Market Overview:

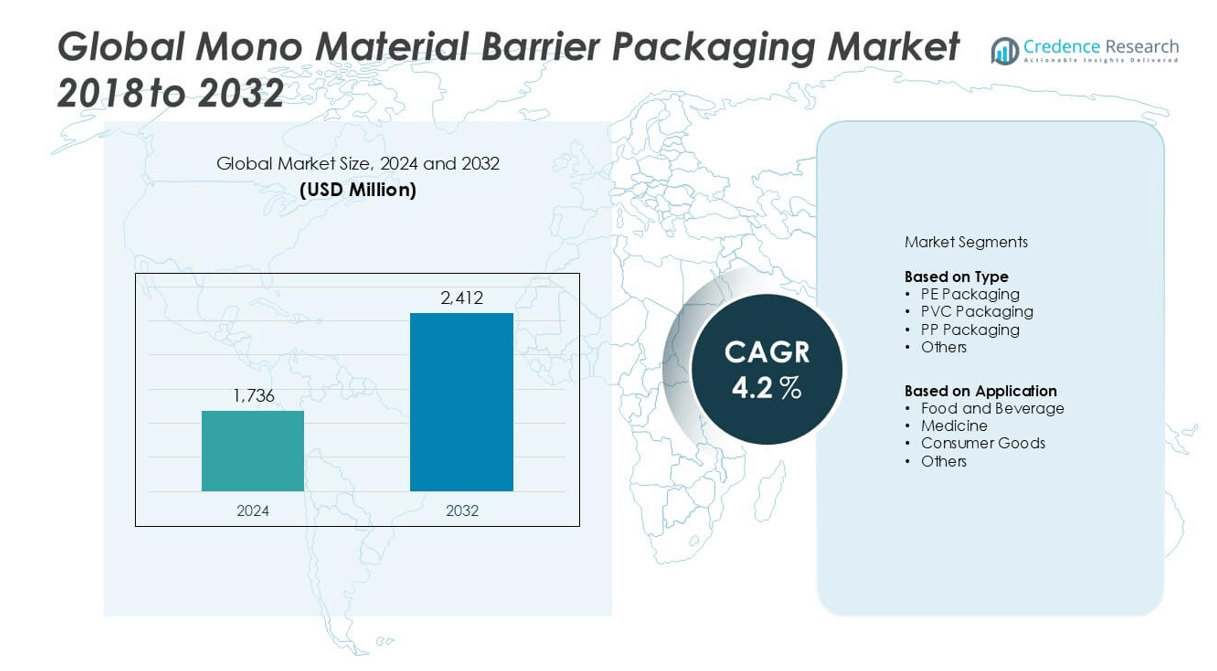

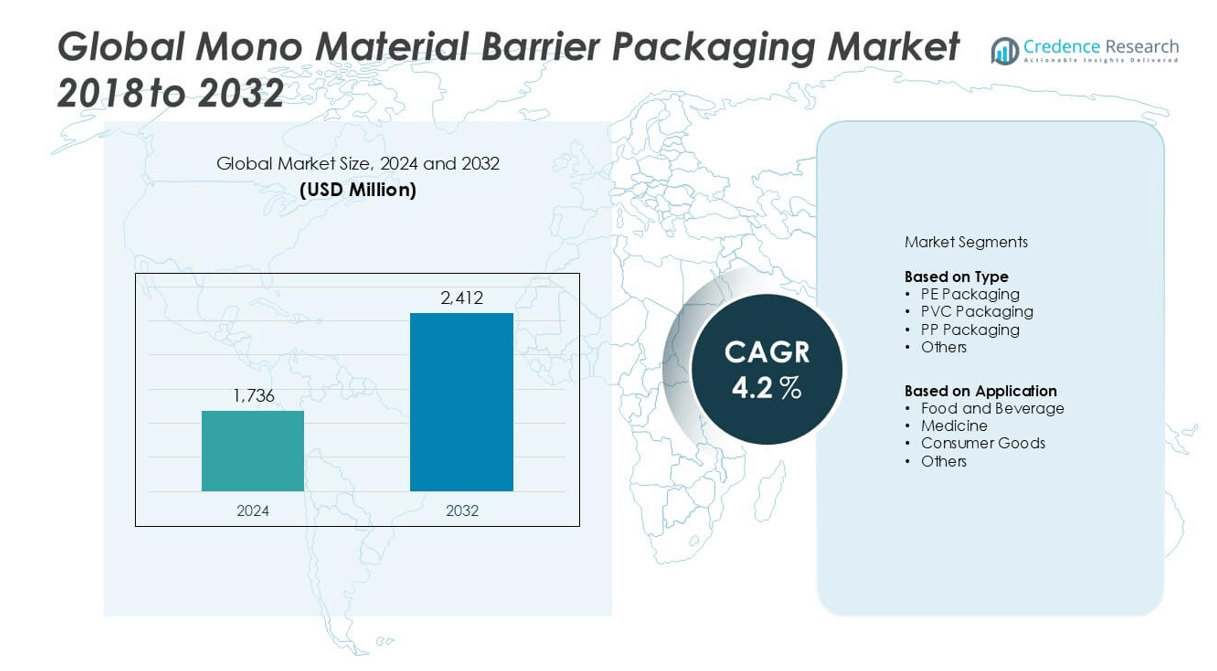

Mono Material Barrier Packaging market size was valued at USD 1,736 million in 2024 and is anticipated to reach USD 2,412 million by 2032, at a CAGR of 4.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mono Material Barrier Packaging Market Size 2024 |

USD 1,736 million |

| Mono Material Barrier Packaging Market, CAGR |

4.2% |

| Mono Material Barrier Packaging Market Size 2032 |

USD 2,412 million |

The Mono Material Barrier Packaging market is led by key players such as Amcor, Mondi Group, Sealed Air, Constantia Flexibles, Smurfit Kappa Group, Berry Global, Tetra Pak, Huhtamaki, and Coveris. These companies dominate the market through robust R&D capabilities, strong global distribution networks, and a strategic focus on recyclable and high-performance mono material solutions. Europe emerged as the leading region in 2024, accounting for 32% of the global market share, driven by stringent environmental regulations and advanced recycling infrastructure. North America followed with a 28% share, supported by brand-led sustainability commitments and growing consumer demand for eco-friendly packaging alternatives.

Market Insights

- The Mono Material Barrier Packaging market was valued at USD 1,736 million in 2024 and is expected to reach USD 2,412 million by 2032, growing at a CAGR of 4.2% during the forecast period.

- Growing environmental concerns and stringent recycling regulations are driving demand for mono material packaging, especially in food, beverage, and pharmaceutical sectors.

- Key trends include the adoption of recyclable PE and PP materials, rising brand commitments toward circular economy goals, and technological innovations in barrier coatings.

- Leading players such as Amcor, Mondi Group, and Sealed Air dominate the market through product innovation and strategic partnerships; PE packaging holds the largest segment share due to its recyclability and cost-efficiency.

- Europe leads regionally with 32% market share, followed by North America at 28% and Asia-Pacific at 25%; growth is restrained by performance limitations of mono materials and inadequate recycling infrastructure in emerging economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

In the Mono Material Barrier Packaging market, PE packaging emerged as the dominant sub-segment in 2024, accounting for the largest market share due to its superior barrier properties, cost-effectiveness, and wide acceptance across industries. PE materials offer excellent moisture resistance and are highly compatible with recycling processes, aligning with the increasing demand for sustainable packaging solutions. PP packaging follows closely, favored for its thermal stability and strength in high-performance applications. Meanwhile, PVC packaging is declining in popularity due to environmental concerns and regulatory restrictions. The “Others” category includes emerging biodegradable options, gaining slow but steady traction amid rising eco-consciousness.

- For instance, Berry Global introduced BPP80, a mono-material PP film that supports high-barrier food applications and is compatible with existing recycling streams, enabling the company to produce over 25 million recyclable snack pouches annually.

By Application

The food and beverage segment held the highest market share in 2024, driven by growing consumer demand for extended shelf life, lightweight materials, and recyclable packaging. Mono material solutions in this sector help manufacturers meet stringent safety standards and environmental regulations while maintaining product freshness. The medicine segment is rapidly expanding, propelled by increasing pharmaceutical exports and the need for contamination-resistant packaging. Consumer goods represent a stable sub-segment, supported by personal care and household product manufacturers transitioning to sustainable options. “Others,” including industrial and agricultural applications, are gradually contributing to the market as companies seek alternatives to multi-material barriers.

- For instance, Nestlé, in collaboration with Huhtamaki, switched to mono-material PE-based packaging for its YES! snack bars in Europe, leading to a production shift of over 420 million units annually into recyclable formats.

Market Overview

Rising Demand for Sustainable Packaging Solutions

The global push toward environmental sustainability is a major driver for the Mono Material Barrier Packaging market. Regulatory bodies and consumers alike are pressuring manufacturers to reduce plastic waste and improve recyclability. Mono material packaging, being easier to recycle than multi-layer alternatives, meets these demands effectively. Brands are increasingly adopting PE- and PP-based mono materials to align with their sustainability goals. This shift is particularly strong in the food and beverage sector, where companies aim to enhance circular economy practices while maintaining shelf-life and performance standards.

- For instance, Tetra Pak developed a mono-material barrier film suitable for UHT milk, eliminating aluminum and reducing packaging weight by 336 metric tons per year.

Regulatory Support and Plastic Waste Reduction Policies

Governments across regions are implementing strict regulations on plastic packaging waste, favoring recyclable and single-material solutions. The European Union’s Packaging and Packaging Waste Regulation (PPWR) and similar mandates in North America and Asia-Pacific are accelerating the transition to mono material barrier formats. These policies incentivize brands to adopt sustainable packaging alternatives by imposing fines and Extended Producer Responsibility (EPR) requirements. As regulations tighten, mono material packaging becomes a strategic choice for companies to maintain compliance while enhancing their public environmental image.

- For instance, Smurfit Kappa’s MonoFlexPaper™ packaging was designed to comply with EU’s recyclability standards and has been adopted in over 150 consumer goods SKUs within 18 months of its launch.

Technological Advancements in Barrier Coatings

Innovations in coating and film technology are enhancing the barrier properties of mono material packaging, making them viable alternatives to complex multi-material structures. Improved oxygen, moisture, and aroma barrier coatings have expanded the application scope of mono material formats, especially in sensitive sectors like pharmaceuticals and perishable food items. Companies are investing in R&D to develop coatings that maintain recyclability without compromising protection. These advancements are crucial in driving adoption and ensuring mono materials deliver comparable performance to traditional packaging.

Key Trends & Opportunities

Brand-Led Shifts Toward Circular Economy Models

Major consumer goods and food brands are increasingly adopting circular economy principles, committing to fully recyclable or compostable packaging by set targets (e.g., 2025 or 2030). Mono material packaging plays a pivotal role in achieving these goals. The trend is leading to redesigns of entire product packaging lines and partnerships with recycling and packaging technology firms. This brand-driven transition opens significant market opportunities for suppliers of recyclable mono material films and coatings, particularly in Europe and North America where consumer pressure is highest.

- For instance, Procter & Gamble converted 95% of its Ariel detergent pods packaging in Europe to mono-PP film by partnering with RecyClass-certified suppliers, enabling closed-loop recyclability.

Growth in E-commerce and Convenient Packaging Formats

The rapid growth of e-commerce is creating demand for lightweight, durable, and recyclable packaging formats, in which mono material solutions fit well. These materials not only reduce shipping costs but also help retailers and manufacturers meet sustainability targets. In addition, the shift toward user-friendly, resealable, and shelf-ready designs is favoring flexible mono material barrier packaging over rigid formats. This trend is especially visible in personal care, health supplements, and packaged food sectors, where packaging serves both protective and marketing purposes.

Key Challenges

Limitations in Barrier Performance Compared to Multi-materials

One of the significant challenges in the mono material barrier packaging market is achieving equivalent barrier performance to that of traditional multi-layer composites. While mono materials are more recyclable, they often fall short in protecting against oxygen, moisture, or light, which are critical for food and pharmaceutical products. This performance gap limits their use in certain high-barrier applications, requiring further technological development. Manufacturers must balance performance and recyclability without compromising product safety or shelf life.

- For instance, BASF and Siegwerk co-developed a mono-PE structure enhanced with barrier coatings achieving OTR of <0.1 cc/m²/day, making it suitable for sensitive snack foods and pharmaceutical powders without compromising recyclability.

High Initial Development and Transition Costs

Transitioning to mono material packaging involves high R&D investment, redesign of packaging formats, and retooling of existing production lines. These costs can be a deterrent, especially for small and medium-sized enterprises. Additionally, compliance with regional recycling standards and testing for material compatibility adds further complexity. While long-term savings and regulatory compliance offer advantages, the upfront expenditure and operational disruption pose significant challenges to widespread adoption.

Inadequate Recycling Infrastructure in Emerging Markets

Despite the recyclability benefits of mono material packaging, its effectiveness is limited by the recycling infrastructure, particularly in emerging economies. In many regions, collection, sorting, and recycling systems are either underdeveloped or inconsistent, reducing the overall impact of mono material use. This gap diminishes the environmental advantages and slows down adoption rates. For mono material packaging to realize its full potential, investments in end-of-life processing systems and consumer education are essential across global markets.

Regional Analysis

North America

North America held a significant share of the mono material barrier packaging market in 2024, accounting for approximately 28% of the global market. The region’s growth is driven by strong regulatory frameworks promoting recyclable packaging, rising consumer awareness, and active sustainability commitments by key brands. The U.S. and Canada are leading adopters, with growing demand across food, beverage, and healthcare industries. Technological advancements in barrier coatings and established recycling infrastructure further support market expansion. E-commerce growth and demand for convenient, lightweight packaging formats also contribute to the increased use of mono materials across various end-user sectors.

- For instance, Sealed Air launched its CRYOVAC® brand mono-PE shrink bags for meat packaging in the U.S., replacing over 12,000 tons of non-recyclable multilayer films annually.

Europe

Europe dominated the mono material barrier packaging market in 2024 with an estimated 32% market share, attributed to robust environmental regulations and the EU’s ambitious recycling targets under the Packaging and Packaging Waste Regulation (PPWR). Countries like Germany, France, and the Netherlands are at the forefront of adopting mono material solutions. The region benefits from a mature recycling ecosystem and high consumer demand for sustainable packaging. Innovation in biodegradable mono materials and strong industry collaborations further propel market growth. The food and beverage sector leads adoption, while the pharmaceutical and personal care industries are rapidly increasing their usage of recyclable materials.

- For instance, Constantia Flexibles converted over 300 SKUs in the EU to its EcoLam family of mono-material solutions, avoiding the use of 1,800 metric tons of aluminum-based films annually.

Asia-Pacific

Asia-Pacific accounted for around 25% of the global mono material barrier packaging market in 2024, driven by growing environmental concerns, rising disposable incomes, and increasing urbanization. Major economies such as China, Japan, India, and South Korea are witnessing increased investments in sustainable packaging technologies. Government initiatives to curb plastic waste and rising demand in food processing, personal care, and pharmaceutical sectors support market growth. Although recycling infrastructure is still developing in parts of the region, multinational brands and regional manufacturers are pushing forward mono material adoption to meet both regulatory and consumer expectations.

Latin America

Latin America represented approximately 8% of the global mono material barrier packaging market in 2024. The region is gradually adopting sustainable packaging practices, driven by growing regulatory efforts and the rising influence of multinational FMCG companies. Brazil and Mexico are leading contributors due to their expanding food and beverage industries and increased awareness about eco-friendly alternatives. However, limited recycling infrastructure and economic constraints continue to pose challenges. Still, partnerships between governments and packaging firms are encouraging investments in mono material solutions to enhance recyclability and reduce environmental impact.

Middle East & Africa

The Middle East & Africa held a modest 7% share of the global mono material barrier packaging market in 2024. Growth in this region is mainly driven by increasing demand for sustainable packaging in the food, pharmaceutical, and consumer goods sectors. The UAE and South Africa are key markets, benefiting from rising awareness of plastic pollution and growing retail activities. However, underdeveloped recycling systems and inconsistent regulations hinder broader adoption. Despite these challenges, rising urbanization and international investments are expected to create future opportunities for mono material packaging across emerging markets in the region.

Market Segmentations:

By Type

- PE Packaging

- PVC Packaging

- PP Packaging

- Others

By Application

- Food and Beverage

- Medicine

- Consumer Goods

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mono material barrier packaging market is characterized by the presence of several global and regional players striving to enhance their market position through innovation, strategic partnerships, and sustainability initiatives. Key companies such as Amcor, Mondi Group, Sealed Air, Constantia Flexibles, and Berry Global lead the market with extensive product portfolios and strong R&D capabilities. These players are actively investing in advanced barrier technologies and recyclable mono material solutions to meet evolving regulatory requirements and consumer demand for sustainable packaging. Tetra Pak, Huhtamaki, and Smurfit Kappa Group are leveraging their expertise in food and beverage packaging to expand into recyclable formats. Additionally, firms like Coveris are focusing on regional expansion and customization to cater to specific end-user needs. Mergers, acquisitions, and collaborations across the value chain are common strategies used to gain competitive advantage, improve production efficiency, and accelerate the commercialization of innovative mono material barrier solutions.

- For instance, Amcor’s AmPrima™ mono-material PE films achieved recyclability certification from How2Recycle and RecyClass and are now used in over 1.2 billion packs annually.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor

- Mondi Group

- Sealed Air

- Constantia Flexibles

- Smurfit Kappa Group

- Berry Global

- Tetra Pak

- Huhtamaki

- Coveris

Recent Developments

- In April 2025, Aegis Packaging, a Singapore-based leader in high-barrier coatings for flexible plastic packaging, and SMX (Security Matters) PLC, a pioneer in digitizing tangible objects for a circular economy, announced a strategic partnership. Through this partnership, Aegis Packaging’s O2XTM coating technology and SMX’s blockchain-based platform and invisible molecular marking are combined to provide a smooth method of improving the recyclable and verifiable nature of plastic packaging.

- In April 2025, Kai Liang, Business Development Manager at Aegis Packaging, stated that the partnership between SMX (Security Matters) PLC and Aegis Packaging guarantees that companies can simply document and prove regulatory compliance, lower reputational risk, and implement scalable, more economical packaging solutions in addition to providing end-to-end traceability of plastic packaging. The brands aiming to innovate in sustainable plastics will be stimulated by the combination of Aegis’ high-barrier coating and SMX’s “physical to digital” capacity.

- In December 2024, according to AR Packaging, the Ecoflex offers a sustainable substitute for PA-based materials while completely adhering to OPRL regulations. Ecoflex is made of “premium” PE polymers and is primarily intended as a thermoforming base web. It has enhanced rip resistance and strong puncture resistance, and can be used for vacuum or MAP.

- In April 2024, Siegwerk stated that it will co-develop 100% recyclable mono-material solutions with Borouge, a premier petrochemicals firm that offers unique and inventive polyolefins solutions, to further advance packaging design for a circular economy. The partnership aims to satisfy the market’s increasing need for environmentally friendly packaging by creating a pipeline of solutions that will allow converters all over the world to create sophisticated mono-material packaging.

Market Concentration & Characteristics

The Mono Material Barrier Packaging Market exhibits moderate to high market concentration, with a few global players holding a significant share due to their technological capabilities, established supply chains, and investment in sustainable packaging solutions. It is characterized by innovation-driven competition, with key companies focusing on recyclable materials like PE and PP to comply with evolving environmental regulations. The market demonstrates a strong alignment with circular economy goals, particularly in developed regions where consumer demand and government mandates support mono material adoption. It shows robust application diversity, spanning food, beverage, pharmaceuticals, and consumer goods, with the food and beverage segment leading in volume demand. The market remains cost-sensitive, and the performance gap between mono and multi-materials continues to influence adoption rates. Regional disparities in recycling infrastructure also affect product viability across different geographies. Europe maintains the highest market share, followed by North America and Asia-Pacific. It relies on both technological advancements in barrier properties and regulatory frameworks to drive growth and improve recyclability outcomes.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will continue to grow steadily due to increasing demand for recyclable and sustainable packaging solutions.

- Regulatory pressures will accelerate the shift from multi-layer to mono material packaging across key industries.

- Technological advancements in barrier coatings will enhance the performance of mono materials in moisture and oxygen protection.

- Food and beverage applications will remain the dominant end-use segment, supported by rising demand for safe and eco-friendly packaging.

- Pharmaceutical and personal care sectors will increasingly adopt mono material formats to meet hygiene and compliance standards.

- Brand commitments toward circular economy goals will drive large-scale adoption of recyclable mono material packaging.

- Europe will maintain its leading position due to robust environmental regulations and advanced recycling infrastructure.

- Asia-Pacific will witness strong growth fueled by industrial expansion, urbanization, and rising environmental awareness.

- Investment in localized recycling infrastructure will become critical for widespread adoption in emerging markets.

- Market players will focus on innovation, strategic partnerships, and regional expansion to strengthen their competitive position.