Market Overview

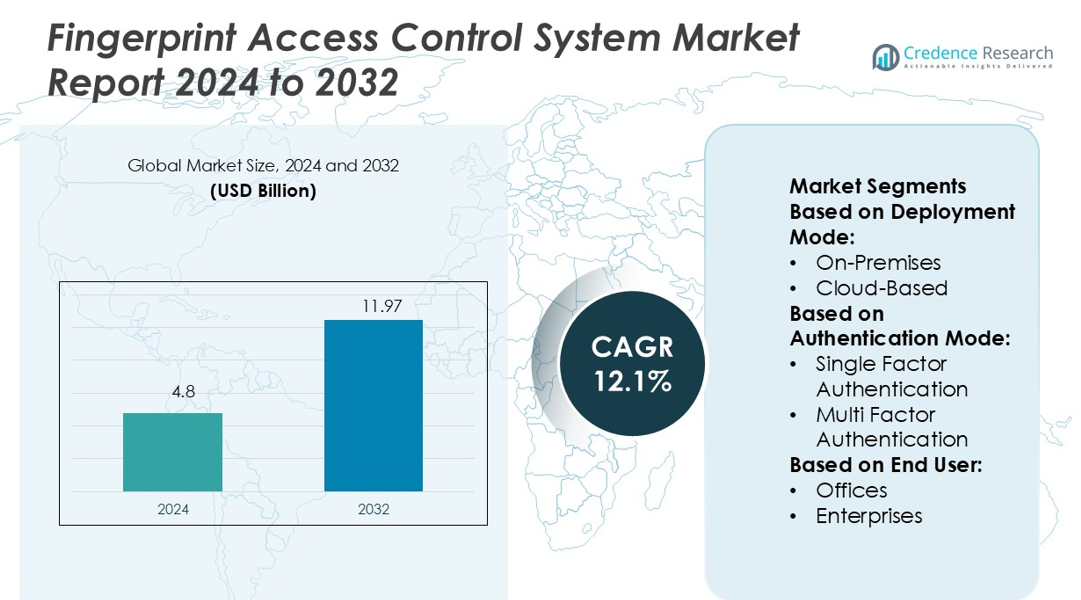

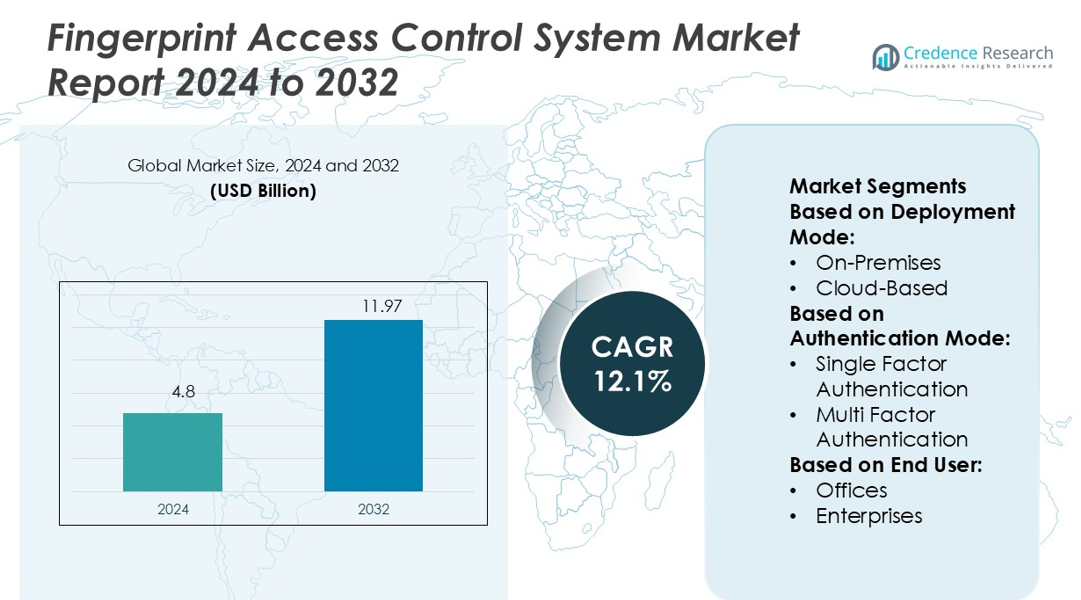

Fingerprint Access Control System Market Report size was valued USD 4.8 billion in 2024 and is anticipated to reach USD 11.97 billion by 2032, at a CAGR of 12.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fingerprint Access Control System Market Size 2024 |

USD 4.8 billion |

| Fingerprint Access Control System Market, CAGR |

12.1% |

| Fingerprint Access Control System Market Size 2032 |

USD 11.97 billion |

The fingerprint access control system market is driven by top players including Johnson Controls Inc., Suprema Inc., HID Global Corporation, UNIONCOMMUNITY Co., Ltd, BOSCH Security, NEC Corporation, IDEMIA, 3M Cogent, Inc., Hitachi, Ltd., and Matrix Systems. These companies focus on developing advanced biometric technologies, integrating AI, cloud platforms, and contactless solutions to enhance speed, accuracy, and security. Strategic initiatives such as partnerships, product innovation, and global expansion strengthen their market presence. North America leads the market with a 36.8% share, supported by strong security infrastructure, early technology adoption, and increasing deployment in commercial, residential, and government sectors. This regional dominance highlights the region’s pivotal role in driving technological advancements and market growth.

Market Insights

- The fingerprint access control system market was valued at USD 4.8 billion in 2024 and is projected to reach USD 11.97 billion by 2032, growing at a CAGR of 12.1%.

- Growing security concerns and rapid adoption of AI-enabled biometric solutions are key drivers, supported by increasing deployment across commercial, residential, and government facilities.

- Integration of cloud-based platforms, contactless authentication, and IoT-driven access control is shaping market trends, enhancing speed, flexibility, and operational efficiency.

- The competitive landscape is dominated by leading players focusing on product innovation, partnerships, and global expansion to strengthen their market positions.

- North America leads with a 36.8% regional share, followed by Europe and Asia Pacific, while cloud-based deployment holds the largest segment share, reflecting rising demand for scalable and secure authentication solutions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment Mode

The on-premises segment leads the fingerprint access control system market with a 51.2% share. Enterprises prefer on-premises solutions for full control over security infrastructure and data privacy. This model enables direct hardware integration, reducing reliance on third-party networks. Organizations in sectors like finance and defense deploy on-premises systems to meet strict regulatory standards. High reliability and low latency make this deployment ideal for critical access points. Increased investments in advanced biometric infrastructure further strengthen the segment’s dominance.

- For instance, Johnson Controls’ iSTAR G2 door controller supports up to 1,000,000 cardholders in local memory, ensuring on-site management without cloud dependency.

By Authentication Mode

Single-factor authentication currently dominates the market with a 57.4% share due to its simplicity and cost efficiency. Fingerprint scanning provides quick identity verification, making it suitable for small and medium facilities. This method requires minimal infrastructure and supports faster throughput at entry points. It is widely adopted in corporate offices, residential buildings, and education institutions. While multi-factor authentication adoption is rising, single-factor solutions remain the preferred choice for organizations prioritizing convenience and low implementation costs.

- For instance, Suprema’s BioEntry P2 compact fingerprint terminal uses a 1.0 GHz CPU and its internal algorithm supports a matching speed of 10,000 matches per second. It can register and authenticate up to 10,000 users, store 1,000,000 text event logs, and support both 125 kHz and 13.56 MHz RFID standards along with OSDP V2 interface for interoperable integration.

By End User

The commercial segment holds the largest market share at 43.8%, driven by demand from offices and enterprises. Companies deploy fingerprint access systems to secure workspaces, manage employee entry, and reduce unauthorized access. High footfall in commercial buildings increases the need for fast, reliable, and tamper-resistant authentication methods. Fingerprint systems offer real-time access logs, helping enhance operational security and compliance. Growing investments in smart office infrastructure are also supporting this segment’s leadership in the market.

Key Growth Drivers

Rising Demand for Secure Authentication

The growing focus on enhanced security across residential and commercial sectors is driving fingerprint access control adoption. These systems provide high accuracy, fast authentication, and reduced risk of unauthorized entry. Governments and enterprises are increasingly deploying biometric systems to protect critical infrastructure. Their integration into smart buildings and offices further boosts demand. Advanced algorithms and AI-backed sensors improve identification accuracy and response time, strengthening the market’s growth momentum. Continuous investments in biometric R&D enhance security standards and user convenience.

- For instance, HID’s Signo Biometric Reader 25B uses a patented multispectral sensor that captures fingerprint data from both skin surface and subdermal layers to maintain high match reliability even on wet or dry fingers.

Rapid Expansion of Smart Infrastructure

Smart city initiatives are accelerating the adoption of fingerprint access control systems. Modern infrastructure projects include integrated biometric security for buildings, airports, and public facilities. These systems enable seamless access management while reducing manual verification costs. The growing penetration of IoT devices and connected technologies further supports this trend. Governments and private developers are investing in advanced security technologies to meet regulatory and safety standards. The demand for scalable and cost-efficient security solutions is expected to sustain this growth trajectory.

- For instance, UNIONCOMMUNITY’s UBio-X terminal series leverages a unified hardware platform with edge-AI capabilities. For example, the UBio-X Face Pro model is equipped with a quad-core CPU and a built-in NPU capable of up to 2.3 TOPS for on-device biometric inference.

Technological Advancements in Biometric Solutions

Recent innovations in biometric technology are enhancing system reliability and user experience. Fingerprint sensors now offer faster processing speeds, higher accuracy, and spoof detection capabilities. AI and machine learning integration improve pattern recognition and reduce error rates. Contactless fingerprint solutions are gaining traction in hygiene-sensitive environments. These advancements enable widespread deployment across sectors including healthcare, finance, and defense. Continuous product innovation by key players is expanding the application base, strengthening the market outlook over the forecast period.

Key Trends & Opportunities

Integration with Cloud-Based Platforms

Fingerprint access control systems are increasingly integrated with cloud infrastructure. Cloud deployment allows real-time monitoring, centralized access management, and remote control. Businesses benefit from lower infrastructure costs and better scalability. Advanced encryption ensures data security and compliance with global regulations. The growing adoption of hybrid work models drives demand for flexible and secure access solutions. This shift is opening new revenue streams for biometric system providers.

- For instance, Bosch’s BioEntry W2 (ARD-FPBEW2-H2), which is a re-branded Suprema BioEntry W2, supports up to 500,000 users in local memory. It integrates with Bosch AMS, BIS, and ACE systems for the centralized management and synchronization of fingerprint templates and cardholder data.

Adoption of Multi-Factor Authentication

Organizations are adopting multi-factor authentication to strengthen security layers. Combining fingerprint scanning with PIN codes, smart cards, or facial recognition reduces vulnerability to breaches. This trend is especially strong in banking, healthcare, and government sectors. Multi-factor solutions help meet strict regulatory standards and enhance user trust. Increasing cybersecurity threats are accelerating investment in layered access control systems. This approach also supports scalable deployment across large enterprise networks.

- For instance, NEC’s Bio-IDiom multimodal authentication solution combines face and iris recognition to deliver a false acceptance rate of one in 10 billion, supporting high-security use cases requiring layered biometrics.

Emergence of Contactless Biometric Solutions

The post-pandemic environment has boosted demand for contactless fingerprint technologies. These solutions reduce hygiene concerns while maintaining high accuracy. Airports, hospitals, and commercial spaces are key adopters. Contactless systems improve user throughput and operational efficiency. Vendors are investing in optical and ultrasonic sensor technologies to enhance reliability. This trend aligns with the broader shift toward touch-free security solutions, creating opportunities for innovation and expansion.

Key Challenges

High Installation and Maintenance Costs

The high cost of deploying advanced fingerprint access systems limits adoption among small enterprises. Hardware components, integration services, and periodic maintenance add to operational expenses. Many organizations face budget constraints, especially in developing regions. Cost barriers also impact large-scale upgrades to newer biometric technologies. Vendors must focus on affordable, scalable solutions to address this gap. Subscription-based models and cloud integration may help reduce upfront investments.

Data Privacy and Security Concerns

Fingerprint access control systems handle sensitive biometric data, making security breaches a critical risk. Unauthorized access or data misuse can damage user trust and create legal liabilities. Strict regulations, such as GDPR, increase compliance complexity for vendors. Ensuring end-to-end encryption and secure storage remains a challenge. Enterprises must balance convenience with data protection standards. Addressing these concerns is essential for broader market acceptance and sustained growth.

Regional Analysis

North America

North America holds a 36.8% market share in the fingerprint access control system market. The region benefits from strong investments in advanced security infrastructure across government, enterprise, and healthcare facilities. The U.S. leads adoption due to early technology integration, high security standards, and growing demand for contactless authentication. Increasing deployment in airports, corporate campuses, and defense installations further boosts growth. Major vendors are expanding their product portfolios with AI-powered fingerprint sensors and cloud-based platforms. The region’s focus on cybersecurity compliance and workforce access management strengthens its leadership in the global market.

Europe

Europe accounts for 27.5% of the market share, supported by strict data protection regulations and widespread use of biometric technologies. Countries such as Germany, the U.K., and France are key contributors to adoption in government, commercial, and residential sectors. EU’s emphasis on GDPR compliance drives demand for secure and encrypted access control systems. The region also sees rising investments in smart building projects and public infrastructure modernization. Fingerprint systems integrated with multi-factor authentication are gaining traction. Continuous upgrades to access management solutions reinforce Europe’s position as a significant market for biometric security technologies.

Asia Pacific

Asia Pacific captures a 28.6% market share, driven by rapid urbanization, strong government initiatives, and expanding smart city projects. China, Japan, South Korea, and India lead adoption with large-scale deployments in airports, transportation hubs, and public infrastructure. Increasing awareness of security threats and rising investments in digital transformation support market expansion. Enterprises are embracing AI-enabled and contactless fingerprint solutions to enhance efficiency and compliance. Local and international vendors are focusing on cost-effective and scalable solutions, which strengthens the region’s role as a key growth engine in the global fingerprint access control system market.

Latin America

Latin America represents a 4.1% market share, with growing adoption of biometric access solutions in commercial and public sectors. Brazil and Mexico lead regional growth due to rising security concerns and infrastructure modernization initiatives. The region is witnessing increased deployment in banking, education, and transportation sectors. Government-backed safety regulations are encouraging companies to adopt advanced access control systems. Limited budget allocations remain a challenge, but cloud-based and subscription models are improving affordability. The expanding presence of international vendors is expected to accelerate the adoption of fingerprint authentication technologies in the coming years.

Middle East & Africa

The Middle East & Africa holds a 3.0% market share, supported by growing investment in critical infrastructure and public security. Countries such as the UAE, Saudi Arabia, and South Africa are adopting fingerprint access systems in airports, government offices, and commercial complexes. Smart city initiatives and national ID programs are strengthening biometric integration. The region is gradually shifting from traditional keycard systems to AI-enabled fingerprint solutions. While high upfront costs pose barriers, rising security awareness and government-led modernization are driving steady growth. Strategic partnerships with global vendors are further enhancing technological adoption in the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Deployment Mode:

By Authentication Mode:

- Single Factor Authentication

- Multi Factor Authentication

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the fingerprint access control system market is shaped by key players such as Johnson Controls Inc., Suprema Inc., HID Global Corporation, UNIONCOMMUNITY Co., Ltd, BOSCH Security, NEC Corporation, IDEMIA, 3M Cogent, Inc., Hitachi, Ltd., and Matrix Systems. The fingerprint access control system market is characterized by strong competition and rapid technological advancement. Companies are focusing on delivering faster, more accurate, and secure authentication solutions. Many vendors are investing in AI and machine learning to improve pattern recognition and reduce error rates. Cloud-based access management platforms are gaining traction, enabling remote monitoring and scalable deployment. Product differentiation through advanced sensor technology, contactless solutions, and integration with building management systems is becoming a key strategy. Partnerships, mergers, and expansion into emerging markets help strengthen market presence. Continuous innovation and compliance with data protection standards drive competitive positioning.

Key Player Analysis

Recent Developments

- In April 2025, Smart Bolt Elite, a cutting-edge smart lock tailored for the rental housing sector. This device integrates Rently’s expertise in leasing automation and smart home technology with ASSA ABLOY’s advanced SmartKey Security re-keying solution.

- In March 2025, Johnson Controls, a provider of smart, healthy, and sustainable building solutions, unveiled a series of enhancements to its Access Control And Video Surveillance (ACVS) offerings. These upgrades are designed to integrate with existing security systems, thereby improving the management of critical security operations and providing comprehensive protection for people, buildings, and assets.

- In January 2025, dormakaba Group, announced the expansion of its partnership with technology company Rohde & Schwarz from the airport sector to the critical infrastructure domain. The two companies have developed an innovative automated personnel screening solution designed to enhance security checks while increasing capacity and efficiency.

- In June 2023, Apple introduced significant privacy and security innovations, including major enhancements to Safari Private Browsing, which now includes advanced fingerprinting protections to prevent websites from tracking users. This update underscores Apple’s commitment to safeguarding user data through cutting-edge privacy measures.

Report Coverage

The research report offers an in-depth analysis based on Deployment Mode, Authentication Mode, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see wider adoption of AI-powered fingerprint authentication solutions.

- Contactless fingerprint systems will become a preferred choice in hygiene-sensitive environments.

- Cloud-based access control platforms will gain strong momentum across enterprises.

- Integration with IoT and smart building technologies will drive new deployments.

- Multi-factor authentication will become standard for critical infrastructure security.

- Regulatory compliance and data protection standards will shape product innovation.

- Biometric systems will expand rapidly in government, defense, and healthcare sectors.

- Cost-efficient and subscription-based models will increase adoption in small enterprises.

- Vendors will invest heavily in R&D to enhance sensor performance and reliability.

- Emerging markets will play a key role in driving future industry growth.