Market Overview:

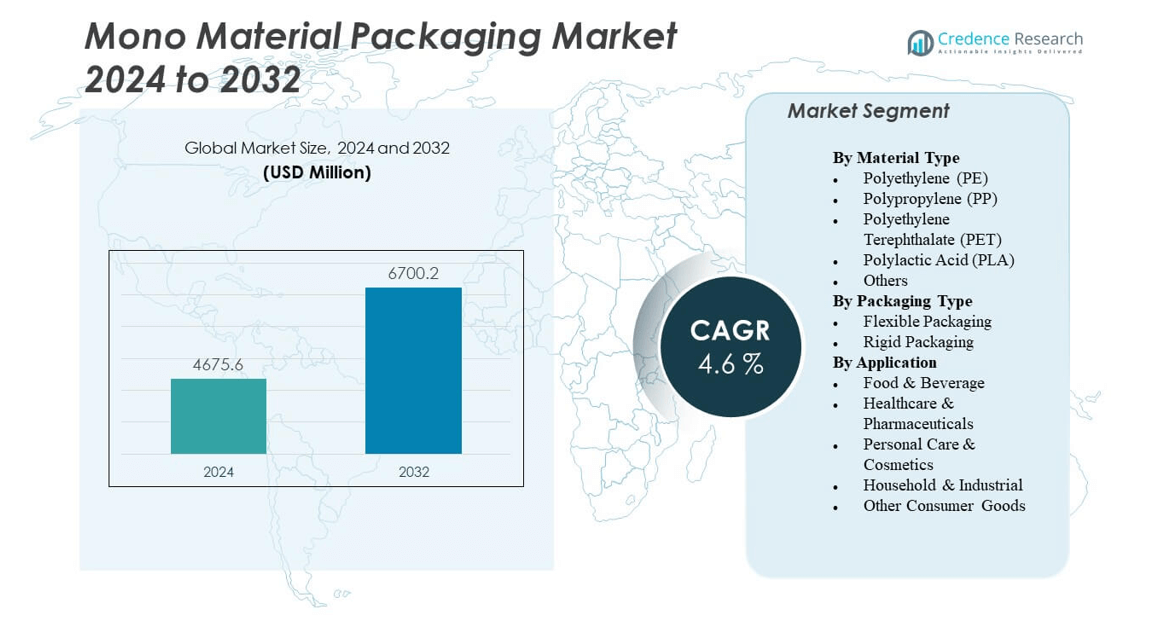

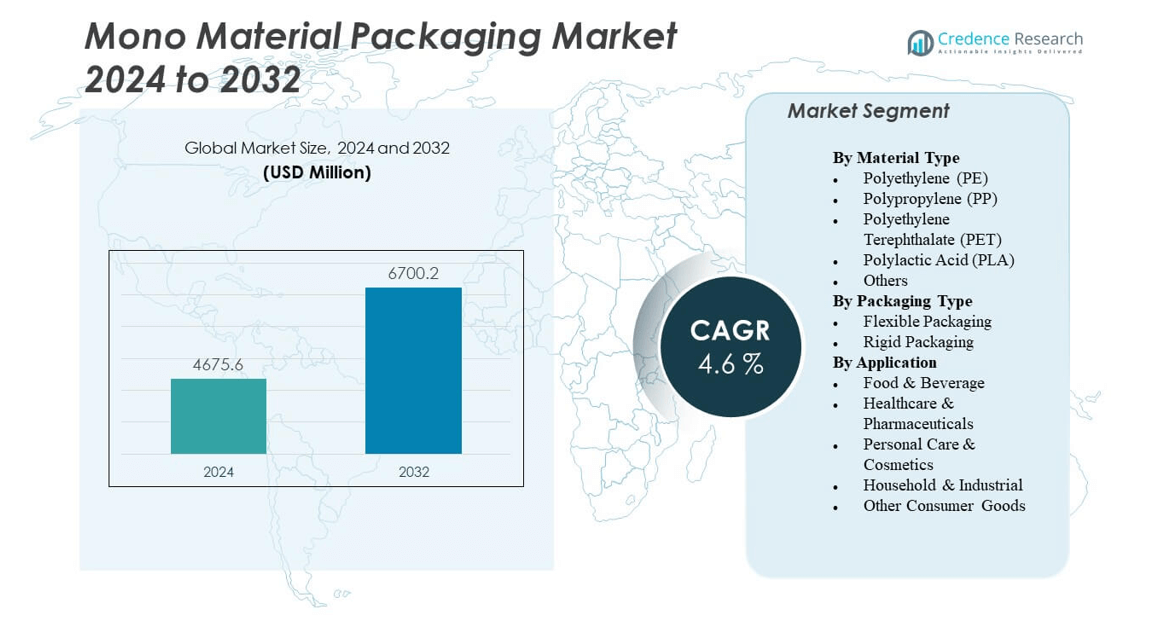

The Mono Material Packaging Market is projected to grow from USD 4675.6 million in 2024 to an estimated USD 6700.2 million by 2032, with a compound annual growth rate (CAGR) of 4.6% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mono Material Packaging Market Size 2024 |

USD 4675.6 million |

| Mono Material Packaging Market, CAGR |

4.6% |

| Mono Material Packaging Market Size 2032 |

USD 6700.2 million |

Growing emphasis on sustainability, recyclability, and circular economy principles is driving the adoption of mono material packaging. Brand owners and packaging manufacturers are shifting toward single-polymer solutions to simplify recycling and reduce environmental impact. Rising regulatory pressure on plastic waste management, along with consumer demand for eco-friendly packaging in food, beverages, personal care, and household products, is fueling growth. Additionally, technological advancements in barrier films and lightweight packaging support the broader application of mono material formats across diverse industries.

Regionally, Europe leads the mono material packaging market due to strict sustainability regulations and strong recycling infrastructure. North America is also showing significant adoption, supported by brand commitments and packaging innovation. In contrast, Asia-Pacific is emerging as the fastest-growing region, driven by rising consumer awareness, rapid industrialization, and government initiatives promoting eco-friendly materials. Countries such as China and India are key contributors, while developed markets like Japan and South Korea continue to strengthen sustainable packaging practices.

Market Insights:

- The Mono Material Packaging Market is projected to grow from USD 4675.6 million in 2024 to USD 6700.2 million by 2032, registering a CAGR of 4.6% during the forecast period.

- Sustainability regulations and recycling mandates are driving manufacturers to replace multi-layered structures with mono-material packaging solutions.

- Rising consumer preference for eco-friendly packaging supports demand across food, beverage, personal care, and household sectors.

- Technical limitations in barrier performance and shelf-life protection act as restraints for wider adoption in sensitive applications.

- High conversion costs and gaps in recycling infrastructure challenge scalability, especially in developing markets.

- Europe leads the market due to strict packaging waste directives and advanced recycling systems, while Asia-Pacific emerges as the fastest-growing region.

- North America maintains steady growth through strong brand commitments and innovation, while Latin America and the Middle East & Africa show rising momentum supported by policy initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Strong Emphasis on Sustainability and Environmental Regulations Driving Adoption of Mono Material Packaging

The growing demand for sustainable packaging solutions is one of the strongest drivers. Governments are implementing stricter recycling regulations to reduce environmental impact. Consumers are increasingly aware of eco-friendly packaging and actively prefer recyclable formats. Companies are responding with commitments to replace multi-layer plastics with single-polymer alternatives. It creates a streamlined recycling process that aligns with circular economy goals. Food and beverage companies lead adoption due to rising scrutiny on plastic waste. Personal care and household product manufacturers also push investment in sustainable solutions. The Mono Material Packaging Market benefits from this convergence of regulation, consumer demand, and corporate responsibility.

- For instance, Nestlé reported in its 2023 sustainability report that 86.6% of its packaging was reusable, recyclable, or compostable, and that 83.5% of the plastic packaging they use is designed for recycling, highlighting its shift toward mono-material packaging to support circularity.

Expanding Applications of High-Performance Barrier Films and Technological Advancements in Packaging Materials

The industry is experiencing growth through innovations in barrier film technology. New mono material films offer strength, durability, and moisture resistance suitable for sensitive goods. These films are replacing complex laminates without compromising performance standards. Flexible packaging manufacturers see value in simplified processing and material cost reduction. It supports broader adoption across industries including dairy, snacks, frozen food, and pharmaceuticals. Packaging equipment suppliers are optimizing systems to handle mono material substrates effectively. This integration improves production efficiency while maintaining product quality. The Mono Material Packaging Market is advancing due to material science innovation and equipment alignment.

Corporate Sustainability Commitments and Circular Economy Principles Fueling Material Shift Toward Single Polymers

Corporate sustainability programs are reshaping packaging design priorities. Leading brands pledge measurable reductions in non-recyclable plastics. Retailers and consumer goods companies are driving demand for recyclable formats across supply chains. It accelerates collaboration with packaging converters and raw material suppliers to achieve compliance. These initiatives align with circular economy strategies promoting reuse and resource efficiency. Industrial buyers prioritize packaging that fits within established recycling streams. Regulations are reinforcing this shift by holding producers accountable for packaging waste. The Mono Material Packaging Market benefits from these commitments that promote scalable transformation.

- For instance, Unilever publicly commits to making all of its plastic packaging reusable, recyclable, or compostable by 2030 for rigid plastics and by 2035 for flexible plastics, with their latest progress report showing 53% of plastic packaging meeting these criteria as of 2023.

Rising Consumer Demand for Eco-Friendly Products and Packaging Waste Reduction Initiatives Boosting Market Growth

Changing consumer behavior is shaping material preferences. Shoppers increasingly choose brands that adopt sustainable packaging. Surveys show strong loyalty to products with clear recyclability labels. It encourages companies to innovate packaging that meets both aesthetic and sustainability expectations. Waste reduction campaigns and government awareness programs reinforce these choices. Retail chains also promote sustainable packaging to enhance brand image. Growing urban populations with rising purchasing power amplify the shift. The Mono Material Packaging Market is positioned to expand due to this strong consumer influence.

Market Trends:

Increasing Digital Printing Integration with Mono Material Packaging for Customization and Branding Advantages

Digital printing is emerging as a key trend for mono material packaging. Brands adopt advanced printing techniques to enhance consumer engagement. High-resolution graphics create attractive shelf presence without multiple materials. It enables flexible runs for seasonal or personalized packaging campaigns. Digital systems reduce waste and align with sustainability targets. Packaging producers integrate these capabilities to meet rapid product turnover. E-commerce platforms further demand visually distinctive packaging that enhances unboxing experience. The Mono Material Packaging Market is evolving with digital printing integration supporting growth.

- For example, The HP Indigo 20000 Digital Press supports flexible packaging on mono-material films, delivering print resolutions up to 812 dpi. It eliminates plates, reduces waste between jobs, and enables personalized short runs with high-quality output. The press is designed for sustainable flexible packaging applications, offering compatibility with substrates such as polyethylene and other recyclable films.

Growing Popularity of Transparent Packaging Solutions Designed for Visibility and Consumer Trust Enhancement

Transparent mono material packaging is gaining traction across industries. Food companies value visibility for freshness assurance and consumer confidence. Clear packaging also appeals in personal care and household product categories. It eliminates the need for window films or secondary materials. Packaging converters are developing durable transparent polymers with improved strength. It creates opportunities to balance functionality with recyclability. Retailers recognize consumer trust in transparent packaging, driving widespread application. The Mono Material Packaging Market is influenced by this trend that combines visibility and sustainability.

- For example, Amcor’s AmLite Ultra transparent metal-free high-barrier film provides an oxygen barrier that outperforms aluminum by 30% after 100 Gelbo-Flex cycles, indicating superior durability and barrier performance suitable for sensitive food products. The film offers over 90% clarity and enhances recyclability by eliminating aluminum layers traditionally used in barriers.

Expansion of Smart Packaging Features Within Single-Polymer Structures to Enhance Functionality and Consumer Experience

Smart packaging technologies are increasingly compatible with mono material formats. Brands add QR codes and NFC tags for digital interaction. It allows tracking, authentication, and enhanced consumer engagement. These features improve product transparency in food, healthcare, and luxury goods. Packaging designers integrate these technologies without compromising recyclability. Recycling systems accept packaging without removing added digital layers. Companies view this as a way to differentiate in competitive markets. The Mono Material Packaging Market is growing with innovation in functional smart packaging solutions.

Rising Focus on Lightweight Packaging and Material Efficiency Across Food and Beverage Applications

Lightweighting strategies dominate packaging development goals. Mono material solutions reduce material weight while maintaining strength. It lowers transportation costs and improves supply chain efficiency. Food and beverage companies prioritize lightweight packaging to manage logistics. Sustainable sourcing initiatives reinforce the importance of efficiency gains. Packaging converters invest in materials that balance weight reduction and barrier properties. The trend aligns with energy-saving goals across industries. The Mono Material Packaging Market continues to advance through lightweight packaging adoption.

Market Challenges Analysis:

Technical Limitations in Barrier Properties and Performance Standards Restraining Widespread Application Across Industries

One major challenge lies in material performance limitations. Multi-layer packaging has traditionally provided superior oxygen and moisture barriers. Mono material options sometimes fail to meet stringent food safety and shelf-life demands. It restricts adoption in dairy, frozen foods, and high-moisture categories. Manufacturers face difficulties balancing recyclability with necessary product protection. Development costs rise with attempts to engineer stronger films. This limits widespread use in applications where quality cannot be compromised. The Mono Material Packaging Market must overcome these technical constraints for broader industry penetration.

Recycling Infrastructure Gaps and High Conversion Costs Hindering Large-Scale Implementation in Global Markets

Recycling infrastructure remains inconsistent across regions. Many countries lack advanced facilities to process single-polymer packaging effectively. It creates obstacles in achieving a truly circular economy. Conversion from traditional laminates requires capital-intensive investment in equipment and training. Small and medium enterprises struggle to justify these costs. Brand owners face slow returns when scaling new packaging solutions. Consumer awareness gaps further challenge adoption in developing regions. The Mono Material Packaging Market encounters barriers linked to economic feasibility and infrastructure readiness.

Market Opportunities:

Advancements in High-Performance Mono Material Films Opening New Possibilities in Healthcare and Industrial Packaging Applications

Innovation in high-barrier mono material films is expanding possibilities. Healthcare companies seek sterile packaging that meets recycling goals. Industrial sectors need heavy-duty films that support bulk transport. It creates opportunities for suppliers to diversify applications beyond consumer goods. Pharmaceutical adoption is particularly promising due to strict waste reduction policies. Barrier improvements extend product shelf life without sacrificing recyclability. Packaging equipment upgrades support these advancements at scale. The Mono Material Packaging Market gains opportunities through these specialized applications.

Expanding Role of Collaborative Partnerships and Sustainability Alliances Driving Long-Term Market Growth and Consumer Acceptance

Collaborations between packaging converters, material suppliers, and brand owners are opening new pathways. Industry alliances focus on standardizing recyclable solutions across value chains. It strengthens adoption by reducing confusion and increasing efficiency. Retailers partner with manufacturers to launch sustainable packaging lines. Policy makers support these alliances through eco-design incentives. Such collaborations foster innovation at reduced cost and time-to-market. Consumer trust grows when partnerships demonstrate measurable sustainability impact. The Mono Material Packaging Market can achieve significant growth through these collaborative initiatives.

Market Segmentation Analysis:

By Material Type

Polyethylene (PE) dominates due to its versatility, durability, and recyclability. Polypropylene (PP) follows with strong demand in food and personal care packaging. Polyethylene Terephthalate (PET) gains traction in beverage and transparent packaging formats. Polylactic Acid (PLA) attracts interest as a bio-based alternative with growing use in eco-friendly applications. Other polymers such as specialty resins serve niche markets that require tailored performance features. The Mono Material Packaging Market benefits from this mix of widely used and emerging materials.

By Packaging Type

Flexible packaging leads growth due to its lightweight, cost efficiency, and ability to support high-volume food and beverage applications. It aligns with recycling systems and reduces transportation impact. Rigid packaging retains demand in healthcare, personal care, and household products that require stability and strength. It remains relevant for items where product protection is critical. Both formats expand steadily, offering manufacturers design flexibility and performance assurance.

- For example, Gualapack, a flexible packaging specialist, produces recyclable mono-material stand-up pouches primarily from polyethylene, used in food and beverage sectors to reduce carbon footprint and support circular economy initiatives.

By Application

Food and beverage hold the largest share, driven by regulatory compliance and consumer demand for sustainable formats. Healthcare and pharmaceuticals rely on mono materials for sterile and secure packaging solutions. Personal care and cosmetics adopt recyclable designs to strengthen brand image and consumer trust. Household and industrial applications use these materials for durability and cost efficiency. Other consumer goods sectors explore tailored mono material options to enhance circular economy goals. It positions the Mono Material Packaging Market for sustained expansion across diverse end uses.

- For example, Dividella offers 100% mono-material packaging solutions designed for pharmaceutical sterility and sustainability, reducing waste and total cost of ownership in healthcare packaging.

Segmentation:

By Material Type

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polylactic Acid (PLA)

- Others

By Packaging Type

- Flexible Packaging

- Rigid Packaging

By Application

- Food & Beverage

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Household & Industrial

- Other Consumer Goods

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America and Europe Leading with Strong Regulatory Push and Advanced Recycling Systems

North America accounts for 27% of the market share, supported by strong packaging innovation and consumer awareness. The U.S. drives growth with major food and beverage brands adopting recyclable mono material solutions to meet corporate sustainability targets. Healthcare and personal care sectors also integrate recyclable designs to comply with regulations. Europe holds 33% of the market share, leading globally due to strict packaging waste directives and advanced recycling infrastructure. Countries such as Germany, France, and the U.K. prioritize circular economy strategies and promote investment in single-polymer packaging solutions. The Mono Material Packaging Market benefits from these regions through established infrastructure, stringent compliance standards, and consumer-driven demand.

Asia-Pacific Emerging as the Fastest Growing Region with Expanding Consumer Base and Industrialization

Asia-Pacific captures 25% of the market share and represents the fastest-growing region. Rising urban populations in China, India, and Southeast Asia create strong demand for packaged food and consumer goods. Local governments promote eco-friendly policies to address increasing packaging waste, encouraging adoption of recyclable formats. Japan and South Korea strengthen regional presence with innovation in lightweight and high-barrier mono material films. Global packaging companies expand operations in the region to meet rising consumption and improve waste management practices. It positions the region as a significant growth hub for the Mono Material Packaging Market.

Latin America and Middle East & Africa Gaining Momentum Through Policy Initiatives and Retail Expansion

Latin America holds 8% of the market share, with Brazil and Mexico leading through policy-driven adoption of sustainable packaging. Growth is supported by rising middle-class consumption and multinational food companies investing in recyclable solutions. The Middle East & Africa account for 7% of the market share, where adoption is slower but expanding through retail growth and government-led waste reduction programs. South Africa and the UAE demonstrate early progress by supporting mono material packaging in food, personal care, and healthcare sectors. Global players collaborate with local suppliers to improve accessibility and align products with environmental goals. It reflects growing momentum across these regions that strengthens the overall performance of the Mono Material Packaging Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Amcor Plc

- Berry Global Group

- Mondi Group

- Sealed Air Corporation

- Sonoco Products Company

- Constantia Flexibles

- ProAmpac

- Smurfit Kappa Group

- DuPont Teijin Films

- Jindal Poly Films

- Toray Plastics / Toray Industries Inc.

- RKW SE

- Uflex Ltd.

- SABIC

- Huhtamaki Oyj

Competitive Analysis:

The Mono Material Packaging Market is highly competitive with global players investing in innovation, partnerships, and sustainable product development. Leading companies such as Amcor, Berry Global, and Mondi focus on recyclable packaging portfolios and advanced mono-polymer films to meet regulatory and consumer demands. It demonstrates strong competition where Smurfit Kappa, Huhtamaki, and Constantia Flexibles enhance portfolios through paper-based and hybrid mono material solutions. SABIC, Toray Industries, and DuPont Teijin Films strengthen the market with resin and film innovations that support high-barrier properties. Companies such as ProAmpac, Uflex, and RKW SE expand global presence by aligning with circular economy principles. Growing collaboration between raw material suppliers and packaging converters accelerates scalable solutions for diverse industries. Regional players emphasize cost efficiency and local adaptation, further intensifying competition. The competitive landscape reflects a strong balance between sustainability leadership, material innovation, and strategic expansion across multiple geographies.

Recent Developments:

- In June 2025, Amcor Plc partnered with Cofigeo to develop a recyclable three-compartment tray for ready meals, specifically designed around a mono-material approach that delivers a 12-month shelf life and enhanced sustainability. This unique tray structure makes recycling more accessible by using single material construction and marks an industry move towards convenient and environmentally friendly packaging for food applications.

- In May 2025, Amcor announced a partnership with Metsä Group to create molded fiber-based packaging solutions featuring recyclable mono-material construction and innovative lidding technology. The solution is designed for food packaging and is expected to launch commercially in Europe later in 2025, reflecting both companies’ dedication to sustainability and circular economy principles.

- In December 2024, Berry Global Group collaborated with VOID Technologies to introduce a high-performance polyethylene (PE) film for pet food packaging. Their solution employs patented technology to deliver an all-PE, recycle-ready mono-material pack with superior strength and toughness, helping companies transition away from multi-material, non-recyclable packaging.

Report Coverage:

The research report offers an in-depth analysis based on Material Type, Packaging Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Sustainability regulations will drive packaging manufacturers to accelerate adoption of mono material formats.

- Technological innovations in barrier films will expand applications across food, beverage, and pharmaceutical sectors.

- Flexible packaging will remain the dominant type due to its cost efficiency and lightweight characteristics.

- Rigid packaging will sustain demand in healthcare and household products where durability is essential.

- Bio-based polymers such as PLA will gain traction as eco-friendly alternatives to conventional plastics.

- E-commerce growth will push demand for recyclable, lightweight, and visually distinctive packaging solutions.

- Digital printing integration will enhance customization, brand engagement, and reduce production waste.

- Collaboration among material suppliers, converters, and brand owners will strengthen scalable solutions.

- Asia-Pacific will emerge as the fastest-growing region, fueled by industrial expansion and rising consumption.

- Circular economy strategies will create long-term opportunities for market leaders and regional players.