Market Overview

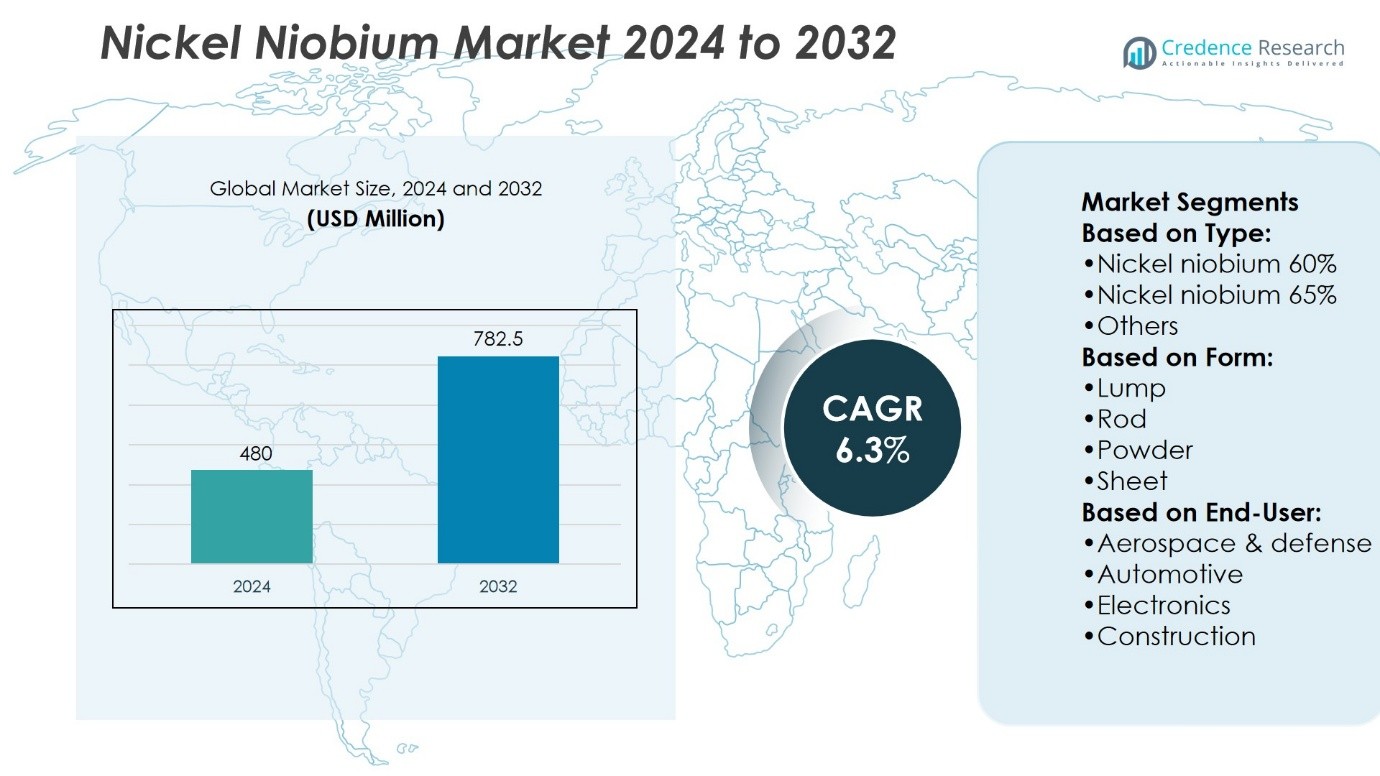

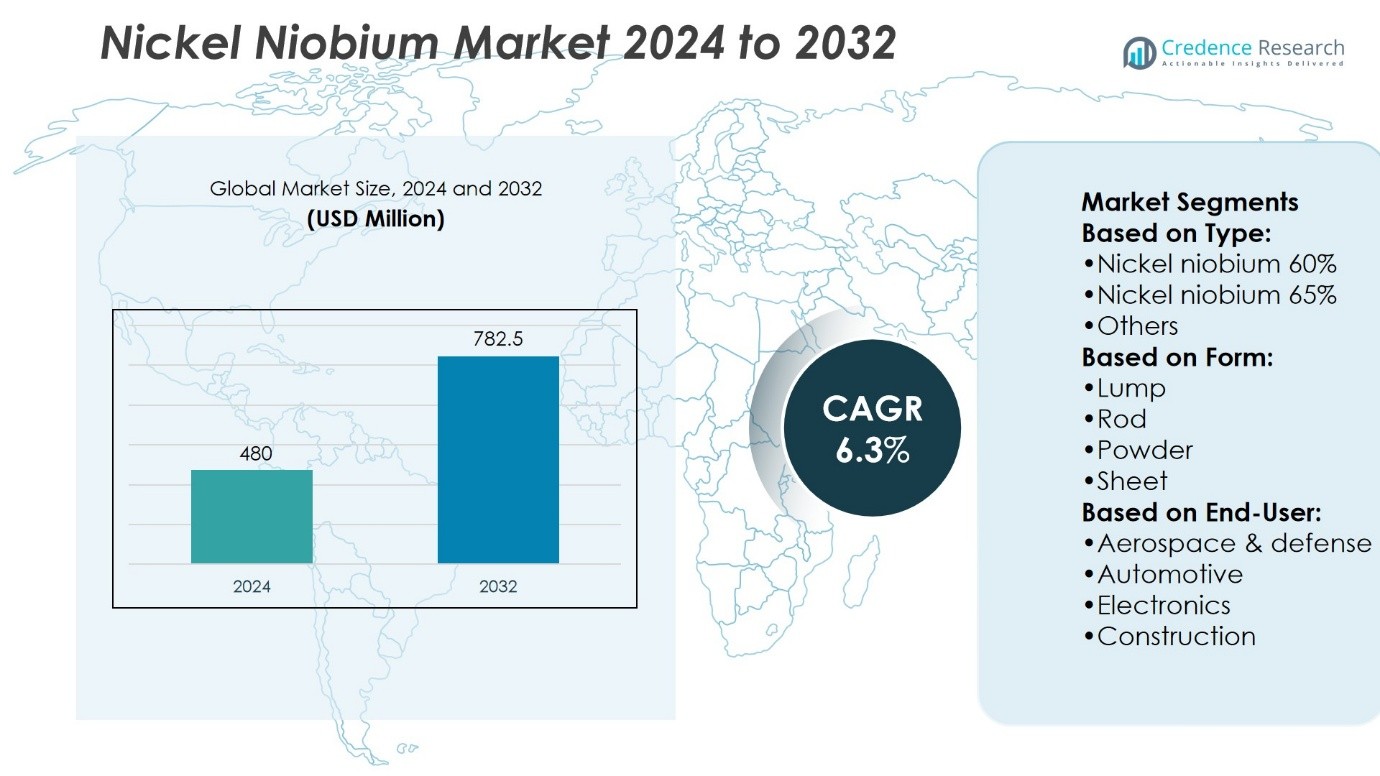

Nickel Niobium Market size was valued at USD 480 million in 2024 and is anticipated to reach USD 782.5 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nickel Niobium Market Size 2024 |

USD 480 Million |

| Nickel Niobium Market, CAGR |

6.3% |

| Nickel Niobium Market Size 2032 |

USD 782.5 Million |

The Nickel Niobium Market is driven by rising demand from aerospace, automotive, electronics, and renewable energy industries, where high-performance alloys enhance durability, conductivity, and thermal resistance. It benefits from growing adoption in electric vehicles, renewable infrastructure, and advanced defense technologies. Trends include expanding use in additive manufacturing, where nickel niobium powders support 3D-printed precision components, and increasing emphasis on sustainable production through recycling technologies. The market also advances with continuous innovations in alloy design, supporting applications in semiconductors, turbines, and structural components. These factors collectively strengthen its position as a critical material for next-generation industrial applications.

The Nickel Niobium Market shows strong geographical presence across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia Pacific and North America leading demand due to aerospace, automotive, and electronics industries. Europe follows with significant adoption in green energy and advanced manufacturing. Latin America remains a key supplier with abundant niobium reserves. Major players shaping the market include CMOC Group Limited, Companhia Brasileira de Metalurgia e Mineracao, TANIOBIS, Niobec, and Magris Performance Materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Nickel Niobium Market size reached USD 480 million in 2024 and is projected to hit USD 782.5 million by 2032, at a CAGR of 6.3%.

- Rising demand from aerospace, automotive, electronics, and renewable energy sectors drives market expansion.

- Increasing use in electric vehicles, defense technologies, and renewable infrastructure strengthens long-term growth prospects.

- Expanding application in additive manufacturing supports adoption of nickel niobium powders for precision 3D printing.

- High production costs and limited raw material availability act as key restraints for wider adoption.

- Asia Pacific and North America dominate demand, while Europe advances in green energy applications and Latin America remains a critical supplier.

- Leading players focus on innovation, supply chain integration, and sustainable production, shaping a competitive market landscape.

Market Drivers

Rising Demand from Aerospace and Automotive Industries

The Nickel Niobium Market gains momentum from strong demand in aerospace and automotive sectors. Lightweight, high-performance alloys support advanced engine efficiency and safety standards. Manufacturers adopt it in turbine blades, jet engines, and automotive exhaust systems to enhance strength and durability. The rising trend toward electric vehicles further increases consumption in battery components and lightweight structural parts. It ensures superior resistance to high temperatures and corrosion, which is critical for long-term performance. Growing global fleet expansion and stricter emission regulations continue to accelerate its use.

- For instance, in the Inconel 625 alloy (used in exhaust systems), niobium and tantalum content ranges from 3.15 g to 4.15 g per 100 g of material, contributing to creep and weldability performance.

Expanding Role in Electronics and Energy Applications

The market experiences robust growth from increasing demand in electronics and energy segments. Nickel niobium alloys enable reliable performance in capacitors, superconducting materials, and semiconductor devices. It supports stability in high-voltage environments and improves conductivity for power transmission applications. Renewable energy projects adopt these alloys for wind turbines and solar technologies due to their durability. The transition toward smart grids and energy-efficient technologies reinforces adoption in infrastructure. Rising investments in next-generation electronics strengthen the need for advanced materials like nickel niobium.

- For instance, NioCorp Developments Ltd. holds a significant deposit of critical minerals at its Elk Creek project, with the latest available data from its 2022 feasibility study indicating probable reserves of 36.656 million tonnes of ore.

Rising Infrastructure Investments and Industrial Growth

Infrastructure expansion across emerging economies significantly boosts the Nickel Niobium Market. Construction, oil and gas, and heavy machinery rely on nickel niobium alloys for structural reinforcement. It delivers high wear resistance, extending the lifespan of industrial equipment. Growing investments in large-scale projects and urban development create sustained demand. Oil refineries and petrochemical plants adopt these alloys to withstand extreme operating environments. Industrial growth in Asia Pacific and the Middle East further fuels material requirements. The integration of high-strength alloys ensures operational reliability in critical projects.

Innovation and Material Advancements Driving Adoption

Continuous advancements in material science create new growth avenues for the Nickel Niobium Market. Research institutions and companies explore alloy modifications to improve thermal stability and machinability. It supports the production of next-generation superalloys used in defense, medical, and advanced manufacturing. Additive manufacturing techniques leverage nickel niobium powders for precise 3D printing applications. Innovations in recycling technologies also improve material efficiency and supply chain sustainability. The rising focus on high-performance, eco-friendly materials ensures broader applications across industries. Growing emphasis on advanced alloy engineering strengthens its long-term market position.

Market Trends

Growing Focus on High-Performance Alloys for Aerospace and Defense

The Nickel Niobium Market shows strong growth in aerospace and defense applications. High-performance alloys deliver superior resistance to extreme heat and stress. It supports the manufacturing of turbine blades, engine components, and defense-grade structural materials. Rising defense budgets and global fleet expansions reinforce adoption across advanced military and commercial aircraft. Manufacturers prioritize lightweight yet durable alloys to improve fuel efficiency and operational reliability. Growing demand for advanced aviation materials sustains a steady trend in this segment.

- For instance, the C-103 niobium alloy is characterized by a yield strength of 341 MPa at room temperature. This property makes it suitable for use in engine components within jet propulsion systems.

Rising Integration in Electric Vehicles and Clean Energy

The market benefits from a growing shift toward electric vehicles and renewable energy. Nickel niobium alloys improve battery performance and structural stability in EV components. It enables enhanced durability in high-voltage systems and reduces weight for greater energy efficiency. Wind turbines and solar systems adopt these alloys for their strength and corrosion resistance. Rising investments in renewable infrastructure encourage wider industrial applications. The global transition to clean energy strengthens the long-term growth trend for nickel niobium adoption.

- For instance, TANIOBIS employs around 660 staff globally across six sites—including Germany, Japan, the USA, and Thailand—supporting large-scale production and integration of niobium powders into EV and clean energy components.

Increasing Role in Electronics and Advanced Manufacturing

Electronics and advanced manufacturing industries create consistent demand for the Nickel Niobium Market. Superconductors, semiconductors, and capacitors rely on nickel niobium alloys for reliability and conductivity. It ensures high stability under extreme conditions, making it vital in modern electronics. Additive manufacturing expands opportunities by using nickel niobium powders for precise 3D printing. The growing shift toward automation and smart devices drives sustained demand for advanced materials. Rising innovation in electronics keeps alloy adoption on a growth trajectory.

Strong Emphasis on Sustainability and Recycling Technologies

Sustainability trends drive innovation across the Nickel Niobium Market. Manufacturers invest in recycling technologies to optimize alloy recovery and reduce raw material waste. It supports environmental regulations and lowers reliance on limited primary resources. Companies adopt circular economy practices, strengthening supply chain resilience. The push toward eco-friendly materials reinforce adoption in green infrastructure projects. Rising global focus on reducing carbon footprints makes sustainable alloy solutions more attractive. This trend ensures long-term market expansion with responsible material use.

Market Challenges Analysis

Limited Raw Material Availability and Supply Chain Constraints

The Nickel Niobium Market faces challenges from limited raw material availability and supply chain risks. Niobium is concentrated in a few regions, creating high dependency on specific suppliers. It exposes manufacturers to price volatility and potential shortages during geopolitical tensions. Transport disruptions and export restrictions further complicate access to consistent supplies. Rising demand from multiple industries intensifies competition for available resources. Companies struggle to balance stable procurement with fluctuating global trade dynamics. These constraints make long-term planning more difficult for industry stakeholders.

High Production Costs and Technical Complexities in Alloy Development

The market encounters obstacles from high production costs and technical challenges in alloy development. Processing nickel niobium requires advanced technologies and strict quality control, raising manufacturing expenses. It limits adoption in cost-sensitive industries despite strong performance benefits. Smaller producers find it difficult to compete with established players due to capital-intensive operations. Complexities in maintaining alloy consistency also restrict large-scale applications. Rising energy prices and environmental regulations add further cost pressures. These factors create hurdles that slow expansion in certain industrial segments.

Market Opportunities

Expanding Applications in Advanced Energy and Electric Mobility

The Nickel Niobium Market holds strong opportunities in advanced energy and electric mobility. Demand for efficient batteries and lightweight components supports its role in electric vehicles. It improves structural strength, conductivity, and thermal resistance, making alloys suitable for high-voltage systems. Renewable energy projects adopt nickel niobium alloys for wind turbines, solar systems, and energy storage solutions. Governments encourage clean energy adoption, creating favorable conditions for alloy integration. Growing emphasis on sustainable energy infrastructure broadens opportunities for long-term market expansion.

Rising Potential in Aerospace, Defense, and Additive Manufacturing

Opportunities increase as aerospace, defense, and additive manufacturing sectors expand globally. Nickel niobium alloys offer high performance in turbine blades, spacecraft, and defense equipment. It ensures durability under extreme environments, making it vital for next-generation technologies. Additive manufacturing unlocks demand for nickel niobium powders in 3D-printed precision components. Defense budgets and commercial aviation growth strengthen material adoption across applications. Rising investment in advanced manufacturing methods creates new opportunities for wider alloy penetration in high-value industries.

Market Segmentation Analysis:

By Type

The market is divided into nickel niobium 60%, nickel niobium 65%, and others. Nickel niobium 60% holds significant demand due to its cost-effectiveness and suitability in various industrial alloys. Nickel niobium 65% is preferred in aerospace and defense applications for its higher strength and corrosion resistance. Other types include customized compositions designed for specific manufacturing needs. It allows industries to adopt specialized alloys tailored to performance requirements. Both standard and custom formulations enhance the versatility of nickel niobium across end-use industries.

- For instance, CMOC’s Brazil NML Niobium Mine produced approximately 9.5 million kg of niobium in 2023, supplying ferroniobium alloys such as Ni‑Nb 60% for a range of industrial uses.

By Form

The Nickel Niobium Market is segmented into lump, rod, powder, sheet, and others. Lump form dominates due to its widespread use in alloy manufacturing for aerospace and automotive industries. Rod form finds applications in defense and construction where structural strength is critical. Powder form is gaining traction with the rise of additive manufacturing and 3D printing technologies. Sheet form supports electronics and renewable energy applications by enabling compact designs and durability. It ensures flexibility for multiple industrial uses, creating diverse opportunities across sectors.

- For instance, Edgetech delivers specialized niobium sheets and foils, primarily serving niche markets like aerospace, medical, and electronics, rather than producing 1 million kg annually. Their business model focuses on high-quality, advanced materials for technical applications.

By End User

End users include aerospace and defense, automotive, electronics, and construction. Aerospace and defense lead adoption with strong reliance on nickel niobium alloys for high-performance turbines and structural parts. Automotive follows with demand in lightweight, durable components and EV battery systems. Electronics use it in superconductors, capacitors, and semiconductors requiring high conductivity and stability. Construction applies nickel niobium in infrastructure and heavy machinery for durability under stress. The growing adoption across all end-user segments highlights its critical role in supporting advanced industrial applications.

Segments:

Based on Type:

- Nickel niobium 60%

- Nickel niobium 65%

- Others

Based on Form:

Based on End-User:

- Aerospace & defense

- Automotive

- Electronics

- Construction

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a market share of 32% in the Nickel Niobium Market, driven by robust demand from aerospace, defense, and automotive sectors. The United States leads adoption due to its advanced aerospace programs, large defense budgets, and established automotive manufacturing base. It supports turbine blades, jet engines, and high-performance vehicles where durability and lightweight structures are critical. Growing electric vehicle adoption in the U.S. and Canada adds momentum, with nickel niobium alloys used in EV batteries and high-voltage components. Strong research and development investments across universities and defense agencies accelerate innovation in alloy applications. Government initiatives encouraging clean energy and sustainable infrastructure further strengthen nickel niobium use across construction and renewable energy projects. The region’s strong industrial base and innovation ecosystem secure its dominant role in market growth.

Europe

Europe accounts for a market share of 27% in the Nickel Niobium Market, supported by its established aerospace, automotive, and electronics industries. Germany, France, and the United Kingdom lead demand through major aerospace manufacturing and high-performance automotive production. It supports advanced alloys used in commercial aviation, luxury vehicles, and renewable energy systems. The European Union’s commitment to green technologies and emission reduction policies encourages alloy adoption in electric mobility and wind power projects. Strong presence of automotive giants and aerospace leaders boosts consumption of nickel niobium across manufacturing hubs. Construction and infrastructure projects across Western and Central Europe also rely on durable alloys to meet safety and sustainability requirements. Continuous investment in innovation and strong regulatory support ensure Europe remains a critical growth region.

Asia Pacific

Asia Pacific captures a market share of 29% in the Nickel Niobium Market, with China, Japan, and India emerging as key contributors. Rapid industrialization, urbanization, and rising infrastructure investments drive alloy consumption across the region. It supports high demand in electronics manufacturing, with Asia Pacific serving as a global hub for semiconductors, capacitors, and advanced consumer devices. China dominates aerospace and automotive expansion, further fueling alloy requirements. Japan and South Korea strengthen demand through their advanced automotive and electronics industries, particularly in EVs and consumer electronics. India’s growing infrastructure development and defense modernization programs provide new opportunities for alloy applications. Expanding renewable energy capacity across the region also creates sustained adoption in solar and wind projects. Strong manufacturing bases and growing technological investments reinforce Asia Pacific’s competitive position.

Latin America

Latin America holds a market share of 7% in the Nickel Niobium Market, with Brazil as the dominant producer of niobium resources. The region benefits from being a key supplier of raw materials, creating strategic importance for global markets. It supports demand in construction, mining equipment, and infrastructure projects across Brazil, Mexico, and Argentina. Adoption in aerospace and automotive sectors is growing steadily as regional industries expand production capacity. Renewable energy initiatives, particularly in wind and solar projects, add to demand for durable alloys. Governments in the region promote industrialization and local manufacturing, which enhances alloy usage. Latin America’s strong resource availability and growing industrial adoption make it a vital support region for global supply chains.

Middle East & Africa

The Middle East & Africa region accounts for a market share of 5% in the Nickel Niobium Market, with steady growth in infrastructure and energy projects. Gulf countries invest heavily in construction and renewable energy, boosting alloy demand in solar, wind, and large-scale infrastructure. South Africa supports mining equipment and defense-related applications, strengthening regional demand. It also gains traction in oil and gas sectors, where alloys are needed to withstand extreme environments. Industrial diversification programs across the Middle East further encourage adoption of advanced materials. Limited local production creates reliance on imports, but growing partnerships with global manufacturers improve access to nickel niobium alloys. The region’s long-term infrastructure strategies and focus on economic diversification sustain steady growth in adoption.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Westbrook Resources

- Titan International

- Edgetech Industries LLC

- Companhia Brasileira de Metalurgia e Mineracao

- CMOC Group Limited

- Magris Performance Materials

- TANIOBIS

- Niobec

- NioCorp Development Ltd

- American Elements

Competitive Analysis

The Nickel Niobium Market companies include Westbrook Resources, Titan International, Edgetech Industries LLC, Companhia Brasileira de Metalurgia e Mineracao, CMOC Group Limited, Magris Performance Materials, TANIOBIS, Niobec, NioCorp Development Ltd, and American Elements. The Nickel Niobium Market is highly competitive, with companies focusing on production efficiency, innovation, and expanding applications across industries. Competition is shaped by control over raw material supply, technological advancements in alloy processing, and the ability to meet strict quality standards. Producers invest in research to develop high-performance alloys that cater to aerospace, automotive, electronics, and renewable energy demands. Supply chain integration and long-term partnerships with manufacturers strengthen competitive positioning. Sustainability also influences strategies, with emphasis on recycling technologies and eco-friendly production processes. Growing demand for lightweight and durable materials continues to intensify competition, driving firms to enhance capabilities and expand global reach.

Recent Developments

- In July 2025, TANIOBIS developed the company says its niobium-based AMtrinsic powders are intended to meet rising demand for components that must maintain mechanical integrity. Their AMtrinsic C-103 and AMtrinsic FS-85 powders enable complex 3D-printed components for jet engine nozzles and satellite thrusters, meeting rising aerospace industry demands.

- In April 2025, CMOC Group Limited reported the Company produces new energy metals such as copper and cobalt, as well as strategic metals including molybdenum, tungsten, niobium. Despite a slight year-on-year price decline, demand remains strong, especially in Asian markets like China and India, driven by automotive and emerging applications.

- In April 2025, Companhia Brasileira de Metalurgia e Mineracao (CBMM) remains a dominant global player with continuous investment in niobium production and sustainability. Their Araxá mine in Brazil continues to supply critical raw material with strategic importance for aerospace, automotive, and green technology sectors.

- In August 2024, NOVONIX and CBMM entered into an agreement to jointly develop new nickel-based cathode materials using NOVONIX’s patented all-dry, zero-waste synthesis process for an environmentally friendly approach and CBMM’s niobium products for improved stability and performance in cathode active materials.

Report Coverage

The research report offers an in-depth analysis based on Type, Form, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for nickel niobium alloys will rise in aerospace and defense applications.

- Electric vehicle growth will boost adoption in batteries and lightweight components.

- Electronics manufacturing will expand usage in superconductors and semiconductors.

- Renewable energy projects will drive demand in wind turbines and solar systems.

- Additive manufacturing will create opportunities through nickel niobium powder applications.

- Recycling technologies will gain importance for sustainable material supply.

- Infrastructure growth will increase usage in construction and heavy machinery.

- Research in advanced alloys will enhance performance and broaden applications.

- Global supply chains will strengthen with investments in production and processing.

- Environmental regulations will encourage adoption of durable and eco-friendly alloys.