| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Middle East RFID Market Size 2024 |

USD 298.35 Million |

| Middle East RFID Market, CAGR |

7.5% |

| Middle East RFID Market Size 2032 |

USD 575.51 Million |

Market Overview

The Middle East RFID Market is projected to grow from USD 298.35 million in 2024 to an estimated USD 575.51 million by 2032, with a compound annual growth rate (CAGR) of 7.5% from 2025 to 2032. This growth is driven by increasing adoption across various industries, including retail, logistics, healthcare, and manufacturing, as organizations seek to improve operational efficiency, reduce costs, and enhance asset tracking capabilities.

Key drivers for the Middle East RFID market include the growing need for efficient supply chain management and inventory control solutions. Retailers and logistics companies are particularly focused on streamlining their operations, improving inventory accuracy, and enhancing customer satisfaction through the integration of RFID technology. Additionally, increasing awareness of RFID’s role in enabling contactless transactions, security, and traceability in industries like healthcare and transportation further accelerates its adoption.

Geographically, the Middle East is experiencing rapid adoption of RFID technology, with countries like the UAE, Saudi Arabia, and Qatar leading the way in market growth. These countries are heavily investing in smart infrastructure, smart city projects, and advanced technology to foster innovation. Key players in the market include Zebra Technologies, Honeywell International Inc., Impinj Inc., and NXP Semiconductors, who are strategically expanding their presence in the region to capitalize on emerging opportunities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Middle East RFID market is projected to grow from USD 298.35 million in 2024 to USD 575.51 million by 2032, with a CAGR of 7.5%. The demand for RFID technology is increasing due to its efficiency in asset tracking, inventory management, and automation.

- The Global RFID Market is projected to grow from USD 14,378.18 million in 2024 to an estimated USD 34,461.82 million by 2032, with a compound annual growth rate (CAGR) of 10.2% from 2025 to 2032.

- Key drivers include the increasing adoption of RFID across retail, logistics, healthcare, and manufacturing. Organizations are focusing on improving operational efficiency and reducing costs through the use of RFID systems.

- High initial deployment costs and complex integration with existing systems are key barriers to RFID adoption in some industries, particularly for small and medium-sized enterprises (SMEs).

- The UAE, Saudi Arabia, and Qatar are leading the adoption of RFID technology in the Middle East, fueled by government investments in smart city infrastructure and digital transformation projects.

- The logistics and supply chain sector is increasingly adopting RFID to enhance asset tracking, improve visibility, and streamline operations across regional trade hubs.

- The healthcare industry in the Middle East is embracing RFID for patient tracking, equipment management, and pharmaceutical traceability, improving efficiency and patient safety.

- Advancements in RFID technology, such as improved tag sensitivity and integration with IoT and AI, are enhancing the capabilities and accessibility of RFID solutions across various industries in the region.

Report Scope

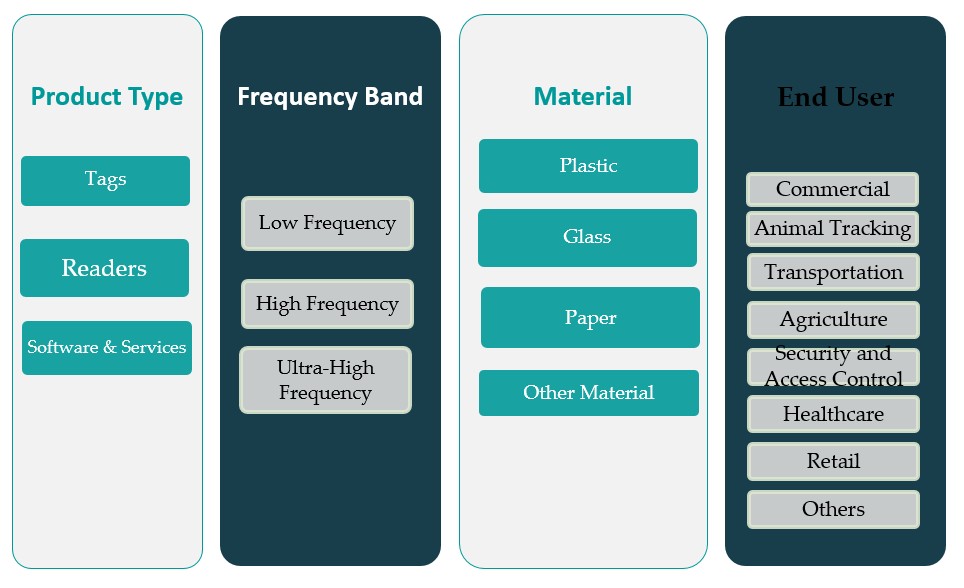

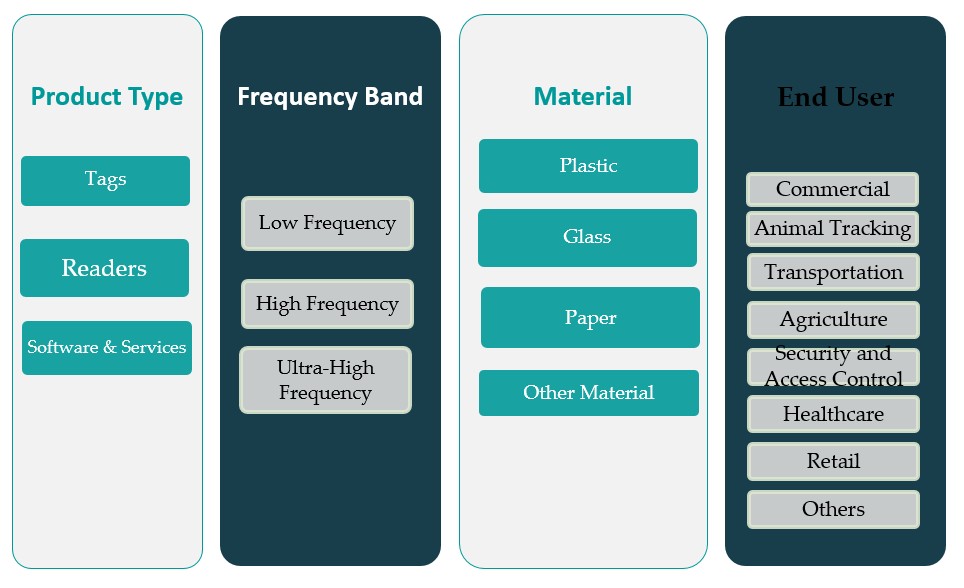

This report segments the Middle East RFID Market as follows:

Market Drivers

Increasing Adoption of Smart Technologies and Digital Transformation Initiatives

The Middle East has witnessed rapid advancements in digital transformation across various sectors, spurring the demand for smart technologies such as RFID (Radio Frequency Identification). Governments in the region are heavily investing in smart infrastructure, including smart cities, connected transportation systems, and intelligent supply chain networks, to drive efficiency and innovation. RFID technology plays a pivotal role in these initiatives by enabling real-time tracking, automated inventory management, and enhanced operational efficiency. As organizations seek to integrate RFID systems into their operations for improved data accuracy and resource optimization, this growing trend is fueling the widespread adoption of RFID technology. For instance, a logistics company in Saudi Arabia implemented RFID tracking across its distribution centers, reducing misplaced inventory by 6,800 units annually. The UAE, Saudi Arabia, and Qatar, in particular, are at the forefront of these advancements, with the UAE’s Vision 2021 and Saudi Arabia’s Vision 2030 focusing heavily on technological upgrades and the implementation of smart solutions. This demand for modern infrastructure and automated systems creates a significant growth opportunity for the RFID market in the Middle East.

Rise in Demand for Efficient Supply Chain Management and Inventory Control

As the Middle East region continues to emerge as a global trade hub, supply chain efficiency and inventory accuracy have become crucial priorities for businesses in sectors such as retail, logistics, and manufacturing. RFID technology provides a powerful solution to streamline operations, reduce human errors, and minimize operational costs. RFID tags can track products in real-time across the entire supply chain, offering improved visibility, accuracy, and speed. This is particularly valuable in industries such as retail, where inventory management and product availability are key to maintaining competitive advantage. For instance, a retail chain in the UAE integrated RFID into its inventory system, reducing stock discrepancies by 4,500 units annually. Additionally, logistics companies benefit from RFID by enhancing fleet management, reducing theft, and ensuring timely deliveries. The ability of RFID to provide real-time insights into the supply chain drives its adoption across the region, leading to significant market growth.

Growth in Healthcare and Pharmaceutical Sectors

The healthcare sector in the Middle East is undergoing significant transformation, driven by the need to improve patient care, reduce medical errors, and optimize hospital operations. RFID technology is increasingly being utilized in hospitals and clinics to track medical equipment, pharmaceuticals, and patients, helping improve efficiency and safety. RFID tags are used to monitor the location of critical assets such as infusion pumps, ventilators, and wheelchairs, ensuring their availability and reducing the time wasted in locating equipment. Additionally, RFID is used in pharmaceutical tracking to prevent counterfeiting and ensure the integrity of drugs throughout the supply chain, which is a growing concern in the Middle East. Saudi Arabia and the UAE are pioneering the implementation of RFID-based systems for tracking patient records and improving medication management. As the healthcare industry focuses on technological advancements to streamline operations and improve patient outcomes, RFID adoption is expected to rise significantly, contributing to the market’s growth in the region.

Supportive Government Policies and Investments in RFID Infrastructure

Governments across the Middle East are recognizing the strategic importance of RFID technology and are increasingly investing in initiatives that promote its adoption. National policies aimed at fostering innovation, improving public services, and increasing economic diversification play a key role in accelerating RFID deployment. In particular, the UAE and Saudi Arabia are offering favorable environments for technology adoption through government-backed smart city projects, public-private partnerships, and digital infrastructure initiatives. For instance, the UAE government’s push for the implementation of smart technologies as part of its “Smart Dubai” initiative has led to widespread integration of RFID systems in transportation, retail, and logistics sectors. Similarly, Saudi Arabia’s Vision 2030 outlines plans to modernize infrastructure and implement cutting-edge technology in various industries, including supply chain management and healthcare, both of which are prime beneficiaries of RFID. Furthermore, the government’s efforts to improve ease of doing business and attract foreign investments in technology contribute to the increased availability and affordability of RFID systems. With continued support from policymakers, RFID technology is expected to see sustained growth across the region.

Market Trends

Integration of RFID with IoT for Smart City Development

As the Middle East accelerates its push towards smart city development, the integration of RFID with the Internet of Things (IoT) is emerging as a key trend. RFID-enabled IoT systems are being deployed to provide real-time tracking and data analysis across various sectors, including transportation, waste management, and security. For instance, smart traffic management systems in cities like Dubai and Abu Dhabi utilize RFID sensors to monitor vehicle flow, reduce congestion, and enhance road safety. This integration allows cities to gather comprehensive data on infrastructure, logistics, and public services, facilitating better urban planning and resource management. Reports indicate that Middle Eastern governments are actively investing in IoT and RFID technologies to enhance operational efficiency and improve citizens’ quality of life. As more governments in the region focus on creating sustainable, connected environments, the adoption of RFID technology is expected to grow.

Increased Use of RFID in Retail and E-commerce

The retail sector in the Middle East is increasingly leveraging RFID technology to optimize supply chains, improve inventory management, and enhance the customer experience. RFID tags are being used to automate inventory tracking, reducing stockouts and improving replenishment cycles. For instance, major retailers in the region have reported improved operational efficiency and reduced inventory errors due to RFID implementation. Retailers are also adopting RFID for real-time product visibility, enabling quicker response times to consumer demand. Furthermore, the rise of e-commerce has created a need for more efficient logistics and fulfillment processes, where RFID technology plays a significant role. Reports highlight that RFID adoption in Middle Eastern retail has enhanced customer experience through seamless shopping solutions, including click-and-collect services and in-store navigation. As retail and e-commerce continue to expand in the region, RFID is expected to play a crucial role in meeting increasing demand.

Adoption of RFID for Healthcare and Pharmaceutical Tracking

The healthcare industry in the Middle East is rapidly adopting RFID technology for tracking medical equipment, pharmaceuticals, and even patients. RFID enables healthcare providers to maintain a real-time inventory of medical assets, ensuring that critical equipment is readily available when needed, while reducing theft or misplacement. RFID is also gaining traction in the pharmaceutical industry, where it helps prevent counterfeit drugs by ensuring the authenticity and traceability of products throughout the supply chain. Hospitals in the UAE and Saudi Arabia are leading this trend by incorporating RFID systems into patient identification and medication administration processes. This integration improves patient safety, reduces medical errors, and ensures the integrity of the supply chain. As the healthcare sector in the region continues to expand, RFID technology will play a crucial role in enhancing operational efficiency, security, and patient care.

RFID for Asset and Fleet Management in Logistics

In the logistics and transportation sectors, RFID is increasingly being used for asset and fleet management. RFID tags are being deployed to monitor the location and condition of goods in transit, ensuring that products are delivered on time and in optimal condition. This is especially important in the Middle East, where the logistics industry is growing due to the region’s strategic location as a global trade hub. RFID technology provides real-time visibility into the movement of goods, allowing companies to streamline their operations, reduce delays, and prevent losses. In addition, RFID helps businesses improve fleet management by tracking vehicles, monitoring fuel consumption, and ensuring timely maintenance. This trend is gaining traction in logistics companies across the region, including those operating in key trade hubs like Dubai and Saudi Arabia. As demand for efficient and transparent logistics continues to grow, RFID technology will be critical in transforming the supply chain.

Market Challenges

High Initial Deployment Costs and Integration Complexity

One of the primary challenges facing the Middle East RFID market is the high initial cost associated with deploying RFID technology. The cost of RFID tags, readers, and supporting infrastructure can be significant, particularly for small and medium-sized enterprises (SMEs). While RFID provides long-term benefits in terms of operational efficiency and cost savings, the upfront investment required for hardware, software, and system integration can deter some businesses from adopting the technology.For instance, companies in the region have reported that RFID tags vary in price depending on their type and functionality, with passive tags being more affordable compared to active tags. Additionally, RFID readers and antennas require substantial investment, with businesses often needing to allocate additional resources for integration and maintenance.Integrating RFID systems with existing enterprise resource planning (ERP) systems and supply chain management platforms can be complex and time-consuming. Reports indicate that businesses in the Middle East struggle with the cost of upgrading RFID infrastructure, particularly in industries like healthcare and logistics, where seamless tracking and data accuracy are critical.This complexity often requires specialized technical expertise, adding to the cost and potential delay in deployment. Companies have expressed concerns about the feasibility of RFID adoption due to logistical constraints and the need for additional investment in supporting infrastructure.Many organizations in the Middle East may also face challenges in training staff to effectively utilize RFID systems, further hindering adoption. Businesses have reported that training employees to operate RFID systems requires additional investment in specialized programs and technical support.The high cost of RFID implementation and integration poses a considerable barrier to widespread adoption, especially in industries with tight budget constraints, such as logistics and retail, where cost savings are often a primary concern.

Data Privacy and Security Concerns

As RFID technology collects and transmits data in real-time, it raises concerns about data privacy and security, particularly in industries like healthcare, finance, and retail, where sensitive customer or patient information is involved. The risk of unauthorized access to RFID data and potential security breaches remains a major challenge in the Middle East RFID market. Since RFID tags transmit data wirelessly, they are vulnerable to hacking or interception, which could lead to misuse of personal data or unauthorized access to confidential business information. The regulatory landscape surrounding data privacy and security in the Middle East is still evolving, and there is a need for stronger frameworks to ensure the safe use of RFID technology. Without proper encryption and access control measures, businesses may hesitate to fully embrace RFID solutions, especially in sectors where security is paramount. Ensuring the protection of sensitive information and maintaining compliance with emerging data protection regulations will be critical for the continued growth and adoption of RFID technology in the region.

Market Opportunities

Expansion of Smart City Initiatives

The Middle East’s ongoing investment in smart cities presents a significant opportunity for the RFID market. With governments across the region, particularly in the UAE and Saudi Arabia, focusing on creating technologically advanced, sustainable urban environments, the demand for RFID solutions is expected to increase. RFID technology plays a pivotal role in enabling smart city infrastructure, from automated traffic management and waste tracking to energy optimization and enhanced public safety. By providing real-time data and improving operational efficiency, RFID systems are integral to the seamless functioning of smart cities. The UAE’s Vision 2021 and Saudi Arabia’s Vision 2030 outline extensive plans to implement smart technologies across urban centers, creating an ideal environment for RFID adoption in sectors such as transportation, logistics, and utilities. As smart city projects continue to expand in the region, RFID technology will play a critical role in shaping the future of urban living, offering substantial growth opportunities for RFID solution providers.

Growth in E-commerce and Retail Sectors

The rapid growth of e-commerce and retail in the Middle East presents a lucrative opportunity for the RFID market. The region has seen a surge in online shopping and demand for efficient supply chain and inventory management solutions. RFID technology offers real-time tracking of products, improving inventory accuracy, reducing stockouts, and enhancing customer experiences. Retailers are increasingly adopting RFID for smarter inventory management and to streamline operations across brick-and-mortar stores and e-commerce platforms. As the retail sector grows and e-commerce platforms expand, RFID will be crucial in meeting the demands for faster fulfillment, optimized supply chains, and better customer service. This trend creates significant opportunities for RFID technology providers to cater to the evolving needs of the retail and e-commerce industries in the Middle East.

Market Segmentation Analysis

By Product Type

The RFID market in the Middle East is segmented into three key product types: tags, readers, and software & services. Tags are the most commonly used RFID components, accounting for a significant share of the market. These tags are applied across a wide range of industries to track inventory, assets, and personnel. Readers, which collect data from RFID tags, are essential for enabling the functioning of RFID systems. The market for RFID readers is growing as more businesses seek to automate operations and enhance tracking capabilities. Software and services are integral to RFID systems, enabling the management of data collected by readers and providing analytics that enhance operational decision-making. The demand for RFID software solutions is increasing as businesses look for more efficient ways to integrate RFID technology into their operations.

By Frequency

The RFID market is further divided by frequency into low frequency (LF), high frequency (HF), and ultra-high frequency (UHF). Low-frequency RFID systems are typically used for applications like access control and animal tracking, where short-range communication is sufficient. High-frequency RFID is used in applications such as library systems, ticketing, and contactless payments, offering a higher range and faster data transfer speeds. Ultra-high frequency RFID, with its longer read range and faster data transfer rates, is widely used in logistics, retail, and supply chain management, where real-time asset tracking is essential. UHF RFID is expected to dominate the market as more industries in the Middle East adopt RFID for logistics and inventory management.

Segments

Based on Product Type

- Tags

- Readers

- Software and Services

Based on Frequency

- Low Frequency

- High Frequency

- Ultra-High Frequency

Based on Material

- Plastic

- Glass

- Paper

- Others

Based on End User

- Commercial

- Animal Tracking

- Transportation

- Agriculture

- Security and Access Control

- Healthcare

- Retail

- Others

Based on Region

Regional Analysis

UAE (40%)

The UAE holds the largest share of the Middle East RFID market, accounting for approximately 40% of the market share. The country’s rapid digital transformation and ongoing smart city initiatives, particularly in Dubai and Abu Dhabi, have propelled RFID adoption. The UAE government’s investment in smart infrastructure and its push towards automation in various sectors such as transportation, logistics, and retail is expected to continue driving RFID demand. The country’s strategic location as a global trade hub also contributes to the growing adoption of RFID in logistics and supply chain management. The UAE’s leadership in implementing cutting-edge technologies makes it a key player in the Middle East RFID market.

Saudi Arabia (35%)

Saudi Arabia is the second-largest contributor to the Middle East RFID market, with an estimated market share of 35%. The country’s Vision 2030 plan, which emphasizes economic diversification and technological innovation, has accelerated the adoption of RFID across various industries. RFID technology is particularly in demand within logistics, retail, and healthcare sectors, where the need for improved efficiency and real-time asset tracking is critical. The Kingdom’s increasing focus on infrastructure development, such as smart cities and integrated transport systems, further boosts RFID adoption. Saudi Arabia’s growing reliance on RFID for supply chain optimization and asset management positions it as a key market player.

Key players

- Zebra Technologies Corporation

- Honeywell International Inc

- Microchip Technology

- AVERY DENNISON CORPORATION

- HID Global Corporation

- Impinj Inc.

- Smartrac

- Alien Technology LLC

- MetraTech

- Dubai Smart Government

- RFID Middle East

- Advanced Technology Solutions

- CardTech

Competitive Analysis

The Middle East RFID market is highly competitive, with several global and regional players driving innovation and market growth. Leading companies such as Zebra Technologies Corporation and Honeywell International Inc. dominate the market with a diverse portfolio of RFID products, including tags, readers, and software solutions, aimed at improving operational efficiency across various industries. Regional players like RFID Middle East and Dubai Smart Government contribute to the market by offering tailored solutions for local needs, often integrating RFID technology into government and smart city projects. Additionally, companies like Microchip Technology and Impinj Inc. provide advanced RFID chips and components, further enhancing the technology’s capabilities. The competitive landscape is also influenced by companies focusing on emerging applications, such as healthcare, logistics, and retail, creating opportunities for growth through targeted product innovations and strategic partnerships.

Recent Developments

- In June 2024, GlobeRanger released iMotion Data Orchestration, a solution that helps businesses manage edge devices such as IoT sensors, RFID readers, and other digital devices, capturing and processing data they generate.

- In February 2023, HID Global highlighted its support for an array of IoT technologies, emphasizing its role in developing RFID devices for various sectors including automotive, manufacturing, logistics, aerospace, and energy.

- On September 27, 2023, Zebra Technologies released its 2023 Global Warehousing Study, revealing that 58% of warehouse decision-makers plan to deploy RFID technology by 2028 to enhance inventory visibility and reduce out-of-stocks.

- In March 2024, Impinj settled a longstanding patent-infringement dispute with NXP Semiconductors, resulting in a one-time payment of $45 million and an annual license fee starting at $15 million in 2024, with incremental increases. Both companies withdrew any ongoing proceedings and signed a patent cross-licensing agreement.

- In April 2024, Identiv announced an agreement to sell certain operations and assets to security solutions provider Vitaprotech for $145 million. This includes divesting its physical security, access card, and identity reader operations. The transaction is expected to close in the third quarter.

- In November 2023, Avery Dennison completed the acquisition of Silver Crystal Group, a company specializing in customized jerseys and apparel for sports organizations.

Market Concentration and Characteristics

The Middle East RFID market exhibits a moderate to high level of concentration, with a mix of global players and regional entities driving market dynamics. Leading multinational companies such as Zebra Technologies, Honeywell International, and Impinj Inc. hold a significant share due to their extensive product portfolios, technological innovation, and strong regional presence. These companies focus on offering comprehensive RFID solutions, including tags, readers, and software, across industries like retail, logistics, healthcare, and transportation. At the same time, regional players like RFID Middle East and Dubai Smart Government are contributing to market growth by providing localized solutions, particularly for government-driven smart city projects. The market is characterized by intense competition, with companies focusing on continuous technological advancements, cost-effective solutions, and strategic partnerships to cater to the growing demand for RFID technology in various sectors across the Middle East. This combination of global expertise and regional customization shapes a dynamic and evolving market landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Frequency, Material, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Middle East’s investment in smart city initiatives will drive increased adoption of RFID solutions. RFID technology will become integral to smart transportation, public safety, and urban infrastructure projects.

- RFID adoption in healthcare will rise, focusing on patient tracking, asset management, and medication safety. This will enhance operational efficiency, reduce medical errors, and improve patient care in hospitals and clinics.

- Retailers will continue to leverage RFID for inventory management, supply chain visibility, and enhanced customer experience. RFID will play a crucial role in omnichannel retail strategies and efficient order fulfillment.

- Government initiatives, especially in the UAE and Saudi Arabia, will continue to support RFID integration in public sector projects. This will include applications in security, transportation, and government services, enhancing overall efficiency.

- The logistics sector will experience heightened demand for RFID, driven by the need for real-time tracking and improved inventory management. RFID will streamline supply chain operations and reduce costs.

- Industrial sectors will increasingly adopt RFID for asset tracking, fleet management, and equipment maintenance. RFID solutions will improve operational efficiency and reduce downtime in manufacturing and production environments.

- Continued technological advancements, such as improved tag sensitivity, faster data processing, and better integration with IoT, will expand RFID’s capabilities. These innovations will make RFID solutions more accessible and efficient.

- RFID will see greater adoption in agriculture, especially for livestock tracking and crop management. It will support traceability and enhance the monitoring of agricultural assets in the region.

- RFID will increasingly be integrated with IoT and artificial intelligence (AI) systems to enable smarter decision-making. This combination will improve data analytics and automation across various industries.

- Passive RFID tags will dominate the market due to their cost-effectiveness and wide application. As businesses seek affordable solutions for large-scale asset tracking, passive tags will remain a preferred choice in the Middle East.