Market Overview:

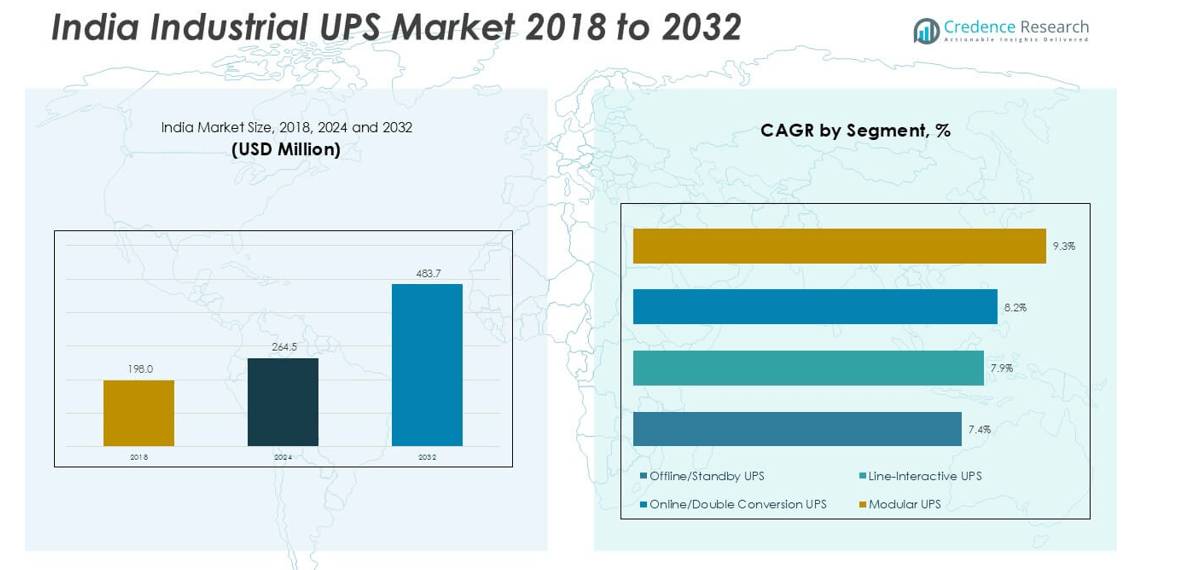

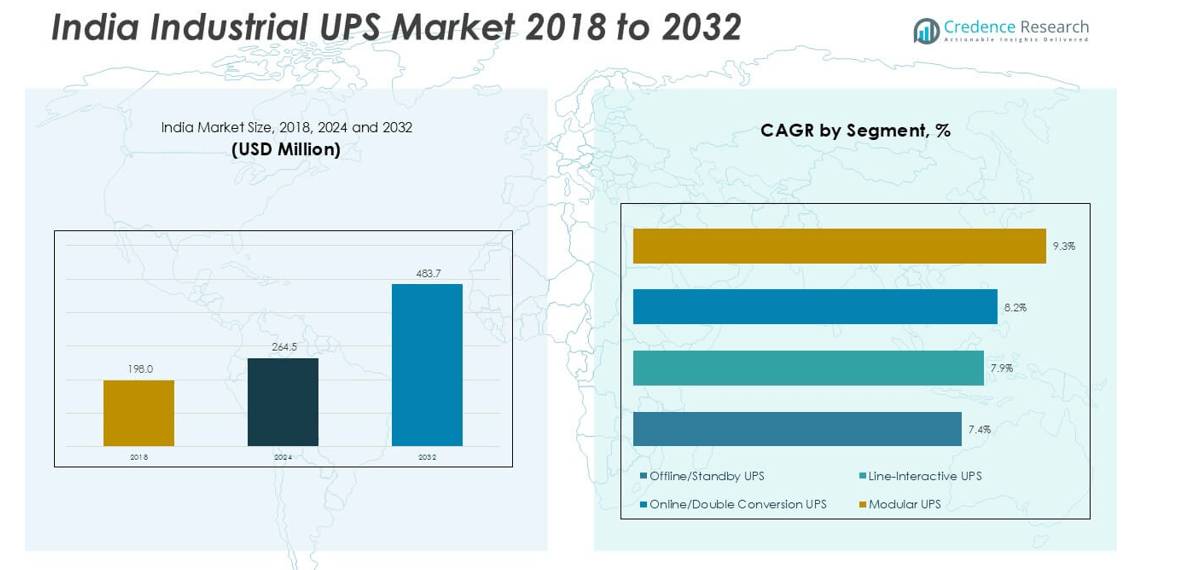

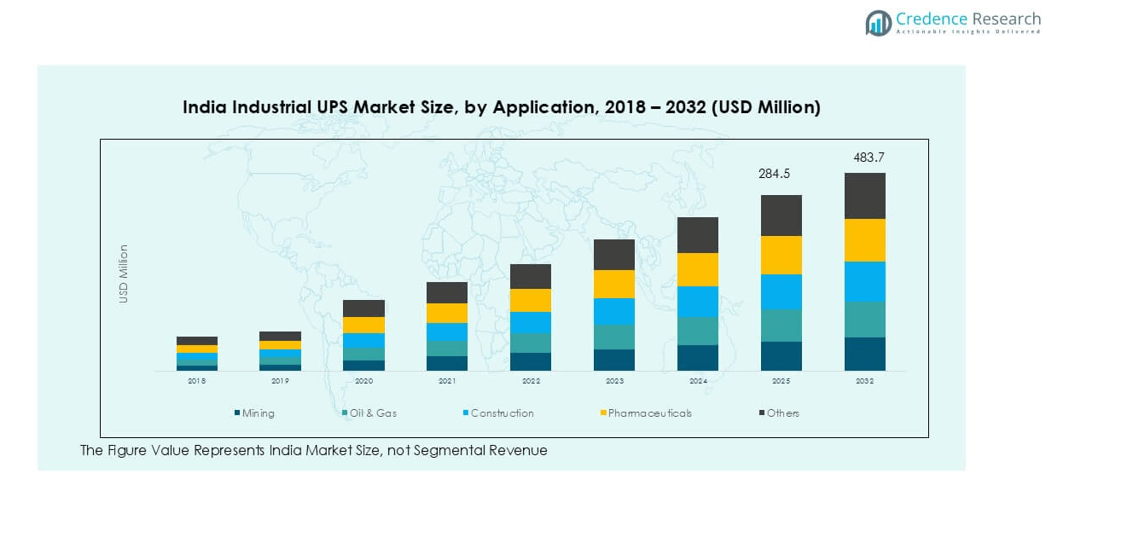

India Industrial UPS market size was valued at USD 198.0 million in 2018, growing to USD 264.5 million in 2024, and is anticipated to reach USD 483.7 million by 2032, registering a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Industrial UPS Market Size 2024 |

USD 264.5 million |

| India Industrial UPS Market, CAGR |

7.9% |

| India Industrial UPS Market Size 2032 |

USD 483.7 million |

Schneider Electric, Eaton, and Vertiv lead the India industrial UPS market with strong portfolios of online and modular UPS systems, catering to large enterprises and mission-critical facilities. Luminous Power Technologies and Microtek maintain a robust presence in the SME and cost-sensitive segments, while Delta Power Solutions and Hitachi Hi-Rel focus on high-efficiency solutions for process industries and data centers. South India dominated the market in 2024 with around 30% share, supported by its IT hubs, electronics clusters, and pharmaceutical industries. North India followed with 28% share, driven by industrial corridors and infrastructure projects.

Market Insights

- India Industrial UPS market was valued at USD 264.5 million in 2024 and is projected to reach USD 483.7 million by 2032, growing at a CAGR of 7.9% during 2025–2032.

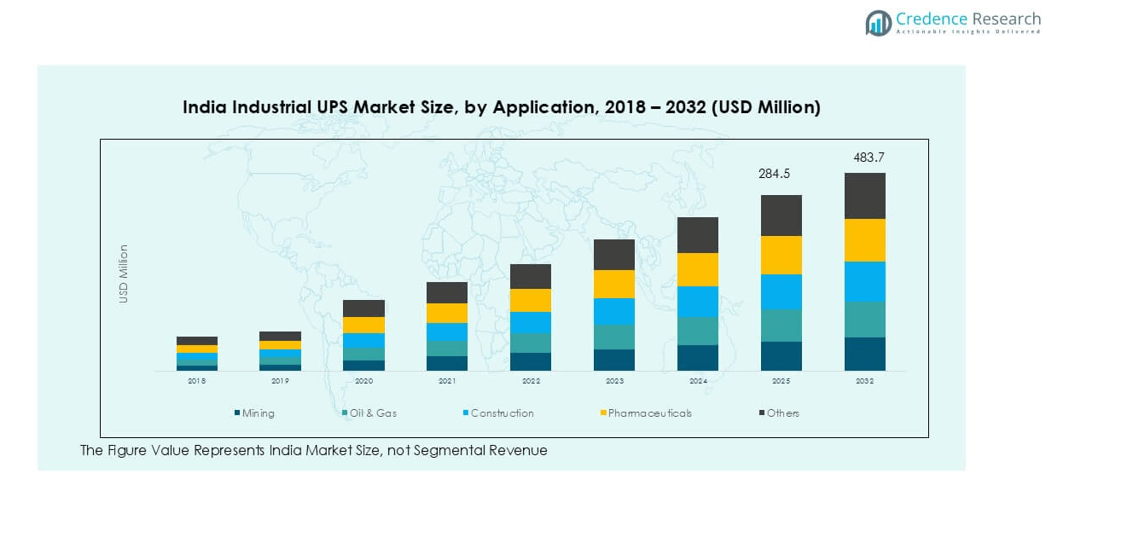

- Growth is driven by rising industrialization, automation, and infrastructure development across oil & gas, pharmaceuticals, telecom, and construction sectors. Online/Double Conversion UPS dominated with over 40% share, followed by modular UPS gaining traction for scalability.

- Key trends include adoption of modular and lithium-ion battery-based UPS systems, integration with renewable energy, and deployment of remote monitoring for predictive maintenance.

- The market is moderately consolidated with players like Schneider Electric, Eaton, Vertiv, Luminous, and Microtek competing on technology, service coverage, and efficiency. Price-sensitive SMEs drive demand for cost-effective standby UPS solutions.

- South India led with 30% share, followed by North India with 28% and West India at 26%, supported by industrial corridors, manufacturing hubs, and data center growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Online/Double Conversion UPS dominated the India industrial UPS market with over 40% share in 2024. This segment leads due to its ability to deliver continuous, high-quality power to critical equipment in industrial and process sectors. Industries with sensitive electronics, such as manufacturing and data centers, favor this type for its superior voltage regulation and zero transfer time during outages. Growing automation in production lines and stricter requirements for uninterrupted operations are further driving demand for online UPS systems. Modular UPS is also gaining traction as enterprises seek scalability and ease of maintenance.

- For instance, Schneider Electric is an established provider of industrial uninterruptible power supply (UPS) systems, such as the Galaxy VX, which is designed for mission-critical applications like large data centers and industrial facilities. The company has a significant presence in India and actively serves the automotive and eMobility sectors with industrial automation and energy management solutions.

By Application

Oil & gas held the largest share of over 35% in 2024, making it the dominant application segment. This demand is fueled by the need for reliable power backup to maintain process control systems, drilling operations, and safety mechanisms in remote and hazardous sites. Mining and telecom sectors follow, driven by investments in digital monitoring systems and uninterrupted communications infrastructure. Construction sites are increasingly adopting UPS solutions to safeguard equipment and ensure smooth project timelines. Rising pharmaceutical manufacturing activities also boost demand for clean, uninterrupted power supply.

- For instance, Eaton delivered 800 kVA of UPS capacity for Coal India’s digital mine monitoring centers in Jharkhand and Odisha in 2024.

By Power Rating

The 101–500 kVA power rating segment accounted for the largest share at nearly 38% in 2024. This range is preferred for medium to large industrial facilities requiring high power reliability, such as refineries, petrochemical plants, and manufacturing clusters. Its dominance is supported by rapid industrialization and expansion of process industries in India’s key states. The 10–50 kVA segment is also witnessing healthy growth, driven by SMEs investing in backup power to avoid production losses. Higher adoption of automation and digital control systems is pushing demand across multiple power rating categories.

Market Overview

Growing Industrialization and Infrastructure Development

India’s rapid industrialization is a major driver for the industrial UPS market. Expansion in sectors such as oil & gas, pharmaceuticals, mining, and manufacturing increases the need for reliable backup power systems. Modern production lines, SCADA systems, and process automation require uninterrupted power to prevent equipment downtime and data loss. The government’s push for “Make in India” and significant infrastructure investments, including smart cities, industrial corridors, and metro projects, are strengthening demand for high-capacity UPS systems. New manufacturing units are adopting online and modular UPS systems to ensure process continuity. In addition, the rise of large warehousing and logistics facilities drives adoption of UPS solutions to support automated material handling systems.

- For instance, ABB has a long-standing history of collaboration with ONGC, with past projects including the provision of automation systems for ONGC’s drilling and production facilities. ABB routinely provides its industrial UPS technology to the oil and gas sector to support the continuous operation of critical infrastructure.

Digitalization and Adoption of Industry 4.0

The adoption of Industry 4.0 technologies is significantly accelerating UPS demand. Automation, robotics, and IoT-enabled equipment rely on constant power availability to function without interruptions. Indian industries are increasingly integrating digital twins, predictive analytics, and AI-based monitoring systems to improve efficiency, which increases reliance on a stable power infrastructure. UPS systems play a critical role in preventing data corruption, unplanned shutdowns, and production delays. Sectors such as automotive, electronics, and pharmaceuticals are leading this digital transformation, further driving UPS adoption. Additionally, the expansion of data centers and cloud infrastructure in India supports the need for high-efficiency online and modular UPS systems.

- For instance, Vertiv supplied a significant number of Liebert EXL S1 online UPS systems to various industries in India in 2024. These UPS systems likely contributed to protecting critical infrastructure, including SCADA systems and robotics, from power outages.

Rising Power Outages and Grid Instability

India continues to face challenges with power quality and grid reliability, particularly in remote and semi-urban areas where many industrial projects are located. Frequent voltage fluctuations, short circuits, and unplanned outages can damage sensitive equipment, resulting in costly downtime. Industrial UPS systems provide a crucial buffer by offering stable voltage and frequency, allowing operations to continue during interruptions. Growing dependence on automated process control systems in oil & gas, chemical, and mining sectors further fuels demand for robust UPS systems. Seasonal weather disruptions, such as monsoons causing power failures, also increase reliance on backup power. With rising investments in renewable energy projects and hybrid microgrids, UPS systems are becoming essential to balance intermittent supply. Industries view UPS adoption as a preventive measure to avoid losses, safeguard equipment, and maintain productivity, making grid instability a strong demand driver across various sectors in the country.

Key Trends & Opportunities

Shift Toward Modular and Scalable UPS Systems

A major trend in the India industrial UPS market is the adoption of modular UPS solutions. These systems allow scalability as industries expand operations, reducing upfront capital expenditure and simplifying maintenance. Modular designs also minimize downtime since faulty modules can be replaced without disrupting operations. Growing demand from data centers, telecom networks, and manufacturing units is pushing suppliers to develop compact, energy-efficient modular UPS systems. Indian enterprises prefer solutions with high flexibility and quick deployment capabilities to adapt to fast-changing load requirements. This trend supports cost efficiency and meets sustainability targets, as modular UPS systems typically have higher energy efficiency ratings. The increasing focus on operational agility and lifecycle cost reduction ensures that modular UPS adoption will continue to expand, particularly among SMEs and large enterprises undergoing digital transformation and capacity expansion in high-growth industrial clusters across India.

- For instance, Delta Electronics manufactures modular UPS units with N+X redundancy and hot-swappable modules that enable zero-downtime maintenance, and these systems are used in industries like pharmaceuticals where uninterrupted power is critical.

Energy Efficiency and Green Power Integration

Energy efficiency is becoming a critical factor in UPS selection as industries look to reduce operating costs and meet sustainability goals. High-efficiency UPS systems with lower power losses and advanced battery management are gaining popularity. Government initiatives promoting renewable energy integration and reduced carbon emissions are encouraging industries to adopt UPS systems compatible with solar and hybrid power solutions. Lithium-ion battery-based UPS systems are witnessing increased demand due to their longer lifecycle, compact size, and faster recharge capabilities. The market is also seeing a shift toward UPS systems that offer intelligent energy management and remote monitoring to optimize performance and minimize wastage. This trend aligns with India’s ESG commitments and helps companies achieve compliance with green building certifications. The push for sustainable energy management creates opportunities for manufacturers to innovate and provide eco-friendly UPS solutions that combine reliability, efficiency, and digital control features.

Key Challenges

High Capital and Maintenance Costs

One of the major challenges for the India industrial UPS market is the high capital investment required for advanced UPS systems. Large online and modular UPS units with higher power ratings can be expensive, creating budget constraints for SMEs and mid-scale industries. In addition, the cost of batteries, particularly lithium-ion variants, remains high, affecting affordability. Maintenance expenses add further burden, as regular servicing and periodic battery replacement are required to ensure reliability. Companies with limited budgets may delay upgrades, which impacts overall market penetration. Vendors are working to address this challenge by offering leasing models, financing options, and service contracts. However, price sensitivity in the Indian market continues to slow adoption, especially in cost-driven sectors such as small manufacturing and construction, limiting potential growth despite rising awareness about the importance of power continuity and equipment protection.

Limited Awareness and Skilled Workforce Shortage

A lack of awareness about advanced UPS technologies is another barrier to growth. Many small and medium enterprises still rely on basic standby systems and are unaware of the benefits of online or modular UPS solutions. Limited knowledge about lifecycle costs, efficiency benefits, and reduced downtime hinders investment in high-performance systems. Additionally, there is a shortage of skilled technicians capable of installing and maintaining complex UPS systems, especially in remote regions. This leads to improper deployment, suboptimal performance, and higher failure rates. The gap in technical expertise also increases dependence on external service providers, which can be costly and time-consuming. To overcome this challenge, manufacturers and industry associations are conducting training programs and awareness campaigns, but widespread adoption of advanced UPS technologies will depend on sustained education and capacity-building efforts in the Indian industrial sector.

Regional Analysis

North India

North India accounted for around 28% of the market share in 2024, driven by strong demand from manufacturing, automotive, and power generation sectors in states such as Haryana, Uttar Pradesh, and Delhi NCR. The presence of large industrial clusters, IT hubs, and data centers is boosting adoption of online and modular UPS systems. Rapid infrastructure development, including metro projects and smart city initiatives, further fuels growth. Government support for industrial corridors such as DMIC is creating demand for reliable backup power solutions to ensure operational continuity across factories, logistics hubs, and process industries.

West India

West India held nearly 26% market share in 2024, supported by strong demand from oil & gas refineries, petrochemical complexes, and pharmaceuticals concentrated in Gujarat and Maharashtra. The region’s large automotive and engineering manufacturing base requires stable power supply to protect automation systems and maintain production quality. Growing investments in logistics parks and warehousing also drive UPS adoption. Industrial UPS demand in this region is supported by ports, SEZs, and rapid growth of renewable energy projects, which need power stability for grid synchronization. Increasing deployment of digital infrastructure further strengthens the region’s market growth prospects.

South India

South India led the market with the largest share of about 30% in 2024, driven by robust presence of IT hubs, electronics manufacturing clusters, and data centers in Karnataka, Tamil Nadu, and Telangana. The region’s thriving pharmaceutical sector and large-scale industrial parks require uninterrupted power for critical processes. Adoption of modular UPS systems is rising due to scalability and low maintenance needs. Supportive state policies for electronics manufacturing and EV production are boosting demand for higher power rating UPS systems. The region’s focus on Industry 4.0 adoption and automation further accelerates UPS penetration in manufacturing facilities.

East India

East India contributed approximately 10% of the market share in 2024, with demand led by mining, steel, and power generation sectors in Odisha, Jharkhand, and West Bengal. Industrial UPS systems are crucial for ensuring smooth operations in remote mining sites and large steel plants that experience frequent grid fluctuations. The expansion of coal-fired and renewable power plants in this region further drives UPS demand for process control systems. Growing infrastructure projects such as metro expansions in Kolkata and new industrial parks are expected to create additional opportunities, gradually boosting the region’s share in the coming years.

Central India

Central India held nearly 6% market share in 2024, with demand concentrated in Madhya Pradesh and Chhattisgarh. The region’s cement, mining, and power generation industries rely heavily on UPS systems to maintain uninterrupted operations. Investments in smart grid projects and state-led industrial growth initiatives are helping drive adoption of modern online and modular UPS solutions. While the region is smaller compared to other zones, rising industrialization and capacity expansions in thermal power and manufacturing facilities are expected to improve its market share steadily through 2032, creating new opportunities for UPS vendors and service providers.

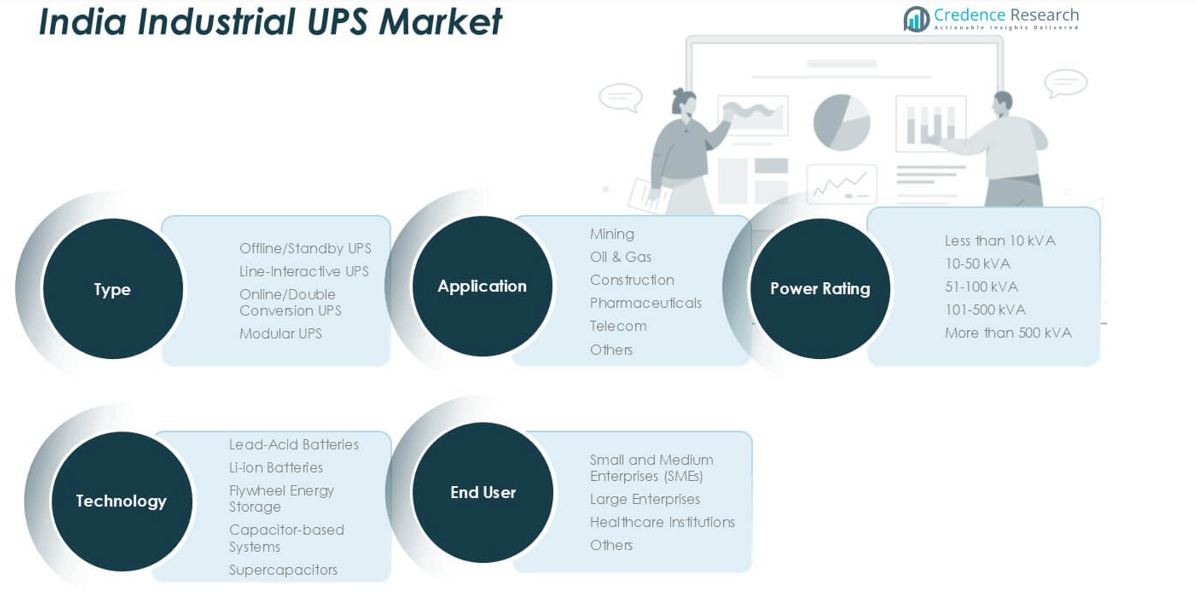

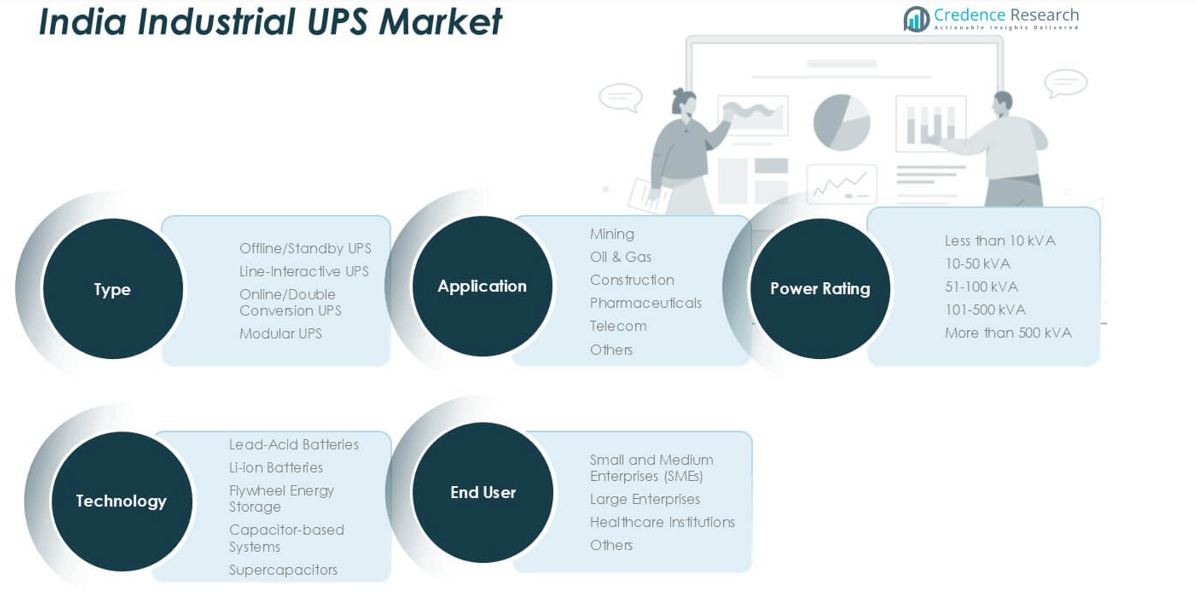

Market Segmentations:

By Type

- Offline/Standby UPS

- Line-Interactive UPS

- Online/Double Conversion UPS

- Modular UPS

By Application

- Mining

- Oil & Gas

- Construction

- Pharmaceuticals

- Telecom

- Others

By Power Rating

- Less than 10 kVA

- 10–50 kVA

- 51–100 kVA

- 101–500 kVA

- More than 500 kVA

By Technology

- Lead-Acid Batteries

- Li-ion Batteries

- Flywheel Energy Storage

- Capacitor-based Systems

- Supercapacitors

By End User

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- Healthcare Institutions

- Others

By Geography

- North India

- West India

- South India

- East India

- Central India

Competitive Landscape

The India industrial UPS market is moderately consolidated, with global and domestic players competing on technology, reliability, and service offerings. Schneider Electric, Eaton, and Vertiv dominate the premium online and modular UPS segments, focusing on high-efficiency solutions for large enterprises and critical facilities. Luminous Power Technologies and Microtek hold strong positions in the mid-range and SME segments, supported by wide distribution networks and cost-competitive products. Delta Power Solutions and Hitachi Hi-Rel are expanding their presence with scalable and energy-efficient UPS systems designed for process industries and data centers. Local players such as Zebronics and Genus Power cater to niche and price-sensitive markets, providing basic standby systems. Companies are investing in lithium-ion battery technology, remote monitoring capabilities, and service contracts to differentiate their offerings. Strategic collaborations, capacity expansions, and product launches are key growth strategies aimed at capturing demand from rapidly growing industrial clusters and infrastructure projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric

- Luminous Power Technologies

- Microtek

- Eaton

- Vertiv

- Hitachi Hi-Rel

- STMicroelectronics

- Delta Power Solutions

- Zebronics

- Genus Power

Recent Developments

- In 2025, Riello UPS will showcase its energy-efficient solutions at DCN Riyadh 2025, where Dr. Antonio Coccia will present strategies for optimizing UPS systems for performance and sustainability. The event will host over 750 decision-makers, focusing on the future of data center infrastructure. This participation strengthens Riello UPS’s brand visibility among industry stakeholders and consumers.

- In January 2024, EPI launched the “Modular Data Center Standard” (MDCS) to standardize and enhance sustainability in modular data center construction. Huawei Digital Power Technologies Co., Ltd is actively contributing to this initiative, driving innovation and growth in the sector.

- In 2023, Kehua Tech successfully supported the 31st FISU World University Games in Chengdu, China, providing over 700 units of MR and KR Series UPS to ensure reliable power for key venues, including the opening and closing ceremonies, media centers, and hotels. This exposure helped strengthen its market presence and build trust with potential clients in diverse sectors.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Power Rating, Technology, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising industrial automation and digital infrastructure projects.

- Adoption of modular UPS systems will increase due to scalability and low maintenance benefits.

- Lithium-ion battery UPS systems will gain higher penetration for efficiency and longer lifecycle.

- Data center expansion across tier-2 and tier-3 cities will boost demand for high-capacity UPS units.

- SMEs will increasingly adopt mid-range UPS systems to avoid production downtime.

- Integration with renewable and hybrid energy systems will become a key selection criterion.

- Government initiatives like Make in India and industrial corridors will create new opportunities.

- Vendors will focus on remote monitoring, IoT, and predictive maintenance features.

- Competition will intensify with global players and domestic brands enhancing service networks.

- Market share of southern and western regions will continue to grow with new industrial hubs.