Market Overview:

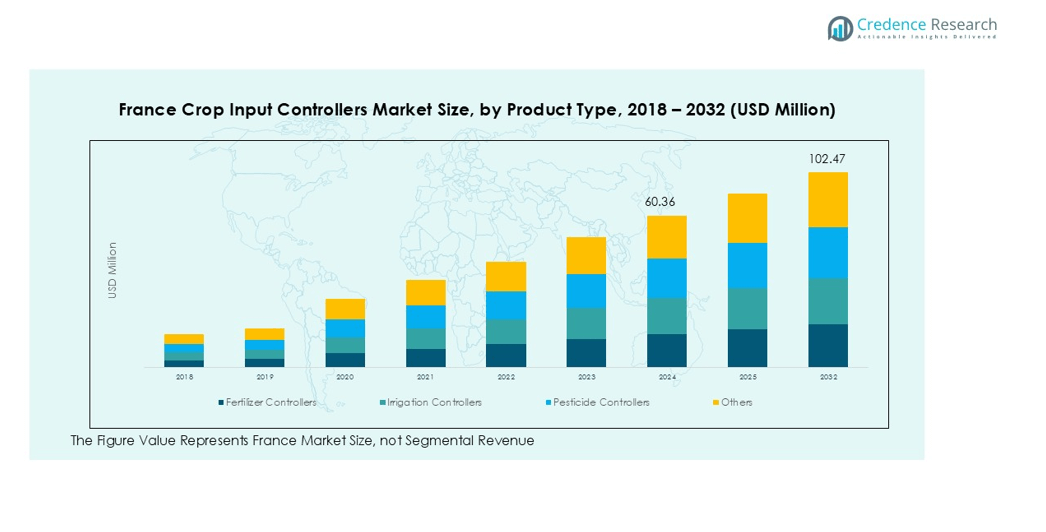

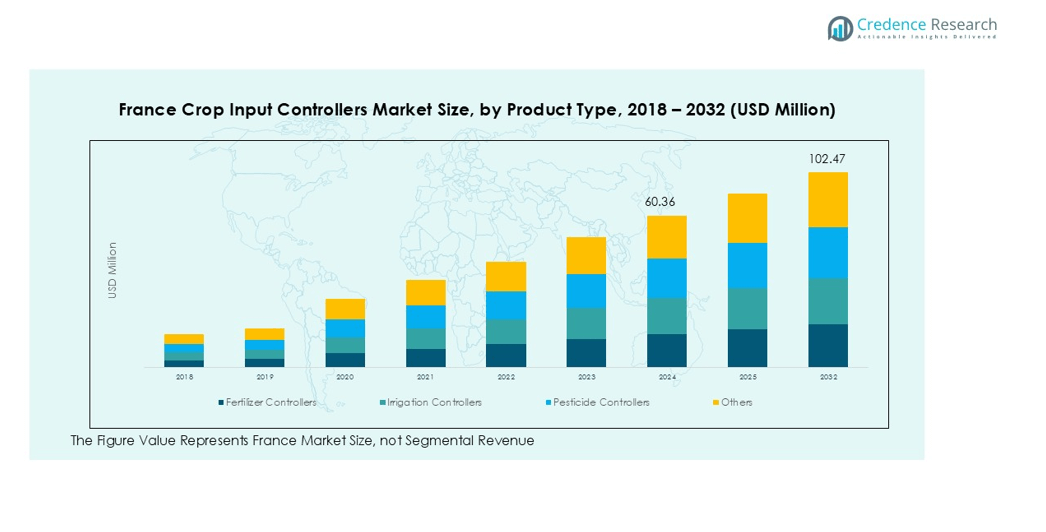

The France Crop Input Controllers size was valued at USD 46.08 million in 2018 to USD 60.36 million in 2024 and is anticipated to reach USD 102.47 million by 2032, at a CAGR of 6.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| France Crop Input Controllers Market Size 2024 |

USD 60.36 million |

| France Crop Input Controllers Market, CAGR |

6.84% |

| France Crop Input Controllers Market Size 2032 |

USD 102.47 million |

Key drivers for the French market include regulatory support from the European Union’s Common Agricultural Policy (CAP) and national strategies promoting sustainable farming. The demand for precise nutrient management and water conservation is rising in response to climate change pressures and stricter emission rules. The adoption of GPS-guided systems, real-time soil sensors, and variable rate technologies further supports efficient crop management, while government incentives accelerate modernization of farming equipment.

Regionally, northern France leads the market due to its dominance in cereals and large-scale mechanized farming. Western regions such as Brittany are increasingly deploying controllers in dairy-related crop production, while southern regions like Occitanie and Provence emphasize adoption in vineyards and high-value horticulture. This balanced regional growth underscores France’s strategic push toward digital farming and sustainable crop input management.

Market Insights:

- The France Crop Input Controllers market is expected to reach USD 102.47 million by 2032, growing at a CAGR of 6.84%.

- EU Common Agricultural Policy funding and French national programs strongly support modernization of farming equipment.

- Demand for precise nutrient and water management rises due to climate change pressures and emission regulations.

- Adoption of GPS-guided systems, soil sensors, and variable rate technologies strengthens efficiency and crop yield outcomes.

- Northern France holds 41% share, driven by large-scale cereal farming and advanced mechanized practices.

- Western France accounts for 27% share, with Brittany and Pays de la Loire leading dairy-linked crop production.

- Southern and central regions represent 32% share, with strong adoption in vineyards, orchards, and high-value horticulture.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Government Policies and Subsidies Encouraging Precision Agriculture

Government support plays a central role in driving the adoption of crop input controllers across France. The European Union’s Common Agricultural Policy (CAP) provides funding to modernize farm equipment and promote digital farming practices. National programs further encourage investment in technologies that reduce fertilizer and pesticide usage. France Crop Input Controllers gain traction through these incentives, as farmers see a clear path to cost savings and compliance with environmental standards. This alignment between policy and innovation creates a stable growth environment.

- For instance, under France’s rural development programs, young farmers can receive a grant of up to €40,000 to purchase equipment and establish their businesses, supporting the modernization of the agricultural sector.

Growing Demand for Sustainable and Climate-Smart Farming Practices

Environmental concerns are shaping demand for advanced input management tools in French agriculture. Farmers are under pressure to reduce greenhouse gas emissions, water consumption, and chemical runoff. France Crop Input Controllers address these requirements by delivering precise input application that supports sustainability targets. It enables efficient nutrient delivery and minimizes resource wastage while protecting soil health. Strong alignment with France’s climate-smart agriculture goals reinforces adoption.

- For instance, the French company Naïo Technologies has developed and manufactured over 300 agricultural robots that perform autonomous weeding, helping to advance sustainable farming practices worldwide.

Integration of Advanced Technologies Enhancing Operational Efficiency

The rise of automation, GPS, and sensor-based systems strengthens the role of controllers in French farming. Farmers increasingly rely on real-time monitoring to make data-driven decisions on crop inputs. France Crop Input Controllers integrate with variable rate technologies to optimize efficiency and yields. It reduces manual errors and ensures accuracy in applying fertilizers, pesticides, and irrigation. Technology integration transforms controllers into critical tools for modern farms.

Regional Specialization in High-Value Crop Production Driving Adoption

Regional crop patterns create unique opportunities for adopting input controllers. Northern France’s cereal production relies heavily on efficiency-driven solutions, while southern regions prioritize vineyard and horticulture applications. France Crop Input Controllers support diverse farming requirements across these specialized areas. It allows growers to tailor input use to the specific needs of regional crops. This versatility strengthens nationwide adoption and builds market momentum.

Market Trends:

Adoption of Digital Farming Platforms and Data-Driven Solutions

The French agricultural sector is witnessing strong adoption of digital platforms that complement input controllers. Farmers are shifting toward integrated systems that combine satellite imagery, soil sensors, and weather data to guide precise input application. France Crop Input Controllers align with these platforms to ensure seamless decision-making across farms of varying sizes. It enables real-time adjustments that help reduce input waste while improving crop performance. Strong demand for traceability and transparency across the food supply chain supports the integration of advanced software into controller systems. This trend accelerates digital transformation in farming practices, reinforcing the value of controllers in long-term sustainability strategies.

- For instance, La Ferme Digitale (The Digital Farm) is central to this thriving sector in France and is focused on developing digital solutions for agriculture, this community supports over 100 startups and companies, fostering innovations that address the economic and environmental challenges in farming.

Customization for Specialty Crops and Emerging Automation Models

French growers are increasingly adopting controllers tailored to specialty crops such as vineyards, fruits, and high-value horticulture. Controllers designed for these applications provide accuracy in irrigation scheduling and nutrient application, meeting the demands of sensitive crops. France Crop Input Controllers are being developed with automation models that enhance scalability and reduce reliance on manual operations. It supports cost efficiency while addressing labor shortages in agriculture. Farmers also favor modular and portable designs that can adapt to diverse farm structures, making technology more accessible. This shift highlights the importance of customization and flexibility in ensuring broad adoption across regions and crop types.

- For instance, the Rain Bird ESP-LXIVM Pro controller is an advanced irrigation automation system that is capable of supporting up to 240 individual stations.

Market Challenges Analysis:

High Implementation Costs and Limited Access for Small-Scale Farmers

The cost of advanced controllers remains a significant barrier for smaller farms in France. High upfront investment in precision equipment, software integration, and training limits widespread adoption. France Crop Input Controllers are often viewed as suitable for large farms with greater capital resources. It creates a gap in accessibility, particularly for family-owned and medium-sized farms that dominate the agricultural landscape. Financing options and subsidy coverage do not always offset the total cost, slowing penetration in certain regions. This challenge highlights the need for affordable models and flexible purchase options.

Complexity of Technology Integration and Lack of Skilled Workforce

Integration of crop input controllers with farm machinery and digital platforms demands technical expertise. Many farmers face challenges in operating advanced systems, leading to underutilization of available features. France Crop Input Controllers require consistent updates, maintenance, and skilled operation to deliver maximum value. It becomes difficult when the agricultural workforce lacks adequate training or digital literacy. Limited access to professional support services further complicates adoption, especially in rural areas. This creates a clear gap between technology availability and its effective utilization across the French agricultural sector.

Market Opportunities:

Expansion of Smart Farming and Sustainable Agriculture Practices

The growing focus on smart farming creates strong opportunities for technology providers in France. Farmers are under pressure to balance productivity with environmental sustainability, which increases demand for advanced controllers. France Crop Input Controllers support efficient fertilizer, pesticide, and water use that aligns with EU sustainability goals. It enables precise resource management that reduces costs while improving yields. Rising government incentives and expanding access to digital platforms further strengthen the case for adoption. This trend positions controllers as essential tools in the country’s shift toward sustainable agriculture.

Growth Potential in Specialty Crops and Regional Diversification

France’s diverse agricultural profile offers significant potential for customized controller solutions. Vineyards, horticulture, and high-value crops present strong demand for precision systems that protect quality and optimize inputs. France Crop Input Controllers are well-suited to these applications by supporting targeted irrigation and nutrient delivery. It enhances productivity in regions like Occitanie and Provence where specialty crops dominate. Rising consumer demand for traceable, high-quality produce reinforces investment in technology. This creates long-term opportunities for suppliers to expand across both traditional and specialty farming sectors.

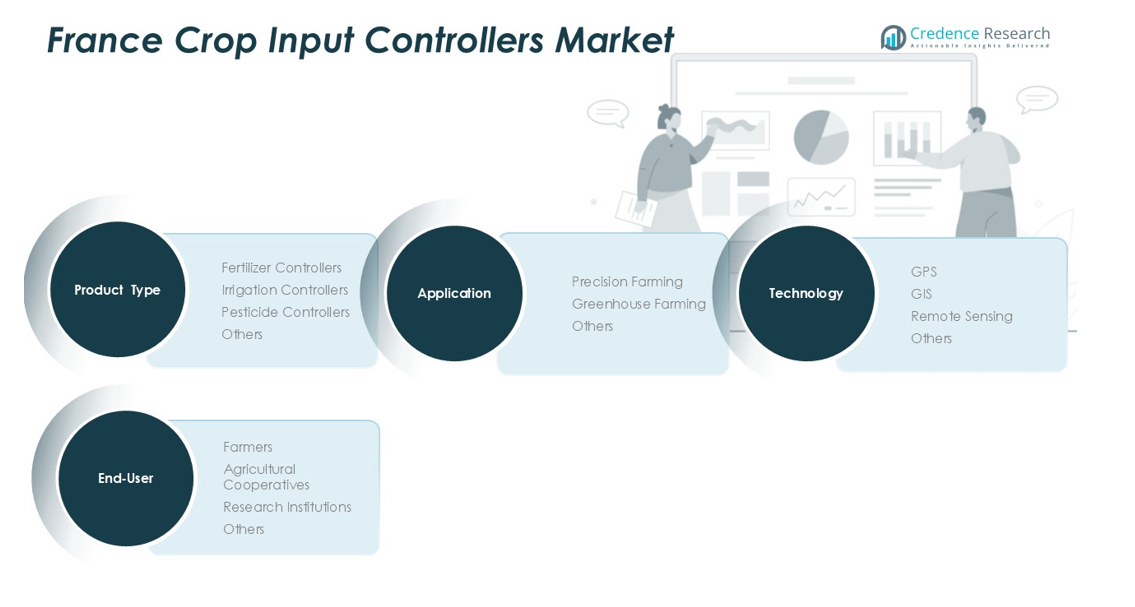

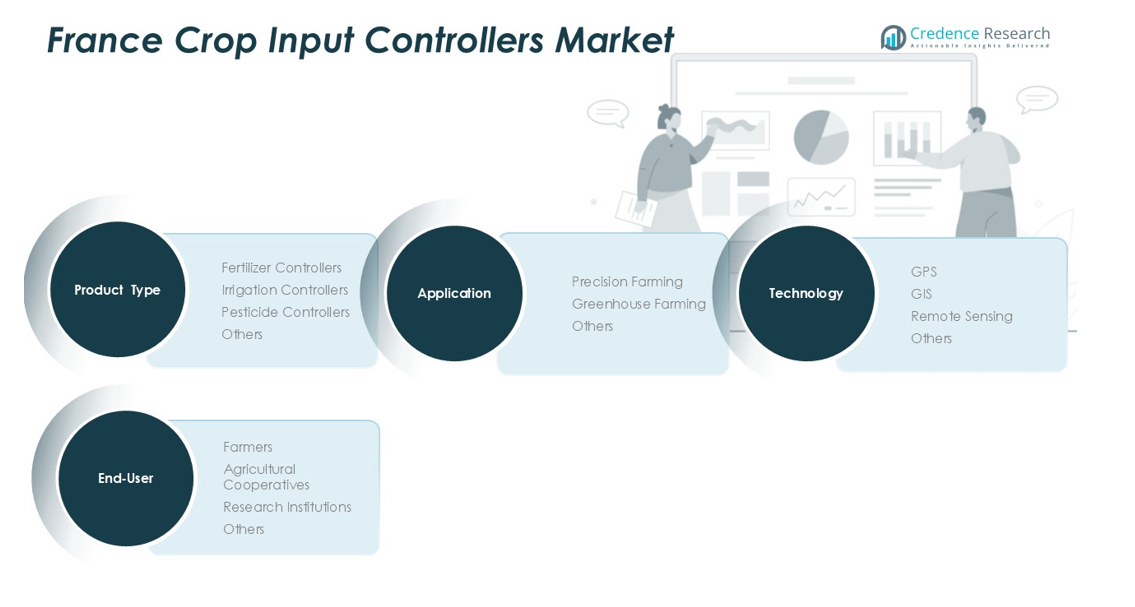

Market Segmentation Analysis:

By Product Type

Fertilizer controllers dominate the France Crop Input Controllers market with strong usage across cereal and oilseed farming. Irrigation controllers follow closely, driven by demand in vineyards and horticulture where water efficiency is critical. Pesticide controllers hold a growing share as farmers address pest resistance and regulatory limits on chemical use. Others, including multifunctional units, serve niche farms seeking integrated solutions. France Crop Input Controllers provide flexibility across product categories, making adoption viable for diverse farming systems.

- For instance, the French company Sulky-Burel has developed the ECONOV variable rate control for its fertilizer spreaders, which can manage application across 12 sections to minimize overlap.

By Application

Precision farming leads the market due to large-scale adoption in northern France’s cereal production and mechanized operations. Greenhouse farming contributes significantly in regions cultivating vegetables, fruits, and flowers under controlled environments. France Crop Input Controllers help optimize conditions in greenhouses where input accuracy directly influences crop quality. It ensures resource efficiency and higher profitability for growers. The “others” category includes specialty applications such as orchards and forage crops linked to dairy production.

By Technology

GPS-based controllers hold the largest share due to widespread integration with modern farm machinery. GIS solutions enhance mapping and variable rate applications, supporting advanced nutrient and irrigation planning. Remote sensing is gaining ground with the use of drones and satellite imagery to guide input application. France Crop Input Controllers benefit from these technologies, enabling real-time decision-making and resource optimization. It strengthens operational efficiency across farms of all sizes while aligning with sustainability requirements.

- For instance, John Deere’s StarFire 7000 receiver, widely used in France, offers an RTK (Real-Time Kinematic) signal that provides a repeatable accuracy of 2.5 centimeters, enabling precise autosteering for field operations.

Segmentations:

- By Product Type

- Fertilizer Controllers

- Irrigation Controllers

- Pesticide Controllers

- Others

- By Application

- Precision Farming

- Greenhouse Farming

- Others

- By Technology

- GPS

- GIS

- Remote Sensing

- Others

- By End-User

- Farmers

- Agricultural Cooperatives

- Research Institutions

- Others

Regional Analysis:

Dominance of Northern France in Large-Scale Crop Production

Northern France holds 41% share of the national market, driven by extensive cereal production. Large farms in this region lead adoption due to mechanized operations and strong investment in digital tools. France Crop Input Controllers support accurate fertilizer and pesticide application, reducing input costs and improving yields. It enables efficient management of large acreage, helping farmers comply with strict environmental regulations. Strong infrastructure and early technology adoption make northern France the country’s key hub for modernized agriculture.

Emergence of Western France in Dairy-Linked Crop Management

Western France accounts for 27% share of the market, with Brittany and Pays de la Loire driving demand. Forage crop production linked to dairy farming increases reliance on smart monitoring systems. France Crop Input Controllers deliver precision in irrigation and nutrient management, supporting higher feed quality and consistent crop output. It helps farmers optimize resource allocation and limit unnecessary expenditure. The steady adoption in this region highlights the integration of advanced technologies into livestock-oriented farming practices.

Specialized Applications in Southern and Central France

Southern and central regions together represent 32% share of the market, led by Occitanie and Provence. Vineyards, orchards, and horticulture drive demand for specialized controllers tailored to high-value crops. France Crop Input Controllers ensure precise water management and nutrient delivery that protect crop quality. It proves vital in regions facing water scarcity and climate-related pressures. Balanced adoption across these regions underscores the versatility of controllers in supporting both traditional and specialty farming.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

Competitive Analysis:

Competition centers on hardware-software integration, agronomy services, and data interoperability standards. Global OEMs dominate through bundled controllers, ISOBUS compliance, and factory-fit precision kits. CNH, John Deere, and AGCO leverage dealer networks and connected platforms for retention. Trimble and Topcon differentiate with retrofit kits, GNSS accuracy tiers, and open APIs. Bayer, Syngenta, BASF, and Yara push agronomic platforms that prescribe input rates. It intensifies ecosystem lock-in by pairing digital prescriptions with certified controller workflows. Local specialists compete on vineyard, orchard, and greenhouse use-cases, emphasizing micro-dosing control. Cybersecurity, telemetry reliability, and CAP compliance support become decisive enterprise procurement criteria. France Crop Input Controllers vendors pursue partnerships with co-ops for scale and field validation. Pricing pressure persists; vendors respond with subscription analytics, modular upgrades, and seasonal financing.

Recent Developments:

- In August 2025, the New Holland brand launched its PowerStar Electro Command tractor in North America, featuring a 16×16 semi-powershift transmission.

- In August 2025, John Deere partnered with the agricultural technology startup platform, the Reservoir, to foster innovation for high-value crops by offering startups access to its technology and grower networks.

- In September 2025, Bayer Crop Science Canada introduced Raxil® Rise, a new seed treatment for cereals that provides comprehensive protection against various seed- and soil-borne diseases.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Application, Technology and End-User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Adoption of smart controllers will expand as French farms prioritize sustainability and efficiency.

- Integration with digital platforms will strengthen interoperability between sensors, drones, and satellite systems.

- Demand for customized solutions will increase in vineyards and horticulture, supporting high-value crop segments.

- Precision nutrient and water management will remain central to meeting EU environmental compliance goals.

- Farmers will favor modular and retrofit designs that lower upfront costs and enable gradual upgrades.

- Agricultural cooperatives will play a larger role in accelerating technology adoption among small and medium farms.

- Cloud-based analytics and real-time dashboards will enhance decision-making and operational control.

- Training programs and advisory services will grow, addressing the current gap in digital literacy.

- Local technology providers will gain ground by developing region-specific solutions and service support.

- France Crop Input Controllers will evolve toward integrated ecosystems that combine automation, sustainability, and profitability in modern farming.