Market Overview:

The Middle East Asia Cuisine Market size was valued at USD 28.16 million in 2018 to USD 29.19 million in 2024 and is anticipated to reach USD 38.22 million by 2032, at a CAGR of 3.43% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East Asia Cuisine Market Size 2024 |

USD 29.19 Million |

| Middle East Asia Cuisine Market, CAGR |

3.43% |

| Middle East Asia Cuisine Market Size 2032 |

USD 38.22 Million |

Rising consumer interest in authentic Asian culinary experiences drives market growth. Urban populations increasingly seek diverse dining options, prompting restaurants to expand menus and offer premium Asian dishes. Higher disposable incomes support frequent dining out and experimentation with flavors. Ready-to-eat and frozen Asian food products gain traction for convenience. Food festivals and social media influence enhance awareness and demand. Quick-service and casual dining chains adopt Asian offerings to capture a broader audience. Tourism further boosts market expansion by attracting international and local consumers.

Geographically, the GCC region dominates, led by the UAE and Saudi Arabia, due to high expatriate populations, disposable incomes, and strong tourism. Emerging markets such as Qatar, Oman, and Kuwait show increasing adoption, fueled by growing middle-class consumers. North Africa maintains gradual growth, while Levant countries witness niche adoption of Asian cuisines. Urban centers with multicultural dining cultures serve as primary demand hubs. Market penetration strengthens in regions emphasizing international culinary experiences and modern foodservice infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East Asia Cuisine Market size was valued at USD 29.19 million in 2024 and is projected to reach USD 38.22 million by 2032, growing at a CAGR of 3.43%.

- Rising consumer preference for authentic Asian flavors and diverse dining experiences drives market growth.

- Urbanization and higher disposable incomes encourage frequent dining at restaurants offering Japanese, Chinese, and Korean cuisines.

- Ready-to-eat and frozen Asian food products support convenience-focused consumer demand.

- Market expansion faces challenges from cultural barriers and limited availability of authentic ingredients in some regions.

- The GCC region, particularly UAE and Saudi Arabia, leads the market due to high expatriate populations and tourism.

- Emerging markets like Qatar, Oman, and Kuwait show growth potential, supported by increasing middle-class consumers and modern foodservice infrastructure.

Market Drivers

Rising Demand For Authentic Asian Culinary Experiences Across Urban Centers

The Middle East Asia Cuisine Market benefits from growing consumer interest in authentic Asian flavors. Urban populations increasingly prefer diverse dining experiences, boosting restaurant visits and foodservice spending. It encourages chefs to innovate menus while retaining traditional tastes. Higher disposable incomes allow consumers to explore premium Asian dishes. Food festivals and pop-up events increase exposure to regional cuisines. The availability of imported ingredients supports menu authenticity. Retail channels introduce ready-to-eat Asian products, expanding market access. Social media influence strengthens consumer awareness of trending dishes. Tourists also contribute to higher adoption of authentic Asian food.

Expansion Of Quick-Service And Casual Dining Chains Offering Asian Cuisine

Quick-service and casual dining chains drive market growth by expanding Asian menu options. The Middle East Asia Cuisine Market gains traction through strategic openings in urban and suburban areas. It attracts younger demographics seeking convenient dining experiences. Chain restaurants standardize quality while introducing regional specialties. Partnerships with delivery platforms increase accessibility. It encourages competition, prompting innovation in flavors and presentation. Promotions and loyalty programs enhance consumer retention. Market penetration improves through franchise models across multiple cities. Growing awareness of health-conscious Asian dishes further supports expansion.

- For example, Panda Express has been expanding in the Middle East, with new outlets opening in key cities such as Dubai and Riyadh, supported by the company’s global growth strategy through both company-owned and franchise models.

Increasing Popularity Of Ready-To-Eat And Frozen Asian Food Products Among Consumers

The demand for ready-to-eat and frozen Asian products fuels market growth. The Middle East Asia Cuisine Market benefits from modern retail chains stocking diverse Asian options. It allows consumers to replicate restaurant-quality meals at home. Convenience and longer shelf life appeal to working professionals and expatriates. Packaging innovations preserve freshness and flavor integrity. Distribution networks improve product availability across regions. It drives collaborations between Asian food producers and local retailers. Consumers explore a wide variety of dishes without visiting restaurants. Cooking tutorials and social media exposure increase adoption of packaged products.

- For example, Saudi Arabia represents one of the largest frozen food markets in the Middle East, with leading players such as Al Kabeer Group and Americana Foods driving strong demand for ready-to-eat and Asian-style frozen meals.

Influence Of Social Media And Digital Food Delivery Platforms On Market Growth

Digital platforms accelerate the market by connecting consumers with Asian food providers. The Middle East Asia Cuisine Market experiences higher awareness through online promotions and reviews. It motivates restaurants to maintain consistent quality and innovative offerings. Food delivery apps increase reach beyond urban centers. Online campaigns highlight trending dishes and limited-time specials. It allows smaller vendors to gain visibility alongside established brands. Consumer feedback guides menu adjustments and service improvements. Mobile platforms simplify ordering, boosting sales volume. Interactive content, including live cooking sessions, engages potential customers consistently.

Market Trends

Integration Of Fusion Cuisine And Regional Asian Flavors In Modern Menus

Middle East Asia Cuisine Market shows a growing trend of combining Asian flavors with local culinary practices. It encourages chefs to experiment while maintaining authenticity. Fusion dishes attract adventurous diners seeking new taste experiences. Menu diversification increases restaurant competitiveness. It promotes cross-cultural culinary education for consumers. Signature dishes are modified to suit regional preferences. Media coverage highlights innovative offerings, boosting popularity. It expands potential consumer base beyond traditional Asian cuisine enthusiasts. Emerging restaurants leverage fusion trends to differentiate from competitors.

- For examples, Orfali Bros Bistro in Dubai secured the No. 1 spot in Middle East & North Africa’s 50 Best Restaurants for 2025. It is recognized for its inventive Aleppian fusion dishes and features menu items such as shish barak à la gyoza and corn bomb.

Adoption Of Sustainable And Health-Conscious Ingredients Across Asian Menus

Sustainability and health consciousness drive menu development in the Middle East Asia Cuisine Market. It encourages the use of organic vegetables, lean proteins, and locally sourced produce. Consumers prefer dishes with lower sodium, sugar, and artificial additives. Restaurants highlight transparent ingredient sourcing in marketing. It aligns with global health trends and wellness initiatives. Eco-friendly packaging enhances the dining experience while reducing environmental impact. Chefs create balanced meals catering to dietary restrictions. It stimulates innovation in recipe formulation. Health-focused menu offerings strengthen brand reputation and customer loyalty.

Expansion Of Digital Ordering Systems And Cloud Kitchens For Asian Cuisine

The Middle East Asia Cuisine Market leverages technology through cloud kitchens and online ordering systems. It reduces overhead costs while increasing market reach. Consumers gain convenient access to diverse Asian dishes. It encourages rapid scaling of new concepts without traditional infrastructure. Data analytics inform menu design and targeted promotions. It supports operational efficiency through inventory and delivery management. Collaboration with food delivery platforms increases order frequency. It enhances customer experience via real-time tracking and feedback. Urban areas see accelerated adoption, strengthening market penetration.

- For example, Kitopi, headquartered in Dubai, has grown into the largest multi-brand cloud kitchen platform in the Middle East, operating across several countries and supporting hundreds of restaurant brands through its technology-driven kitchens.

Growing Investment In Culinary Tourism And Experiential Dining Experiences

Experiential dining becomes a prominent trend in the Middle East Asia Cuisine Market. It offers consumers immersive Asian culinary experiences beyond traditional meals. Cooking classes, themed restaurants, and cultural events attract food enthusiasts. It enhances brand visibility and drives foot traffic. Partnerships with travel and hospitality sectors increase exposure. Social media amplification of unique experiences stimulates broader interest. It encourages repeat visits and long-term loyalty. Regional flavors are showcased to educate diners. Market players capitalize on combining taste with interactive entertainment.

Market Challenges Analysis

High Import Costs And Supply Chain Complexities For Asian Ingredients

The Middle East Asia Cuisine Market faces challenges due to high import costs of authentic ingredients. It relies on overseas suppliers for key spices, sauces, and specialty products. Currency fluctuations affect pricing stability for restaurants. It creates operational uncertainty and impacts profit margins. Limited local availability hinders menu variety and consistency. It increases dependency on distributors and logistics networks. Regulatory approvals and import tariffs delay deliveries. It forces restaurants to adjust pricing or substitute ingredients. Maintaining authenticity remains a persistent operational challenge.

Cultural Preferences And Competition From Established Local And International Cuisines

Consumer acceptance varies due to cultural and taste preferences, challenging market penetration. The Middle East Asia Cuisine Market competes with established Middle Eastern and Western cuisine options. It requires continuous marketing and educational initiatives to promote adoption. Limited awareness of regional Asian dishes restricts customer reach. It demands training staff for authentic preparation and service standards. Brand loyalty to familiar cuisines slows trial rates. It increases pressure on innovation while controlling costs. Consumer skepticism toward new flavors limits expansion potential. Maintaining differentiation while appealing to mainstream tastes requires strategic focus.

Market Opportunities

Rising Interest In Health-Oriented And Specialized Asian Cuisine Offering New Growth Prospects

The Middle East Asia Cuisine Market has opportunities in health-oriented menus, vegan options, and allergen-free dishes. It attracts health-conscious consumers seeking nutritious and balanced meals. Partnerships with nutritionists enhance menu credibility. It encourages the introduction of functional foods and low-calorie dishes. Emerging consumer segments show willingness to explore authentic flavors with dietary benefits. It opens avenues for ready-to-eat healthy Asian products. Digital marketing highlights these offerings effectively. It strengthens brand positioning while expanding consumer reach. Growth prospects align with wellness trends across urban populations.

Expansion Through E-Commerce And Innovative Delivery Models To Enhance Market Penetration

Online platforms and delivery-focused operations create new avenues for the Middle East Asia Cuisine Market. It allows small and medium players to reach wider audiences without traditional restaurant infrastructure. Cloud kitchens reduce operational costs while increasing geographic coverage. It fosters partnerships with major delivery platforms and apps. Consumer convenience drives repeat orders and brand loyalty. It enables market entry into emerging cities with growing demand. Data-driven insights optimize menu offerings and pricing strategies. It strengthens overall market competitiveness and scalability. Digital engagement supports targeted promotions and customer retention.

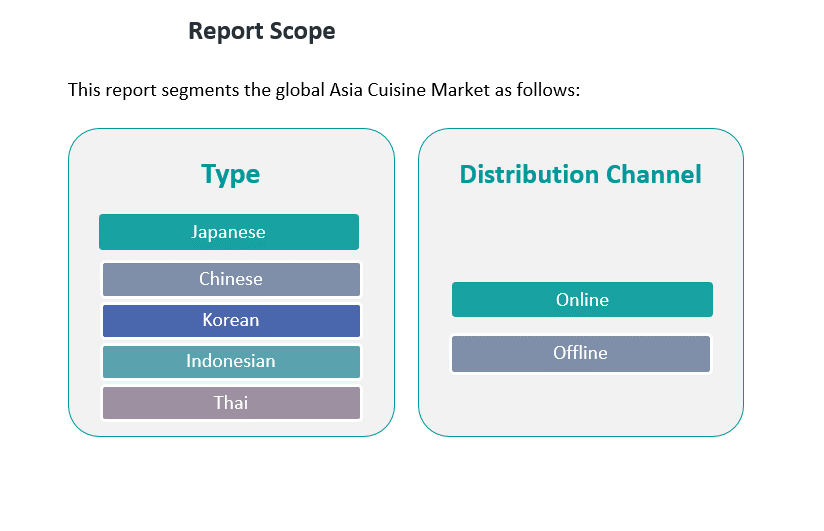

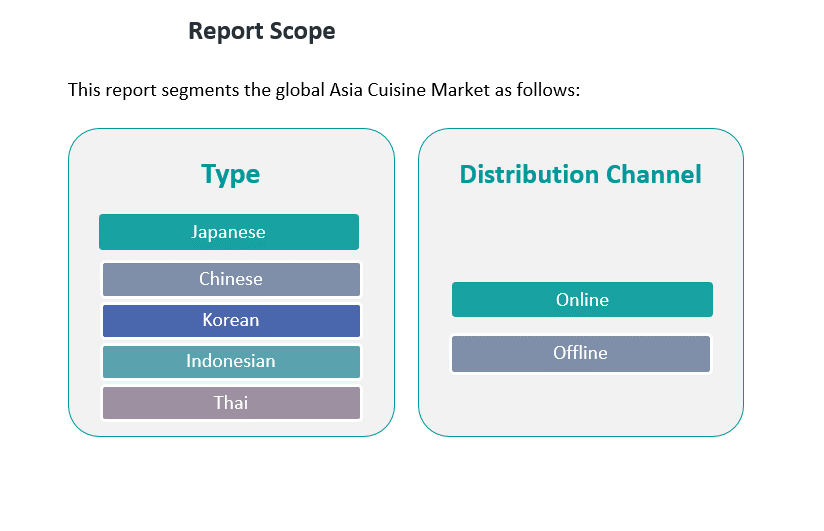

Market Segmentation Analysis

By Type

The Japanese cuisine segment leads the Middle East Asia Cuisine Market due to high consumer preference for sushi, ramen, and other traditional dishes. It benefits from urban consumers seeking authentic flavors and premium dining experiences. The Chinese cuisine segment follows, driven by widespread popularity of dim sum, noodles, and regional specialties. Korean cuisine gains traction through increasing interest in barbecue, kimchi, and fusion dishes. Indonesian cuisine maintains a niche presence, appealing to adventurous diners and expatriate communities. The “Others” category captures diverse Asian cuisines, supporting experimentation and menu variety across restaurants. It strengthens market diversity and encourages innovation in flavor offerings.

- For example, Kura Sushi, a leading Japanese conveyor belt sushi chain, is recognized for its large-scale, technology-driven dining formats, using extensive conveyor systems and automation to deliver meals efficiently across hundreds of seats in its restaurants.

By Distribution Channel

Offline channels dominate the Middle East Asia Cuisine Market, including dine-in restaurants, casual dining, and quick-service outlets. It ensures consistent consumer experiences, menu authenticity, and brand visibility. Online channels, including food delivery platforms and cloud kitchens, are rapidly growing due to convenience and urban lifestyle adoption. It enables smaller players to reach wider audiences without large physical infrastructure. Integration of digital ordering apps enhances customer engagement and repeat purchases. Both channels complement each other, expanding market reach while maintaining quality standards. Strategic expansion across these channels supports long-term market growth.

- For example, Talabat has piloted autonomous delivery robots, known as “Talabots,” in Dubai Silicon Oasis, supporting last-mile delivery trials in partnership with local authorities as part of Dubai’s smart mobility initiatives.

Segmentation

By Type

- Japanese

- Chinese

- Korean

- Indonesian

- Others

By Distribution Channel

Regional Analysis

Gulf Cooperation Council (GCC) Region

The GCC region leads the Middle East Asia Cuisine Market, accounting for approximately 60% of the market share. Countries like Saudi Arabia and the UAE are major contributors, driven by high disposable incomes, a growing expatriate population, and a strong tourism sector. The proliferation of quick-service restaurants (QSRs) and casual dining establishments offering Asian cuisines has further fueled market growth. The UAE, in particular, is experiencing rapid expansion due to its diverse population and status as a global tourism hub. Saudi Arabia’s Vision 2030 initiative also supports the diversification of the foodservice sector, including Asian culinary offerings.

Levant and North Africa

The Levant and North Africa together hold about 25% of the market share. Countries such as Lebanon, Jordan, and Egypt are witnessing a steady rise in the popularity of Asian cuisines, particularly Chinese and Japanese. This trend is attributed to increasing urbanization, exposure to international cultures, and a growing middle class with a taste for diverse culinary experiences. While the market is expanding, it remains more niche compared to the GCC region, with Asian cuisine often integrated into local dining preferences.

Iran and Turkey

Iran and Turkey collectively contribute around 15% to the market. In Iran, Asian cuisine is gaining traction, especially in urban centers like Tehran, due to a younger population and exposure to global food trends. However, economic sanctions and import restrictions pose challenges to the availability of authentic ingredients, affecting the authenticity and growth of Asian culinary establishments. Turkey, with its rich culinary heritage, exhibits a moderate interest in Asian cuisines, primarily in cosmopolitan cities like Istanbul, where fusion and international cuisines are more prevalent.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The Middle East Asia Cuisine Market is characterized by a diverse competitive landscape, featuring a mix of international chains, regional players, and local establishments. International brands like Panda Express and Noodles & Company have established a presence, capitalizing on the growing demand for Asian cuisines. Regional giants such as Americana Group and Savola Group dominate the market, leveraging extensive networks and local market knowledge to offer a wide range of Asian food options. Local players, including independent restaurants and food trucks, contribute to the market’s vibrancy by providing authentic and innovative Asian dishes tailored to local tastes. The competition is intensifying as consumer preferences shift towards healthier, sustainable, and convenient dining options, prompting both established and emerging players to innovate and adapt to these trends.

Recent Developments

- In June 2025, Noodles & Company strengthened its global culinary appeal by partnering with the Food Network to curate four new “Food Network Favorites” entrees. This menu refresh brought more than two-thirds new or improved dishes, aiming to position the brand at the forefront of globally inspired noodle innovations, including flavors reminiscent of East and Southeast Asian cuisine.

- In June 2025, Conagra Brands introduced over 50 new frozen food products, including globally inspired, plant-based, and single-serve meals. This launch emphasized convenience, flavor, and multicultural culinary influences (notably Asian and Middle Eastern cuisines) and strengthened the brand’s leadership as a pace-setter in frozen foods for the region.

- In August 2025, Spinneys announced a landmark joint venture with the Alshaya Group to enter the Kuwait market the chain’s fourth Gulf territory. The first of 10 planned premium supermarkets is set to open in 2026, aiming to bring Spinneys’ fresh-focused and globally inspired cuisine, including Asian flavors, to Kuwaiti consumers.

Report Coverage

The research report offers an in-depth analysis based on Type and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Expansion of quick-service and casual dining chains will drive market penetration across urban centers.

- Rising consumer preference for authentic Asian flavors will encourage menu innovation and premium offerings.

- Growth of digital ordering platforms and cloud kitchens will enhance accessibility and convenience.

- Health-conscious and diet-specific Asian cuisine options will attract a larger consumer base.

- Fusion and regional flavor adaptations will create opportunities for differentiation among competitors.

- Increasing expatriate populations and tourism will continue to boost demand for Asian culinary experiences.

- Retail channels will expand the availability of ready-to-eat and frozen Asian cuisine products.

- Investments in marketing and social media engagement will strengthen brand visibility and consumer awareness.

- Sustainable sourcing and eco-friendly packaging will appeal to environmentally conscious consumers.

- Strategic partnerships, mergers, and regional expansions will reinforce competitive positioning and market growth.