Market Overview:

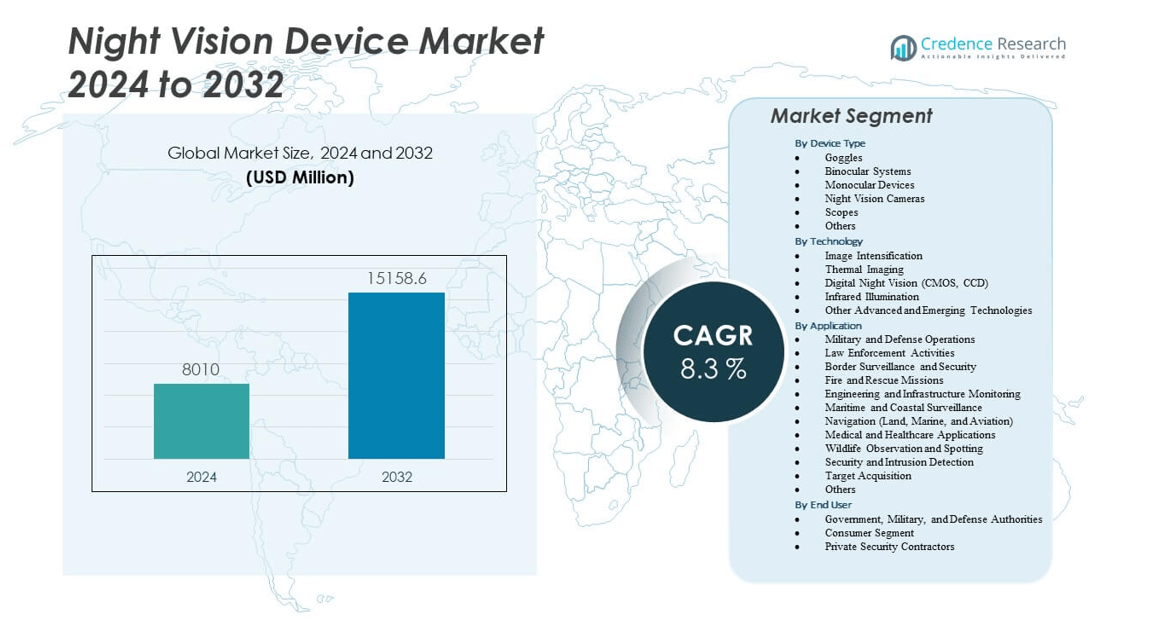

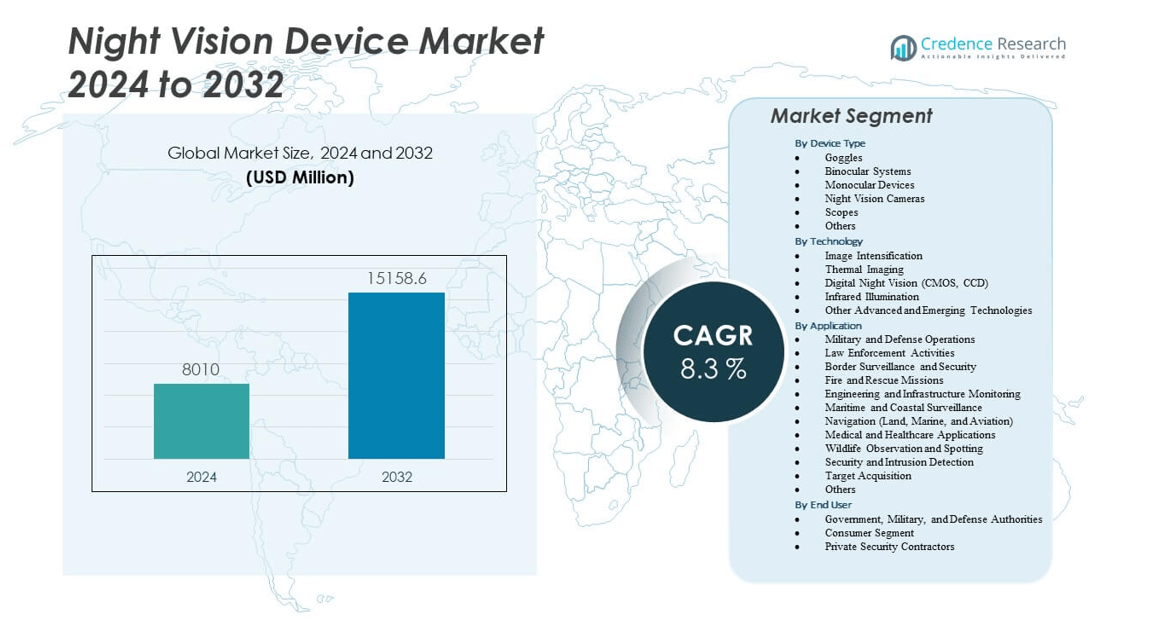

The Night Vision Device Market is projected to grow from USD 8010 million in 2024 to an estimated USD 15158.6 million by 2032, with a compound annual growth rate (CAGR) of 8.3% from 2024 to 2032.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Night Vision Device Market Size 2024 |

USD 8010 million |

| Night Vision Device Market, CAGR |

8.3% |

| Night Vision Device Market Size 2032 |

USD 15158.6 million |

In the evolving landscape of surveillance, defense, and wildlife observation, demand for night vision devices is intensifying. Advances in image intensifier tubes and digital sensors are enabling superior clarity in no-light and low-light environments, attracting both military and civil sectors. Manufacturers are actively investing in miniaturization and integration of thermal imaging with augmented reality overlays to enhance usability. These innovations drive adoption across law enforcement agencies and private security firms, while rising concerns about border control and nighttime safety further catalyze market expansion.

Regionally, North America maintains a dominant position due to substantial defense spending, robust R&D capabilities, and early adoption of cutting-edge technologies. Europe follows closely, supported by strong defense collaboration and growing demand for homeland security solutions. Meanwhile, the Asia-Pacific region is emerging rapidly, with countries investing in modernization of armed forces and infrastructure, bolstering demand in China, India, and Southeast Asia. Latin America and the Middle East are also witnessing increasing adoption, driven by rising security concerns and expanding private sector usage, positioning them as fast-growing markets.

Market Insights:

- The Night Vision Device Market is projected to grow from USD 8010 million in 2024 to USD 15158.6 million by 2032, registering a CAGR of 8.3% during the forecast period.

- Rising defense modernization programs and border security initiatives are driving large-scale adoption of advanced night vision technologies.

- Increasing demand from law enforcement agencies and homeland security bodies is strengthening procurement of portable and high-performance systems.

- High product costs and strict regulatory restrictions remain key restraints, limiting widespread adoption in civilian and price-sensitive markets.

- North America leads the market with 38% share, supported by strong defense spending and advanced R&D, while Europe holds 26% share with collaborative defense initiatives.

- Asia Pacific, with 24% share, is the fastest-growing region due to rapid military modernization in China, India, and Japan.

- Expanding civilian use in outdoor, medical, and commercial surveillance applications highlights diversification beyond traditional defense segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising global defense investments and modernization programs strengthening demand for advanced optical solutions

Military organizations worldwide are allocating significant budgets toward night vision technologies to enhance tactical advantage. Governments are focusing on strengthening border security and counter-terrorism capabilities, which creates steady procurement cycles. It is driving consistent adoption of advanced binoculars, monoculars, and weapon-mounted devices. Law enforcement agencies are integrating these systems to improve surveillance and reconnaissance. Growing cross-border conflicts and territorial disputes accelerate the urgency for reliable night operations. Technology upgrades in lightweight and durable designs support broader usage. The Night Vision Device Market gains momentum as militaries emphasize battlefield efficiency and night dominance. Countries with rising defense budgets are prioritizing indigenous production to reduce dependency on imports. Strategic collaborations between local firms and global players expand long-term procurement opportunities.

- For example, Elbit Systems manufactures the XACT nv33 lightweight night-vision goggles, which are in operational use across multiple NATO forces and police organizations. The company has confirmed that more than 10,000 units of this system are deployed among NATO partners, highlighting its role in enhancing reconnaissance and soldier performance in low-light conditions.

Expanding applications in law enforcement and homeland security boosting procurement of next-generation solutions

National and regional law enforcement agencies are equipping personnel with night vision devices to monitor urban and rural areas effectively. It ensures improved visibility in critical operations including anti-smuggling patrols, counter-narcotics missions, and riot control. Rising security concerns in densely populated cities are driving the demand for portable, easy-to-use devices. Border security forces benefit from multi-spectral solutions that deliver clear visibility during low-light conditions. Continuous threats of organized crime elevate the importance of 24/7 monitoring. Integration with body-worn equipment enables seamless field adoption. The Night Vision Device Market experiences rising traction with stronger focus on homeland security frameworks. Governments are establishing training centers to ensure proper usage of advanced devices. Public-private partnerships are enhancing equipment supply chains and availability.

Increasing civilian adoption for outdoor activities and wildlife observation fueling commercial growth

Consumer markets are demonstrating heightened interest in night vision tools for recreational and professional purposes. Wildlife enthusiasts, campers, and hunters rely on these devices for safe navigation and tracking in dark environments. It supports ecotourism and scientific research by enabling safe wildlife monitoring during nighttime. Affordable and compact designs are making the technology accessible to non-military buyers. Retail channels and online platforms are expanding product visibility across multiple geographies. Rising personal safety concerns encourage adoption by private individuals for property monitoring. The Night Vision Device Market is experiencing robust penetration in non-traditional end-user segments. Growing awareness campaigns highlight the use of these devices for responsible outdoor exploration. Manufacturers are expanding warranty and service offerings to build consumer confidence.

Technological advancements in imaging and digital integration creating strong industry momentum

Progress in digital imaging sensors, infrared illumination, and augmented displays is transforming product capability. It allows users to obtain enhanced clarity and precision under extreme conditions. Manufacturers are investing in miniaturization and integration with thermal technologies to improve performance. Advanced optics are reducing power consumption, improving field usability for extended operations. Integration with mobile applications and GPS tracking creates added value for tactical and civilian use. The defense and commercial sectors are responding positively to rapid product innovation cycles. The Night Vision Device Market continues to benefit from a growing pipeline of R&D-driven advancements. Companies are filing more patents in optics and electronics, reflecting intense innovation activity. Collaborative R&D initiatives with defense agencies accelerate the development of specialized solutions.

- For example, L3Harris has introduced the Enhanced Night Vision Goggle–Binocular (ENVG-B), a helmet-mounted system that fuses image intensification with thermal imaging. It features a full-color 1280×1024 display that supports operational overlays, rapid target acquisition, and augmented reality functions, enhancing situational awareness for U.S. Army units.

Market Trends

Integration of artificial intelligence and data analytics reshaping tactical decision-making and surveillance efficiency

Artificial intelligence is transforming night vision systems into intelligent platforms capable of detecting and classifying objects automatically. It improves accuracy in identifying threats during surveillance missions. Predictive algorithms enable enhanced situational awareness for defense and policing forces. Automated recognition reduces human error and increases mission safety. Manufacturers are incorporating AI features into portable and vehicle-mounted devices. The combination of AI with infrared technology enhances operational reliability under varied conditions. The Night Vision Device Market is evolving with a strong emphasis on AI-driven capability upgrades. Continuous improvements in AI chips enable faster data processing in compact devices. Partnerships with AI software providers create more scalable solutions for global markets.

- For example, FLIR Systems launched the Ranger HDC MR, a high-definition mid-range surveillance system equipped with a 1280×720 thermal imager and an optional 1920×1080 HD color camera. It incorporates embedded analytics and onboard AI processing to enhance threat detection, reduce false alarms, and support faster decision-making in challenging operational environments.

Growing demand for wearable and hands-free designs enhancing usability for both defense and commercial users

Head-mounted displays and helmet-integrated goggles are gaining traction due to ease of movement and operational flexibility. It provides military and law enforcement units with freedom during critical missions. Civilian users including adventurers and security professionals are adopting compact wearable options. Lightweight materials and ergonomic designs enhance long-duration usability. Manufacturers are focusing on creating multi-functional wearable units that integrate seamlessly with existing equipment. Demand for wearable systems is rising in both developed and emerging economies. The Night Vision Device Market benefits from expanding preference toward hands-free operations. Continuous product launches in compact formats increase adoption across tactical markets. Strong demand for modular accessories enhances the utility of wearable devices.

Development of multi-sensor fusion technologies improving real-time vision clarity and cross-environment performance

Manufacturers are combining thermal imaging, low-light sensors, and digital enhancements into a single device. It ensures greater adaptability across different operational environments including fog, smoke, and total darkness. Real-time sensor fusion allows clearer images with improved depth perception. Military forces benefit from higher accuracy in target acquisition under challenging weather conditions. Civil defense applications also gain from enhanced operational safety. This trend drives innovation in both hardware and software design. The Night Vision Device Market is progressing toward greater integration of multi-sensor technologies. Collaborations between optical specialists and semiconductor firms boost fusion capabilities. Demand for ruggedized fusion devices is increasing in harsh field environments.

Expansion of commercial retail channels and e-commerce platforms broadening product accessibility for global users

Online marketplaces and specialized retailers are driving strong growth in consumer adoption. It provides wide access to multiple brands and device categories at competitive pricing. Outdoor enthusiasts and private security buyers are benefiting from the availability of mid-range and entry-level products. Retail expansion encourages global manufacturers to diversify product portfolios. Marketing campaigns highlight both recreational and professional use cases. Regional distributors are strengthening partnerships to reach underserved areas. The Night Vision Device Market is extending its reach through well-structured commercial distribution networks. Direct-to-consumer sales strategies are gaining momentum with global shipping options. Exclusive retail partnerships are increasing brand visibility in local markets.

- For example, ATN Corp launched its X-Sight 4K Pro series, featuring day/night digital rifle scopes equipped with high-definition sensors and integrated Ballistic Calculator functionality. These scopes deliver crisp visuals and precise targeting, and they now enjoy expanded availability through Amazon’s international retail channels, improving accessibility for civilian users worldwide.

Market Challenges Analysis

High product costs and regulatory constraints limiting widespread adoption across civilian and developing markets

Advanced night vision systems involve significant production and R&D expenses, resulting in high retail pricing. It restricts adoption in price-sensitive consumer segments. Regulatory frameworks in several countries impose restrictions on civilian use of military-grade products. Export controls further limit cross-border trade opportunities for manufacturers. The high cost of maintenance and training reduces adoption in smaller defense budgets. Product lifecycle costs discourage procurement by non-military buyers. The Night Vision Device Market faces significant barriers to universal accessibility due to price and policy factors. Limited availability of financing programs constrains acquisition in emerging economies. Rising currency fluctuations further affect affordability in international trade.

Intense competition and cybersecurity risks creating operational and industry-level challenges for market growth

The market is crowded with global and regional players competing aggressively on technology and price. It leads to constant pressure on margins and profitability. Counterfeit and low-quality devices entering the market threaten brand credibility. Cybersecurity concerns arise as modern devices integrate digital connectivity and AI features. Data vulnerability undermines confidence in advanced systems. Evolving global trade tensions impact supply chain stability. The Night Vision Device Market must address competition and security risks to sustain long-term growth. Increasing pressure for regulatory compliance increases costs for manufacturers. Customer concerns about product reliability hinder adoption in sensitive sectors.

Market Opportunities

Rising focus on border protection and smart surveillance systems opening new avenues for manufacturers and technology providers

Governments are intensifying efforts to secure borders with advanced surveillance technologies. It creates opportunities for providers of integrated night vision and thermal imaging systems. Investment in smart city projects drives demand for enhanced public safety solutions. Manufacturers can leverage partnerships with defense ministries and homeland security agencies. Expanding use of drones with night vision payloads further supports demand. Civil aviation and maritime security sectors present additional growth prospects. The Night Vision Device Market gains momentum from evolving requirements in national security and infrastructure safety. Dedicated research budgets accelerate product innovation for specialized surveillance tasks. Opportunities also arise from joint ventures between public and private security agencies.

Growing interest in hybrid technologies and consumer-grade adoption expanding revenue potential for the industry

Hybrid devices combining digital night vision and thermal imaging are gaining market appeal. It offers users versatility for both professional and recreational applications. Rising disposable incomes and awareness encourage consumer adoption across developed and emerging regions. Manufacturers can target hunting, camping, and adventure tourism sectors with affordable models. Technology partnerships enable faster development cycles and innovative features. Expanding use in industrial inspections and search-and-rescue missions opens niche markets. The Night Vision Device Market is positioned to capture value from hybridization and broader consumer interest. Demand for rugged and water-resistant products is expanding in outdoor industries. Strategic marketing campaigns enhance visibility among lifestyle-oriented consumers.

Market Segmentation Analysis:

The Night Vision Device Market is segmented

By device type into goggles, binocular systems, monocular devices, night vision cameras, scopes, and others. Goggles and binocular systems dominate due to their wide adoption in defense and tactical operations. Monocular devices and scopes find strong demand among law enforcement and hunters due to portability and precision. Cameras are gaining traction in surveillance, while other devices support niche applications across both civilian and professional sectors. It reflects a diversified device portfolio meeting varying operational requirements.

- For example, Elbit Systems, through its UK subsidiary, delivered XACT nv33 night-vision goggles to the British Army under contracts extended in 2022 and 2024. Over 3,500 units were supplied to high-readiness units, with the lightweight systems also seeing deployment in NATO operations.

By technology, the market is classified into image intensification, thermal imaging, digital night vision (CMOS, CCD), infrared illumination, and other advanced and emerging technologies. Image intensification remains the most widely used technology in defense applications, while thermal imaging is increasingly valued for all-weather performance. Digital systems appeal to consumers seeking affordable options, and infrared illumination ensures visibility in total darkness. Emerging technologies expand scope by integrating advanced optics and smart capabilities.

By applications cover military and defense operations, law enforcement activities, border surveillance, fire and rescue, engineering, maritime monitoring, navigation, medical, wildlife observation, security, and target acquisition. Defense and law enforcement lead demand, but growing adoption in commercial security, wildlife research, and healthcare demonstrates sector diversification. Each application highlights the importance of visibility in low-light environments.

- For example, L3Harris Technologies has supplied over 10,000 ENVG-B units to the U.S. Army, enhancing navigation and target acquisition with fused imaging. Hikvision deployed night-capable cameras in African conservation areas, supporting continuous wildlife monitoring and biodiversity protection.

By end user, the market serves government, military, and defense authorities, consumers, and private security contractors. Government and defense remain the primary buyers due to strategic needs, while consumer and private security adoption is growing steadily with expanding affordability and accessibility.

Segmentation:

By Device Type

- Goggles

- Binocular Systems

- Monocular Devices

- Night Vision Cameras

- Scopes

- Others

By Technology

- Image Intensification

- Thermal Imaging

- Digital Night Vision (CMOS, CCD)

- Infrared Illumination

- Other Advanced and Emerging Technologies

By Application

- Military and Defense Operations

- Law Enforcement Activities

- Border Surveillance and Security

- Fire and Rescue Missions

- Engineering and Infrastructure Monitoring

- Maritime and Coastal Surveillance

- Navigation (Land, Marine, and Aviation)

- Medical and Healthcare Applications

- Wildlife Observation and Spotting

- Security and Intrusion Detection

- Target Acquisition

- Others

By End User

- Government, Military, and Defense Authorities

- Consumer Segment

- Private Security Contractors

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

North America holds the largest share of the Night Vision Device Market, accounting for 38%. Strong defense spending in the United States, combined with advanced R&D initiatives, drives consistent procurement of night vision systems across the region. Law enforcement agencies and homeland security departments adopt portable devices for surveillance and tactical operations. It benefits from an established ecosystem of manufacturers, distributors, and technology innovators. Canada also contributes to regional growth with investments in border security and military modernization. The region remains a hub for early adoption of next-generation imaging and wearable night vision solutions.

Europe represents 26% of the Night Vision Device Market, supported by collaborative defense initiatives and increasing focus on counter-terrorism. Countries such as Germany, the UK, and France prioritize modernization programs for ground and aerial forces. Law enforcement agencies in urban centers are adopting compact night vision systems for surveillance and riot control. Maritime surveillance along coastal borders strengthens demand for cameras and goggles. It is also supported by active participation of regional manufacturers supplying both domestic and global markets. Growth in this region is further supported by rising civilian adoption in outdoor and recreational applications.

Asia Pacific captures 24% of the Night Vision Device Market and is the fastest-growing region due to strong investments by China, India, and Japan in military modernization and border control. Increasing demand in wildlife conservation and maritime security also supports adoption. Latin America accounts for 6% of the market, driven by security challenges, private sector usage, and gradual government procurement programs. The Middle East & Africa represents 6% of the market share, with GCC countries and South Africa showing notable demand for surveillance and defense. It demonstrates strong growth potential as governments strengthen internal and external security frameworks. The combined regions reflect expanding opportunities driven by diverse applications and improving distribution networks.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Teledyne FLIR LLC (US)

- L3Harris Technologies Inc. (US)

- Thales Group (France)

- BAE Systems PLC (UK)

- Elbit Systems Ltd. (Israel)

- Raytheon Company (US)

- Collins Aerospace

- Bharat Electronics Limited (India)

- American Technologies Network Corp. (US)

- Yukon Advanced Optics Worldwide

- Bushnell

- Firefield

- Apresys, Inc.

- SATIR

- Luna Optics, Inc.

Competitive Analysis:

The Night Vision Device Market is highly competitive, with leading companies focusing on innovation, product expansion, and strategic partnerships. Major players such as Teledyne FLIR, L3Harris Technologies, Thales, BAE Systems, and Elbit Systems dominate the defense and aerospace segments with advanced imaging technologies. Consumer-focused firms including ATN, Bushnell, Yukon, and Luna Optics strengthen their presence through affordable digital and thermal devices. It reflects a dual structure where global defense suppliers emphasize government contracts while commercial brands target private security and recreational users. Recent developments include the integration of artificial intelligence in night vision systems, expansion of wearable and handheld solutions, and growing emphasis on hybrid technologies combining thermal and digital imaging. Partnerships with defense agencies and increased investment in R&D continue to shape competition.

Recent Developments:

- In August 2025, THEON International acquired 100% of Kappa Optronics GmbH, a German specialist in aviation and land optronics, strengthening its night vision and electro-optics capabilities. The acquisition expands THEON’s product base and enhances its global platform in the night vision domain.

- In Feb 2025, Deepnight, a startup founded by Google alumni, raised $5.5 million to develop affordable AI-driven military night vision goggles. It combines low-light cameras with advanced AI image processing to enhance visibility using just a smartphone and secured $4.6 million in contracts from the U.S. Army, Air Force, and private firms.

- In Jan 2025, L3Harris Technologies secured a significant contract with the U.S. Army for enhanced night vision goggle-binoculars (ENVG-B) featuring augmented reality interfaces. That deal bolsters its leadership in tactical vision systems by integrating situational overlays to support battlefield awareness.

- In July 2024, Teledyne FLIR introduced the Boson+ thermal camera module, featuring an enhanced sensitivity of 30 mK and advanced onboard image processing for improved detection in low-light environments.

Market Concentration & Characteristics:

The Night Vision Device Market demonstrates moderate to high concentration, led by established defense contractors alongside specialized consumer optics firms. It is characterized by continuous innovation in digital imaging, thermal sensors, and miniaturized designs. Market leaders hold strong bargaining power through government and defense contracts, while smaller firms compete by offering cost-effective consumer solutions. The industry exhibits a mix of high barriers to entry in military applications and relatively accessible entry in civilian markets, creating a dynamic yet segmented competitive landscape. Continuous focus on technology differentiation remains the key factor shaping long-term competitiveness.

Report Coverage:

The research report offers an in-depth analysis based on Device Type, Technology, Application and End User. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Increasing defense modernization programs will drive steady procurement of advanced night vision systems across multiple regions.

- Integration of thermal imaging with digital night vision technologies will expand adoption in both military and civilian applications.

- Rising investments in artificial intelligence will enhance object detection, image clarity, and operational safety.

- Wearable and lightweight designs will gain traction among law enforcement, security professionals, and outdoor users.

- Expansion of commercial retail channels and e-commerce platforms will improve accessibility for consumer-grade devices.

- Growing interest in hybrid technologies will create new opportunities for manufacturers to diversify product portfolios.

- Strengthening demand for border surveillance and homeland security will fuel partnerships between governments and technology providers.

- Advancements in miniaturization and energy-efficient designs will increase usability in extended field operations.

- Emerging applications in medical, industrial inspection, and search-and-rescue missions will broaden market scope.

- Increasing collaboration between global defense suppliers and regional manufacturers will shape competitive dynamics and accelerate innovation.