Market Overview

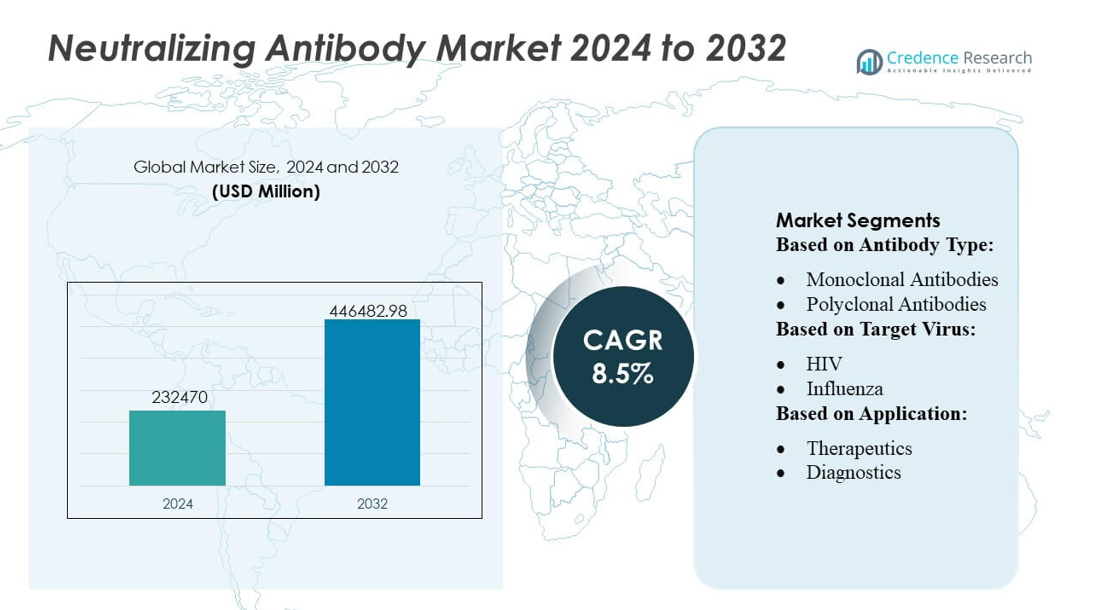

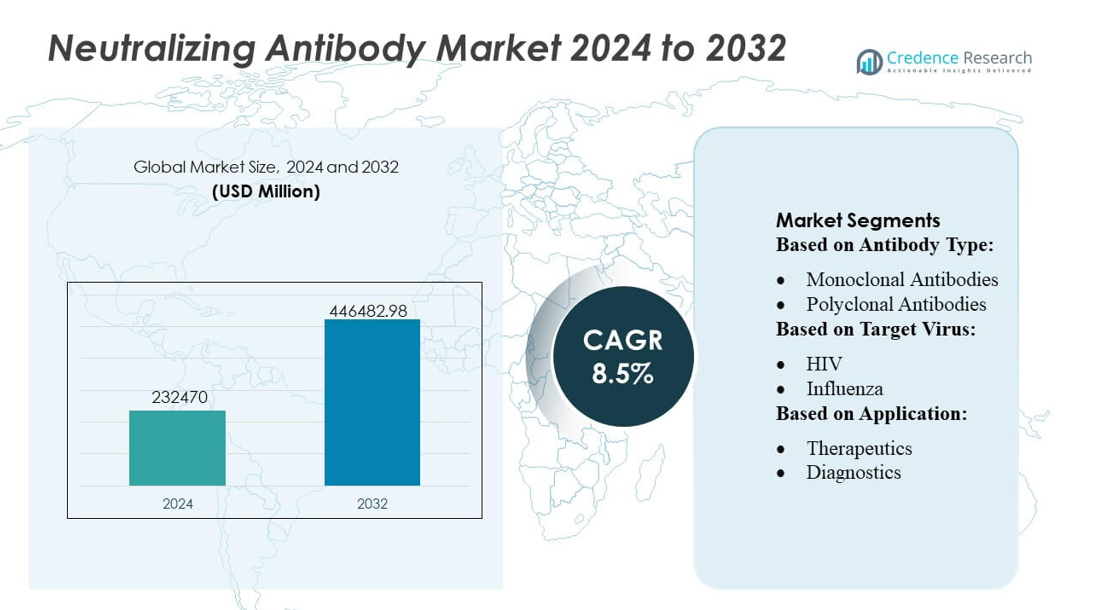

Neutralizing Antibody Market size was valued USD 232470 million in 2024 and is anticipated to reach USD 446482.98 million by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Neutralizing Antibody Market Size 2024 |

USD 232470 million |

| Neutralizing Antibody Market, CAGR |

8.5% |

| Neutralizing Antibody Market Size 2032 |

USD 446482.98 million |

The global neutralizing antibody market features major players such as Pfizer Inc., Regeneron Pharmaceuticals, Inc., AstraZeneca PLC, Roche Holding AG, Eli Lilly and Company, Sanofi SA, GlaxoSmithKline plc, Merck & Co., Inc., and Johnson & Johnson, each maintaining strong R&D pipelines and broad therapeutic portfolios. These firms spearhead development of monoclonal and bispecific neutralizing antibodies targeting infectious diseases and oncology indications, leveraging robust clinical programs and manufacturing capacity. The market exhibits moderate concentration, with top-tier companies sustaining leadership through innovation, regulatory approvals, and global distribution networks. Regionally, North America leads the neutralizing antibody market, accounting for approximately 42% of global share, supported by advanced healthcare infrastructure, high biologics adoption rates, and strong investment in biotechnology. The dominance of North America underscores its critical role in shaping market trends, funding, and therapeutic adoption worldwide.

Market Insights

- The Neutralizing Antibody Market was valued at USD 232,470 million in 2024 and is projected to reach USD 446,482.98 million by 2032, registering a CAGR of 8.5%.

- Market growth is driven by increasing adoption of monoclonal and bispecific antibodies for infectious diseases and oncology, supported by expanding clinical pipelines from leading developers.

- A key trend includes rising integration of AI-driven antibody discovery platforms, enabling faster identification of high-affinity neutralizing antibodies and strengthening innovation among top-tier companies.

- Competitive intensity remains high as Pfizer, Regeneron, AstraZeneca, Roche, and Eli Lilly continue to secure regulatory approvals; however, restraints include high production costs, complex manufacturing, and supply-chain dependencies for biologics.

- Regionally, North America holds 42% share, driven by strong biologics uptake, while among segments, monoclonal neutralizing antibodies dominate due to broad therapeutic applicability and extensive commercialization by global pharmaceutical leaders.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Antibody Type

Monoclonal antibodies dominate the Neutralizing Antibody Market with an estimated 72–75% share, supported by their high specificity, consistent batch performance, and expanded clinical adoption across infectious disease management. Their rapid scale-up through recombinant platforms and strong regulatory approval pipeline further strengthens leadership. Polyclonal antibodies maintain steady demand in niche and emergency-use applications, particularly where broad epitope recognition provides therapeutic advantage. Growth across both categories is reinforced by rising viral mutation rates, increasing global surveillance programs, and accelerating investments in precision antibody engineering.

- For instance, Abbott’s SARS-CoV-2 IgG test running on its ARCHITECT and Alinity platforms demonstrated a specificity of 99.6% and sensitivity of 100% when administered 14 or more days after symptoms onset.

By Target Virus

SARS-CoV-2 remains the leading target virus with an estimated 48–50% share, driven by global vaccination programs, variant-focused therapeutic development, and ongoing demand for next-generation neutralizing antibody candidates. HIV represents the second-largest segment due to long-term research funding, development of broadly neutralizing antibodies, and persistent global disease burden. Influenza, Ebola, Zika, and Hepatitis C collectively contribute incremental growth as manufacturers enhance antibody libraries for emerging and re-emerging pathogens. The expansion of pandemic-preparedness frameworks and cross-reactive antibody platforms continues to support diversified pipeline development across all viral categories.

- For instance, AstraZeneca’s Evusheld (tixagevimab–cilgavimab) demonstrated a mean serum half-life of approximately 90 days due to its YTE-engineered Fc region, and its PROVENT Phase III trial reported a 77% reduction in symptomatic COVID-19 at 28 days and 83% at 6 months, supported by neutralization potency with IC50 values as low as 13.7 ng/mL against the ancestral SARS-CoV-2 strain.

By Application

Therapeutics account for the dominant application segment with an estimated 62–65% share, as neutralizing antibodies gain significant traction for acute treatment, post-exposure prophylaxis, and high-risk patient management. Diagnostics follow, supported by antibody-based rapid assays, advanced neutralization tests, and laboratory-developed testing solutions that require high-affinity antibody reagents. Research and development applications accelerate as biotechnology firms expand screening programs, structural-biology studies, and high-throughput antibody discovery platforms. Growth in this segment is reinforced by increased funding for virology research, development of variant-responsive antibodies, and integration of AI-driven antibody design systems.

Key Growth Drivers

Rapid Advancement in Antibody Engineering Technologies

The market grows strongly as antibody engineering technologies evolve toward higher affinity, improved neutralization potency, and broader epitope recognition. Advances in Fc engineering, structure-guided design, and optimized expression systems enable faster development of next-generation neutralizing antibodies with enhanced stability and reduced immunogenicity. Automated screening platforms and AI-driven predictive models accelerate candidate selection and reduce R&D timelines. These capabilities support expanded therapeutic pipelines, strengthen preclinical success rates, and attract sustained investments from biotechnology firms and government-funded infectious disease programs.

- For instance, Eli Lilly exemplifies this with its development of bamlanivimab (LY-CoV555) and etesevimab (LY-CoV016) for SARS-CoV-2 neutralization.

Rising Global Burden of Infectious Diseases and Variant Emergence

Increasing incidence of viral outbreaks and the persistence of high-burden diseases such as HIV, influenza, and hepatitis C significantly fuel market expansion. New viral mutations and frequent variant emergence intensify demand for neutralizing antibodies that retain broad protection while offering rapid therapeutic response. Public health agencies and international consortia continue to prioritize funding for antiviral drug development, pandemic preparedness, and immunotherapeutic research. This ecosystem supports accelerated clinical trials, emergency-use authorizations, and expansion of neutralizing antibody libraries for both emerging and re-emerging pathogens.

- For instance, DS-5670 recently showed in a Phase 3 booster trial that one dose yielded a geometric mean titer (GMT) of blood neutralizing antibodies against the omicron BA.5 subvariant that was non-inferior to the active comparator vaccine at four weeks after administration.

Growing Adoption of Antibody-Based Therapeutics in High-Risk Patient Groups

Neutralizing antibodies gain traction as frontline or adjunct therapies for immunocompromised, elderly, and high-risk individuals who respond inadequately to vaccines. Their rapid onset of action, targeted mechanism, and ability to reduce viral load elevate clinical relevance across hospital and outpatient settings. Increasing integration of monoclonal antibody therapies into treatment guidelines for respiratory and blood-borne viral infections strengthens adoption. Expanded insurance reimbursement, improved manufacturing scalability, and greater clinical evidence supporting early-stage intervention further accelerate uptake across developed and emerging markets.

Key Trends & Opportunities

Expansion of Broadly Neutralizing Antibodies and Multi-Specific Platforms

A major trend centers on the development of broadly neutralizing antibodies and multi-specific constructs capable of targeting multiple epitopes simultaneously. These platforms offer resilience against viral escape and demonstrate enhanced neutralization breadth across variants. Opportunities emerge as biotech firms explore trispecific, bispecific, and combination-antibody formats, supported by structural biology insights and next-generation sequencing tools. Growing interest in pan-virus antibody candidates incentivizes strategic partnerships and cross-pathogen R&D programs aligned with global pandemic-preparedness strategies.

- For instance, (GSK4182136) has shown potent live-virus neutralization in preclinical assays, binding to a conserved epitope on the SARS-CoV-2 spike protein and maintaining neutralizing activity in pseudovirus tests against multiple variants.

Increasing Use of AI and High-Throughput Screening for Antibody Discovery

AI-assisted modeling, machine-learning–guided epitope prediction, and high-throughput microfluidic screening redefine antibody discovery processes. These tools improve candidate accuracy, shorten development timelines, and enhance prediction of cross-reactive neutralization profiles. Pharma and biotech companies increasingly invest in digital discovery platforms and automated cell-line development systems to expand antibody libraries. The trend creates opportunities for scalable, fast-response programs capable of addressing emerging pathogens within compressed development windows, strengthening industry readiness for future outbreaks.

- For instance, JNJ‑79635322 (JNJ-5322). In a Phase 1 trial of 36 patients with relapsed or refractory multiple myeloma treated at the recommended Phase 2 dose, JNJ-5322 achieved an overall response rate (ORR) of 86.1%, and in 27 patients naïve to BCMA and GPRC5D–directed therapies the ORR reached 100%.

Growth in Diagnostic and Surveillance Applications

Neutralizing antibodies play a growing role in diagnostic assays designed for variant detection, immune-response monitoring, and viral neutralization testing. Demand rises for high-affinity antibodies suitable for rapid tests, pseudovirus neutralization platforms, and laboratory-developed confirmatory assays. Opportunities emerge as global surveillance systems expand, requiring more precise reagents to track immune escape and monitor population-level immunity. This trend supports a broader shift toward integrated diagnostics-therapeutics models and strengthens collaboration between diagnostic developers and antibody manufacturers.

Key Challenges

High Production Costs and Complex Manufacturing Requirements

The market faces limitations due to high manufacturing costs, stringent purification requirements, and reliance on advanced bioreactor infrastructure. Producing consistent, high-potency neutralizing antibodies requires tight process control, increasing operational expenditure for both small and large manufacturers. Supply-chain constraints for critical raw materials and sensitivity to scale-up inefficiencies further elevate production challenges. These cost pressures reduce accessibility in low-resource regions and challenge broad adoption without supportive reimbursement frameworks or government procurement programs.

Risk of Viral Escape and Limited Long-Term Efficacy

A persistent challenge arises from viral mutations that diminish the long-term efficacy of existing neutralizing antibody therapies. Rapid antigenic drift, recombination events, and emergence of immune-evasive variants reduce neutralization potency, requiring continuous reformulation of antibody candidates. This dynamic environment increases R&D complexity and can shorten commercial lifecycles. Maintaining clinical relevance demands ongoing surveillance, accelerated redesign platforms, and multi-epitope targeting strategies that can withstand evolutionary pressure and reduce the likelihood of therapeutic resistance.

Regional Analysis

North America

North America leads the Neutralizing Antibody Market with an estimated 38–40% share, driven by strong biopharmaceutical infrastructure, rapid adoption of antibody-based therapeutics, and extensive funding for infectious disease research. The region benefits from advanced clinical trial networks, high diagnostic penetration, and consistent government support for pandemic-preparedness programs. Major companies expand antibody discovery pipelines through AI-driven platforms and large-scale bioreactor systems, strengthening production capabilities. Robust healthcare expenditure, high awareness of immunotherapeutic applications, and active incorporation of neutralizing antibodies into treatment guidelines further reinforce the region’s dominant position in global market growth.

Europe

Europe holds approximately 28–30% market share, supported by strong R&D intensity, advanced biotechnology ecosystems, and rising investments in antiviral immunotherapies. Countries such as Germany, the U.K., and France drive innovation through public–private research partnerships and growing adoption of monoclonal antibody therapies in infectious disease management. Regulatory frameworks that emphasize safety and accelerated approval for high-need therapeutics help expand market penetration. Increasing focus on cross-border surveillance, early pathogen detection, and development of variant-resistant neutralizing antibodies continues to strengthen Europe’s strategic role in shaping clinical and commercial advancements across the global market.

Asia-Pacific

Asia-Pacific accounts for an estimated 22–24% share, propelled by expanding biotechnology hubs, rising incidence of infectious diseases, and improving access to advanced therapeutic platforms. China, Japan, South Korea, and India enhance market growth through increased investments in antibody engineering, biomanufacturing capacity, and academic–industry collaborations. Growing clinical trial participation and heightened government priorities around outbreak preparedness support broader adoption of neutralizing antibodies. Improved regulatory harmonization and rapid expansion of CRO-led research further elevate the region’s competitiveness, positioning Asia-Pacific as one of the fastest-growing markets with strong long-term development potential.

Latin America

Latin America captures around 6–7% market share, supported by rising awareness of monoclonal antibody–based treatments and growing national initiatives to strengthen infectious disease management. Brazil and Mexico lead regional demand with expanding diagnostic infrastructure, improved vaccine-response monitoring, and adoption of antibody technologies for high-risk populations. Limited biomanufacturing capacity and cost constraints temper growth, yet ongoing partnerships with global pharmaceutical companies help introduce advanced neutralizing antibody therapies. Increased investment in public health resilience, faster regulatory approvals for innovative biologics, and government-backed surveillance programs continue to support gradual but steady market expansion.

Middle East & Africa

The Middle East & Africa region holds an estimated 4–5% share, characterized by rising healthcare modernization efforts and increasing interest in antibody-based therapeutics for viral outbreaks. Gulf countries including the UAE and Saudi Arabia stimulate demand through enhanced clinical infrastructure, greater funding for biologics, and partnerships with global biotech firms. Broader adoption remains challenged by high treatment costs and limited local production capacity, particularly in Sub-Saharan Africa. However, emerging vaccination programs, surveillance initiatives, and improved diagnostic capabilities support incremental growth, gradually expanding access to neutralizing antibodies across priority infectious disease applications.

Market Segmentations:

By Antibody Type:

- Monoclonal Antibodies

- Polyclonal Antibodies

By Target Virus:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Neutralizing Antibody Market features a competitive landscape anchored by Abbott Laboratories, AstraZeneca plc, Pfizer Inc, Eli Lilly And Company, Daiichi Sankyo Company, Limited, Johnson & Johnson Services, Inc., GlaxoSmithKline plc, Amgen Inc., Novartis AG, and Merck & Co., Inc. the Neutralizing Antibody Market continues to strengthen as major biopharmaceutical companies expand their focus on advanced immunotherapies, variant-resistant antibody constructs, and rapid-response antiviral platforms. Manufacturers prioritize high-affinity monoclonal antibody development, multi-specific antibody engineering, and accelerated discovery pipelines supported by AI-driven epitope prediction and high-throughput screening systems. Strategic partnerships with biotechnology firms, research institutes, and government health agencies enhance clinical translation and enable faster progression from preclinical evaluation to regulatory approval. Companies also invest heavily in scalable bioreactor infrastructure and continuous manufacturing technologies, improving production efficiency and ensuring rapid supply availability during outbreak-driven demand surges.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Abbott Laboratories

- AstraZeneca plc

- Pfizer Inc

- Eli Lilly And Company

- Daiichi Sankyo Company, Limited

- Johnson & Johnson Services, Inc.

- GlaxoSmithKline plc

- Amgen Inc.

- Novartis AG

- Merck & Co., Inc.

Recent Developments

- In November 2024, BioNTech announced an agreement to acquire Biotheus, securing worldwide rights to their promising bispecific antibody BNT327 (targeting PD-L1 and VEGF-A) and expanding BioNTech’s oncology pipeline, giving them access to Biotheus’ antibody platform and manufacturing in China. The deal, completed in early 2025, involved cash and stock, with milestone payments, aiming to use BNT327 as a core treatment for various cancers.

- In February 2024, Biocytogen and Gilead Sciences announced a major agreement where Gilead gained access to Biocytogen’s extensive human antibody library (from their RenMice platforms) for three years to discover and develop new antibody drugs, with options for global development, milestone payments, and royalties for Biocytogen, highlighting a key trend in the ADC (Antibody-Drug Conjugate) space.

- In November 2023, Almirall for moderate-to-severe atopic dermatitis (AD) in adults and adolescents (12+ years, 40kg+) eligible for systemic therapy, marking a significant step for this IL-13 inhibitor in Europe, with launches beginning in Germany

Report Coverage

The research report offers an in-depth analysis based on Antibody Type, Target Virus, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand as neutralizing antibodies become central to next-generation antiviral and immunotherapy strategies.

- Developers will advance antibody engineering platforms to improve potency, stability, and manufacturability.

- Partnerships between biotech firms and vaccine manufacturers will accelerate rapid-response antibody programs.

- Broader clinical adoption will rise with growing evidence supporting long-term protection across multiple infectious diseases.

- Pipeline diversification will strengthen as companies target respiratory, vector-borne, and emerging pathogens.

- Manufacturing capacity will increase through greater investment in continuous and single-use bioprocessing systems.

- Regulatory pathways will streamline as agencies refine evaluation frameworks for fast-acting biologics.

- Real-world data integration will enhance post-market surveillance and guide precision immunotherapy development.

- Competitive differentiation will intensify as firms leverage AI-driven antibody discovery and structural prediction tools.

- Global access will improve as technology transfer and regional production enable broader availability in developing markets.