Market Overview:

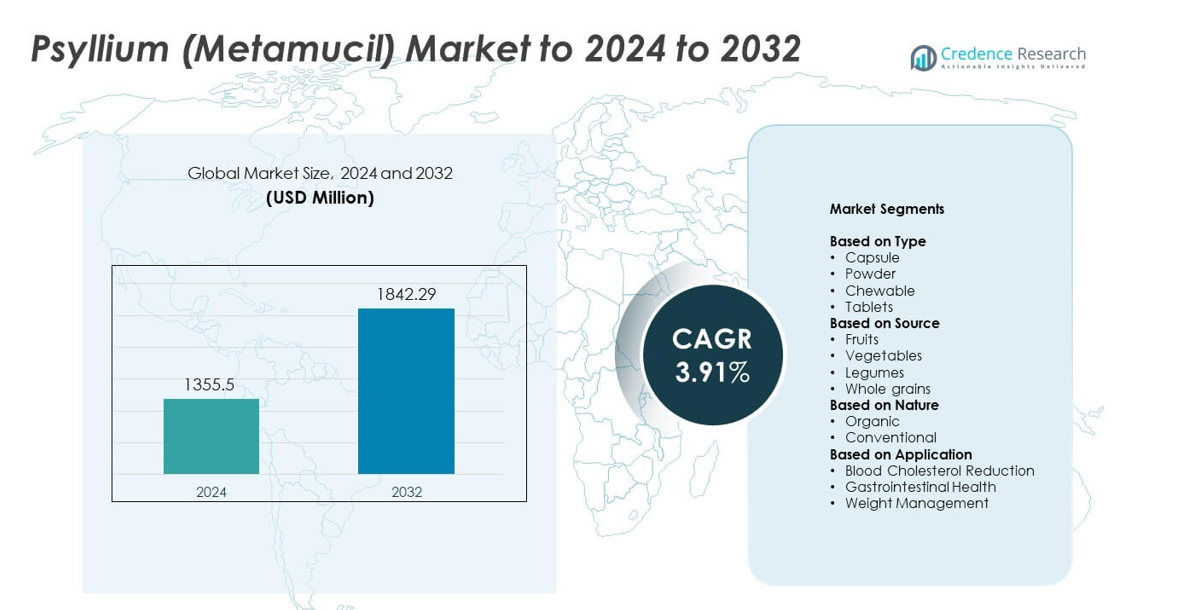

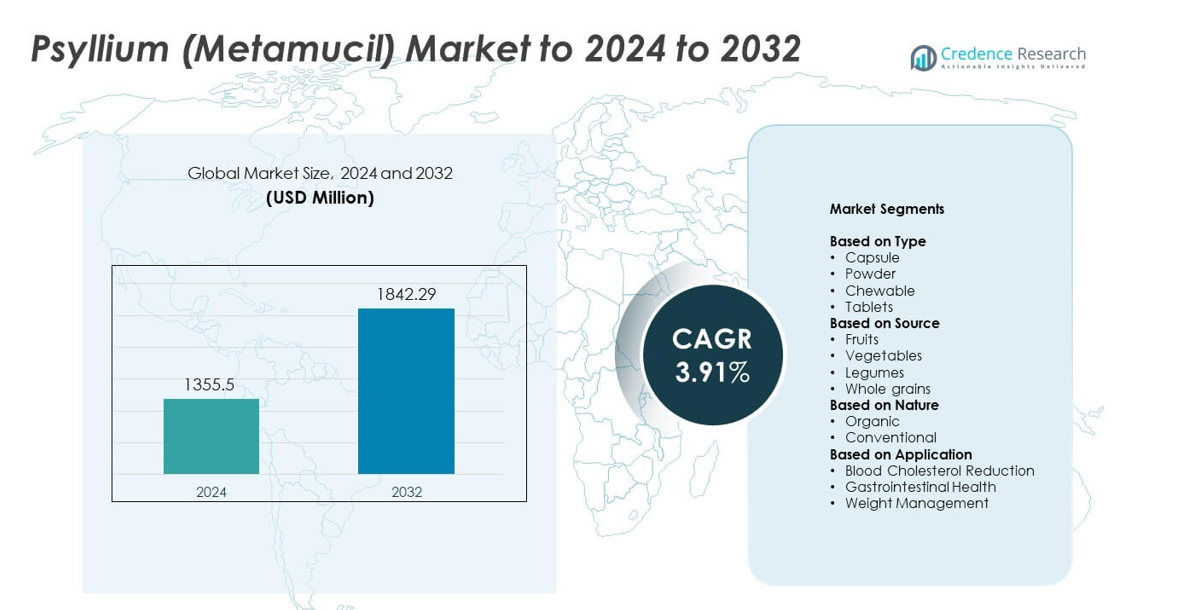

Psyllium (Metamucil) Market size was valued USD 1355.5 Million in 2024 and is anticipated to reach USD 1842.29 Million by 2032, at a CAGR of 3.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Psyllium (Metamucil) Market Size 2024 |

USD 1355.5 Million |

| Psyllium (Metamucil) Market CAGR |

3.91% |

| Psyllium (Metamucil) Market Size 2032 |

USD 1842.29 Million |

The Psyllium (Metamucil) Market features major players such as Garden of Life, Optimum Nutrition, Citrucel, SPECIES, Now, Metamucil, Renew Life, Robinson Pharma, Inc., BarnDad’s, Twinlab, Benefiber, Walgreens, and Myogenix. These companies strengthened their presence through clean-label products, expanded retail coverage, and strong digital engagement. Asia Pacific led the global market in 2024 with 31% share due to major cultivation and processing hubs, followed by North America with 34% share supported by high digestive health awareness and strong supplement adoption. Europe accounted for 28% share, driven by rising interest in natural fiber solutions and preventive wellness.

Market Insights

- Psyllium (Metamucil) Market reached USD 1355.5 Million in 2024 and is projected to hit USD 1842.29 Million by 2032, growing at a CAGR of 3.91%.

- Demand grew as consumers focused on digestive wellness, preventive health habits, and natural fiber intake across daily routines.

- Clean-label trends accelerated adoption of powder formats, with the powder segment holding about 58% share due to wider acceptance and stronger retail visibility.

- Competition intensified as global and regional brands expanded product lines, improved traceability, and strengthened e-commerce reach to capture rising fiber supplement demand.

- Asia Pacific led the market with 31% share, followed by North America at 34% and Europe at 28%, while conventional products dominated the nature segment with nearly 71% share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Powder held the dominant share in 2024 with about 58% due to its wider consumer acceptance, ease of mixing, and higher dosage flexibility. Powder products supported better digestive regulation and offered faster solubility, which helped boost daily fiber intake. Capsule and tablet formats expanded among users seeking portability, while chewable forms gained attention in younger and elderly groups. Growth across other types came from rising adoption of convenient formats that fit modern consumption habits.

- For instance, NOW Foods’ Organic Psyllium Husk Powder supplement facts panel lists 7 grams of total dietary fiber (6 grams of which is soluble fiber) in a 9-gram serving (1 level tablespoon), showing how powder formats deliver dense fiber doses per spoon.

By Source

Legumes led the source segment in 2024 with nearly 52% share because psyllium husk is derived from Plantago ovata, a legume crop widely cultivated in India. This category benefited from large-scale farming, stable supply chains, and strong export capacity. Whole grains and vegetables showed steady growth as brands blended additional natural fibers into mixes. Fruit-based variants grew at a slower pace due to limited fiber concentration compared with legume-derived psyllium.

- For instance, According to an ICRA ratings report, Satnam Psyllium Industries indeed has an installed capacity to process approximately 30 metric tons of raw psyllium seeds per day.

By Nature

Conventional products dominated the nature segment in 2024 with around 71% share, supported by large-scale farming, easier processing, and wider retail availability. Conventional psyllium offered competitive pricing and consistent supply, driving use in mass-market fiber supplements. Organic psyllium grew as health-conscious consumers sought clean-label and pesticide-free options. Expansion in organic lines continued as brands invested in certified farms and premium wellness positioning.

Key Growth Drivers

Rising Digestive Health Awareness

Consumers showed stronger interest in gut health, which pushed higher demand for natural fiber supplements. Psyllium gained traction because many people sought solutions for constipation, cholesterol control, and overall digestive comfort. Rising lifestyle disorders and sedentary habits increased the need for daily fiber intake. Retail pharmacies and online platforms amplified visibility, helping psyllium products reach broader age groups in both developed and emerging regions.

- For instance, Procter & Gamble’s Metamucil Sugar-Free Orange Smooth Powder provides 2.4 grams of soluble fiber from psyllium in each labeled serving, supporting clinical guidance that several grams of soluble fiber daily can aid digestive and heart health.

Expansion of Preventive Healthcare Consumption

Preventive healthcare adoption increased as more people aimed to avoid chronic diseases. Psyllium became a regular part of wellness routines due to its role in regulating bowel movements and supporting heart health. Doctors and nutritionists recommended psyllium for managing mild digestive issues, boosting long-term acceptance. Stronger brand communication and growing awareness of fiber deficiency helped expand repeat consumption patterns across global households.

- For instance, CVS Health reports operating roughly 9,000 retail pharmacy locations across the United States, giving preventive products such as fiber supplements nationwide shelf presence within walkable distance for many households.

Growth of Clean-Label and Natural Supplement Demand

Natural ingredients gained preference as consumers reduced reliance on synthetic laxatives. Psyllium appealed to this shift because it offered plant-based fiber with simple formulations and minimal additives. Brands promoted transparency and product purity, which supported premium positioning. Rising interest in vegan, gluten-free, and non-GMO supplements fueled steady demand across health-conscious shoppers in online and offline retail channels.

Key Trends & Opportunities

Rising Adoption in Functional Foods and Beverages

Manufacturers added psyllium to bakery mixes, cereals, nutrition bars, and beverages to boost fiber content. This broadened psyllium’s presence beyond supplements and created new revenue streams. Food companies used psyllium to enhance texture and support satiety, aligning with weight-management trends. Growing interest in fortified foods opened opportunities for expansion across mainstream grocery formats.

- For instance, Kellogg’s All-Bran Buds cereal, which includes psyllium seed husk, declares 17 grams of dietary fiber in a 45-gram half-cup serving, showing how mainstream breakfast products embed high fiber loads for daily diets.

Growth in Organic and Sustainable Farming Practices

Demand for organic psyllium increased as consumers prioritized transparency and chemical-free production. Brands invested in certified farms and traceable supply chains to meet rising expectations. Sustainable farming practices helped protect soil quality and supported premium price positioning. This trend created new opportunities for exporters, especially in countries shifting toward eco-friendly agriculture.

- For instance, Two Brothers Organic Farms in India reports training over 20,000 farmersand helping convert over 1,000 acres to certified organic and regenerative land, evidencing the rapid expansion of sustainable cultivation models.

Expansion Through Digital Retail and DTC Brands

Online platforms boosted accessibility by offering quick delivery, subscription models, and product comparisons. Direct-to-consumer brands used targeted marketing to reach younger audiences seeking natural gut-health solutions. Digital visibility helped smaller brands compete with established players and expand into global markets. Growing online education about fiber needs further supported long-term demand.

Key Challenges

Supply Dependence on Limited Cultivation Regions

Psyllium relies heavily on cultivation concentrated in specific regions, especially India. Any weather disruption, crop disease, or export restriction can affect global availability. Supply fluctuations lead to price instability and challenge long-term planning for manufacturers. Limited production clusters also create risks for companies that depend on consistent quality and steady raw material flow.

Low Awareness Among New Consumers in Emerging Markets

Many consumers in developing regions remain unfamiliar with psyllium’s digestive and heart-health benefits. Limited healthcare guidance and low adoption of fiber supplements slow market penetration. Brands face challenges in educating shoppers who rely more on traditional remedies. Marketing campaigns and medical practitioner awareness remain essential to close knowledge gaps and boost long-term demand.

Regional Analysis

North America

North America held about 34% share in 2024, driven by strong demand for fiber supplements and high awareness of digestive wellness. The region saw steady use of psyllium products among adults managing constipation, cholesterol, and weight control. Retail pharmacies and online platforms supported higher penetration, while major brands expanded flavored and sugar-free variants. Rising preventive healthcare habits and strong marketing campaigns helped widen adoption across age groups. The United States remained the largest market due to higher disposable incomes and greater acceptance of natural health products.

Europe

Europe accounted for nearly 28% share in 2024, supported by rising preference for plant-based and natural digestive aids. Consumers shifted toward high-fiber diets as part of broader wellness trends, boosting psyllium use across supplements and functional foods. Retailers expanded shelf space for fiber powders and capsules, while regional regulations encouraged clean-label product adoption. Germany, the United Kingdom, and France led market demand due to strong awareness and established distribution networks. Growing interest in cholesterol management also contributed to consistent psyllium consumption across the region.

Asia Pacific

Asia Pacific held the largest share of about 31% in 2024, driven by strong production concentration in India and rising domestic consumption of fiber supplements. Increasing digestive disorders, urban lifestyles, and expanding health education programs encouraged higher intake of natural fiber. India dominated regional supply and usage, while China, Japan, and Southeast Asia saw rising demand through pharmacies and e-commerce. Growing investment in organic farming and export capacity boosted the region’s influence in global supply chains, strengthening both manufacturing and consumption growth.

Latin America

Latin America captured around 4% share in 2024, supported by gradual adoption of digestive health supplements and increasing awareness of fiber deficiency. Urban consumers in Brazil, Mexico, and Argentina began incorporating psyllium powders and capsules into daily routines. Expansion of retail pharmacies and online platforms improved availability across major cities. Although the market remained smaller than developed regions, rising interest in weight management and natural remedies helped drive steady growth. Local brands also promoted psyllium as an affordable and plant-based wellness option.

Middle East and Africa

Middle East and Africa accounted for about 3% share in 2024, reflecting early-stage adoption and growing health awareness. Increasing digestive concerns, rising lifestyle diseases, and higher interest in natural supplements supported gradual market expansion. Countries like the United Arab Emirates, Saudi Arabia, and South Africa saw stronger demand through modern retail and pharmacy chains. Limited consumer education and lower supplement spending slowed faster adoption, but ongoing health campaigns and wider e-commerce access continued to open new opportunities across urban populations.

Market Segmentations:

By Type

- Capsule

- Powder

- Chewable

- Tablets

By Source

- Fruits

- Vegetables

- Legumes

- Whole grains

By Nature

By Application

- Blood Cholesterol Reduction

- Gastrointestinal Health

- Weight Management

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Psyllium (Metamucil) Market includes leading brands such as Garden of Life, Optimum Nutrition, Citrucel, SPECIES, Now, Metamucil, Renew Life, Robinson Pharma, Inc., BarnDad’s, Twinlab, Benefiber, Walgreens, and Myogenix. Companies focused on expanding their psyllium-based product lines through flavored powders, sugar-free mixes, capsules, and convenient portable formats. Many brands strengthened their supply reliability by partnering with certified growers and improving raw material traceability. Firms also invested in clean-label formulations to meet rising demand for natural digestive health solutions. Marketing strategies increasingly targeted gut health, heart health, and weight management benefits to attract diverse consumer groups. E-commerce growth supported wider reach, allowing companies to scale through subscription programs and online education. Competition intensified as both legacy supplement manufacturers and new wellness entrants sought stronger positioning within the rapidly expanding fiber supplement category.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Garden of Life

- Optimum Nutrition

- Citrucel

- SPECIES

- Now

- Metamucil

- Renew Life

- Robinson Pharma, Inc.

- BarnDad’s

- Twinlab

- Benefiber

- Walgreens

- Myogenix

Recent Developments

- In 2025, Robinson Pharma, Inc. expanded its manufacturing capabilities significantly, adding 10 new softgel machines to increase its production of softgel capsules, tablets, capsules, liquids, and gummies for nutraceuticals including fiber supplements.

- In 2025, Benefiber (Haleon) launched new products in Canada designed to “ease fiber consumption,” expanding formats such as stick packs for easier daily prebiotic fiber intake.

- In 2022, Metamucil continued to emphasize the multihealth benefits of its psyllium fiber, focusing on cholesterol reduction, digestive health, and blood sugar level maintenance, while occasionally releasing limited-edition or regional flavors of its powder format.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Nature, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Psyllium demand will grow as digestive health awareness continues to rise worldwide.

- Preventive wellness habits will push higher daily use of fiber supplements.

- Organic psyllium will expand as consumers prefer clean-label and chemical-free products.

- Functional food makers will adopt more psyllium for fiber enrichment across product lines.

- Digital retail and subscription models will strengthen repeat purchases.

- Brands will invest in taste-improved and easy-mix formulations to boost acceptance.

- Research on heart health and glycemic control will support broader medical recommendations.

- Supply chain upgrades will focus on stable sourcing and better crop traceability.

- Emerging markets will see faster adoption as awareness programs increase.

- Competition will intensify as new wellness brands enter the fiber supplement category.