| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Military Vehicle Sustainment Market Size 2024 |

USD 708.74 Million |

| UK Military Vehicle Sustainment Market, CAGR |

7.86% |

| UK Military Vehicle Sustainment Market Size 2032 |

USD 1,298.37 Million |

Market Overview

UK Military Vehicle Sustainment Market size was valued at USD 708.74 million in 2024 and is anticipated to reach USD 1,298.37 million by 2032, at a CAGR of 7.86% during the forecast period (2024-2032).

The UK Military Vehicle Sustainment market is experiencing steady growth due to rising defense expenditure and the increasing need to extend the service life of aging vehicle fleets. The government’s commitment to modernizing its armed forces, particularly through initiatives like the Integrated Review and Defence Command Paper, is driving demand for advanced sustainment solutions. Key drivers include the adoption of predictive maintenance technologies, emphasis on cost-effective lifecycle management, and the need for enhanced operational readiness amid evolving geopolitical tensions. Additionally, growing reliance on digital twins, data analytics, and AI-powered diagnostics is transforming maintenance strategies, enabling more proactive and efficient support. Industry players are also focusing on public-private partnerships to strengthen sustainment capabilities and streamline supply chains. These trends collectively reflect a strategic shift towards integrated, technology-driven sustainment models aimed at improving fleet availability, mission reliability, and overall defense readiness in a rapidly changing security landscape.

The geographical landscape of the UK Military Vehicle Sustainment market is characterized by the strategic distribution of defense facilities and industrial hubs across key regions such as London, Manchester, Birmingham, and Scotland. These regions play a vital role in supporting sustainment operations, with London serving as the administrative center, while cities like Manchester and Birmingham contribute through strong manufacturing and logistical capabilities. Scotland, with its military bases and rugged training environments, supports specialized vehicle maintenance for northern deployments. The market is highly competitive and features a blend of domestic and international players. Leading companies such as BAE Systems, Rheinmetall AG, Leonardo S.p.A., and Thales Group are actively involved in delivering advanced sustainment solutions, including modernization programs and digital maintenance technologies. Other notable participants include Saab AB, General Dynamics UK, Krauss-Maffei Wegmann (KMW), Patria Group, and MBDA Systems, all contributing to enhancing fleet readiness and extending the service life of military vehicle assets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The UK Military Vehicle Sustainment market was valued at USD 708.74 million in 2024 and is projected to reach USD 1,298.37 million by 2032, growing at a CAGR of 7.86%.

- Increased focus on fleet readiness and vehicle availability is driving sustained investments in maintenance, overhaul, and modernization programs.

- Integration of advanced technologies such as AI-based diagnostics, digital twins, and predictive maintenance tools is transforming sustainment operations.

- Leading players like BAE Systems, Rheinmetall AG, Thales Group, and Leonardo S.p.A. are enhancing their market presence through strategic contracts and digital service offerings.

- High operational costs and the complexity of upgrading aging fleets remain key challenges for market growth.

- Regional hubs such as London, Manchester, Birmingham, and Scotland play distinct roles in supporting the UK’s defense sustainment infrastructure.

- The market is witnessing a shift toward performance-based logistics and long-term public-private partnerships to improve efficiency and lifecycle management.

Report Scope

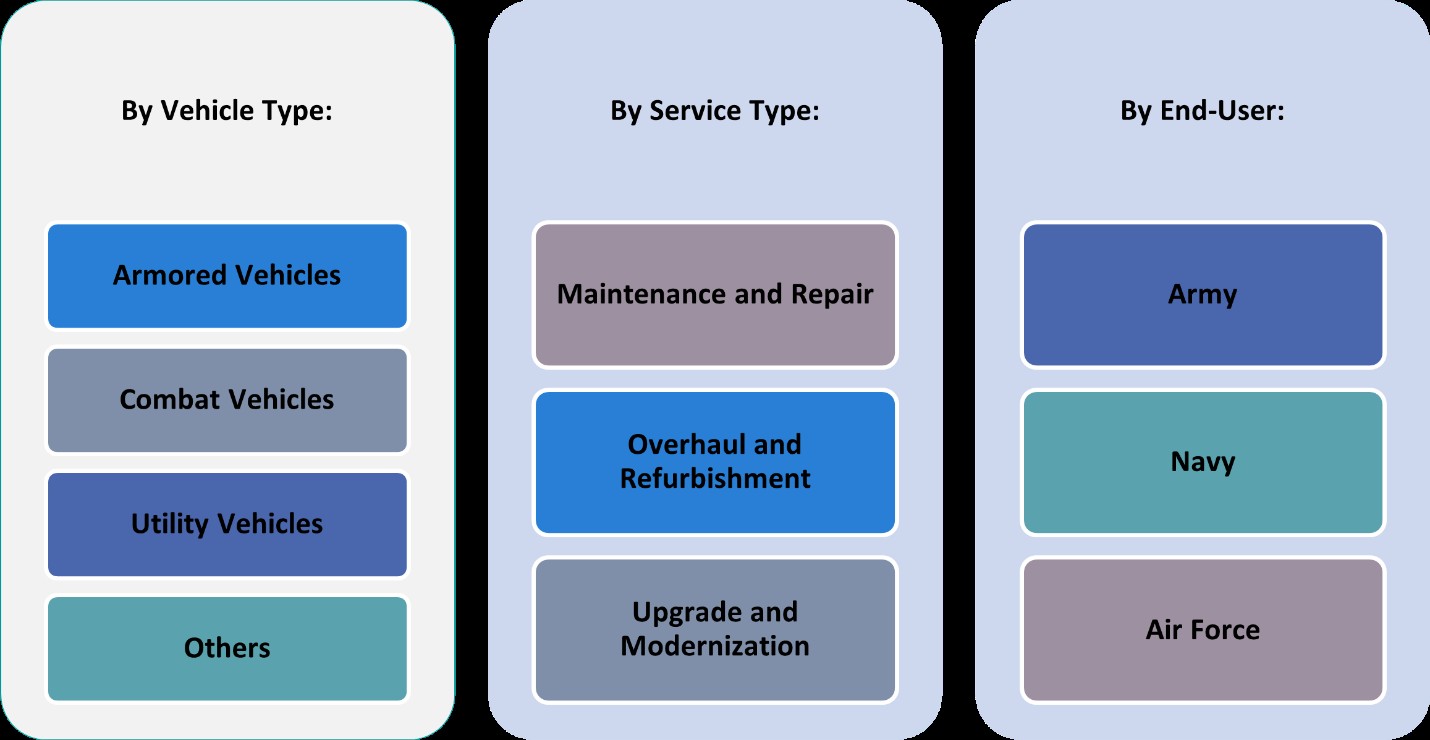

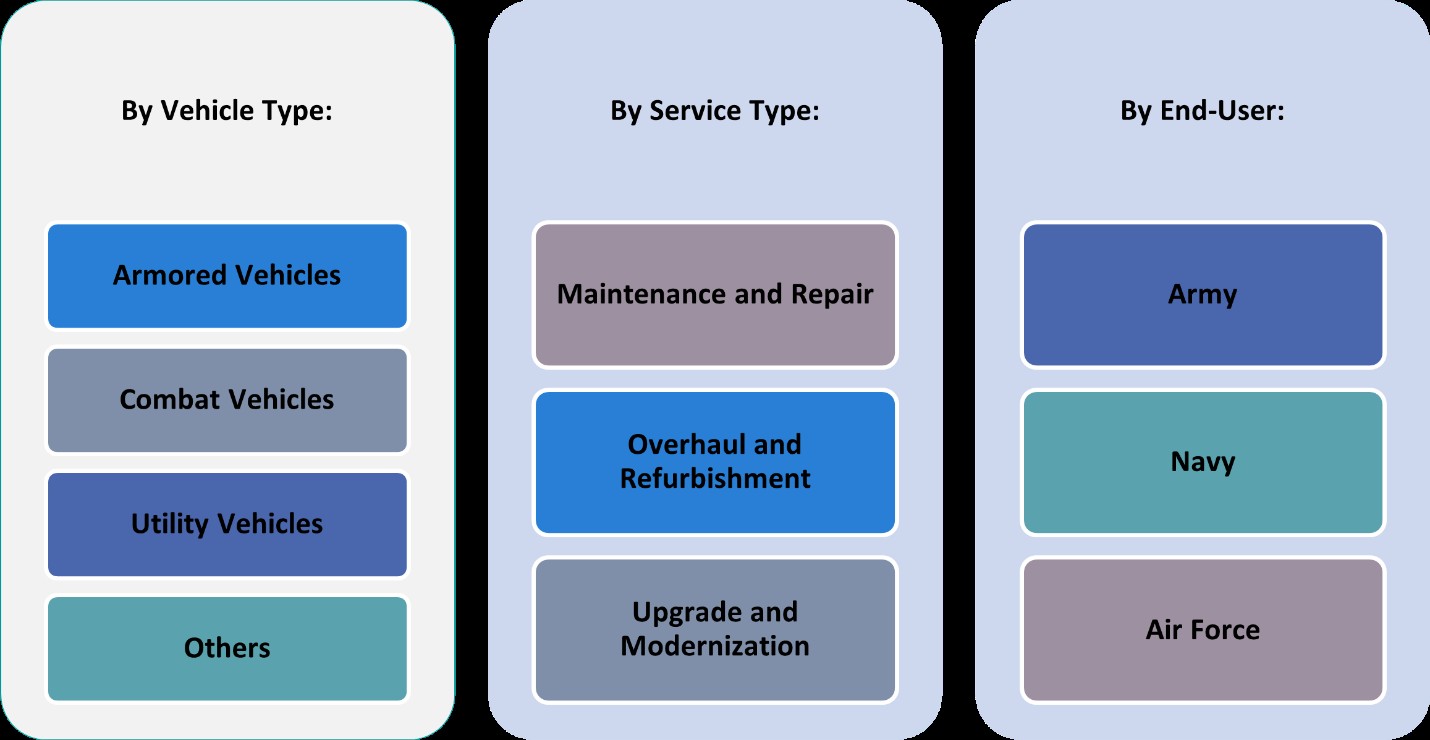

This report segments the UK. Military Vehicle Sustainment Market as follows:

Market Drivers

Rising Defense Budget and Strategic Military Commitments

The UK’s steadily increasing defense budget serves as a foundational driver for the military vehicle sustainment market. With a focus on maintaining global military presence and strengthening homeland defense capabilities, the UK Ministry of Defence (MoD) continues to allocate significant resources to ensure the operational readiness of its land-based assets. For instance, the UK’s Integrated Review and Defence Command Paper have outlined modernization plans that emphasize the extension of vehicle life cycles through sustainment operations. The government’s Integrated Review and Defence Command Paper have outlined a multi-year modernization plan, emphasizing not only the acquisition of new equipment but also the enhancement and longevity of existing platforms. This long-term strategy underscores the importance of sustainment operations, ensuring that aging fleets remain mission-ready while reducing the need for frequent replacements. By prioritizing the extension of vehicle life cycles, the UK is strategically managing its defense assets, thereby fueling demand for maintenance, repair, and overhaul (MRO) services across the armed forces.

Emphasis on Lifecycle Cost Efficiency and Fleet Availability

Another critical driver is the growing emphasis on reducing total lifecycle costs and improving fleet availability. As military vehicles become increasingly sophisticated and expensive, the cost of sustaining them over decades has become a major focus area for defense planners. Sustainment strategies now aim to minimize downtime and avoid costly unscheduled repairs by implementing robust preventive and predictive maintenance programs. These efforts are essential for maintaining high availability rates, particularly during deployments or training operations. Additionally, cost-efficiency is being pursued through modular system upgrades and the use of common platforms that simplify spare parts logistics and maintenance procedures. This evolving sustainment philosophy ensures optimal resource utilization while supporting the MoD’s goal of achieving long-term value from its defense investments.

Strong Public-Private Collaboration in Defense Sustainment

Public-private partnerships (PPPs) are playing a pivotal role in advancing the UK military vehicle sustainment market. For instance, the UK Ministry of Defence has engaged with leading defense contractors under performance-based logistics (PBL) contracts to align sustainment goals and improve mission availability. The MoD continues to engage with leading defense contractors and logistics providers to deliver integrated support solutions under long-term contracts. These collaborations enable the pooling of expertise, infrastructure, and technological capabilities to ensure efficient sustainment outcomes. Such partnerships not only enhance responsiveness and accountability but also stimulate ongoing innovation in the sustainment domain, making PPPs a vital driver of market expansion.

Integration of Advanced Technologies into Sustainment Practices

The integration of advanced technologies is transforming sustainment operations and driving market growth. The adoption of predictive maintenance tools powered by artificial intelligence (AI), machine learning, and big data analytics enables more accurate diagnostics and proactive servicing of military vehicles. These technologies help identify issues before they escalate into critical failures, thereby enhancing mission readiness and minimizing unplanned maintenance. Furthermore, the use of digital twins and sensor-based monitoring systems allows for real-time health assessments of vehicles, supporting more informed decision-making across the sustainment lifecycle. This digital transformation aligns with the UK military’s broader modernization goals and is creating new opportunities for defense contractors and technology providers within the sustainment sector.

Market Trends

Shift Toward Predictive and Condition-Based Maintenance

One of the most significant trends shaping the UK Military Vehicle Sustainment market is the shift from reactive maintenance to predictive and condition-based maintenance (CBM) models. Traditionally reliant on scheduled servicing, the defense sector is increasingly adopting advanced monitoring systems that utilize real-time data and analytics to assess the health of military vehicles. For instance, the UK Ministry of Defence (MoD) has implemented CBM programs that leverage IoT sensors and machine learning algorithms to optimize operational availability and extend asset lifespan. Additionally, the MoD has emphasized the integration of AI-powered predictive maintenance tools as part of its modernization and digitalization initiatives.

Growing Adoption of Digital Twin and Simulation Technologies

Digital twin technology is emerging as a key enabler in enhancing military vehicle sustainment strategies. This trend involves creating virtual replicas of vehicles that simulate real-world conditions, allowing maintenance teams to predict failures, plan interventions, and optimize performance. For instance, the UK Ministry of Defence has supported the use of digital twins to streamline diagnostics and maintenance workflows, improving fleet reliability and reducing lifecycle costs. Additionally, simulation-based sustainment strategies have been highlighted by the MoD as critical for mission readiness evaluations and design upgrades. The increasing use of simulation-based sustainment strategies is streamlining diagnostics and maintenance workflows, thus improving fleet reliability and reducing overall lifecycle costs.

Modular Upgrades and Standardized Components for Efficiency

Another notable trend is the move toward modular system design and the use of standardized components across multiple vehicle platforms. This approach simplifies repair and maintenance activities, enhances interchangeability, and reduces the logistical complexity of managing large and diverse fleets. In the UK, defense programs are increasingly prioritizing modularity in vehicle design to enable faster field-level upgrades and maintenance. By using common parts and systems across platforms, the armed forces can improve supply chain efficiency and ensure faster turnaround times for sustainment tasks. This modular approach not only supports operational readiness but also contributes to cost savings over the vehicle’s service life.

Emphasis on Green Sustainment and Environmental Compliance

Sustainability and environmental compliance are becoming important considerations in military vehicle sustainment operations. The UK government’s push for decarbonization and net-zero carbon emissions is influencing defense policies and procurement strategies. Sustainment programs are now incorporating eco-friendly practices such as energy-efficient maintenance facilities, reduced use of hazardous materials, and the integration of hybrid and electric vehicle components where feasible. The trend toward green sustainment aligns with broader national environmental goals and reflects the military’s role in supporting responsible, sustainable operations without compromising combat effectiveness or readiness.

Market Challenges Analysis

Budget Constraints and High Operational Costs

Despite the UK government’s commitment to defense modernization, budgetary limitations remain a key challenge for the military vehicle sustainment market. While significant investments are allocated toward new defense technologies, balancing these expenditures with the ongoing costs of sustaining legacy systems proves complex. For instance, the UK Ministry of Defence (MoD) has emphasized the importance of strategic trade-offs between investing in new capabilities and maintaining operational readiness of existing platforms. Additionally, the MoD has highlighted inflationary pressures and rising labor costs as factors that strain available funds, complicating the execution of sustainment programs. These financial constraints pose a challenge to achieving cost-effective, long-term sustainment strategies without compromising mission readiness or fleet availability.

Supply Chain Disruptions and Skills Shortages

The UK Military Vehicle Sustainment market also faces ongoing challenges related to supply chain vulnerabilities and a shortage of skilled personnel. Global disruptions—exacerbated by geopolitical instability, post-Brexit trade complications, and pandemic-related delays—have impacted the timely delivery of spare parts, components, and raw materials. These supply chain issues increase maintenance lead times and affect the overall reliability of sustainment schedules. Moreover, the defense sector is experiencing a growing skills gap, particularly in areas such as advanced diagnostics, AI-based maintenance tools, and systems integration. Recruiting and retaining qualified technicians and engineers is increasingly difficult amid competition from the private sector. These workforce shortages can delay essential MRO operations and hinder the adoption of next-generation sustainment technologies. Addressing these issues requires sustained investment in workforce development, training programs, and robust supplier networks to ensure the resilience and efficiency of the UK’s military sustainment infrastructure.

Market Opportunities

The UK Military Vehicle Sustainment market presents substantial opportunities driven by the increasing demand for modernization and technology integration across the defense sector. As the UK government continues to emphasize digital transformation and defense innovation, there is growing potential for the adoption of AI-powered predictive maintenance, Internet of Things (IoT) sensors, and digital twin technologies. These advanced tools not only optimize the maintenance lifecycle but also enhance vehicle availability and reduce downtime, offering attractive prospects for technology providers and maintenance contractors. Furthermore, as military fleets transition toward hybrid and electric platforms to align with environmental objectives, there is a rising need for specialized sustainment services and infrastructure to support new propulsion systems. This shift opens doors for companies that can deliver tailored maintenance solutions for next-generation, eco-friendly vehicles and energy-efficient components.

In addition, long-term public-private partnerships and performance-based logistics (PBL) contracts offer lucrative avenues for private sector involvement in military vehicle sustainment. The Ministry of Defence’s increasing reliance on industry-led support programs is creating consistent demand for innovative service delivery models that ensure high operational readiness and cost efficiency. Companies that can offer integrated, scalable sustainment solutions—covering everything from field-level maintenance to lifecycle management and digital analytics—are well-positioned to capture market share. There is also significant opportunity in workforce development, with defense organizations seeking to partner with educational and technical institutions to train skilled personnel capable of supporting complex sustainment operations. As the UK expands its defense footprint in response to shifting geopolitical landscapes, the need for agile and responsive sustainment capabilities will grow, creating a favorable environment for industry stakeholders to introduce cutting-edge technologies and strategic collaborations tailored to the evolving defense ecosystem.

Market Segmentation Analysis:

By Vehicle Type:

The UK Military Vehicle Sustainment market, when segmented by vehicle type, includes Armored Vehicles, Combat Vehicles, Utility Vehicles, and Others. Among these, armored vehicles represent a dominant segment due to their critical role in ensuring frontline protection and survivability in high-threat environments. These vehicles, including main battle tanks and armored personnel carriers, require regular sustainment to maintain operational readiness and mobility. Combat vehicles, such as infantry fighting vehicles, are also seeing increased investment in sustainment as the UK focuses on enhancing its mechanized infantry capabilities. Utility vehicles, while less complex, form the backbone of logistical and transport operations and thus represent a consistent demand for maintenance and support services. The “Others” segment, which may include engineering and recovery vehicles, also contributes to the market as they support specialized missions. The broad use of various vehicle types across defense operations ensures that each category continues to receive focused sustainment efforts, tailored to its operational requirements and lifecycle status.

By Service Type:

Based on service type, the UK Military Vehicle Sustainment market is segmented into Maintenance and Repair, Overhaul and Refurbishment, and Upgrade and Modernization. Maintenance and repair services account for the largest share, driven by the continuous need to ensure vehicle operability and reduce downtime. These services include routine checks, fault diagnostics, and component replacements. Overhaul and refurbishment are gaining traction, particularly for aging platforms, as the UK aims to extend service life while deferring large-scale procurement costs. This segment often involves comprehensive restoration to bring vehicles back to near-original performance. Upgrade and modernization services are expected to witness strong growth, supported by the Ministry of Defence’s push for digitization and enhanced battlefield capabilities. These upgrades typically involve the integration of advanced electronics, armor, and communications systems. Together, these service segments reflect a balanced approach to fleet sustainment—preserving legacy systems, improving mission effectiveness, and aligning with modern combat requirements.

Segments:

Based on Vehicle Type:

- Armored Vehicles

- Combat Vehicles

- Utility Vehicles

- Others

Based on Service Type:

- Maintenance and Repair

- Overhaul and Refurbishment

- Upgrade and Modernization

Based on End- User:

Based on the Geography:

- London

- Manchester

- Birmingham

- Scotland

Regional Analysis

London

London holds the largest share in the UK Military Vehicle Sustainment market, accounting for approximately 34% in 2024. This dominance is attributed to the city’s role as the administrative and strategic hub of the United Kingdom’s defense infrastructure. Home to the Ministry of Defence and key procurement agencies, London plays a central role in defense planning, budget allocation, and policy development, which directly influences sustainment operations across the country. Additionally, the presence of major defense contractors and consulting firms facilitates a highly integrated approach to military vehicle lifecycle management. The concentration of government and private sector collaboration within the capital enhances access to resources, technology, and expertise. As the government continues to invest in modernizing the armed forces, London’s strategic leadership and proximity to decision-making centers ensure that it remains a critical region driving growth in vehicle maintenance, overhaul, and upgrade initiatives.

Manchester

Manchester captures a significant 27% share of the UK Military Vehicle Sustainment market, supported by its expanding defense manufacturing and logistics ecosystem. The region has witnessed growing investments in advanced manufacturing, making it a key contributor to the sustainment of military land systems. Manchester is home to several engineering firms and MRO (Maintenance, Repair, and Overhaul) providers that specialize in armored and combat vehicle servicing. Its geographic positioning also makes it a central logistics node for supply chain operations across northern England. The availability of skilled technical labor and well-established transportation networks further enhances the efficiency and responsiveness of sustainment activities. With increasing emphasis on regional defense hubs, Manchester is poised to play a growing role in supporting both current and future sustainment demands, particularly as the MoD seeks to decentralize operations and build regional maintenance capabilities.

Birmingham

Birmingham accounts for 21% of the UK Military Vehicle Sustainment market, benefiting from its strong industrial base and proximity to major defense training centers and logistics units. The city’s history as a manufacturing powerhouse continues to support its involvement in defense supply chains, particularly in component production and heavy vehicle servicing. Birmingham’s location in the Midlands enables it to serve as a strategic connector between northern and southern sustainment operations. The region has also embraced innovation through partnerships with universities and defense research organizations, promoting R&D in vehicle diagnostics and predictive maintenance tools. These capabilities support not only traditional maintenance services but also the ongoing modernization of military vehicle fleets. As the UK Armed Forces prioritize long-term service support, Birmingham’s role as a regional sustainment hub is expected to strengthen further.

Scotland

Scotland contributes approximately 18% to the UK Military Vehicle Sustainment market, with a growing focus on supporting land forces deployed across northern territories and remote locations. The region is home to key military bases and training grounds, particularly those involved in heavy vehicle operations and cold-weather missions. Sustainment activities in Scotland are tailored to support rugged terrain requirements, which demand specialized maintenance capabilities and vehicle configurations. Additionally, Scotland’s commitment to renewable energy and sustainability aligns with emerging trends in green military logistics, including energy-efficient maintenance facilities. The Scottish government’s support for defense-related SMEs also contributes to regional sustainment infrastructure. While its market share is currently the smallest among the four regions, Scotland’s strategic value and evolving capabilities position it as a vital player in the national sustainment network, especially in future vehicle platform upgrades and cold-environment readiness programs.

Key Player Analysis

- Rheinmetall AG

- Leonardo S.p.A.

- BAE Systems

- Thales Group

- Nexter Systems

- Saab AB

- GDELS (General Dynamics UK and Land Systems)

- Krauss-Maffei Wegmann (KMW)

- Patria Group

- MBDA Systems

Competitive Analysis

The UK Military Vehicle Sustainment market is highly competitive, with several prominent players driving innovation, service excellence, and technological integration. Leading companies in this space include BAE Systems, Rheinmetall AG, Leonardo S.p.A., Thales Group, Nexter Systems, Saab AB, General Dynamics UK, Krauss-Maffei Wegmann (KMW), Patria Group, and MBDA Systems. These firms are actively involved in delivering integrated sustainment services, including maintenance, upgrades, overhauls, and modernization programs that align with the evolving operational needs of the UK Armed Forces. Many of these players leverage advanced digital technologies such as predictive analytics, digital twins, and AI-based diagnostic platforms to enhance vehicle reliability and reduce downtime. Additionally, companies are focusing on expanding their local presence, forging long-term service agreements with the Ministry of Defence, and investing in performance-based logistics models. Strategic collaborations, R&D investments, and legacy fleet support are central to maintaining a competitive edge. The market dynamics favor firms that can combine technological capabilities with flexible, scalable sustainment solutions tailored to the UK’s defense modernization goals.

Recent Developments

- In April 2025, Leonardo received a £165 million contract extension from the UK Ministry of Defence to continue maintaining the Royal Navy’s fleet of 54 Merlin helicopters. This includes depth maintenance, spare supplies, training, technical support, and obsolescence management.

- In April 2025, BAE Systems Hägglunds ordered Saab’s Universal Tank and Anti-Aircraft System (UTAAS) sight and fire control system for Combat Vehicle 90 (CV90), valued at SEK 880 million (~£66 million).

- In January 2025, Patria signed a Memorandum of Understanding with Babcock International Group to propose its 6×6 vehicle platform for the British Army’s Medium Protected Mobility category under the Land Mobility Programme. The vehicles will be locally built and supported in line with UK industrial strategies.

- In February 2024, Rheinmetall MAN Military Vehicles UK secured a £282 million contract to deliver 500 HX 8×8 Palletised Load System (PLS) trucks to the British Army. The trucks are designed for logistical missions, including transporting ammunition, food, and water, and feature advanced off-road capabilities.

Market Concentration & Characteristics

The UK Military Vehicle Sustainment market demonstrates a moderate to high level of market concentration, with a handful of well-established defense contractors and specialized service providers holding significant influence over procurement and lifecycle support activities. Characterized by long-term government contracts, high entry barriers, and a strong emphasis on quality assurance and regulatory compliance, the market favors experienced players with proven capabilities in managing complex military platforms. The sector exhibits a demand-driven structure, shaped by evolving defense strategies, operational requirements, and fleet modernization initiatives. Sustainment services are increasingly performance-based, focusing on availability, reliability, and cost-efficiency. Additionally, the market is defined by strong collaboration between public and private sectors, encouraging innovation in digital maintenance, predictive analytics, and remote diagnostics. As the UK Armed Forces continue to emphasize fleet readiness and longevity, the market remains responsive to technological advancements and tailored service models that meet evolving defense operational goals.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Ministry of Defence is prioritizing modernization programs, such as the Challenger 3 tank upgrade, to enhance fleet readiness and extend vehicle lifecycles.

- Predictive maintenance technologies, utilizing AI and IoT, are being adopted to reduce downtime and optimize maintenance schedules.

- Modular vehicle designs are gaining traction, allowing for cost-effective upgrades and adaptability to evolving mission requirements.

- The transition to electric and hybrid propulsion systems is underway, aligning with sustainability goals and reducing the logistical footprint.

- Public-private partnerships are expanding, fostering innovation and efficiency in sustainment operations.

- The MoD is implementing procurement reforms to enhance export potential and streamline acquisition processes.

- Emphasis on data-driven decision-making is increasing, with advanced analytics improving maintenance planning and resource allocation.

- Regional sustainment hubs are being developed to decentralize operations and improve responsiveness across the UK.

- Investment in workforce development is growing to address skills shortages in advanced maintenance and support roles.

- The UK is focusing on enhancing supply chain resilience to mitigate disruptions and ensure timely availability of critical components.