Market Overview

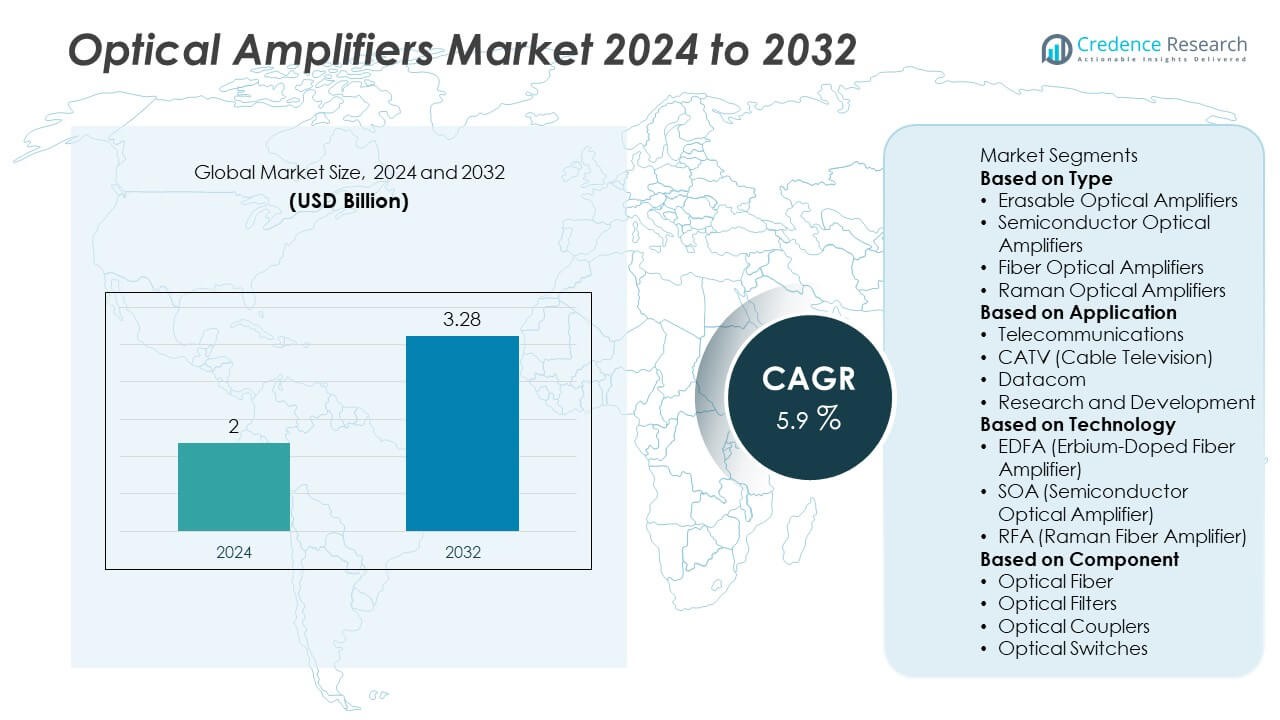

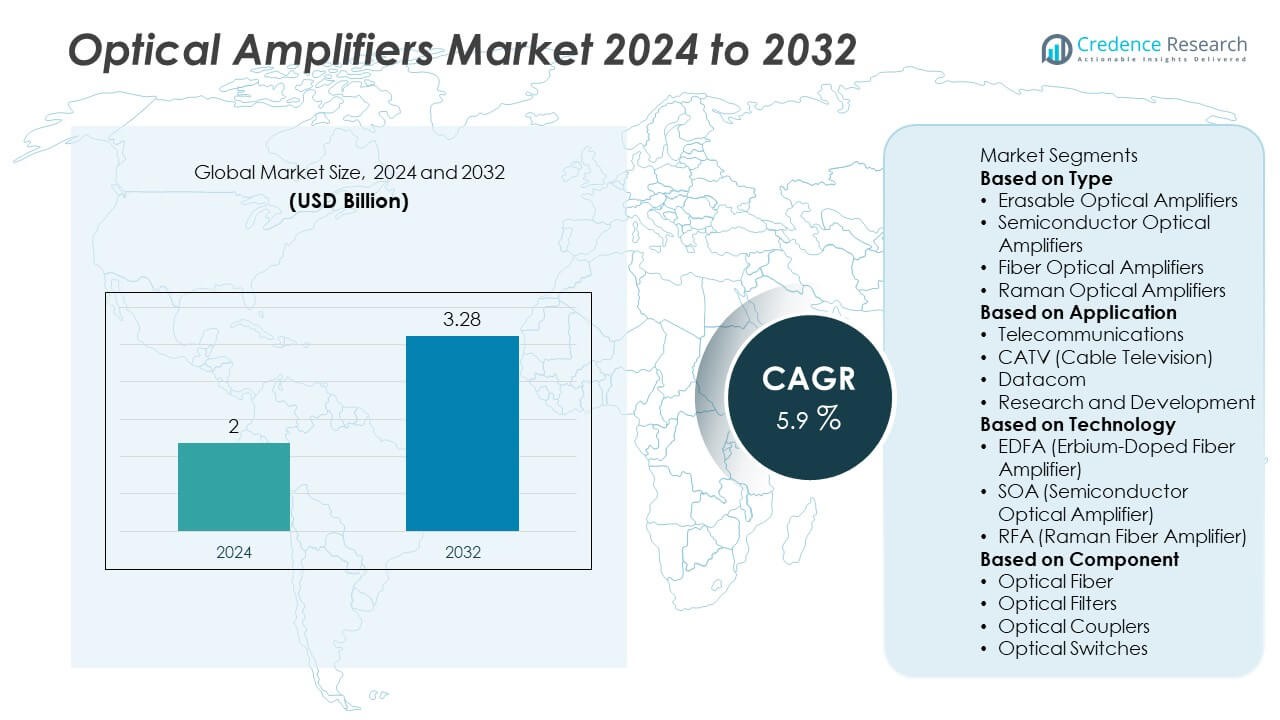

The optical amplifiers market was valued at USD 2 billion in 2024 and is expected to reach USD 3.28 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Optical Amplifiers Market Size 2024 |

USD 2 Billion |

| Optical Amplifiers Market, CAGR |

5.9% |

| Optical Amplifiers Market Size 2032 |

USD 3.28 Billion |

The optical amplifiers market is driven by top players including Cisco Systems, Nistica, Mellanox Technologies, Fujitsu, Infinera Corporation, Amdocs, ADVA Optical Networking, Huawei Technologies, Nokia Corporation, and Typeset. These companies focus on advancing EDFA, SOA, and Raman amplifier technologies to meet rising demand for high-speed data transmission and reliable network performance. North America leads the market with 34% share, supported by extensive 5G rollouts and strong data center infrastructure, while Asia-Pacific follows closely with 30% share driven by massive fiber deployments in China, India, and Japan. Europe holds 28% share, fueled by digitalization initiatives and submarine cable projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The optical amplifiers market was valued at USD 2 billion in 2024 and is projected to reach USD 3.28 billion by 2032, growing at a CAGR of 5.9% during the forecast period.

- Growth is driven by rising demand for high-speed internet, 5G backhaul, and data center expansion, with fiber optical amplifiers leading the type segment with over 45% share in 2024.

- Key trends include adoption of energy-efficient amplifier modules, deployment of DWDM systems, and integration of compact EDFAs and Raman amplifiers for metro and long-haul networks.

- The market is competitive, with major players such as Cisco Systems, Fujitsu, Huawei Technologies, Nokia Corporation, and Infinera focusing on R&D, network partnerships, and submarine cable projects.

- North America holds 34% share, Asia-Pacific 30%, and Europe 28%, supported by large-scale broadband rollouts and digitalization initiatives, while Latin America and MEA collectively contribute the remaining 8% share.

Market Segmentation Analysis:

By Type

Fiber optical amplifiers dominated the optical amplifiers market in 2024, holding over 45% share. Their widespread adoption in long-haul and metro networks drives demand, as they provide low noise, high gain, and cost-effective signal boosting over long distances. The segment benefits from increasing deployment of high-capacity optical fiber networks and data-intensive applications. Erasable optical amplifiers and semiconductor optical amplifiers serve niche roles in metro and access networks, while Raman optical amplifiers find use in ultra-long-haul and submarine communication links where low noise figures and extended reach are critical.

- For instance, Agiltron’s Erbium-Doped Fiber Amplifier (EDFA) modules available in 2025 provide output power up to 26 dBm across the 1528-1565 nm wavelength range, and feature automatic power control modes that maintain constant output power even with varying input levels.

By Application

Telecommunications led the market with over 50% share in 2024, driven by rapid expansion of high-speed broadband and 5G backhaul networks worldwide. Growing internet penetration and demand for seamless video streaming, cloud services, and IoT connectivity fuel amplifier installations across telecom infrastructure. The CATV segment is expanding steadily with rising digital cable penetration and bandwidth upgrades. Datacom applications gain traction from hyperscale data centers and enterprise networks. Research and development remains a smaller segment, primarily supporting optical system innovations and next-generation photonic technology testing in academic and industrial labs.

- For instance, in early 2025, Huawei introduced a high-power coherent optical networking platform capable of transmitting 1.2 terabits per second over a distance of 240 kilometers, optimizing hyperscale cloud infrastructure connectivity.

By Technology

EDFA (Erbium-Doped Fiber Amplifier) technology accounted for over 55% share in 2024, making it the dominant segment due to its reliability, low noise performance, and suitability for dense wavelength division multiplexing (DWDM) systems. EDFAs are widely used in telecom and CATV systems to amplify multiple wavelengths simultaneously, enabling higher capacity transmission. SOA technology follows with use in compact integrated systems, while Raman fiber amplifiers are increasingly adopted for ultra-long-haul links requiring distributed amplification. Continuous innovation in EDFA modules, including energy-efficient designs, supports the strong position of this technology in core network deployments.

Key Growth Drivers

Rising Demand for High-Speed Internet and 5G Networks

The expansion of high-speed internet and 5G networks is a primary growth driver, contributing to over 40% of new installations in 2024. Telecom operators are rapidly upgrading their backbone infrastructure to support high-bandwidth services like video streaming, cloud computing, and IoT connectivity. Optical amplifiers ensure seamless long-distance signal transmission without regeneration, reducing operational costs. This growing need for low-latency, high-capacity data transfer drives large-scale deployment across urban and rural networks, especially in Asia-Pacific and North America, where broadband penetration and 5G rollouts are accelerating.

- For instance, NTT Corporation developed a multi-core optical amplifier in September 2023 that reduces power consumption by 67% compared to conventional devices. This enables significant efficiency gains by allowing multiple cores to share a single excitation laser, which would benefit capacity expansion in optical communication platforms, such as those supporting dense 5G networks.

Proliferation of Data Centers and Cloud Computing

The growing number of hyperscale data centers fuels optical amplifier demand, holding around 35% share of market revenue growth. Data center operators deploy optical amplifiers to maintain signal integrity across interconnects supporting massive data transfers. Rising adoption of cloud services, edge computing, and AI workloads further boosts traffic on optical networks. Amplifiers such as EDFAs enable high-capacity transmission over dense wavelength division multiplexing (DWDM) links, supporting scalability and reliability. Continuous investment by tech giants in building and upgrading data centers is expected to sustain market growth over the next decade.

- For instance, Infinera’s ICE7 optical engine supports symbol rates up to 148 GBaud and enables 800G-based transmission over 3,000 km spans, and its optical line system can provide usable spectrum up to 12 THz on a single fibre.

Increasing Deployment of WDM and Long-Haul Networks

Deployment of wavelength division multiplexing (WDM) and long-haul optical networks is driving demand, with this segment representing over 30% of total amplifier installations. WDM systems allow multiple data channels to be transmitted simultaneously, requiring optical amplifiers to boost multi-wavelength signals. The trend toward long-haul and submarine communication systems, supported by rising international bandwidth requirements, strengthens demand. Optical amplifiers reduce signal loss over transcontinental distances, improving efficiency. Investments in cross-border fiber projects and submarine cables, particularly in Europe and Asia-Pacific, continue to create opportunities for advanced amplifier technologies.

Key Trends & Opportunities

Adoption of Energy-Efficient Amplifier Designs

Manufacturers are focusing on energy-efficient amplifier modules, helping operators reduce operating costs and carbon footprints. Low-power EDFAs and Raman amplifiers with intelligent gain control optimize energy use while maintaining signal quality. This trend aligns with global sustainability goals and supports telecom companies’ efforts to meet green network targets. Energy efficiency is emerging as a differentiator in procurement decisions, opening opportunities for players offering compact, low-heat, and high-reliability solutions tailored for space-constrained data centers and remote field deployments.

- For instance, Furukawa Electric introduced its Dual Port Raman Pump Laser (DPRP) in March 2025, reducing Raman amplifier power consumption by 32-39% while maintaining high output power performance across the S-, C-, and L-bands for optical communication networks.

Integration of Optical Amplifiers in IoT and Smart Infrastructure

The rising adoption of IoT-enabled smart cities and industrial automation creates new opportunities for optical amplifier suppliers. These projects require robust, low-latency optical networks to connect sensors, devices, and edge computing nodes. Amplifiers play a key role in ensuring uninterrupted data flow across distributed networks. Governments are investing in smart grid, transportation, and surveillance infrastructure, boosting demand for compact and scalable amplification solutions. Market players offering modular designs that support future bandwidth expansion stand to gain from this trend.

- For instance, Thorlabs booster optical amplifiers, such as the BOA1084S and BOA1084P, provide a typical small-signal gain of 20 dB and saturation output powers of 17 dBm across the 1685 nm wavelength band. These devices are housed in compact 14-pin butterfly packages.

Key Challenges

High Initial Investment and Deployment Costs

The high cost of installing optical amplifiers, especially for long-haul and DWDM systems, remains a significant barrier. Capital-intensive network upgrades deter smaller operators and enterprises from adopting advanced amplification solutions. Additional expenses for skilled labor, network integration, and maintenance further raise the total cost of ownership. This cost challenge slows adoption in developing regions where budget constraints limit large-scale network modernization despite rising data demand.

Competition from Alternative Technologies

Alternative transmission technologies, such as all-optical regeneration and advanced modulation schemes, pose a challenge to amplifier adoption. These technologies can extend network reach without multiple amplification stages, reducing reliance on traditional amplifiers. Rapid innovation in silicon photonics and integrated optical systems also creates price pressure by enabling compact, cost-effective solutions. Market players must continue investing in innovation to maintain competitiveness and ensure optical amplifiers remain the preferred choice for high-capacity networks.

Regional Analysis

North America

North America led the optical amplifiers market with 34% share in 2024, driven by strong demand from telecom operators, hyperscale data centers, and early 5G rollouts. The U.S. dominates regional growth with major investments in upgrading backbone networks and expanding rural broadband coverage under federal programs. Canada is witnessing steady growth with increased adoption of fiber-to-the-home and CATV upgrades. Presence of leading players, high R&D spending, and a mature network infrastructure ecosystem support continuous deployment of EDFAs and SOAs. Growing demand for low-latency cloud connectivity and cross-border data traffic further drives regional market expansion.

Europe

Europe accounted for 28% share in 2024, supported by extensive deployment of high-capacity fiber optic networks and government-led digitalization initiatives. Countries like Germany, the U.K., and France are driving adoption through nationwide gigabit broadband projects and data center expansion. The region’s focus on energy-efficient telecom infrastructure and strict network reliability standards encourage use of advanced EDFA and Raman amplifiers. Investments in submarine cable projects connecting Europe to Africa and Asia enhance long-haul transmission requirements. Vendors in the region are also prioritizing compact amplifier solutions that meet sustainability goals, aligning with the European Green Deal targets.

Asia-Pacific

Asia-Pacific held 30% share in 2024, emerging as the fastest-growing regional market due to large-scale fiber network rollouts and rapid internet penetration. China, India, and Japan lead adoption with massive investments in 5G backhaul, data centers, and cross-border connectivity projects. Rising demand for high-speed broadband and OTT streaming services fuels amplifier installations across metro and long-haul networks. Regional vendors are expanding production capacity to meet surging demand and reduce costs. Government initiatives promoting smart city development and digital transformation further boost the use of high-performance EDFA and Raman amplifier technologies across telecom and enterprise applications.

Latin America

Latin America captured 5% share in 2024, with growth driven by expanding broadband coverage and fiber-to-the-home projects in Brazil, Mexico, and Chile. Rising demand for digital services and OTT streaming is pushing network operators to invest in optical amplifier solutions for metro and core networks. Deployment of undersea cable systems connecting the region to North America and Europe is creating additional demand for long-haul amplifiers. However, high capital costs and slower economic growth limit faster adoption. Opportunities exist for low-cost, energy-efficient amplifier solutions that can address rural connectivity challenges and support regional digital inclusion initiatives.

Middle East & Africa

The Middle East & Africa region accounted for 3% share in 2024, with demand concentrated in Gulf countries and South Africa. Investment in hyperscale data centers, smart city projects, and undersea cable infrastructure drives amplifier deployment. The UAE and Saudi Arabia are leading adopters, supporting 5G rollouts and digital economy strategies. Africa is witnessing gradual growth with expanding international bandwidth and government-backed broadband initiatives. Vendors targeting the region focus on compact, cost-effective solutions that meet long-distance transmission needs while withstanding challenging environmental conditions, making it a promising but price-sensitive market for optical amplifier suppliers.

Market Segmentations:

By Type

- Erasable Optical Amplifiers

- Semiconductor Optical Amplifiers

- Fiber Optical Amplifiers

- Raman Optical Amplifiers

By Application

- Telecommunications

- CATV (Cable Television)

- Datacom

- Research and Development

By Technology

- EDFA (Erbium-Doped Fiber Amplifier)

- SOA (Semiconductor Optical Amplifier)

- RFA (Raman Fiber Amplifier)

By Component

- Optical Fiber

- Optical Filters

- Optical Couplers

- Optical Switches

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the optical amplifiers market features key players such as Cisco Systems, Nistica, Mellanox Technologies, Fujitsu, Infinera Corporation, Amdocs, ADVA Optical Networking, Huawei Technologies, Nokia Corporation, and Typeset. These companies focus on developing advanced EDFA, SOA, and Raman amplifier solutions to address the growing demand for high-speed, high-capacity optical networks. Strategic initiatives include product innovations, network upgrades, and collaborations with telecom operators and data center providers. Many players are investing in energy-efficient designs and compact form factors to support next-generation 5G, IoT, and cloud infrastructure. Partnerships for submarine cable projects, metro network expansion, and DWDM deployments are common strategies to strengthen market share. Continuous R&D investments and competitive pricing strategies are shaping the market, with Asia-Pacific and North America being primary targets for expansion due to rapid network infrastructure growth and increasing bandwidth consumption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In May 2025, Nistica introduced a compact semiconductor optical amplifier (SOA) with integrated photonic circuits, achieving 18 dB gain and 3 dB noise figure.

- In April 2025, Chalmers University of Technology, A chip amplifier was demonstrated that gives 10× the data transmission capacity over existing fiber-optic systems, using ultra-broadband amplification.

- In February 2025, Nokia Corporation / Infinera Corporation, The EU approved Nokia’s acquisition of Infinera for about USD 2.3 billion.

- In October 2024, Huawei released an EDFA optical amplifier module (QSFP28-SMF) that supports 400G ZR and ZR+ modules, works over 1535-1555 nm range, with maximum transmit (average) optical power of 17.5 dBm.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Technology, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for optical amplifiers will grow steadily with rising global data traffic and 5G expansion.

- Fiber optical amplifiers will remain the dominant type, driven by long-haul and metro network deployments.

- EDFA technology will continue to lead due to its efficiency and compatibility with DWDM systems.

- Asia-Pacific will see the fastest growth, supported by large-scale fiber rollouts in China and India.

- Energy-efficient and compact amplifier designs will gain preference to meet sustainability goals.

- Data center interconnect applications will create new opportunities for high-performance amplifier solutions.

- Raman amplifiers will gain traction in ultra-long-haul and submarine cable systems.

- Collaboration between telecom operators and equipment vendors will intensify to expand network reach.

- Continuous R&D investment will drive innovations in low-noise, high-gain optical amplification.

- Growing smart city and IoT projects will boost amplifier demand in urban infrastructure networks.