Market Overview

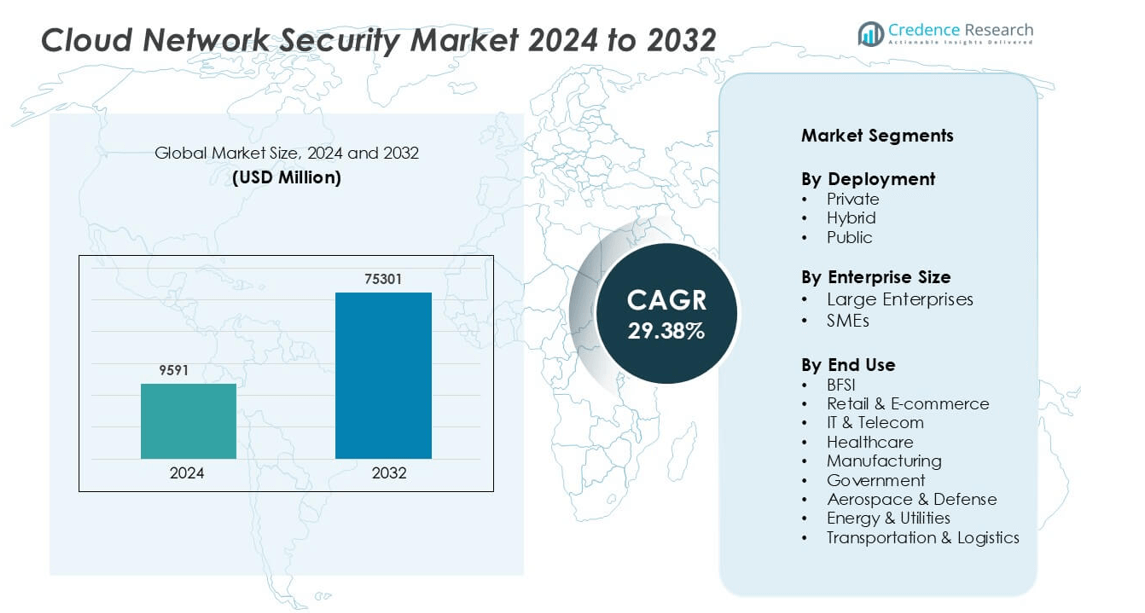

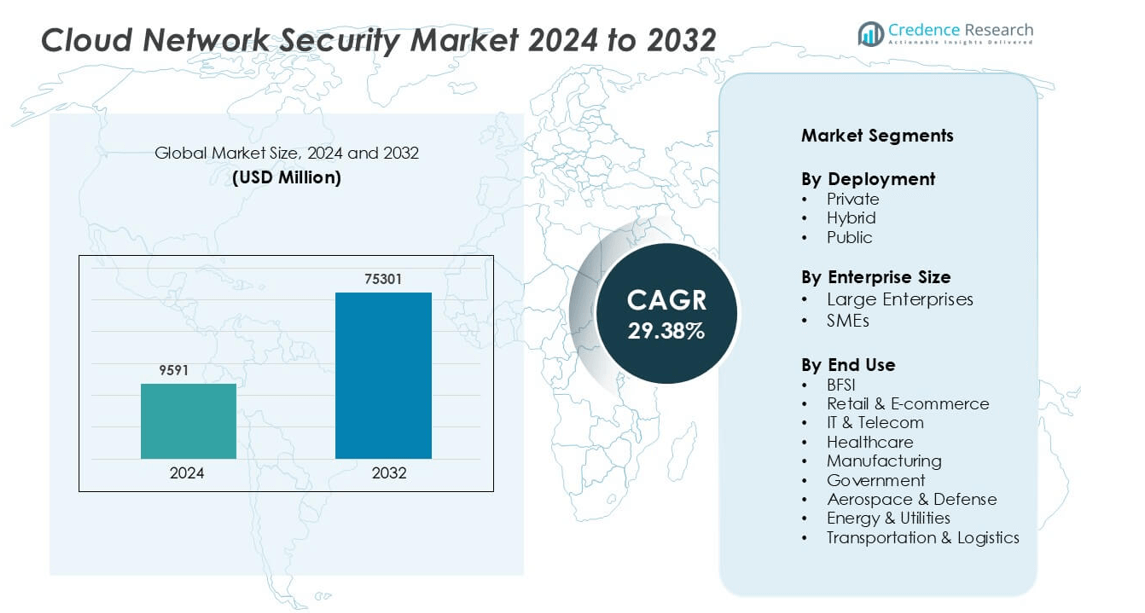

Cloud Network Security Market was valued at USD 9591 million in 2024 and is anticipated to reach USD 75301 million by 2032, growing at a CAGR of 29.38 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cloud Network Security Market Size 2024 |

USD 9591 million |

| Cloud Network Security Market, CAGR |

29.38% |

| Cloud Network Security Market Size 2032 |

USD 75301 million |

Top players in the cloud network security market include IBM Corporation, Forcepoint, Check Point Software Technologies Ltd., Extreme Networks, Imperva, Fortinet, Cisco Systems, F5, Broadcom, and Amazon Web Services. These companies compete through AI-based threat analytics, zero-trust frameworks, secure gateways, and automated monitoring tools that protect multi-cloud and hybrid environments. They also expand through partnerships with telecom operators, managed security providers, and enterprise software vendors. North America leads the global market with 38% share, supported by high cloud adoption, strict cybersecurity regulations, and strong investment in data protection across BFSI, healthcare, and government sectors.

Market Insights

- The cloud network security market is valued at USD 9591 in 2024 and is projected to reach USD 75301 by 2032 at a CAGR of 29.38%, driven by rising cloud adoption across enterprises.

- Growing cyberattacks on cloud workloads, API breaches, and ransomware incidents push organizations to deploy zero-trust models, encryption, and automated threat detection.

- AI-driven analytics, secure access service edge, and multi-cloud visibility tools are key trends as companies protect distributed networks and remote workforces.

- Competition involves IBM, Forcepoint, Fortinet, Cisco Systems, F5, Broadcom, and AWS, focusing on product innovation, managed services, and compliance-based solutions.

- North America holds 38% share as the leading region, while the public cloud segment dominates deployments due to scalability and cost advantages.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Deployment

The public cloud deployment segment holds the largest share in the cloud network security market because organizations prefer its scalability, lower upfront costs, and flexible subscription models. Public platforms allow quick deployment of firewalls, intrusion detection, and zero-trust solutions without heavy hardware investments. Businesses across IT, banking, healthcare, and retail adopt public cloud security tools to manage multi-location networks and remote workforces. The demand also grows due to rising cyberattacks on cloud workloads and the need for real-time threat detection. Vendors focus on automated patching, AI-based analytics, and policy control to reduce risks and downtime.

- For instance, Palo Alto Networks Prisma Cloud scans more than 1 trillion events each day for real-time threat detection, and the platform enforces a vast number of policy checks across more than 650 out-of-the-box policies and various compliance standards.

By Enterprise Size

Large enterprises dominate this segment and account for the highest market share due to their complex network environments and mission-critical data traffic. These companies run hybrid architectures, multi-cloud workloads, and global operations, requiring advanced cloud security to prevent breaches and ensure compliance. Large enterprises invest in automated monitoring, identity access control, and encryption to secure sensitive data. The rise of ransomware and targeted threats pushes them to adopt analytics-driven security and managed services. Vendors offer scalable solutions, central dashboards, and rapid incident response to support enterprise-level protection.

- For instance, Cisco’s SecureX platform can correlate telemetry from more than 150 integrated tools and reduces average investigation time by 77 hours through automated workflows and threat detection.

By End Use

The BFSI segment leads the market and represents the largest share, driven by strict regulatory requirements and high exposure to cyber threats. Banks, insurers, and payment service providers use cloud network security to protect customer data, payment gateways, and digital banking platforms. Demand rises as fintech adoption, online transactions, and API-based banking increase. BFSI firms rely on AI-based monitoring, encryption, and multi-factor authentication to reduce data theft and fraud risks. Vendors customize solutions for compliance, real-time visibility, and intrusion prevention, making BFSI the dominant end-use industry in this market.

Key Growth Drivers

Rising Frequency of Cyberattacks on Cloud Workloads

Growing cloud adoption increases attack surfaces across industries, pushing organizations to secure distributed networks, virtual machines, and cloud-native applications. Cybercriminals target misconfigured storage, exposed APIs, and weak identity systems, causing data theft, service disruption, and financial losses. Companies adopt cloud network security for intrusion detection, automated policy enforcement, and zero-trust architectures. Remote work and BYOD practices further expand access points, increasing the need for continuous monitoring. As enterprises move sensitive workloads to public and hybrid clouds, demand grows for AI-driven threat analytics, micro-segmentation, and multi-factor authentication. Vendors offer unified dashboards for real-time visibility, enabling faster incident response.

- For instance, CrowdStrike Falcon processes over 2 trillion security events per day using cloud-native analytics to detect threats across virtual machines and workloads.

Growing Shift Toward Multi-Cloud and Hybrid Cloud Models

Businesses use multiple cloud service providers to improve performance, cost efficiency, and resilience, but multi-cloud environments increase network complexity. Managing varied cloud endpoints, encryption standards, and traffic flows requires scalable security that works across vendors. Cloud network security platforms deliver centralized policy control, cross-cloud scanning, container security, and secure gateways. Enterprises adopt secure access service edge (SASE), cloud firewalls, and SD-WAN security to prevent lateral movement of threats. As SaaS, PaaS, and microservices expand, organizations need automated compliance, secure APIs, and real-time analytics to protect workloads. These factors accelerate market growth.

- For instance, Zscaler Zero Trust Exchange handles more than 500 billion transactions per day while inspecting encrypted traffic to stop lateral attacks across multi-cloud networks.

Regulatory Compliance and Data Protection Mandates

Regulations such as GDPR, HIPAA, PCI-DSS, and national cybersecurity acts compel enterprises to protect financial records, health data, and customer information. Cloud network security helps organizations meet audit requirements, encryption standards, and breach reporting rules. BFSI, healthcare, and government sectors invest heavily in access control, tokenization, secure tunnels, and encryption to avoid penalties and reputational damage. Vendors provide compliance dashboards, automated logs, data residency controls, and secure key management. As digital banking, telemedicine, and online public services expand, demand for compliant cloud security rises. Governments also mandate cybersecurity spending, strengthening long-term adoption.

Key Trends & Opportunities

Rapid Adoption of Zero-Trust Security Architectures

Zero-trust models assume no user or device is trustworthy until verified, which fits cloud environments with distributed workloads and remote access. Enterprises deploy identity-based segmentation, continuous authentication, and least-privilege access to reduce breaches. Cloud vendors integrate IAM, behavioral analytics, and encrypted traffic inspection to stop privilege abuse and insider threats. The shift from perimeter security to user-centric controls creates opportunities for solutions like SASE, micro-segmentation, and secure gateways. As 5G and edge computing expand, zero-trust gains further relevance for securing IoT and remote devices. This makes it one of the fastest-growing trends.

- For instance, Google BeyondCorp authenticates more than 100,000 internal users and devices without a traditional VPN, enforcing identity-based access on every request.

AI-Driven Threat Detection and Automated Security Operations

Cloud providers integrate machine learning and automation to detect anomalies, flag suspicious activity, and respond without manual intervention. Automated workflows reduce response times, prevent human error, and stop attacks before they spread. AI-driven analytics scan encrypted traffic, virtual machines, and APIs for advanced threats like ransomware and command-and-control activity. Security orchestration tools help enterprises manage policies across multi-cloud networks and enforce compliance in real time. This trend opens opportunities for vendors offering autonomous security frameworks, automated patching, and predictive analytics. Adoption increases as enterprises want faster, cost-effective security operations.

- For instance, Microsoft processes 78 trillion daily signals and uses machine learning to correlate telemetry from firewalls, endpoints, and cloud workloads.

Key Challenges

Complex Security Management in Multi-Cloud Environments

Organizations struggle to manage different firewall rules, identity policies, and encryption techniques across multiple providers. Lack of visibility across clouds makes it hard to track unauthorized access, misconfigurations, and lateral threat movement. Teams require unified dashboards, automated monitoring, and standardized controls, but many legacy tools cannot support distributed environments. Skills shortages in cloud security further increase risk. As hybrid IT stacks grow, enterprises face integration issues between on-premise systems and cloud networks. These challenges raise operational costs and slow deployment, making simplified, centralized security a critical need.

Shortage of Skilled Cybersecurity Professionals

Cloud network security requires expertise in threat analytics, identity management, compliance, DevSecOps, and API security. Many organizations lack trained staff to configure tools, detect attacks, and respond quickly. Cybersecurity workloads increase due to fast-changing threats, making manual management difficult. Without skilled teams, companies struggle with secure deployments, patching, and incident response. The talent gap affects SMEs the most, pushing them toward managed services, automation, and outsourced security operations. As demand rises faster than workforce availability, skill shortages remain a major barrier to adoption and effective defense.

Regional Analysis

North America

North America holds the largest share in the cloud network security market, accounting for nearly 35% of total revenue. High cloud adoption across BFSI, healthcare, IT, and government sectors drives continuous investment in network firewalls, zero-trust models, and AI-based threat analytics. The United States leads growth as enterprises secure multi-cloud environments and remote workforce traffic against ransomware and data breaches. Strict compliance rules and frequent cyberattacks reinforce the need for automated monitoring, identity access control, and encryption. The presence of major cloud and cybersecurity vendors further strengthens North America’s dominant market position.

Europe

Europe represents close to 25% market share, supported by strong GDPR-driven compliance requirements and cybersecurity spending across banks, telecoms, and public institutions. Countries such as Germany, the UK, and France lead adoption due to rapid digitalization and high exposure to cyberthreats. Organizations deploy cloud-based intrusion prevention, secure gateways, and encryption tools to protect sensitive data and reduce breach penalties. Growth also benefits from expanding e-commerce and fintech activity. Regional focus on data sovereignty, secure data storage, and cross-border protection continues to drive stable market demand across Europe.

Asia Pacific

Asia Pacific accounts for nearly 30% market share and remains the fastest-growing region. Rapid digital transformation in China, India, Japan, and South Korea pushes enterprises to secure cloud-native workloads, digital banking platforms, and telecom infrastructure. Increasing cyberattacks on financial services, healthcare, and e-commerce platforms fuel spending on identity security, AI-driven monitoring, and managed services. Governments support cybersecurity investment through national policies and data protection laws. Growing adoption of public and hybrid clouds, along with rising SME digitization, continues to expand the region’s share in the global market.

Middle East & Africa

The Middle East & Africa holds roughly 6% market share, driven by expanding cloud deployment in public services, oil & gas, banking, and telecom. Countries such as the UAE and Saudi Arabia lead adoption due to smart city initiatives, digital governance, and strict cybersecurity strategies. Organizations invest in cloud access control, encryption, and real-time monitoring to secure data centers and remote access platforms. Limited in-house expertise pushes enterprises toward managed security services. Continuous digital transformation and government-led cybersecurity frameworks support growing demand across the region.

Latin America

Latin America accounts for around 4% market share and is steadily expanding due to rising cloud usage in banking, retail, telecom, and logistics. Brazil and Mexico lead regional adoption as enterprises secure digital payments, e-commerce platforms, and remote workforce systems. Increasing exposure to ransomware and data breaches encourages investment in secure gateways, identity management, and intrusion detection. Many organizations lack skilled cybersecurity staff, driving reliance on managed service providers. Growing fintech activity, data privacy regulations, and cloud modernization projects continue to strengthen market penetration across Latin America.

Market Segmentations:

By Deployment

By Enterprise Size

By End Use

- BFSI

- Retail & E-commerce

- IT & Telecom

- Healthcare

- Manufacturing

- Government

- Aerospace & Defense

- Energy & Utilities

- Transportation & Logistics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the cloud network security market consists of global cybersecurity vendors, cloud service providers, and emerging specialized firms competing through advanced technology, integrated platforms, and service scalability. Companies emphasize AI-driven threat detection, zero-trust architectures, secure access service edge, automated monitoring, and encrypted traffic inspection to reduce breach risks. Leading players expand through mergers, product launches, and strategic partnerships with telecom operators, system integrators, and managed service providers. Vendors also invest in secure API gateways, identity access management, and multi-cloud visibility tools to support enterprises migrating from traditional security models. Strong competition drives continuous innovation, with providers focusing on real-time analytics, compliance automation, and centralized policy control. As cloud adoption rises across BFSI, healthcare, manufacturing, and government, demand for scalable and low-latency protection intensifies, encouraging market expansion and deeper vendor differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- IBM Corporation

- Forcepoint

- Check Point Software Technologies Ltd.

- Extreme Networks, Inc.

- Imperva

- Fortinet, Inc.

- Cisco Systems, Inc.

- F5, Inc.

- Broadcom, Inc.

- Amazon Web Services, Inc.

Recent Developments

- In August 2025, IBM Doubled default Network ACL rule limit in IBM Cloud VPC. Raised cap from 100 to 200 rules. Enables finer-grained network traffic control.

- In June 2025, Check Point Launched India-based Harmony SASE instance. Adds local data residency and compliance for Indian firms. Delivers cloud-delivered network security at scale.

- In April 2025, Forcepoint Launched Forcepoint Data Security Cloud, an AI-powered unified platform. Delivers end-to-end data visibility and control across clouds. Targets hybrid and remote work needs.

Report Coverage

The research report offers an in-depth analysis based on Deployment, Enterprise Size, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Cloud network security spending will rise as more businesses migrate workloads to multi-cloud environments.

- Zero-trust adoption will increase to protect remote users, applications, and distributed data centers.

- AI and machine learning will play a larger role in real-time threat detection and automated response.

- Secure access service edge will gain traction as enterprises combine networking and security into unified cloud-based platforms.

- Identity and access management will become a core investment, driven by rising credential-based attacks.

- Encryption and tokenization demand will grow as enterprises protect sensitive data in transit and at rest.

- Managed security services will expand due to limited in-house cyber expertise and rising operational complexity.

- Compliance automation tools will gain importance as organizations face stricter data protection and reporting rules.

- Segment growth will continue in BFSI, healthcare, telecom, and government as digital services scale.

- Vendors will invest more in API security, container protection, and cloud-native firewall capabilities.