Market Overview

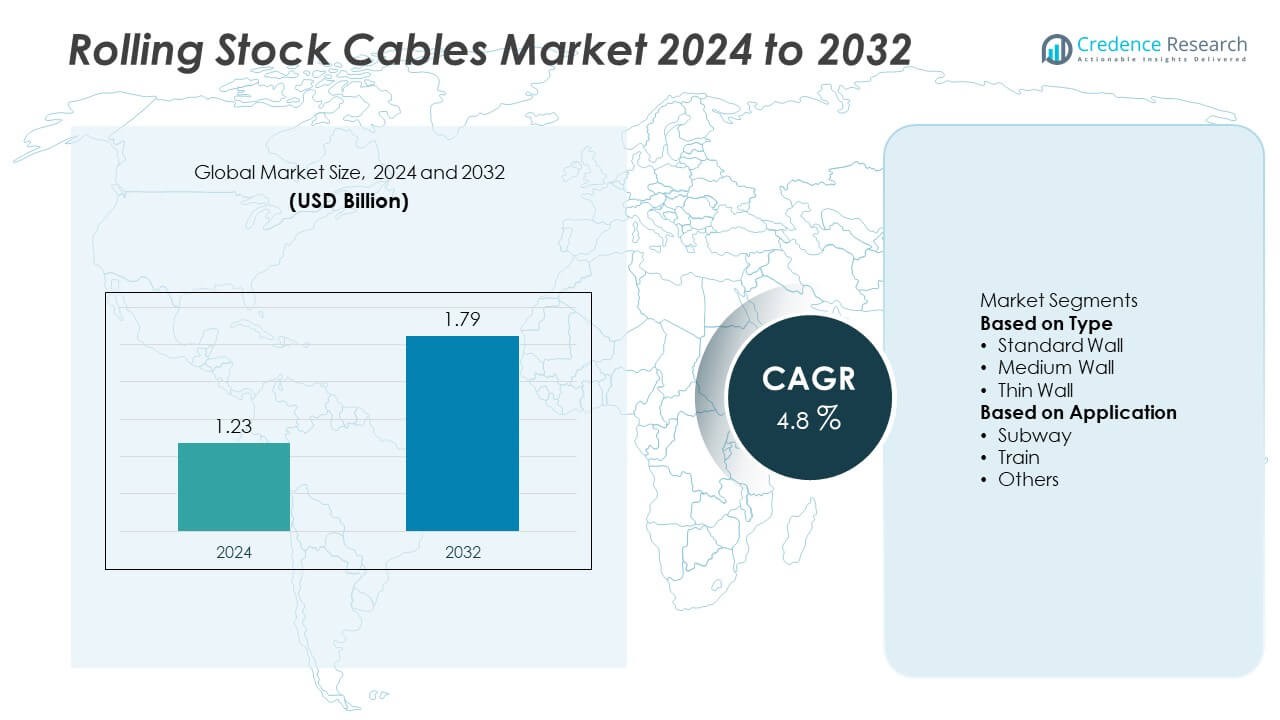

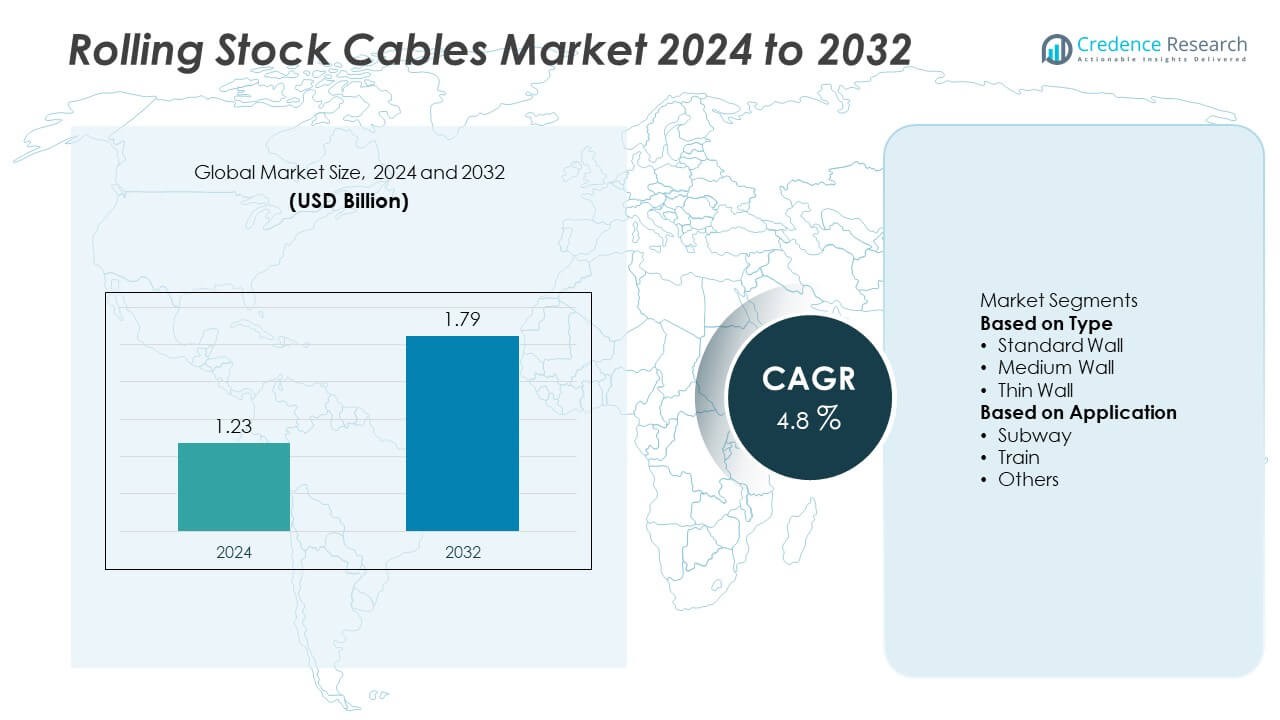

The Rolling Stock Cables Market was valued at USD 1.23 billion in 2024 and is projected to reach USD 1.79 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Rolling Stock Cables Market Size 2024 |

USD 1.23 Billion |

| Rolling Stock Cables Market, CAGR |

4.8% |

| Rolling Stock Cables Market Size 2032 |

USD 1.79 Billion |

The rolling stock cables market is driven by key players including Tratos, PRYSMIAN GROUP, Hengfei Cable, ATL Technology, Eugania Rail Pacific, Siechem, Caledonian Cables, Electric Fever, NEXANS, and Prysmian. These companies focus on developing advanced, fire-resistant, and halogen-free cable solutions to meet stringent rail safety standards and support modernization projects. Asia-Pacific led the market with 32% share in 2024, driven by metro expansions and high-speed rail development in China and India. North America accounted for 30% share, supported by freight rail upgrades and urban transit projects, while Europe held 28% share, benefiting from ongoing electrification and stringent EN 45545 fire-safety regulations.

Market Insights

Market Insights

- The rolling stock cables market was valued at USD 1.23 billion in 2024 and is projected to reach USD 1.79 billion by 2032, growing at a CAGR of 4.8% during the forecast period.

- Rising investments in railway infrastructure, metro expansions, and electrification projects are driving demand for fire-resistant and durable rolling stock cables across passenger and freight segments.

- Key trends include the adoption of halogen-free, low-smoke, and lightweight cables to meet EN 45545 safety standards and improve energy efficiency in modern rolling stock.

- Competitive landscape features Tratos, PRYSMIAN GROUP, NEXANS, Hengfei Cable, and Siechem focusing on R&D, capacity expansion, and partnerships with OEMs to strengthen market presence.

- Asia-Pacific led with 32% share in 2024, followed by North America at 30% and Europe at 28%, while train applications dominated with 55% share, supported by high-speed rail and metro development projects.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Standard wall cables dominated the rolling stock cables market in 2024, accounting for 45% share due to their durability, cost-effectiveness, and ability to withstand mechanical stress in rail applications. These cables are widely used in power transmission, control, and signaling systems where reliability is critical. Their excellent insulation and resistance to vibration make them suitable for long-term use in high-speed trains and commuter rail networks. Medium wall and thin wall cables are gaining traction in lightweight train designs, but they hold smaller shares compared to the widespread adoption of standard wall cables.

- For instance, Tratos continued its work in the European rail industry in the first half of 2025, attending industry events like TOC Europe and exhibiting new products for railway and mass transit cables. The company has a long history of supporting high-speed and commuter rail projects, such as Italy’s “Alta Velocità” line

By Application

Train applications led the market with 55% share in 2024, driven by rising production of passenger and freight trains globally. The segment benefits from modernization projects, electrification initiatives, and increasing demand for energy-efficient and fire-safe cable solutions. Subway applications follow with steady growth, supported by the expansion of urban metro networks and focus on safety compliance in underground systems. Other applications, including trams and monorails, contribute a smaller but growing share as cities invest in sustainable public transportation infrastructure.

- For instance, PRYSMIAN GROUP is a major supplier of railway and electrification infrastructure and delivered a significant amount of rolling stock cables for projects in European cities in the past, consistent with its strong performance.

Key Growth Drivers

Rising Rail Infrastructure Investments

Significant investments in rail infrastructure are driving demand for rolling stock cables worldwide. Governments are expanding high-speed rail networks, metro systems, and freight corridors to improve connectivity and reduce congestion. These projects require reliable, fire-resistant, and durable cable solutions to ensure passenger safety and operational efficiency. Electrification of railways in developing economies is further boosting demand for power and control cables. Increasing urbanization and government focus on sustainable transportation are expected to support consistent market growth over the forecast period.

- For instance, Prysmian Group has supplied thousands of kilometers of cables for Italian high-speed rail lines, including fire-retardant LSZH designs certified to EN 45545 standards to ensure passenger safety, with one such project being the ongoing Brescia–Verona section of the Milan–Verona high-speed line.

Modernization and Electrification of Rolling Stock

Rail operators are investing in modernizing existing fleets with advanced electrical systems, which is increasing demand for high-performance cables. Upgrades include energy-efficient traction systems, advanced signaling, and smart train control technologies that require robust cable infrastructure. Electrification projects across Europe, Asia, and parts of North America are replacing diesel locomotives, further fueling cable consumption. OEMs and maintenance providers are focusing on lightweight, halogen-free, and low-smoke cables to meet safety regulations, driving innovation and adoption in both passenger and freight trains.

- For instance, Nexans provides its FLAMEX® line of halogen-free cables for rolling stock applications, designed for enhanced fire safety in tunnels by emitting low levels of smoke in the event of a fire. These cables are compliant with European railway fire safety standards, such as EN 45545-2, which sets criteria for ignitability, flame spread, and smoke opacity, contributing to safer evacuation.

Growing Demand for High-Speed and Metro Trains

The rising preference for high-speed rail and urban metro systems is a key growth driver. High-speed trains require advanced cable systems to handle higher power transmission, reduce signal interference, and maintain reliability under continuous vibration. Metro rail expansions in major cities worldwide are creating significant demand for fire-resistant and flexible cables. Government initiatives to promote public transport as a sustainable alternative to road travel are accelerating metro and suburban train projects, which directly boosts the installation of rolling stock cables.

Key Trends & Opportunities

Shift Toward Lightweight and Halogen-Free Cables

Manufacturers are increasingly developing lightweight and halogen-free rolling stock cables to meet stringent fire safety and environmental regulations. Halogen-free cables emit low smoke and no toxic gases, improving passenger safety during fire incidents. Lightweight designs help reduce train weight, improving energy efficiency and operational performance. This trend offers opportunities for suppliers to differentiate their products and secure contracts for new rolling stock projects. Growing focus on sustainability and compliance with EN 45545 standards is further driving adoption of such advanced cable solutions.

- For instance, Caledonian Cables regularly manufactures halogen-free rolling stock cables that comply with the EN 45545 fire safety standards and are used in numerous urban rail network projects, including the Singapore Metro, Hong Kong MTR, and Sydney Metro.

Integration of Smart Train Technologies

The increasing deployment of smart train technologies is creating opportunities for advanced cable systems. IoT-enabled monitoring, real-time data transmission, and automated control systems require high-performance data and signal cables. Manufacturers are investing in cables with superior electromagnetic compatibility and durability to support digital connectivity onboard. The trend toward predictive maintenance and smart diagnostics also drives demand for sensor cables. This creates growth opportunities for cable producers that can deliver customized, high-spec solutions to support next-generation rail systems.

- For instance, Hengfei Cable offers a range of rail transit control and sensor cables featuring enhanced EMC shielding for digital train control and predictive maintenance systems. The company has extensive experience in the industry, and its cables are used in major rail projects, particularly those for China Railway Rolling Stock Corporation (CRRC).

Key Challenges

High Installation and Maintenance Costs

Rolling stock cables require specialized installation processes and periodic maintenance, which increase operational costs. For existing fleets, retrofitting with new halogen-free or fire-resistant cables can be expensive and time-consuming. Smaller rail operators may delay upgrades due to budget constraints, affecting overall market growth. Manufacturers are working to develop cost-efficient solutions, but the high upfront investment remains a significant barrier for widespread adoption, particularly in developing economies with limited rail funding.

Supply Chain Volatility and Raw Material Costs

Fluctuations in copper and aluminum prices, key raw materials for cable manufacturing, pose challenges for market stability. Supply chain disruptions, especially during global crises, can delay production and project timelines. Dependence on imported materials in some regions adds to cost pressures. Manufacturers are diversifying suppliers and exploring alternative materials, but price volatility continues to impact profit margins. Ensuring consistent quality and timely delivery under these constraints remains a critical challenge for industry players.

Regional Analysis

North America

North America held 30% share of the rolling stock cables market in 2024, supported by rising investments in freight rail upgrades and urban transit projects. The United States leads the region with extensive modernization programs for commuter trains and metro networks, boosting demand for high-performance and fire-resistant cables. Canada contributes steadily with expansion of light rail systems, while Mexico focuses on electrification projects and cross-border freight corridors. Government emphasis on sustainable and efficient public transport infrastructure continues to drive cable installations, supported by strong safety regulations and growing adoption of halogen-free cable technologies.

Europe

Europe accounted for 28% share of the rolling stock cables market in 2024, driven by ongoing electrification of railway networks and expansion of high-speed rail corridors. Countries such as Germany, France, and the UK are investing heavily in modernizing existing rolling stock, which drives demand for advanced cables with superior insulation and fire safety properties. EU regulations like EN 45545 are pushing adoption of halogen-free, low-smoke cables across passenger trains and metro systems. Strong government support for green mobility and cross-border connectivity projects continues to fuel cable consumption across the region’s railway industry.

Asia-Pacific

Asia-Pacific captured 32% share of the rolling stock cables market in 2024 and remains the fastest-growing region. China, India, and Japan lead demand, driven by rapid urbanization, metro expansions, and development of high-speed rail projects. Domestic production capacity for cables is increasing to meet growing demand, reducing import dependency. Rising investment in electrification and modernization of railway infrastructure across Southeast Asia further boosts growth. Regional manufacturers are focusing on producing lightweight and cost-effective cables to support large-scale railway projects, making Asia-Pacific a key hub for future rolling stock cable production and supply.

Latin America

Latin America represented 6% share of the rolling stock cables market in 2024, with Brazil and Mexico being the primary contributors. The region is witnessing renewed investment in metro systems, commuter trains, and freight corridors to improve urban mobility and trade connectivity. Demand for rolling stock cables is rising as countries work on electrification and safety compliance in railway projects. Economic recovery and public-private partnerships are encouraging new infrastructure development. Modernization of aging rolling stock and adoption of halogen-free cables are gaining traction, supporting steady market growth over the forecast period.

Middle East & Africa

The Middle East & Africa accounted for 4% share of the rolling stock cables market in 2024, supported by expanding metro rail networks and investments in high-speed rail projects. The Gulf countries are leading developments, with projects such as Riyadh Metro and Etihad Rail driving cable demand. South Africa contributes through freight and passenger train modernization initiatives. Limited domestic production capacity creates reliance on imports, but rising government focus on infrastructure development and improved passenger safety standards is expected to create new opportunities for cable manufacturers in the coming years.

Market Segmentations:

By Type

- Standard Wall

- Medium Wall

- Thin Wall

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the rolling stock cables market includes key players such as Tratos, PRYSMIAN GROUP, Hengfei Cable, ATL Technology, Eugania Rail Pacific, Siechem, Caledonian Cables, Electric Fever, NEXANS, and Prysmian. These companies focus on developing fire-resistant, halogen-free, and lightweight cable solutions to meet stringent railway safety regulations. Strategic initiatives such as capacity expansions, product innovations, and partnerships with rolling stock manufacturers are driving their market presence. Many players are investing in R&D to improve cable performance for high-speed rail and metro applications. Expansion into emerging markets, particularly in Asia-Pacific and Latin America, is a priority to capture growing infrastructure investments. Additionally, companies are strengthening their supply chains to ensure timely delivery and compliance with international standards, helping them remain competitive and secure long-term contracts in global railway modernization projects.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tratos

- PRYSMIAN GROUP

- Hengfei Cable

- ATL Technology

- Eugania Rail Pacific

- Siechem

- Caledonian Cables

- Electric Fever

- NEXANS

- Prysmian

Recent Developments

- In August 2025, Siechem expanded its manufacturing facility in Puducherry, India, increasing rolling stock cable production capacity to 50,000 metric tons annually. The upgraded facility incorporates state-of-the-art electron beam cross-linking technology, enhancing cable durability and fire resistance. Monthly output reached approximately 15 million meters of specialty wires and cables for rail coach wiring and industrial applications.

- In July 2025, Prysmian North America earned an Innovators’ Award for microduct cable.

- In June 2025, Caledonian Cables completed delivery of 60,000 meters of halogen-free, fire-retardant rolling stock cables for urban metro rail projects across the UK, supporting new train fleet upgrades with compliance to EN 45545 standards.

- In May 2025, PRYSMIAN GROUP posted Q1 results and highlighted transport cable portfolio execution.

Report Coverage

The research report offers an in-depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to grow steadily at a CAGR of 4.8% through 2032.

- Demand for halogen-free and low-smoke cables will continue to rise with strict safety standards.

- Train applications will remain dominant, supported by new high-speed rail and metro projects.

- Asia-Pacific will record the fastest growth driven by urbanization and railway electrification programs.

- Manufacturers will invest in R&D to develop lightweight and energy-efficient cable solutions.

- Smart train technologies will boost demand for advanced data and signal transmission cables.

- OEM installations will remain the largest segment as new train production increases globally.

- Public and private investment in freight corridors will create strong opportunities for cable suppliers.

- Strategic partnerships with rolling stock manufacturers will expand market presence for leading players.

- Supply chain optimization and sustainable production processes will be a key focus for competitiveness.

Market Insights

Market Insights