Market Overview

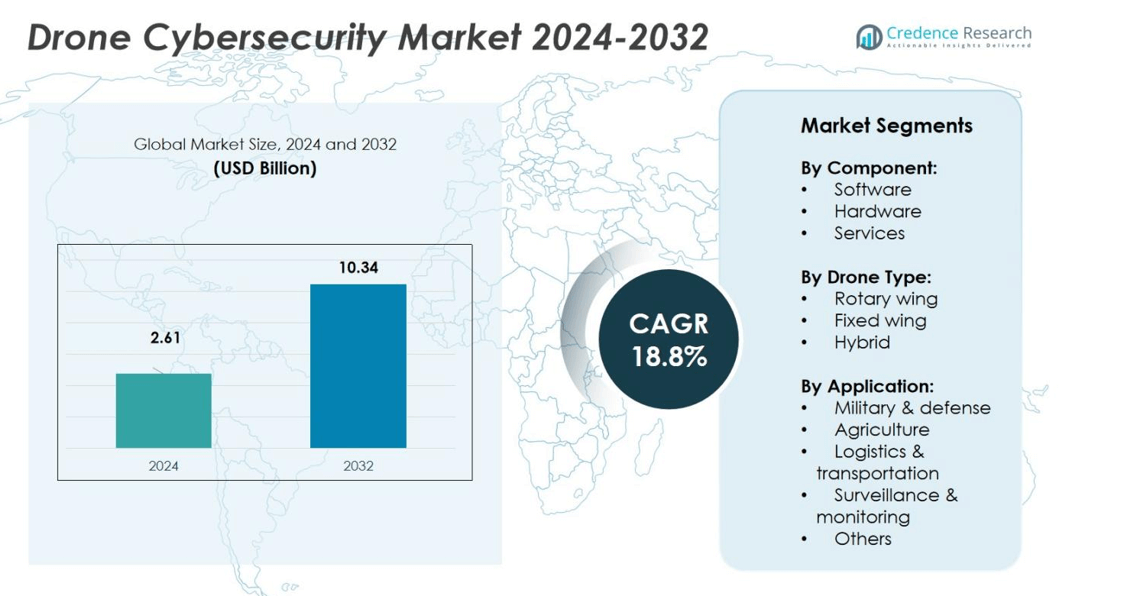

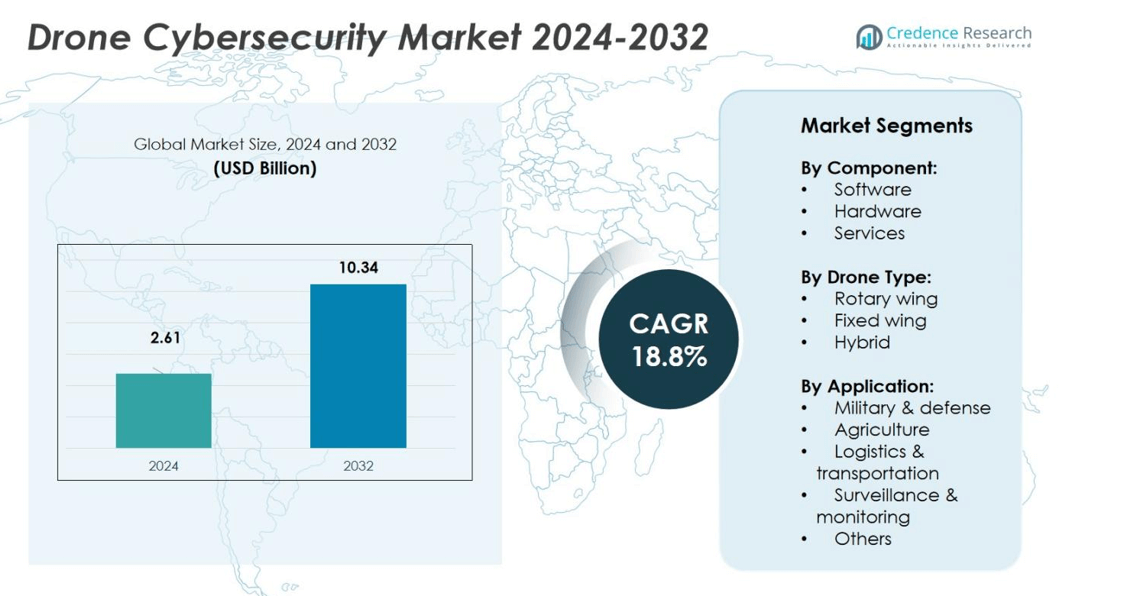

Drone Cybersecurity Market size was valued USD 2.61 Billion in 2024 and is anticipated to reach USD 10.34 Billion by 2032, at a CAGR of 18.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drone Cybersecurity Market Size 2024 |

USD 2.61 Billion |

| Drone Cybersecurity Market, CAGR |

18.8% |

| Drone Cybersecurity Market Size 2032 |

USD 10.34 Billion |

The Drone Cybersecurity Market is characterized by strong competition among major players such as 3M, Toray Industries, Hexcel Corporation, DuPont, SABIC, BASF, ArcelorMittal, Victrex, Alcoa Corporation, and Honeywell International. These companies focus on developing integrated cybersecurity solutions that enhance drone communication security, encryption, and real-time threat detection. Strategic alliances with defense and aerospace agencies drive advancements in AI-based intrusion prevention and blockchain-enabled data protection. North America leads the global market with a 36% share in 2024, supported by robust defense investments, advanced technological infrastructure, and stringent regulatory frameworks that promote secure drone operations across both commercial and military applications.

Market Insights

- The Drone Cybersecurity Market was valued at USD 2.61 Billion in 2024 and is projected to reach USD 10.34 Billion by 2032, growing at a CAGR of 18.8%.

- Rising drone adoption in defense, logistics, and surveillance applications drives demand for advanced cybersecurity solutions to secure communication and data systems.

- The market trends highlight increasing integration of AI, blockchain, and quantum encryption for real-time threat detection and secure drone operations.

- Key players such as 3M, Toray Industries, DuPont, SABIC, and Honeywell International focus on R&D, partnerships, and regulatory compliance to expand market presence.

- North America leads with a 36% share, followed by Europe with 28% and Asia-Pacific with 25%, while the software segment dominates the market with 52% share in 2024 due to growing demand for encryption and real-time monitoring solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

Software dominates the drone cybersecurity market with a 52% share in 2024, driven by the need for real-time threat detection, encryption, and secure communication protocols. Software solutions enable autonomous drones to identify, analyze, and mitigate cyberattacks instantly through AI-driven analytics and machine learning algorithms. For instance, companies integrate advanced firmware protection and network firewalls to prevent GPS spoofing and data breaches. The rising demand for cloud-based monitoring and cybersecurity-as-a-service platforms further boosts adoption across both commercial and defense drone operations.

- For instance, Fortress Information Security provides a platform for managing the cybersecurity of assets and software within critical infrastructure supply chains, including uncrewed aerial systems (UAS or drones), to help organizations meet defense-grade operational and regulatory standards.

By Drone Type

Rotary-wing drones hold the leading 58% market share in 2024, supported by their widespread use in surveillance, logistics, and agricultural monitoring. Their continuous flight capability and vertical takeoff features make them more prone to cybersecurity vulnerabilities, creating strong demand for secure control systems and encrypted communication links. Manufacturers deploy AI-enabled intrusion prevention and endpoint security systems for rotary models to safeguard flight control data. The expanding use of rotary-wing drones in defense and urban delivery operations accelerates cybersecurity investments in this sub-segment.

- For instance, DJI’s Matrice 300 RTK employs AES-256 encryption and Trusted Execution Environment (TEE) technology to secure flight data and user information. The drone platform supports offline updates and local data mode to enhance operational security, with over 15,000 units deployed worldwide for public safety and industrial monitoring applications.

By Application

Military and defense applications dominate with a 47% share in 2024, due to the critical need to protect mission-sensitive data and ensure operational integrity. Armed forces increasingly rely on encrypted communication systems, secure command-and-control (C2) links, and blockchain-based authentication to prevent signal jamming and data interception. Cyber threats such as spoofing and malware infiltration have prompted defense agencies to adopt layered cybersecurity solutions. Growing use of unmanned aerial vehicles (UAVs) in reconnaissance, border surveillance, and combat missions continues to strengthen cybersecurity integration across this segment.

Key Growth Drivers

Rising Drone Adoption Across Commercial and Defense Sectors

The increasing use of drones across logistics, agriculture, surveillance, and defense sectors is driving demand for robust cybersecurity systems. Military drones require secure communication and navigation to prevent data interception and mission compromise. Similarly, commercial drones used for mapping, delivery, and inspection need encrypted networks for data transfer. The growing reliance on drones for real-time intelligence and delivery operations encourages manufacturers to integrate end-to-end encryption and secure command links, making cybersecurity a key differentiator in system reliability.

- For instance,Pantherun integrates AES encryption directly into drone controllers, enabling encryption and decryption cycles within 5 milliseconds, thus preventing real-time command hijacking in industrial drones.

Increasing Incidents of Drone-Related Cyber Threats

Cyberattacks on drones have become more frequent, targeting GPS signals, flight data, and communication systems. Hackers exploit unprotected links to hijack drones or disrupt their missions. In response, companies are developing stronger firmware, intrusion detection systems, and encrypted protocols. The growing awareness among drone operators about security vulnerabilities also contributes to higher adoption of cybersecurity measures. This rise in threat intensity drives innovation and deployment of advanced defense technologies for unmanned systems globally.

- For instance, Fortem Technologies deploys radar-based drone detection systems capable of scanning airspace continuously with coverage of up to 15 kilometers, enabling the interception of unauthorized drones before they can breach secure zones

Technological Advancements in Encryption and AI-Based Security

Artificial intelligence and advanced encryption technologies are transforming drone cybersecurity. AI-driven systems detect anomalies and respond to threats in real time, while machine learning enhances predictive threat analysis. Blockchain solutions provide tamper-proof transaction records between drones and control stations, ensuring transparency. Manufacturers are also adopting quantum-resistant cryptography to future-proof data security. These technological improvements enhance system resilience and promote the development of intelligent, adaptive cybersecurity frameworks for both defense and commercial drone applications.

Key Trends & Opportunities

Integration of Blockchain and Decentralized Security Networks

Blockchain technology is emerging as a key enabler of secure drone operations. It ensures transparent communication and immutable recordkeeping across drone networks. Decentralized identity verification minimizes unauthorized access while maintaining traceable mission data. Smart contracts within blockchain systems automate authentication, mission validation, and control protocols. This innovation supports secure swarm operations and fosters trust in large-scale drone deployments for surveillance, logistics, and emergency response missions.

- For instance, the DroneCrypt IFF system uses Hyperledger Fabric to manage drone identities with a blockchain capacity of processing up to 20,000 transactions per second, ensuring tamper-proof identity verification for secure urban air mobility deployments.

Expansion of Cybersecurity-as-a-Service (CaaS) Models

Cybersecurity-as-a-Service models are gaining traction as drone operators seek flexible and cost-effective protection. These cloud-based solutions provide continuous monitoring, risk detection, and automated updates for large drone fleets. CaaS platforms reduce infrastructure costs and allow remote management of cybersecurity layers. Drone manufacturers and service providers increasingly collaborate to deliver scalable subscription-based protection, creating new opportunities for recurring revenue and stronger fleet-level security across industrial and government sectors.

- For instance, DroneShield has deployed over 4,000 counter-drone devices globally, with more than 1,500 of these devices connected to its cloud-based software platform, enabling real-time threat detection and response for large drone fleets

Key Challenges

High Implementation Costs and Integration Complexity

The integration of advanced cybersecurity tools within drone systems increases both production and operational costs. Small and medium drone manufacturers often face financial barriers when adopting AI-driven or blockchain-based systems. Compatibility between hardware, communication protocols, and cloud infrastructure adds complexity to deployment. The requirement for specialized expertise in cybersecurity also limits adoption among smaller operators, slowing market expansion despite the growing threat landscape.

Lack of Standardized Regulations and Compliance Frameworks

The absence of uniform cybersecurity standards across nations creates uncertainty for drone manufacturers and operators. Regulatory inconsistencies make it difficult to design universal protection systems that meet diverse security requirements. This challenge affects international drone operations, especially in defense and commercial logistics sectors. Efforts by aviation and defense authorities to establish global cybersecurity guidelines are ongoing but fragmented, delaying cross-border deployment of secure and compliant drone systems.

Regional Analysis

North America

North America dominates the drone cybersecurity market with a 36% share in 2024, driven by strong defense investments and commercial drone adoption. The United States leads regional growth, supported by high defense spending, cybersecurity infrastructure, and the presence of key players developing AI-powered security systems. The Federal Aviation Administration (FAA) regulations also encourage compliance with cybersecurity protocols. Growing use of drones for surveillance, logistics, and law enforcement further increases demand for advanced threat detection and encryption technologies across the U.S. and Canada.

Europe

Europe holds a 28% market share in 2024, fueled by rising adoption of unmanned aerial systems for logistics, border security, and environmental monitoring. Countries such as Germany, France, and the U.K. lead the regional growth, emphasizing compliance with strict EU cybersecurity regulations. Collaborative defense initiatives like the European Defence Fund support research into secure drone communication systems. The expansion of commercial drone fleets and the need for standardized cybersecurity frameworks drive innovation across both public and private sectors.

Asia-Pacific

Asia-Pacific accounts for a 25% share in 2024, driven by growing drone deployment in agriculture, logistics, and defense sectors. China, Japan, and India are major contributors, investing heavily in UAV manufacturing and secure navigation systems. Increasing government support for smart city and surveillance projects accelerates adoption of secure drone communication networks. Regional startups are focusing on AI-driven cybersecurity software for drone data protection. The expanding e-commerce and logistics industries also push demand for secure and compliant drone operations.

Latin America

Latin America represents a 7% market share in 2024, with growing opportunities in infrastructure inspection, mining surveillance, and agriculture. Brazil and Mexico lead regional adoption, supported by government programs encouraging safe and regulated drone operations. Rising concerns about data security in cross-border drone operations promote demand for secure communication protocols. However, limited awareness of advanced cybersecurity solutions among local operators constrains rapid market growth. Partnerships between global cybersecurity firms and regional drone service providers are expected to strengthen market development.

Middle East & Africa

The Middle East & Africa region captures a 4% share in 2024, supported by rising drone usage in defense, oil and gas monitoring, and infrastructure projects. Countries like the UAE, Saudi Arabia, and South Africa are investing in drone surveillance systems with embedded cybersecurity measures. Government-driven smart infrastructure projects and increasing security concerns along borders accelerate demand for encrypted data communication. Although the market is in its early stages, strategic partnerships and regulatory initiatives are fostering growth and digital resilience in drone operations.

Market Segmentations:

By Component:

- Software

- Hardware

- Services

By Drone Type:

- Rotary wing

- Fixed wing

- Hybrid

By Application:

- Military & defense

- Agriculture

- Logistics & transportation

- Surveillance & monitoring

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Drone Cybersecurity Market is defined by the presence of key players such as 3M, Toray Industries, Hexcel Corporation, DuPont, SABIC, BASF, ArcelorMittal, Victrex, Alcoa Corporation, and Honeywell International. These companies focus on developing integrated hardware and software solutions that enhance drone communication security, data encryption, and real-time threat monitoring. Strategic collaborations with defense agencies and drone manufacturers drive innovation in anti-hacking technologies and AI-enabled threat detection systems. Market leaders emphasize the use of blockchain, quantum encryption, and intrusion prevention to strengthen drone data integrity. Continuous investments in R&D, regulatory compliance, and cloud-based security platforms enable these players to expand global presence. The competition remains intense, with firms pursuing mergers, product diversification, and partnerships to capture opportunities in commercial, military, and industrial drone applications worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2024, Axon announced the acquisition of Dedrone, aiming to enhance public safety and accelerate the development of advanced drone security solutions.

- In Jul 2024, Thales and Garuda Aerospace have signed an MoU to promote secure drone operations and innovation in India, focusing on UTM solutions, UAV detection, and system integration.

- In October 2025, Mobilicom Limited launched Secured Autonomy™, recognized as the industry’s first full-scale cybersecurity framework designed for autonomous drones and robotics, offering advanced protection across communication and control systems.

- In August 2025, DroneShield Ltd. deployed its next-generation counter-UAS technology during the multinational defense exercise “Project FlyTrap,” showcasing enhanced cyber-electromagnetic security capabilities for drone detection and neutralization.

Report Coverage

The research report offers an in-depth analysis based on Component, Drone Type, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for AI-driven drone cybersecurity systems will continue to rise across industries.

- Governments will implement stricter cybersecurity regulations for drone operations and data protection.

- Defense and surveillance applications will remain the largest consumers of advanced drone security solutions.

- Blockchain integration will enhance transparency and authentication in drone communication networks.

- Cloud-based cybersecurity platforms will gain traction for fleet-level monitoring and threat response.

- The expansion of commercial drone delivery and logistics will increase the need for real-time data protection.

- Partnerships between cybersecurity firms and drone manufacturers will strengthen solution portfolios.

- Quantum encryption and zero-trust frameworks will emerge as key technologies in drone security.

- Asia-Pacific will witness rapid adoption due to growing smart city and defense initiatives.

- Continuous innovation and compliance with global standards will define long-term market competitiveness.