Market Overview

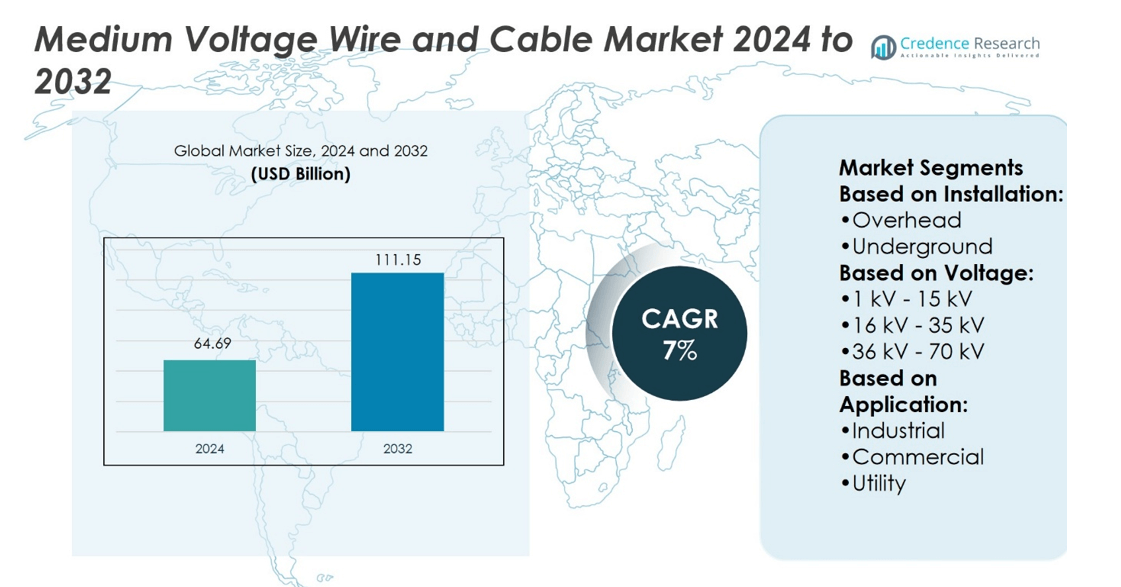

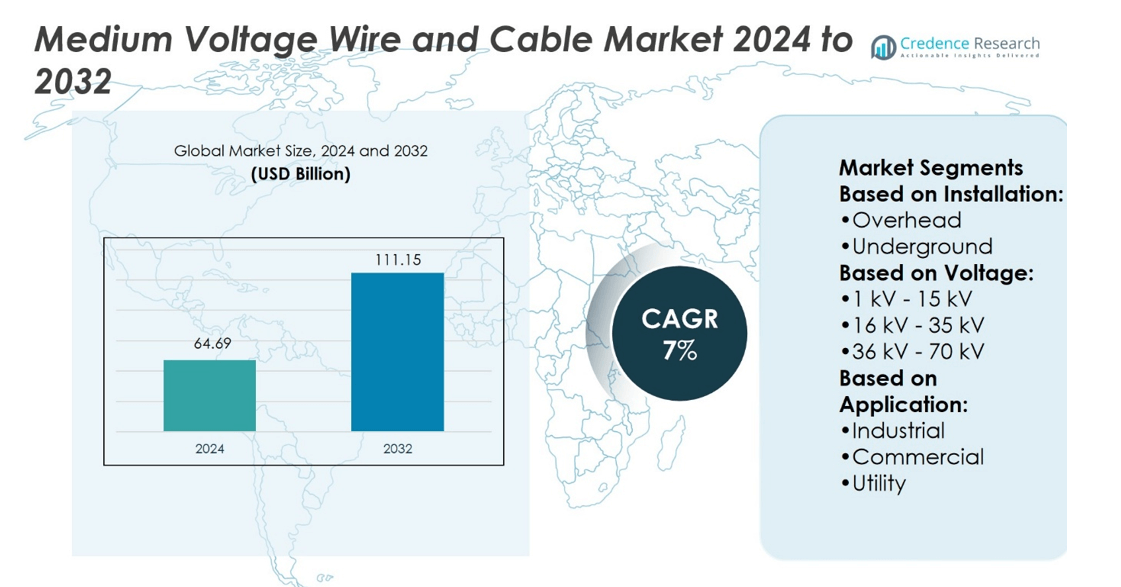

Medium Voltage Wire and Cable Market size was valued at USD 64.69 billion in 2024 and is anticipated to reach USD 111.15 billion by 2032, at a CAGR of 7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Medium Voltage Wire and Cable Market Size 2024 |

USD 64.69 billion |

| Medium Voltage Wire and Cable Market, CAGR |

7% |

| Medium Voltage Wire and Cable Market Size 2032 |

USD 111.15 billion |

The Medium Voltage Wire and Cable Market grows through strong drivers and evolving trends that reshape global demand. Rising urbanization and industrial expansion increase the need for efficient power distribution networks. Governments enforce strict regulations, pushing utilities to adopt advanced and safer cabling systems. Renewable energy integration, including solar and wind projects, further accelerates demand for durable medium voltage solutions. Smart grid initiatives and digital monitoring enhance reliability and efficiency. Manufacturers innovate with eco-friendly materials and improved insulation technologies. These combined drivers and trends ensure steady adoption of medium voltage wire and cable solutions across industrial, commercial, and utility sectors.

Asia Pacific holds the largest share of the Medium Voltage Wire and Cable Market, driven by rapid industrialization, infrastructure growth, and renewable energy projects. North America and Europe follow with strong investments in grid modernization and stricter safety standards, while the Middle East and Latin America record steady growth through electrification and urban expansion. Key players shaping the competitive landscape include BELDEN, Ducab, Jeddah Cables, Bahra Cables, HELUKABEL, Elsewedy Electric, Brugg Kabel AG, Fujikura, Federal Cables, and alfanar Group.

Market Insights

- Medium Voltage Wire and Cable Market size was valued at USD 64.69 billion in 2024 and is projected to reach USD 111.15 billion by 2032, at a CAGR of 7%.

- Rising urbanization and industrial development increase the demand for efficient medium voltage distribution systems.

- Renewable energy projects such as wind and solar farms create consistent demand for durable cabling.

- Manufacturers focus on eco-friendly materials and improved insulation technologies to meet safety and efficiency standards.

- The market faces restraints from high installation costs and fluctuations in raw material prices.

- Asia Pacific holds the largest share, followed by North America and Europe, while the Middle East and Latin America show steady growth.

- Competition is shaped by key players including BELDEN, Ducab, Jeddah Cables, Bahra Cables, HELUKABEL, Elsewedy Electric, Brugg Kabel AG, Fujikura, Federal Cables, and alfanar Group.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand from Expanding Industrial and Infrastructure Projects

The Medium Voltage Wire and Cable Market benefits from the expansion of industrial zones and infrastructure projects. Governments prioritize power distribution networks to support urban development and manufacturing growth. New construction in residential, commercial, and industrial sectors creates higher demand for reliable cabling solutions. It enables stable electricity transmission while meeting safety and efficiency standards. Manufacturers focus on customized cable designs that match project requirements. The push for industrialization in emerging economies sustains consistent market growth opportunities.

- For instance, Ducab commissioned its high-voltage (HV) cable plant in Jebel Ali, Dubai. The facility has an annual production capacity of 1,500 kilometers of HV underground cable and supplies medium- and high-voltage cables for UAE renewable energy and infrastructure projects.

Adoption of Renewable Energy and Grid Modernization Efforts

Medium Voltage Wire and Cable Market growth accelerates with the global transition toward renewable energy sources. Solar and wind farms require robust transmission lines for grid integration. It supports stable power delivery across decentralized systems. Governments and utilities invest in modernizing grids to improve resilience and efficiency. Smart grid initiatives also expand the need for advanced medium voltage cabling solutions. The increasing penetration of distributed energy resources further drives investment in reliable wire and cable networks.

- For instance, Jeddah Cables introduced a pioneering 130-meter-high Vertical Continuous Vulcanization (VCV) tower in Saudi Arabia. It manufactures EHV power cables up to 500 kV using precise XLPE layering via a continuous process, enhancing insulation uniformity and reducing electrical faults.

Technological Advancements Enhancing Cable Performance and Reliability

The Medium Voltage Wire and Cable Market strengthens through innovation in insulation materials and manufacturing processes. Improved designs enhance resistance to thermal stress, mechanical wear, and electrical faults. It ensures long service life and reduces maintenance costs for utilities and industries. Adoption of cross-linked polyethylene (XLPE) and other advanced insulation materials boosts efficiency. Manufacturers develop cables capable of withstanding harsher operating environments. These advancements align with stricter safety standards and rising energy efficiency requirements.

Government Regulations and Safety Compliance Driving Market Adoption

The Medium Voltage Wire and Cable Market expands through strict regulatory frameworks on energy safety and efficiency. Compliance requirements encourage utilities and contractors to adopt advanced cabling technologies. It ensures adherence to national and international quality standards. Government-backed electrification programs in rural and urban areas further boost demand. Investments in grid reliability and fault detection strengthen market penetration. Safety-driven procurement policies increase the replacement rate of outdated cabling networks. This regulatory emphasis underpins steady long-term demand for medium voltage solutions.

Market Trends

Growing Focus on Smart Grid Integration and Digital Monitoring

The Medium Voltage Wire and Cable Market is experiencing rising adoption of smart grid technologies. Utilities implement digital monitoring systems to improve efficiency and fault detection. It enhances reliability and reduces downtime across distribution networks. Integration of sensors and IoT-based platforms creates demand for advanced cabling infrastructure. Grid modernization projects in both developed and developing regions accelerate this trend. Growing investment in intelligent distribution systems ensures long-term opportunities for medium voltage solutions.

- For instance, Bahra Electric configured its entire medium-voltage cable production lines to support decentralized control software, enabling real-time data communication both upstream and downstream across 100 % of equipment. This setup allowed live monitoring of cable extrusion parameters—like temperature and feed rate—with data updates every second for continuous quality control.

Increasing Use of Eco-Friendly and Sustainable Materials in Cable Manufacturing

The Medium Voltage Wire and Cable Market shows a clear shift toward sustainable production practices. Manufacturers adopt recyclable materials and low-emission insulation compounds. It reduces environmental impact and supports compliance with global sustainability goals. Rising demand for green infrastructure projects encourages innovation in cable designs. Companies focus on lowering carbon footprints through eco-friendly manufacturing. Environmental regulations across key markets make sustainable product lines a strategic necessity.

- For instance, Elsewedy Electric’s wire and cable division has an annual production capacity of approximately 350,000 tons. With 34 manufacturing facilities across all its business sectors in 19 countries, the company exports to more than 100 countries.

Rising Demand from Renewable Energy Expansion and Decentralized Power Systems

The Medium Voltage Wire and Cable Market benefits from accelerating renewable energy deployment. Solar farms, offshore wind projects, and hybrid systems rely on durable cabling networks. It ensures reliable power transfer from remote sites to central grids. Decentralized energy models increase demand for flexible cabling infrastructure. Governments support these installations through policy incentives and large-scale investment programs. Expansion of distributed generation drives steady growth in specialized cable solutions.

Technological Advancements Driving Higher Durability and Performance Standards

The Medium Voltage Wire and Cable Market advances with innovations in insulation, design, and safety standards. Cross-linked polyethylene and improved shielding materials extend cable life cycles. It enhances resistance to high thermal loads and mechanical stress. R&D investments focus on cables that support higher voltage capacities with minimal losses. Manufacturers introduce fire-resistant and low-smoke materials to improve safety. These improvements strengthen adoption across urban grids, industrial facilities, and critical infrastructure projects.

Market Challenges Analysis

High Installation Costs and Complex Maintenance Requirements

The Medium Voltage Wire and Cable Market faces challenges from high installation expenses and demanding maintenance needs. Large infrastructure projects require significant upfront investment in cabling, accessories, and skilled labor. It raises overall project costs and limits adoption in budget-constrained regions. Maintenance complexity increases further when cables are installed in underground or harsh environments. Any fault or breakdown results in costly repairs and prolonged downtime. Limited availability of specialized expertise also delays timely inspection and maintenance schedules.

Volatility in Raw Material Prices and Supply Chain Disruptions

The Medium Voltage Wire and Cable Market struggles with fluctuations in raw material costs, particularly copper, aluminum, and polymers. These materials account for a major share of production costs, and price volatility reduces profitability. It also impacts long-term supply contracts and creates uncertainty for manufacturers. Global supply chain disruptions from geopolitical conflicts and trade restrictions intensify procurement challenges. Extended lead times and higher logistics expenses further burden producers. Dependence on imported raw materials adds risk, especially in regions with weak domestic production capacity.

Market Opportunities

Expanding Electrification Programs and Infrastructure Development Worldwide

The Medium Voltage Wire and Cable Market holds strong opportunities through large-scale electrification projects and infrastructure expansion. Governments invest heavily in extending reliable power access to rural and urban regions. It strengthens demand for advanced cabling networks that can support growing electricity consumption. Rapid urbanization in Asia, Africa, and Latin America fuels investment in residential, commercial, and industrial power systems. Smart city initiatives also prioritize modern cabling for efficient distribution. Long-term development strategies ensure steady adoption across diverse end-use applications.

Rising Adoption of Renewable Energy and Energy-Efficient Technologies

The Medium Voltage Wire and Cable Market benefits from the global push toward renewable energy integration. Solar farms, offshore wind projects, and hybrid installations require durable medium voltage cabling for stable grid connectivity. It supports decentralized power systems and accelerates investment in sustainable infrastructure. Growing emphasis on energy efficiency increases demand for high-performance insulation materials and innovative designs. Policy incentives and green funding programs further boost market opportunities. Expanding reliance on clean energy solutions positions medium voltage cabling as a vital enabler of the energy transition.

Market Segmentation Analysis:

By Installation

The Medium Voltage Wire and Cable Market divides into overhead and underground installations, each addressing distinct requirements. Overhead installations remain widely used in regions with lower infrastructure costs and open land availability. They provide ease of deployment and quicker maintenance access, making them suitable for expanding utility networks. Underground installations gain momentum in urban and high-density areas where space constraints and safety standards demand secure cabling. It offers protection against weather-related disruptions and reduces the risk of outages. Increasing urbanization and regulatory emphasis on safety drive the adoption of underground cabling systems.

- For instance, Brugg Kabel AG engineered underground cable systems with circuit lengths up to 40 km in XLPE technology for voltages up to 500 kV, delivering enhanced insulation uniformity and extreme durability over decades of operation.

By Voltage

The Medium Voltage Wire and Cable Market segments into 1 kV–15 kV, 16 kV–35 kV, and 36 kV–70 kV categories. Cables in the 1 kV–15 kV range dominate industrial and commercial applications due to versatility and cost-effectiveness. The 16 kV–35 kV range supports medium-scale utility projects and industrial operations requiring higher power stability. It offers a balance between efficiency and reliability, making it an essential choice for expanding grid infrastructure. The 36 kV–70 kV segment caters to heavy-duty projects such as mining, offshore wind, and large-scale power plants. Increasing investment in renewable energy and high-capacity infrastructure strengthens demand for this category.

- For instance, Federal Cables (Fedcab) produces XLPE-insulated power cables rated up to 1,000 V, with conductor cross-sections reaching 630 mm², available in single-core and multi-core formats for diverse installations.

By Application

The Medium Voltage Wire and Cable Market serves industrial, commercial, and utility sectors, reflecting broad end-user adoption. Industrial applications dominate due to rising demand in oil and gas, mining, and manufacturing facilities. It ensures reliable power delivery in operations where continuous energy supply is critical. Commercial installations, including retail complexes, offices, and institutional facilities, expand through urban development. Utility applications grow rapidly with grid expansion and modernization initiatives worldwide. Large-scale transmission and distribution projects ensure stable demand across utilities seeking reliable medium voltage solutions. This multi-application adoption pattern positions the market for steady long-term growth across diverse sectors.

Segments:

Based on Installation:

Based on Voltage:

- 1 kV – 15 kV

- 16 kV – 35 kV

- 36 kV – 70 kV

Based on Application:

- Industrial

- Commercial

- Utility

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for about 20 % of the market. The U.S. and Canada focus on replacing aging grid networks with advanced, safer, and more efficient systems. Federal infrastructure programs and renewable energy policies support large investments in power distribution. It also benefits from the growth of electric vehicle charging networks, smart city projects, and industrial power upgrades. Utilities demand cables with high durability, advanced insulation, and improved fire safety. Companies invest in research to meet stricter regulatory requirements and reduce transmission losses. The region continues to expand both renewable and traditional energy networks, which ensures steady demand for medium voltage cabling.

Europe

Europe holds close to 20 % share of the Medium Voltage Wire and Cable Market. The region is shaped by strict safety rules, carbon reduction policies, and the push for renewable integration. Countries such as Germany, France, and the UK lead investments in smart grids and energy storage systems. Utilities prioritize fire-resistant, low-emission, and eco-friendly cables to meet European standards. Offshore wind farms in the North Sea and solar projects across southern Europe create strong demand for medium voltage solutions. It also benefits from large replacement projects in older networks across Eastern and Central Europe. The European Green Deal and related initiatives will continue driving the need for reliable cabling infrastructure.

Asia Pacific

Asia Pacific holds the largest share at 35 % of the Medium Voltage Wire and Cable Market. The region benefits from rapid industrialization, strong urban growth, and heavy investment in infrastructure. Countries such as China and India lead in grid expansion programs, new housing developments, and industrial power needs. It also sees strong demand from renewable energy projects, including solar farms, offshore wind, and hydroelectric stations. Governments continue to expand rural electrification programs to connect millions of households. Manufacturers in Asia produce a wide variety of medium voltage cables at competitive costs, which further supports demand. This dominance reflects both current usage and long-term opportunities for energy infrastructure across the region.

Europe

Europe holds close to 20 % share of the Medium Voltage Wire and Cable Market. The region is shaped by strict safety rules, carbon reduction policies, and the push for renewable integration. Countries such as Germany, France, and the UK lead investments in smart grids and energy storage systems. Utilities prioritize fire-resistant, low-emission, and eco-friendly cables to meet European standards. Offshore wind farms in the North Sea and solar projects across southern Europe create strong demand for medium voltage solutions. It also benefits from large replacement projects in older networks across Eastern and Central Europe. The European Green Deal and related initiatives will continue driving the need for reliable cabling infrastructure.

Latin America

Latin America holds around 5 – 10 % share. The region records steady demand from expanding industrial zones, mining operations, and new housing projects. Brazil, Mexico, and Chile lead grid modernization efforts and renewable energy deployment. Governments expand electricity access to rural areas, often with international aid and development funds. It creates new opportunities for both underground and overhead cabling. Renewable energy adoption, especially in solar and hydro, supports additional growth. The market also gains traction from oil and gas investments that require durable medium voltage networks. Despite some economic challenges, Latin America shows consistent long-term demand for cabling systems.

Middle East

The Middle East controls about 10 % share of the global market. The region uses oil revenues to fund major city developments, power plants, and utility upgrades. Countries such as Saudi Arabia, UAE, and Qatar focus on building smart cities with advanced power distribution. Renewable projects, especially solar parks, drive fresh demand for medium voltage cabling. It also needs highly durable cables that withstand desert conditions, high temperatures, and sand exposure. Governments continue to diversify energy away from oil, investing in nuclear and renewable power. This shift expands opportunities for suppliers of advanced medium voltage wire and cable solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BELDEN

- Ducab

- Jeddah Cables

- Bahra Cables

- HELUKABEL

- Elsewedy Electric

- Brugg Kabel AG

- Fujikura

- Federal Cables

- alfanar Group

Competitive Analysis

The Medium Voltage Wire and Cable Market players including BELDEN, Ducab, Jeddah Cables, Bahra Cables, HELUKABEL, Elsewedy Electric, Brugg Kabel AG, Fujikura, Federal Cables, and alfanar Group. The Medium Voltage Wire and Cable Market remains highly competitive, driven by continuous innovation and infrastructure expansion. Companies focus on developing cables with advanced insulation, higher durability, and better efficiency to meet global safety and performance standards. Strong demand from renewable energy projects, smart grids, and urban electrification pushes manufacturers to expand production capacity and diversify offerings. Competition also centers on cost efficiency, supply chain reliability, and compliance with strict regulatory frameworks. Firms invest in research and development to create eco-friendly and fire-resistant products that align with sustainability goals. The overall landscape reflects a balance of global leaders and regional manufacturers working to capture opportunities in both developed and emerging markets.

Recent Developments

- In January 2025, V-Marc India Limited announced its expansion plans in Kerala. Known for its embrace of technology and innovation, Kerala is a key market for V-Marc to introduce its latest range of advanced wire and cable solutions.

- In June 2024, a French subsea power cable manufacturer, Nexans, completed the acquisition of La Triveneta Cavi s.p.a., an Italian company specializing in medium and low-voltage cables. This acquisition marks a major advancement in Nexans’ strategy to establish itself as a dedicated electrification player.

- In May 2024, BELDEN launched new OSDP and fire alarm cables, Hirschmann IT Wi-Fi 6 radios for railways, enterprise managed switches, and robust industrial connectors to support reliable communication in critical and harsh environments, reflecting continued innovation in medium voltage cable solutions.

- In February 2024, Itron, Inc. and Schneider Electric are collaborating to improve energy and power grid management as homeowners and businesses increasingly adopt distributed energy resources (DER) such as rooftop solar, battery energy storage, electric vehicles and grid-side microgrids. Companies are gradually integrating their smart grid and distributed energy resources (DER) management solutions to digitize electricity supply and demand in medium voltage range.

Report Coverage

The research report offers an in-depth analysis based on Installation, Voltage, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for grid modernization projects worldwide.

- Renewable energy growth will drive higher need for durable medium voltage cabling.

- Underground cable adoption will increase due to urbanization and safety regulations.

- Smart grid development will create opportunities for intelligent and sensor-enabled cables.

- Manufacturers will invest in eco-friendly materials to meet sustainability targets.

- Industrial expansion in emerging economies will support long-term demand for medium voltage solutions.

- Technological innovation will improve insulation, fire resistance, and overall cable performance.

- Electrification of transport and charging infrastructure will raise market requirements.

- Replacement of aging infrastructure will strengthen opportunities in mature markets.

- Global energy transition will ensure consistent investment in reliable cable networks.