Market Overview

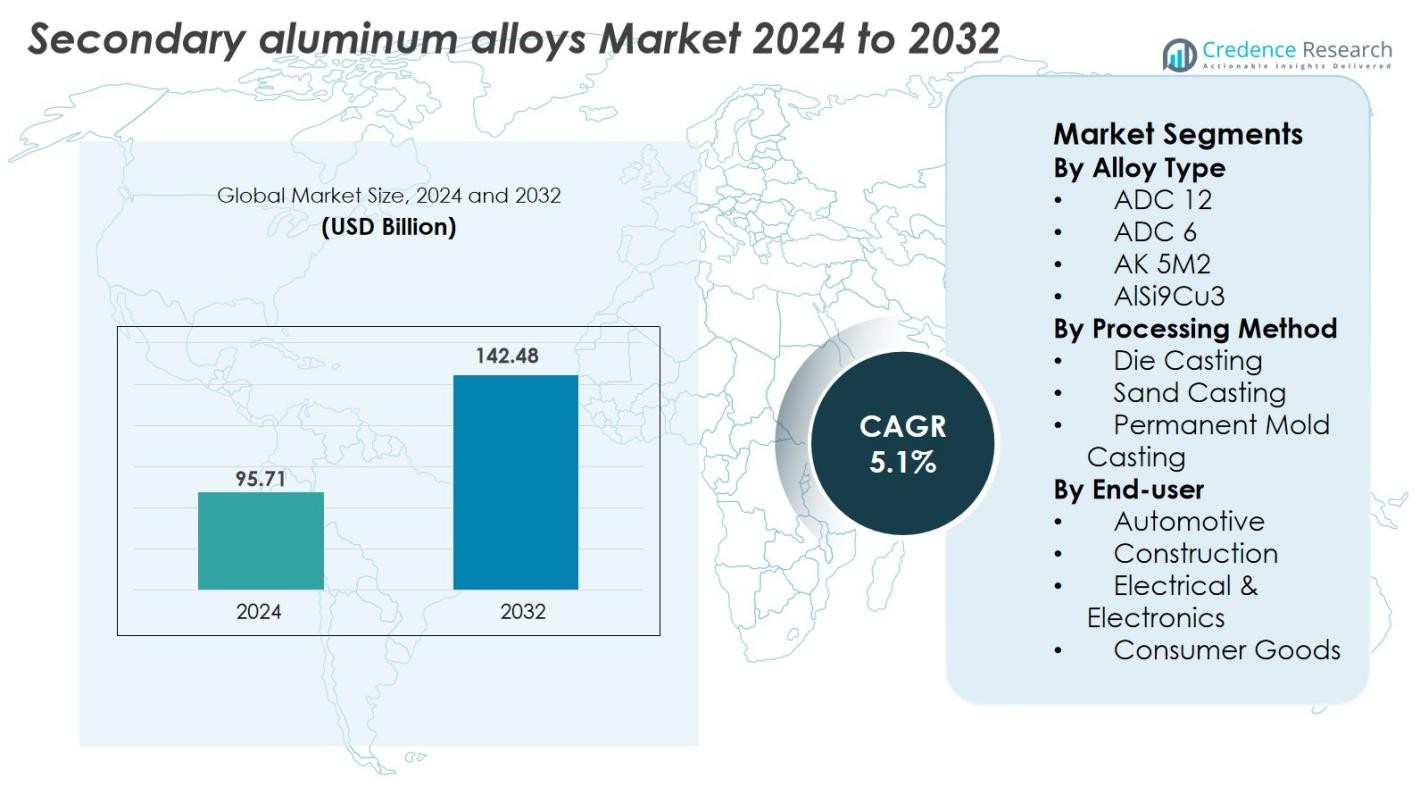

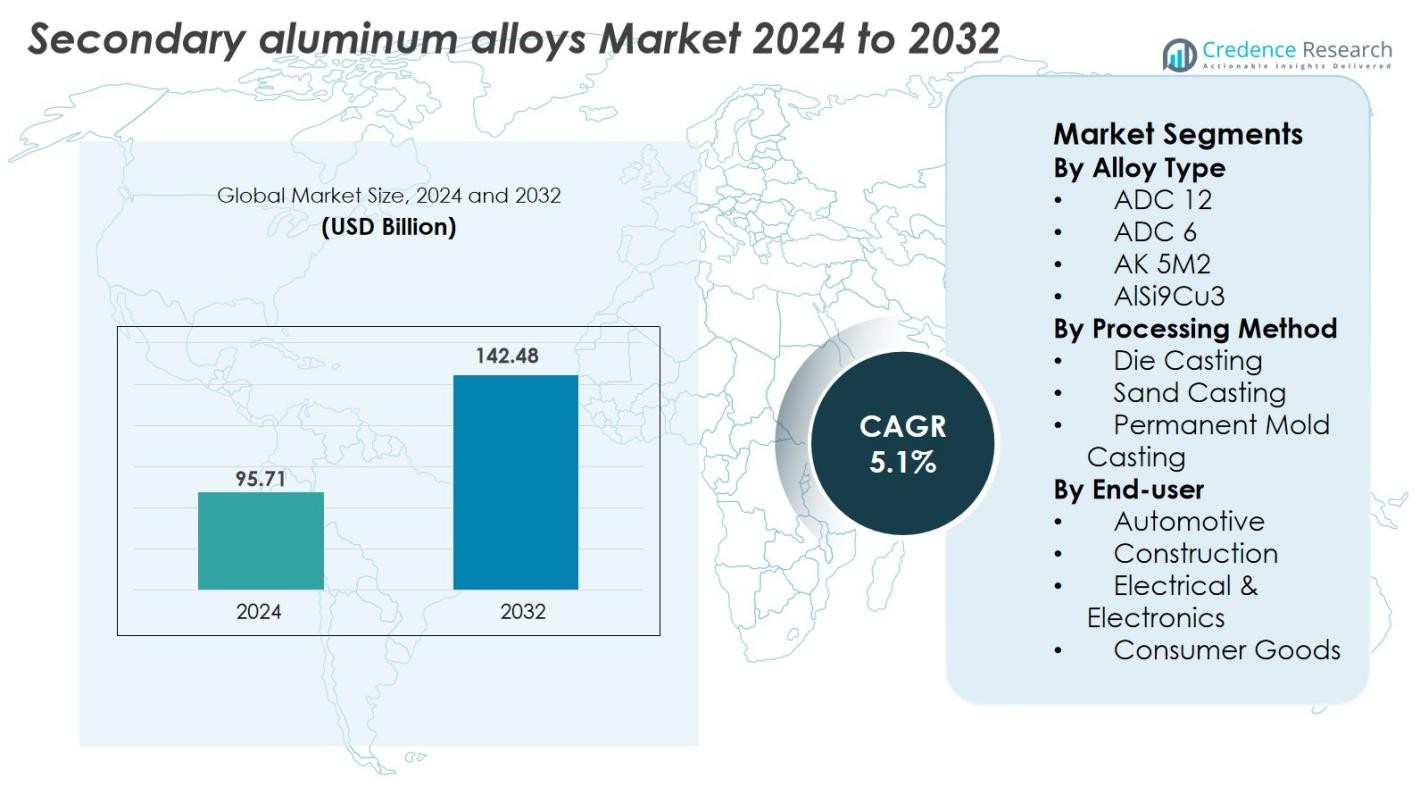

Secondary Aluminum Alloys Market size was valued at USD 95.71 Billion in 2024 and is anticipated to reach USD 142.48 Billion by 2032, at a CAGR of 5.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Secondary Aluminum Alloys Market Size 2024 |

USD 95.71 Billion |

| Secondary Aluminum Alloys Market, CAGR |

5.1% |

| Secondary Aluminum Alloys Market Size 2032 |

USD 142.48 Billion |

Secondary Aluminum Alloys Market is led by prominent players such as Century Metal Recycling Limited, Daiki Aluminum Industry Co. Ltd., Superior Aluminum Alloys LLC, Metal Exchange Corporation, and Allocco Recycling Ltd., which focus on high-purity alloy production and sustainable recycling practices. These companies leverage advanced casting technologies and extensive scrap recovery systems to serve key industries like automotive, construction, and electronics. Regionally, Asia Pacific dominates the market with approximately 35% share in 2024, driven by rapid industrialization, automotive expansion, and strong recycling infrastructure in China, India, and Japan. Europe follows closely with an estimated 32% share, supported by stringent emission regulations and adoption of circular economy principles.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Secondary Aluminum Alloys Market was valued at USD 95.71 Billion in 2024 and is expected to reach USD 142.48 Billion by 2032, registering a CAGR of 5.1% during the forecast period.

- Growing emphasis on lightweight materials across automotive and industrial sectors is driving demand, especially for alloys like ADC 12 and AlSi9Cu3 used in die casting and structural components.

- Trends such as circular economy adoption, rising metal scrap recovery, and advancements in sorting technologies are reshaping production efficiency and material purity.

- Key players including Century Metal Recycling Limited, Daiki Aluminum Industry Co. Ltd., and Metal Exchange Corporation are focusing on refining technologies and partnerships to maintain competitive positioning.

- Asia Pacific holds the largest share at 35%, followed by Europe at 32%, while the automotive segment leads with over 50% share due to stringent emission norms and lightweighting initiatives globally.

Market Segmentation Analysis

By Alloy Type

The Secondary Aluminum Alloys Market is segmented into ADC 12, ADC 6, AK 5M2, and AlSi9Cu3, with ADC 12 holding the dominant share of over 45% in 2024. ADC 12 is widely used in die casting applications due to its excellent fluidity, corrosion resistance, and mechanical strength, making it a preferred choice for automotive and electronic components. Growth in lightweight vehicle production and the increasing shift toward recycled materials are driving demand for this alloy. AK 5M2 and AlSi9Cu3 are also gaining traction for their versatility in complex casting applications.

- For instance, Ryobi Limited manufactures a wide range of die-cast aluminum components for internal combustion engines (such as engine brackets and cylinder head covers), transmissions, and chassis using various aluminum-silicon based alloys, including the widely used ADC12 alloy (equivalent to the A383 alloy in the U.S.) across its global facilities, including those in the U.S. and Japan. Ryobi supplies these components to major automotive OEMs worldwide, including the Volkswagen Group, Suzuki, Toyota, and Honda.

By Processing Method

The market for secondary aluminum alloys by processing method includes Die Casting, Sand Casting, and Permanent Mold Casting. Die Casting dominates with approximately 55% market share in 2024, driven by its ability to produce high-precision and complex components used in automotive and consumer electronics. Its cost-efficiency, high production rates, and compatibility with recycled alloys fuel adoption. Permanent mold casting follows due to its superior mechanical properties, while sand casting remains relevant for low-volume and larger parts, especially in industrial and construction applications where flexibility and lower tooling costs are important drivers.

- For instance, Bühler Group’s Carat series achieves clamp forces up to 92,000 kN, enabling production of large structural castings for automotive OEMs.

By End-user

Secondary aluminum alloys serve end users in Automotive, Construction, Electrical & Electronics, and Consumer Goods, with the Automotive sector leading at over 50% market share in 2024. The dominance of this segment is attributed to growing demand for lightweight vehicles and compliance with strict emission norms, where secondary aluminum is used for engine blocks, transmission cases, and structural components. The Electrical & Electronics market is also expanding due to the rise in energy-efficient consumer devices. Construction holds a substantial share driven by sustainable building materials, while consumer goods benefit from recyclable and cost-effective components.

Key Growth Drivers

Demand for Lightweight Materials in Automotive Industry

The increasing demand for lightweight vehicles to improve fuel efficiency and reduce emissions is a major factor driving the secondary aluminum alloys market. Automakers are increasingly adopting high-strength recycled aluminum alloys to replace heavier components made from steel and iron. Secondary aluminum alloys, particularly ADC 12, are used extensively in engine blocks, transmission cases, and wheels due to their strength-to-weight ratio, corrosion resistance, and cost-effectiveness. Regulatory pressures to meet stringent CO₂ emission standards further reinforce this shift. This driver is amplified by the growing penetration of electric vehicles, which rely on lightweight materials to maximize battery efficiency and performance. Additionally, recycling aluminum consumes up to 95% less energy compared to primary production, making it a sustainable solution aligned with circular economy principles. As automotive OEMs increasingly prioritize sustainability, recycled aluminum alloys are positioned to play a critical role in next-generation vehicle design and manufacturing.

- For instance, Novelis is a key supplier to automakers like Ford, providing aluminum for applications such as body panels and structural parts through a closed-loop recycling system. Novelis supplies aluminum products with an average of 63% recycled content across its product lines globally, and for specific automotive applications, this figure can be up to 85%.

Growth in Construction and Infrastructure Development

Rapid urbanization, housing demands, and infrastructural investments across emerging markets are accelerating the use of secondary aluminum alloys in the building and construction sector. These alloys are used in window frames, roofing systems, façades, and structural components due to their strength, thermal conductivity, and recyclability. Government initiatives to promote green buildings and reduce carbon footprints support the substitution of traditional materials like steel and concrete with eco-friendly alternatives. The recyclability of aluminum makes it particularly attractive for sustainable construction practices, with end-of-life recovery rates exceeding 90% in many regions. Additionally, the expansion of commercial spaces, smart cities, and renovation of aging infrastructure further drives demand. Expansion in construction activities across Asia-Pacific and the Middle East, coupled with technological advancements in casting, welding, and fabrication techniques, position secondary aluminum alloys as essential materials for modern, energy-efficient architectural applications.

- For instance, Hydro Building Systems uses recycled aluminum alloys in its WICONA façade solutions, achieving embodied carbon levels as low as 2.3 kg CO₂e per kilogram of aluminum—one of the lowest levels recorded in the European construction market.

Rising Emphasis on Sustainability and Circular Economy

The global push for sustainability and circular metal usage is significantly boosting the secondary aluminum alloys market. Recycling aluminum not only conserves raw materials but also substantially reduces energy consumption and greenhouse gas emissions. Industries are now under pressure to reduce their environmental footprint, adopt cleaner technologies, and optimize waste utilization. Secondary alloys, made from post-industrial and post-consumer scrap, play a pivotal role in achieving these goals. Governments are introducing policies that incentivize recycling and penalize heavy carbon emitters, encouraging manufacturers to shift from primary to secondary aluminum. Major industries, including automotive, packaging, and electronics, are integrating recycled aluminum to meet ESG targets and consumer expectations for green products. A growing number of companies are also developing technologies to improve scrap sorting and alloy purity, enhancing the performance and usability of recycled aluminum alloys across high-value applications. This sustainability-driven shift is expected to strengthen market growth over the next decade.

Key Trends & Opportunities

Technological Advancements in Scrap Processing and Casting

Technological innovations in scrap sorting, melting, and alloy purification are reshaping productivity in the secondary aluminum alloys market. Advanced automated sorting systems, using AI and optical sensors, can identify and segregate scrap with high precision, enabling production of alloys with superior purity and consistent composition. Improvements in continuous casting, induction melting, and energy-efficient furnaces have also reduced production costs. These innovations enhance the mechanical properties and corrosion resistance of secondary aluminum alloys, making them competitive with primary aluminum alloys. AlSi9Cu3 and ADC 6, once limited to non-critical parts, are now suitable for high-performance applications. The integration of Industry 4.0 and real-time monitoring within recycling facilities offers additional opportunities to optimize energy use and reduce emissions. This technological evolution not only improves profitability but positions recycled aluminum as a high-quality material suitable for expanding applications across automotive, aerospace, and consumer electronics.

- For instance, TOMRA Sorting Solutions’ AUTOSORT™ technology uses dual-energy X-ray transmission and AI-based recognition to sort mixed aluminum scrap at rates exceeding 5 tons per hour with over 98% purity, significantly improving downstream alloy quality.

Expanding Role in Electric Vehicles and Renewable Energy Systems

The rapid adoption of electric vehicles (EVs) and renewable energy technologies offers significant growth opportunities for secondary aluminum alloy producers. EV manufacturers are increasingly using aluminum alloys to reduce vehicle weight and improve battery range. Recycled alloys like ADC 12 are being used in battery housings, powertrain components, and structural parts due to their light weight, thermal management properties, and sustainability profile. Similarly, renewable energy systems such as solar frames, wind turbine components, and energy storage systems utilize aluminum for its durability and recyclability. The increasing demand for energy-efficient and eco-friendly components creates an opportunity for producers to align with global decarbonization goals. Governments offering subsidies for EVs and green energy infrastructure further reinforce this trend. As sustainability gains traction across the energy and mobility sectors, investment in high-performance recycled alloys with optimized properties will become a key strategic focus for manufacturers.

- For instance, Audi integrates recycled aluminum alloy castings in specific components like the battery enclosures and shock towers of its e-tron electric SUV. The battery housing alone uses approximately 160 kilograms of secondary (recycled) aluminum content, achieved through a “closed loop” system with suppliers like Hydro.

Key Challenges

Supply Chain Instability and Fluctuations in Scrap Availability

One of the most pressing challenges in the secondary aluminum alloys market is the unpredictable availability and pricing of aluminum scrap. With rising global demand for recycled metals, competition for high-quality scrap has intensified, driving up costs. Economic disruptions, trade restrictions, and changing regulatory frameworks further complicate scrap sourcing, affecting pricing stability and supply continuity. Variability in scrap quality can also lead to inconsistencies in alloy composition, which impacts performance in critical applications like automotive and aerospace. This challenge is heightened in regions with limited recycling infrastructure or low collection rates. Manufacturers are increasingly investing in in-house scrap processing and long-term scrap procurement partnerships to mitigate risk. However, the lack of standardized global practices for scrap quality, collection, and reporting continues to hamper efficiency, and addressing these issues remains essential for stable market growth.

Technological and Performance Limitations in High-end Applications

While secondary aluminum alloys offer substantial benefits in sustainability and cost, they still face performance limitations compared to primary aluminum in certain high-end applications. Impurities, residual elements, and variability in mechanical properties can affect tensile strength and fatigue resistance, making them less suitable for critical aerospace, defense, and heavy-duty structural components. High-performance applications require strict compliance with global quality and performance standards, which can be challenging to meet using recycled content. Advancements in sorting and refining technologies are reducing this gap, but investment costs remain high. Additionally, some manufacturers are resistant to shifting from primary to secondary alloys due to perceived reliability concerns. Overcoming these limitations will require industry-wide innovation in purification processes, alloy design, and qualification protocols, along with educational initiatives to build confidence among OEMs in using recycled aluminum for high-specification products.

Regional Analysis

North America

North America holds approximately 28% market share in the secondary aluminum alloys market in 2024, driven by strong demand in the automotive and packaging industries. The United States leads the region due to increased use of recycled aluminum in automotive lightweighting, electric vehicle production, and consumer electronics. Stringent environmental regulations, coupled with incentives for recycling, encourage manufacturers to integrate secondary alloys into production. Technological advancements in scrap sorting and reprocessing further enhance material quality and efficiency. The region also benefits from well-established recycling infrastructure and rising industrial automation, positioning it as a key contributor to global sustainability goals.

Europe

Europe accounts for roughly 32% of the global secondary aluminum alloys market, making it the leading region in 2024. Countries like Germany, Italy, and France drive this dominance due to robust automotive manufacturing, stringent circular economy policies, and a mature recycling ecosystem. The EU’s Green Deal and regulations encouraging reduced carbon emissions have enhanced demand for recycled aluminum in transportation, building, and electronics sectors. Advanced metal recovery technologies and strong industrial standards for aluminum processing have further supported adoption. The presence of major automotive OEMs and a strong focus on sustainability underpin Europe’s continued leadership in secondary alloy applications.

Asia Pacific

Asia Pacific represents the fastest-growing region, holding around 35% market share in 2024, supported by expanding automotive production, infrastructure development, and electronics manufacturing. China and India are major contributors due to their large-scale industrial operations and growing adoption of circular economy practices. The region benefits from cost-effective scrap availability and a rising focus on lightweight materials for fuel-efficient vehicles. Increasing government policies promoting recycling and sustainable resource use, especially in Japan and South Korea, further bolster market expansion. Investments in die casting technologies and growing export demand for aluminum components are strengthening Asia Pacific’s dominance in the secondary alloys market.

Latin America

Latin America captures approximately 4% of the secondary aluminum alloys market in 2024, with Brazil and Mexico driving regional adoption. The growth is primarily supported by automotive assembly operations, beverage packaging, and construction developments. Expanding urbanization and a gradual shift toward sustainable manufacturing practices are encouraging the use of recycled aluminum alloys. However, limited recycling infrastructure and fluctuating scrap availability pose challenges. Efforts to improve metal collection systems and collaborate with global players are creating growth opportunities. Regional governments are also introducing initiatives to reduce landfill waste and promote circular resource use, which could accelerate future market expansion.

Middle East & Africa

The Middle East & Africa region holds a modest 1% market share but demonstrates steady potential due to rising construction activities and industrial diversification. Countries such as the UAE and Saudi Arabia are investing in sustainable building practices and metal recycling to support long-term environmental targets. The automotive sector, though relatively small, is also adopting lightweight materials for future mobility projects. Limited regional recycling capacity and dependency on imports remain constraints. However, ongoing investment in smelting technologies and increased collaboration with international aluminum recyclers are expected to enhance market penetration in the coming years, particularly in Africa’s growing urban centers.

Market Segmentations

By Alloy Type

- ADC 12

- ADC 6

- AK 5M2

- AlSi9Cu3

By Processing Method

- Die Casting

- Sand Casting

- Permanent Mold Casting

By End-user

- Automotive

- Construction

- Electrical & Electronics

- Consumer Goods

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Secondary Aluminum Alloys Market is characterized by a mix of global leaders and regional specialists focused on delivering high-performance recycled aluminum alloys for automotive, construction, electronics, and industrial applications. Key players such as Century Metal Recycling Limited, Daiki Aluminum Industry Co. Ltd., Superior Aluminum Alloys LLC, Metal Exchange Corporation, Allocco Recycling Ltd., Shin Wen Ching Metal Enterprise Ltd., and Keiaisha Co. Ltd. command significant market presence through integrated recycling facilities, advanced metal refining technologies, and strategic global supply chains. These companies continuously invest in scrap sorting systems, eco-friendly casting processes, and production automation to improve alloy purity and performance. Partnerships with leading automotive OEMs and construction firms help expand their product reach and ensure alignment with evolving sustainability requirements. The industry also sees active participation from emerging players like Namo Alloys Pvt. Ltd. and Sunalco Industries Pvt. Ltd., who leverage regional scrap networks and tailored alloy solutions to meet local market needs while contributing to circular economy goals.

Key Player Analysis

- Allocco Recycling Ltd.

- Shin Wen Ching Metal Enterprise Ltd.

- Keiaisha Co. Ltd.

- Superior Aluminum Alloys LLC

- Daiki Aluminum Industry Co. Ltd.

- Namo Alloys Pvt. Ltd.

- Sunalco Industries Pvt. Ltd.

- Metal Exchange Corporation

- Kawashima Co. Ltd.

- Century Metal Recycling Limited

Recent Developments

- In May 2025, Aluminium Dunkerque (France) inaugurated a new dedicated aluminium‑scrap recycling furnace (Furnace 8) adding up to 20,000 t/year capacity to its secondary alloy production.

- In June 2024, Hydro Aluminium announced an investment of US $85 million to expand its aluminium recycling plant in Henderson, Kentucky (USA), the new production line is expected to supply high‑quality recycled aluminium automotive components starting in 2026.

- In August 2024, Emirates Global Aluminium (EGA) announced that it intends to acquire 80% of Spectro Alloys Corporation (a U.S.-based recycled‑aluminium alloy producer), as part of its expansion of recycling operations in the United States.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Alloy Type, Processing Method, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Future demand for secondary aluminum alloys will rise as automakers accelerate lightweighting strategies and electric vehicle production.

- Advancements in scrap sorting and melting technologies will enhance alloy purity and expand applications in high-performance sectors.

- Circular economy initiatives and stricter environmental regulations will support the shift from primary to recycled aluminum.

- Increased investment in automated recycling plants will boost production efficiency and reduce energy consumption.

- Emerging markets in Asia and Latin America will contribute significantly to growth through expanding construction and manufacturing sectors.

- Alloy innovation will enable improved mechanical properties, making recycled aluminum suitable for aerospace and industrial uses.

- Global partnerships between recyclers and OEMs will streamline supply chains and scrap collection networks.

- Demand for sustainability-certified products will drive adoption among consumer electronics and packaging manufacturers.

- Supply chain resilience and scrap availability will remain critical to ensuring stable pricing and production.

- Policy support and green incentives will accelerate adoption across renewable energy and infrastructure projects.