| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mexico Feminine Hygiene Products Market Size 2023 |

USD 599.97 Million |

| Mexico Feminine Hygiene Products Market, CAGR |

5.77% |

| Mexico Feminine Hygiene Products Market Size 2032 |

USD 994.59 Million |

Market Overview:

Mexico Feminine Hygiene Products Market size was valued at USD 599.97 million in 2023 and is anticipated to reach USD 994.59 million by 2032, at a CAGR of 5.77% during the forecast period (2023-2032).

The growth of the feminine hygiene products market in Mexico is driven by multiple factors. Increased awareness about menstrual hygiene, supported by various educational campaigns, has led to a broader adoption of feminine hygiene products across different demographics. As more women become aware of the importance of proper menstrual care, the demand for sanitary products has surged. Additionally, rising disposable incomes in urban areas have enabled women to afford premium hygiene products, further fueling market growth. Another key driver is the continuous innovation in product offerings, including organic, eco-friendly, and sustainable options, which have gained traction among health-conscious and environmentally aware consumers. Government programs aimed at improving menstrual health education and facilitating better access to hygiene products, especially in underserved areas, have also played a significant role in driving market expansion.

Mexico’s feminine hygiene market exhibits a clear regional divide in terms of market penetration. Urban centers like Mexico City, Guadalajara, and Monterrey experience high demand for feminine hygiene products due to better awareness, higher disposable incomes, and greater availability of retail outlets. These metropolitan areas are where the adoption of modern hygiene products is most prominent, driven by consumer preferences for a wide range of options available in supermarkets, pharmacies, and convenience stores. In contrast, rural areas face challenges, including limited access to products and lower levels of awareness, largely due to cultural taboos surrounding menstruation. However, efforts by governmental organizations and NGOs are working to bridge this gap, improving access to hygiene products and promoting menstrual health education in these regions. As the market continues to grow, the expansion of distribution channels and targeted awareness campaigns will help foster broader acceptance and accessibility, ensuring that both urban and rural consumers benefit from improved menstrual care options.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Mexico Feminine Hygiene Products market was valued at USD 599.97 million in 2023 and is expected to reach USD 994.59 million by 2032, growing at a CAGR of 5.77% during the forecast period.

- The global feminine hygiene products market, valued at USD 23,490.00 million in 2023, is projected to reach USD 43,917.35 million by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

- Increasing awareness of menstrual health, driven by educational campaigns and government programs, is significantly contributing to market growth.

- Rising disposable incomes in urban areas are enabling women to afford premium hygiene products, including eco-friendly and organic alternatives.

- The demand for sustainable and innovative products, such as menstrual cups and organic cotton tampons, is rising due to growing health and environmental consciousness.

- Government and NGO support have been instrumental in improving menstrual health education and providing better access to hygiene products, especially in underserved regions.

- Urban areas, particularly Mexico City, Guadalajara, and Monterrey, show the highest market penetration due to better access to products and higher awareness.

- Rural areas face challenges like limited access to products and cultural taboos, but government and NGO efforts are improving product availability and education in these regions.

Market Drivers:

Increasing Awareness and Education

One of the primary drivers of growth in Mexico’s feminine hygiene products market is the increasing awareness and education surrounding menstrual health. Over the past few years, various campaigns and programs have significantly contributed to raising awareness about the importance of menstrual hygiene. For instance, the international Menstrual Hygiene Day on May 28th is widely observed in Mexico, with organizations conducting workshops and campaigns to promote healthy menstrual habits among women and girls. Educational initiatives, often supported by NGOs, government bodies, and social media influencers, have played a key role in transforming societal attitudes toward menstruation. These initiatives focus on breaking cultural taboos, providing accurate information on menstrual care, and emphasizing the importance of using hygienic products. As a result, women in Mexico are now more informed and empowered to make better choices about the menstrual products they use, driving market demand.

Rising Disposable Income

Another significant driver of the feminine hygiene products market in Mexico is the rising disposable income among women, particularly in urban areas. As the Mexican middle class grows, more women are able to afford a wider range of personal care products, including premium and specialized feminine hygiene items. This increase in purchasing power is enabling women to move beyond traditional products such as sanitary pads and tampons to more advanced, environmentally friendly options such as menstrual cups and organic cotton products. The demand for these innovative products is rising, driven by a growing desire for health-conscious and sustainable alternatives. The rise in disposable income is thus making feminine hygiene products more accessible to a larger population, which is fueling market growth.

Product Innovation and Eco-Friendly Alternatives

Product innovation is another key factor driving the growth of the feminine hygiene market in Mexico. In recent years, there has been a noticeable shift toward the development of more sustainable, eco-friendly, and organic products. Many consumers, especially younger generations, are becoming more health-conscious and environmentally aware, prompting brands to introduce innovative solutions that align with these values. For example, sanitary products now include ultra-size pads with high absorbency and special side leakage protection, catering to the needs of a growing segment of health-conscious and environmentally aware consumers. Menstrual cups, reusable sanitary pads, and organic cotton tampons are gaining popularity as consumers seek out alternatives that minimize environmental impact. This trend is further supported by the growing demand for plastic-free and biodegradable products. As the market continues to innovate, more women are becoming willing to switch from traditional products to these greener options, thus driving the overall growth of the feminine hygiene market.

Government and NGO Support

Government initiatives and support from non-governmental organizations (NGOs) have also played a crucial role in expanding the market for feminine hygiene products in Mexico. Several government programs focus on improving menstrual health literacy and ensuring that women, especially in rural areas, have access to sanitary products. These initiatives aim to address period poverty, a significant issue that affects women’s ability to afford basic menstrual products. In addition, NGOs are actively involved in raising awareness about menstrual health and advocating for better access to feminine hygiene products. Through collaboration with local governments and international organizations, these efforts have not only improved awareness but also facilitated better distribution of hygiene products in underserved areas. This support helps reduce barriers to accessing quality feminine hygiene products, contributing to the market’s expansion across the country.

Market Trends:

Shift Toward Premium and Specialized Products

In recent years, Mexican consumers have exhibited a growing preference for premium and specialized feminine hygiene products. This trend is particularly evident in urban areas, where women are increasingly seeking products that offer enhanced comfort, better absorption, and eco-friendly attributes. For instance, Articulos Higienicos, a 100% Mexican company with over 30 years of experience, manufactures and markets disposable feminine hygiene products that include options tailored for comfort and specific needs. Items such as organic cotton sanitary pads, menstrual cups, and intimate washes are gaining popularity as consumers become more health-conscious and environmentally aware. This shift reflects a broader global movement towards sustainable and health-focused personal care products.

Growth in E-Commerce and Online Retail Channels

The Mexican feminine hygiene market is experiencing a significant transformation with the rise of e-commerce and online retail channels. Platforms like Amazon and Mercado Libre are becoming increasingly popular for purchasing feminine hygiene products, offering consumers the convenience of home delivery and a wide range of product options. This shift is particularly appealing to younger demographics who are more accustomed to online shopping. The growth of online retail is also encouraging brands to enhance their digital presence and engage with consumers through targeted online marketing strategies.

Influence of Social Media and Digital Marketing

Social media platforms and digital marketing are playing a pivotal role in shaping consumer perceptions and driving demand in the Mexican feminine hygiene market. For instance, campaigns such as UNICEF Mexico’s promotion of the Oky menstrual health app have reached over 2.4 million users, with 91.9% identifying as female and 65% aged 13 to 17. Brands are leveraging influencers and online campaigns to promote awareness about menstrual health and the benefits of using quality hygiene products. This digital engagement is not only educating consumers but also fostering a sense of community and support around menstrual health issues. As a result, there is a noticeable increase in brand loyalty and consumer trust in products that are actively promoted through these channels.

Expansion of Product Availability in Retail Outlets

The availability of feminine hygiene products in various retail outlets across Mexico is expanding, making these products more accessible to a broader consumer base. Supermarkets, pharmacies, and convenience stores are increasingly stocking a diverse range of feminine hygiene products, catering to different consumer preferences and needs. This expansion is particularly beneficial for consumers in rural and underserved areas, where access to such products was previously limited. The increased product availability is contributing to the overall growth of the feminine hygiene market in Mexico, as more women are able to purchase the products they require with greater ease.

Market Challenges Analysis:

Cultural Taboos and Stigmas

One of the primary restraints in the growth of the feminine hygiene products market in Mexico is the persistence of cultural taboos and societal stigmas surrounding menstruation. In many regions, menstruation remains a sensitive topic, and there are still significant barriers to open discussions about menstrual health. These cultural stigmas can deter women, particularly in rural areas, from seeking or using feminine hygiene products, thereby limiting market penetration. Traditional beliefs may also influence the willingness to adopt newer, more sustainable products, such as menstrual cups or organic cotton products.

Limited Access in Rural Areas

Access to feminine hygiene products remains a significant challenge in rural areas of Mexico. Despite ongoing efforts to improve menstrual health awareness, women in remote regions continue to face difficulties in obtaining essential hygiene products due to poor distribution networks and limited availability in local stores. While urban areas benefit from better access and wider product offerings, rural consumers often rely on informal markets, which may not offer a comprehensive range of high-quality products. This geographical disparity hampers the overall growth potential of the market.

High Product Costs

The relatively high cost of premium and eco-friendly feminine hygiene products poses a challenge to the broader adoption of these products in Mexico. Although there is growing demand for organic, biodegradable, and reusable options, the higher price points of these products make them less accessible to low-income consumers. For instance, according to UN data poor women in Mexico often face significant challenges in accessing menstrual hygiene products and that a disproportionate amount of their income may be spent on these essential items. For many women, particularly in rural or economically disadvantaged areas, the cost barrier can deter the purchase of more sustainable alternatives, thus limiting the overall market growth in these segments.

Lack of Awareness in Underserved Communities

While awareness of menstrual health is improving, there are still gaps in knowledge, especially in underserved communities. A lack of education about the benefits of modern feminine hygiene products contributes to low adoption rates, with many women continuing to use traditional and less effective methods. Continued efforts to raise awareness and improve access to menstrual hygiene education are essential for overcoming this challenge.

Market Opportunities:

A significant market opportunity in Mexico’s feminine hygiene products sector lies in the growing demand for eco-friendly and sustainable alternatives. As consumers become more environmentally conscious, there is an increasing shift toward products such as organic cotton sanitary pads, reusable menstrual cups, and biodegradable tampons. This trend aligns with global movements toward sustainability, providing brands the opportunity to tap into the environmentally-conscious segment. The rise in awareness about the environmental impact of traditional hygiene products, coupled with the rising disposable incomes in urban areas, opens avenues for companies to introduce innovative, eco-friendly solutions. This offers an untapped market for companies that can offer sustainable, effective, and affordable alternatives to mainstream products.

Another promising opportunity lies in addressing the gap in feminine hygiene product accessibility in rural areas of Mexico. Despite progress in urban centers, rural regions continue to face significant barriers in accessing quality menstrual care products. This presents a valuable market opportunity for businesses to expand their reach through improved distribution channels, such as partnerships with local retailers and mobile vendors. Additionally, investing in educational programs that raise awareness about menstrual health can drive product adoption in underserved regions. Government and NGO initiatives, in collaboration with private companies, can further accelerate market penetration by ensuring that both urban and rural consumers have equal access to essential hygiene products. This expansion can foster greater inclusivity in the market, creating new growth prospects for brands targeting underserved demographics.

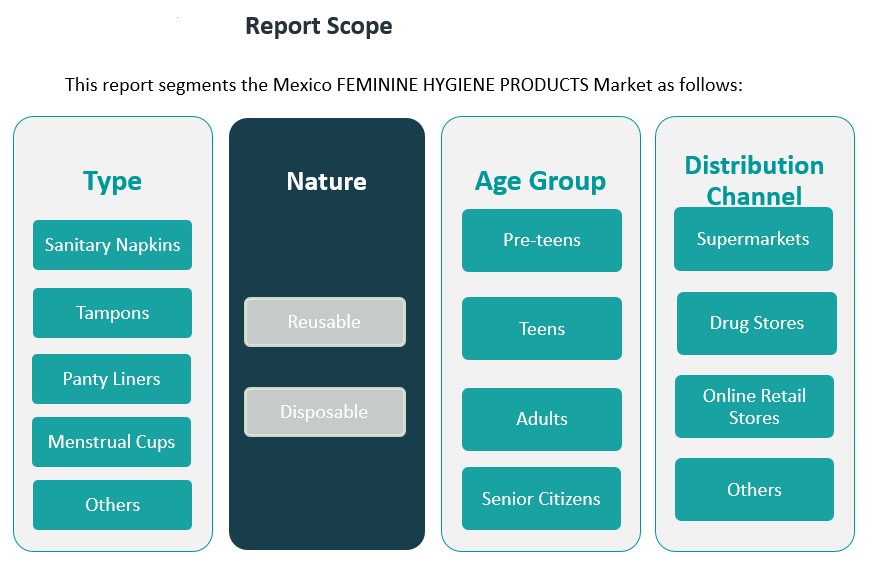

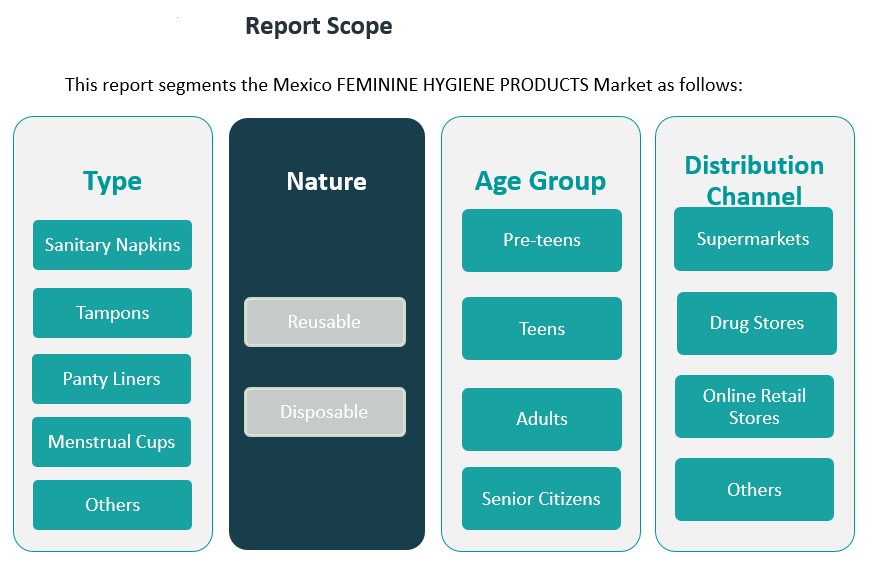

Market Segmentation Analysis:

By types the major segments include sanitary napkins, tampons, panty liners, menstrual cups, and others. Sanitary napkins dominate the market due to their widespread use and convenience, while tampons and panty liners also maintain strong demand, particularly among women seeking discrete and comfortable solutions. Menstrual cups are gaining popularity, driven by the growing trend towards eco-friendly and sustainable products. The “Others” category includes alternative products like organic cotton pads and period underwear, reflecting consumer interest in non-traditional options.

By product nature, disposable products continue to hold the largest share in Mexico’s feminine hygiene market, offering convenience and ease of use. However, reusable products such as menstrual cups and cloth pads are experiencing steady growth as more women seek environmentally friendly alternatives. This segment is driven by a shift towards sustainability and the increasing affordability and accessibility of reusable products.

By age group segmentation reveals that adults form the largest consumer base, with women in their 20s to 40s purchasing the majority of feminine hygiene products. However, growing awareness has led to an increased demand from pre-teens, teens, and even senior citizens, who are becoming more informed about their menstrual health and product options.

By distribution, supermarkets and drug stores remain the dominant sales channels, providing widespread accessibility. However, online retail stores are experiencing significant growth, especially among younger consumers who prefer the convenience and discretion of shopping online. The “Others” category includes smaller retail formats and pharmacies, which also play a role in expanding product availability.

Segmentation:

By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

By Nature

By Age-Group

- Pre-teens

- Teens

- Adults

- Senior Citizens

By Distribution Channel

- Supermarkets

- Drug Stores

- Online Retail Stores

- Others

Regional Analysis:

Mexico’s feminine hygiene products market exhibits notable regional disparities, shaped by factors such as urbanization, income levels, and cultural attitudes toward menstruation. These regional differences influence product accessibility, consumer behavior, and overall market growth dynamics. As a result, certain regions hold a larger share of the market, while others remain underdeveloped in terms of product penetration and awareness.

Urban vs. Rural Consumption Patterns

Urban regions, particularly Mexico City, Guadalajara, and Monterrey, dominate the feminine hygiene market, accounting for the majority of the market share. These areas represent roughly 60-65% of total market consumption due to higher disposable incomes, greater awareness of menstrual health, and better access to retail outlets. In urban centers, consumers tend to purchase a broad range of feminine hygiene products, including sanitary napkins, tampons, menstrual cups, and eco-friendly alternatives. Furthermore, urban consumers are more likely to shop online, enjoying the convenience and variety that digital platforms offer.

In contrast, rural areas of Mexico face significant challenges regarding access to feminine hygiene products, lower levels of awareness, and cultural taboos surrounding menstruation. These factors contribute to a much smaller share of the market, with rural areas accounting for approximately 25-30% of overall consumption. However, efforts from both governmental and non-governmental organizations to improve access to hygiene products and educate the population are gradually changing the landscape in these regions. These initiatives aim to break societal taboos and promote healthier menstrual practices, paving the way for growth in these underserved markets.

Key Player Analysis:

- Johnson & Johnson

- Procter & Gamble

- Kimberly-Clark

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Articulos Higienicos

Competitive Analysis:

The competitive landscape of Mexico’s feminine hygiene products market is characterized by the presence of both international and domestic brands. Leading global players such as Procter & Gamble (P&G), Kimberly-Clark, and Johnson & Johnson dominate the market with well-established product lines, including sanitary napkins, tampons, and panty liners. These companies benefit from strong distribution networks and brand recognition, which help them maintain a significant share of the market. Additionally, local brands are gaining traction by offering cost-effective solutions tailored to regional preferences and pricing sensitivities. Emerging players are capitalizing on the growing demand for sustainable and eco-friendly products, such as menstrual cups, organic cotton pads, and reusable items. These alternatives are gaining popularity, particularly among younger, environmentally conscious consumers. Companies focusing on innovation, product differentiation, and digital marketing are positioning themselves to capture a larger share of the market, especially in urban regions and online retail channels.

Recent Developments:

- In June 2022, hygiene and health company Essity, along with its feminine care brand Saba, extended its partnership with UNICEF in Mexico through a new three-year agreement. This collaboration, which began in 2016, aims to jointly educate and raise awareness about the importance of good hand hygiene and to break taboos surrounding menstruation. The initiative, known as “Hygiene is our Right,” focuses on promoting health, education, and gender equality among children and young people.

- In March 2025, Procter & Gamble launched Always Pocket Flexfoam, a new addition to its feminine care line, designed for portability and on-the-go protection. The launch was celebrated with a high-profile partnership at Coachella 2025, where Always and Tampax became the festival’s first-ever period care partners, providing products and on-site activations for attendees. This campaign highlights P&G’s commitment to both product innovation and experiential marketing in the feminine hygiene space.

- In July 2023, Unicharm’s subsidiary in Indonesia launched Charm Daun Sirih + Herbal Bio sanitary napkins, featuring eco-friendly materials. The company continues to innovate with products using bio-materials and is expanding its range of disposable period underwear to meet growing demand, particularly among younger consumers.

Market Concentration & Characteristics:

The Mexican feminine hygiene products market is moderately concentrated, with a few dominant players holding significant market share. Leading international brands such as Procter & Gamble, Kimberly-Clark, and Essity have established a strong presence through extensive distribution networks and brand recognition. These companies leverage their global expertise to cater to the diverse needs of Mexican consumers, offering a wide range of products including sanitary napkins, tampons, panty liners, and menstrual cups. In addition to these global giants, local manufacturers are gaining traction by providing cost-effective alternatives tailored to regional preferences. These domestic players often focus on affordability and accessibility, catering to price-sensitive segments of the population. The competitive landscape is further diversified by the emergence of niche brands emphasizing organic and eco-friendly products, responding to the growing consumer demand for sustainable options. This trend reflects a shift towards environmental consciousness and health awareness among Mexican consumers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Nature, Age-Group and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market for feminine hygiene products in Mexico is expected to see steady growth due to increasing awareness of menstrual health.

- The demand for eco-friendly and sustainable products like menstrual cups and organic cotton pads will continue to rise.

- Digital and online retail channels will gain more prominence, especially among younger, tech-savvy consumers.

- More local brands will emerge to cater to price-sensitive consumers, expanding accessibility in rural areas.

- Urbanization and rising disposable incomes will lead to greater adoption of premium hygiene products.

- Government and NGO initiatives will continue to improve access and awareness in underserved regions.

- Consumer preferences will shift towards multi-functional and value-added products, including intimate washes and wipes.

- Innovations in product design and packaging will enhance convenience and attract new customers.

- The expansion of product offerings in supermarkets, pharmacies, and convenience stores will improve distribution.

- Stronger regulatory frameworks on product safety and environmental impact will shape future market trends.