Market Overview

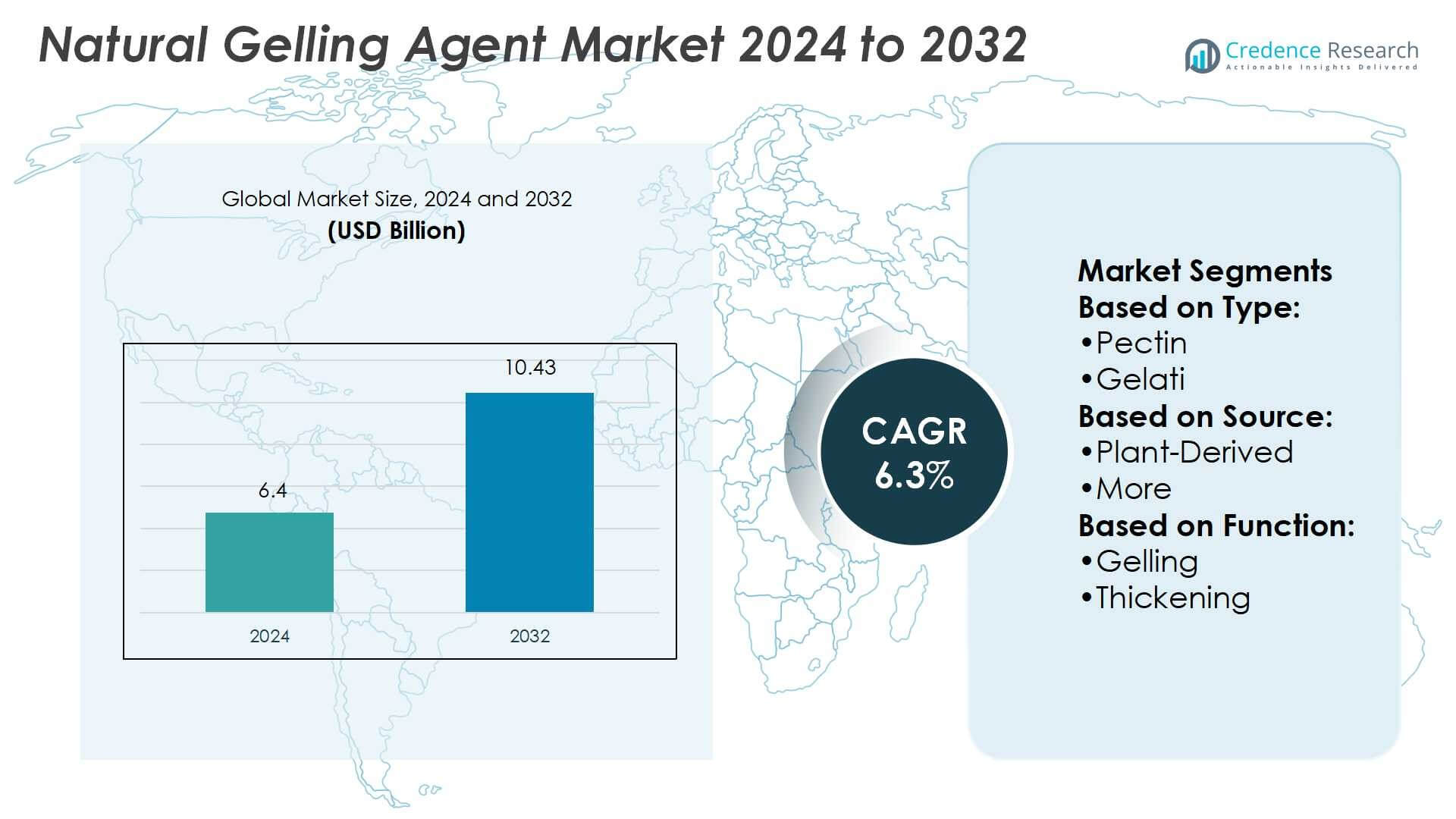

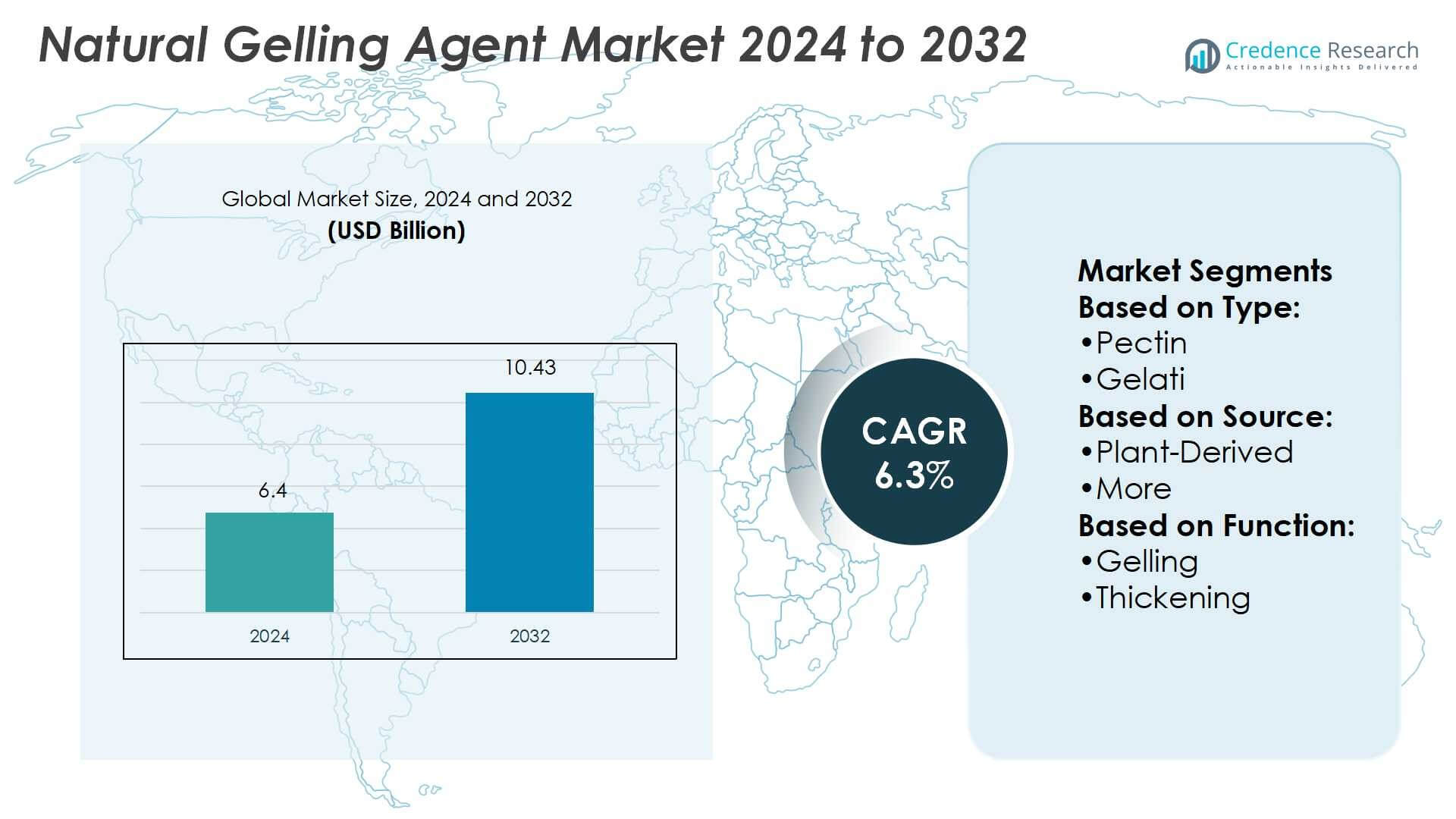

Natural Gelling Agent Market size was valued at USD 6.4 billion in 2024 and is anticipated to reach USD 10.43 billion by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Natural Gelling Agent Market Size 2024 |

USD 6.4 Billion |

| Natural Gelling Agent Market, CAGR |

6.3% |

| Natural Gelling Agent Market Size 2032 |

USD 10.43 Billion |

The Natural Gelling Agent Market is driven by rising demand for clean-label, plant-based, and sustainable ingredients across food, beverage, pharmaceutical, and personal care industries. Consumers increasingly favor natural alternatives to synthetic additives, pushing manufacturers to innovate with eco-friendly sourcing and advanced extraction methods. Strong regulatory support for safe, natural formulations further accelerates adoption. Key trends include the expansion of vegan and functional foods, growing use in nutraceuticals, and wider applications in cosmetics. Technological advancements that improve purity, performance, and cost-efficiency strengthen competitiveness, while sustainability initiatives and transparent supply chains continue to shape long-term market growth.

The Natural Gelling Agent Market shows strong geographical presence with North America and Europe leading adoption due to advanced regulations and consumer preference for clean-label products, while Asia-Pacific dominates production with abundant raw materials like seaweed and guar gum. Latin America and the Middle East & Africa show steady growth driven by expanding food and personal care industries. Key players include Cargill Incorporated, Tate & Lyle, Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group, Naturex, CP Kelco, Riken Vitamin, Agro Gums, and E. I. DuPont De Nemours.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Natural Gelling Agent Market size was valued at USD 6.4 billion in 2024 and is projected to reach USD 10.43 billion by 2032, growing at a CAGR of 6.3%.

- Rising demand for clean-label, plant-based, and sustainable ingredients is a key growth driver.

- Expanding use in vegan, functional foods, nutraceuticals, and cosmetics highlights strong market trends.

- Competitive strategies focus on innovation, eco-friendly sourcing, and transparent supply chains to build consumer trust.

- High production costs and raw material dependency act as restraints for large-scale adoption.

- North America and Europe lead adoption due to advanced regulations, while Asia-Pacific dominates production with abundant seaweed and guar gum resources.

- Latin America and Middle East & Africa show steady growth, supported by food, personal care, and pharmaceutical applications.

Market Drivers

Rising Demand for Clean Label and Natural Ingredients

The Natural Gelling Agent Market benefits strongly from the consumer shift toward clean-label food products. Growing preference for natural over synthetic additives is driving manufacturers to reformulate products. It supports the food and beverage sector by delivering safe texture and stability solutions without compromising health concerns. Rising consumer awareness about artificial ingredients has led to stricter purchasing choices. It provides manufacturers with an opportunity to expand natural formulations across dairy, bakery, and confectionery products. Rising focus on transparency in labeling continues to reinforce adoption across developed and emerging markets.

- For instance, Agro Gums produces a guar gum powder (grade AG 40/60) whose viscosity in water is high enough that even at concentrations below 1 % it delivers textured thickening, and the product is certified under ISO 9001, BRC, FSSC 22000, Halal and Kosher standards.

Expanding Applications in Food and Pharmaceutical Industries

The Natural Gelling Agent Market gains traction from its versatility across multiple industries. It finds widespread use in food and beverage applications for texturization, thickening, and shelf-life stability. Rising adoption in pharmaceutical formulations further supports market growth, especially in controlled-release drug systems and nutraceuticals. Gelling agents derived from natural sources ensure safety and compatibility with health-driven product lines. It is also increasingly used in dietary supplements and medical nutrition products. Rising integration across these industries underscores its role in expanding beyond traditional applications.

- For instance, Ingredion’s product NATIONAL™ 77-1760 modified starch is a high-performance, cold-water-swelling (CWS) starch derived from waxy maize. It is known for its excellent viscosity in both hot and cold systems and its ability to disperse easily.

Growth Driven by Health and Wellness Trends

The Natural Gelling Agent Market aligns with the global shift toward health and wellness. Consumers increasingly seek low-calorie, fat-free, and natural formulations where gelling agents play a key role. It provides solutions in functional foods, fortified beverages, and plant-based alternatives, all of which are rapidly growing categories. Rising adoption in vegan and vegetarian diets drives further acceptance of natural gelling solutions. Manufacturers leverage these agents to meet demand for better texture and mouthfeel in healthy formulations. Rising awareness about natural health benefits strengthens product positioning in this evolving consumer landscape.

Support from Regulatory and Sustainability Initiatives

The Natural Gelling Agent Market benefits from favorable regulations that promote natural additives in consumer products. Regulatory bodies encourage the replacement of synthetic stabilizers and gelling agents with natural alternatives. It ensures manufacturers comply with environmental and health safety standards. Growing sustainability efforts push companies to explore gelling agents from renewable and plant-based sources. Rising emphasis on waste reduction and resource optimization further contributes to product development. Strong support from both regulatory frameworks and sustainability initiatives continues to accelerate market expansion.

Market Trends

Market Trends

Rising Popularity of Plant-Based and Vegan Alternatives

The Natural Gelling Agent Market is witnessing increasing demand from plant-based and vegan product categories. It supports the development of dairy alternatives, meat substitutes, and confectionery with clean textures. Rising preference for vegan diets accelerates innovation in seaweed, pectin, and agar-based gelling systems. Food companies focus on natural, animal-free ingredients to expand product lines. It provides a functional solution that aligns with ethical and lifestyle choices. Rising consumption of plant-based products strengthens the role of natural gelling agents in mainstream markets.

- For instance, Cosmetic ingredients require low microbial loads for safety. Distributors like Azelis and technical data provided by CP Kelco confirm that these cosmetic-grade carrageenans have a low bacterial plate count, typically 200 cfu/g.

Advancements in Extraction and Processing Technologies

The Natural Gelling Agent Market experiences strong growth through technological improvements in extraction and processing. It benefits from advanced methods that increase yield, purity, and consistency of gelling agents. New techniques in enzymatic extraction and clean processing reduce energy consumption and waste generation. Manufacturers adopt innovative technologies to improve stability and performance in food and pharmaceutical applications. It ensures that products meet strict quality and safety standards while supporting sustainability goals. Rising investment in technology strengthens production efficiency and global competitiveness.

- For instance, DuPont’s “Innovate for Good” report says that more than 30 new product offerings were launched that delivered sustainability and performance advantages across its global businesses.

Expansion into Functional and Fortified Foods

The Natural Gelling Agent Market is expanding its influence within functional and fortified food categories. It helps manufacturers create nutritionally enriched products with enhanced textures and stability. Rising consumer demand for probiotic yogurts, fortified beverages, and dietary supplements boosts adoption. Gelling agents play a key role in maintaining bioactive stability during processing and storage. It enhances sensory appeal while preserving nutritional content across diverse food formats. Rising focus on health-driven product development reinforces their application in functional food innovations.

Growing Interest in Sustainable and Eco-Friendly Sourcing

The Natural Gelling Agent Market is shaped by the trend toward sustainable and eco-friendly sourcing. It pushes manufacturers to utilize renewable raw materials such as seaweed, citrus peels, and plant fibers. Rising awareness of environmental responsibility influences companies to adopt greener supply chains. Certification programs and traceability systems gain importance in addressing consumer expectations for sustainability. It supports the broader movement toward circular economy practices in food and pharmaceutical sectors. Rising alignment with sustainability trends drives long-term market relevance and consumer trust.

Market Challenges Analysis

High Production Costs and Supply Chain Volatility

The Natural Gelling Agent Market faces significant challenges linked to high production costs and raw material dependency. It relies heavily on agricultural and marine sources such as seaweed, citrus peels, and plant extracts, which are subject to seasonal fluctuations. Rising costs of cultivation, harvesting, and extraction create instability for manufacturers. Limited availability of premium-grade raw materials restricts consistent supply for large-scale production. It forces companies to invest in advanced processing technologies, further increasing operational expenses. Rising competition from synthetic alternatives also pressures pricing strategies and market penetration.

Regulatory Complexity and Performance Limitations

The Natural Gelling Agent Market encounters hurdles from diverse regulatory frameworks and product performance constraints. It must comply with strict safety and labeling requirements across regions, leading to complex approval processes. Variations in international food and pharmaceutical regulations delay product launches and restrict market expansion. Performance limitations in certain applications, such as stability under extreme pH or heat conditions, reduce adoption. It requires continuous innovation to match the versatility of synthetic agents without compromising safety. Rising consumer expectations for clean label and cost-effectiveness intensify the challenge of balancing compliance with performance.

Market Opportunities

Expanding Applications in Health and Wellness-Oriented Products

The Natural Gelling Agent Market holds strong opportunities in health and wellness-driven categories. It supports the growing demand for functional foods, fortified beverages, and dietary supplements with clean textures and stability. Rising consumer interest in low-fat, low-sugar, and vegan options enhances the role of natural gelling agents. Pharmaceutical and nutraceutical companies are adopting these agents in drug delivery systems and medical nutrition solutions. It enables controlled release, improved mouthfeel, and safer formulations. Rising focus on preventive healthcare and natural ingredients expands adoption across both developed and emerging economies.

Rising Demand for Sustainable and Renewable Solutions

The Natural Gelling Agent Market benefits from opportunities driven by sustainability and eco-friendly practices. It leverages renewable raw materials such as seaweed, fruits, and plant fibers to align with environmental goals. Rising consumer preference for green sourcing creates demand for transparent and traceable supply chains. Food and beverage manufacturers are prioritizing natural additives that reduce ecological impact. It opens opportunities for companies to innovate with circular economy models and waste valorization. Rising global focus on climate-conscious production positions natural gelling agents as preferred solutions for long-term industry growth.

Market Segmentation Analysis:

By Type

The Natural Gelling Agent Market by type includes pectin, gelatin, agar, carrageenan, sodium alginate, and others. Pectin dominates in jams, jellies, and beverages where it delivers stability and texture. Gelatin remains important in confectionery, dairy, and pharmaceutical capsules due to its versatile properties. Agar and carrageenan, derived from seaweed, are gaining traction as vegan and vegetarian alternatives. Sodium alginate plays a strong role in dairy stabilization and pharmaceutical applications. It allows manufacturers to select agents that balance functionality, dietary needs, and compliance with regulations.

- For instance, Cargill pectin products (UniPECTINE®) include High Methoxyl (HM) pectins with Degree of Esterification (DE) ≥ 50%, and Low Methoxyl (LM) pectins where DE < 50%. Amidated LM (LMA) and conventional LM (LMC) pectins differ in calcium reactivity and gel thermal stability.

By Source

The Natural Gelling Agent Market by source is divided into plant-derived and other categories. Plant-based gelling agents such as pectin, agar, and carrageenan lead demand due to clean-label and vegan trends. These options align with the industry’s movement toward renewable and sustainable raw materials. Animal-derived gelatin continues to serve confectionery and capsule markets but faces ethical and dietary restrictions. It supports the rapid shift toward plant-based alternatives in food and personal care industries. Rising awareness of sustainability strengthens adoption of plant-origin products across global markets.

- For instance, Naturex has published the StabilEnhance® product line is marketed for its preservative and antioxidant properties, which function to stabilize food products. OSR 2.5 specifically functions to inhibit lipid oxidation, preserving the product’s color and taste.

By Function

The Natural Gelling Agent Market by function covers gelling, thickening, stabilizing, emulsifying, and others. Gelling dominates with strong demand in bakery, confectionery, and processed food categories. Thickening applications are widely used in sauces, dressings, and beverages. Stabilizing and emulsifying functions enhance performance in dairy, frozen desserts, and nutraceuticals. It ensures improved mouthfeel, consistency, and product shelf life. Functional diversity drives adoption across industries that prioritize natural and high-performing ingredients.

Segments:

Based on Type:

Based on Source:

Based on Function:

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 35.8% share of the Natural Gelling Agent Market. The United States dominates due to strong clean-label food demand and advanced regulations supporting natural additives. Canada contributes steadily with growth in food, beverages, and personal care products. It benefits from established processing technologies and sustainable sourcing practices. Manufacturers focus on plant-based and vegan formulations to meet shifting consumer preferences. The region shows consistent growth, supported by innovation and strict quality standards.

Europe

Europe accounts for 38.3% share in the Natural Gelling Agent Market, led by strong demand in food, beverages, and pharmaceuticals. Western Europe emphasizes strict safety, labeling, and sustainability regulations, driving adoption of natural solutions. Countries such as Germany, France, and the U.K. are major consumers. It benefits from advanced production capabilities and R&D investments. Growing interest in vegan and organic products accelerates regional adoption. Europe continues to balance regulatory compliance with innovation in plant-based alternatives.

Asia-Pacific

Asia-Pacific represents 36.7% share of the Natural Gelling Agent Market. China, India, and Southeast Asia dominate production and consumption, driven by rapid urbanization and dietary changes. The region benefits from abundant raw material sources such as seaweed and guar gum. Rising disposable incomes and a growing middle class fuel demand for processed foods and beverages. It shows one of the fastest growth rates globally. Strong supply chains and export capacity strengthen its competitive position.

Latin America

Latin America holds a smaller but growing share of the Natural Gelling Agent Market, near 7%. Brazil and Mexico lead regional demand, supported by expanding food processing industries. Rising popularity of packaged foods and beverages strengthens adoption. It also benefits from growth in cosmetics and nutraceutical sectors. Supply chain limitations and price volatility challenge producers. However, increasing focus on natural ingredients presents clear opportunities for expansion.

Middle East and Africa

The Middle East and Africa contribute 5% share of the Natural Gelling Agent Market. Demand is driven by cosmetics, halal-certified foods, and pharmaceuticals. The Gulf countries show rising adoption due to premium product demand. Africa grows steadily with expansion of food processing industries. It faces challenges in raw material sourcing and limited infrastructure. Despite barriers, rising urbanization and consumer awareness offer strong long-term opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kerry Group

- Agro Gums

- Ingredion Incorporated

- CP Kelon

- Tate & Lyle

- I. DuPont De Nemours

- Cargill Incorporated

- Riken Vitamin

- Archer Daniels Midland Company

- Naturex

Competitive Analysis

the Natural Gelling Agent Market players such as Cargill Incorporated, Tate & Lyle, Archer Daniels Midland Company (ADM), Ingredion Incorporated, Naturex, Kerry Group, Agro Gums, Riken Vitamin, CP Kelco, E. I. DuPont De Nemours. The Natural Gelling Agent Market is highly competitive, shaped by global demand for clean-label and plant-based solutions. Companies focus on developing advanced extraction methods to improve yield, purity, and sustainability. Strong emphasis is placed on meeting regulatory standards and addressing consumer preferences for vegan and natural formulations. Competition is also driven by the need to balance performance with cost efficiency, particularly in food, beverages, cosmetics, and pharmaceuticals. Innovation in eco-friendly sourcing, functional versatility, and transparent supply chains defines the strategic direction of the market. Firms that align product portfolios with health, wellness, and sustainability trends maintain stronger positions and capture long-term growth opportunities.

Recent Developments

- In January 2025, GELITA introduced Endotoxin Controlled Excipients (ECE) for bioscience applications. The product line includes VACCIPRO and MEDELLAPRO, which meet the requirements of biomedical and pharmaceutical applications. The ECE portfolio consists of medical-grade gelatins and collagen peptides for biomedical applications.

- In August 2024, Traumagel, the latest bleeding control tool, gets approval from the Food and Drug Administration’s medical device clearance, which can address severe bleeding in seconds. It is the 30-ml syringe of an algae- and fungi-based hemostatic gel with the texture and color of hummus.

- In July 2024, KMC a Danish ingredient supplier, introduced the potato-starch-based new gelling agent following the plant-based confectionery production having a soft, chewy texture.

- In March 2023, Hydrosol developed stabilizing and texturing systems to reduce sugar and fat in dairy and deli foods. The developed systems use selected hydrocolloids and vegetable fiber to substitute for the beneficial technological properties of sugar and fat.

Report Coverage

The research report offers an in-depth analysis based on Type, Source, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for plant-based gelling agents will continue to rise with vegan and clean-label trends.

- Technological advancements in extraction methods will improve yield, purity, and consistency.

- Food and beverage applications will remain the largest revenue driver across global markets.

- Pharmaceutical and nutraceutical adoption will expand with demand for safe and functional excipients.

- Sustainability initiatives will push sourcing from renewable and eco-friendly raw materials.

- Regulatory support for natural additives will strengthen compliance and product innovation.

- Emerging economies will witness faster adoption due to rising processed food consumption.

- Cosmetics and personal care industries will increase usage for texture and stability enhancement.

- Strategic collaborations and R&D investments will shape competitive advantages in the sector.

- Digital traceability and transparent supply chains will become key to building consumer trust.

Market Trends

Market Trends