Market Overview

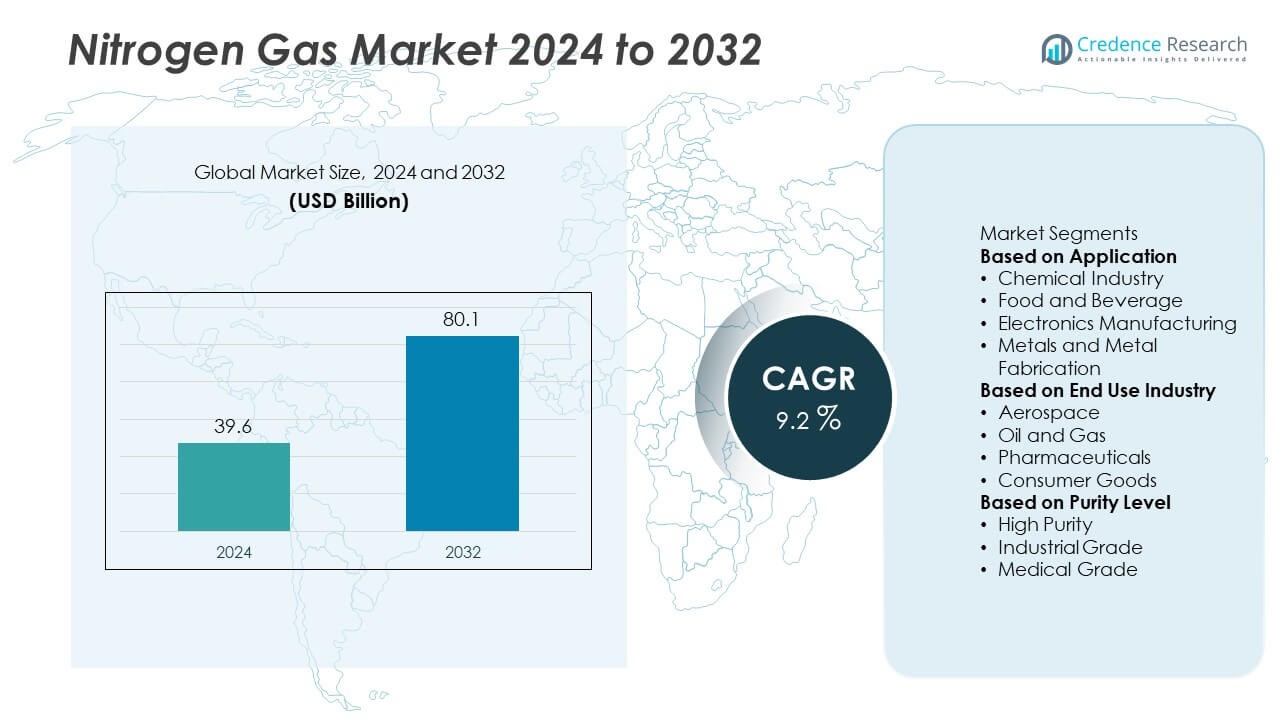

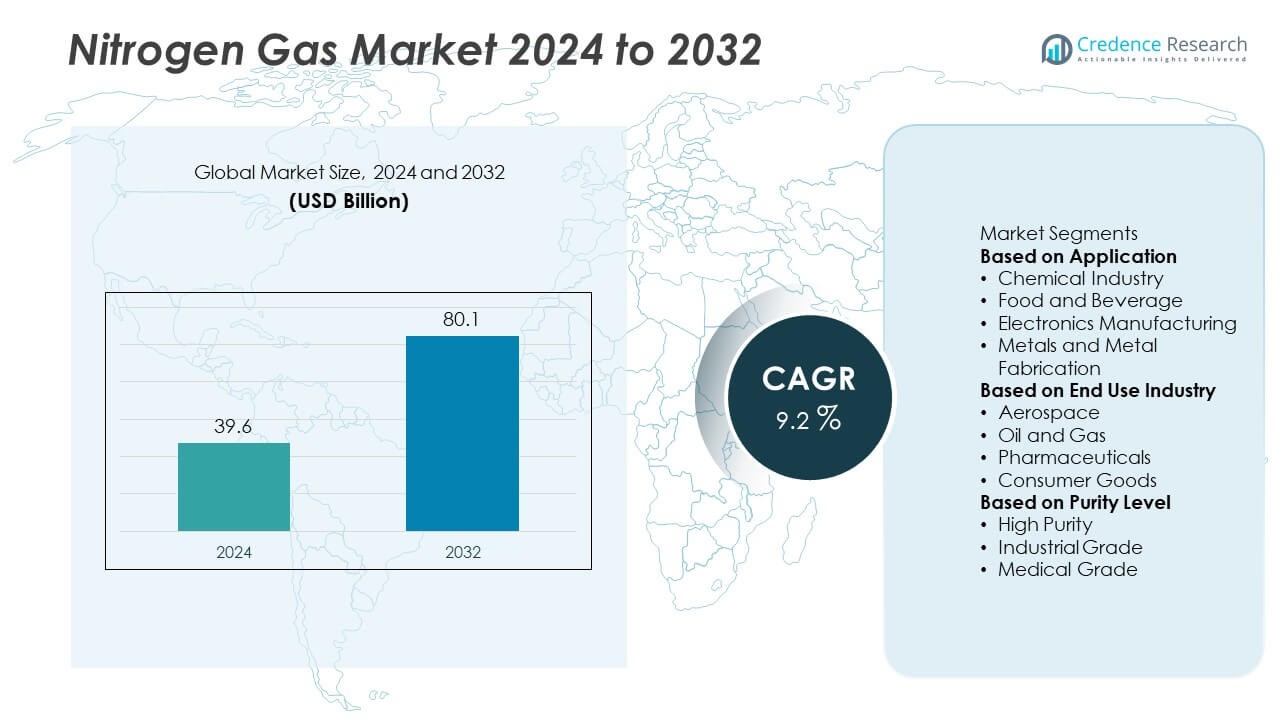

The Nitrogen Gas Market was valued at USD 39.6 billion in 2024 and is projected to reach USD 80.1 billion by 2032, expanding at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Nitrogen Gas Market Size 2024 |

USD 39.6 Billion |

| Nitrogen Gas Market, CAGR |

9.2% |

| Nitrogen Gas Market Size 2032 |

USD 80.1 Billion |

The Nitrogen Gas Market grows through rising demand from food packaging, healthcare, electronics, and energy sectors. It benefits from strict quality standards in pharmaceuticals and biotechnology, where nitrogen ensures product stability and safe storage. Expanding semiconductor manufacturing drives adoption of ultra-high-purity nitrogen to prevent contamination.

The Nitrogen Gas Market demonstrates strong presence across all major regions, driven by diverse industrial and consumer applications. Asia-Pacific leads with significant demand from electronics, pharmaceuticals, and food processing industries in China, Japan, South Korea, and India. Europe advances with sustainability-focused adoption in food preservation, healthcare, and advanced manufacturing, supported by strict environmental regulations. North America shows steady growth through strong demand from biotechnology, energy, and packaged food sectors, while Latin America and the Middle East & Africa expand through oil, gas, and industrial applications. It benefits from modernization of infrastructure and adoption of on-site generation systems across these regions. Key players shaping the market include Linde, a global leader in industrial gases, Air Products and Chemicals, known for advanced on-site generation solutions, Yara International, a major supplier of nitrogen-based products, and Taiyo Nippon Sanso Corporation, which plays a crucial role in electronics and healthcare-focused nitrogen supply.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Nitrogen Gas Market was valued at USD 39.6 billion in 2024 and is expected to reach USD 80.1 billion by 2032, expanding at a CAGR of 9.2% during the forecast period.

- Rising demand from food packaging, pharmaceuticals, and biotechnology drives the market, with nitrogen ensuring longer shelf life, safe storage, and controlled atmospheres for sensitive products.

- Strong trends emerge in on-site nitrogen generation systems, ultra-high-purity nitrogen use in semiconductors, and adoption of sustainable production technologies powered by renewable energy sources.

- The market remains competitive with key players such as Linde, Air Products and Chemicals, Yara International, BASF, and Taiyo Nippon Sanso Corporation focusing on technological advancements and strategic partnerships.

- High production costs linked to energy-intensive processes and compliance with strict safety standards act as restraints, limiting rapid adoption in cost-sensitive industries and developing markets.

- Asia-Pacific leads due to strong demand from electronics, food, and healthcare, while Europe advances through sustainable packaging and pharmaceuticals. North America benefits from biotechnology and energy applications, with Latin America and Middle East & Africa expanding through oil, gas, and industrial sectors.

- Growing opportunities arise from healthcare expansion, semiconductor production, and adoption of eco-friendly nitrogen systems, positioning nitrogen gas as a critical enabler of innovation, safety, and efficiency across industries worldwide.

Market Drivers

Rising Demand from Food and Beverage Industry

The Nitrogen Gas Market benefits from strong demand in the food and beverage sector. Nitrogen extends shelf life by displacing oxygen and preventing spoilage in packaged goods. It is widely used in modified atmosphere packaging for meat, dairy, and ready-to-eat products. It ensures freshness and supports global supply chains. Growing demand for processed and convenience foods fuels wider application of nitrogen in packaging lines. It strengthens the market position of nitrogen as a critical enabler of food safety and quality.

- For instance, The CRYOLINE® CF is a cabinet freezer designed for batch freezing of smaller product quantities and is not an in-line system. A larger, continuous-belt unit like the CRYOLINE® CW or CRYOLINE® XF would be used for high-volume processing, as they are capable of rates over 500 kilograms per hour.

Expanding Applications in Healthcare and Pharmaceuticals

The Nitrogen Gas Market grows through rising usage in healthcare and pharmaceutical industries. Nitrogen provides an inert atmosphere for storing drugs, vaccines, and biological samples. It supports cryopreservation of cells and tissues in laboratories and medical research. It also plays a key role in drug manufacturing processes requiring controlled environments. Growing investments in biotechnology and personalized medicine increase its demand. It reinforces nitrogen’s value in ensuring quality and stability of sensitive medical products.

- For instance, Air Products and Chemicals supplied liquid nitrogen systems and specialized freezers for vaccine storage during the COVID-19 distribution phase. Storage units maintained ultra-cold temperatures, with some holding temperatures as low as -80°C to preserve the biological integrity of mRNA vaccines like those from Pfizer-BioNTech.

Increasing Use in Electronics and Semiconductor Manufacturing

The Nitrogen Gas Market expands with the growth of electronics and semiconductor manufacturing. Nitrogen offers a controlled environment that reduces oxidation during chip fabrication. It supports soldering, reflow processes, and cleaning of sensitive components. It ensures reliability and performance of microchips in advanced devices. Growing production of smartphones, electric vehicles, and consumer electronics drives demand for high-purity nitrogen. It highlights the importance of nitrogen in sustaining innovation across technology-driven sectors.

Rising Demand in Oil, Gas, and Industrial Applications

The Nitrogen Gas Market gains momentum from its use in oil, gas, and broader industrial applications. Nitrogen is applied in enhanced oil recovery, pressure maintenance, and pipeline purging. It also provides inerting and blanketing solutions in chemical manufacturing and metal processing. It enhances safety by reducing fire and explosion risks in hazardous environments. Expanding energy exploration projects and industrial operations sustain steady demand. It underlines nitrogen’s critical role in supporting large-scale industrial efficiency and safety.

Market Trends

Growing Shift Toward On-Site Nitrogen Generation Systems

The Nitrogen Gas Market shows a rising preference for on-site generation systems over bulk supply. Industries adopt membrane and pressure swing adsorption technologies to produce nitrogen directly at facilities. It reduces reliance on external suppliers and ensures continuous availability. On-site systems also lower operational costs and enhance supply chain efficiency. Growing demand from food packaging, electronics, and chemical plants accelerates this trend. It positions localized generation as a strategic solution for industries requiring high-purity nitrogen.

- For instance, Parker Hannifin offers several NITROSource on-site nitrogen generator systems, including the advanced NITROSource Plus, that can produce ultra-high purity nitrogen up to 99.999% or even 99.9995%. While the systems are modular and can be combined for very high output, a single generator’s maximum flow rate varies greatly depending on the required purity level.

Increasing Role of High-Purity Nitrogen in Advanced Manufacturing

The Nitrogen Gas Market benefits from the expanding use of ultra-high-purity nitrogen in precision manufacturing. Semiconductor, pharmaceutical, and aerospace sectors require nitrogen with purity levels exceeding 99.999%. It prevents contamination, oxidation, and unwanted reactions in sensitive production processes. Growing adoption of nanotechnology and miniaturized components strengthens the requirement for ultra-pure gases. It highlights nitrogen’s role in safeguarding product integrity in high-tech industries. Rising investment in advanced electronics and cleanroom operations fuels this trend further.

- For instance, Taiyo Nippon Sanso supplies ultra-high-purity nitrogen with 99.9999% purity levels to Japanese semiconductor fabs, supporting advanced lithography and chip fabrication processes requiring contamination-free environments.

Integration of Digital Monitoring and Smart Gas Management

The Nitrogen Gas Market evolves with the adoption of digital monitoring systems for gas production and distribution. Smart sensors and IoT platforms enable real-time tracking of flow rates, purity, and pressure. It ensures process reliability and prevents costly downtime in industrial operations. Remote monitoring also allows predictive maintenance and optimized energy consumption. Industries benefit from greater efficiency and improved compliance with safety standards. It reflects a shift toward intelligent gas management solutions that enhance operational resilience.

Growing Sustainability Focus Across End-Use Industries

The Nitrogen Gas Market aligns with global sustainability goals through energy-efficient production methods. Companies invest in eco-friendly nitrogen generation units that reduce carbon footprints. It supports industries aiming to balance productivity with environmental responsibility. Adoption of renewable energy sources to power gas production units is also increasing. Food, healthcare, and electronics industries emphasize nitrogen’s role in reducing waste and improving safety. It underscores how sustainability remains central to long-term market expansion strategies.

Market Challenges Analysis

High Production and Operational Costs

The Nitrogen Gas Market faces challenges from high production and operational costs linked to energy-intensive processes. Air separation units and cryogenic distillation systems require significant capital investment. It increases the financial burden on small and medium-scale industries with limited budgets. Rising electricity prices further add pressure, making nitrogen production less cost-effective in some regions. Maintenance of generation equipment and supply chain logistics also contribute to higher expenses. It limits broader adoption in industries where cost sensitivity remains a key factor.

Regulatory Compliance and Safety Concerns

The Nitrogen Gas Market also confronts strict regulatory requirements and safety concerns. Nitrogen is inert but poses asphyxiation risks in confined environments, requiring specialized handling protocols. It compels industries to invest in safety equipment and training, raising operational costs. Compliance with environmental regulations on gas emissions during production adds complexity for manufacturers. Variations in regional standards make it difficult for global suppliers to streamline processes. It creates barriers for expansion and slows adoption in markets with evolving safety frameworks.

Market Opportunities

Expansion in Healthcare and Biotechnology Applications

The Nitrogen Gas Market presents strong opportunities through rising demand in healthcare and biotechnology. Cryopreservation of cells, tissues, and reproductive materials requires consistent nitrogen supply to maintain ultra-low temperatures. It supports pharmaceutical manufacturing, where nitrogen provides controlled atmospheres for drug formulation and storage. Growing investments in gene therapy and advanced biologics increase its role in laboratory and clinical research. It also enhances vaccine preservation, strengthening cold chain infrastructure worldwide. The rapid expansion of healthcare and biotech industries opens significant growth avenues for nitrogen suppliers.

Adoption of On-Site Generation and Sustainable Solutions

The Nitrogen Gas Market gains opportunities from adoption of on-site generation systems and energy-efficient technologies. On-site production reduces dependency on external suppliers and ensures continuous availability for industries with high nitrogen needs. It enables cost savings and offers flexibility in managing gas purity and volume. The push for sustainability creates demand for eco-friendly nitrogen systems powered by renewable energy sources. It supports industries such as food packaging, electronics, and chemicals in meeting green production targets. Growing adoption of sustainable gas solutions positions nitrogen as a critical enabler of industrial innovation and efficiency.

Market Segmentation Analysis:

By Application

The Nitrogen Gas Market is segmented by application into food packaging, medical, electronics, chemicals, and oil and gas. Food packaging dominates due to nitrogen’s ability to displace oxygen and extend product shelf life. It is widely applied in modified atmosphere packaging for meat, dairy, and snacks. Medical applications include cryopreservation and controlled atmospheres for drug storage and manufacturing. Electronics manufacturing relies on nitrogen for soldering, reflow, and oxidation prevention in semiconductor production. In oil and gas, nitrogen supports pressure maintenance, well stimulation, and pipeline purging. It shows growing use across diverse applications, reflecting its role as a versatile industrial gas.

- For instance, Air Products and Chemicals supplies over 1,500 nitrogen generation systems worldwide, including units capable of delivering 10,000 Nm³/hour to support oilfield operations and semiconductor manufacturing facilities.

By End Use Industry

The Nitrogen Gas Market serves end use industries such as food and beverage, healthcare, electronics, chemicals, and energy. The food and beverage sector accounts for significant demand due to increased consumption of packaged and processed foods. Healthcare relies on nitrogen for biological storage, cryogenics, and pharmaceutical processes. Electronics manufacturers require high-purity nitrogen for cleanroom operations and advanced chip fabrication. In chemicals, nitrogen ensures inert conditions in reactors and storage facilities. Energy and oil sectors adopt nitrogen for enhanced oil recovery and fire prevention. It highlights nitrogen’s cross-industry relevance, supporting both consumer-driven and industrial markets.

- For instance, Linde does operate multiple air separation units in Germany, supplying various industries, including healthcare, with gases like high-purity oxygen and nitrogen. While customized Linde plants can produce between 1,000 and 5,500 tons of oxygen per day, a 2,000 tpd capacity is a significant, but not unprecedented, amount for a single plant, typically serving very large industrial customers.

By Purity Level

The Nitrogen Gas Market is segmented by purity level into high purity, ultra-high purity, and standard grade. High-purity nitrogen is widely used in electronics, healthcare, and laboratories where contamination risks must be minimized. Ultra-high-purity nitrogen, exceeding 99.999% purity, is critical in semiconductor manufacturing and advanced pharmaceuticals. Standard-grade nitrogen finds application in industries such as food packaging, welding, and metal fabrication. It ensures cost-effective solutions for processes that do not require extremely high specifications. The growing demand for ultra-high-purity nitrogen reflects advancements in technology-intensive industries. It underscores how different purity levels align with diverse operational needs across sectors.

Segments:

Based on Application

- Chemical Industry

- Food and Beverage

- Electronics Manufacturing

- Metals and Metal Fabrication

Based on End Use Industry

- Aerospace

- Oil and Gas

- Pharmaceuticals

- Consumer Goods

Based on Purity Level

- High Purity

- Industrial Grade

- Medical Grade

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds around 23% share of the Nitrogen Gas Market, supported by strong industrial, healthcare, and food packaging demand. The United States dominates the region due to its large-scale pharmaceutical production, advanced biotechnology research, and expanding frozen and packaged food industry. Canada contributes with rising investments in healthcare infrastructure and industrial manufacturing, while Mexico strengthens its position through a growing electronics and automotive base. It benefits from mature supply networks and wide adoption of on-site nitrogen generation technologies across industries. The energy sector in the U.S. also drives nitrogen demand for oil recovery and pipeline purging. Regional suppliers focus on developing high-purity and ultra-high-purity nitrogen systems to meet the needs of semiconductor and biotechnology industries.

Europe

Europe accounts for about 27% of the Nitrogen Gas Market, with Germany, France, and the UK leading adoption. Strong emphasis on food preservation and packaging supports consistent nitrogen use across the region. Healthcare and pharmaceutical industries also create robust demand, particularly in vaccine production and biologics storage. It sees rapid adoption of eco-friendly nitrogen generation systems aligned with European Union sustainability goals. Electronics and semiconductor growth in countries such as Germany and the Netherlands further push the need for ultra-high-purity nitrogen. Energy companies across Norway and the UK offshore oil and gas fields also drive demand for nitrogen applications in exploration and safety. The presence of multinational industrial gas companies ensures competitive innovation and steady supply.

Asia-Pacific

Asia-Pacific dominates the Nitrogen Gas Market with nearly 35% share, led by China, Japan, South Korea, and India. China drives significant demand from its expanding electronics, automotive, and food processing sectors. Japan and South Korea rely heavily on ultra-high-purity nitrogen for semiconductor and advanced electronics production. India shows rising demand from pharmaceuticals, biotechnology, and packaged foods, supported by rapid urbanization and healthcare growth. It also benefits from strong investment in energy and petrochemical industries across the region. Increasing preference for on-site nitrogen generation systems reduces operational costs and ensures consistent supply for high-volume industries. Asia-Pacific’s dominance is reinforced by large-scale industrialization and continuous expansion of high-tech sectors.

Latin America

Latin America represents around 8% of the Nitrogen Gas Market, with Brazil and Mexico as the largest contributors. Brazil’s strong food and beverage industry fuels nitrogen adoption in packaging and preservation. Mexico shows growing usage in electronics, automotive, and healthcare applications. It faces infrastructure challenges but steadily embraces on-site generation systems to improve reliability and reduce costs. Oil and gas exploration in Brazil and Mexico also drives nitrogen demand for enhanced recovery and safety processes. Governments encourage modernization across industrial operations, supporting gradual adoption of advanced nitrogen technologies. Latin America’s position continues to strengthen through international collaborations and regional investment in manufacturing capabilities.

Middle East & Africa

The Middle East & Africa account for approximately 7% of the Nitrogen Gas Market, supported by energy, healthcare, and industrial applications. The Middle East shows high demand in oil and gas projects where nitrogen is critical for well stimulation, pipeline purging, and safety. Africa contributes with rising demand from food preservation, healthcare, and chemical industries, particularly in countries like South Africa and Nigeria. It also benefits from growing infrastructure investments and regional industrialization efforts. However, limited technological infrastructure restricts faster adoption of high-purity nitrogen applications. Suppliers work with local governments and companies to expand access to modern nitrogen generation solutions. The region continues to show steady growth potential through expansion in both energy and consumer industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- CF Industries

- NOVA Chemicals

- Linde

- Taiyo Nippon Sanso Corporation

- BASF

- Yara International

- Nippon Gases

- Gases Specialty

- Air Products and Chemicals

- Showa Denko

Competitive Analysis

The competitive landscape of the Nitrogen Gas Market features leading players such as Linde, Air Products and Chemicals, Yara International, BASF, Taiyo Nippon Sanso Corporation, Nippon Gases, Showa Denko, NOVA Chemicals, CF Industries, and Gases Specialty. These companies focus on strengthening their portfolios through technological innovation, large-scale production facilities, and global distribution networks. They emphasize on-site nitrogen generation systems, ultra-high-purity nitrogen supply, and energy-efficient production technologies to meet growing demand across food packaging, healthcare, and semiconductor industries. Strategic partnerships, acquisitions, and joint ventures are key approaches used to expand regional presence and gain competitive advantage. Sustainability is also central, with players investing in renewable-powered nitrogen plants and carbon-reduction initiatives. Competitive differentiation is shaped by product quality, purity levels, and integration of digital monitoring solutions to improve supply reliability. Intense rivalry pushes each company to enhance operational efficiency and target emerging opportunities in Asia-Pacific, Europe, and North America, reinforcing nitrogen’s role as an essential industrial gas across diverse sectors.

Recent Developments

- In July 2025, CF Industries began operations at its Donaldsonville Complex CO₂ dehydration and compression unit, enabling permanent sequestration of up to 2 million metric tons of CO₂ per year.

- In July 2025, Linde plans construction of a new ASU in Brownsville, Texas, supplying liquid nitrogen, oxygen, and argon, expected operational in Q1 2026 to support aerospace applications.

- In June 2025, Linde signed a long-term agreement to supply nitrogen and oxygen to the massive Blue Point low‑carbon ammonia facility in Louisiana.

- In February 2025, Air Products exited three U.S.-based projects and recorded a pre-tax charge not to exceed USD 3.1 billion.

Report Coverage

The research report offers an in-depth analysis based on Application, End Use Industry, Purity Level and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Nitrogen supply integration with renewable-powered air separation units will expand in high-demand regions.

- On-site nitrogen generator deployment will increase across food packaging and electronics plants.

- Suppliers will focus on ultra-high-purity nitrogen to support semiconductor and biotech sectors.

- Modular and compact generation systems will gain traction in remote or flexible industrial setups.

- Digital monitoring and IoT-based control will become standard in nitrogen generation systems.

- Clean ammonia and green nitrogen derived from renewable hydrogen will enter fertilizer and industrial gas segments.

- Emerging economies will drive localized nitrogen production to support expanding manufacturing and packaging industries.

- Collaboration between gas producers and renewable energy providers will enhance carbon-efficient production.

- Asia-Pacific will strengthen its leadership through infrastructure investments and on-site generation uptake.

- Growth of cryogenic air separation unit markets will support scalable nitrogen supply in heavy industries.