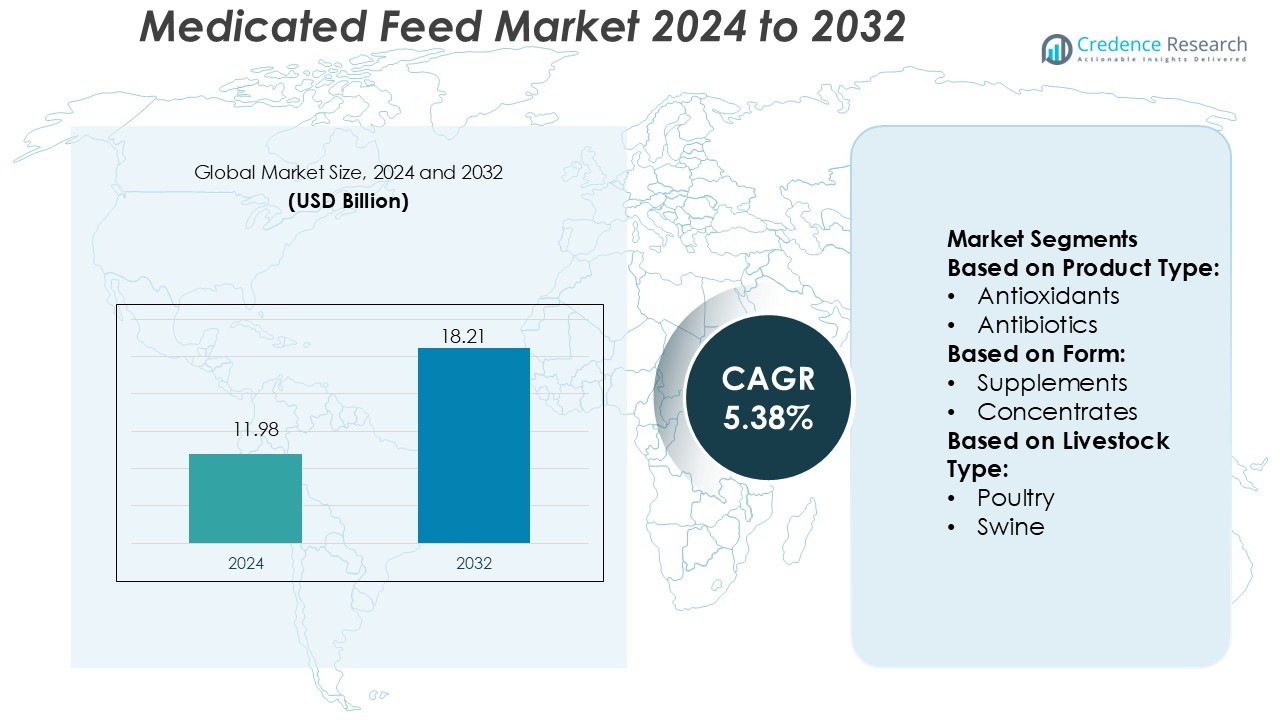

Medicated Feed Market size was valued USD 11.98 billion in 2024 and is anticipated to reach USD 18.21 billion by 2032, at a CAGR of 5.38% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medicated Feed Market Size 2024 |

USD 11.98 Billion |

| Medicated Feed Market, CAGR |

5.38% |

| Medicated Feed Market Size 2032 |

USD 18.21 Billion |

The Medicated Feed Market is highly competitive, with major players such as Cargill, Archer Daniels Midland Company (ADM), BASF SE, Alltech, Biomin Holdings, Ajinomoto Eurolysine, Bentoli, Bioseutica, Champrix, and Adilisa Holding Group leading global operations. These companies focus on research-driven product development, sustainable feed formulations, and expansion across emerging livestock markets. North America dominates the market with a 34% share, supported by advanced animal health infrastructure, high awareness of feed safety, and strong presence of multinational feed producers. Strategic investments in antibiotic alternatives, precision nutrition, and region-specific formulations further strengthen North America’s leadership in global medicated feed production and distribution.

Market Insights

- The Medicated Feed Market was valued at USD 11.98 billion in 2024 and is projected to reach USD 18.21 billion by 2032, expanding at a CAGR of 5.38%.

- Rising livestock disease cases and growing demand for antibiotic-free animal nutrition remain the key growth drivers.

- The market is witnessing trends such as adoption of probiotic-based formulations, digital monitoring tools, and precision feed technologies.

- High production costs and regulatory restrictions on antibiotic use act as key restraints for smaller feed producers.

- North America holds 34% of the global share, while Asia-Pacific records the fastest growth, supported by livestock expansion and aquaculture demand; among segments, multi-layer and enzyme-based formulations account for the largest share due to efficiency and performance benefits.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Antibiotics dominate the Medicated Feed Market with a 36% share, driven by their widespread use in disease prevention and performance enhancement across poultry and swine sectors. They help reduce mortality rates and improve feed efficiency in intensive livestock systems. However, rising regulatory scrutiny over antimicrobial resistance is pushing demand for probiotics and prebiotics, which account for a growing share. These alternatives promote gut health and immunity naturally. Amino acids and enzymes support nutritional balance, while antioxidants extend feed shelf life and stability, enhancing overall animal productivity and feed quality.

- For instance, Biomin Holdings launched its Digestarom DC range, demonstrating a 6.5% improvement in feed conversion ratio and a 12% reduction in pathogenic bacteria in broiler trials across Europe.

By Form

Premix feeds lead the market with a 42% share, favored for their precise nutrient composition and ease of blending with bulk feed. They ensure uniform dosage delivery and support large-scale livestock production systems. Supplements and concentrates follow, offering flexibility for small and medium farmers aiming to enhance feed performance without full formulation changes. Base mixes gain adoption among integrated producers due to simplified logistics and consistency in feed conversion. The shift toward standardized premix solutions reflects producers’ focus on productivity optimization and reduced feed variability.

- For instance, Cargill opened a 220,000 square-foot premix and nutrition facility in Lewisburg, Ohio, which features gram-level precision dosing hoppers and four segregated production lines that can each complete a mix in about one hour.

By Livestock Type

Poultry holds the largest market share at 45%, supported by the rapid growth of broiler and layer production across emerging economies. High feed conversion rates and disease prevention needs drive antibiotic and enzyme inclusion in poultry diets. Swine represent the second-largest segment, where medicated feeds aid in gut health and weight gain efficiency. Aquaculture shows strong growth, supported by rising fish farming and probiotic-based feed demand. Other livestock types, including cattle and sheep, contribute steadily through nutritional supplementation and preventive healthcare programs.

Key Growth Drivers

Rising Livestock Disease Incidence

Increasing prevalence of bacterial, parasitic, and viral infections among livestock is driving medicated feed adoption. Farmers use antibiotic- and enzyme-based feeds to improve immunity and recovery rates. Demand is strong in poultry and swine sectors where respiratory and digestive diseases are common. For instance, the European Food Safety Authority reported over 40% of poultry health issues linked to bacterial infections, reinforcing the need for medicated feed. This trend supports higher productivity and reduces mortality, enhancing profitability for commercial farms.

- For instance, Ajinomoto Eurolysine (now part of Ajinomoto Animal Nutrition Europe S.A.S.) developed its AjiPro™-L lysine formulation featuring 80% rumen bypass and 64% intestinal bioavailability, ensuring more essential amino acid reaches the intestine for absorption.

Growing Demand for High-Quality Animal Protein

Expanding global meat and dairy consumption is boosting the need for animal health management through medicated nutrition. Consumers are more aware of food safety, driving stricter farm-level health standards. Medicated feed ensures faster growth and safer end products by controlling disease outbreaks. For instance, the U.S. Department of Agriculture observed a 25% increase in medicated feed use in poultry farms between 2020–2024 to maintain protein quality standards. This shift supports sustainable animal productivity and long-term food supply stability.

- For instance, Champrix introduced its Champ-Green antibiotic-free essential oil blend, which independent trials report reduced E. coli counts by 25 CFU/g in broiler gut samples under controlled conditions.

Expansion of the Livestock Sector in Emerging Economies

Developing nations like India, Brazil, and Vietnam are witnessing rapid livestock expansion, supported by government subsidies and private sector investments. Rising incomes and urbanization fuel higher meat and dairy demand, encouraging farms to adopt preventive feed solutions. For instance, India’s livestock output grew 7% annually between 2019–2023, with increasing reliance on medicated concentrates to improve animal performance. These regions offer significant growth opportunities for feed manufacturers due to favorable regulations and expanding distribution networks.

Key Trends & Opportunities

Shift Toward Natural and Antibiotic-Free Formulations

Growing regulatory restrictions on antibiotic use have accelerated the shift toward probiotics, prebiotics, and enzyme-based medicated feeds. Producers are investing in natural additives to sustain gut health and immunity. For instance, DSM Animal Nutrition launched a probiotic feed additive line in 2023 to replace conventional antibiotics. This trend supports cleaner production and aligns with consumer demand for residue-free animal products.

- For instance, Adilisa Holding Group operates a fully automated additives production line with a capacity of 3,000 metric tons per month and a pre-initiator feed line at 700 metric tons per month.

Integration of Precision Livestock Nutrition

Digital monitoring and smart feeding technologies are enabling customized medicated feed formulations. Precision nutrition improves dosage accuracy, minimizes wastage, and ensures timely disease prevention. For instance, Cargill introduced digital feed monitoring platforms that analyze animal health data and adjust medication levels automatically. Such innovations enhance efficiency and profitability for large-scale livestock operations.

- For instance, Alltech’s InTouch toolkit, comprising a control unit, mobile app, and online dashboard, enabled a finishing beef enterprise to reduce feed mixing errors by 96%, while maintaining consistent ration loading and mixing times across multiple operators.

Expansion of Aquaculture Medicated Feed

Rising aquaculture production in Asia and South America presents a strong opportunity for medicated feed makers. Controlled medication through feed improves water quality and reduces disease spread. For instance, Skretting developed medicated fish feed variants targeting bacterial infections in salmon and tilapia. The expansion of sustainable aquaculture is likely to support future market growth.

Key Challenges

Regulatory Restrictions on Antibiotic Use

Stringent global regulations limit the inclusion of antibiotic-based compounds in animal feed. The European Union and U.S. FDA impose restrictions on non-therapeutic antibiotic applications to prevent antimicrobial resistance. For instance, the EU banned preventive antibiotic feed use since 2022, forcing producers to reformulate products. Compliance increases R&D costs and limits product flexibility, challenging smaller manufacturers.

High Cost of Medicated Feed Formulation

Medicated feed production requires precision dosing, quality control, and pharmaceutical-grade ingredients, increasing manufacturing expenses. Fluctuating raw material prices and storage constraints further strain profit margins. For instance, amino acid and enzyme prices rose by over 15% globally in 2023, raising production costs for medicated feed producers. These financial pressures hinder adoption among small-scale farmers in developing markets.

Regional Analysis

North America

North America holds the leading position with a 34% market share in the global medicated feed market. The United States and Canada dominate due to advanced livestock management practices and strong demand for high-quality meat and dairy. The presence of major feed producers, including Cargill and ADM, supports innovation in antibiotic alternatives and precision nutrition. Rising concerns about zoonotic diseases and stricter food safety regulations drive continuous product development. The region’s well-established distribution channels and high adoption of customized formulations sustain its competitive edge and long-term growth potential.

Europe

Europe accounts for 27% of the global medicated feed market, driven by strict regulations and growing emphasis on antibiotic-free feed. Countries such as Germany, France, and the Netherlands lead production due to advanced research and high animal welfare standards. Manufacturers increasingly invest in probiotics, enzymes, and phytogenic additives to comply with EU feed directives. For instance, regional players like De Heus and Nutreco focus on residue-free formulations to meet consumer expectations. The mature livestock industry, combined with strong government monitoring, sustains Europe’s steady market share and innovation-driven development.

Asia-Pacific

Asia-Pacific captures 29% of the global medicated feed market, making it the fastest-growing region. Rapid livestock expansion in China, India, and Vietnam drives significant feed demand. Government-backed disease prevention programs and rising meat consumption accelerate adoption. Multinational companies are expanding production facilities to cater to local needs. For instance, Alltech and Charoen Pokphand Group increased medicated feed output to meet regional livestock growth. Increasing aquaculture activity and urban dietary changes also support expansion. The combination of economic development and evolving animal health infrastructure enhances the region’s global influence.

Latin America

Latin America holds 6% of the global medicated feed market, supported by a robust livestock export industry. Brazil and Mexico lead regional demand, driven by poultry and beef production growth. Rising awareness about disease control and feed efficiency boosts the use of medicated concentrates and supplements. For instance, Brazilian feed producers are adopting probiotics to enhance export compliance with EU regulations. Despite infrastructure challenges, increasing foreign investments in feed mills and R&D facilities strengthen the region’s production capacity and competitiveness in global animal health nutrition.

Middle East & Africa

The Middle East & Africa region represents 4% of the global medicated feed market, showing gradual expansion. Growing poultry and dairy farming activities in Saudi Arabia, Egypt, and South Africa stimulate feed demand. Governments are investing in livestock vaccination and feed safety programs to reduce disease outbreaks. International feed manufacturers are entering partnerships with local cooperatives to improve access to medicated formulations. Despite limited manufacturing capacity, the region benefits from increasing awareness of animal health management, supported by imports of veterinary-grade feed additives and supplements.

Market Segmentations:

By Product Type:

By Form:

By Livestock Type:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Medicated Feed Market features key players such as Biomin Holdings, Cargill, Ajinomoto Eurolysine, Champrix, Adilisa Holding Group, Alltech, BASF SE, Bentoli, Bioseutica, and Archer Daniels Midland Company (ADM). The Medicated Feed Market is characterized by continuous innovation, strategic alliances, and a strong focus on sustainable livestock nutrition. Companies invest heavily in research and development to create antibiotic-free formulations and enhance animal immunity through probiotics, enzymes, and amino acids. Mergers, acquisitions, and regional expansions strengthen global market penetration, while digital technologies support precision feeding and disease management. Manufacturers increasingly collaborate with veterinary institutions and farmers to develop customized medicated feed solutions that improve growth efficiency and food safety. This competitive environment fosters rapid product diversification and drives consistent market advancement worldwide.

Key Player Analysis

- Biomin Holdings

- Cargill

- Ajinomoto Eurolysine

- Champrix

- Adilisa Holding Group

- Alltech

- BASF SE

- Bentoli

- Bioseutica

- Archer Daniels Midland Company (ADM)

Recent Developments

- In March 2025, Kemin Industries launched PROSIDIUM™, a new feed pathogen control system based on peroxy acids, at the VIV Asia 2025 trade show. The system uses a novel application method to eliminate pathogens like Salmonella and viruses from animal feed, aiming to improve overall biosecurity and food safety.

- In September 2024, Growel Group launched its new pet food brand, Carniwel, to expand into the pet food market with affordable, premium nutrition for both dogs and cats. Carniwel offers a range of products, including vegetarian options, enriched with superfoods and fresh proteins like chicken and lamb.

- In August 2024, Boehringer Ingelheim India and Vvaan Lifesciences Private Limited formed a strategic distribution partnership for Boehringer Ingelheim’s pet parasiticide portfolio.

- In July 2024, Merck Animal Health completed the acquisition of Elanco’s aquaculture business for which significantly strengthens its position in the industry by expanding its portfolio of fish health, welfare, and sustainability solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Form, Livestock Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for antibiotic-free and probiotic-based medicated feed will continue to rise.

- Precision livestock farming will boost adoption of customized medicated formulations.

- Aquaculture medicated feed will expand due to growing fish farming activities.

- Integration of digital monitoring tools will enhance feed dosing accuracy.

- Emerging economies will drive large-scale investments in livestock nutrition.

- Regulatory reforms will encourage innovation in natural and enzyme-based products.

- Collaborations between feed manufacturers and veterinary firms will strengthen product development.

- Sustainable sourcing of raw materials will become a major competitive factor.

- Increasing awareness of animal health will influence purchasing behavior among farmers.

- Technological advancements in feed processing will improve product efficiency and shelf life.