Market Overview:

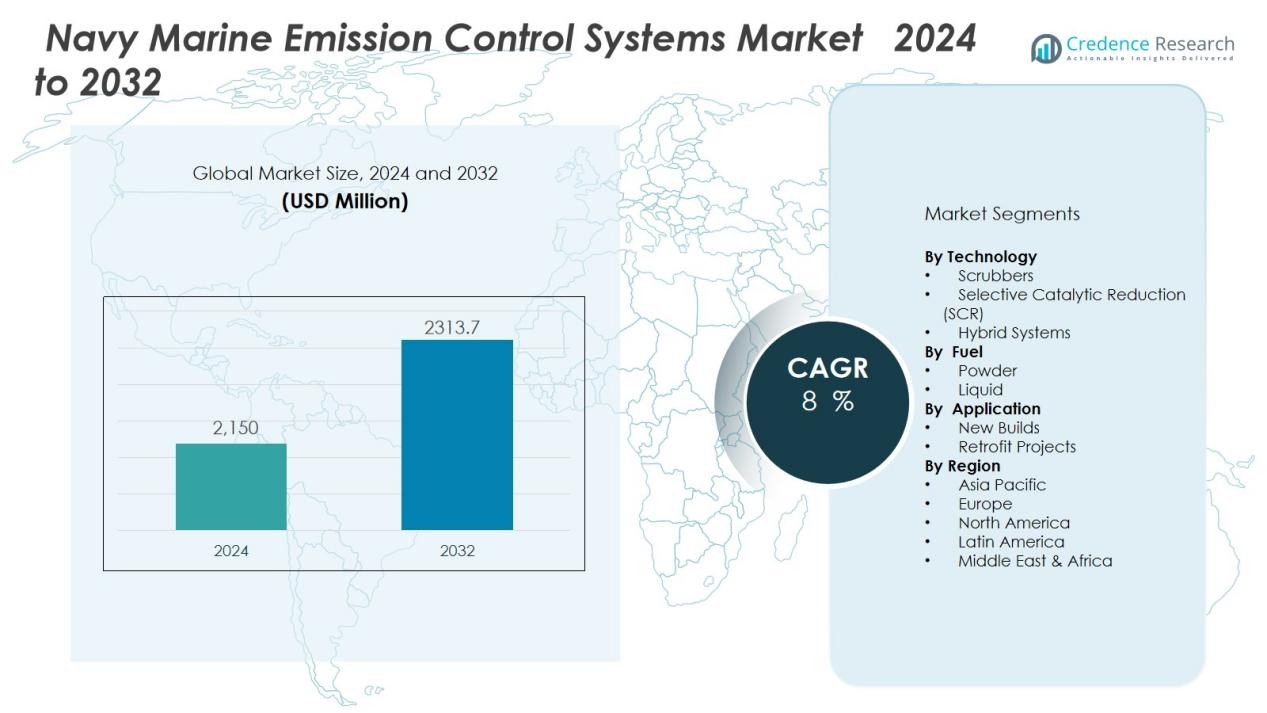

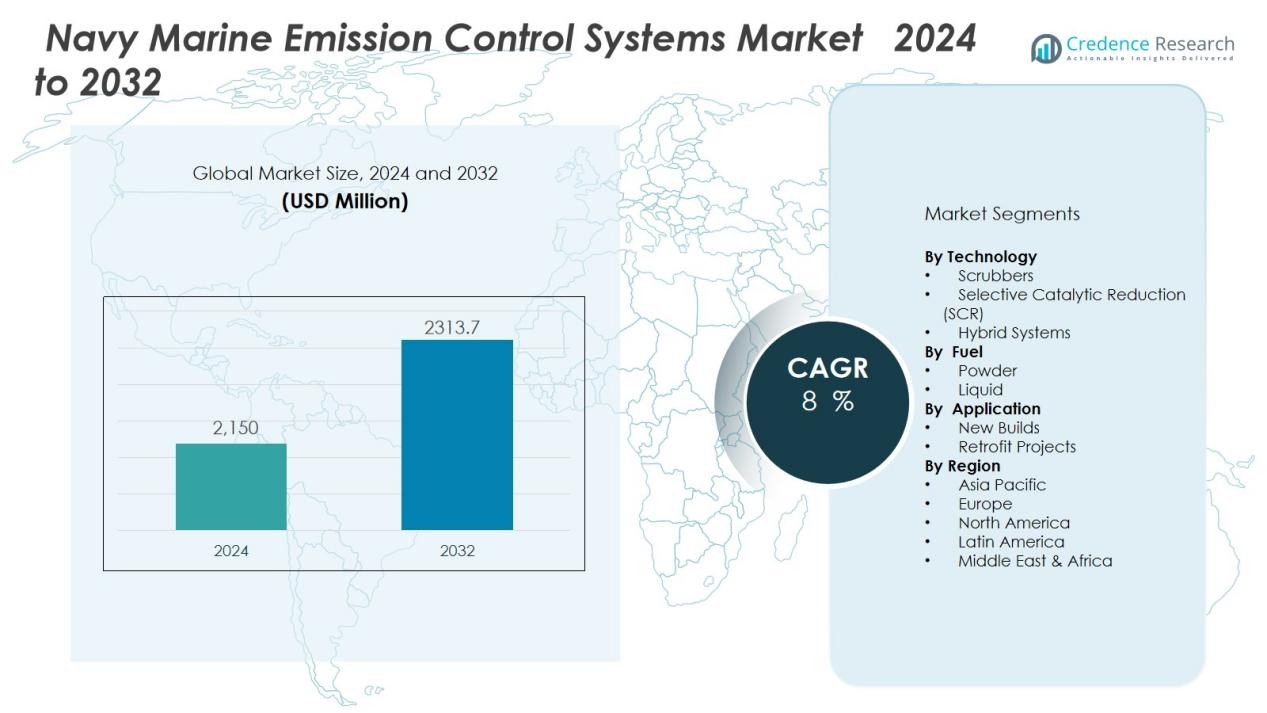

The Navy Marine Emission Control Systems Market size was valued at USD 2,150 million in 2024 and is anticipated to reach USD 2313.7 million by 2032, at a CAGR of 8 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Navy Marine Emission Control Systems Market Size 2024 |

USD 2,150 Million |

| Navy Marine Emission Control Systems Market, CAGR |

8 % |

| Navy Marine Emission Control Systems Market Size 2032 |

USD 2313.7 Million |

Market growth is driven by stringent environmental regulations, rising awareness of naval fleet emissions, and the global shift toward decarbonization. Military operations require compliance with evolving international and regional emission rules, pushing defense organizations to adopt sustainable solutions. Increasing integration of liquefied natural gas (LNG) propulsion, renewable-based auxiliary systems, and hybrid-electric drives further boosts demand. The emphasis on reducing sulfur oxides (SOx), nitrogen oxides (NOx), and particulate matter emissions supports steady adoption across developed and emerging naval fleets.

Regionally, North America and Europe dominate the navy marine emission control systems market due to advanced naval modernization programs and strict environmental compliance. Asia-Pacific is expected to register the fastest growth, supported by rising defense spending in China, India, and Japan, along with expanding shipbuilding capabilities. The Middle East and Latin America are also emerging, driven by naval fleet upgrades and increasing maritime security requirements. This geographic spread highlights a balanced global adoption trend with both developed and developing regions contributing to demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Navy marine emission control systems market was valued at USD 2,150 million in 2024 and is projected to reach USD 2,313.7 million by 2032 at a CAGR of 8%.

- Stringent International Maritime Organization (IMO) regulations on SOx, NOx, and particulate matter emissions are a key driver, accelerating adoption of scrubbers, selective catalytic reduction, and hybrid systems.

- Rising naval modernization and fleet upgrade programs are expanding demand, with LNG propulsion and hybrid-electric systems becoming central to new builds and retrofits.

- Environmental sustainability has become a procurement priority, with defense forces adopting renewable auxiliary power systems and advanced fuel solutions to reduce their carbon footprint.

- High installation and maintenance costs remain a major challenge, with retrofitting older vessels creating financial and technical barriers for countries with limited naval budgets.

- North America leads with 36% share in 2024, supported by strong defense budgets, modernization, and strict compliance, followed by Europe with 29%, driven by EU emission regulations and hybrid adoption.

- Asia-Pacific holds 24% share in 2024 and is the fastest-growing region, fueled by rising defense spending, naval modernization in China, India, Japan, and South Korea, and expanding shipbuilding capacity.

Market Drivers:

Stringent International Maritime Regulations Driving Adoption:

The Navy marine emission control systems market is strongly influenced by International Maritime Organization (IMO) rules. Stricter global emission limits on sulfur oxides, nitrogen oxides, and particulate matter are pressing naval fleets to adopt advanced solutions. Governments are ensuring compliance through monitoring and enforcement. This regulatory pressure directly accelerates the integration of scrubbers, selective catalytic reduction systems, and hybrid emission solutions into naval vessels.

- For instance, Wärtsilä has successfully delivered CCS-Ready scrubber systems for four 8,200 TEU container vessels in 2023, demonstrating their capability to achieve 98% SOx removal efficiency while enabling continued use of economical heavy fuel oil.

Rising Naval Modernization and Fleet Upgrades:

Defense forces are prioritizing modernization programs to strengthen naval efficiency and sustainability. The Navy marine emission control systems market benefits from these initiatives, as emission reduction is now part of fleet upgrade strategies. It is essential for new ships and retrofitted vessels to incorporate technologies that enhance operational compliance. Growing investments in LNG-based propulsion and hybrid systems also expand market opportunities.

- For instance, MAN Energy Solutions secured a contract to supply 10 × 20V32/44CR marine engines (12 MW each) for five Indian Navy Fleet Support Ships, representing the largest MAN four-stroke marine engines delivered to the Indian Navy in their 50-year partnership.

Increasing Focus on Environmental Sustainability in Defense:

Environmental concerns have become a central factor shaping naval procurement. The Navy marine emission control systems market reflects this transition, where emission reduction aligns with broader decarbonization efforts. It supports defense forces in reducing their carbon footprint while maintaining operational readiness. Adoption of renewable auxiliary power systems and advanced fuel solutions underlines this sustainability-driven demand.

Expanding Maritime Security and Regional Defense Spending:

Rising geopolitical tensions and maritime security challenges are increasing naval budgets across many regions. The Navy marine emission control systems market gains from this higher spending, as defense authorities link fleet expansion with compliance to emission standards. It is a priority for both established navies and emerging powers to equip fleets with eco-efficient technologies. Strong regional investments in Asia-Pacific and the Middle East reinforce the pace of adoption globally.

Market Trends:

Integration of Hybrid and LNG-Based Propulsion Systems:

The Navy marine emission control systems market is witnessing strong adoption of hybrid and LNG-based propulsion technologies. Naval fleets are moving away from traditional heavy fuels toward cleaner alternatives that reduce sulfur and nitrogen oxide output. LNG-fueled vessels combined with hybrid-electric systems help defense organizations meet stricter global emission standards. It is also creating demand for advanced scrubbers and catalytic systems that can operate efficiently with multiple fuel types. Shipbuilders are aligning new vessel designs with these technologies, while retrofit programs for existing fleets expand steadily. This trend highlights a dual approach of modernization and sustainability in naval operations.

- For instance, MAN Energy Solutions delivered a comprehensive propulsion package to the Indian Navy for five Fleet Support Ships, featuring 10 × 20V32/44CR marine engines with 12 MW power output per engine, representing the largest MAN four-stroke marine engines delivered to the Indian Navy during their 50-year relationship.

Advancements in Digital Monitoring and Modular Solutions:

The industry is also moving toward advanced digital monitoring and modular system designs. Real-time emission tracking tools are being deployed to help naval authorities ensure compliance and improve operational control. The Navy marine emission control systems market benefits from modular architectures that allow flexible installation and upgrades on different classes of vessels. It is enabling cost efficiency, reduced downtime, and scalability in fleet operations. Manufacturers are focusing on compact, adaptable systems that support both short-term retrofits and long-term modernization. The combination of digital oversight and modular engineering is shaping the future of emission control across naval applications.

- For instance, ABB’s CEMcaptain GAA610-M system incorporates a robust modular design specifically engineered for marine environments, capable of operating at ambient temperatures up to 55°C with high vibration resistance, featuring integrated analyzer modules and sample handling components in a standalone cabinet.

Market Challenges Analysis:

High Costs of Installation and Maintenance:

The Navy marine emission control systems market faces a significant challenge due to the high cost of installation and upkeep. Advanced scrubbers, catalytic converters, and hybrid solutions require large capital investments, which strain naval budgets. Retrofitting older vessels with these systems adds to complexity and expense, often requiring extended downtime. It creates financial barriers for countries with limited defense spending capacity. Maintenance of these advanced systems also demands skilled personnel and continuous supply of specialized parts, which raises operational costs. This cost factor limits widespread and uniform adoption across global naval fleets.

Technical Complexity and Integration Barriers:

Another major challenge lies in the technical complexity of emission control systems and their integration with naval platforms. The Navy marine emission control systems market must address compatibility issues with different classes of ships, from submarines to aircraft carriers. It is difficult to integrate modular systems into existing fleet structures without compromising efficiency. Limited availability of standardized solutions further complicates adoption. Reliability concerns during long missions in harsh marine environments also raise doubts about long-term performance. These barriers highlight the need for more adaptable and durable systems to ensure consistent compliance and operational efficiency.

Market Opportunities:

Expansion of Naval Modernization and Green Defense Programs:

The Navy marine emission control systems market presents strong opportunities through ongoing naval modernization and green defense initiatives. Governments are increasingly aligning defense procurement with environmental policies, creating steady demand for low-emission technologies. It supports fleet renewal programs where new vessels integrate LNG propulsion, hybrid-electric systems, and advanced scrubbers from the design stage. Retrofit projects also open new revenue streams, as existing ships are upgraded to comply with stricter international emission standards. Defense budgets in both developed and emerging economies are incorporating sustainability targets, which expands the market’s addressable scope. This alignment of modernization with environmental responsibility strengthens long-term adoption.

Rising Role of Digitalization and Emerging Regional Investments:

Opportunities also lie in the adoption of digital emission monitoring and smart fleet management tools. The Navy marine emission control systems market benefits from rising interest in systems that offer real-time compliance tracking and predictive maintenance features. It enhances operational readiness while reducing lifecycle costs for naval forces. Growth in Asia-Pacific and the Middle East, supported by defense spending and new shipbuilding activities, creates high-potential markets. Regional investments in maritime security and fleet expansion highlight strong prospects for emission control suppliers. Companies that combine digital solutions with modular, scalable technologies can capture a growing share of these opportunities.

Market Segmentation Analysis:

By Technology:

The Navy marine emission control systems market is segmented into scrubbers, selective catalytic reduction (SCR), and hybrid solutions. Scrubbers hold the dominant share due to their effectiveness in reducing sulfur oxides and compatibility with different naval vessel types. SCR technology is gaining traction as navies focus on nitrogen oxide reduction to meet stricter international standards. Hybrid systems are emerging as a preferred choice for fleets seeking flexibility and efficiency in diverse operational conditions. It benefits from modular design and integration with LNG or dual-fuel propulsion. Growing emphasis on multipollutant control reinforces the adoption of advanced hybrid technologies.

- For instance, WinGD developing X-DF dual-fuel engines that achieve 500 kW per cylinder power output while providing immediate greenhouse gas emission reductions of 15-20% when operating on LNG compared to conventional marine fuels.

By Fuel:

The market is segmented by fuel into heavy fuel oil (HFO), marine diesel oil (MDO), and liquefied natural gas (LNG). LNG holds the fastest growth due to its clean-burning nature and strong support from naval modernization programs. HFO remains in use but requires advanced scrubbers to meet emission standards. MDO offers a balance between cost and compliance, making it suitable for retrofitted vessels. It is evident that LNG adoption is expanding as navies align with global decarbonization initiatives. The shift toward alternative fuels creates new opportunities for emission control suppliers.

- For instance, Royal Navy’s Type 26 frigates are designed with Rolls-Royce MT30 marine gas turbines integrated with LNG-capable systems, generating 36 megawatts each, significantly lowering NOx and SOx emissions.

By Application:

By application, the market is categorized into new builds and retrofit projects. New builds dominate as naval forces integrate emission control technologies into ship design from the start. Retrofit projects also contribute significantly, driven by the need to upgrade older fleets for compliance. It ensures operational readiness while meeting environmental mandates. Hybrid solutions are increasingly used in both categories due to their adaptability. This dual demand highlights balanced growth across applications in global naval operations.

Segmentations:

By Technology:

- Scrubbers

- Selective Catalytic Reduction (SCR)

- Hybrid Systems

By Fuel:

- Heavy Fuel Oil (HFO)

- Marine Diesel Oil (MDO)

- Liquefied Natural Gas (LNG)

By Application:

- New Builds

- Retrofit Projects

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America:

North America holds 36% market share in the Navy marine emission control systems market in 2024. The region maintains its lead due to strong defense budgets, modernization programs, and strict environmental regulations. The United States Navy continues to invest heavily in low-emission propulsion systems and retrofitting of older vessels with advanced scrubbers and catalytic reduction units. Canada also contributes to regional demand with its naval upgrade initiatives focused on sustainability. It benefits from a well-established network of technology providers and shipbuilders, ensuring efficient adoption. Strong emphasis on reducing naval emissions while maintaining combat readiness reinforces growth in this market.

Europe:

Europe accounts for 29% market share in the Navy marine emission control systems market in 2024. The region benefits from stringent European Union regulations on marine emissions that extend to naval fleets. Countries such as the United Kingdom, France, and Germany are upgrading their naval assets with hybrid-electric and LNG propulsion technologies. Shipyards across Europe are integrating modular emission control solutions in both new builds and retrofit programs. It helps navies align with broader decarbonization goals while securing operational efficiency. Regional initiatives focused on clean maritime technologies are expected to further enhance adoption in the years ahead.

Asia-Pacific:

Asia-Pacific holds 24% market share in the Navy marine emission control systems market in 2024. The region is witnessing rapid growth due to rising defense spending by China, India, Japan, and South Korea. Expanding shipbuilding capabilities and large-scale naval modernization programs are creating strong demand for emission control technologies. It is driving adoption of LNG-based propulsion, hybrid systems, and advanced monitoring solutions across different classes of naval vessels. Governments in the region are linking emission compliance with maritime security programs, reinforcing long-term demand. The increasing focus on fleet expansion and sustainability positions Asia-Pacific as the fastest-growing regional market globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- ALFA LAVAL

- Clean Marine

- Babcock and Wilcox Enterprises

- CR Ocean Engineering

- Ecospray Technologies

- Fuji Electric

- Ecospec

- Langh Tech

- Tenneco

- VDL AEC Maritime

- ME Production

Competitive Analysis:

The Navy marine emission control systems market is highly competitive with global and regional players offering advanced solutions. Key companies include Alfa Laval, Clean Marine, Babcock and Wilcox Enterprises, CR Ocean Engineering, Ecospray Technologies, Fuji Electric, Ecospec, and Langh Tech. It is shaped by continuous innovation in scrubbers, selective catalytic reduction systems, and hybrid technologies to meet stricter naval emission standards. Leading firms focus on modular systems, integration with LNG propulsion, and digital monitoring tools to gain a competitive edge. Strategic collaborations with shipbuilders and defense organizations strengthen their position in modernization and retrofit projects. The market is characterized by rising investments in research, regional expansion, and emphasis on cost-efficient solutions. Strong differentiation lies in technical expertise, compliance support, and long-term service capabilities that ensure reliability across diverse naval fleets.

Recent Developments:

- In July 2025, Alfa Laval completed the acquisition of the cryogenics business unit from the French group Fives, expanding its capabilities in cryogenic heat transfer and pump technologies for LNG, hydrogen, and carbon capture.

- In May 2025, Babcock & Wilcox sold major assets of its Denmark-based subsidiary B&W A/S to Kanadevia Inova Denmark, including waste-to-energy combustion technologies.

Report Coverage:

The research report offers an in-depth analysis based on Technology,Fuel, Application, Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The Navy marine emission control systems market will expand with stricter international emission regulations targeting naval fleets.

- Adoption of LNG and hybrid propulsion technologies will accelerate to support sustainable defense operations.

- Digital monitoring solutions will gain prominence, offering real-time compliance tracking and predictive maintenance.

- Retrofit programs for existing naval vessels will create steady demand for modular emission control systems.

- Defense budgets in Asia-Pacific and the Middle East will fuel rapid adoption of eco-efficient naval technologies.

- Partnerships between shipbuilders and technology providers will strengthen integration of advanced emission reduction solutions.

- The shift toward renewable-based auxiliary power systems will influence design and procurement strategies.

- Naval modernization projects will increasingly prioritize emission reduction alongside combat readiness and operational efficiency.

- Continuous research in compact and durable systems will drive deployment across diverse vessel classes.

- Long-term opportunities will emerge from alignment of defense sustainability goals with global decarbonization efforts.