| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Military Vehicle Sustainment Market Size 2024 |

USD 5,003.44 Million |

| U.S. Military Vehicle Sustainment Market, CAGR |

8.05% |

| U.S. Military Vehicle Sustainment Market Size 2032 |

USD 9,297.14 Million |

Market Overview

U.S. Military Vehicle Sustainment market size was valued at USD 5,003.44 million in 2024 and is anticipated to reach USD 9,297.14 million by 2032, at a CAGR of 8.05% during the forecast period (2024-2032).

The U.S. military vehicle sustainment market is experiencing significant growth due to increasing investments in defense modernization and fleet readiness. The Department of Defense continues to prioritize the maintenance, repair, and overhaul (MRO) of aging armored vehicles to ensure operational efficiency and extended service life. This trend is further supported by the rising deployment of advanced technologies such as predictive maintenance, condition-based monitoring, and digitized logistics systems. Additionally, growing geopolitical tensions and the demand for rapid mobility in diverse terrains are prompting the military to focus on vehicle reliability and mission readiness. The integration of automation and artificial intelligence in sustainment operations is enhancing performance forecasting and reducing downtime. Furthermore, collaborative efforts between public and private defense contractors are improving supply chain efficiency and accelerating innovation in sustainment practices. These factors collectively contribute to the market’s expansion, ensuring continued support for a robust and responsive military vehicle fleet across various operational theaters.

The geographical landscape of the U.S. military vehicle sustainment market is shaped by the strategic distribution of defense installations and support infrastructure across the Western, Southern, Midwestern, and Northeastern regions. Each region contributes uniquely, with the Western and Southern regions leading in sustainment activity due to the presence of major military bases, robust supply chains, and advanced maintenance facilities. The Midwestern region supports the market with its strong industrial base and vehicle manufacturing hubs, while the Northeastern region focuses on innovation and technology-driven sustainment practices. Key players driving this market include Lockheed Martin Corporation, General Dynamics Corporation, Oshkosh Defense, Raytheon Technologies Corporation, BAE Systems, Northrop Grumman Corporation, AM General LLC, Textron Systems, L3Harris Technologies, and Navistar Defense. These companies play critical roles in offering integrated maintenance, modernization, and logistics support solutions, often through long-term contracts with the U.S. Department of Defense, thereby enhancing fleet readiness and extending vehicle lifecycles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. military vehicle sustainment market was valued at USD 5,003.44 million in 2024 and is projected to reach USD 9,297.14 million by 2032, growing at a CAGR of 8.05%.

- Rising demand for fleet readiness and operational efficiency is a key driver boosting the need for maintenance, repair, and modernization services.

- Integration of advanced diagnostics, AI-based predictive maintenance, and digital sustainment tools is transforming traditional vehicle support operations.

- Leading players like Lockheed Martin, General Dynamics, and BAE Systems dominate the market through long-term defense contracts and advanced technical capabilities.

- High dependency on government budgets and long procurement cycles act as major restraints for new market entrants and service scalability.

- Western and Southern U.S. regions lead the market due to the concentration of military bases, logistics hubs, and defense infrastructure.

- The market is evolving toward a technology-driven ecosystem focused on automation, cost-efficiency, and lifecycle extension of aging fleets.

Report Scope

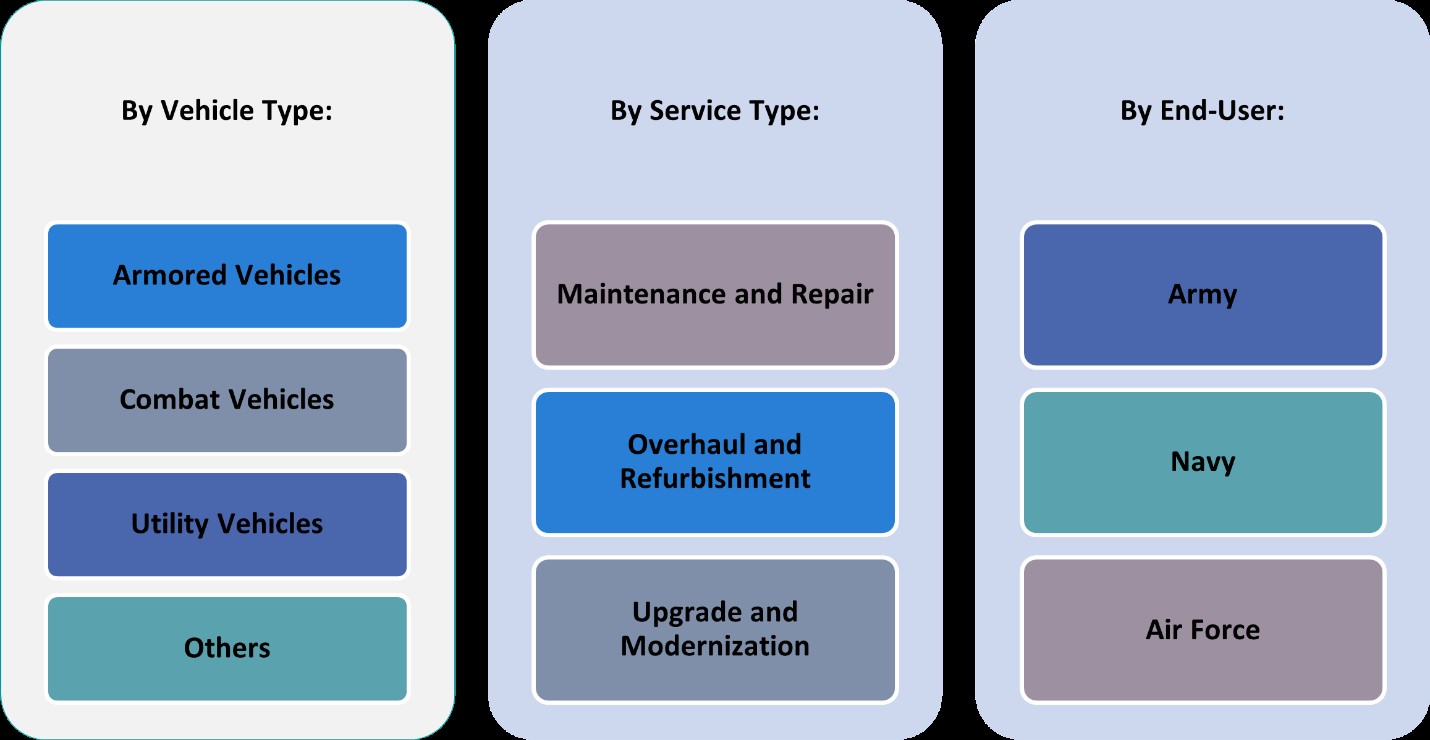

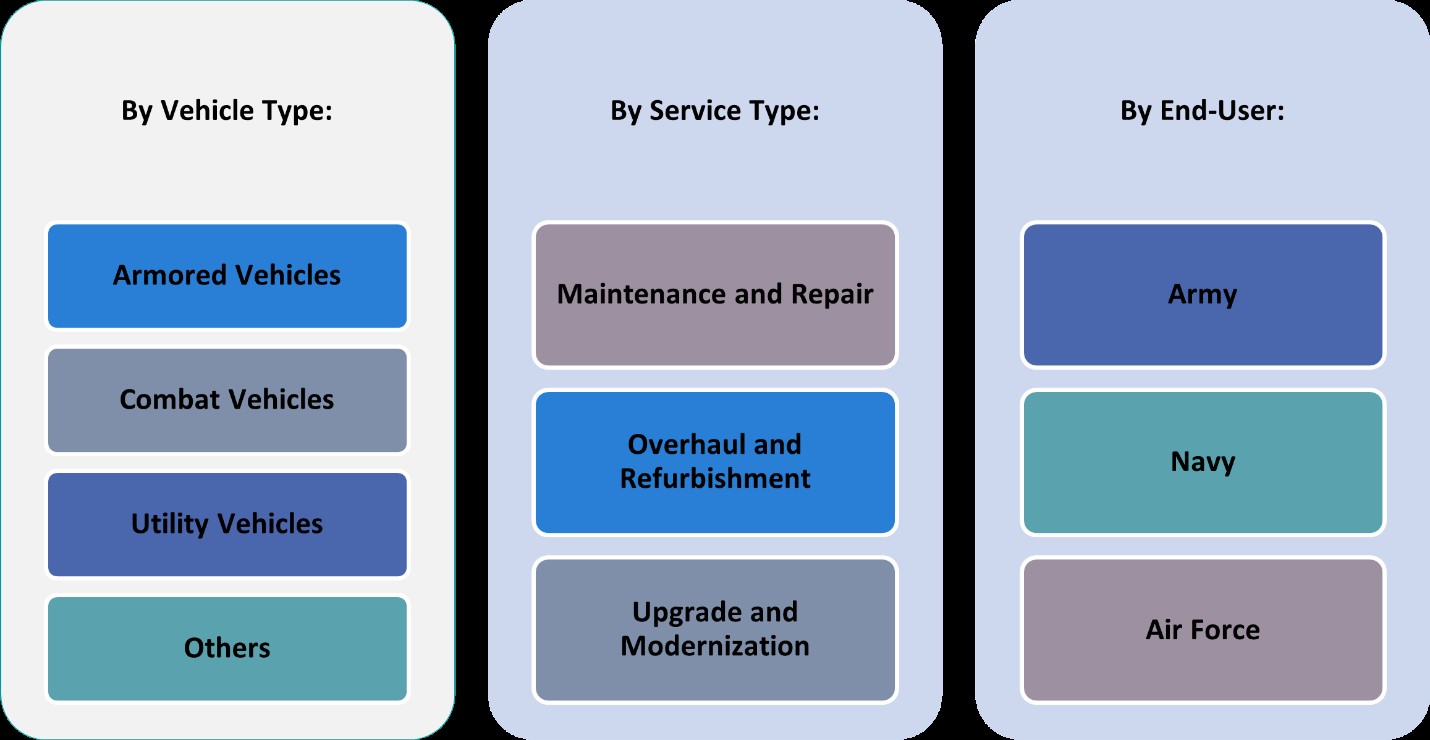

This report segments the U.S. Military Vehicle Sustainment Market as follows:

Market Drivers

Aging Fleet and Lifecycle Extension Requirements

One of the primary drivers fueling the U.S. military vehicle sustainment market is the aging fleet of military ground vehicles that require continuous maintenance, repair, and overhaul (MRO) services. For instance, the U.S. Department of Defense (DoD) has emphasized the importance of lifecycle extension programs for vehicles like Humvees and Bradley Fighting Vehicles, which remain critical to national defense operations. Replacing entire fleets is cost-prohibitive; hence, the Department of Defense (DoD) is investing heavily in sustainment programs to extend the operational lifespan of existing assets. These lifecycle extension efforts include structural refurbishment, engine upgrades, and integration of new technologies, which are critical for maintaining performance standards and ensuring mission readiness. As a result, sustainment services remain a strategic priority to preserve fleet capability and reliability over extended periods.

Increasing Defense Budget and Strategic Prioritization

The steady increase in the U.S. defense budget has significantly supported the growth of the military vehicle sustainment market. The DoD allocates a substantial portion of its budget to operations and maintenance (O&M), which directly funds sustainment initiatives. With greater emphasis on readiness and resilience, the U.S. military continues to prioritize funding for sustainment activities that ensure vehicles are fully operational and combat-ready. Moreover, strategic policy directives such as the Army’s focus on “People First, Readiness Always” reinforce the importance of vehicle upkeep in maintaining force effectiveness. The continued flow of funding enables military branches to modernize their sustainment infrastructure and adopt cutting-edge techniques for condition-based and predictive maintenance, ultimately driving long-term market growth.

Technological Advancements in Predictive Maintenance

Rapid advancements in technologies such as artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are revolutionizing the military vehicle sustainment landscape. For instance, the U.S. Army Futures Command has integrated predictive maintenance tools powered by real-time data analytics to identify potential equipment failures before they occur. Additionally, the implementation of digital twins and automated diagnostic platforms is streamlining the maintenance process and accelerating decision-making. These technologies allow for the accurate simulation of wear-and-tear scenarios, helping sustainment teams plan timely interventions. The integration of such advanced systems is becoming increasingly prevalent across U.S. military branches, making technological innovation a key driver of market expansion.

Geopolitical Tensions and Operational Readiness Needs

Growing geopolitical uncertainties and the evolving nature of global conflict demand that U.S. military forces maintain high levels of operational readiness. To respond effectively to rapid deployments, both domestically and internationally, military units must ensure that their vehicle fleets are always in optimal condition. Sustainment services play a vital role in enabling mobility, survivability, and logistical support in diverse and often harsh environments. As the military continues to operate in regions characterized by unpredictable threats, sustainment efforts are crucial for maintaining the strategic advantage. Furthermore, the need for interoperability and joint-force capabilities across different vehicle platforms has led to standardized sustainment practices, further reinforcing market demand. In this context, military vehicle sustainment is not just a support function—it is an operational necessity that directly contributes to mission success.

Market Trends

Shift Toward Predictive and Condition-Based Maintenance

The U.S. military is increasingly shifting from traditional reactive maintenance to predictive and condition-based maintenance (CBM) strategies. This trend is driven by the growing need to reduce vehicle downtime, enhance operational efficiency, and optimize the lifecycle of military assets. For instance, the U.S. Department of Defense (DoD) has implemented CBM programs that leverage real-time data from embedded sensors to monitor vehicle performance and detect anomalies. Additionally, the U.S. Army Materiel Command has emphasized the role of telematics in scheduling proactive maintenance, aligning with modernization goals to ensure higher fleet availability.

Integration of Advanced Digital Technologies

The integration of digital technologies such as artificial intelligence (AI), machine learning (ML), blockchain, and the Internet of Things (IoT) is transforming sustainment operations across the U.S. military. For instance, the U.S. Army Futures Command has adopted AI-powered platforms to analyze historical data and predict future maintenance needs, enhancing decision-making capabilities. Similarly, the DoD has supported the use of digital twin technology to simulate vehicle performance under various operational conditions, refining maintenance schedules and improving efficiency.

Emphasis on Public-Private Partnerships

There is a growing emphasis on public-private partnerships (PPPs) as the U.S. military collaborates with private contractors and OEMs to streamline and enhance vehicle sustainment services. These partnerships bring commercial best practices, technical expertise, and innovation into the military sustainment ecosystem. Contractors play a vital role in depot-level maintenance, field service support, and technology integration, helping reduce logistical bottlenecks and improve readiness. Moreover, long-term performance-based logistics (PBL) contracts are becoming more common, aligning the interests of defense agencies and private partners toward shared sustainment goals. The increasing reliance on PPPs reflects a trend toward more collaborative, efficient, and scalable sustainment solutions.

Focus on Sustainable and Energy-Efficient Practices

Sustainability and energy efficiency are becoming key considerations in military vehicle sustainment. The U.S. Department of Defense is actively working to reduce its environmental footprint by promoting the use of eco-friendly materials, renewable energy sources, and greener maintenance practices. This includes retrofitting older vehicles with more fuel-efficient systems and utilizing biodegradable lubricants and cleaning agents. In addition, the military is investing in hybrid and electric vehicle technologies that require new forms of sustainment planning and infrastructure. As environmental regulations tighten and the military’s commitment to sustainability grows, energy-efficient practices are emerging as a significant trend shaping the future of vehicle sustainment operations.

Market Challenges Analysis

Logistical Complexities and Budgetary Constraints

One of the most pressing challenges in the U.S. military vehicle sustainment market is the logistical complexity involved in maintaining a large and diverse fleet across multiple global locations. Coordinating timely maintenance, repair, and overhaul (MRO) activities for various vehicle types—from tactical wheeled vehicles to armored combat systems—demands a highly efficient supply chain, skilled workforce, and availability of spare parts. Any disruption in logistics can delay repair cycles and impact mission readiness. Additionally, while the defense budget remains substantial, sustainment operations often compete with other modernization and procurement priorities for funding. The need to balance short-term operational requirements with long-term maintenance investments poses a significant constraint. This is further complicated by rising costs of advanced materials and components, making it difficult for program managers to allocate resources efficiently without compromising fleet performance or readiness.

Integration of Advanced Technologies and Workforce Limitations

While technological innovation is a growth driver, it also presents integration challenges that may hinder the efficiency of sustainment operations. Incorporating AI-based diagnostics, predictive maintenance tools, and IoT systems requires substantial upfront investment, cybersecurity readiness, and system compatibility across aging platforms. For instance, the U.S. Army Futures Command has reported difficulties in retrofitting legacy vehicles with digital integration capabilities, leading to interoperability issues. Additionally, the U.S. Department of Defense has emphasized the need for specialized training programs to address the growing skills gap within the sustainment workforce, ensuring personnel are equipped to manage advanced analytics and automation systems effectively.

Market Opportunities

The U.S. military vehicle sustainment market presents substantial growth opportunities driven by the increasing adoption of advanced digital technologies and evolving defense strategies. As the Department of Defense emphasizes modernization, there is a rising demand for smart maintenance solutions that incorporate artificial intelligence, machine learning, and IoT-enabled platforms. These technologies offer predictive insights, streamline diagnostics, and enable real-time performance monitoring, allowing for more efficient maintenance planning and reduced lifecycle costs. Additionally, the shift towards digitized logistics and automated inventory systems opens avenues for tech companies and defense contractors to offer integrated software-hardware solutions tailored to military requirements. The growing focus on condition-based and performance-based maintenance strategies further enhances opportunities for innovation in service delivery and technological integration across vehicle platforms.

Another promising area of opportunity lies in expanding public-private partnerships and long-term service agreements. Defense agencies are increasingly collaborating with private sector players for depot-level sustainment, component refurbishment, and technical support services. This model not only boosts operational efficiency but also invites investment in specialized infrastructure, workforce training, and R&D. Furthermore, the military’s commitment to environmental sustainability is driving the demand for greener maintenance practices and energy-efficient vehicle upgrades, such as hybrid and electric retrofits. Companies offering eco-friendly solutions, recyclable materials, and alternative fuel technologies can tap into this emerging niche within the sustainment space. As geopolitical tensions persist and rapid deployment capabilities become critical, the need for agile, resilient, and well-maintained vehicle fleets will continue to grow, reinforcing a long-term demand for robust sustainment solutions across all branches of the U.S. armed forces.

Market Segmentation Analysis:

By Vehicle Type:

The U.S. military vehicle sustainment market, when segmented by vehicle type, includes armored vehicles, combat vehicles, utility vehicles, and others. Among these, armored vehicles account for a significant share due to their critical role in ground-based operations, particularly in high-risk environments. These vehicles demand frequent maintenance, refurbishment, and structural upgrades to ensure survivability and combat-readiness. Combat vehicles, such as infantry fighting vehicles and main battle tanks, also contribute robustly to the market, driven by their intensive use in training and active deployments. Sustaining their mechanical and electronic systems is essential for maintaining operational effectiveness. Meanwhile, utility vehicles like Humvees and tactical trucks experience high wear due to their widespread logistical and transportation functions. Their high operational tempo leads to continuous demand for maintenance and lifecycle support services. The “Others” segment, which includes engineering and recovery vehicles, contributes moderately but remains relevant due to their specialized functions. Overall, the diversity of vehicle platforms necessitates tailored sustainment strategies to maintain mission readiness and fleet longevity.

By Service Type:

Based on service type, the market is segmented into maintenance and repair, overhaul and refurbishment, and upgrade and modernization. Maintenance and repair services dominate this segment as they are essential for ensuring the day-to-day operational availability of military vehicles. These include routine checks, parts replacement, and minor mechanical fixes that help prevent mission-critical breakdowns. Overhaul and refurbishment services cater to aging fleets that require deeper structural and system-level interventions to extend their service life. This segment is particularly important for legacy systems that remain in use due to high replacement costs. The upgrade and modernization segment is witnessing strong growth, propelled by the integration of advanced communication systems, armor enhancements, and energy-efficient powertrains. With the U.S. military’s increasing focus on battlefield digitization and fleet modernization, this segment is expected to expand rapidly in the coming years. The combination of these services ensures a balanced sustainment ecosystem, supporting both legacy vehicles and modern platforms across all branches of the armed forces.

Segments:

Based on Vehicle Type:

- Armored Vehicles

- Combat Vehicles

- Utility Vehicles

- Others

Based on Service Type:

- Maintenance and Repair

- Overhaul and Refurbishment

- Upgrade and Modernization

Based on End- User:

Based on the Geography:

- Western United States

- Midwestern United States

- Southern United States

- Northeastern United States

Regional Analysis

Western United States

The Western United States holds the largest market share in the U.S. military vehicle sustainment market, accounting for approximately 34% of the total revenue in 2024. This dominance is attributed to the presence of several key military bases and defense contractors located in states such as California, Arizona, and Washington. The region hosts critical Army and Marine Corps facilities, including Fort Irwin and Camp Pendleton, which are actively engaged in training, operations, and vehicle deployment. The proximity to defense technology hubs and aerospace industries further enhances the region’s capabilities in vehicle diagnostics, upgrade programs, and predictive maintenance services. The increasing focus on modernizing tactical and armored vehicle fleets through advanced technologies is also driving sustainment demand in this region, making it a key growth engine for the market.

Southern United States

The Southern United States follows closely, contributing around 29% to the overall market share in 2024. This region encompasses major Army and Air Force installations in Texas, Georgia, and North Carolina, which collectively support a large fleet of utility and combat vehicles. The hot and humid climate also imposes higher wear-and-tear on vehicle systems, increasing the frequency and intensity of maintenance and repair services. Moreover, several defense logistics hubs and private MRO service providers operate in the South, facilitating rapid response capabilities and streamlined supply chain operations. The ongoing military readiness initiatives, including regular training exercises and deployment support, continue to boost demand for overhaul and refurbishment services across vehicle categories in this region.

Midwestern United States

The Midwestern United States captures a market share of approximately 21% in 2024. Although the region has fewer large-scale military installations compared to the West and South, it plays a vital role in vehicle sustainment through its robust manufacturing and industrial base. States like Michigan and Ohio are home to key vehicle production and refurbishment facilities, where OEMs and defense contractors collaborate on modernization projects and fleet upgrades. The Midwestern region benefits from strategic transportation networks, enabling efficient movement of vehicles and components between facilities. With rising investment in digitized sustainment programs and a skilled engineering workforce, the region is positioned for steady growth in the military vehicle support sector.

Northeastern United States

The Northeastern United States holds the smallest market share, at approximately 16% in 2024. Despite its limited share, the region is strategically important due to its concentration of command centers, research institutions, and support units in states like New York and Massachusetts. The region primarily focuses on advanced vehicle diagnostics, software-driven upgrades, and integration of new-age defense technologies into legacy systems. Furthermore, Northeastern contractors are increasingly involved in R&D projects aimed at improving sustainment efficiency through AI, blockchain, and IoT applications. While physical MRO activities may be limited compared to other regions, the Northeast contributes significantly to innovation and long-term strategic planning within the sustainment ecosystem.

Key Player Analysis

- Lockheed Martin Corporation

- General Dynamics Corporation

- Oshkosh Defense

- Raytheon Technologies Corporation

- BAE Systems

- Northrop Grumman Corporation

- AM General LLC

- Textron Systems

- L3Harris Technologies

- Navistar Defense

Competitive Analysis

The competitive landscape of the U.S. military vehicle sustainment market is defined by a few dominant players with deep-rooted partnerships with the Department of Defense and broad capabilities across maintenance, repair, overhaul, and modernization services. Leading companies such as Lockheed Martin Corporation, General Dynamics Corporation, Oshkosh Defense, Raytheon Technologies Corporation, BAE Systems, Northrop Grumman Corporation, AM General LLC, Textron Systems, L3Harris Technologies, and Navistar Defense have established their market presence through long-term contracts, extensive infrastructure, and consistent innovation. These players possess advanced technical expertise, integrated logistics support systems, and the ability to provide comprehensive lifecycle solutions for a wide range of military vehicles. Most of these companies operate specialized sustainment centers and collaborate with military depots to deliver rapid, mission-critical support. Their focus on digital transformation, AI-based maintenance technologies, and modular vehicle upgrades positions them as frontrunners in meeting evolving defense demands. Their strong financial backing and global supply chains further reinforce their competitive edge, limiting opportunities for new entrants.

Recent Developments

- In April 2025, Northrop Grumman partnered with Raytheon on MK72 solid rocket motor development as part of efforts to enhance missile systems production capacity.

- In March 2025, Lockheed Martin announced the rollout of the first Block 4 software updates for the F-35 program, aimed at enhancing combat capabilities through upgrades in sensors, electronic warfare, weapons integration, and survivability. These updates are built on the Technology Refresh 3 (TR-3) hardware platform, which significantly improves processing power and memory.

- In February 2025, Oshkosh Defense secured $214.7 million in contracts for Family of Medium Tactical Vehicles (FMTVs). These vehicles are designed to enhance tactical mobility, reduce sustainment costs, and improve operational effectiveness. The contracts include variants such as low velocity air-drop (LVAD) vehicles for rapid deployment.

- In October 2024, General Dynamics Land Systems delivered two TRX unmanned ground vehicle prototypes to the U.S. Army for testing under the Robotic Combat Vehicle (RCV) program. The TRX features modular architecture, hybrid-electric propulsion, and multi-mission capabilities such as reconnaissance, surveillance, and counter-drone operations.

Market Concentration & Characteristics

The U.S. military vehicle sustainment market exhibits a high level of market concentration, characterized by the dominance of a few well-established defense contractors with long-standing relationships with the Department of Defense. Companies such as Lockheed Martin, General Dynamics, and BAE Systems play pivotal roles due to their extensive capabilities in lifecycle support, technological integration, and vehicle modernization. These firms often operate under multi-year contracts, which reinforces their market position and ensures continuity of sustainment services. The market is also defined by its mission-critical nature, with a strong emphasis on reliability, compliance with military standards, and rapid response capabilities. Technological advancements, such as predictive maintenance, AI-driven diagnostics, and modular upgrades, are reshaping sustainment practices, enabling higher operational readiness and cost-efficiency. Despite its concentrated structure, the market offers opportunities for specialized service providers and technology firms to contribute innovative solutions that address evolving military needs, particularly in the areas of digital transformation and fleet modernization.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is projected to grow steadily, driven by increased defense spending and the need to extend the lifespan of aging vehicle fleets.

- Integration of artificial intelligence and Internet of Things technologies will enhance predictive maintenance capabilities, reducing downtime and improving operational readiness.

- Additive manufacturing, such as 3D printing, will enable rapid production of spare parts, streamlining repair processes and reducing supply chain dependencies.

- Emphasis on sustainability will lead to the adoption of eco-friendly practices, including the use of alternative fuels and energy-efficient systems in vehicle maintenance.

- The shift towards modular vehicle designs will facilitate easier upgrades and maintenance, allowing for quicker adaptation to evolving mission requirements.

- Public-private partnerships will become more prevalent, fostering innovation and leveraging commercial technologies for military applications.

- Cybersecurity measures will be increasingly integrated into sustainment operations to protect against potential threats to vehicle systems and data integrity.

- Training programs will evolve to equip maintenance personnel with skills to manage advanced technologies and digital tools effectively.

- Data analytics will play a crucial role in decision-making processes, enabling more efficient allocation of resources and proactive maintenance scheduling.

- The market will witness increased collaboration among defense contractors, technology firms, and government agencies to develop comprehensive sustainment solutions.