Market Overview

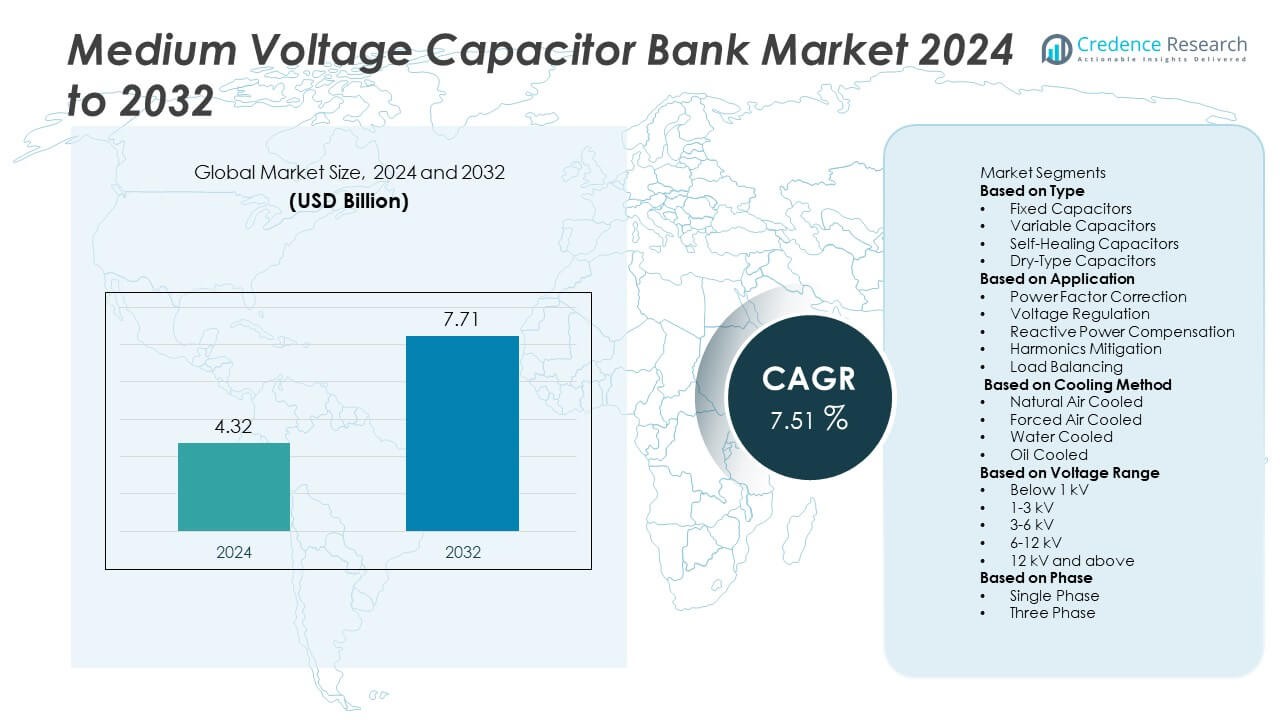

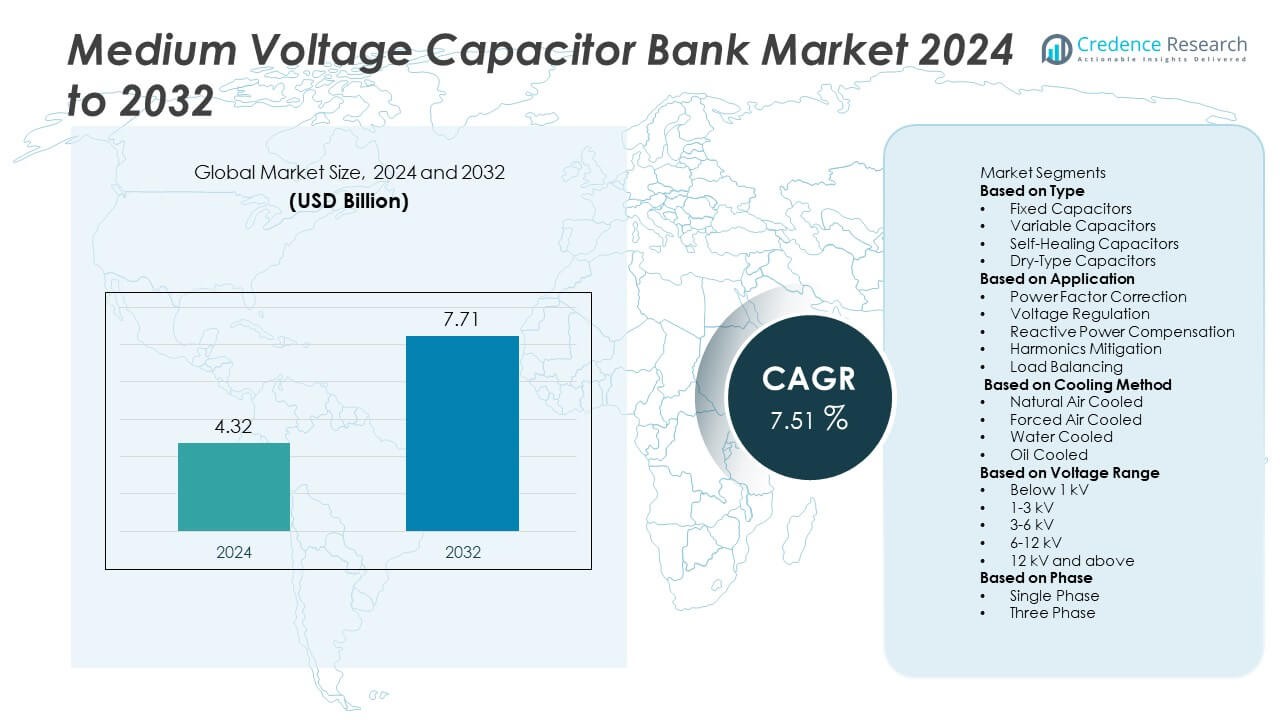

The Medium Voltage Capacitor Bank Market was valued at USD 4.32 billion in 2024 and is projected to reach USD 7.71 billion by 2032, expanding at a CAGR of 7.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Voltage Capacitor Bank Market Size 2024 |

USD 4.32 Billion |

| Medium Voltage Capacitor Bank Market, CAGR |

7.51% |

| Medium Voltage Capacitor Bank Market Size 2032 |

USD 7.71 Billion |

The Medium Voltage Capacitor Bank Market grows through strong drivers such as rising demand for power factor correction, grid stability, and reduced transmission losses across industrial and utility sectors. It benefits from expanding renewable energy integration, where capacitor banks support voltage regulation and efficiency in variable generation.

The Medium Voltage Capacitor Bank Market demonstrates strong growth potential across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, supported by grid modernization, renewable energy integration, and industrial expansion. North America leads with significant investments in smart grid technologies and energy efficiency programs, while Europe emphasizes sustainable energy transition and advanced industrial applications. Asia-Pacific emerges as the fastest-growing region, driven by rapid urbanization, large-scale infrastructure projects, and government-backed electrification initiatives. Latin America and the Middle East show steady adoption through industrial growth and renewable integration efforts. Key players such as Siemens AG, General Electric, Eaton Corporation, and Mitsubishi Electric Corporation strengthen the market through innovations in smart capacitor bank solutions, automation, and digital monitoring systems. These companies collaborate with utilities and industries to deliver advanced technologies that enhance energy efficiency, reliability, and operational performance across diverse power networks worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Medium Voltage Capacitor Bank Market was valued at USD 4.32 billion in 2024 and is projected to reach USD 7.71 billion by 2032, growing at a CAGR of 7.51% during the forecast period.

- Market drivers include the rising demand for power factor correction, voltage stability, and reduced transmission losses across utilities, industrial facilities, and infrastructure projects.

- Trends highlight the adoption of smart and automated capacitor bank systems with real-time monitoring, predictive maintenance, and integration into modern grid infrastructure.

- Competitive dynamics are shaped by key players such as Siemens AG, General Electric, Eaton Corporation, and Mitsubishi Electric Corporation, which focus on product innovation, automation, and global partnerships to strengthen their presence.

- Market restraints involve high initial installation costs, technical limitations in harmonic-rich environments, and the need for skilled labor to operate and maintain advanced capacitor bank systems.

- Regional analysis shows North America leading with grid modernization projects, Europe emphasizing renewable integration and energy efficiency, and Asia-Pacific emerging as the fastest-growing region due to industrialization and urbanization.

- Latin America and the Middle East & Africa demonstrate gradual but steady growth, driven by infrastructure expansion, renewable energy projects, and government-backed electrification programs, presenting long-term opportunities for suppliers.

Market Drivers

Rising Demand for Power Factor Correction in Industrial Operations

The Medium Voltage Capacitor Bank Market is strongly driven by the increasing need for power factor correction in heavy industrial applications. Manufacturing plants, refineries, and mining operations require stable voltage and efficient power use to reduce operational costs. It supports utilities and industries in minimizing reactive power losses, thereby improving overall energy efficiency. Capacitor banks also enable reduced electricity bills through optimized load management. Adoption of these systems ensures compliance with grid regulations that mandate efficient power use. The demand for reliable capacitor bank installations continues to rise across energy-intensive sectors.

- For instance, Eaton Corporation supplied customized capacitor bank solutions to a U.S. steel plant that reduced reactive power penalties by nearly 1,200 kVAR per unit.

Growing Integration of Renewable Energy Sources into Power Grids

The global shift toward renewable energy integration creates significant momentum for capacitor bank deployment. Wind and solar power often introduce fluctuations and instability into distribution networks. It addresses these issues by providing voltage stability and reactive power support. Capacitor banks allow utilities to maintain grid reliability while handling variable energy input. They also improve the efficiency of renewable energy projects by reducing transmission losses. The ongoing expansion of renewable power capacity globally strengthens the role of medium voltage capacitor banks in grid operations.

- For instance, Siemens MSCDNs are high-voltage devices used to stabilize grid voltage and absorb harmonic distortions, which become more critical with the integration of new, intermittent renewable sources like offshore wind farms.

Expansion of Transmission and Distribution Infrastructure

The expansion and modernization of power transmission and distribution networks drive sustained demand for capacitor banks. Emerging economies invest heavily in new substations and grid upgrades to meet rising electricity consumption. It enhances voltage regulation, reduces line losses, and ensures stable power delivery to urban and rural areas. Utilities implement capacitor banks to optimize energy flow and maintain grid performance under increasing load conditions. Growing electrification in developing regions further amplifies the demand. Infrastructure investments continue to position capacitor banks as an essential component of reliable energy systems.

Adoption of Smart and Automated Capacitor Bank Solutions

Technological advancements create new opportunities for improved capacitor bank deployment. Smart and automated systems provide real-time monitoring, predictive maintenance, and adaptive voltage regulation. It allows utilities to manage power quality more effectively and prevent system failures. Integration with digital technologies ensures higher operational efficiency and reduced downtime. Automated capacitor banks also support remote operation, which benefits large-scale utilities managing multiple substations. The demand for smart solutions continues to grow, enhancing the competitiveness of advanced capacitor bank technologies.

Market Trends

Increasing Shift Toward Renewable Energy Integration

The Medium Voltage Capacitor Bank Market reflects a strong trend toward renewable energy integration within national grids. Rising solar and wind installations require efficient solutions to address intermittent generation and voltage fluctuations. It ensures reactive power compensation and stable power delivery under variable conditions. Capacitor banks improve renewable project efficiency by lowering grid losses and enhancing voltage profiles. Utilities worldwide prioritize these systems to support decarbonization goals and energy transition strategies. The growing penetration of renewable sources strengthens demand for reliable capacitor bank solutions.

- For instance, Hitachi Energy supplied a 1400 MVAr series capacitor bank for Minnesota Power’s Great Northern Transmission Line project, enabling the reliable integration of 883 MW of hydropower and stabilizing a 500 kV network spanning 224 miles.

Adoption of Digital Monitoring and Smart Grid Solutions

The digitalization of power networks drives a clear shift toward smart capacitor bank systems. Utilities adopt intelligent control systems with real-time monitoring, fault detection, and predictive analytics. It allows operators to enhance performance, reduce downtime, and improve asset management. Integration with advanced SCADA and IoT platforms supports greater operational flexibility and remote control. The demand for digital technologies aligns with global efforts to modernize grid infrastructure. Smart solutions elevate the role of capacitor banks in next-generation power networks.

- For instance, Siemens AG implemented its Gridscale X digital twin software in Trieste, Italy in 2025, creating a real-time model of medium- and low-voltage grids that enhanced monitoring and improved power management efficiency across more than 200 substations.

Growing Focus on Energy Efficiency and Sustainability Goals

Sustainability initiatives are reshaping investment decisions in the power sector. The Medium Voltage Capacitor Bank Market benefits from policies that mandate energy efficiency and reduced carbon emissions. It helps industries and utilities cut energy waste by minimizing reactive power and lowering transmission losses. Compliance with efficiency standards accelerates the adoption of capacitor banks across diverse regions. Organizations align deployments with broader environmental and operational sustainability goals. Rising regulatory support ensures consistent demand for efficient capacitor bank technologies.

Expansion of Infrastructure in Emerging Economies

Developing regions invest heavily in electricity infrastructure to meet growing demand. Governments and utilities across Asia, Africa, and Latin America expand power distribution networks and rural electrification projects. It enables wider use of capacitor banks for maintaining voltage stability and ensuring reliable supply. Urbanization and industrial growth in these markets create long-term opportunities for suppliers. Infrastructure upgrades also support modern grid technologies, driving greater deployment of advanced capacitor bank systems. This trend reinforces the importance of capacitor banks in building resilient energy infrastructure.

Market Challenges Analysis

High Initial Costs and Complex Installation Requirements

The Medium Voltage Capacitor Bank Market faces challenges related to high upfront investment and complex installation processes. Many utilities and industries hesitate to adopt advanced systems due to capital cost constraints, especially in developing regions. It requires skilled labor and specialized equipment to install and integrate capacitor banks within substations and industrial facilities. Limited availability of trained technicians further delays deployment. Compatibility issues with existing grid infrastructure create additional hurdles for widespread adoption. These barriers slow down large-scale implementation despite clear efficiency benefits.

Operational Risks, Maintenance Concerns, and Technical Limitations

Operational risks and maintenance challenges also impact the growth of the Medium Voltage Capacitor Bank Market. Capacitor banks are prone to failures caused by overvoltage, harmonics, and overheating in demanding environments. It increases the need for continuous monitoring and timely replacement of faulty units. Maintenance costs remain significant for utilities managing large networks with multiple installations. Technical limitations, such as sensitivity to harmonic distortion, reduce efficiency in certain applications. Reliability concerns discourage small and mid-sized operators from investing in advanced systems. Addressing these issues requires strong focus on product durability and robust monitoring solutions.

Market Opportunities

Rising Demand from Renewable Energy and Grid Modernization Projects

The Medium Voltage Capacitor Bank Market presents strong opportunities through renewable energy expansion and grid modernization programs. Growing integration of wind and solar projects requires effective voltage regulation and reactive power compensation. It enables utilities to stabilize grids while handling intermittent renewable generation. Governments worldwide continue to invest in smart grid infrastructure, creating a favorable environment for advanced capacitor bank solutions. Suppliers that offer systems integrated with digital monitoring and automation will gain competitive advantages. The transition toward sustainable energy systems ensures steady demand for innovative capacitor bank technologies.

Growth Potential in Emerging Economies and Industrial Expansion

Emerging economies create new opportunities for capacitor bank adoption through rapid urbanization and industrial development. Expanding transmission and distribution infrastructure in Asia, Africa, and Latin America drives the need for reliable power factor correction. It supports industries such as mining, steel, and petrochemicals that require stable medium voltage supply. Rural electrification initiatives further widen the scope for deployment in underserved regions. Increasing focus on energy efficiency and cost savings motivates both utilities and private operators to invest in capacitor banks. Strong industrial growth in developing markets enhances the long-term opportunity landscape.

Market Segmentation Analysis:

By Type

The Medium Voltage Capacitor Bank Market is segmented by type into fixed capacitor banks, automatic capacitor banks, and filter capacitor banks. Fixed units are commonly used in industrial facilities with relatively stable load requirements, where they provide reliable power factor correction at lower costs. Automatic capacitor banks dominate in applications where load fluctuations are frequent, as they adjust compensation dynamically through advanced controllers. Filter capacitor banks are increasingly deployed in industries with heavy harmonic distortion, such as steel, cement, and mining, to improve system reliability and protect sensitive equipment. It demonstrates how each type serves specific operational needs across utilities and industrial sectors. Growing demand for dynamic and adaptive solutions positions automatic and filter banks as critical drivers of future market growth.

- For instance, CG Power and Industrial Solutions Ltd supplied a 10 MVAr automatic capacitor bank to a large steel manufacturer in India, reducing harmonic distortion by 30% and stabilizing voltage across a 132 kV grid connection.

By Application

Applications span across utilities, industrial plants, commercial establishments, and infrastructure projects. Utilities adopt capacitor banks to regulate voltage, reduce line losses, and improve the overall efficiency of transmission and distribution networks. It supports stable grid performance under increasing electricity demand and renewable energy integration. Industrial users, especially in energy-intensive sectors, implement capacitor banks to reduce penalties from low power factor and achieve significant cost savings. Commercial establishments, including large office complexes and data centers, adopt them to maintain energy efficiency and reliable supply. Infrastructure projects, such as transportation networks and smart cities, also create opportunities for advanced capacitor bank installations. The breadth of application underlines the versatility of capacitor banks in supporting both operational efficiency and sustainability goals.

- For instance, Eaton Corporation delivered a 15-unit pole-mounted capacitor bank system rated at 7,200 kVAR for a U.S. utility, which reduced distribution line losses by 4.5 million kWh annually while improving voltage profiles for more than 25,000 customers.

By Cooling Method

Cooling methods in medium voltage capacitor banks are primarily categorized into air-cooled and liquid-cooled systems. Air-cooled capacitor banks remain the most widely used due to their simple design, low maintenance requirements, and suitability for moderate operating conditions. It finds strong application in utilities and commercial sectors with relatively stable loads. Liquid-cooled systems are preferred in heavy-duty industrial environments where higher capacity, efficiency, and thermal management are critical. They offer improved performance under harsh conditions and extend the life of components by maintaining optimal temperatures. The adoption of liquid-cooled solutions is rising in industries such as petrochemicals, metallurgy, and renewable energy, where operational reliability is a priority. The choice of cooling method reflects the balance between cost-effectiveness, efficiency, and environmental demands in diverse applications.

Segments:

Based on Type

- Fixed Capacitors

- Variable Capacitors

- Self-Healing Capacitors

- Dry-Type Capacitors

Based on Application

- Power Factor Correction

- Voltage Regulation

- Reactive Power Compensation

- Harmonics Mitigation

- Load Balancing

Based on Cooling Method

- Natural Air Cooled

- Forced Air Cooled

- Water Cooled

- Oil Cooled

Based on Voltage Range

- Below 1 kV

- 1-3 kV

- 3-6 kV

- 6-12 kV

- 12 kV and above

Based on Phase

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for nearly 30% of the Medium Voltage Capacitor Bank Market in 2024, supported by well-established grid infrastructure and a strong focus on energy efficiency. The United States drives the majority of demand due to extensive investment in transmission and distribution networks, along with policies encouraging utilities to reduce energy losses. It benefits from the adoption of smart capacitor banks integrated with monitoring and control technologies that align with digital grid modernization programs. Canada and Mexico contribute steadily, with growing emphasis on industrial expansion and renewable integration. Widespread deployment across industrial facilities, such as oil and gas, data centers, and heavy manufacturing, further supports demand. The region’s regulatory framework, which encourages efficiency and reliability, ensures sustained adoption of capacitor banks across utilities and industries.

Europe

Europe represents about 25% of the Medium Voltage Capacitor Bank Market, driven by its advanced industrial sector and strong sustainability commitments. Germany, France, and the United Kingdom are at the forefront of adopting capacitor banks to improve grid efficiency and reduce carbon emissions. It aligns with Europe’s regulatory mandates that encourage energy savings and power factor correction in both utilities and industrial operations. The market also benefits from rising renewable energy penetration, with capacitor banks providing voltage stability for wind and solar projects across the region. Southern European countries, including Spain and Italy, adopt capacitor banks for infrastructure modernization and industrial growth. The focus on green energy transition and digital transformation further strengthens the regional outlook, making Europe a competitive hub for advanced solutions.

Asia-Pacific

Asia-Pacific holds more than 35% of the Medium Voltage Capacitor Bank Market, making it the largest and fastest-growing region. China leads adoption with massive investments in power grid infrastructure, industrial manufacturing, and renewable energy integration. Japan and South Korea follow with advanced utility systems that rely on capacitor banks for grid reliability and efficiency. India demonstrates strong growth through expanding industrial operations and government-backed rural electrification programs. It drives widespread installation of capacitor banks to stabilize grids under growing load conditions. Southeast Asian economies, including Indonesia, Vietnam, and Malaysia, also contribute with increasing demand for stable and efficient power distribution. Rapid urbanization, rising industrialization, and large-scale infrastructure projects make Asia-Pacific a primary driver of future market growth.

Latin America

Latin America captures close to 5% of the Medium Voltage Capacitor Bank Market, with Brazil and Mexico as the primary contributors. Growth in this region is linked to infrastructure expansion, industrialization, and increasing demand for reliable electricity supply. It provides significant opportunities through adoption in industries such as mining, oil and gas, and steel manufacturing, where stable medium voltage power is critical. Countries like Chile, Colombia, and Argentina also demonstrate gradual adoption driven by utility upgrades and regulatory support for energy efficiency. Despite challenges such as limited capital investment and infrastructure gaps, capacitor banks are increasingly deployed to reduce losses and improve network performance. The region’s untapped potential offers long-term opportunities for suppliers targeting emerging markets.

Middle East and Africa

The Middle East and Africa together account for roughly 5% of the Medium Voltage Capacitor Bank Market, with the Middle East leading adoption. Saudi Arabia and the United Arab Emirates invest heavily in grid modernization, smart city projects, and renewable energy integration, creating strong demand for capacitor banks. It supports power factor correction and voltage stability in energy-intensive sectors, including petrochemicals and construction. Africa demonstrates early-stage adoption, with South Africa, Nigeria, and Egypt investing in transmission and distribution improvements. Industrial growth and urbanization across these regions gradually increase the need for capacitor banks to enhance grid reliability. Despite challenges such as limited infrastructure and higher upfront costs, ongoing investments in electrification projects point to promising growth potential.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Westinghouse Electric Corporation

- Hitachi Ltd

- CG Power and Industrial Solutions Ltd

- Siemens AG

- IHI Corporation

- Eaton Corporation

- Nissin Electric Holdings Corporation

- Mitsubishi Electric Corporation

- General Electric

- Doosan Heavy Industries Construction

Competitive Analysis

The competitive landscape of the Medium Voltage Capacitor Bank Market is defined by the active participation of leading companies such as Doosan Heavy Industries Construction, Eaton Corporation, IHI Corporation, Mitsubishi Electric Corporation, Siemens AG, Nissin Electric Holdings Corporation, Westinghouse Electric Corporation, CG Power and Industrial Solutions Ltd, General Electric, and Hitachi Ltd. Market leaders strengthen their positions with comprehensive portfolios that integrate smart and automated capacitor bank solutions, supporting grid modernization and improved reliability. Advanced digital monitoring systems are being emphasized to enhance operational efficiency and optimize performance across industrial and utility applications. Scalable solutions tailored for diverse end users play a key role in maintaining competitiveness, while infrastructure projects in emerging economies create new opportunities for growth. Regional players contribute by offering cost-effective designs and customized solutions that address specific market needs. Overall, competition revolves around product innovation, operational efficiency, and strong partnerships with utilities and industries, ensuring steady adoption and global expansion of medium voltage capacitor bank technologies.

Recent Developments

- In June 2025, Siemens AG began deploying its Gridscale X software to help AcegasApsAmga develop a digital twin of its medium and low-voltage grid in Trieste. This solution enhances situational awareness and supports electrification efforts for the busy port infrastructure.

- In February 2025, Mitsubishi Electric announced it developed the world’s first “Operation Log-driven Development Technology” to accelerate digital transformation (DX) system development.

- In January 2025, Siemens AG began deploying its Gridscale X digital twin software to help AcegasApsAmga build a real-time model of its medium- and low-voltage grid in Trieste, enhancing situational awareness for port infrastructure electrification.

- In December 2024, Siemens’ innovative modular medium-voltage power skid solution enables faster construction of Compass data center facilities The agreement helps Compass Datacenters meet rocketing demand from cloud and hyperscale customers, while also lowering the cost of critical power systems.

Market Concentration & Characteristics

The Medium Voltage Capacitor Bank Market shows a moderately consolidated structure with leading global players holding strong influence through technology, innovation, and large-scale projects. It is characterized by high demand from utilities, industrial facilities, and infrastructure sectors that require reliable power factor correction, voltage stability, and efficiency improvements. Companies focus on developing advanced capacitor banks with digital monitoring, automated control, and modular designs to meet evolving grid requirements. The market displays strong competition driven by product performance, scalability, and cost-effectiveness, with regional suppliers also contributing through tailored solutions. It reflects a balance between established multinational corporations and emerging players that serve localized needs. Strategic collaborations, renewable integration, and grid modernization programs continue to shape its competitive landscape. The Medium Voltage Capacitor Bank Market remains dynamic, with innovation, regulatory compliance, and operational reliability acting as the core characteristics that define growth and long-term adoption.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Cooling Method, Voltage Range, Phase and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Medium Voltage Capacitor Bank Market will expand steadily with rising demand for grid stability and energy efficiency.

- Utilities will adopt advanced capacitor banks to support renewable energy integration and voltage regulation.

- Smart and automated capacitor banks with digital monitoring will gain stronger adoption.

- Industrial users will continue to deploy capacitor banks to optimize power factor and reduce operational costs.

- Investments in transmission and distribution upgrades will create consistent opportunities for suppliers.

- Emerging economies will drive growth through rural electrification and infrastructure expansion.

- Sustainability policies will increase focus on energy-efficient capacitor bank technologies.

- Modular and prefabricated solutions will see wider deployment for faster installation and flexibility.

- Technological collaborations between utilities and manufacturers will accelerate innovation.

- Competition will intensify as global leaders and regional players expand offerings with advanced features.