| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

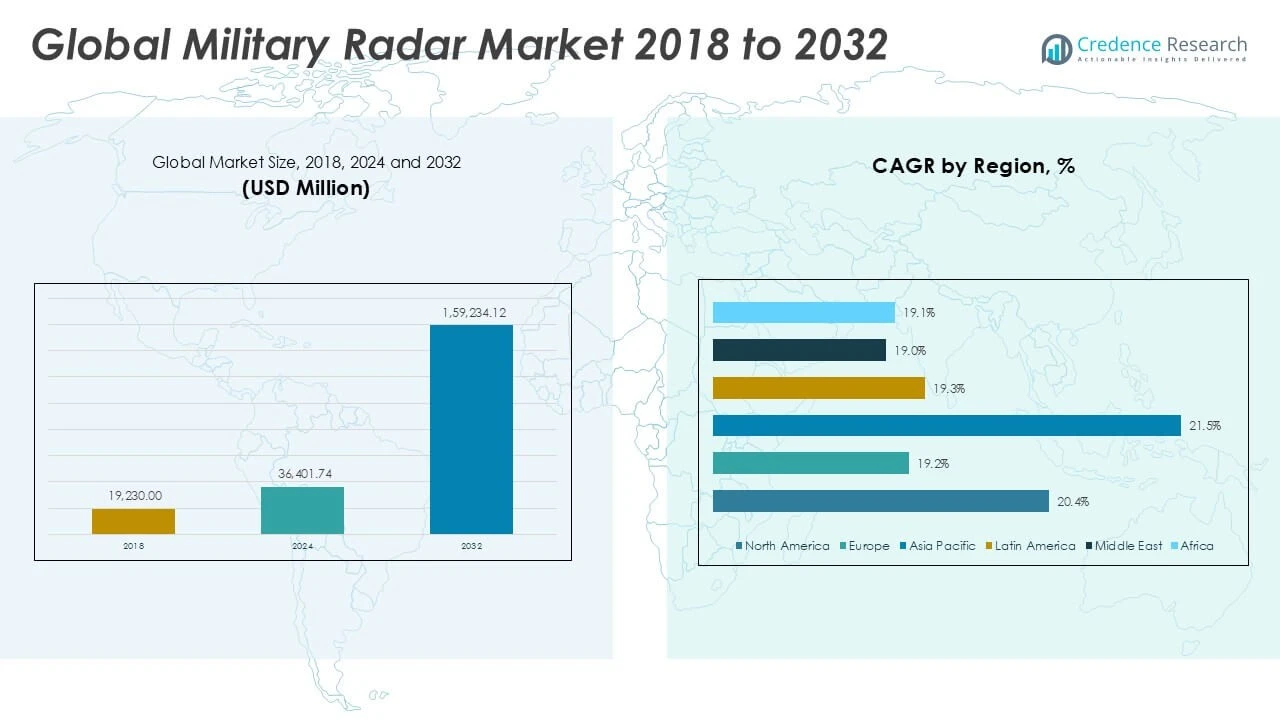

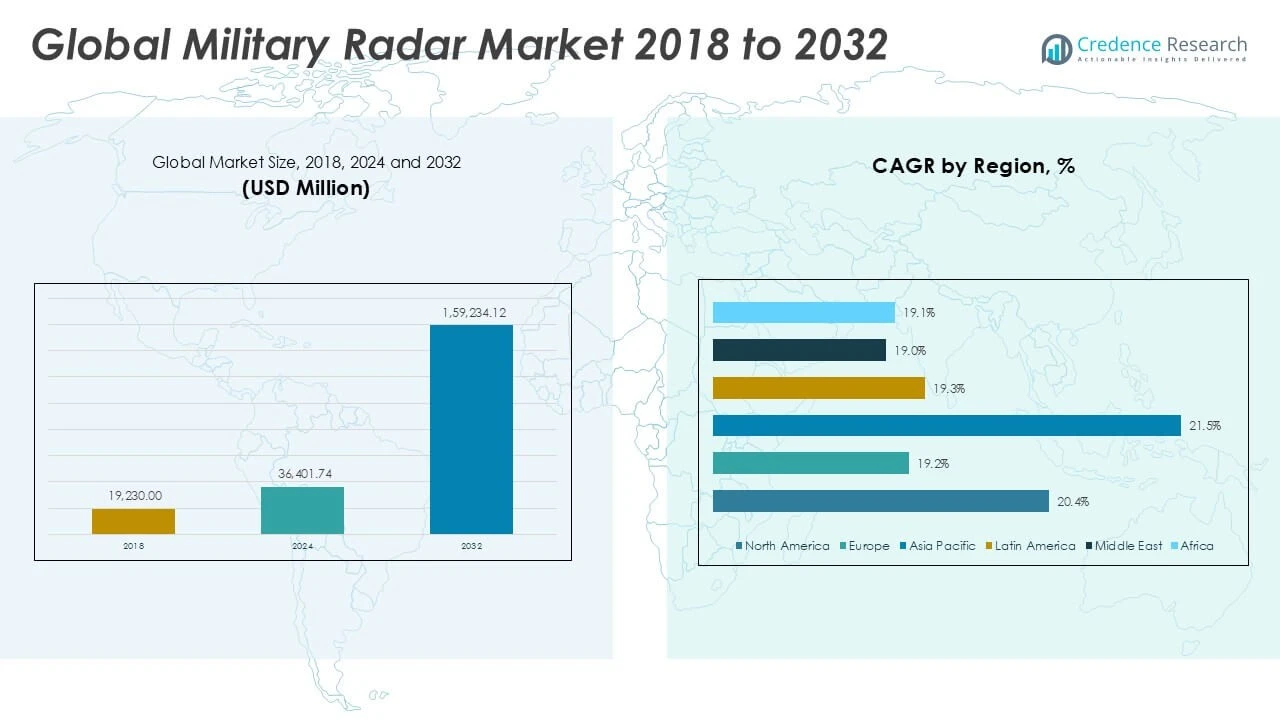

| Military Radar Market Size 2024 |

USD 36,401.74 million |

| Military Radar Market, CAGR |

20.26% |

| Military Radar Market Size 2032 |

USD 159,234.12 million |

Market Overview

The Global Military Radar Market is projected to grow from USD 36,401.74 million in 2024 to an estimated USD 159,234.12 million by 2032, registering a compound annual growth rate (CAGR) of 20.26% from 2025 to 2032.

Key drivers of the military radar market include the growing emphasis on modernizing defense infrastructure and integrating radar systems with advanced technologies such as artificial intelligence (AI), machine learning (ML), and cloud computing. Trends indicate a shift towards multifunctional radar systems capable of operating across multiple frequency bands to improve accuracy and reduce detection time. Additionally, the development of compact, lightweight, and low-power radar systems for unmanned aerial vehicles (UAVs) and other autonomous platforms further accelerates market growth.

Geographically, North America dominates the military radar market due to substantial defense spending by the United States and Canada and strong technological capabilities. Asia-Pacific is expected to witness the highest growth rate, driven by increasing defense budgets in countries like China, India, and South Korea. Key players operating in this market include Lockheed Martin Corporation, Raytheon Technologies Corporation, BAE Systems plc, Thales Group, and Northrop Grumman Corporation, all of which focus on innovation and strategic partnerships to strengthen their market position.

Market Insights

- The Global Military Radar Market is projected to grow from USD 36,401.74 million in 2024 to USD 159,234.12 million by 2032, registering a CAGR of 20.26%.

- Increasing global defense budgets and modernization initiatives drive the demand for advanced radar systems with improved detection and tracking capabilities.

- Integration of artificial intelligence and machine learning enhances radar accuracy, operational efficiency, and real-time threat analysis.

- High development costs, complex integration processes, and vulnerability to electronic warfare pose challenges to market growth.

- North America holds the largest market share due to significant defense spending and technological advancements, maintaining a strong leadership position.

- Asia Pacific is the fastest-growing region, fueled by rising defense expenditure in China, India, and South Korea amid geopolitical tensions.

- Demand for compact, multifunctional radar systems suitable for unmanned platforms and network-centric warfare boosts innovation and market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Defense Budgets and Modernization Initiatives Propel Market Expansion

The Global Military Radar Market benefits significantly from increased defense spending across several countries. Governments prioritize upgrading and modernizing their defense systems to counter evolving threats, which creates strong demand for advanced radar technologies. Investments focus on improving the detection, tracking, and surveillance capabilities of military radars. Modernization initiatives emphasize replacing legacy systems with multifunctional radars that offer enhanced range, accuracy, and resistance to electronic warfare. Military organizations also aim to integrate radars with broader command and control networks, boosting operational efficiency. These strategic priorities drive continuous procurement and development activities in the radar segment.

- For instance, India allocated ₹6,21,940 crore for defense spending in 2024-25, reflecting a strong commitment to modernization and self-reliance in military technology.

Technological Advancements Enhance Radar Capabilities and Application Scope

Rapid innovation in radar technology fuels growth within the Global Military Radar Market. The incorporation of artificial intelligence and machine learning enhances target recognition, reduces false alarms, and optimizes signal processing. Advancements in phased array radar, synthetic aperture radar, and active electronically scanned array (AESA) systems improve detection speed and reliability. These technologies expand radar applications beyond traditional air surveillance to maritime, ground, and space domains. It also enables radars to operate effectively in complex environments with clutter and electronic countermeasures. Continuous technology upgrades support military forces in maintaining tactical advantages.

- For instance, advancements in AESA radar technology have led to widespread adoption in fighter jets, eliminating mechanical steering and improving scanning speed and accuracy.

Integration of Unmanned Systems and Autonomous Platforms Expands Market Demand

Military radars play a critical role in supporting unmanned aerial vehicles (UAVs), drones, and other autonomous systems. These platforms require compact, lightweight radar solutions with low power consumption and high precision. The growing adoption of unmanned systems for intelligence, surveillance, reconnaissance, and combat missions increases radar demand. It also pushes manufacturers to develop specialized radar variants tailored for integration with autonomous platforms. The synergy between unmanned technologies and radar systems broadens operational capabilities and encourages further innovation in radar designs.

Geopolitical Tensions and Security Concerns Drive Strategic Radar Deployments

Heightened geopolitical conflicts and emerging security threats contribute to the growing reliance on military radar systems. Nations seek to bolster their border surveillance, early warning systems, and missile defense networks to respond to potential aggression. It leads to increased radar deployments in contested regions and strategic locations worldwide. Military radar solutions help monitor airspace violations, detect incoming threats, and provide actionable intelligence for defense planning. The continuous focus on national security ensures sustained demand for advanced radar technologies and supports market growth globally.

Market Trends

Adoption of Multifunctional Radar Systems with Enhanced Performance Capabilities

The Global Military Radar Market increasingly favors multifunctional radar systems that combine detection, tracking, and targeting functions into a single platform. These systems reduce hardware footprint and operational costs while improving situational awareness on the battlefield. It supports simultaneous tracking of multiple targets across air, sea, and ground domains with high precision. Manufacturers focus on developing radars that operate across multiple frequency bands to enhance detection accuracy and resilience against jamming. This trend aligns with military demands for flexible, efficient solutions that address diverse operational requirements. The shift toward multifunctional radars marks a significant evolution in defense technology.

- For instance, Hanwha Systems has developed multi-function radar (MFR) that integrates detection, tracking, electronic warfare, and missile guidance into a single system, enhancing operational efficiency and reducing hardware footprint.

Integration of Artificial Intelligence and Machine Learning for Advanced Threat Analysis

Military radar technologies integrate artificial intelligence (AI) and machine learning (ML) algorithms to optimize target recognition and decision-making processes. The Global Military Radar Market benefits from AI-driven systems that analyze vast volumes of radar data in real time to reduce false positives and prioritize critical threats. It enables faster response times and improved operational efficiency. AI also assists in adapting radar parameters dynamically based on environmental conditions and threat characteristics. This trend strengthens radar systems’ ability to operate in contested and cluttered environments. The adoption of AI and ML represents a key technological advancement influencing radar system development.

- For instance, a study on machine learning in military surveillance highlights how AI-driven threat detection systems improve accuracy and adaptability, reducing false positives and enhancing real-time decision-making.

Expansion of Compact and Lightweight Radar Solutions for Unmanned Platforms

Compact and lightweight radar systems gain traction due to their suitability for integration with unmanned aerial vehicles (UAVs), drones, and autonomous platforms. The Global Military Radar Market responds to the rising demand for smaller, power-efficient radars that maintain high performance despite size constraints. These radars enhance the operational capabilities of unmanned systems by providing accurate situational awareness and target tracking. It drives innovation in miniaturization and energy-efficient radar designs. The trend reflects the growing importance of unmanned and remotely operated technologies in modern warfare scenarios.

Focus on Network-Centric Warfare through Advanced Radar Connectivity

Military forces prioritize network-centric warfare strategies that rely heavily on interconnected radar systems and sensor networks. The Global Military Radar Market supports the deployment of radars with enhanced data sharing, real-time communication, and interoperability features. It facilitates integrated battlefield management and coordinated defense responses across multiple platforms. Networked radars enable comprehensive surveillance coverage and improve threat detection accuracy by sharing information across command centers and units. This trend emphasizes the increasing role of connectivity and data integration in military radar solutions.

Market Challenges

High Development Costs and Complex Integration Processes Hinder Market Growth

The Global Military Radar Market faces challenges related to the high costs associated with research, development, and production of advanced radar systems. Developing cutting-edge technologies such as active electronically scanned arrays (AESA) and integrating artificial intelligence requires substantial investment. It often leads to extended development cycles and budget constraints for defense organizations. Complex integration of radar systems with existing military infrastructure and other sensor networks also complicates deployment. Compatibility issues and the need for specialized technical expertise slow down adoption rates. These factors create barriers for both manufacturers and end-users in implementing new radar solutions efficiently.

- For instance, the U.S. Department of Defense allocated over 147 million for sea-based X-band radar systems and 133.5 million for anti-radar missile improvements in its 2024 budget

Vulnerability to Electronic Warfare and Rapid Technological Obsolescence

Military radar systems encounter risks from sophisticated electronic warfare tactics aimed at jamming, deceiving, or disabling radar signals. The Global Military Radar Market must continuously adapt to emerging countermeasures to maintain operational effectiveness. It requires frequent upgrades and innovation to counteract evolving threats, increasing maintenance and lifecycle costs. Rapid technological advancements also cause quick obsolescence of radar equipment, forcing military forces to invest in newer systems regularly. Balancing cost-efficiency with technological superiority remains a persistent challenge for stakeholders. This dynamic environment demands ongoing research and agile development approaches.

Market Opportunities

Expanding Demand for Advanced Radar Technologies in Modern Defense Systems

The Global Military Radar Market offers significant opportunities driven by the increasing need to upgrade aging radar infrastructure worldwide. It creates demand for cutting-edge radar systems featuring artificial intelligence, machine learning, and multifunctional capabilities. Militaries seek solutions that enhance situational awareness, target detection, and electronic warfare resilience. The growing adoption of unmanned aerial vehicles and autonomous platforms further broadens the market for compact, lightweight radar systems. It encourages manufacturers to develop innovative products tailored to diverse operational requirements. The continuous evolution of threat landscapes compels armed forces to invest in advanced radar technologies, presenting sustained growth potential.

Growth Potential in Emerging Regions with Rising Defense Expenditure

Emerging markets in the Asia Pacific, Middle East, and Latin America provide lucrative growth opportunities for the Global Military Radar Market. It benefits from increased defense budgets and strategic focus on border security, maritime surveillance, and airspace control in these regions. Governments emphasize local manufacturing and technology transfer initiatives to reduce reliance on imports. This trend encourages collaboration between international radar providers and regional defense organizations. Expanding geopolitical tensions also drive demand for sophisticated radar systems capable of early warning and rapid response. The growing focus on network-centric warfare promotes integration of radar platforms, fostering market expansion across emerging economies.

Market Segmentation Analysis

By Component

The Global Military Radar Market divides into key components such as transmitters, antennas, receivers, duplexers, and others. Transmitters generate the radio frequency signals essential for radar operation, while antennas direct and receive these signals for effective detection. Receivers process incoming signals to identify and track targets with precision. Duplexers enable the radar to switch between transmission and reception modes efficiently. The “others” segment includes power supplies, processors, and signal modulators that support overall system functionality. Each component plays a vital role in enhancing radar performance and reliability, influencing procurement decisions within military programs.

By Application

Military radar systems serve multiple applications including weapon guidance, airspace monitoring and traffic management, airborne mapping, ground surveillance and intruder detection, navigation, and others. Weapon guidance relies on radar for precise targeting and missile tracking. Airspace monitoring ensures controlled and secure flight operations in both military and civilian zones. Airborne mapping uses radar to generate detailed terrain and weather data for strategic planning. Ground surveillance detects and tracks enemy movements, enhancing battlefield awareness. Navigation applications provide positioning support for military vehicles and aircraft. These diverse applications drive the demand for specialized radar solutions tailored to mission-specific requirements.

By Frequency

The market segments radar systems by frequency bands such as C-band, S-band, X-band, L-band, UHF/VHF, and Ku/K/Ka-band. Each frequency offers distinct advantages in range, resolution, and penetration capabilities. For example, X-band radars provide high resolution ideal for target tracking and fire control, while L-band radars cover long distances suited for early warning. UHF/VHF bands facilitate detection through foliage and adverse weather. The selection of frequency bands depends on operational needs and environmental conditions. It allows militaries to deploy radars optimized for different combat scenarios.

By Range

Military radar systems classify based on operational range: very short, short, medium, and long. Long-range radars focus on early threat detection over extensive distances, enabling timely response and strategic planning. Medium-range radars balance detection range with mobility and versatility for tactical battlefield use. Short and very short-range radars provide close-in surveillance and targeting support, crucial for quick reaction and defense. These range categories address varied mission requirements from wide-area monitoring to point defense.

By Platform

Radar systems in the Global Military Radar Market deploy across airborne, land, and naval platforms. Airborne radars equip aircraft and UAVs, providing aerial surveillance, targeting, and navigation. Land radars serve ground forces with applications including border security and artillery fire control. Naval radars safeguard maritime assets by detecting surface and underwater threats, ensuring fleet protection. Platform-specific design considerations influence radar capabilities, enabling optimal performance in diverse operational environments.

Segments

Based on Component

- Transmitter

- Antenna

- Receiver

- Duplexer

- Others

Based on Application

- Weapon Guidance

- Airspace Monitoring & Traffic Management

- Airborne Mapping

- Ground Surveillance & Intruder Detection

- Navigation

- Others

Based on Frequency

- C-Band

- S-Band

- X-Band

- L-Band

- UHF/VHF

- Ku/K/Ka-Band

Based on Range

- Long

- Medium

- Short

- Very Short

Based on Platform

- Airborne Radar

- Land Radar

- Naval Radar

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysi

North America Military Radar Market

The North America Military Radar Market holds the largest regional share of approximately 38% in 2024, with a market value of USD 13,864.88 million, projected to reach USD 60,817.09 million by 2032. It is expected to grow at a CAGR of 20.4% during the forecast period. The region’s dominance stems from significant defense budgets in the United States and Canada, coupled with advanced technological capabilities. The presence of major defense contractors and continuous investments in modernization programs strengthen its market leadership. It remains a crucial hub for innovation and development of cutting-edge radar systems tailored to meet evolving military needs.

Europe Military Radar Market

Europe accounts for a substantial regional market share of about 18% in 2024, with a market value of USD 6,701.62 million and projected growth to USD 27,085.98 million by 2032. The region exhibits a CAGR of 19.2%, driven by countries like Germany, France, and the United Kingdom investing in defense modernization. Europe focuses on enhancing airspace security and border surveillance capabilities through advanced radar deployment. It also benefits from collaborative defense initiatives within the European Union and NATO, promoting technology sharing and joint development programs. The steady growth reflects strategic efforts to upgrade existing radar infrastructure.

Asia Pacific Military Radar Market

The Asia Pacific Military Radar Market commands a significant regional market share of nearly 29% in 2024, valued at USD 10,524.47 million and expected to reach USD 49,888.85 million by 2032. It projects a CAGR of 21.5%, the highest among all regions. Increasing defense expenditure by China, India, South Korea, and Australia fuels this growth. The region prioritizes border security, maritime surveillance, and air defense systems to address geopolitical tensions. It also drives demand for technologically advanced radar systems and indigenous manufacturing capabilities. The Asia Pacific’s expanding military radar market reflects its rising strategic importance in global defense.

Latin America Military Radar Market

Latin America holds a regional market share of roughly 7% in 2024, with a Military Radar Market valued at USD 2,538.37 million and projected to reach USD 10,356.90 million by 2032, at a CAGR of 19.3%. Countries including Brazil, Mexico, and Argentina invest in upgrading defense infrastructure and enhancing surveillance systems. It focuses on improving coastal security and counter-narcotics operations, which increase demand for versatile radar solutions. The region’s market expansion reflects gradual modernization and growing security concerns. It presents opportunities for radar manufacturers targeting emerging defense markets.

Middle East Military Radar Market

The Middle East Military Radar Market holds an estimated regional market share of 4% in 2024, with a valuation of USD 1,444.00 million, anticipated to grow to USD 5,759.26 million by 2032 at a CAGR of 19.0%. Regional geopolitical tensions and the need for robust border and airspace security drive radar adoption. It prioritizes missile defense, surveillance, and early warning systems across countries such as Saudi Arabia, the UAE, and Israel. Strategic military partnerships and defense spending support market growth. The Middle East remains a vital region for radar technology deployment to counter evolving threats.

Africa Military Radar Market

Africa’s Military Radar Market accounts for around 4% regional market share in 2024, valued at USD 1,328.40 million and expected to reach USD 5,326.05 million by 2032, growing at a CAGR of 19.1%. The market benefits from increased defense budgets among countries like South Africa, Nigeria, and Egypt. It addresses challenges related to border security, counter-terrorism, and maritime surveillance. Investments in radar technology enhance situational awareness and defense preparedness. The region presents growth potential driven by rising security needs and infrastructure development.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- L3Harris Technologies, Inc.

- BAE Systems

- Leonardo S.p.A.

- General Dynamics Corporation

- Lockheed Martin Corporation

- Northrop Grumman

- RTX

- Thales

- Saab

Competitive Analysis

The Military Radar Market features intense competition among established global defense contractors. Leading companies such as Lockheed Martin Corporation, Northrop Grumman, and L3Harris Technologies, Inc. leverage strong R\&D capabilities and extensive product portfolios to maintain market leadership. It drives continuous innovation in radar technologies, including advanced phased array systems and AI integration. Competitors focus on strategic partnerships, mergers, and acquisitions to expand their geographic reach and technological expertise. Price competitiveness and customization for specific military needs influence contract awards. Emerging players invest in niche technologies targeting unmanned systems and electronic warfare to differentiate themselves. The dynamic market environment demands agility and sustained investment in innovation to secure and grow market share.

Recent Developments

- In May 2025, Raytheon, an RTX business, delivered the first AN/TPY-2 radar equipped with a complete Gallium Nitride (GaN) populated array to the U.S. Missile Defense Agency. This advanced radar system enhances the detection, tracking, and discrimination of ballistic missiles, including hypersonic threats, by providing greater sensitivity, increased range, and expanded surveillance capacity. Additionally, the radar features the latest CX6 high-performance computing software, offering more precise target discrimination and protection against electronic attacks.

- In May 2025, Thales and Tawazun signed an agreement to initiate the domestic production of Ground Master series air surveillance radars in the UAE, enhancing regional defense capabilities.

- In May 2025, Saab and NVIDIA announced a collaboration to integrate artificial intelligence (AI) into radar systems, aiming to enhance military radar performance and effectiveness.

Market Concentration and Characteristics

The Military Radar Market exhibits a moderately concentrated structure dominated by a few large defense contractors such as Lockheed Martin, Northrop Grumman, and L3Harris Technologies. It features high entry barriers due to stringent regulatory requirements, significant capital investments, and advanced technological expertise needed to develop sophisticated radar systems. The market emphasizes innovation, quality, and reliability, driving companies to focus on research and development to maintain competitive advantages. Customization for diverse military applications and strategic government contracts shape market dynamics. Collaboration with governments and defense agencies plays a crucial role in securing long-term projects. While large players control most market share, smaller specialized firms contribute through niche technologies and agile solutions, enhancing the overall ecosystem. The Military Radar Market demands continuous adaptation to evolving threats and technological trends, reinforcing its competitive and innovation-driven characteristics.

Report Coverage

The research report offers an in-depth analysis based on Component, Application, Frequency, Range, Platform and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Military Radar Market will witness sustained growth driven by increasing global defense budgets focused on modernizing surveillance and targeting systems.

- Integration of artificial intelligence and machine learning will enhance radar accuracy, threat detection, and decision-making capabilities across military applications.

- Development of multifunctional radars capable of operating across multiple frequency bands will improve operational flexibility and reduce system complexity.

- Demand for compact, lightweight radar systems will rise, supporting the expanding use of unmanned aerial vehicles and autonomous defense platforms.

- Advances in electronic warfare countermeasures will prompt continuous upgrades in radar technologies to maintain effectiveness against sophisticated jamming tactics.

- The Asia Pacific region will emerge as a high-growth market due to rising defense expenditure and increasing focus on border security and maritime surveillance.

- Enhanced network-centric warfare capabilities will drive the adoption of interconnected radar systems that enable real-time data sharing and integrated battlefield awareness.

- Radar manufacturers will invest more in research and development to create cost-effective solutions that balance performance with affordability for diverse military budgets.

- Strategic collaborations and joint ventures between defense contractors and governments will accelerate technology development and market penetration.

- Environmental and regulatory considerations will encourage the design of energy-efficient and sustainable radar systems, aligning with broader defense industry trends.