Market Overview

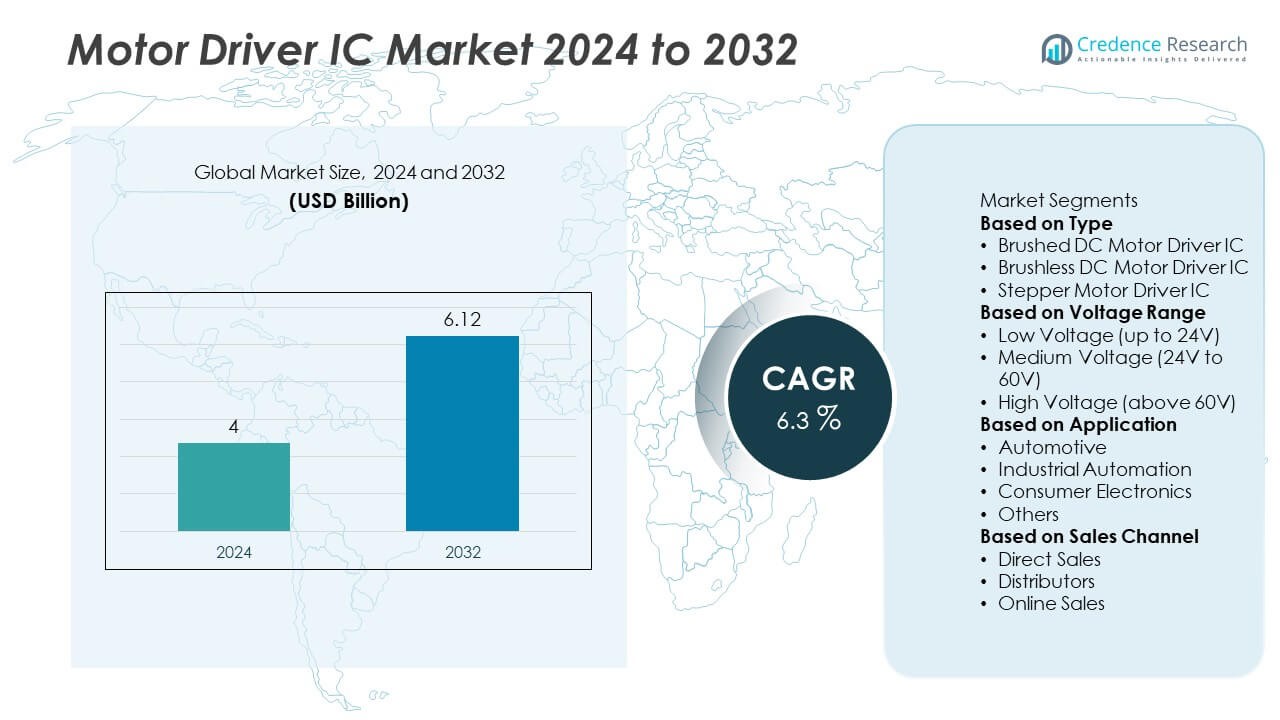

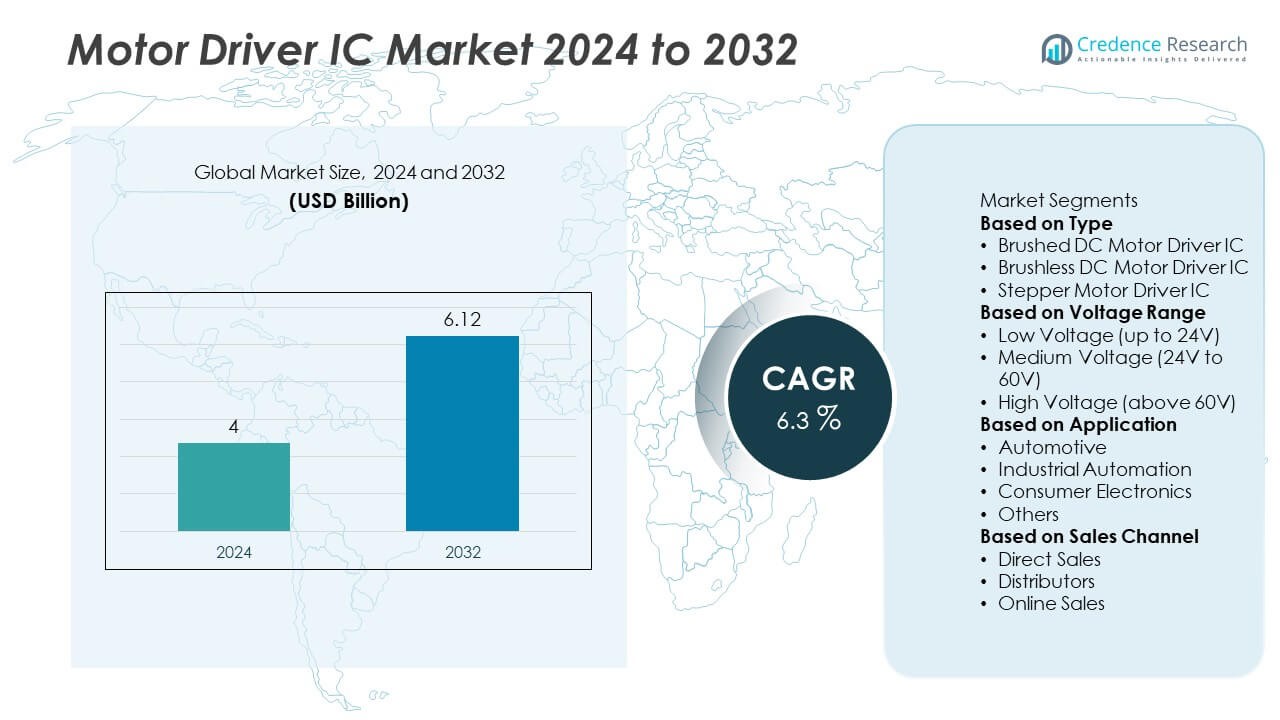

The global motor driver IC market was valued at USD 4 billion in 2024 and is projected to reach USD 6.12 billion by 2032, growing at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Motor Driver IC Market Size 2024 |

USD 4 Billion |

| Motor Driver IC Market, CAGR |

6.3% |

| Motor Driver IC Market Size 2032 |

USD 6.12 Billion |

The motor driver IC market is led by key players including STMicroelectronics, Rohm Semiconductor, Infineon Technologies AG, Texas Instruments Inc., ON Semiconductor, NXP Semiconductors N.V., Toshiba Corporation, Allegro MicroSystems, Renesas Electronics Corporation, and Maxim Integrated Products. These companies deliver advanced motor driver solutions for automotive, industrial automation, and consumer electronics applications. Asia-Pacific held the largest share with 30% in 2024, driven by strong semiconductor production and rising EV manufacturing. North America followed with 32% share, supported by adoption in robotics, smart appliances, and electric vehicles, while Europe accounted for 28% share, fueled by Industry 4.0 initiatives and strict energy efficiency regulations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The motor driver IC market was valued at USD 4 billion in 2024 and is projected to reach USD 6.12 billion by 2032, growing at a CAGR of 6.3%.

- Rising demand for electric and hybrid vehicles, industrial automation, and IoT-enabled devices is driving adoption of energy-efficient and compact motor driver ICs across automotive, consumer electronics, and factory automation sectors.

- Key trends include development of GaN- and SiC-based driver ICs for high-power applications, integration of protection features, and miniaturization to support next-generation robotics and EV systems.

- The market is competitive with STMicroelectronics, Rohm Semiconductor, Infineon Technologies AG, Texas Instruments Inc., ON Semiconductor, and NXP Semiconductors focusing on innovation, cost efficiency, and strategic collaborations with EV and automation solution providers.

- Asia-Pacific led with 30% share in 2024, followed by North America at 32% and Europe at 28%, while brushless DC motor driver ICs accounted for over 45% share by type segment.

Market Segmentation Analysis:

By Type

Brushless DC motor driver ICs dominated the market with over 45% share in 2024, driven by their superior efficiency, longer lifespan, and lower maintenance requirements compared to brushed counterparts. These ICs are widely used in automotive applications such as electric power steering, HVAC systems, and electric vehicles, as well as in drones and robotics. Their ability to deliver high torque with minimal energy loss makes them ideal for performance-driven systems. Increasing adoption of energy-efficient solutions in industrial automation and home appliances further boosts demand for brushless DC motor driver ICs globally.

- For instance, STMicroelectronics continues to supply its STSPIN32F0 brushless DC motor driver IC, which serves automotive, consumer, and industrial electronics markets requiring high-efficiency motor control.

By Voltage Range

The low voltage segment, supporting up to 24V, held the largest share with over 50% in 2024, owing to its widespread use in consumer electronics, small appliances, and battery-powered devices. Demand is strong in applications such as cooling fans, printers, and portable medical equipment where compact and efficient driver solutions are critical. Growing popularity of IoT-enabled devices and smart home systems is further driving adoption of low-voltage ICs. Their lower power consumption and cost-effectiveness make them the preferred choice for high-volume production applications across multiple industries.

- For instance, ROHM Semiconductor offers a wide range of motor driver ICs, including the AEC-Q100 qualified BD63035EFV series. The BD63035EFV-M is a three-phase brushless motor driver designed to drive small-diameter DC fans and other applications, primarily in the automotive sector, at currents up to 1.5 A (2 A peak).

By Application

The automotive segment led the market with over 40% share in 2024, supported by rising electrification of vehicles and integration of advanced driver assistance systems (ADAS). Motor driver ICs are critical in applications including electric powertrains, window lift motors, and seat positioning systems. Rapid growth of electric vehicles and hybrid vehicles is a key demand driver, pushing manufacturers to develop high-efficiency and compact ICs. Industrial automation follows closely, benefiting from rising use of robotics and motion control systems to improve manufacturing efficiency and precision in smart factories.

Key Growth Drivers

Rising Demand for Electric and Hybrid Vehicles

The rapid growth of electric and hybrid vehicles is a major driver for the motor driver IC market. These ICs are essential for controlling traction motors, power steering systems, and thermal management systems. Governments worldwide are promoting EV adoption through incentives and emission regulations, further boosting demand. Automakers are focusing on compact, energy-efficient motor driver ICs to enhance vehicle performance and battery efficiency. This trend is expected to create sustained opportunities for suppliers as global EV production scales rapidly over the next decade.

- For instance, NXP Semiconductors actively provided high-voltage motor control ICs in 2024 for use in electric vehicle (EV) traction inverters, including advanced isolated gate drivers like the GD316x family.

Increasing Adoption of Industrial Automation

Industrial automation is driving significant growth in the motor driver IC market, with factories deploying robotics, conveyors, and motion control systems at scale. Motor driver ICs enable precise control of speed, torque, and position, which are crucial for high-performance automation. The Industry 4.0 movement and rising demand for smart manufacturing are accelerating adoption. Manufacturers are increasingly investing in programmable, high-efficiency ICs to support predictive maintenance and minimize downtime, leading to improved operational efficiency and productivity.

- For instance, in the second quarter of 2025, Texas Instruments’ Analog segment, which includes motor drivers, generated $3.45 billion in revenue, supporting industrial and automotive applications with high-performance integrated circuits.

Growth in Consumer Electronics and IoT Devices

The expansion of consumer electronics and IoT devices is boosting demand for compact, low-power motor driver ICs. These ICs are widely used in cooling fans, printers, surveillance cameras, and household appliances. As smart homes and connected devices become more common, demand for energy-efficient and quiet motor drivers is growing. Miniaturization and integration of control functions in ICs are enabling sleeker, more efficient devices. This segment continues to grow as OEMs focus on performance, noise reduction, and extending product lifespans through improved motor control.

Key Trends & Opportunities

Integration of Smart and Energy-Efficient Designs

Motor driver IC manufacturers are increasingly focusing on developing smart, energy-efficient solutions with integrated protection features such as overcurrent and thermal shutdown. These ICs help reduce overall system cost and improve reliability, making them attractive for EVs, robotics, and appliances. Advancements in semiconductor technology are enabling higher efficiency at lower power consumption. This creates opportunities for suppliers to deliver differentiated solutions that meet sustainability goals while supporting compact product designs in competitive markets.

- For instance, STMicroelectronics produces its STSPIN32F0 smart motor driver IC, which features integrated fault detection and an energy-saving standby mode for use in applications such as electric vehicles and robotics.

Rising Adoption of GaN and SiC Technologies

The shift toward gallium nitride (GaN) and silicon carbide (SiC) power devices is influencing motor driver IC development. These materials allow faster switching speeds, higher power density, and better thermal performance compared to traditional silicon. This trend is particularly strong in high-performance automotive and industrial applications where efficiency and size reduction are critical. The adoption of wide-bandgap materials creates opportunities for next-generation IC designs optimized for high-voltage and high-frequency applications, further enhancing system performance.

- For instance, in 2024 Infineon Technologies demonstrated significant progress in its wide-bandgap technology, pioneering the first 300mm power gallium nitride (GaN) wafers to scale manufacturing and announcing new generations of its CoolGaN™ and CoolSiC™ power devices.

Key Challenges

High Design Complexity and Development Cost

Designing advanced motor driver ICs with integrated protection, high efficiency, and compatibility with multiple motor types increases R&D costs. Manufacturers must invest heavily in engineering resources and testing to meet performance and safety standards. The complexity of designing ICs that work across various voltage ranges and applications can slow time-to-market. This creates barriers for smaller companies and drives competitive pressure to deliver cost-effective solutions without compromising quality.

Supply Chain Disruptions and Semiconductor Shortages

Global semiconductor supply chain challenges pose a risk to the motor driver IC market. Shortages of raw materials and wafer capacity constraints can delay production and lead to price volatility. Automotive and industrial sectors, which depend on consistent supply, face extended lead times that disrupt production schedules. Companies are exploring localized manufacturing and diversifying suppliers to mitigate these risks, but persistent supply chain issues remain a challenge for meeting growing market demand.

Regional Analysis

North America

North America held 32% share of the motor driver IC market in 2024, driven by strong demand from automotive, industrial automation, and consumer electronics sectors. The U.S. leads the region with significant adoption of motor driver ICs in electric vehicles, robotics, and HVAC systems. Government incentives for electric vehicle adoption and advancements in smart manufacturing are fueling growth. Canada contributes with growing deployment of automation in manufacturing and energy-efficient appliances. The presence of major semiconductor companies and robust R&D investments continues to support innovation, ensuring steady demand across multiple end-use industries in the region.

Europe

Europe accounted for 28% share in 2024, supported by rising demand for motor driver ICs in electric mobility, renewable energy, and industrial automation applications. Germany, France, and the U.K. lead adoption due to their strong automotive production base and focus on Industry 4.0 initiatives. The European Union’s strict energy efficiency regulations encourage the use of advanced motor control systems to reduce power consumption. Growth in robotics for manufacturing and logistics further boosts demand. Collaboration between automakers and semiconductor companies is driving the development of efficient, compact ICs to meet evolving sustainability and performance requirements.

Asia-Pacific

Asia-Pacific dominated in growth and held 30% share in 2024, fueled by rapid industrialization and expansion of consumer electronics manufacturing in China, Japan, South Korea, and India. The region is a global hub for semiconductor production, ensuring strong supply chain capabilities and competitive pricing. Demand is supported by the surge in electric vehicle production, automation in factories, and widespread use of smart appliances. Government initiatives promoting local semiconductor manufacturing and electric mobility adoption are boosting market expansion. Continuous investments in R&D and growing domestic demand position Asia-Pacific as the fastest-growing regional market.

Middle East & Africa

The Middle East & Africa captured 5% share in 2024, with growth driven by increasing adoption of motor driver ICs in HVAC systems, smart building projects, and industrial applications. Gulf countries such as UAE and Saudi Arabia are focusing on automation in infrastructure development and energy efficiency projects. The region is witnessing growing investments in renewable energy and smart city initiatives, which require advanced motor control solutions. In Africa, rising manufacturing activity and gradual adoption of robotics and electric vehicles are contributing to market growth, although the pace remains slower compared to developed regions.

Latin America

Latin America accounted for 5% share in 2024, with Brazil and Mexico leading adoption of motor driver ICs in automotive, consumer electronics, and industrial automation sectors. The region is seeing growth in EV assembly operations and modernization of manufacturing facilities, which drives demand for efficient motor control solutions. Government initiatives promoting energy-efficient appliances and industrial productivity improvements further support the market. Local production of electronics and rising investments in smart infrastructure projects are helping drive consistent growth despite economic volatility, positioning Latin America as an emerging opportunity for semiconductor manufacturers.

Market Segmentations:

By Type

- Brushed DC Motor Driver IC

- Brushless DC Motor Driver IC

- Stepper Motor Driver IC

By Voltage Range

- Low Voltage (up to 24V)

- Medium Voltage (24V to 60V)

- High Voltage (above 60V)

By Application

- Automotive

- Industrial Automation

- Consumer Electronics

- Others

By Sales Channel

- Direct Sales

- Distributors

- Online Sales

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the motor driver IC market is shaped by major players such as STMicroelectronics, Rohm Semiconductor, Infineon Technologies AG, Texas Instruments Inc., ON Semiconductor, NXP Semiconductors N.V., Toshiba Corporation, Allegro MicroSystems, Renesas Electronics Corporation, and Maxim Integrated Products. These companies focus on developing energy-efficient, compact, and high-performance motor driver ICs to meet demand across automotive, industrial, and consumer electronics applications. Strategic initiatives include investments in R&D to improve thermal efficiency, integration of protection features, and support for high-voltage applications. Many players are leveraging partnerships with EV manufacturers and automation solution providers to strengthen market presence. Competition is also driven by innovations in GaN- and SiC-based designs for higher power density and efficiency. The market remains highly dynamic, with players focusing on cost optimization, scalability, and expanding manufacturing capacities to address growing global demand for motor control solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- STMicroelectronics

- Rohm Semiconductor

- Infineon Technologies AG

- Texas Instruments Inc.

- ON Semiconductor

- NXP Semiconductors N.V.

- Toshiba Corporation

- Allegro MicroSystems

- Renesas Electronics Corporation

- Maxim Integrated Products

Recent Developments

- In June 2025, STMicroelectronics introduced the STDRIVE102H/102BH three-phase BLDC gate drivers, starting a new generation of integrated motor drivers.

- In March 2025, ROHM Semiconductor unveiled a new three-phase motor driver aimed at medium-voltage tools and fans, reducing switching losses.

- In January 2025, Infineon Technologies AG announced MOTIX™ BTM90xx full-bridge ICs and new EiceDRIVER™ isolated drivers for traction inverters.

- In January 2025, NXP Semiconductors N.V. moved to acquire TTTech Auto for $625 million to strengthen safety-critical automotive control stacks supporting motor-drive platforms.

Report Coverage

The research report offers an in-depth analysis based on Type, Voltage Range, Application, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for motor driver ICs will grow with increasing adoption of electric and hybrid vehicles worldwide.

- Brushless DC motor driver ICs will see rising use due to efficiency and longer lifespan benefits.

- Integration of GaN and SiC technologies will enhance power density and thermal performance.

- Industrial automation and robotics expansion will boost demand for precision motor control solutions.

- Miniaturization and integration will drive compact, energy-efficient IC designs for consumer electronics.

- Smart home devices and IoT applications will create consistent demand for low-voltage motor drivers.

- Partnerships between semiconductor makers and automakers will accelerate customized automotive IC development.

- Investment in R&D will focus on adding safety, diagnostics, and protection features in ICs.

- Asia-Pacific will remain the fastest-growing region due to EV production and manufacturing expansion.

- Supply chain diversification and local production will become a priority to address semiconductor shortages.