Market Overview

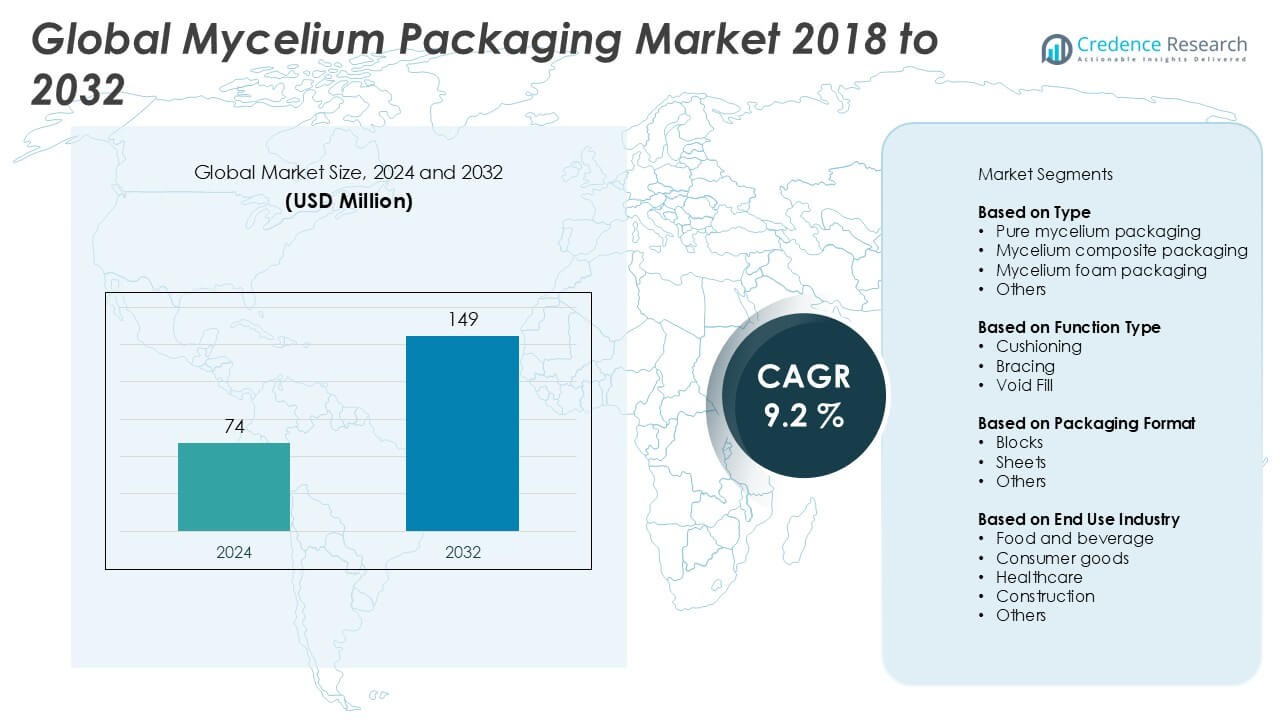

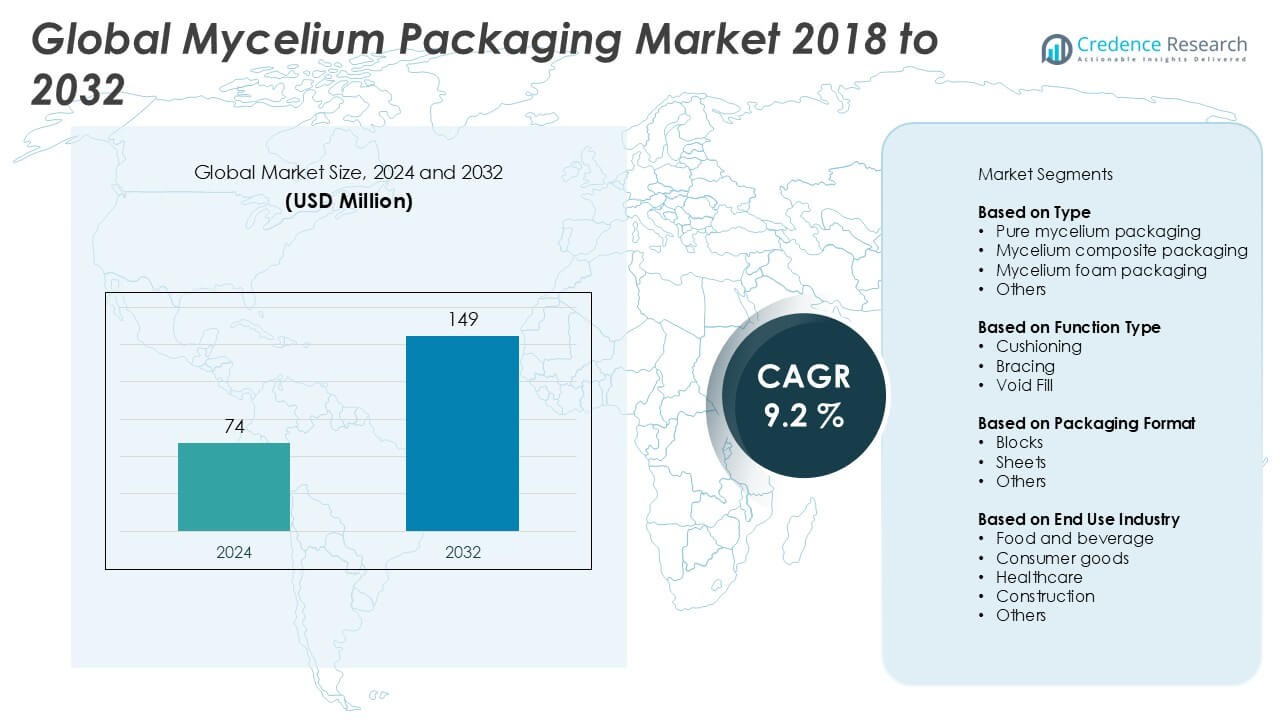

The Mycelium Packaging market size was valued at USD 74 million in 2024 and is anticipated to reach USD 149 million by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mycelium Packaging Market Size 2024 |

USD 74 Million |

| Mycelium Packaging Market, CAGR |

9.2% |

| Mycelium Packaging Market Size 2032 |

USD 149 Million |

The mycelium packaging market is led by key players such as Ecovative Design LLC, Mushroom Packaging, Mycelium Energy Solutions, Cascadia Mycelium, and Bloom, all of which are actively driving innovation in sustainable packaging solutions. These companies focus on bio-based material engineering, scalability, and partnerships with eco-conscious brands to strengthen their market position. North America emerged as the leading region in 2024, holding a dominant 38% share of the global market, driven by strong regulatory support and high adoption rates across consumer goods, electronics, and food sectors. Europe followed with 32%, propelled by circular economy policies and rising environmental awareness.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Mycelium Packaging market was valued at USD 74 million in 2024 and is projected to reach USD 149 million by 2032, growing at a CAGR of 9.2% during the forecast period.

- Growth is driven by increasing demand for sustainable and biodegradable packaging alternatives, strict regulations on single-use plastics, and rising consumer awareness of environmental impacts.

- Key trends include growing adoption in premium and luxury segments, technological advancements in biofabrication, and expanding application across industries like electronics, cosmetics, and food services.

- The market is moderately fragmented, with leading players such as Ecovative Design LLC, Mushroom Packaging, and Mycelium Energy Solutions competing through innovation, strategic collaborations, and eco-conscious product offerings.

- North America holds the largest share at 38%, followed by Europe at 32%, while Asia-Pacific is the fastest-growing region. By type, mycelium composite packaging leads the segment with a 45% market share due to its durability and commercial versatility.

Market Segmentation Analysis:

By Type

The Mycelium Packaging market is segmented into pure mycelium packaging, mycelium composite packaging, mycelium foam packaging, and others. Among these, mycelium composite packaging held the largest market share in 2024, accounting for over 45% of the global revenue. Its dominance is driven by its enhanced durability, adaptability to various industrial packaging needs, and ease of manufacturing. Industries such as electronics and consumer goods prefer composite forms due to their structural integrity and lightweight properties. Additionally, the growing demand for sustainable alternatives to plastic and Styrofoam is significantly fueling this segment’s growth.

- For instance, Ecovative Design reported producing over 600,000 packaging units annually using its composite mycelium platform, tailored for high-volume consumer electronics and retail applications.

By Function Type

Based on function, the market is categorized into cushioning, bracing, and void fill. Cushioning emerged as the dominant function segment in 2024, holding approximately 48% of the market share. This segment benefits from mycelium’s inherent shock-absorbing and compression-resistant properties, making it ideal for protecting fragile products during shipping. With rising e-commerce activity and increasing demand for biodegradable and compostable packaging materials, cushioning solutions made from mycelium have gained widespread acceptance among packaging manufacturers and logistics companies seeking eco-friendly alternatives.

- For instance, Mushroom Packaging supplies cushioning materials to over 120 commercial clients worldwide, including environmentally conscious retailers in North America and Europe.

By Packaging Format

In terms of packaging format, the market is divided into blocks, sheets, and others. Blocks accounted for the highest market share in 2024, comprising nearly 50% of the total segment. Their popularity stems from their versatility in molding, structural strength, and wide applications across multiple end-use sectors including appliances, industrial equipment, and electronics. Blocks offer excellent customization potential and allow manufacturers to replace petroleum-based foams effectively. The increasing focus on reducing environmental impact in packaging design is further propelling the demand for block-format mycelium packaging solutions.

Key Growth Drivers

Rising Demand for Sustainable Packaging

The global shift toward environmentally responsible products is a major driver for the mycelium packaging market. With increasing awareness about the harmful effects of plastic and polystyrene packaging, both consumers and industries are seeking sustainable alternatives. Mycelium packaging, being biodegradable and compostable, aligns with regulatory mandates and corporate sustainability goals. Government initiatives banning single-use plastics and encouraging green packaging further accelerate adoption. As a result, industries ranging from electronics to food and beverages are investing in eco-friendly packaging solutions, positioning mycelium packaging as a preferred choice.

- For instance, IKEA replaced polystyrene foam with mycelium packaging in their U.S. logistics operations, covering more than 30 product lines as part of their zero-waste initiative.

Technological Advancements in Biofabrication

Ongoing developments in biofabrication and materials engineering have significantly improved the scalability and performance of mycelium-based packaging. Innovations in growth substrates, molding techniques, and post-processing methods have enhanced the material’s strength, moisture resistance, and application versatility. These advancements enable manufacturers to produce mycelium packaging at competitive costs while meeting the structural and functional demands of various end-use sectors. Additionally, increasing R&D investments from startups and research institutions are fostering innovation, resulting in wider product adoption and expansion into newer industrial domains.

- For instance, MycoComposite™, a patented technology by Ecovative, demonstrated a 20% increase in tensile strength and 30% reduction in water absorption, based on testing by independent labs and field applications.

Expanding Applications Across Industries

The versatility of mycelium packaging has broadened its application across several industries, including electronics, cosmetics, consumer goods, and food services. Its excellent shock absorption, thermal insulation, and lightweight characteristics make it an effective substitute for synthetic foams and plastics. Companies aiming to enhance brand image through eco-conscious practices are integrating mycelium-based solutions into their packaging strategies. The growing presence of sustainable brands and eco-friendly startups globally continues to widen the addressable market, creating robust opportunities for growth in diversified sectors.

Key Trends & Opportunities

Growing Investments and Strategic Partnerships

An increasing number of investments and strategic partnerships among biotechnology firms, packaging manufacturers, and retail brands are shaping the market landscape. Collaborations aimed at scaling up production and commercializing innovative designs have accelerated market penetration. Major consumer brands are partnering with mycelium packaging developers to align with their green goals and enhance sustainability credentials. This trend is creating long-term opportunities for supply chain integration, product customization, and cost optimization in the packaging ecosystem.

- For instance, Ecovative Design secured a $60 million Series D investment in 2022 and expanded its production capacity to over 100,000 packaging units per month through its partnership with Sealed Air Corporation, enabling large-scale supply to brands like Dell Technologies for protective electronic packaging solutions.

Rising Popularity in Luxury and Premium Segments

Mycelium packaging is gaining traction in the luxury and premium product sectors, particularly in cosmetics, jewelry, and specialty foods. Its natural aesthetic, eco-friendliness, and customizability appeal to brands seeking to reinforce their commitment to sustainability while maintaining product elegance. The premium market’s willingness to absorb higher costs for eco-friendly packaging provides a significant opportunity for market expansion. As consumer preferences shift toward responsible consumption, this trend is likely to drive higher demand for bespoke mycelium-based solutions.

- For instance, Oceanium partnered with luxury confectionery brands in the U.K. to supply custom-molded mycelium packaging for over 40,000 limited-edition chocolate boxes in 2024, achieving a full production turnaround time of 72 hours from mold to shipment using precision-grown marine biomass substrates.

Key Challenges

High Production Costs and Limited Scalability

Despite its environmental advantages, the production cost of mycelium packaging remains a key barrier to widespread adoption. Cultivation, processing, and molding require controlled environments and longer production cycles compared to synthetic alternatives. These factors contribute to higher per-unit costs, especially at lower volumes. Additionally, scaling up production without compromising quality poses technical and logistical challenges for manufacturers, particularly in regions with limited access to agricultural waste or biofabrication facilities.

Performance Limitations Under Certain Conditions

Mycelium packaging may face durability and moisture sensitivity issues in specific environments, limiting its application in long-haul shipping or humid climates. While ongoing research aims to enhance resistance properties, current formulations may not meet the performance standards required for all industrial use cases. These limitations can deter adoption in sectors requiring strict mechanical and environmental tolerances, thereby restricting market penetration until suitable improvements are made.

Lack of Awareness and Market Standardization

Limited awareness among end users, particularly in emerging economies, acts as a challenge for the mycelium packaging market. Many businesses remain unfamiliar with its benefits or question its reliability compared to conventional packaging materials. Additionally, the absence of standardized certifications and testing protocols hampers buyer confidence. The lack of regulatory clarity and consistent labeling further complicates procurement decisions, slowing market growth despite rising interest in sustainable alternatives.

Regional Analysis

North America

North America dominated the mycelium packaging market in 2024, accounting for approximately 38% of the global market share. The region’s leadership is driven by strong environmental regulations, heightened consumer awareness, and widespread corporate sustainability initiatives. The U.S. leads in adoption due to its advanced biofabrication infrastructure and presence of key market players. Additionally, the rising preference for eco-friendly packaging in industries such as electronics, cosmetics, and food services continues to drive demand. Supportive government policies, such as bans on single-use plastics and incentives for sustainable innovations, further bolster the market’s growth trajectory across North America.

Europe

Europe held the second-largest share in the global mycelium packaging market in 2024, capturing around 32% of total revenue. The region benefits from stringent environmental policies under the European Green Deal and the widespread adoption of circular economy practices. Countries like Germany, the Netherlands, and France are at the forefront due to active R&D, strong regulatory backing, and consumer preference for sustainable products. The growing use of biodegradable packaging in luxury and FMCG sectors is supporting demand. Additionally, collaboration between research institutions and packaging manufacturers is fostering innovation and improving product performance in the region.

Asia-Pacific

The Asia-Pacific region accounted for nearly 18% of the global mycelium packaging market in 2024 and is expected to grow at the fastest CAGR during the forecast period. Rapid industrialization, increasing environmental awareness, and rising demand for eco-friendly alternatives in countries like China, India, and Japan are major growth drivers. Although the region is still in the early stages of adoption, government initiatives promoting sustainable manufacturing and waste reduction are fueling interest. With a large consumer base and expanding e-commerce sector, Asia-Pacific offers significant untapped potential for mycelium packaging manufacturers and investors alike.

Latin America

Latin America represented about 7% of the global mycelium packaging market in 2024. Countries like Brazil and Mexico are gradually embracing sustainable packaging solutions due to growing environmental concerns and increasing pressure to reduce plastic waste. While adoption is relatively slow compared to other regions, local startups and eco-conscious brands are pioneering the use of biodegradable materials, including mycelium. Market growth is also supported by international collaborations and rising demand from the food and beverage industry. However, limited infrastructure and higher production costs remain barriers to widespread commercialization in the region.

Middle East & Africa

The Middle East & Africa accounted for approximately 5% of the global market share in 2024. Although the region has been slower in adopting mycelium packaging, increasing awareness about environmental sustainability and waste management is driving gradual interest. The hospitality and food service sectors in the UAE and South Africa are key early adopters, experimenting with eco-friendly packaging to align with global sustainability standards. However, challenges such as lack of local production facilities and limited awareness are hindering market expansion. Future growth will depend on policy support and investment in bio-based packaging technologies.

Market Segmentations:

By Type

- Pure mycelium packaging

- Mycelium composite packaging

- Mycelium foam packaging

- Others

By Function Type

- Cushioning

- Bracing

- Void Fill

By Packaging Format

By End Use Industry

- Food and beverage

- Consumer goods

- Healthcare

- Construction

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the mycelium packaging market is characterized by the presence of a mix of emerging startups and innovative sustainability-focused firms. Key players such as Ecovative Design LLC, Mushroom Packaging, and Mycelium Energy Solutions are leading the market through proprietary technologies and strategic collaborations. These companies focus on biofabrication advancements, product customization, and expanding production capacity to meet growing demand across various industries. Other players like Cascadia Mycelium and Bloom are leveraging regional supply chains and forming partnerships with eco-conscious brands to strengthen their market presence. Competition is primarily based on innovation, cost-efficiency, and scalability. Companies are increasingly investing in research and development to improve material strength, moisture resistance, and product versatility. Furthermore, strategic alliances with packaging distributors and retail brands are playing a key role in market expansion. As sustainability becomes a core business priority, the competitive intensity is expected to rise with more entrants and increased commercialization efforts.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Algopack

- Bloom

- Cascadia Mycelium

- CuanTec

- AlgaePac

- Oceanium

- Mycelium Energy Solutions

- Seamore

- Sea6 Energy

- Evoware

Recent Developments

- In September 2024, IKEA announced a switch to biodegradable packaging made from mushrooms, developed by American company Ecovative, in a move to reduce environmental waste. Each year, over 14 million tons of non-biodegradable polystyrene—made from petroleum—are discarded in landfills, contributing to severe pollution, with projections indicating that by 2050, 99% of birds may have plastic in their stomachs.

- In April 2025, In the future, Donald Trump’s proposed tariff policies might possibly impact the mycelium-based packaging industry by increasing production costs and disrupting global trade flows. If tariffs are imposed on imported materials or equipment used in packaging products, producers could face higher operational expenses.

Market Concentration & Characteristics

The Mycelium Packaging Market exhibits a moderately concentrated structure, with a mix of established innovators and emerging startups driving growth. Key players such as Ecovative Design LLC, Mushroom Packaging, and Mycelium Energy Solutions hold a competitive edge through proprietary technologies, strategic collaborations, and sustainable material engineering. It reflects characteristics typical of an emerging bio-based industry, where product innovation, scalability, and regulatory compliance shape competitive positioning. The market remains dynamic, influenced by increasing demand for compostable alternatives and the shift toward circular economy practices. Regional concentration is evident, with North America and Europe accounting for a combined majority of the global share due to strong regulatory frameworks and early adoption. It continues to expand in Asia-Pacific, supported by rising awareness and industrial development. Companies prioritize research and development, customization capabilities, and end-user engagement to meet evolving environmental standards and customer expectations. The market’s future depends on cost reduction, performance optimization, and supply chain integration.

Report Coverage

The research report offers an in-depth analysis based on Type, Function Type, Packaging Format, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption will expand into packaging sectors such as pharmaceuticals, luxury goods, and electronics.

- Improved production methods will lower manufacturing cost and reduce lead times.

- Enhanced material formulations will boost moisture resistance and mechanical strength.

- Collaboration between packaging firms and biotechnology startups will accelerate innovation.

- Rising regulatory support for biodegradable materials will drive broader market acceptance.

- Consumer preference for eco‑friendly products will continue to favor mycelium solutions.

- Emergence of local production hubs in Asia‑Pacific and Latin America will diversify supply chains.

- Integration with circular economy initiatives will promote recycling and composting systems.

- Customized molding and design flexibility will support premium packaging applications.

- Investment in research facilities and pilot plants will facilitate scale‑up across regions.