Market Overview:

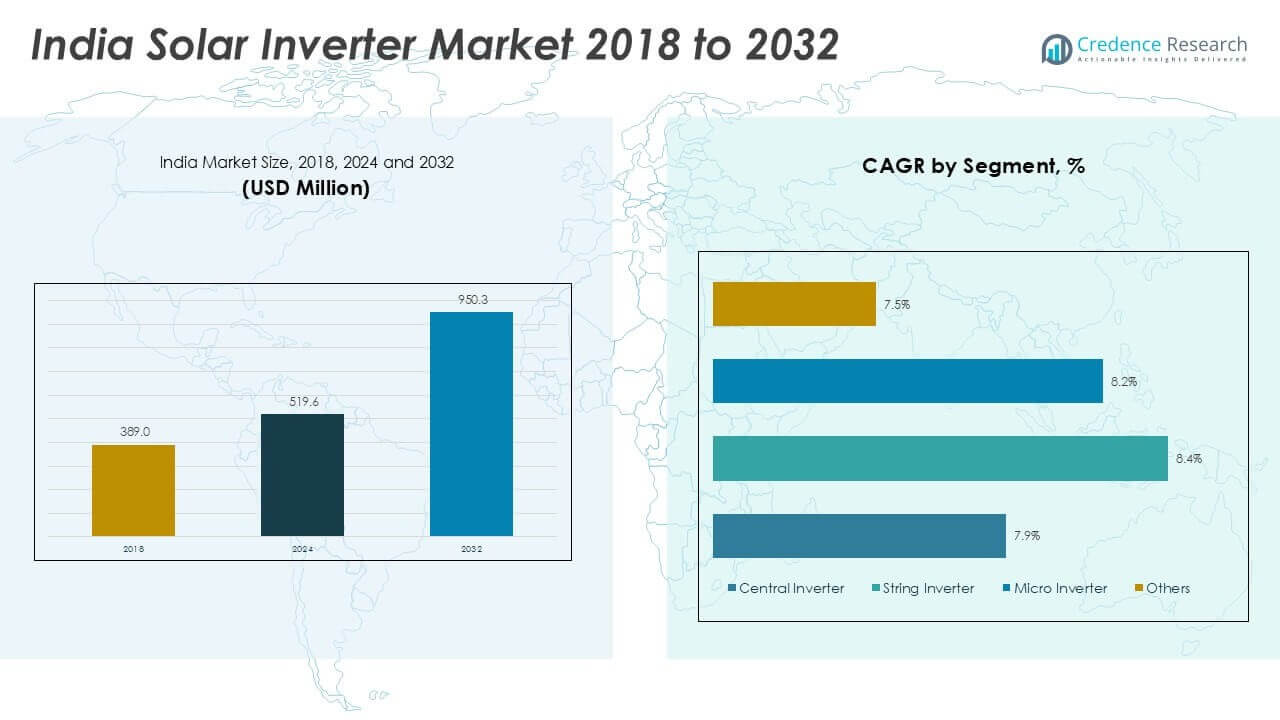

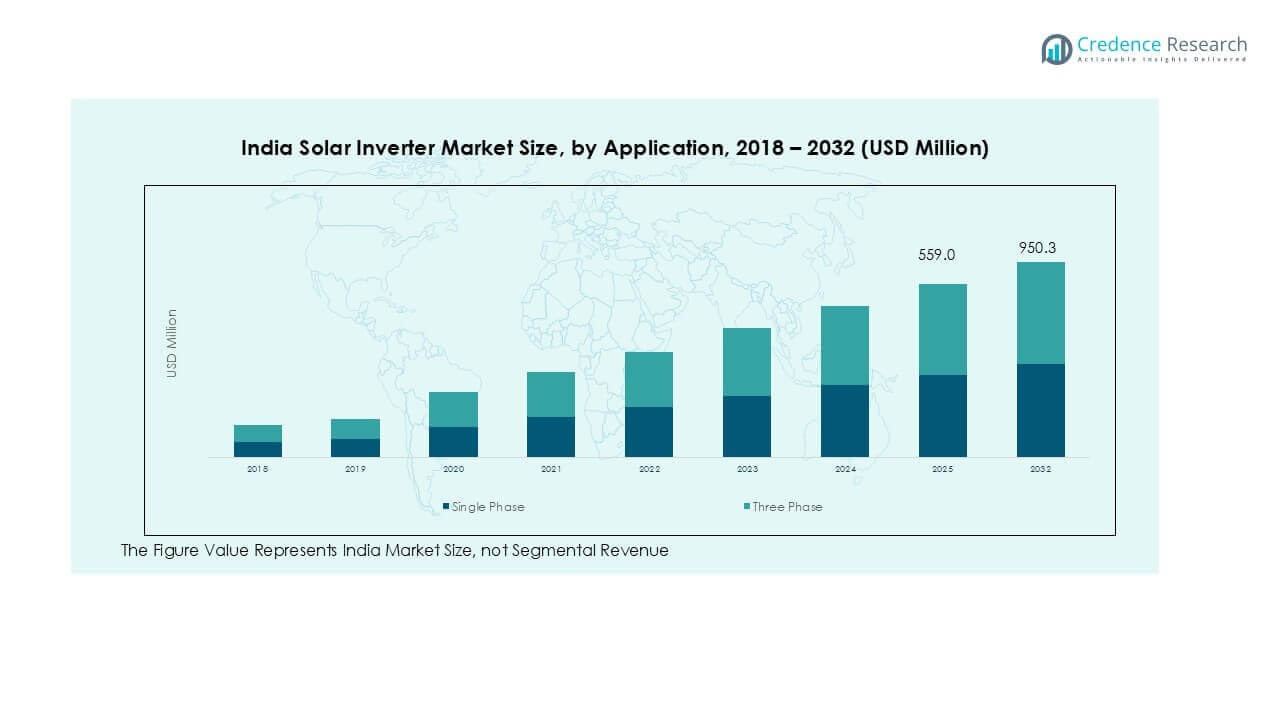

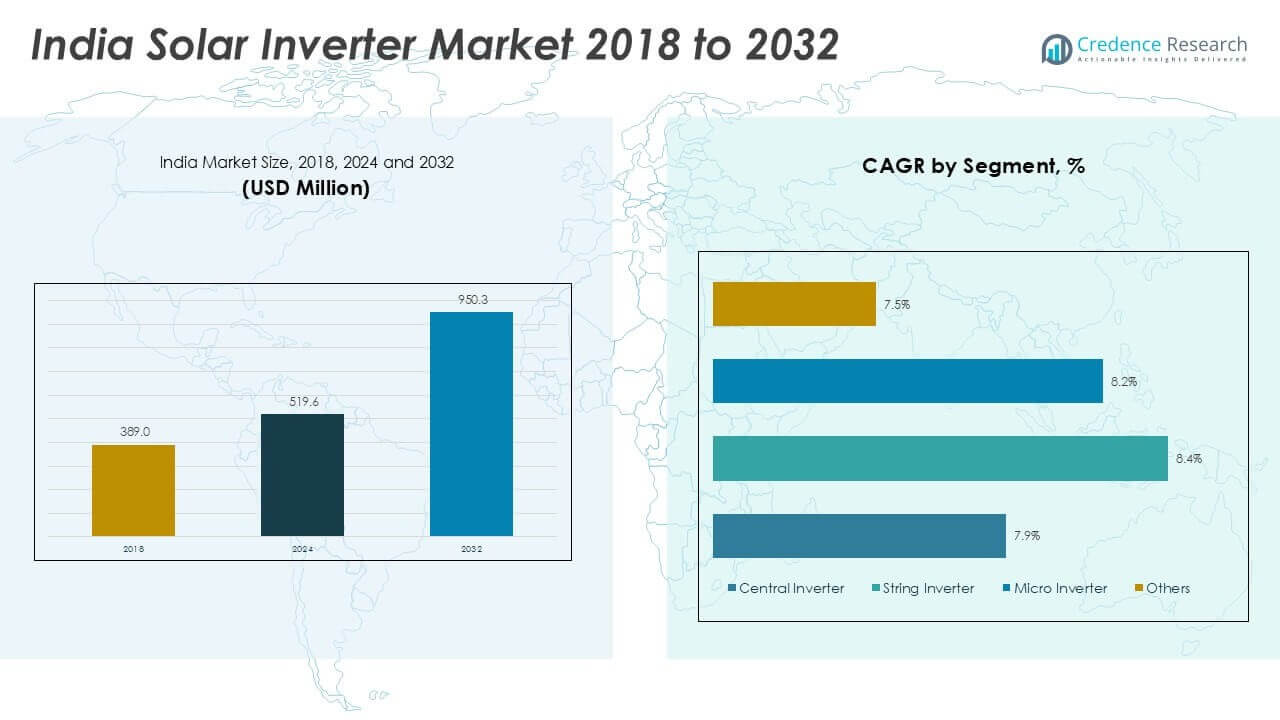

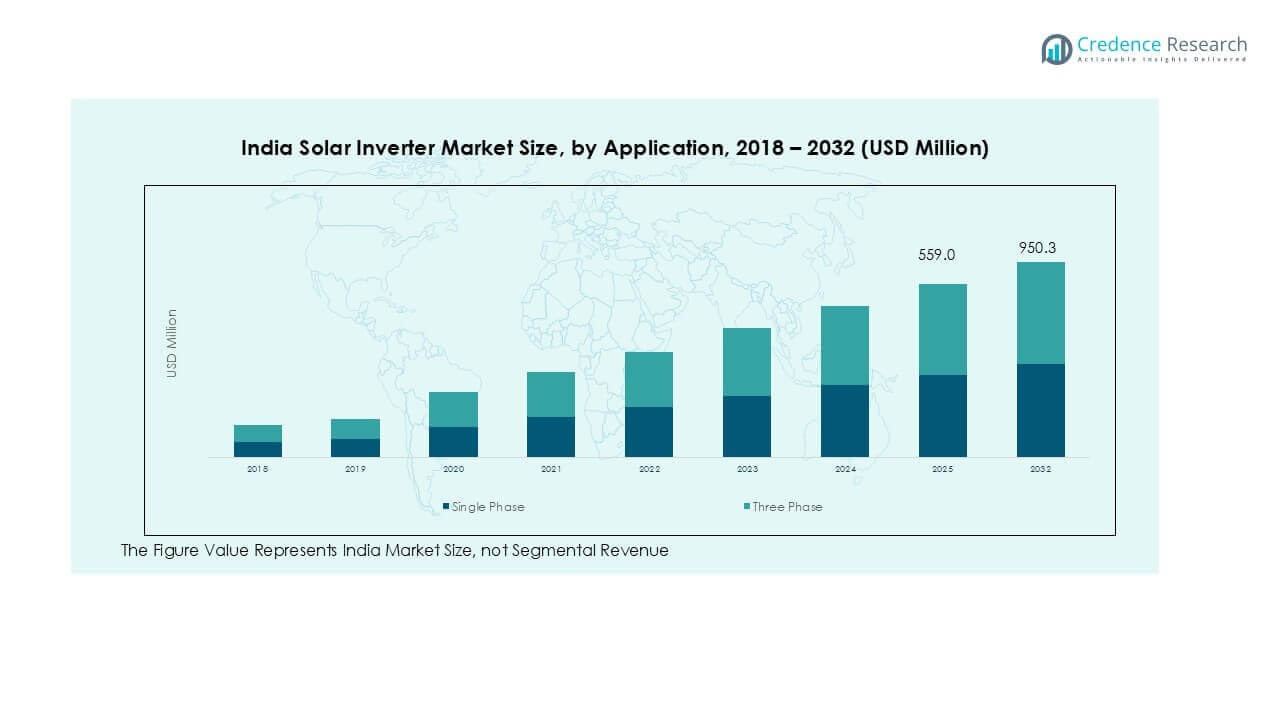

India Solar Inverter market size was valued at USD 389.0 million in 2018, growing to USD 519.6 million in 2024. The market is projected to reach USD 950.3 million by 2032, registering a CAGR of 7.9% during the forecast period (2025–2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Solar Inverter Market Size 2024 |

USD 519.6 million |

| India Solar Inverter Market, CAGR |

7.9% |

| India Solar Inverter Market Size 2032 |

USD 950.3 million |

The India solar inverter market is led by major players such as Schneider Electric, Siemens AG, Mitsubishi Electric Corporation, ABB Ltd, SMA, Delta Electronics, Fronius International GmbH, Sungrow, TMEIC, and GoodWe. These companies dominate through strong portfolios of central, string, and hybrid inverters catering to residential, commercial, and utility-scale projects. North India holds the largest market share at 35%, driven by large-scale solar parks and favorable state policies, followed by West India with 28% share, supported by Gujarat and Maharashtra’s strong rooftop solar programs. South India contributes 22%, led by Karnataka and Tamil Nadu’s industrial solar adoption.

Market Insights

- India solar inverter market size reached USD 519.6 million in 2024 and is projected to hit USD 950.3 million by 2032, growing at a CAGR of 7.9% during 2025–2032.

- Strong government initiatives, including the National Solar Mission and rooftop solar subsidies, drive adoption across residential, commercial, and utility-scale sectors, boosting demand for central and string inverters.

- Key trends include rising adoption of smart IoT-enabled inverters, hybrid systems with energy storage, and growing demand for distributed rooftop solar solutions in urban areas.

- Leading players such as Schneider Electric, Siemens AG, ABB Ltd, Delta Electronics, and Sungrow compete through technology innovation, grid-compliant designs, and strong EPC partnerships to capture market share.

- North India leads with 35% share, followed by West India at 28% and South India at 22%, with central inverters dominating utility projects and string inverters gaining traction in residential and commercial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Central inverters held the dominant share in the India solar inverter market in 2024, accounting for over 40% of total revenue. Their widespread use in utility-scale projects and large commercial installations drives demand. Central inverters offer high efficiency, lower installation costs per watt, and simplified maintenance, making them preferred for large-scale solar farms. String inverters are gaining traction due to their scalability and suitability for residential and small commercial setups. The growth of microinverters remains moderate but rising with rooftop solar adoption in urban areas.

- For instance, Sungrow supplied over 4 GW of central inverters for utility-scale solar farms commissioned across Rajasthan and Gujarat in 2024.

By System Type

On-grid solar inverters dominate the India market with more than 70% market share in 2024. Government initiatives promoting grid-connected solar systems, net metering policies, and rising utility-scale projects support this segment’s growth. On-grid inverters help optimize power export to the grid and provide real-time monitoring, aligning with India’s push toward renewable energy integration. Off-grid systems maintain a smaller share, primarily serving remote and rural regions where grid connectivity is limited, driven by initiatives like rural electrification and microgrid projects.

- For instance, in India, efforts to enhance rural electrification through microgrids continue under new programs, as the previous Saubhagya scheme was officially closed in 2022. While Victron Energy is a known supplier of components for off-grid systems in the Indian market, companies like them participate in various private and government-supported initiatives, rather than a single large-scale project as initially claimed. In 2024, the Indian government continued its support for off-grid electrification for thousands of homes, though this effort is part of newer schemes like the Revamped Distribution Sector Scheme (RDSS) and PM-JANMAN.

By Phase

Three-phase solar inverters lead the market, capturing over 60% revenue share in 2024, owing to their use in large-scale commercial, industrial, and utility projects. These inverters handle higher power capacity and offer superior grid stability, making them ideal for megawatt-scale installations. Single-phase inverters remain significant for residential rooftop solar systems, driven by rapid adoption of distributed solar in urban households. Government subsidies for residential solar rooftop programs are expected to further support single-phase inverter demand, although three-phase continues to dominate due to industrial and utility deployment.

Market Overview

Government Policies and Solar Initiatives

Government programs such as the National Solar Mission and state-specific solar policies are major growth drivers for the India solar inverter market. Net metering regulations, rooftop solar subsidies, and accelerated depreciation benefits encourage both residential and commercial adoption. Incentives for utility-scale solar parks and public-private partnerships have increased grid-connected installations nationwide. The push toward achieving 500 GW of renewable capacity by 2030 has created a strong demand pipeline for solar inverters. In addition, initiatives like PM-KUSUM promote decentralized solar power generation for rural areas, further boosting off-grid and small-capacity inverter sales.

- For instance, Tata Power Solar led India’s rooftop solar market in 2024 with a 19.4% market share. The company’s total installed rooftop capacity as of June 2024 was 343 MW, far short of 1 GW.

Declining Solar Component Costs

Falling prices of solar PV modules, coupled with improved efficiency, significantly lower the overall system cost. This cost reduction makes solar projects more financially attractive for industries, utilities, and households. Affordable financing schemes from banks and NBFCs complement cost reductions and accelerate adoption. Inverter technology advancements, including higher conversion efficiencies and longer product lifespans, improve project ROI and reduce levelized cost of energy (LCOE). As costs decline further, adoption is expected to penetrate deeper into residential and SME sectors, fueling consistent demand for both string and microinverters.

- For instance, IREDA sanctioned ₹37,354 crore and disbursed ₹25,089 crore in loans for renewable energy projects, achieving a record Profit After Tax of ₹1,252 crore.

Rising Electricity Demand and Energy Security Goals

India’s rising power consumption and need for energy diversification drive demand for solar inverters. Industrial growth, urbanization, and rural electrification programs require sustainable and cost-effective energy solutions. Solar power, supported by efficient inverters, addresses peak demand challenges and reduces dependency on fossil fuels. The government’s focus on energy self-sufficiency and reducing carbon emissions under COP commitments creates a favorable investment climate. Corporate ESG initiatives and green building certifications further stimulate solar adoption across commercial and industrial sectors, supporting robust market growth.

Key Trends & Opportunities

Shift Toward Smart and Hybrid Inverters

Smart solar inverters with IoT-enabled remote monitoring and advanced analytics are emerging as a key trend. These systems enable predictive maintenance, real-time performance tracking, and seamless grid integration. Hybrid inverters, which support energy storage, are gaining popularity as businesses and households adopt battery-backed systems to ensure power reliability. This trend aligns with India’s push for energy resilience and self-consumption optimization. Manufacturers offering hybrid-ready and smart-enabled solutions are positioned to capture significant market share as digitalization becomes a core requirement.

- For instance, Sungrow is a major supplier of solar inverters in India and uses its iSolarCloud platform for monitoring installations. The company has deployed SG350HX and other advanced inverters for large-scale projects in the region.

Utility-Scale and Rooftop Solar Expansion

Massive capacity additions in utility-scale solar parks present a strong opportunity for central inverter manufacturers. At the same time, rooftop solar installations in residential and commercial spaces are accelerating, driving demand for string and microinverters. Policies enabling net metering and capital subsidies for rooftop solar adoption create a dual growth engine for both centralized and distributed generation segments. The combination of large projects and small-scale distributed generation ensures a balanced and diverse demand outlook for solar inverter manufacturers.

- For instance, Adani Green Energy commissioned substantial new solar capacity in 2024, prominently at its large-scale project in Khavda, Gujarat.

Key Challenges

Grid Stability and Technical Constraints

Frequent grid fluctuations and voltage variations in many regions challenge inverter performance and system reliability. Inverters must comply with grid codes and provide features such as reactive power control and low-voltage ride-through capabilities. Poor grid infrastructure in rural areas increases maintenance requirements and limits the efficiency of on-grid systems. Manufacturers face the challenge of designing robust inverters that can handle India’s diverse grid conditions without compromising efficiency or lifespan.

High Initial Investment and Financing Barriers

Despite declining component costs, upfront capital expenditure for solar projects remains a challenge, particularly for small businesses and households. Limited access to affordable financing slows adoption in rural and semi-urban markets. Long payback periods deter some consumers, especially where electricity tariffs are already low. Inverter replacement and maintenance costs also add to lifecycle expenses, impacting project economics. Addressing these barriers through innovative financing models, leasing programs, and government-backed credit support is critical for accelerating market penetration.

Regional Analysis

North India

North India accounted for around 35% market share of the India solar inverter market in 2024, leading the overall demand. States such as Rajasthan, Haryana, Uttar Pradesh, and Punjab host large utility-scale solar parks and benefit from high solar irradiance. Government-backed projects like Rajasthan Solar Energy Policy and extensive grid infrastructure development fuel adoption of central inverters. Rooftop solar programs in Delhi NCR and commercial installations in industrial clusters further drive demand for string inverters. Favorable state policies and continued capacity additions will sustain North India’s dominant position during the forecast period.

West India

West India held nearly 28% of the market share in 2024, driven by Maharashtra and Gujarat’s strong renewable energy policies. Gujarat’s rooftop solar incentives and large solar park projects encourage demand for central and string inverters. Maharashtra’s focus on net metering and industrial adoption boosts installations across commercial spaces. The region benefits from robust grid connectivity and higher adoption of smart inverter technology. Strong state-level initiatives like the Solar Power Policy 2021 and ease of project execution position West India as a key growth hub for both on-grid and hybrid inverter systems in coming years.

South India

South India captured about 22% market share in 2024, led by Karnataka, Tamil Nadu, and Telangana. The region has seen significant solar capacity deployment, with Karnataka being a pioneer in large-scale solar parks. Industrial zones and tech parks in Tamil Nadu and Telangana are major users of rooftop solar systems, fueling string inverter demand. Government programs encouraging distributed generation and hybrid solar installations further support growth. Strong solar irradiance and active state-level renewable energy missions ensure South India continues to be a key contributor to the national solar inverter market.

East India

East India represented close to 8% of market share in 2024, reflecting steady but slower adoption compared to other regions. States like Odisha, West Bengal, and Bihar are gradually expanding solar capacity through state-led electrification programs and decentralized energy initiatives. The demand is mainly driven by off-grid systems and small-scale residential rooftop installations. Lack of robust grid infrastructure and lower industrialization levels slightly limit large-scale deployments. However, rural electrification projects and growing government focus on renewable energy penetration present opportunities for inverter manufacturers to expand their footprint in the region.

Central India

Central India accounted for roughly 7% of the market share in 2024, with Madhya Pradesh emerging as the key state in the region. Large-scale solar parks like the Rewa Ultra Mega Solar Park drive central inverter demand. Rooftop solar installations across institutional and commercial sectors are slowly increasing adoption of string inverters. Supportive state policies and competitive solar auction prices make the region attractive for future projects. Grid improvement initiatives and upcoming solar capacity additions are expected to strengthen Central India’s contribution to the overall solar inverter market during the forecast period.

Market Segmentations:

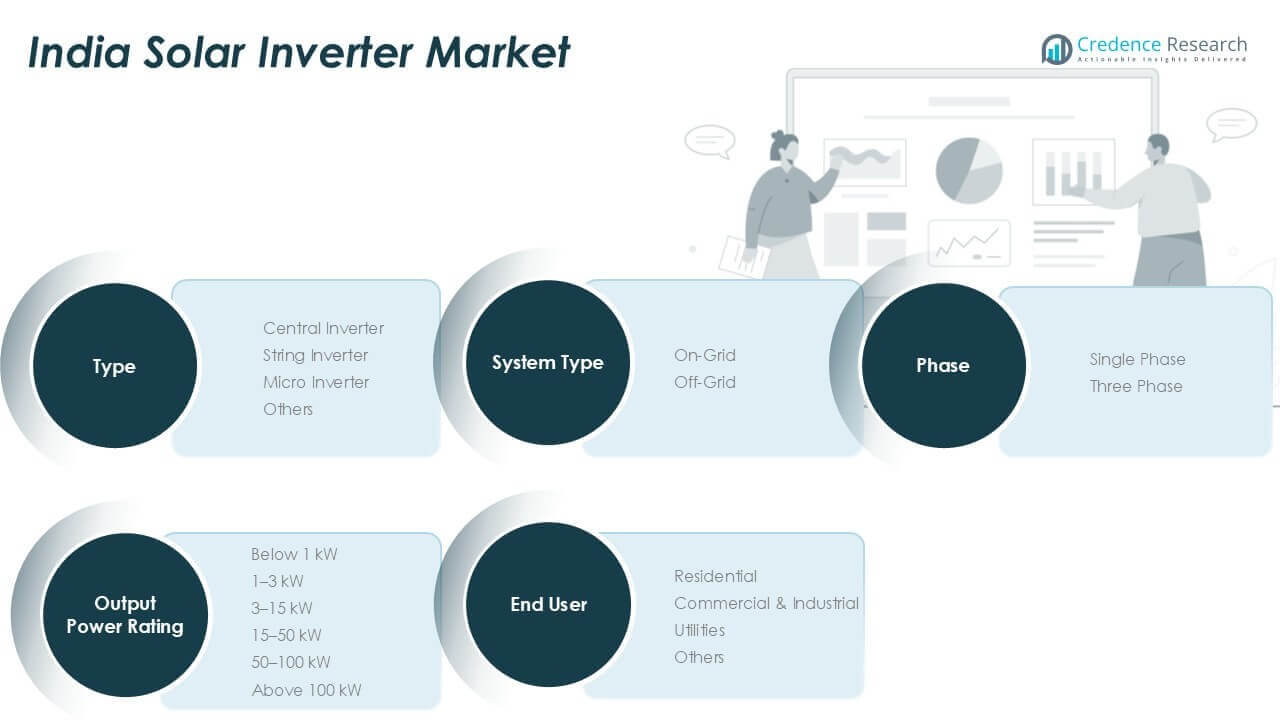

By Type

- Central Inverter

- String Inverter

- Micro Inverter

- Others

By System Type

By Phase

By Output Power Rating

- Below 1 kW

- 1–3 kW

- 3–15 kW

- 15–50 kW

- 50–100 kW

- Above 100 kW

By End User

- Residential

- Commercial & Industrial

- Utilities

- Others

By Geography

- North India

- West India

- South India

- East India

- Central India

Competitive Landscape

The India solar inverter market is highly competitive, with global and domestic players focusing on technology upgrades, partnerships, and capacity expansion. Leading companies include Schneider Electric, Siemens AG, Mitsubishi Electric Corporation, ABB Ltd, SMA, Delta Electronics, Fronius International GmbH, Sungrow, TMEIC, and GoodWe. These players compete by offering advanced central, string, and hybrid inverters with improved efficiency, remote monitoring, and grid compliance features. Strategic initiatives such as collaborations with EPC contractors, participation in government solar tenders, and localization of manufacturing are common to strengthen market presence. Many companies are expanding their service networks and digital monitoring platforms to enhance customer experience. The competitive environment is also influenced by price sensitivity, encouraging firms to innovate cost-efficient solutions while maintaining performance standards. Continuous R&D investment and focus on energy storage-ready solutions will remain key differentiators for maintaining market share in the rapidly growing Indian solar sector.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Schneider Electric

- Siemens AG

- Mitsubishi Electric Corporation

- ABB Ltd

- SMA

- Delta Electronics, Inc

- Fronius International GmbH

- SUNGROW

- TMEIC

- GOODWE

Recent Developments

- In May 2024, Omron Electronic Components Europe announced a diverse range of innovations at the Smarter E Europe Exhibition 2024 to support efficiency and reduce energy losses for electric vehicle charging, electricity storage systems (ESS), and solar applications.

- In February 2024, Siemens AG announced new products and partnerships to achieve transformation and sustainable infrastructure. Siemens customers get access to flagship technologies in the space, including Xcelerator, an open and innovative digital business platform offering integration with more than 400 sellers in the Siemens global ecosystem.

- In October 2023, Fuji Electric India, a leader in the automation industry and cutting-edge energy-efficient solutions for industry operations showed the Central solar inverter PV 1500 series at the Renewable Energy India Expo held from October 4th to 6th at Greater Noida.

- In September 2023,WattPower, one of the major renewable energy firms globally, unveiled a modernized solar inverter production plant located in Tamil Nadu’s district of Chennai as a significant move forward in India’s solar energy sector. With its new string PV inverters, it desires to make an impact on the Indian solar PV industry.

- In July 2023, LG Energy Solution Ltd., a South Korea-based battery manufacturer, introduced new hybrid inverters suitable for private electric power plants. These inverters are designed to work on both low-voltage and high-voltage setups and come with an integrated backup feature that will easily blend with their own line of batteries.

- In April 2023, SolaX Power, which is famous for manufacturing solar inverters, publicized X1-Hybrid LV, another single-phase low-voltage hybrid inverter meant for residential applications. This new technology has been devised for the efficient operation of low-voltage solar photovoltaic (PV) systems.

Report Coverage

The research report offers an in-depth analysis based on Type, System Type, Phase, Output Power Rating, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth driven by rising solar capacity additions across utility and rooftop segments.

- Central inverters will continue dominating utility-scale projects due to their cost efficiency and reliability.

- String and microinverters will see faster growth with increasing residential and commercial rooftop solar installations.

- Hybrid inverters with storage compatibility will gain traction as energy independence becomes a priority.

- Smart inverters with IoT-enabled remote monitoring will become standard in new installations.

- Government policies and net metering regulations will continue to boost adoption in urban and rural areas.

- Domestic manufacturing initiatives under “Make in India” will improve supply chain resilience and reduce costs.

- Falling inverter prices and improved efficiency will enhance project ROI and drive wider penetration.

- Industrial and commercial sectors will adopt solar inverters to meet sustainability and ESG goals.

- Continued grid modernization will support integration of high-capacity solar power systems.