Market Overview

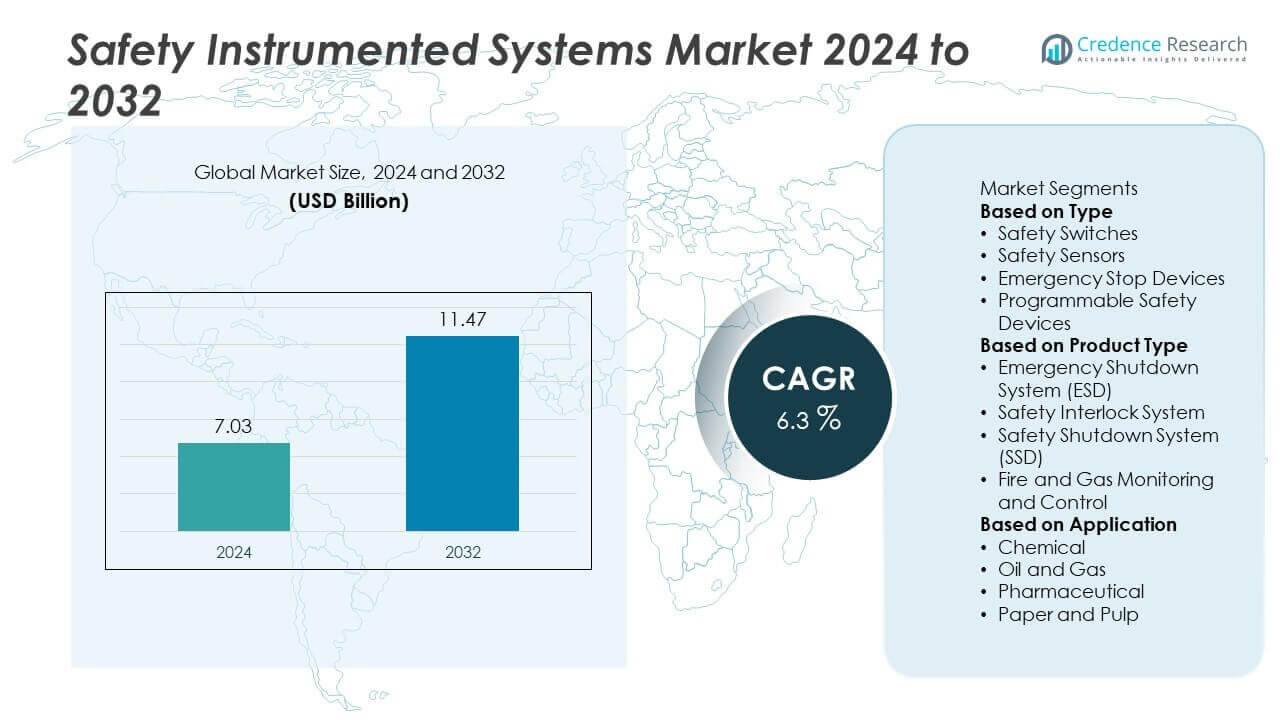

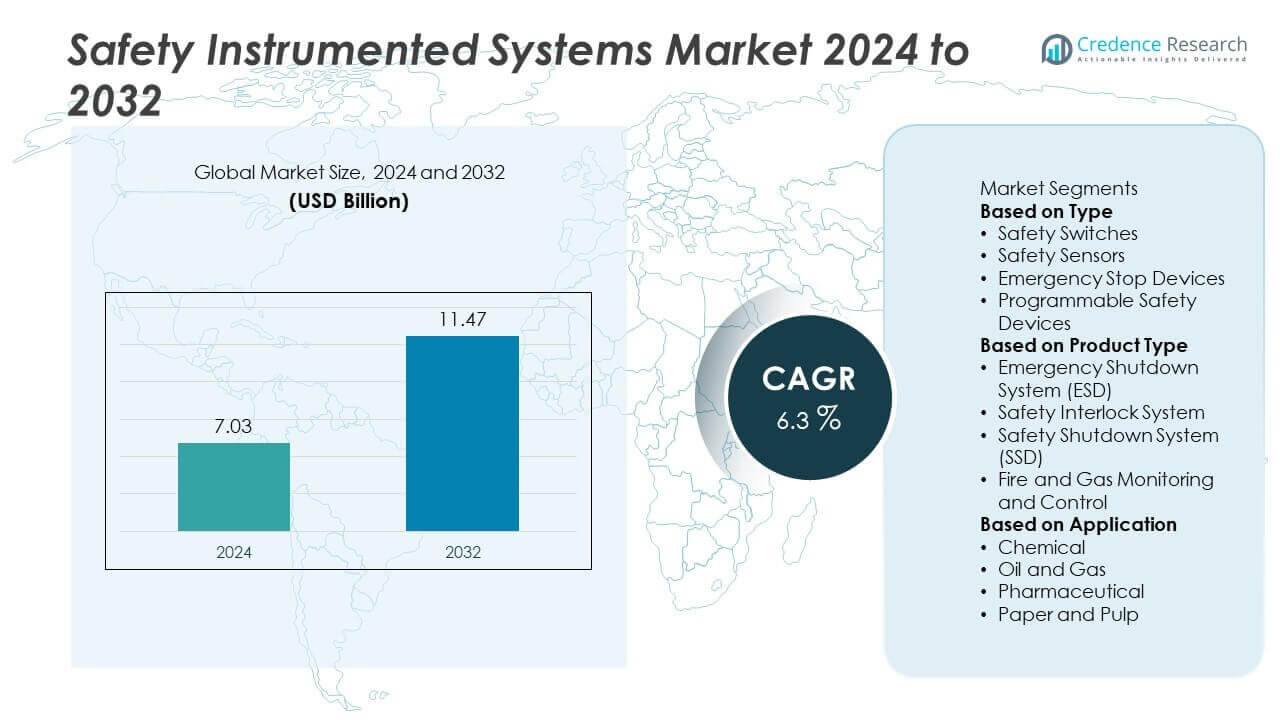

The global safety instrumented systems market was valued at USD 7.03 billion in 2024 and is projected to reach USD 11.47 billion by 2032, growing at a CAGR of 6.3 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Safety Instrumented Systems Market Size 2024 |

USD 7.03 Billion |

| Safety Instrumented Systems Market, CAGR |

6.3% |

| Safety Instrumented Systems Market Size 2032 |

USD 11.47 Billion |

The safety instrumented systems market is led by key players including Rockwell Automation Inc., Johnson Control, Inc., Yokogawa Electric Corporation, Emerson Process Management, Schneider Electric SE, OMRON Corporation, Honeywell International Inc., General Electric Company, ABB Ltd., and Siemens AG. These companies specialize in delivering SIL-rated emergency shutdown systems, fire and gas monitoring, and programmable safety solutions to ensure process reliability. North America held the largest share with 35% in 2024, driven by strict regulatory compliance and high adoption of automation technologies. Europe followed with 30% share, supported by modernization of chemical and energy plants, while Asia-Pacific accounted for 25% share, fueled by rapid industrialization and stricter safety mandates in China, India, and Southeast Asia.

Market Insights

Market Insights

- The safety instrumented systems market was valued at USD 7.03 billion in 2024 and is projected to reach USD 11.47 billion by 2032, growing at a CAGR of 6.3%.

- Rising enforcement of global safety standards such as IEC 61508 and IEC 61511 is driving adoption of SIL-certified systems across oil and gas, chemicals, and power generation industries to reduce risks and ensure compliance.

- Key trends include integration of IIoT-enabled safety solutions, growing use of predictive maintenance analytics, and increasing demand for SIL 3 certified emergency shutdown systems and fire and gas monitoring solutions.

- The market is competitive with major players such as Rockwell Automation Inc., Johnson Control, Inc., Yokogawa Electric Corporation, Emerson Process Management, and Siemens AG focusing on digital transformation, modular SIS solutions, and cybersecurity integration.

- North America led with 35% share in 2024, followed by Europe at 30% and Asia-Pacific at 25%, while emergency shutdown systems accounted for over 40% of the product type share.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Safety sensors dominated the safety instrumented systems market in 2024, holding over 35% share. Their widespread use in detecting pressure, temperature, flow, and gas levels makes them a critical component of industrial safety systems. Rising demand for real-time monitoring and predictive maintenance in high-risk industries such as oil and gas, chemicals, and power generation is boosting adoption. Advanced sensor technologies with enhanced accuracy and diagnostics support early fault detection, preventing system failures and downtime. The growing focus on plant safety and compliance with international safety standards such as IEC 61508 and IEC 61511 is further driving growth.

- For instance, ABB offers a range of advanced safety sensors with enhanced diagnostics and SIL 2/3 compliance for use in applications within the petrochemical and power generation sectors globally.

By Product Type

Emergency Shutdown Systems (ESD) led the market, capturing over 40% share in 2024, due to their essential role in protecting personnel, equipment, and the environment from hazardous events. These systems are widely deployed in oil and gas plants, refineries, and chemical facilities to ensure safe process shutdown during critical situations. Growing investment in process automation and adoption of SIL-certified solutions is driving demand. Integration of ESD systems with distributed control systems (DCS) and Industrial Internet of Things (IIoT) platforms is enabling improved response times and predictive safety management across industrial operations.

- For instance, Honeywell International has a long-standing history of providing Emergency Shutdown Systems (ESS) for refinery and chemical plant operations in North America and Asia, incorporating IIoT-enabled features like smart diagnostics and predictive safety.

By Application

The oil and gas industry dominated the market, accounting for over 45% share in 2024, supported by extensive deployment of safety instrumented systems in upstream, midstream, and downstream operations. Rising demand for safe exploration, refining, and transportation processes has led to the implementation of fire and gas detection systems, shutdown systems, and safety interlocks. Regulatory mandates from OSHA and API further encourage installation of robust safety solutions. The chemical industry follows closely, driven by strict compliance requirements for toxic gas monitoring and emergency response systems to ensure worker and environmental safety.

Key Growth Drivers

Stringent Regulatory Compliance and Safety Standards

Rising enforcement of global safety regulations such as IEC 61508, IEC 61511, and OSHA standards is a major growth driver for the safety instrumented systems market. Industries including oil and gas, chemicals, and power generation are required to deploy SIL-rated systems to reduce operational risks. Regulatory compliance ensures protection of personnel, equipment, and the environment, pushing companies to invest in advanced SIS solutions. This increasing emphasis on risk mitigation is encouraging adoption of automated shutdown systems, fire and gas detection systems, and safety interlocks across critical processes.

- For instance, Yokogawa Electric Corporation has implemented its IEC 61508 and IEC 61511-compliant ProSafe-RS Safety Instrumented Systems in over 2,800 projects globally as of September 2020, enhancing safety and regulatory compliance in global chemical and energy plants.

Increasing Demand for Process Automation

Growing adoption of process automation across industries is driving the need for integrated safety instrumented systems. Companies are investing in smart SIS that communicate with distributed control systems (DCS) for real-time monitoring and faster emergency response. The ability of automated systems to minimize downtime and enhance plant efficiency supports market growth. Industries such as oil and gas and chemicals rely on automation to manage complex operations, making SIS a key component of their safety architecture and long-term reliability strategy.

- For instance, Rockwell Automation has deployed smart Safety Instrumented Systems (SIS) integrated with EtherNet/IP-enabled PlantPAx Distributed Control System (DCS) platforms in multiple North American refineries and manufacturing facilities, leveraging advanced connectivity for improved operational safety, enhanced diagnostics, and quicker response times.

Focus on Asset Protection and Operational Continuity

Industries are prioritizing asset integrity management and business continuity, boosting investment in safety instrumented systems. Unplanned shutdowns can lead to heavy financial losses and reputational damage, making preventive safety measures essential. SIS solutions provide early detection of hazardous conditions, enabling timely intervention and reducing costly incidents. The growing use of predictive maintenance analytics integrated with safety systems further supports operational reliability. This shift toward proactive safety management is strengthening demand for programmable safety devices, sensors, and emergency shutdown systems.

Key Trends & Opportunities

Integration of IIoT and Digitalization

The integration of Industrial Internet of Things (IIoT) with safety instrumented systems is a growing trend. IIoT-enabled SIS provides real-time data collection, remote monitoring, and predictive analytics for improved decision-making. Digital twins and cloud-based platforms are enhancing situational awareness and maintenance planning. This trend creates opportunities for suppliers to offer connected safety solutions that optimize performance, reduce downtime, and ensure regulatory compliance across geographically distributed facilities, especially in oil and gas, chemical, and power sectors.

- For instance, Emerson has implemented numerous projects incorporating IIoT-enabled safety instrumented systems and cloud analytics to enhance remote monitoring and predictive maintenance in the energy and petrochemical sectors.

Growing Adoption of SIL 3 Certified Systems

Industries are increasingly opting for SIL 3 certified safety systems to meet the highest risk reduction requirements. SIL 3 systems offer superior reliability and are preferred for high-hazard applications such as offshore platforms, chemical reactors, and power plants. Manufacturers are investing in developing cost-effective and modular SIL 3 solutions that are easier to integrate with existing infrastructure. This creates opportunities for vendors to expand their product portfolios and target sectors that require maximum safety integrity without compromising productivity.

- For instance, Johnson Controls has a large installed base of fully integrated IEC 61508/61511 (SIL 3) compliant control and safety systems, serving major oil and gas companies worldwide, including those with offshore platforms, to meet stringent regulatory requirements.

Key Challenges

High Installation and Maintenance Costs

The cost of installing and maintaining advanced safety instrumented systems remains a key barrier, particularly for small and medium enterprises. Implementation requires detailed risk analysis, engineering design, and compliance verification, increasing project costs. Regular testing, certification, and maintenance add further expenses. These cost challenges can delay adoption, especially in cost-sensitive industries, compelling vendors to offer scalable, modular solutions that lower total cost of ownership.

Complexity of System Integration

Integrating SIS with existing distributed control systems (DCS) and plant infrastructure can be complex and time-consuming. Compatibility issues and the need for specialized expertise can lead to extended project timelines and higher costs. Moreover, ensuring cybersecurity for connected SIS adds another layer of complexity. Companies must balance modernization efforts with minimal disruption to ongoing operations, which can slow deployment and hinder rapid adoption of advanced safety solutions.

Regional Analysis

North America

North America dominated the safety instrumented systems market with 35% share in 2024, driven by stringent safety regulations and strong adoption of process automation technologies. The U.S. leads the region with extensive deployment of SIL-certified systems across oil and gas, petrochemical, and power generation plants. Growing investment in refinery expansions, LNG projects, and pipeline infrastructure supports demand for emergency shutdown and fire and gas monitoring systems. Canada also contributes significantly with safety upgrades in its chemical and energy sectors. The presence of key automation companies and advanced compliance frameworks ensures steady growth in this region.

Europe

Europe accounted for 30% share in 2024, supported by strict implementation of industrial safety directives and standards such as IEC 61508 and Seveso III. Countries including Germany, the U.K., and France are investing in modernizing chemical plants and energy facilities with advanced safety solutions. The region’s focus on sustainability and digital transformation is encouraging adoption of smart SIS integrated with distributed control systems. Rising demand for safety interlocks and shutdown systems in renewable energy and power plants also supports growth. Strong collaboration between governments, safety authorities, and technology providers drives consistent market expansion.

Asia-Pacific

Asia-Pacific held 25% share in 2024 and is the fastest-growing region due to rapid industrialization in China, India, and Southeast Asia. Expansion of oil refineries, chemical processing units, and power generation facilities fuels demand for safety instrumented systems. Governments are tightening safety compliance requirements following major industrial incidents, encouraging wider adoption of ESD and fire and gas systems. Domestic manufacturers are partnering with global automation companies to deliver cost-effective solutions. Rising investments in LNG terminals, pharmaceutical manufacturing, and petrochemical projects further accelerate market growth across this dynamic region.

Middle East & Africa

The Middle East & Africa captured 6% share in 2024, supported by large-scale investments in oil and gas infrastructure and petrochemical complexes. Countries such as Saudi Arabia, UAE, and Qatar are deploying SIS solutions in upstream, midstream, and downstream facilities to ensure process safety and compliance with international standards. Africa is gradually adopting safety systems, with South Africa and Nigeria investing in refinery modernization and industrial safety upgrades. Growing focus on asset protection and operational reliability in high-risk environments continues to drive demand for shutdown systems and fire and gas monitoring solutions across the region.

Latin America

Latin America accounted for 4% share in 2024, with Brazil and Mexico leading adoption of safety instrumented systems in oil and gas, chemical, and mining industries. The region’s ongoing refinery upgrades, exploration projects, and expansion of petrochemical facilities are key growth drivers. Governments are enforcing stricter industrial safety regulations, encouraging implementation of SIL-rated systems for risk reduction. Local and international vendors are working to provide modular and scalable solutions suitable for cost-sensitive markets. Despite economic volatility in some countries, demand for reliable safety systems is growing to ensure plant efficiency and accident prevention.

Market Segmentations:

By Type

- Safety Switches

- Safety Sensors

- Emergency Stop Devices

- Programmable Safety Devices

By Product Type

- Emergency Shutdown System (ESD)

- Safety Interlock System

- Safety Shutdown System (SSD)

- Fire and Gas Monitoring and Control

By Application

- Chemical

- Oil and Gas

- Pharmaceutical

- Paper and Pulp

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the safety instrumented systems market is shaped by major players such as Rockwell Automation Inc., Johnson Control, Inc., Yokogawa Electric Corporation, Emerson Process Management, Schneider Electric SE, OMRON Corporation, Honeywell International Inc., General Electric Company, ABB Ltd., and Siemens AG. These companies focus on delivering SIL-certified solutions, including emergency shutdown systems, fire and gas monitoring, and programmable safety devices to ensure compliance with international safety standards. Strategic priorities include investments in digital transformation, IIoT-enabled SIS, and integration with distributed control systems for real-time monitoring. Many players are forming partnerships with end-users in oil and gas, chemicals, and power generation to provide customized, modular safety solutions. Competitive intensity remains high, with vendors prioritizing innovation in predictive maintenance, cybersecurity, and advanced diagnostics to improve plant reliability and reduce unplanned downtime while meeting regulatory requirements worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In June 2025, Yokogawa expanded its CENTUM VP integrated control and safety system with new safety instrumented functions supporting SIL3 compliance. By June 2025, over 180 plants had adopted these upgraded systems, improving operational safety and compliance in chemical and power industries.

- In April 2025, Schneider Electric launched the EcoStruxure Triconex™ Safety Instrumented System with enhanced AI-powered predictive diagnostics and cybersecurity features. By April 2025, it had logged over 1 billion safe operating hours across global installations, providing high-integrity protection in oil & gas, chemical, and power sectors.

- In April 2025, Johnson Controls upgraded its safety instrumented system portfolio with enhanced IoT connectivity and analytics capabilities, facilitating predictive maintenance and real-time risk assessment. Deployment exceeded 150 new facilities globally within the first half of 2025, focusing on the energy and process manufacturing sectors.

- In September 2024, Rockwell Automation launched the Logix SIS, a modern, integrated Safety Instrumented System designed for process and hybrid safety applications. It includes SIL 2 and SIL 3 certifications with high availability and built-in redundancy.

Report Coverage

The research report offers an in-depth analysis based on Type, Product Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of IIoT-enabled safety systems will grow to enable real-time monitoring and predictive analytics.

- Demand for SIL 3 certified systems will increase to meet higher safety integrity requirements.

- Integration of safety instrumented systems with distributed control systems will become more common for seamless operations.

- Use of digital twins for simulation and risk assessment will gain traction in process industries.

- Cybersecurity measures will be strengthened to protect connected SIS from potential threats.

- Modular and scalable SIS solutions will see higher demand to support cost-efficient upgrades.

- Growth in refinery expansions and LNG projects will drive investment in emergency shutdown systems.

- Focus on reducing unplanned downtime will encourage adoption of advanced diagnostics and predictive maintenance.

- Emerging markets in Asia-Pacific and the Middle East will see faster adoption due to industrialization and stricter regulations.

- Collaboration between technology vendors and end-users will expand to deliver customized, industry-specific safety solutions.

Market Insights

Market Insights