Market Overview

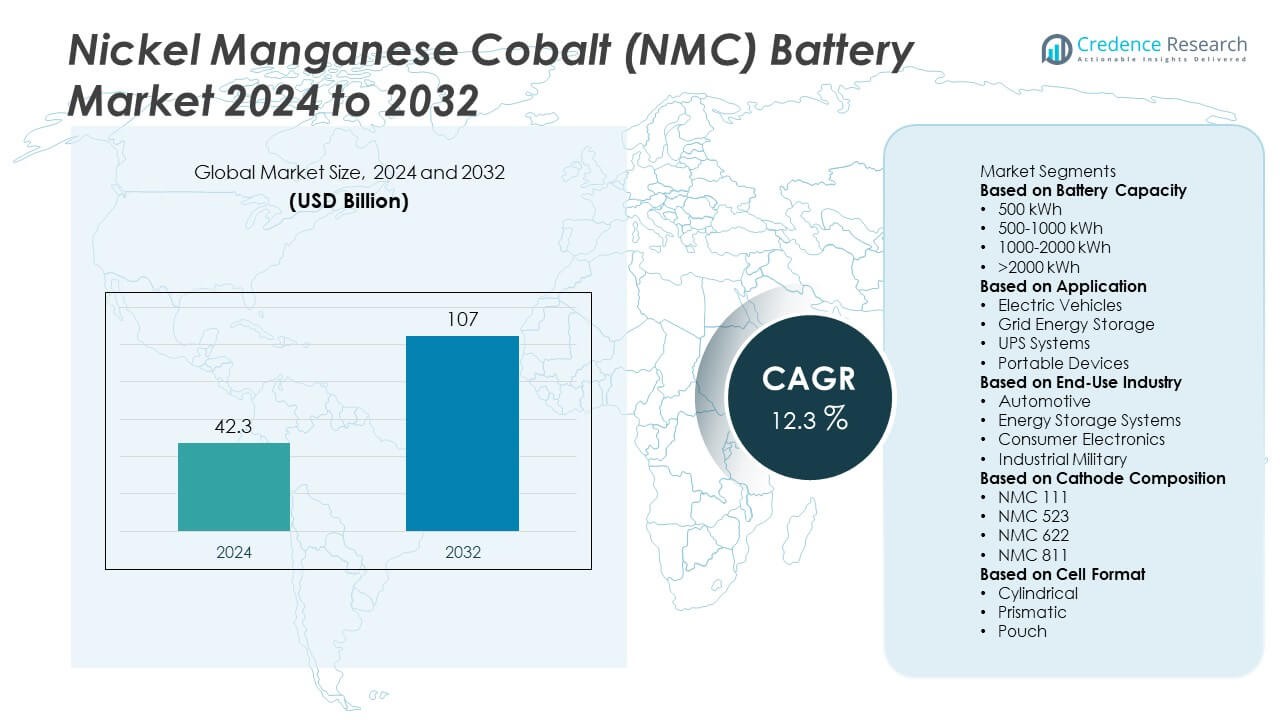

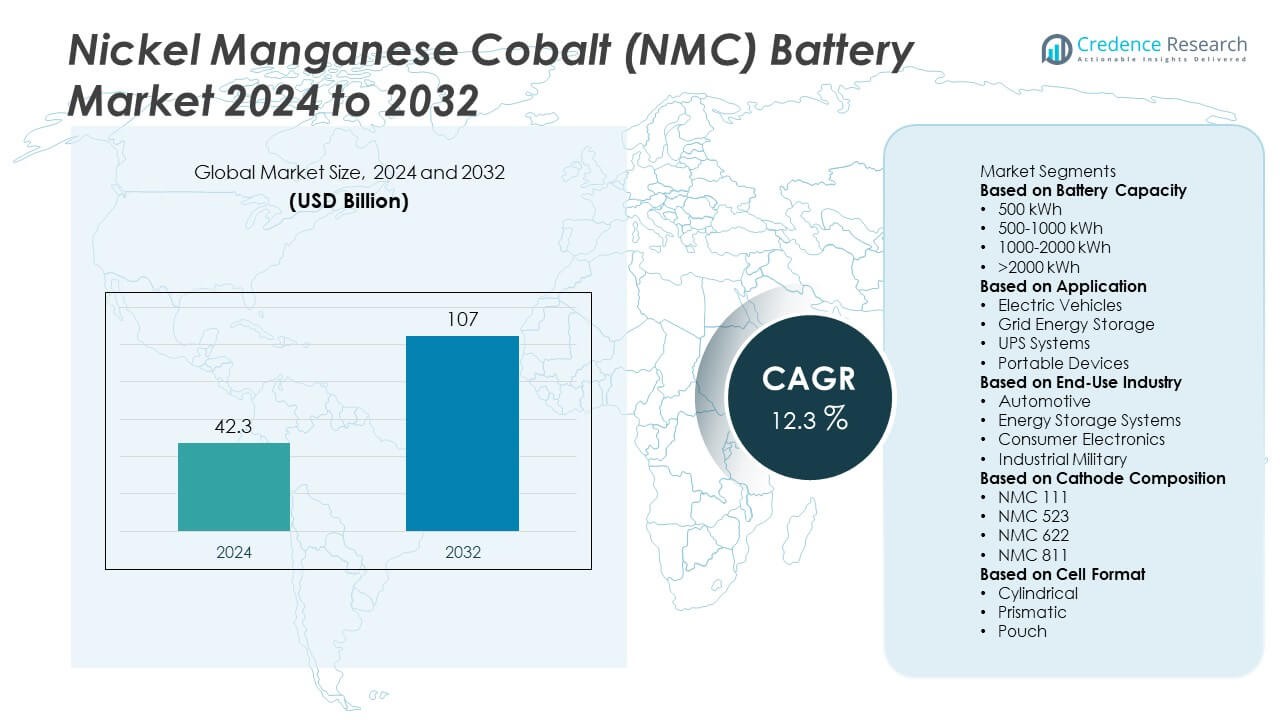

Nickel Manganese Cobalt (NMC) Battery Market was valued at USD 42.3 billion in 2024 and is projected to reach USD 107 billion by 2032, growing at a CAGR of 12.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nickel Manganese Cobalt (NMC) Battery Market Size 2024 |

USD 42.3 Billion |

| Nickel Manganese Cobalt (NMC) Battery Market, CAGR |

12.3% |

| Nickel Manganese Cobalt (NMC) Battery Market Size 2032 |

USD 107 Billion |

The Nickel Manganese Cobalt (NMC) Battery Market grows steadily, driven by rising electric vehicle adoption, expanding renewable energy projects, and strong demand for high-performance energy storage solutions. Automakers favor NMC chemistries for their balance of energy density, safety, and cost efficiency, supporting long-range mobility.

The Nickel Manganese Cobalt (NMC) Battery Market shows strong geographical presence across Asia-Pacific, North America, and Europe, with each region contributing through unique strengths in production, technology, and adoption. Asia-Pacific leads in large-scale manufacturing and raw material processing, with China, Japan, and South Korea hosting major producers and advanced R&D facilities. North America focuses on gigafactory expansions and strong electric vehicle demand, supported by companies like Tesla and General Motors. Europe emphasizes sustainability, recycling, and regulatory alignment to strengthen supply chains and reduce reliance on imports, with Germany and France leading initiatives. Key players shaping the market include Contemporary Amperex Technology Co. Limited (CATL), BYD Company Ltd., Tesla, Inc., and SK Innovation, all investing heavily in next-generation NMC technologies. These players collaborate with automakers and governments to advance battery innovation, expand global production capacity, and ensure stable supply for growing energy and mobility applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Nickel Manganese Cobalt (NMC) Battery Market was valued at USD 42.3 billion in 2024 and is projected to reach USD 107 billion by 2032, growing at a CAGR of 12.3%.

- Strong demand for electric vehicles acts as a key driver, with automakers preferring NMC chemistries for their balance of energy density, cost efficiency, and long cycle life.

- Market trends highlight the shift toward high-nickel variants such as NMC 811, which reduce cobalt dependency, enhance performance, and improve affordability for large-scale automotive and energy applications.

- Competitive intensity is rising, with major companies including CATL, BYD, Tesla, SK Innovation, and General Motors expanding gigafactories, forming partnerships, and investing in recycling technologies to secure supply chains.

- Key restraints include raw material price volatility, limited cobalt availability, and environmental challenges in recycling, which create uncertainty for long-term production and profitability.

- Regional growth is strongest in Asia-Pacific, supported by large-scale production in China, Japan, and South Korea, while North America and Europe advance through government incentives, renewable integration, and regulatory frameworks.

- The market outlook remains positive as investments in gigafactories, sustainable sourcing, and recycling innovations position NMC batteries as a central technology in both electric mobility and renewable energy storage ecosystems.

Market Drivers

Rising Demand from Electric Vehicle Production Driving Large-Scale Adoption

The Nickel Manganese Cobalt (NMC) Battery Market benefits from the rapid growth of electric vehicles worldwide. Automakers prioritize NMC chemistries for their balance of energy density, performance, and affordability. It supports extended driving ranges, making NMC the preferred choice for passenger cars and light commercial fleets. Global initiatives to phase out fossil fuel vehicles accelerate this transition, creating strong demand for high-capacity batteries. Governments implement incentives that encourage faster EV adoption, directly strengthening the market. The continued scale-up of EV production lines sustains long-term requirements for NMC solutions.

- For instance, In June 2024, Tesla’s Gigafactory Nevada produced its 5 millionth drive unit. The company’s global network then celebrated the production of its 10 millionth drive unit in late July 2024.

Growing Focus on Renewable Energy Storage Applications Strengthening Demand Base

The Nickel Manganese Cobalt (NMC) Battery Market experiences growth from rising renewable energy integration into national grids. Solar and wind power expansion require efficient storage systems to stabilize energy supply. It provides a cost-effective solution with reliable cycle life and high energy efficiency. Utilities and energy providers deploy NMC batteries for grid-scale storage projects, ensuring stable electricity delivery. Demand intensifies as countries invest in large-scale energy transition plans. The compatibility of NMC with hybrid energy storage models further accelerates deployment across global power networks.

- For instance, CATL did unveil its second-generation fast-charging Shenxing LFP-based battery in April 2025, and made the claim of 520 km of driving range in 5 minutes of charging.

Continuous Advancements in Material Chemistry Enhancing Battery Performance

The Nickel Manganese Cobalt (NMC) Battery Market evolves with ongoing innovations in cell chemistry and manufacturing processes. Research focuses on optimizing nickel content to increase energy density while reducing cobalt dependency. It helps manufacturers address both cost concerns and supply chain risks. Improvements in electrode composition and coating techniques raise durability and charging efficiency. Industry players invest heavily in pilot projects to commercialize next-generation NMC variants. The emphasis on performance advancements positions NMC technology as a long-term market leader.

Expanding Investments and Strategic Partnerships Driving Production Capacity

The Nickel Manganese Cobalt (NMC) Battery Market grows significantly through rising investments from automotive and energy companies. Global firms commit billions to expand gigafactory operations dedicated to NMC production. It strengthens local supply chains and supports sustainable raw material sourcing. Collaborations between battery makers, mining firms, and technology providers ensure steady availability of critical metals. Partnerships allow cost-sharing in research and development, accelerating innovation cycles. Scaling up production capacities ensures the industry can meet rising global demand efficiently.

Market Trends

Shift Toward High-Nickel Content Chemistries Enhancing Energy Density

The Nickel Manganese Cobalt (NMC) Battery Market is witnessing a strong shift toward high-nickel formulations. Manufacturers increase nickel ratios to improve energy density and extend driving ranges for electric vehicles. It reduces reliance on cobalt, which faces price volatility and supply concerns. Higher nickel content supports faster charging capabilities, making batteries more efficient for both consumer and commercial use. Industry players emphasize scaling production of NMC 811 variants due to their superior performance. This trend aligns with automaker strategies to deliver cost-efficient, long-range electric mobility.

- For instance, CATL high-nickel NMC 811 battery cells do have a significantly higher energy density than 170 Wh/kg. Modern high-nickel NMC cells from CATL, including those with 811 chemistry, can achieve energy densities up to and beyond 300 Wh/kg at the cell level. For instance, CATL’s Qilin battery pack, which uses high-energy NMC chemistry, achieves a pack-level energy density of 255 Wh/kg.

Growing Integration of NMC Batteries in Stationary Energy Storage Systems

The Nickel Manganese Cobalt (NMC) Battery Market expands beyond automotive applications with rising use in stationary storage. Renewable energy adoption requires advanced solutions that stabilize power grids and balance fluctuating supply. It delivers high efficiency and long cycle life, making NMC suitable for solar and wind integration. Utilities and commercial facilities invest in storage systems that rely heavily on NMC chemistry. Demand for hybrid storage solutions combining lithium-ion and renewable power supports this adoption. The trend strengthens as governments commit to decarbonization and long-term sustainability goals.

- For instance, In 2020, Dangjin Eco Power completed the installation of a 9.8 MW solar power plant and a 24.6 MWh Energy Storage System in Dangjin, South Korea, to stabilize power integration.

Focus on Recycling and Circular Economy Models to Secure Supply Chains

The Nickel Manganese Cobalt (NMC) Battery Market is evolving with a growing emphasis on recycling strategies. Companies develop technologies to recover nickel, manganese, and cobalt from end-of-life batteries. It ensures stable raw material supply while reducing environmental impact. Policymakers in major markets enforce stricter regulations for battery collection and reuse. Leading manufacturers establish closed-loop systems that recycle materials directly into new battery production. This trend enhances cost control and builds long-term sustainability across the global value chain.

Strategic Collaborations and Regional Expansion Supporting Market Growth

The Nickel Manganese Cobalt (NMC) Battery Market grows through increasing partnerships between automakers, battery producers, and raw material suppliers. Collaborative agreements secure critical supply and accelerate research into next-generation designs. It strengthens regional manufacturing hubs in Asia-Pacific, North America, and Europe. Governments support local production through subsidies and infrastructure investments. Expansion of gigafactories in multiple regions highlights the focus on capacity building. The trend reflects a global effort to establish resilient, diversified, and sustainable battery ecosystems.

Market Challenges Analysis

High Raw Material Costs and Supply Chain Vulnerabilities Restraining Growth

The Nickel Manganese Cobalt (NMC) Battery Market faces persistent challenges linked to raw material costs and supply chain risks. Volatility in nickel and cobalt prices directly impacts production expenses and reduces profit margins for manufacturers. It increases pressure on battery makers to secure long-term contracts and diversify sourcing channels. Geopolitical tensions and trade restrictions further disrupt access to critical minerals, complicating procurement strategies. Limited availability of cobalt, often concentrated in politically unstable regions, intensifies market uncertainty. These challenges force companies to seek alternatives while balancing performance requirements and economic feasibility.

Technical Limitations and Environmental Concerns Hindering Market Expansion

The Nickel Manganese Cobalt (NMC) Battery Market must address technical and environmental challenges that limit widespread adoption. Safety concerns, including thermal runaway risks, require continuous improvements in design and monitoring systems. It raises costs for research and compliance while slowing large-scale commercialization. Recycling inefficiencies create additional barriers, with only a small fraction of metals recovered from end-of-life batteries. Environmental regulations tighten across major economies, pushing manufacturers to invest in sustainable practices. Despite ongoing advancements, limitations in recycling, safety, and sustainability continue to shape market performance and investment strategies.

Market Opportunities

Rising Electric Mobility and Renewable Energy Deployment Creating Growth Potential

The Nickel Manganese Cobalt (NMC) Battery Market benefits from expanding opportunities in electric mobility and renewable power integration. Governments worldwide support policies that accelerate the adoption of zero-emission vehicles, directly increasing demand for advanced batteries. It offers a competitive mix of energy density and cycle life, making NMC attractive for passenger cars, buses, and commercial fleets. Rapid growth in solar and wind projects also fuels demand for efficient storage solutions that stabilize electricity supply. Utilities and industries invest in large-scale storage systems where NMC batteries provide long-term value. This convergence of automotive and energy applications strengthens the opportunity landscape.

Advancements in Recycling Technologies and Regional Manufacturing Expansion

The Nickel Manganese Cobalt (NMC) Battery Market holds strong opportunities through improved recycling technologies and localized production strategies. Emerging methods to recover nickel, manganese, and cobalt from spent batteries create economic and environmental advantages. It reduces reliance on imports and secures supply chains for critical minerals. Regional governments invest in gigafactories, offering incentives to establish robust manufacturing bases. Partnerships between automakers, mining companies, and technology firms enhance innovation while building sustainable ecosystems. These opportunities highlight the potential for long-term competitiveness and growth across multiple industries.

Market Segmentation Analysis:

By Battery Capacity

The Nickel Manganese Cobalt (NMC) Battery Market shows strong growth across different capacity ranges, addressing diverse energy requirements. Low to mid-capacity batteries dominate consumer electronics, offering efficiency and longer run times for smartphones, laptops, and handheld devices. It meets rising demand for portable power solutions as digital device adoption increases. Medium to high-capacity batteries gain prominence in electric vehicles, supporting extended driving ranges and improved performance. Gigafactories focus on large-capacity variants to align with the rapid scale-up of electric mobility. Utility-scale projects further expand opportunities for ultra-high capacity batteries, reinforcing their role in grid stability and renewable integration.

- For instance, CATL operates numerous production facilities globally, including several gigafactories in and around its Ningde headquarters. The company’s combined annual production capacity is significantly higher than 80 GWh, with its annual sales exceeding 475 GWh in 2024 alone. The company supplies various lithium-ion battery chemistries, including Nickel Manganese Cobalt (NMC) and Lithium Iron Phosphate (LFP), to a broad range of leading automakers worldwide.

By Application

The Nickel Manganese Cobalt (NMC) Battery Market is segmented into electric vehicles, consumer electronics, and energy storage systems. Electric vehicles lead demand due to their need for reliable, high-performance batteries with strong energy density. It supports both passenger and commercial vehicles by enabling cost-effective, long-range mobility. Consumer electronics remain a steady segment, driven by rising global demand for advanced, lightweight devices. Energy storage systems witness strong adoption in solar and wind projects, where NMC batteries ensure grid efficiency and stability. Expanding smart grid initiatives further strengthen opportunities for this application segment.

- For instance, In California, LS Power developed the Vista Energy Storage project, a 40 MW facility that has operated in San Diego County since 2018. The energy storage company Fluence also plays a significant role in California’s grid with other large projects.

By End-User Industry

The Nickel Manganese Cobalt (NMC) Battery Market finds widespread adoption across automotive, consumer electronics, and power generation industries. Automotive leads, supported by government incentives, regulatory pressure, and strong investments in electric mobility. It remains the largest revenue contributor, with carmakers favoring NMC chemistries for performance and cost balance. Consumer electronics sustain consistent growth, with manufacturers integrating NMC batteries to enhance device portability and efficiency. The power generation sector embraces NMC in grid storage, hybrid systems, and renewable energy integration projects. Rising industrial use in backup systems and specialized equipment further diversifies demand across end-user categories.

Segments:

Based on Battery Capacity

- 500 kWh

- 500-1000 kWh

- 1000-2000 kWh

- >2000 kWh

Based on Application

- Electric Vehicles

- Grid Energy Storage

- UPS Systems

- Portable Devices

Based on End-Use Industry

- Automotive

- Energy Storage Systems

- Consumer Electronics

- Industrial Military

Based on Cathode Composition

- NMC 111

- NMC 523

- NMC 622

- NMC 811

Based on Cell Format

- Cylindrical

- Prismatic

- Pouch

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounts for a significant share of the Nickel Manganese Cobalt (NMC) Battery Market, holding around 25% of the global market in 2024. The region benefits from strong adoption of electric vehicles supported by federal and state-level incentives. It gains further momentum through aggressive investments in gigafactories by leading companies such as Tesla, General Motors, and Panasonic. Research and development activities remain a focal point, with U.S.-based institutions and private firms advancing high-nickel formulations to reduce cobalt dependency. Government-backed clean energy programs, such as renewable energy storage initiatives, further strengthen demand for NMC batteries across the region. Canada also contributes significantly by offering access to critical minerals, including nickel and cobalt, supporting local supply chains. This combination of manufacturing expansion, resource availability, and regulatory support ensures North America maintains a competitive position in the global landscape.

Europe

Europe represents approximately 22% of the global Nickel Manganese Cobalt (NMC) Battery Market in 2024, driven by stringent emission regulations and strong adoption of clean mobility. The European Union enforces ambitious carbon neutrality goals, accelerating the need for advanced battery solutions in automotive and grid storage applications. It benefits from government-supported projects that promote gigafactory development in Germany, France, and Sweden, where companies like Northvolt, BASF, and Umicore play a leading role. Europe’s emphasis on recycling and circular economy practices further strengthens the NMC supply chain, reducing reliance on imported raw materials. The region also sees rapid deployment of renewable energy systems where NMC batteries stabilize power grids and support energy security. High demand for electric buses and commercial fleets across urban centers adds to regional adoption. Europe’s alignment of regulatory frameworks, industrial partnerships, and sustainability goals ensures its steady expansion in the global market.

Asia-Pacific

Asia-Pacific dominates the Nickel Manganese Cobalt (NMC) Battery Market with the largest share, standing at around 40% in 2024. China leads the region with extensive manufacturing capacity, home to major companies like CATL, BYD, and LG Energy Solution. It continues to expand electric vehicle adoption through subsidies and large-scale investments in charging infrastructure. South Korea and Japan contribute significantly with strong research, advanced manufacturing, and established partnerships with global automakers. The availability of raw materials, particularly nickel in Indonesia and cobalt processing in China, strengthens the supply chain. Regional governments prioritize localization strategies to build self-sufficient ecosystems in battery production. Rapid growth in both automotive and renewable energy projects ensures that Asia-Pacific remains the largest and fastest-growing hub for NMC batteries.

Middle East & Africa

The Middle East & Africa contributes a smaller portion of the Nickel Manganese Cobalt (NMC) Battery Market, holding around 6% in 2024. Demand grows steadily due to rising investment in renewable energy, especially solar projects in the Gulf countries. It supports energy diversification programs as nations reduce dependency on oil and integrate advanced storage solutions. South Africa plays a strategic role in supplying minerals like manganese, which strengthens regional involvement in the global supply chain. Adoption of electric vehicles remains slower compared to other regions but is gradually gaining attention through government pilot projects. Expansion of smart cities and industrial automation in the Middle East supports future demand for NMC batteries. Although growth is at an early stage, regional resource potential and infrastructure projects present long-term opportunities.

Latin America

Latin America holds about 7% of the Nickel Manganese Cobalt (NMC) Battery Market in 2024, supported by increasing interest in electric mobility and renewable integration. Brazil and Mexico lead adoption through EV pilot programs and government-backed clean energy policies. It benefits from the availability of raw materials such as nickel reserves in Brazil, which supports local and international supply chains. Regional automotive industries slowly integrate NMC batteries as global manufacturers establish joint ventures with local firms. Renewable energy projects, particularly solar and wind in Chile and Brazil, drive demand for energy storage systems using NMC chemistry. Infrastructure gaps and limited policy frameworks remain challenges but are gradually being addressed through regional cooperation. With resource availability and emerging demand, Latin America shows potential for accelerated growth in the coming years.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The competitive landscape of the Nickel Manganese Cobalt (NMC) Battery Market is shaped by leading players including Contemporary Amperex Technology Co. Limited (CATL), BYD Company Ltd., Tesla, Inc., SK Innovation, Ford Motor Company, Toyota Motor Corporation, General Motors, Honda Motor Company, Nissan Motor Company, and LG Energy Solution. These companies dominate through large-scale production, continuous research, and strategic partnerships with automakers and energy providers. They focus on advancing high-nickel NMC chemistries to increase energy density, extend driving ranges, and reduce cobalt dependency, addressing both performance and cost challenges. Investments in gigafactories across Asia-Pacific, North America, and Europe strengthen global supply chains while ensuring steady production capacity. Many players integrate recycling initiatives and closed-loop systems to secure critical raw materials and meet tightening environmental regulations. The industry also witnesses collaborative ventures between battery manufacturers and carmakers to accelerate next-generation battery adoption. Competitive intensity remains high, with each player seeking to secure long-term contracts, scale operations, and drive innovation to maintain leadership in the growing global market.

Recent Developments

- In August 2025, Nissan introduced the N7 sedan in China, featuring a battery pack built on NMC chemistry via Envision AESC.

- In May 2025, Nissan canceled its planned $1.1 billion EV battery (LFP) plant in Kitakyushu, Japan.

- In March 2025, Gigafactory Nevada hit milestones—including production of the 10 millionth drive unit—expanding 4680 cell manufacturing capacity

- In October 2024, Tesla announced plans for four new in-house battery types—including one for a robotaxi—expected to be released in 2026.

Report Coverage

The research report offers an in-depth analysis based on Battery Capacity, Application, End-Use Industry, Cathode Composition, Cell Format and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising demand from electric vehicles and renewable energy projects will fuel market expansion.

- High-nickel chemistries such as NMC 811 will gain momentum due to higher energy density.

- Recycling advancements will improve raw material recovery and enhance supply chain stability.

- Expansion of gigafactories across major regions will increase global production capacity.

- Emerging chemistries like solid-state and sodium-ion will complement but not fully replace NMC.

- Demand for battery-grade nickel will grow significantly to support large-scale production.

- Government incentives and stricter emission policies will accelerate NMC battery adoption.

- Advanced cathode innovations and AI-driven design will improve efficiency and reduce costs.

- Focus on ethical sourcing and environmental sustainability will shape industry strategies.

- NMC batteries will remain dominant in mid to premium EVs and grid-scale energy storage.