Market Overview:

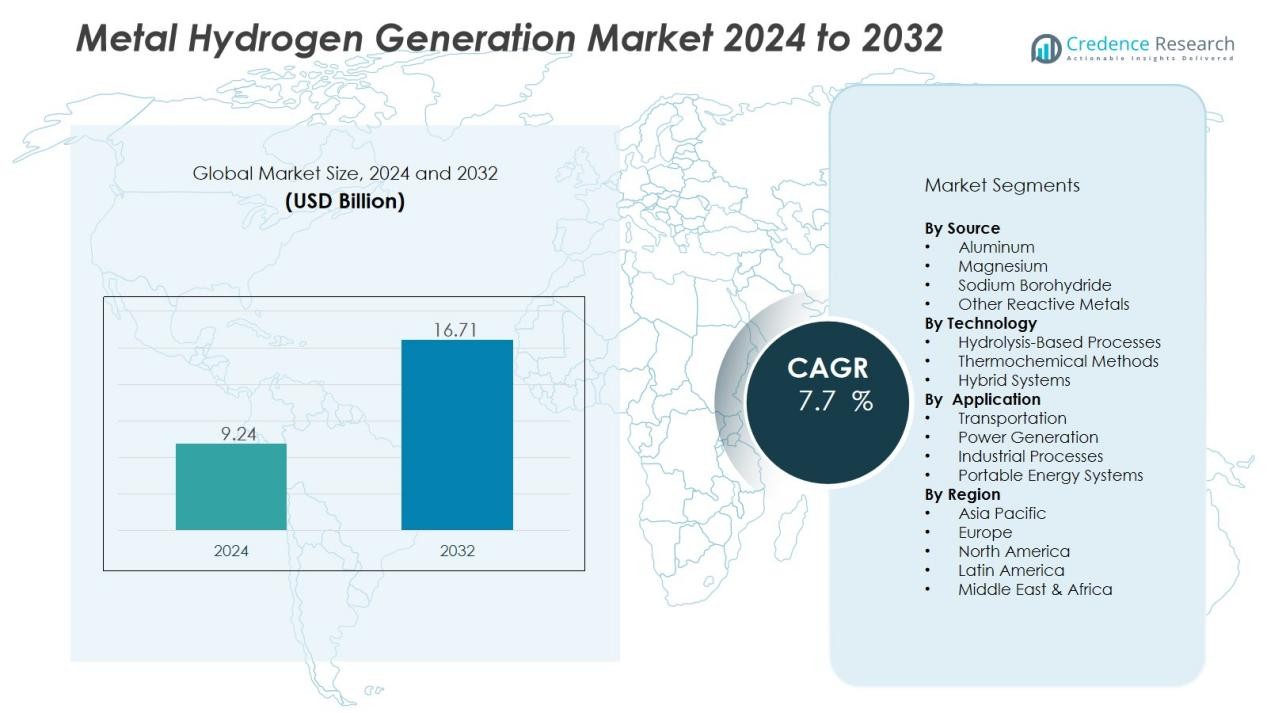

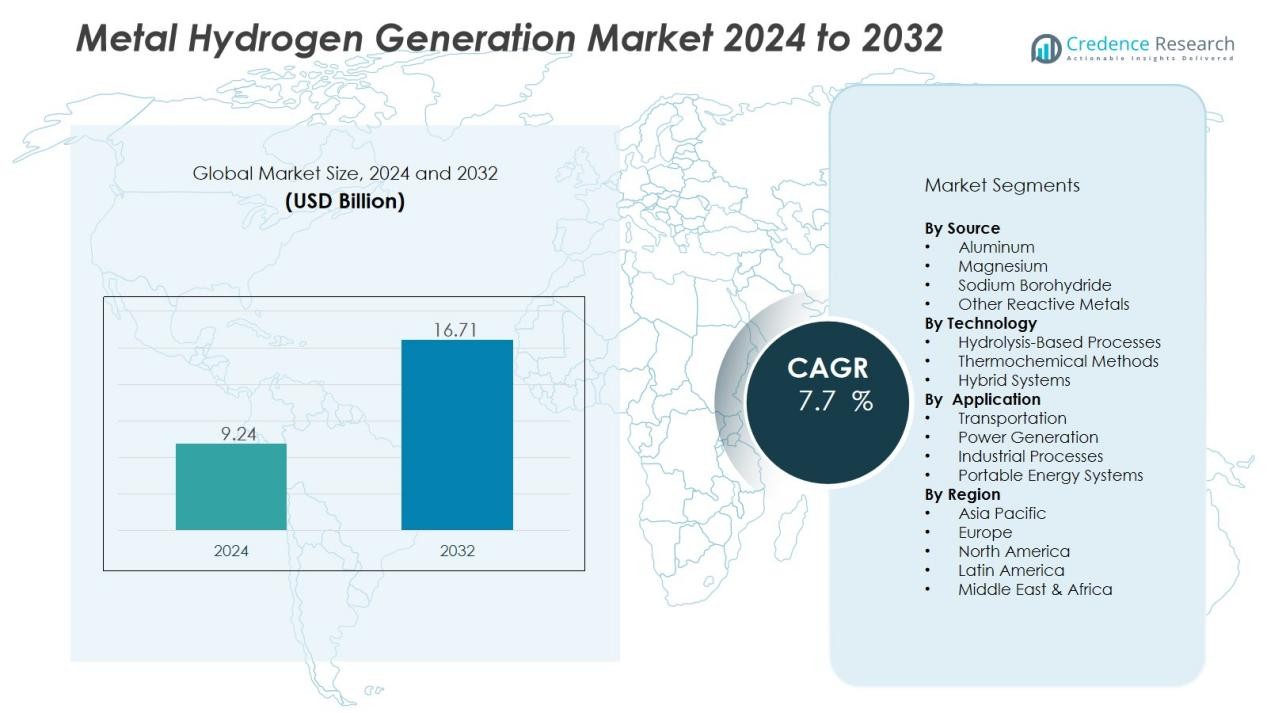

The Metal Hydrogen Generation Market size was valued at USD 9.24 billion in 2024 and is anticipated to reach USD 16.71 billion by 2032, at a CAGR of 7.7 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Metal Hydrogen Generation Market Size 2024 |

USD 9.24 Billion |

| Metal Hydrogen Generation Market, CAGR |

7.7 % |

| Metal Hydrogen Generation Market Size 2032 |

USD 16.71 Billion |

Key drivers include increasing investments in green hydrogen projects and the adoption of metal-based systems such as aluminum, magnesium, and sodium borohydride for efficient hydrogen production. The rising push toward decarbonization, coupled with demand for on-demand hydrogen generation in transport, power, and industrial applications, fuels market growth. Advancements in material technologies and integration with renewable sources further strengthen the market outlook.

Regionally, North America leads due to strong hydrogen infrastructure development and government incentives supporting clean energy adoption. Europe follows closely, driven by ambitious net-zero targets and large-scale hydrogen deployment in mobility and industry. Asia-Pacific is the fastest-growing region, propelled by investments in hydrogen-powered vehicles, energy storage, and industrial applications in China, Japan, and South Korea. The Middle East, Africa, and Latin America also present emerging opportunities through strategic renewable hydrogen initiatives and pilot projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The metal hydrogen generation market was valued at USD 9.24 billion in 2024 and is projected to reach USD 16.71 billion by 2032, growing at a CAGR of 7.7% during the forecast period.

- Rising demand for clean and sustainable energy solutions is fueling adoption of metal-based hydrogen systems across transportation, power, and industrial sectors.

- Technological advancements in aluminum, magnesium, and sodium borohydride systems are improving efficiency, reducing costs, and broadening applications in commercial and industrial use.

- Government incentives, subsidies, and regulatory frameworks are accelerating investments in hydrogen infrastructure, strengthening alignment with decarbonization and energy independence goals.

- High production costs and limited scalability remain key challenges, with raw material expenses and energy inputs impacting competitiveness compared to conventional methods.

- Technical limitations and safety concerns in hydrogen storage, handling, and system durability continue to hinder rapid commercialization.

- North America leads with 34% share in 2024, Europe follows with 29%, and Asia-Pacific is the fastest-growing region with 25% share, driven by infrastructure expansion, industrial demand, and strong policy support.

Market Drivers:

Rising Demand for Clean and Sustainable Energy Solutions:

The metal hydrogen generation market is expanding with the global shift toward cleaner energy sources. Governments and industries are promoting hydrogen as a key alternative to fossil fuels in transportation and power generation. Metal-based hydrogen systems offer on-demand production, supporting applications in vehicles, backup power, and remote operations. This transition strengthens hydrogen’s role in reducing carbon emissions and meeting long-term sustainability goals.

- For instance, Honda began production in 2024 of its CR-V e:FCEV, the first fuel cell electric vehicle made in the U.S., which offers a 270-mile EPA driving range and combines hydrogen fuel cell technology with plug-in electric vehicle capabilities.

Advancements in Metal-Based Hydrogen Production Technologies:

Technological innovation in aluminum, magnesium, and sodium borohydride systems is driving higher efficiency in hydrogen output. Research efforts focus on improving reaction rates, lowering costs, and ensuring scalability for industrial applications. The metal hydrogen generation market benefits from these advancements, which enhance performance and broaden adoption. Continuous improvement in storage, handling, and safety standards also supports the integration of metal-based systems into mainstream energy projects.

- For instance, Hydro successfully produced 200 tons of aluminum using green hydrogen to replace natural gas in high-temperature processes at its Navarra, Spain facility in 2023, demonstrating fuel switch feasibility without compromising aluminum quality or production capacity.

Growing Government Incentives and Policy Support:

Strong regulatory frameworks and funding initiatives are boosting hydrogen infrastructure development worldwide. Incentives for renewable integration, subsidies for hydrogen-powered vehicles, and investment in pilot projects are driving adoption. The metal hydrogen generation market gains momentum through alignment with decarbonization strategies and energy independence goals. It is well-positioned to benefit from government-backed roadmaps targeting large-scale hydrogen deployment.

Expanding Industrial and Transportation Applications:

Hydrogen demand is rising in industries such as chemicals, steelmaking, and refining, where clean alternatives are needed. Transportation is another major growth driver, with fuel cell vehicles and heavy-duty applications gaining traction. The metal hydrogen generation market addresses these demands by providing reliable, on-site hydrogen generation methods. Its role in supporting both stationary and mobile applications creates strong opportunities across multiple sectors.

Market Trends:

Integration of Metal-Based Hydrogen Systems with Renewable Energy and Storage Solutions:

The metal hydrogen generation market is shaped by the growing integration of renewable energy sources into hydrogen production. Industries are increasingly exploring solar and wind power to activate metal-water reactions for on-demand hydrogen. This trend supports grid balancing and energy storage, making hydrogen a key component of flexible power systems. Companies are also investing in portable and modular hydrogen units to supply remote or off-grid locations. It is gaining traction in distributed energy networks where real-time supply and reliability are critical. Such integration enhances the role of hydrogen as both a clean fuel and an energy storage medium.

- For instance, H2 Green Steel in Sweden operates a 700 MW electrolyzer to produce hydrogen for green steel production using renewable energy, supporting up to 4 million tonnes of crude steel annually.

Rising Focus on Transportation, Industrial Applications, and Safety Advancements:

The transportation sector is driving demand for metal-based hydrogen generation, with fuel cell vehicles and heavy-duty trucks requiring scalable solutions. Industrial sectors such as steel, chemicals, and refineries are adopting hydrogen to decarbonize high-emission processes. The metal hydrogen generation market is also witnessing growth in safety and efficiency innovations, with advancements in reactor designs and material handling. It benefits from continuous research into safer storage and reduced operational risks, making adoption more practical for commercial use. Partnerships between energy firms and technology developers are fueling pilot projects across major economies. These trends highlight hydrogen’s increasing role in diverse industries seeking sustainable alternatives.

- For instance, Hyundai Motor Group has pioneered hydrogen fuel cell technology since 1998 and achieved the world’s first mass production of hydrogen fuel cell vehicles in 2013.

Market Challenges Analysis:

High Production Costs and Limited Commercial Scalability:

The metal hydrogen generation market faces cost challenges that hinder its wide-scale adoption. Metal-based systems such as aluminum and magnesium often require expensive raw materials and processing steps. These costs make hydrogen generation less competitive compared to conventional methods like steam methane reforming. Limited infrastructure and lack of mass-production capacity further restrict scalability in industrial and transportation sectors. It is also constrained by high energy inputs, which affect overall efficiency and affordability. Without significant cost reduction strategies, broader commercialization remains difficult in price-sensitive markets.

Technical Limitations and Safety Concerns in Hydrogen Handling:

Hydrogen generation from metals presents technical issues related to storage, reusability, and system durability. Reactions involving metal-water systems can face inconsistencies in output and limited regeneration of raw materials. The metal hydrogen generation market is also challenged by safety concerns in handling, as hydrogen is highly flammable and requires strict standards. It is further impacted by the lack of standardized protocols for integration with existing energy infrastructure. Transportation and storage limitations slow adoption in critical applications such as mobility and large-scale industrial use. Overcoming these technical and safety barriers is essential for achieving long-term growth potential.

Market Opportunities:

Expanding Role in Renewable Energy Integration and Grid Stability:

The metal hydrogen generation market presents strong opportunities in renewable energy integration and grid management. Hydrogen generated from metals can serve as a storage medium for surplus solar and wind energy. This supports energy security while enabling reliable power during fluctuations in renewable supply. It also creates opportunities for modular, on-site hydrogen generation systems in remote or off-grid regions. Industries and utilities are exploring these solutions to reduce dependence on fossil fuels and strengthen resilience. The alignment of hydrogen generation with renewable adoption offers growth prospects in both developed and emerging economies.

Rising Adoption in Industrial and Transportation Applications:

Industrial sectors such as steel, chemicals, and refineries offer high potential for adopting metal-based hydrogen generation technologies. The metal hydrogen generation market is positioned to support clean fuel alternatives in heavy-duty transportation, including trucks, trains, and marine vessels. It provides advantages in portability and on-demand hydrogen supply, which are critical for commercial applications. Government-backed hydrogen roadmaps and funding initiatives further create room for technology deployment in mobility and industry. Partnerships between energy firms, material suppliers, and research organizations are expected to accelerate adoption. These opportunities highlight the market’s potential to become a cornerstone of the global hydrogen economy.

Market Segmentation Analysis:

By Source:

The metal hydrogen generation market by source includes aluminum, magnesium, sodium borohydride, and other reactive metals. Aluminum holds significant potential due to its high reactivity with water and widespread availability. Magnesium is gaining traction for its lightweight properties and energy density, making it suitable for portable systems. Sodium borohydride is valued for controlled hydrogen release, supporting industrial and defense applications. It is expected that innovation in recycling and regeneration of metals will strengthen adoption across sources.

- For instance, Norsk Hydro ASA produced the world’s first batch of recycled aluminum using green hydrogen as an energy source in 2023, successfully operating a casthouse at its Navarra, Spain extrusion plant to produce a test batch of aluminum with no reported quality loss

By Technology:

Key technologies in the market include hydrolysis-based processes, thermochemical methods, and hybrid approaches. Hydrolysis dominates due to its ability to generate hydrogen directly from metal-water reactions without complex equipment. Thermochemical methods are advancing with research into high-temperature processes that improve efficiency and scalability. Hybrid systems combining chemical and thermal pathways are emerging to enhance control and output. The metal hydrogen generation market benefits from these advancements, which expand its industrial and commercial use.

- For instance, Iberdrola’s Puertollano plant in Spain employs a hydrolysis process via electrolysis powered by a 100 MW photovoltaic solar plant, producing hydrogen at a rate of 360 kg/hour with a 20 MW electrolysis system running at 30 bar pressure.

By Application:

Applications include transportation, power generation, industrial processes, and portable energy systems. Transportation is a fast-growing segment, with metal-based hydrogen supporting fuel cell vehicles and heavy-duty mobility. Industrial use in steel, chemicals, and refineries provides steady demand for clean hydrogen alternatives. Power generation and storage systems rely on metal-based units for distributed and backup energy supply. It is well-positioned to meet the needs of diverse sectors seeking reliable and sustainable hydrogen solutions.

Segmentations:

By Source:

- Aluminum

- Magnesium

- Sodium Borohydride

- Other Reactive Metals

By Technology:

- Hydrolysis-Based Processes

- Thermochemical Methods

- Hybrid Systems

By Application:

- Transportation

- Power Generation

- Industrial Processes

- Portable Energy Systems

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America held 34% market share in 2024, supported by large-scale hydrogen infrastructure investments. The United States leads with government-backed initiatives, strong R&D networks, and funding for pilot projects. Canada is advancing clean hydrogen strategies that align with its carbon neutrality goals. The metal hydrogen generation market in this region benefits from collaboration between technology developers and energy firms. It is further supported by the demand for hydrogen in mobility and industrial applications. Regulatory frameworks and tax incentives strengthen commercialization efforts across both transportation and power sectors.

Europe:

Europe accounted for 29% market share in 2024, driven by strict decarbonization targets and industry-wide hydrogen adoption. Germany, France, and the U.K. are leading hydrogen integration into steel, chemical, and transport industries. The European Union supports large-scale projects through funding mechanisms and strategic partnerships. The metal hydrogen generation market here is gaining momentum with a strong focus on renewable integration and sustainable fuel adoption. It is also supported by the presence of advanced manufacturing and research infrastructure. Growing industrial investments and mobility initiatives will expand hydrogen’s role in Europe’s energy transition.

Asia-Pacific:

Asia-Pacific captured 25% market share in 2024, making it the fastest-growing regional segment. China, Japan, and South Korea are investing heavily in hydrogen-powered vehicles and renewable integration. India is also promoting hydrogen adoption through its national energy mission. The metal hydrogen generation market in Asia-Pacific is supported by both government policies and private investments. It is expected to grow with rising industrialization and demand for clean fuels in mobility and manufacturing. Regional collaboration between public and private stakeholders is creating large-scale opportunities. Infrastructure expansion and strong energy demand position Asia-Pacific as a leading hub for hydrogen deployment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Praxair Inc. (US)

- Air Products and Chemicals Inc. (US)

- Air Liquide S.A. (France)

- Hydrogenics (Canada)

- Iwatani (Japan)

- Messer Group (Germany)

- Linde (US)

- Plug Power (US)

- Showa Denko (Japan)

- Ballard Power systems (Canada)

Competitive Analysis:

The metal hydrogen generation market is highly competitive, with leading companies focusing on innovation, partnerships, and scalability. Key players include Praxair Inc. (US), Air Products and Chemicals Inc. (US), Air Liquide S.A. (France), Hydrogenics (Canada), Iwatani (Japan), Messer Group (Germany), and Linde (US). These companies are investing in advanced hydrogen production systems, emphasizing efficiency, safety, and integration with renewable energy. It is driven by rising demand in industrial, transportation, and energy storage applications, which pushes players to expand their technological capabilities. Strategic collaborations with governments and research institutions support infrastructure growth and accelerate commercialization. Regional expansions and targeted investments in pilot projects also strengthen market presence. Competition is defined by cost optimization, product reliability, and alignment with global decarbonization goals.

Recent Developments:

- In August 2025 , Air Liquide announced the signing of an agreement to acquire DIG Airgas, a leading integrated gas player in South Korea, in a €2.85 billion deal expected to close in the first half of 2026.

- In April 2025, Hyundai Motor unveiled the new XCIENT heavy-duty fuel cell truck, showcasing advanced hydrogen fuel cell technology, a sector where Hydrogenics has had involvement through fuel cell systems.

- In August 2025, Messer announced a partnership with U.S. titanium producers to support aerospace and industrial growth, focusing on hydrogen and industrial gas applications.

Report Coverage:

The research report offers an in-depth analysis based on Source, Technology, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The metal hydrogen generation market will expand with rising demand for clean fuel alternatives.

- It will benefit from government-backed hydrogen roadmaps supporting industrial and transportation adoption.

- Ongoing advancements in aluminum, magnesium, and borohydride systems will enhance efficiency and reliability.

- Integration with renewable energy projects will position hydrogen as a storage and balancing solution.

- The market will see increasing adoption in heavy-duty transportation, including trucks, trains, and marine vessels.

- Industrial sectors such as steel and chemicals will create consistent demand for on-site hydrogen generation.

- Safety innovations and standardized protocols will reduce barriers to large-scale deployment.

- Collaborations between energy firms and research institutions will accelerate technology commercialization.

- Developing regions will emerge as growth hubs through renewable hydrogen projects and infrastructure expansion.

- The metal hydrogen generation market will play a vital role in achieving long-term decarbonization goals.